| Pos. | |

Name | |

Today | |

3 weeks | |

6 weeks | |

26 weeks | |

1DAY | |

Ytoday | |

1YEAR | |

|| |

Pos. | |

Name | |

Today | |

3 weeks | |

6 weeks | |

26 weeks | |

1DAY | |

7DAY | |

30DAY | |

Ytoday | |

1YEAR | |

Ratio_GP | |

Ratio_NI | |

ROE | |

| 1.0 |

Communication Equipment |

100.0 |

100.0 |

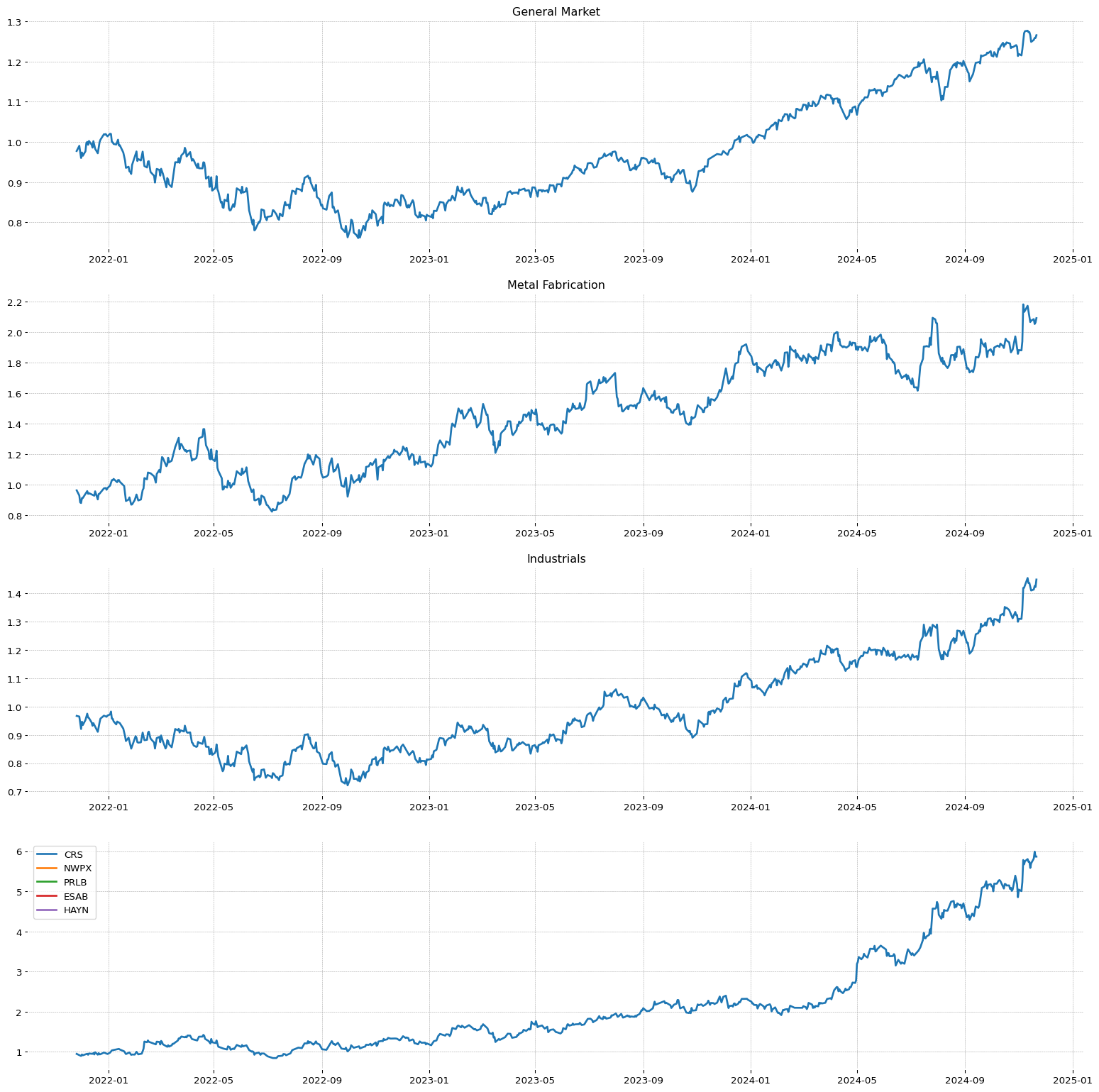

100.0 |

80.0 |

0.25 |

47.79 |

106.33 |

35.01 |

-9.58 |

5.68 |

|| |

26.0 |

Publishing |

82.0 |

97.0 |

96.0 |

44.0 |

-0.22 |

35.95 |

39.88% |

36.84 |

-9.99 |

26.06 |

| 2.0 |

Healthcare Plans |

99.0 |

99.0 |

98.0 |

65.0 |

-2.49 |

39.17 |

61.56 |

43.1 |

-0.1 |

-7.78 |

|| |

27.0 |

Other Precious Metals & Mining |

82.0 |

90.0 |

95.0 |

85.0 |

6.17 |

57.57 |

72.79% |

11.96 |

-10.82 |

-8.47 |

| 3.0 |

Utilities - Independent Power Producers |

98.0 |

98.0 |

99.0 |

98.0 |

-0.07 |

89.71 |

130.87 |

30.83 |

16.36 |

20.5 |

|| |

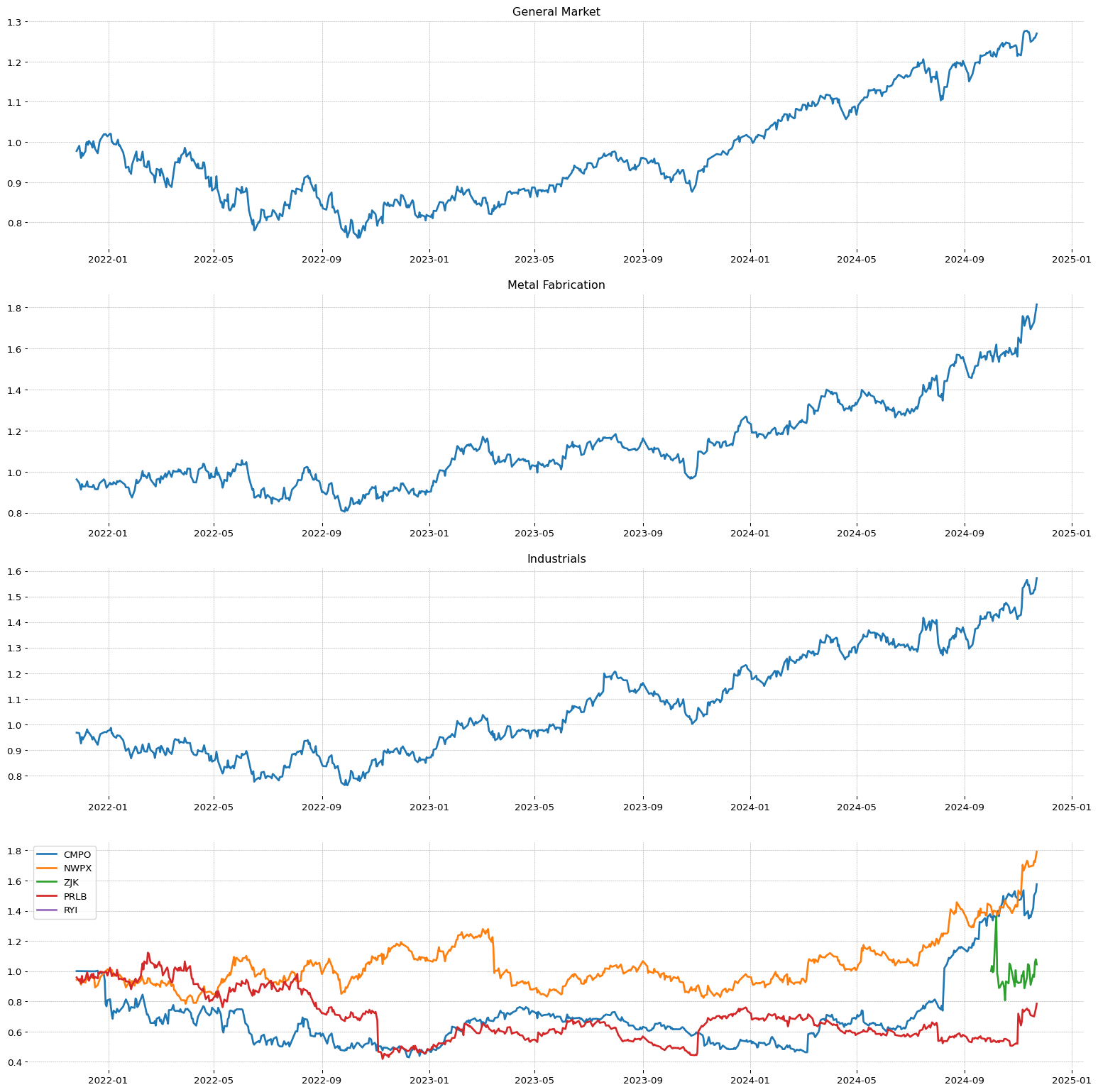

28.0 |

Metal Fabrication |

81.0 |

89.0 |

92.0 |

82.0 |

-0.6 |

35.17 |

64.68% |

25.74 |

4.5 |

8.24 |

| 4.0 |

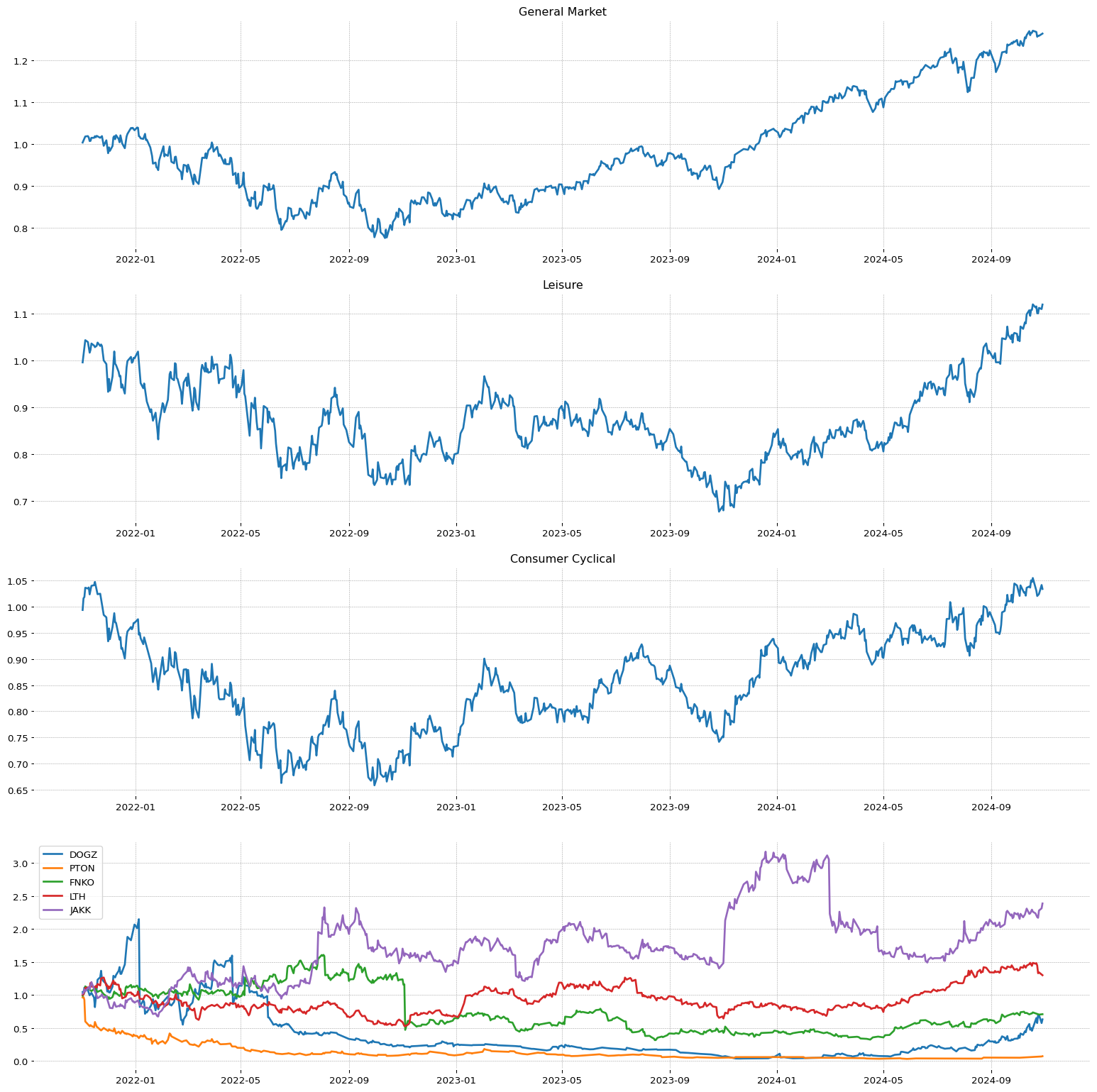

Leisure |

97.0 |

95.0 |

85.0 |

48.0 |

0.82 |

41.69 |

48.96 |

43.22 |

-1.14 |

-0.79 |

|| |

29.0 |

Uranium |

80.0 |

6.0 |

2.0 |

15.0 |

2.6 |

18.51 |

31.82% |

472.0 |

-36.49 |

-9.38 |

| 5.0 |

Capital Markets |

97.0 |

85.0 |

86.0 |

94.0 |

1.06 |

31.37 |

80.5 |

49.53 |

14.87 |

6.26 |

|| |

30.0 |

Financial Data & Stock Exchanges |

80.0 |

63.0 |

63.0 |

69.0 |

1.05 |

19.77 |

50.59% |

62.02 |

24.95 |

5.31 |

| 6.0 |

Information Technology Services |

96.0 |

91.0 |

76.0 |

25.0 |

0.22 |

15.72 |

40.79 |

29.36 |

-1.61 |

27.27 |

|| |

31.0 |

Aerospace & Defense |

79.0 |

73.0 |

69.0 |

68.0 |

-0.08 |

34.23 |

56.1% |

26.07 |

-3.96 |

6.72 |

| 7.0 |

Thermal Coal |

95.0 |

97.0 |

24.0 |

3.0 |

-0.53 |

8.05 |

3.96 |

37.86 |

45.64 |

27.18 |

|| |

32.0 |

Credit Services |

78.0 |

71.0 |

68.0 |

83.0 |

0.23 |

43.76 |

98.66% |

70.56 |

12.16 |

10.18 |

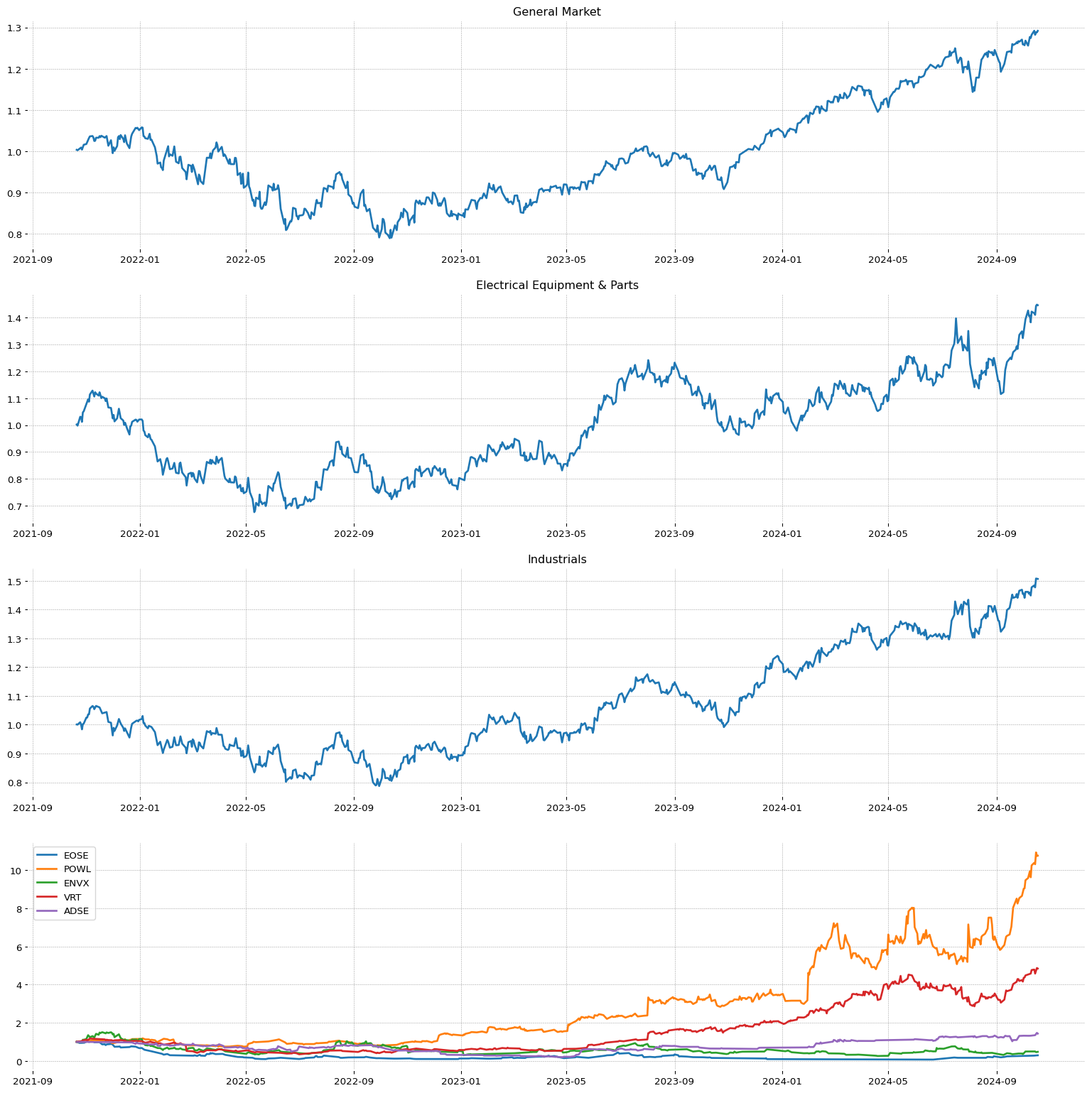

| 8.0 |

Electrical Equipment & Parts |

95.0 |

68.0 |

26.0 |

52.0 |

-0.14 |

30.41 |

40.87 |

5.67 |

-18.34 |

6.71 |

|| |

33.0 |

Diagnostics & Research |

78.0 |

86.0 |

82.0 |

86.0 |

0.23 |

13.57 |

54.08% |

41.35 |

-14.51 |

-4.84 |

| 9.0 |

Pollution & Treatment Controls |

94.0 |

93.0 |

79.0 |

76.0 |

0.19 |

50.03 |

68.69 |

36.49 |

9.13 |

17.02 |

|| |

34.0 |

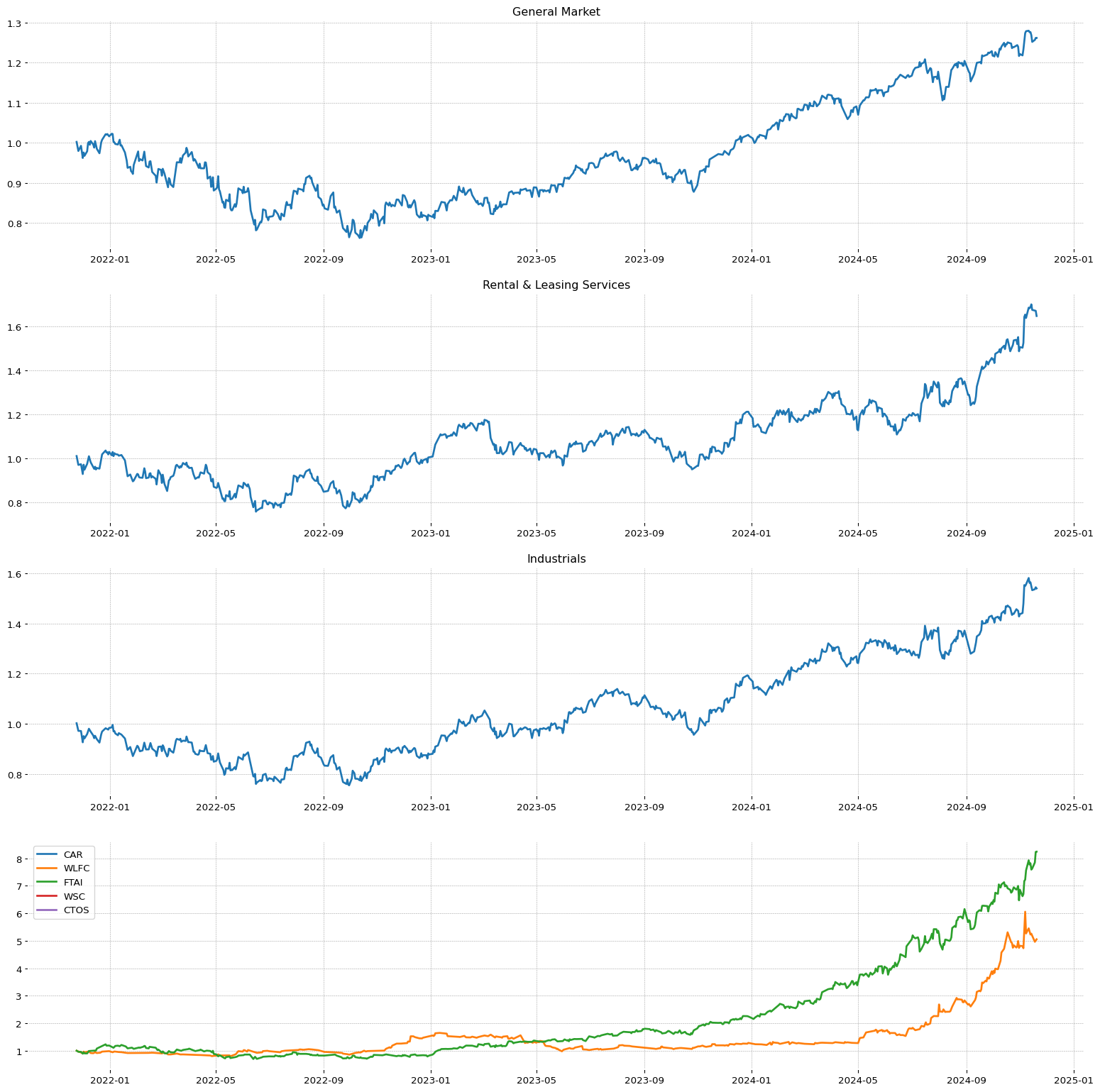

Rental & Leasing Services |

77.0 |

66.0 |

55.0 |

56.0 |

-0.55 |

27.36 |

59.28% |

41.16 |

12.29 |

11.56 |

| 10.0 |

Engineering & Construction |

93.0 |

92.0 |

85.0 |

93.0 |

0.2 |

53.48 |

84.45 |

24.11 |

4.38 |

11.86 |

|| |

35.0 |

Gambling |

76.0 |

70.0 |

83.0 |

70.0 |

-0.38 |

25.38 |

36.05% |

52.61 |

2.41 |

-2.89 |

| 11.0 |

Personal Services |

93.0 |

95.0 |

97.0 |

63.0 |

0.0 |

31.43 |

55.42 |

36.95 |

10.59 |

137.71 |

|| |

36.0 |

Electronic Gaming & Multimedia |

76.0 |

89.0 |

65.0 |

34.0 |

1.14 |

23.77 |

28.67% |

58.61 |

-1.71 |

-19.3 |

| 12.0 |

Financial Conglomerates |

92.0 |

88.0 |

91.0 |

100.0 |

-0.25 |

46.06 |

156.4 |

73.49 |

2.54 |

-19.86 |

|| |

37.0 |

Internet Retail |

75.0 |

75.0 |

42.0 |

95.0 |

3.23 |

22.0 |

60.31% |

41.75 |

-1.66 |

12.96 |

| 13.0 |

Gold |

91.0 |

82.0 |

95.0 |

64.0 |

4.37 |

41.25 |

58.33 |

29.46 |

1.17 |

2.14 |

|| |

38.0 |

Travel Services |

74.0 |

51.0 |

46.0 |

89.0 |

0.37 |

25.83 |

70.7% |

49.64 |

7.13 |

18.17 |

| 14.0 |

Biotechnology |

91.0 |

62.0 |

58.0 |

97.0 |

0.83 |

40.76 |

103.72 |

40.8 |

460.36 |

12.27 |

|| |

39.0 |

Medical Care Facilities |

74.0 |

72.0 |

84.0 |

66.0 |

0.19 |

24.06 |

54.05% |

25.96 |

-1.22 |

37.16 |

| 15.0 |

Insurance Brokers |

90.0 |

93.0 |

97.0 |

71.0 |

-0.52 |

34.59 |

54.69 |

44.15 |

8.36 |

5.37 |

|| |

40.0 |

REIT - Diversified |

73.0 |

81.0 |

90.0 |

31.0 |

0.24 |

10.67 |

37.19% |

62.32 |

18.74 |

3.11 |

| 16.0 |

Real Estate Services |

89.0 |

94.0 |

91.0 |

78.0 |

0.7 |

20.04 |

65.56 |

32.86 |

-1.05 |

-4.18 |

|| |

41.0 |

REIT - Retail |

72.0 |

76.0 |

76.0 |

29.0 |

0.62 |

12.47 |

38.66% |

58.71 |

22.6 |

5.68 |

| 17.0 |

Silver |

89.0 |

65.0 |

77.0 |

63.0 |

7.3 |

54.76 |

65.78 |

16.13 |

2.14 |

2.31 |

|| |

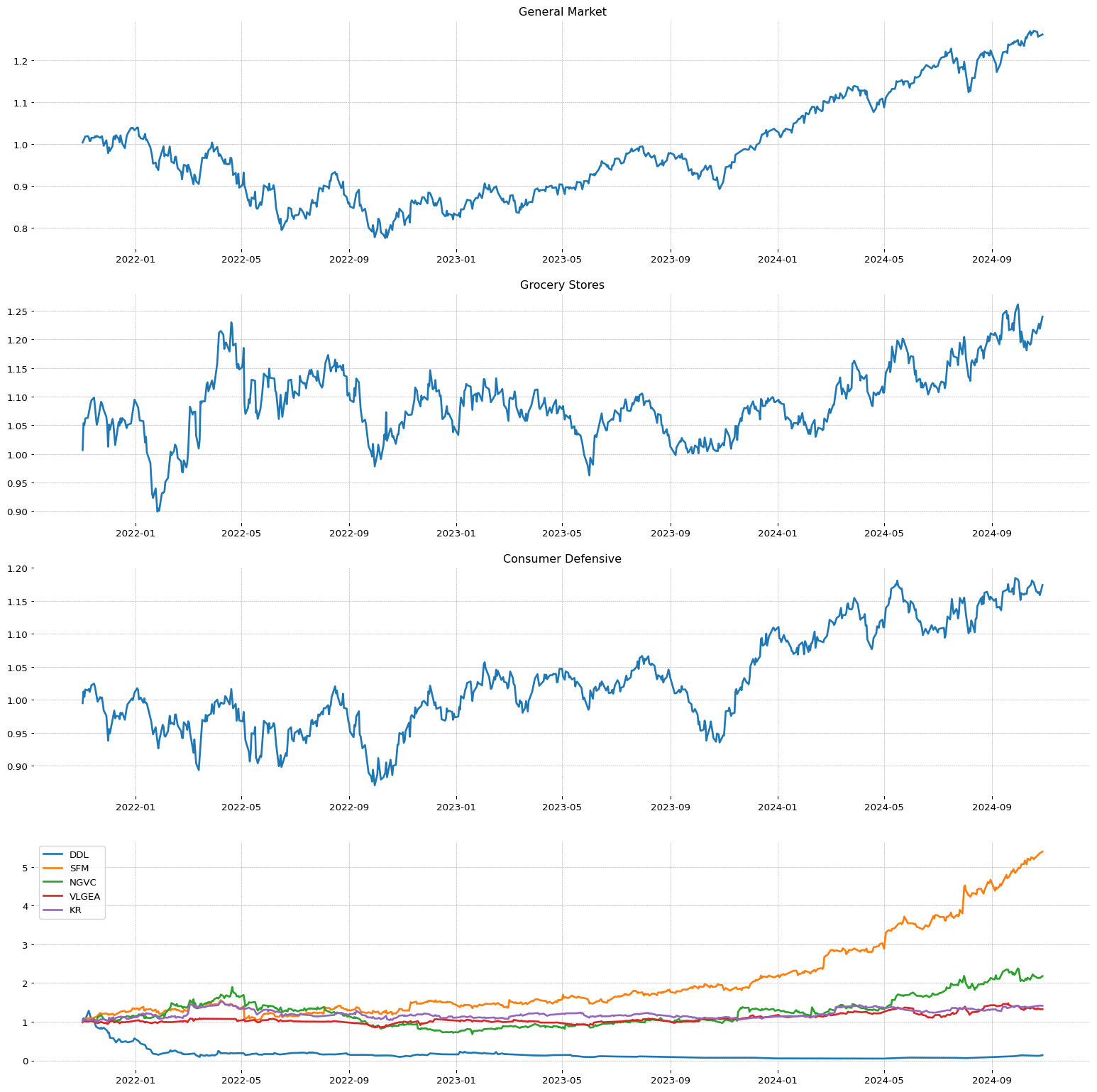

42.0 |

Grocery Stores |

72.0 |

85.0 |

70.0 |

19.0 |

0.08 |

18.55 |

26.64% |

27.58 |

2.56 |

11.62 |

| 18.0 |

Telecom Services |

88.0 |

87.0 |

78.0 |

7.0 |

0.94 |

13.59 |

27.39 |

45.87 |

0.81 |

54.39 |

|| |

43.0 |

Insurance - Life |

71.0 |

56.0 |

61.0 |

48.0 |

-0.5 |

22.19 |

44.74% |

89.15 |

9.9 |

8.17 |

| 19.0 |

REIT - Healthcare Facilities |

87.0 |

96.0 |

94.0 |

27.0 |

0.61 |

14.11 |

32.28 |

50.67 |

2.8 |

1.53 |

|| |

44.0 |

Furnishings, Fixtures & Appliances |

70.0 |

78.0 |

63.0 |

42.0 |

-0.14 |

21.88 |

50.55% |

36.83 |

-0.16 |

18.29 |

| 20.0 |

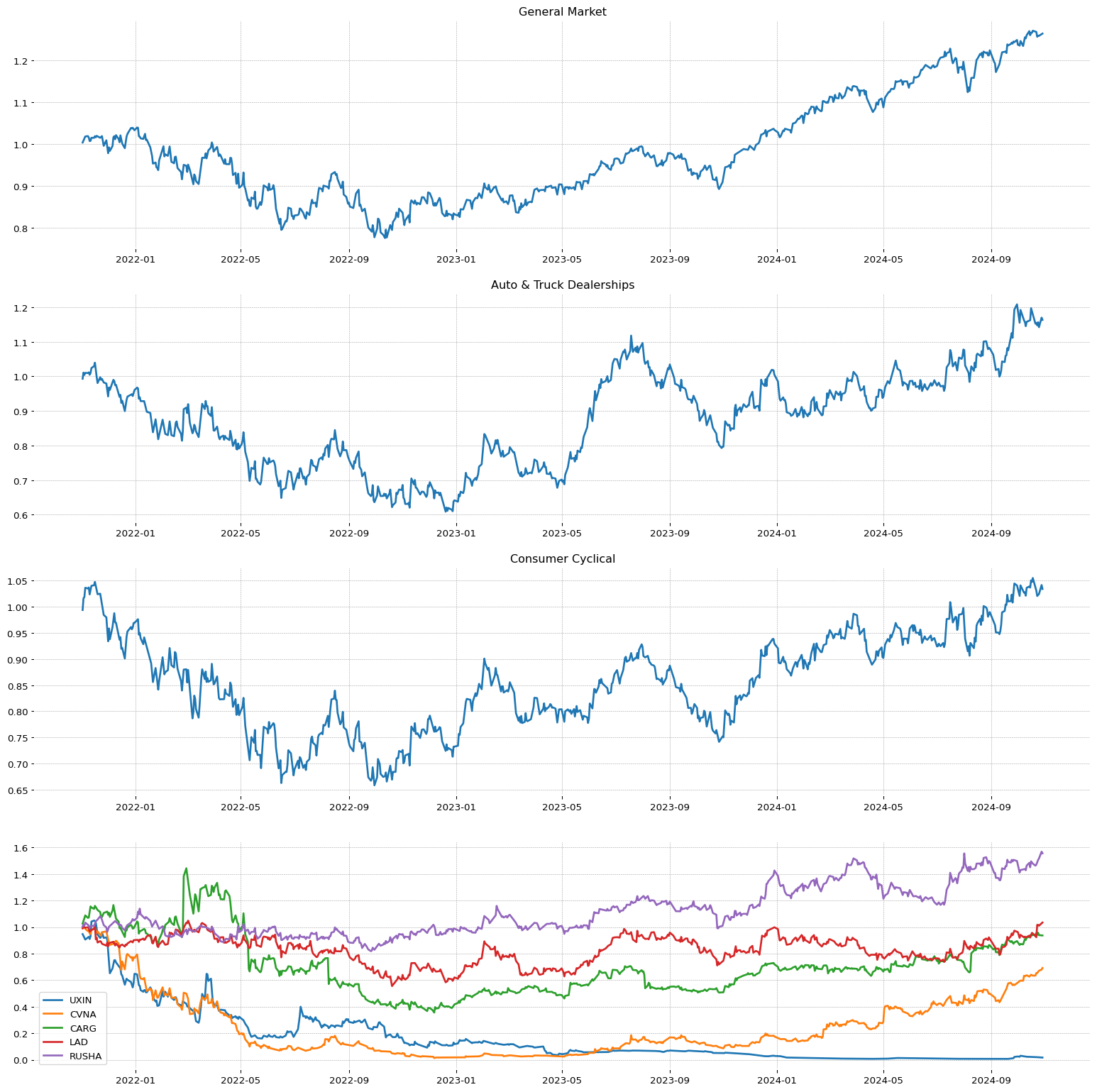

Auto & Truck Dealerships |

87.0 |

87.0 |

60.0 |

55.0 |

0.16 |

15.45 |

43.26 |

28.26 |

-1.4 |

28.75 |

|| |

45.0 |

REIT - Specialty |

70.0 |

67.0 |

54.0 |

28.0 |

0.4 |

11.03 |

36.04% |

47.87 |

18.99 |

5.47 |

| 21.0 |

Drug Manufacturers - Specialty & Generic |

86.0 |

69.0 |

87.0 |

77.0 |

0.51 |

25.08 |

52.14 |

56.18 |

-9.29 |

132.35 |

|| |

46.0 |

Electronics & Computer Distribution |

69.0 |

76.0 |

73.0 |

74.0 |

-0.6 |

28.1 |

54.43% |

14.08 |

2.56 |

12.49 |

| 22.0 |

Residential Construction |

85.0 |

83.0 |

81.0 |

91.0 |

0.41 |

27.4 |

89.96 |

30.69 |

12.41 |

23.07 |

|| |

47.0 |

Insurance - Reinsurance |

68.0 |

78.0 |

89.0 |

23.0 |

-0.7 |

27.27 |

28.45% |

94.88 |

16.22 |

17.32 |

| 23.0 |

REIT - Office |

85.0 |

80.0 |

74.0 |

36.0 |

0.53 |

21.32 |

56.46 |

41.61 |

-3.32 |

-3.9 |

|| |

48.0 |

Lumber & Wood Production |

68.0 |

48.0 |

30.0 |

44.0 |

-0.43 |

6.97 |

43.68% |

28.86 |

8.09 |

12.88 |

| 24.0 |

Banks - Regional |

84.0 |

82.0 |

89.0 |

43.0 |

-0.87 |

16.96 |

53.68 |

90.06 |

15.78 |

11.56 |

|| |

49.0 |

REIT - Industrial |

67.0 |

72.0 |

72.0 |

33.0 |

0.0 |

0.85 |

32.49% |

56.01 |

26.2 |

5.57 |

| 25.0 |

Food Distribution |

83.0 |

64.0 |

44.0 |

41.0 |

0.23 |

16.19 |

39.5 |

13.8 |

0.85 |

14.43 |

|| |

50.0 |

Building Products & Equipment |

66.0 |

65.0 |

48.0 |

97.0 |

-0.17 |

33.56 |

80.43% |

32.15 |

9.66 |

70.07 |

| Pos. | |

Name | |

RS Today | |

RS 3Wk | |

RS 6Wk | |

RS 26wk | |

Secotr | |

Industry | |

Pos Ind | |

EPS | |

SMR | |

A/C | |

CR | |

Ind Pos. | |

Sec Pos. | |

Close. | |

10wk | |

26wk | |

| 1.0 |

BKH |

50.0 |

54.54 |

45.47 |

18.87 |

Utilities |

Utilities - Regulated Gas |

113 |

24.15 |

52.96 |

85.04 |

69.81 |

6.0 |

37.0 |

61.98 |

1.0 |

1.0 |

| 2.0 |

CNA |

49.6 |

54.87 |

73.9 |

56.63 |

Financial |

Insurance - Property and Casualty |

102 |

43.42 |

56.81 |

69.64 |

65.43 |

24.0 |

447.0 |

50.47 |

1.0 |

1.0 |

| 3.0 |

TEL |

49.5 |

49.86 |

51.3 |

58.17 |

Technology |

Electronic Components |

51 |

84.81 |

67.43 |

26.28 |

88.59 |

15.0 |

227.0 |

148.96 |

1.0 |

1.0 |

| 4.0 |

BERY |

48.74 |

38.84 |

41.3 |

39.04 |

Consumer Cyclical |

Packaging and Containers |

115 |

33.18 |

14.14 |

14.55 |

64.92 |

12.0 |

166.0 |

69.72 |

1.0 |

1.0 |

| 5.0 |

HBT |

48.68 |

50.01 |

50.26 |

46.51 |

Financial |

Banks - Regional |

24 |

62.29 |

76.22 |

67.1 |

44.1 |

195.0 |

462.0 |

22.98 |

1.0 |

1.0 |

| 6.0 |

PDI |

48.65 |

46.19 |

48.08 |

43.58 |

Financial |

Closed-End Fund - Debt |

98 |

98.42 |

62.88 |

91.28 |

42.9 |

40.0 |

463.0 |

19.92 |

1.0 |

1.0 |

| 7.0 |

BGH |

48.15 |

48.17 |

52.19 |

46.79 |

Financial |

Closed-End Fund - Debt |

98 |

41.91 |

87.29 |

79.22 |

33.56 |

44.0 |

469.0 |

15.34 |

1.0 |

1.0 |

| 8.0 |

PTA |

48.03 |

47.17 |

54.09 |

49.29 |

Financial |

Closed-End Fund - Debt |

98 |

0.0 |

0.0 |

79.22 |

0.0 |

47.0 |

472.0 |

21.04 |

1.0 |

1.0 |

| 9.0 |

EVRG |

47.63 |

53.71 |

53.41 |

17.21 |

Utilities |

Utilities - Regulated Electric |

60 |

27.83 |

34.58 |

23.8 |

63.92 |

19.0 |

41.0 |

61.34 |

1.0 |

1.0 |

| 10.0 |

JPI |

47.54 |

50.59 |

54.76 |

52.46 |

Financial |

Closed-End Fund - Debt |

98 |

71.35 |

20.14 |

62.88 |

38.52 |

50.0 |

477.0 |

21.04 |

1.0 |

1.0 |

| 11.0 |

ARDC |

47.3 |

48.21 |

62.4 |

58.51 |

Financial |

Closed-End Fund - Debt |

98 |

81.84 |

61.37 |

26.28 |

30.9 |

51.0 |

479.0 |

15.31 |

1.0 |

1.0 |

| 12.0 |

VOYA |

47.23 |

49.12 |

35.6 |

26.24 |

Financial |

Financial Conglomerates |

12 |

87.47 |

77.09 |

90.67 |

80.59 |

2.0 |

481.0 |

83.55 |

1.0 |

1.0 |

| 13.0 |

RMM |

47.11 |

45.02 |

37.9 |

32.35 |

Financial |

Closed-End Fund - Debt |

98 |

0.0 |

0.0 |

42.32 |

0.0 |

53.0 |

483.0 |

15.92 |

1.0 |

1.0 |

| 14.0 |

RLI |

46.84 |

39.52 |

51.7 |

37.5 |

Financial |

Insurance - Property and Casualty |

102 |

75.81 |

52.48 |

97.08 |

91.41 |

26.0 |

486.0 |

163.27 |

1.0 |

1.0 |

| 15.0 |

CHDN |

46.31 |

44.29 |

59.88 |

30.78 |

Consumer Cyclical |

Gambling |

35 |

83.51 |

74.59 |

27.88 |

87.87 |

6.0 |

173.0 |

139.44 |

1.0 |

1.0 |

| 16.0 |

SRE |

45.95 |

53.16 |

57.31 |

24.42 |

Utilities |

Utilities - Diversified |

83 |

78.87 |

50.59 |

17.31 |

76.43 |

3.0 |

44.0 |

85.44 |

1.0 |

1.0 |

| 17.0 |

WDI |

45.73 |

45.82 |

49.67 |

45.15 |

Financial |

Closed-End Fund - Debt |

98 |

0.0 |

0.0 |

35.62 |

0.0 |

61.0 |

500.0 |

15.52 |

1.0 |

1.0 |

| 18.0 |

COR |

45.33 |

51.75 |

74.7 |

79.17 |

Healthcare |

Medical Distribution |

142 |

68.04 |

29.13 |

18.22 |

92.41 |

1.0 |

251.0 |

235.77 |

1.0 |

1.0 |

| 19.0 |

FCN |

45.3 |

54.78 |

64.09 |

47.68 |

Industrials |

Consulting Services |

74 |

69.99 |

87.77 |

83.7 |

95.03 |

3.0 |

227.0 |

229.8 |

1.0 |

1.0 |

| 20.0 |

FELE |

45.0 |

41.35 |

39.28 |

56.81 |

Industrials |

Specialty Industrial Machinery |

66 |

49.45 |

42.76 |

58.13 |

80.8 |

30.0 |

229.0 |

104.87 |

1.0 |

1.0 |

| 21.0 |

TBLD |

44.14 |

51.78 |

56.88 |

38.34 |

Financial |

Closed-End Fund - Equity |

82 |

0.0 |

0.0 |

67.1 |

0.0 |

38.0 |

518.0 |

17.36 |

1.0 |

1.0 |

| 22.0 |

PDX |

44.11 |

52.18 |

78.87 |

82.44 |

Financial |

Closed-End Fund - Equity |

82 |

0.0 |

0.0 |

79.22 |

0.0 |

39.0 |

519.0 |

23.6 |

1.0 |

1.0 |

| 23.0 |

FFA |

44.01 |

44.69 |

47.01 |

50.86 |

Financial |

Closed-End Fund - Equity |

82 |

89.66 |

88.25 |

28.5 |

41.55 |

40.0 |

520.0 |

20.51 |

1.0 |

1.0 |

| 24.0 |

NVS |

43.49 |

39.36 |

57.37 |

26.0 |

Healthcare |

Drug Manufacturers - General |

86 |

90.22 |

83.89 |

19.71 |

85.35 |

4.0 |

260.0 |

116.8 |

1.0 |

1.0 |

| 25.0 |

SPSC |

43.4 |

41.08 |

38.45 |

61.62 |

Technology |

Software - Application |

84 |

63.84 |

56.27 |

89.7 |

93.03 |

63.0 |

243.0 |

194.36 |

1.0 |

1.0 |

| 26.0 |

IVT |

43.34 |

51.11 |

63.29 |

56.84 |

Real Estate |

REIT - Retail |

41 |

57.65 |

23.99 |

74.04 |

49.41 |

18.0 |

98.0 |

29.82 |

1.0 |

1.0 |

| 27.0 |

OGE |

43.22 |

54.11 |

54.03 |

23.99 |

Utilities |

Utilities - Regulated Electric |

60 |

0.0 |

0.0 |

55.05 |

0.0 |

23.0 |

50.0 |

40.86 |

1.0 |

1.0 |

| 28.0 |

POR |

42.97 |

46.86 |

47.22 |

20.17 |

Utilities |

Utilities - Regulated Electric |

60 |

91.27 |

44.3 |

55.05 |

65.67 |

24.0 |

52.0 |

48.4 |

1.0 |

1.0 |

| 29.0 |

BUI |

42.88 |

56.31 |

50.29 |

24.73 |

Financial |

Closed-End Fund - Equity |

82 |

7.82 |

52.51 |

43.62 |

38.38 |

43.0 |

533.0 |

23.84 |

1.0 |

1.0 |

| 30.0 |

JOE |

42.57 |

32.48 |

32.07 |

78.22 |

Real Estate |

Real Estate - Diversified |

64 |

49.21 |

38.75 |

12.91 |

64.74 |

1.0 |

100.0 |

59.61 |

1.0 |

1.0 |

| 31.0 |

ECAT |

42.48 |

48.79 |

52.16 |

46.45 |

Financial |

Closed-End Fund - Equity |

82 |

0.0 |

0.0 |

69.64 |

0.0 |

44.0 |

536.0 |

17.5 |

1.0 |

1.0 |

| 32.0 |

ED |

42.36 |

52.3 |

56.97 |

26.86 |

Utilities |

Utilities - Regulated Electric |

60 |

41.57 |

68.91 |

69.64 |

82.49 |

25.0 |

53.0 |

106.01 |

1.0 |

1.0 |

| 33.0 |

GSBC |

42.26 |

46.55 |

48.78 |

44.07 |

Financial |

Banks - Regional |

24 |

21.55 |

49.66 |

62.88 |

66.57 |

207.0 |

539.0 |

58.63 |

1.0 |

1.0 |

| 34.0 |

PBH |

42.2 |

53.5 |

68.07 |

55.55 |

Healthcare |

Drug Manufacturers - Specialty and Generic |

21 |

66.9 |

68.04 |

44.56 |

74.36 |

25.0 |

264.0 |

72.24 |

1.0 |

1.0 |

| 35.0 |

MPLX |

41.99 |

54.35 |

64.61 |

60.64 |

Energy |

Oil and Gas Midstream |

93 |

90.34 |

71.31 |

47.97 |

64.26 |

18.0 |

43.0 |

43.97 |

1.0 |

1.0 |

| 36.0 |

FNLC |

41.93 |

39.67 |

47.37 |

24.98 |

Financial |

Banks - Regional |

24 |

0.0 |

0.0 |

35.62 |

0.0 |

209.0 |

543.0 |

27.86 |

1.0 |

1.0 |

| 37.0 |

HON |

41.84 |

37.65 |

42.28 |

37.69 |

Industrials |

Conglomerates |

90 |

39.28 |

72.92 |

79.22 |

93.83 |

9.0 |

238.0 |

220.17 |

1.0 |

1.0 |

| 38.0 |

QQQX |

41.07 |

36.12 |

40.11 |

36.05 |

Financial |

Closed-End Fund - Equity |

82 |

72.71 |

61.56 |

28.5 |

44.65 |

45.0 |

551.0 |

25.31 |

1.0 |

1.0 |

| 39.0 |

VICI |

40.79 |

43.53 |

44.28 |

20.01 |

Real Estate |

REIT - Diversified |

40 |

42.74 |

75.32 |

24.76 |

51.55 |

9.0 |

104.0 |

33.08 |

1.0 |

1.0 |

| 40.0 |

NWE |

40.73 |

46.65 |

42.22 |

20.11 |

Utilities |

Utilities - Regulated Electric |

60 |

0.0 |

0.0 |

42.32 |

0.0 |

27.0 |

57.0 |

56.74 |

1.0 |

1.0 |

| 41.0 |

WPP |

40.52 |

42.39 |

35.84 |

19.58 |

Communication Services |

Advertising Agencies |

91 |

62.57 |

19.63 |

24.76 |

61.09 |

10.0 |

76.0 |

51.25 |

1.0 |

1.0 |

| 42.0 |

OBK |

40.49 |

40.04 |

45.66 |

31.15 |

Financial |

Banks - Regional |

24 |

32.38 |

49.75 |

35.62 |

49.44 |

212.0 |

558.0 |

33.05 |

1.0 |

1.0 |

| 43.0 |

MMC |

40.39 |

42.64 |

58.14 |

55.33 |

Financial |

Insurance Brokers |

15 |

68.51 |

79.21 |

29.08 |

93.79 |

10.0 |

560.0 |

225.63 |

1.0 |

1.0 |

| 44.0 |

IIIV |

40.09 |

29.82 |

28.08 |

30.22 |

Technology |

Software - Infrastructure |

63 |

25.82 |

62.78 |

21.37 |

38.55 |

57.0 |

255.0 |

23.19 |

1.0 |

1.0 |

| 45.0 |

ARW |

40.0 |

30.8 |

33.94 |

52.03 |

Technology |

Electronics and Computer Distribution |

46 |

31.73 |

5.0 |

1.64 |

76.94 |

6.0 |

256.0 |

135.69 |

1.0 |

1.0 |

| 46.0 |

EPR |

39.69 |

46.83 |

47.31 |

37.29 |

Real Estate |

REIT - Specialty |

45 |

0.0 |

0.0 |

92.41 |

0.0 |

9.0 |

108.0 |

48.81 |

1.0 |

1.0 |

| 47.0 |

INCY |

39.63 |

36.28 |

31.34 |

10.14 |

Healthcare |

Biotechnology |

14 |

78.41 |

77.83 |

19.71 |

71.91 |

152.0 |

277.0 |

66.37 |

1.0 |

1.0 |

| 48.0 |

GTY |

39.35 |

42.79 |

41.76 |

17.02 |

Real Estate |

REIT - Retail |

41 |

38.75 |

29.09 |

35.62 |

46.27 |

19.0 |

109.0 |

31.8 |

1.0 |

1.0 |

| 49.0 |

BFS |

38.98 |

48.73 |

43.94 |

39.69 |

Real Estate |

REIT - Retail |

41 |

66.03 |

13.79 |

21.37 |

53.82 |

21.0 |

112.0 |

40.5 |

1.0 |

1.0 |

| 50.0 |

NIE |

38.8 |

41.51 |

48.02 |

52.59 |

Financial |

Closed-End Fund - Equity |

82 |

68.82 |

0.0 |

67.1 |

0.0 |

52.0 |

570.0 |

23.45 |

1.0 |

1.0 |

| 51.0 |

CCAP |

38.28 |

36.43 |

47.83 |

66.0 |

Financial |

Asset Management |

70 |

80.42 |

96.59 |

14.55 |

38.42 |

47.0 |

575.0 |

18.59 |

1.0 |

1.0 |

| 52.0 |

KMB |

38.19 |

42.45 |

59.0 |

23.5 |

Consumer Defensive |

Household and Personal Products |

134 |

53.6 |

64.83 |

50.73 |

88.04 |

7.0 |

60.0 |

145.08 |

1.0 |

1.0 |

| 53.0 |

ET |

38.15 |

43.1 |

56.2 |

68.75 |

Energy |

Oil and Gas Midstream |

93 |

73.61 |

34.0 |

50.73 |

32.52 |

21.0 |

49.0 |

16.4 |

1.0 |

1.0 |

| 54.0 |

CHH |

38.09 |

32.6 |

31.46 |

26.52 |

Consumer Cyclical |

Lodging |

67 |

58.89 |

11.48 |

6.58 |

81.04 |

7.0 |

194.0 |

135.19 |

1.0 |

1.0 |

| 55.0 |

SPXX |

37.91 |

38.05 |

45.29 |

34.79 |

Financial |

Closed-End Fund - Equity |

82 |

0.0 |

0.0 |

50.73 |

0.0 |

55.0 |

578.0 |

16.79 |

1.0 |

1.0 |

| 56.0 |

UNF |

37.79 |

50.87 |

38.39 |

35.1 |

Industrials |

Specialty Business Services |

108 |

40.82 |

51.42 |

6.58 |

89.07 |

13.0 |

249.0 |

193.3 |

1.0 |

1.0 |

| 57.0 |

FWONK |

37.76 |

38.97 |

48.94 |

35.34 |

Communication Services |

Entertainment |

89 |

73.16 |

23.53 |

6.58 |

71.74 |

17.0 |

79.0 |

80.05 |

1.0 |

1.0 |

| 58.0 |

HSBC |

37.73 |

38.57 |

55.47 |

61.5 |

Financial |

Banks - Diversified |

73 |

83.42 |

51.36 |

24.76 |

61.85 |

17.0 |

579.0 |

44.66 |

1.0 |

1.0 |

| 59.0 |

SDHY |

37.63 |

42.73 |

43.08 |

40.93 |

Financial |

Closed-End Fund - Debt |

98 |

0.0 |

0.0 |

60.01 |

0.0 |

89.0 |

581.0 |

16.61 |

1.0 |

1.0 |

| 60.0 |

AVT |

37.42 |

37.74 |

38.91 |

59.74 |

Technology |

Electronics and Computer Distribution |

46 |

35.04 |

5.71 |

35.62 |

59.61 |

7.0 |

262.0 |

54.93 |

1.0 |

1.0 |

| 61.0 |

HCKT |

37.3 |

33.83 |

39.06 |

64.52 |

Technology |

Information Technology Services |

6 |

70.58 |

42.22 |

69.64 |

47.41 |

31.0 |

263.0 |

26.05 |

1.0 |

1.0 |

| 62.0 |

BSAC |

37.23 |

40.92 |

46.61 |

40.34 |

Financial |

Banks - Regional |

24 |

43.86 |

37.98 |

49.29 |

36.31 |

215.0 |

585.0 |

20.39 |

1.0 |

1.0 |

| 63.0 |

ROP |

36.62 |

39.73 |

50.07 |

65.85 |

Technology |

Software - Application |

84 |

50.6 |

71.86 |

79.22 |

99.2 |

69.0 |

268.0 |

561.53 |

1.0 |

1.0 |

| 64.0 |

COLM |

36.44 |

42.06 |

53.94 |

23.87 |

Consumer Cyclical |

Apparel Manufacturing |

53 |

28.42 |

16.61 |

79.22 |

74.6 |

10.0 |

201.0 |

83.68 |

1.0 |

1.0 |

| 65.0 |

LFUS |

35.49 |

33.68 |

33.82 |

28.06 |

Technology |

Electronic Components |

51 |

31.95 |

4.26 |

75.08 |

93.48 |

17.0 |

275.0 |

259.72 |

1.0 |

1.0 |

| 66.0 |

VRSK |

35.33 |

37.71 |

49.58 |

58.2 |

Industrials |

Consulting Services |

74 |

54.8 |

50.91 |

19.71 |

94.34 |

4.0 |

260.0 |

268.75 |

1.0 |

1.0 |

| 67.0 |

MMD |

35.24 |

32.51 |

38.02 |

28.47 |

Financial |

Closed-End Fund - Debt |

98 |

39.34 |

74.71 |

30.05 |

32.08 |

96.0 |

600.0 |

16.79 |

1.0 |

1.0 |

| 68.0 |

PG |

35.09 |

43.92 |

56.33 |

41.76 |

Consumer Defensive |

Household and Personal Products |

134 |

0.0 |

0.0 |

52.56 |

0.0 |

8.0 |

65.0 |

172.02 |

1.0 |

1.0 |

| 69.0 |

SOR |

34.81 |

40.07 |

51.39 |

54.84 |

Financial |

Closed-End Fund - Equity |

82 |

94.8 |

82.96 |

46.88 |

65.09 |

60.0 |

603.0 |

44.17 |

1.0 |

1.0 |

| 70.0 |

ARCC |

33.8 |

34.38 |

39.89 |

56.07 |

Financial |

Asset Management |

70 |

80.97 |

88.57 |

35.62 |

43.28 |

49.0 |

611.0 |

21.63 |

1.0 |

1.0 |

| 71.0 |

FTS |

33.49 |

49.28 |

50.84 |

22.94 |

Utilities |

Utilities - Regulated Electric |

60 |

36.74 |

29.96 |

27.88 |

55.89 |

31.0 |

62.0 |

45.12 |

1.0 |

1.0 |

| 72.0 |

WABC |

33.4 |

39.98 |

51.24 |

62.12 |

Financial |

Banks - Regional |

24 |

48.19 |

41.22 |

50.73 |

64.36 |

220.0 |

615.0 |

52.45 |

1.0 |

1.0 |

| 73.0 |

AON |

32.82 |

31.11 |

39.61 |

29.3 |

Financial |

Insurance Brokers |

15 |

40.73 |

48.37 |

24.76 |

96.2 |

11.0 |

622.0 |

357.75 |

1.0 |

1.0 |

| 74.0 |

GLPI |

32.6 |

40.16 |

42.37 |

19.15 |

Real Estate |

REIT - Specialty |

45 |

44.32 |

33.04 |

58.13 |

63.74 |

10.0 |

125.0 |

51.09 |

1.0 |

1.0 |

| 75.0 |

CPZ |

32.54 |

33.09 |

36.3 |

38.37 |

Financial |

Closed-End Fund - Equity |

82 |

0.0 |

0.0 |

62.88 |

0.0 |

64.0 |

626.0 |

15.61 |

1.0 |

1.0 |

| 76.0 |

OGS |

32.48 |

34.99 |

26.8 |

16.28 |

Utilities |

Utilities - Regulated Gas |

113 |

17.84 |

31.82 |

69.64 |

71.19 |

9.0 |

65.0 |

74.43 |

1.0 |

1.0 |

| 77.0 |

NJR |

32.05 |

42.85 |

44.92 |

18.13 |

Utilities |

Utilities - Regulated Gas |

113 |

23.66 |

15.2 |

35.62 |

54.99 |

10.0 |

67.0 |

47.04 |

1.0 |

1.0 |

| 78.0 |

BCSF |

31.44 |

34.04 |

42.19 |

78.0 |

Financial |

Asset Management |

70 |

82.46 |

80.1 |

22.73 |

35.42 |

52.0 |

631.0 |

16.7 |

1.0 |

1.0 |

| 79.0 |

KMT |

31.34 |

29.18 |

29.68 |

31.46 |

Industrials |

Tools and Accessories |

106 |

35.84 |

22.1 |

93.73 |

44.52 |

7.0 |

274.0 |

25.59 |

1.0 |

1.0 |

| 80.0 |

CII |

30.88 |

29.97 |

33.18 |

46.32 |

Financial |

Closed-End Fund - Equity |

82 |

90.31 |

74.75 |

73.38 |

42.97 |

67.0 |

634.0 |

19.82 |

1.0 |

1.0 |

| 81.0 |

IDA |

30.36 |

35.91 |

44.83 |

18.72 |

Utilities |

Utilities - Regulated Electric |

60 |

31.36 |

27.91 |

9.62 |

74.77 |

33.0 |

70.0 |

104.58 |

1.0 |

1.0 |

| 82.0 |

ABR |

29.96 |

35.54 |

20.66 |

64.95 |

Real Estate |

REIT - Mortgage |

114 |

0.0 |

0.0 |

87.59 |

0.0 |

17.0 |

137.0 |

15.2 |

1.0 |

1.0 |

| 83.0 |

LAUR |

28.98 |

45.21 |

41.49 |

58.97 |

Consumer Defensive |

Education and Training Services |

126 |

97.49 |

82.22 |

22.73 |

34.7 |

10.0 |

80.0 |

15.71 |

1.0 |

1.0 |

| 84.0 |

NOC |

28.55 |

47.32 |

66.11 |

39.79 |

Industrials |

Aerospace and Defense |

31 |

41.04 |

20.56 |

35.62 |

97.96 |

29.0 |

286.0 |

528.89 |

1.0 |

1.0 |

| 85.0 |

PEP |

27.76 |

24.96 |

34.03 |

27.82 |

Consumer Defensive |

Beverages - Non-Alcoholic |

97 |

45.25 |

61.88 |

50.73 |

90.48 |

11.0 |

82.0 |

175.0 |

1.0 |

1.0 |

| 86.0 |

XOM |

27.63 |

24.68 |

32.35 |

42.53 |

Energy |

Oil and Gas Integrated |

127 |

71.75 |

8.05 |

28.5 |

81.21 |

6.0 |

64.0 |

119.37 |

1.0 |

1.0 |

| 87.0 |

DE |

27.17 |

34.93 |

30.48 |

45.12 |

Industrials |

Farm and Heavy Construction Machinery |

130 |

64.76 |

46.61 |

79.22 |

98.03 |

12.0 |

293.0 |

405.82 |

1.0 |

1.0 |

| 88.0 |

YORW |

25.85 |

26.24 |

28.61 |

16.77 |

Utilities |

Utilities - Regulated Water |

81 |

0.0 |

0.0 |

19.71 |

0.0 |

7.0 |

73.0 |

37.95 |

1.0 |

1.0 |

| 89.0 |

EXC |

25.0 |

32.18 |

29.43 |

21.03 |

Utilities |

Utilities - Regulated Electric |

60 |

50.13 |

56.4 |

75.08 |

61.54 |

35.0 |

75.0 |

40.87 |

1.0 |

1.0 |

| 90.0 |

NWN |

24.75 |

31.72 |

31.52 |

15.45 |

Utilities |

Utilities - Regulated Gas |

113 |

8.9 |

17.29 |

45.97 |

50.37 |

12.0 |

76.0 |

40.5 |

1.0 |

1.0 |

| 91.0 |

AMED |

24.44 |

26.06 |

39.83 |

59.87 |

Healthcare |

Medical Care Facilities |

39 |

18.55 |

23.58 |

27.88 |

72.5 |

22.0 |

344.0 |

97.42 |

1.0 |

1.0 |

| 92.0 |

BKR |

23.65 |

27.68 |

25.2 |

52.22 |

Energy |

Oil and Gas Equipment and Services |

136 |

81.1 |

86.01 |

27.22 |

59.16 |

10.0 |

72.0 |

36.25 |

1.0 |

1.0 |

| 93.0 |

CHSCL |

23.19 |

26.61 |

34.25 |

35.28 |

Consumer Defensive |

Farm Products |

65 |

0.0 |

10.77 |

44.56 |

0.0 |

8.0 |

92.0 |

26.22 |

1.0 |

1.0 |

| 94.0 |

VTS |

21.44 |

32.24 |

34.37 |

70.08 |

Energy |

Oil and Gas EandP |

141 |

43.92 |

17.26 |

47.97 |

40.79 |

13.0 |

80.0 |

24.9 |

1.0 |

1.0 |

| 95.0 |

TXNM |

19.57 |

24.04 |

26.58 |

12.64 |

Utilities |

Utilities - Regulated Electric |

60 |

8.22 |

0.0 |

92.41 |

0.0 |

37.0 |

81.0 |

43.91 |

1.0 |

1.0 |

| 96.0 |

PFE |

16.93 |

13.91 |

21.12 |

8.26 |

Healthcare |

Drug Manufacturers - General |

86 |

27.62 |

4.49 |

44.56 |

41.31 |

13.0 |

371.0 |

29.14 |

1.0 |

1.0 |

| 97.0 |

FNV |

16.28 |

19.6 |

20.3 |

13.97 |

Basic Materials |

Gold |

13 |

9.92 |

9.27 |

35.62 |

77.56 |

27.0 |

136.0 |

130.0 |

1.0 |

1.0 |

| Pos. | |

Name | |

RS Today | |

RS 3Wk | |

RS 6Wk | |

RS 26wk | |

Secotr | |

Industry | |

Pos Ind | |

EPS | |

SMR | |

A/C | |

CR | |

Ind Pos. | |

Sec Pos. | |

Close. | |

10wk | |

26wk | |

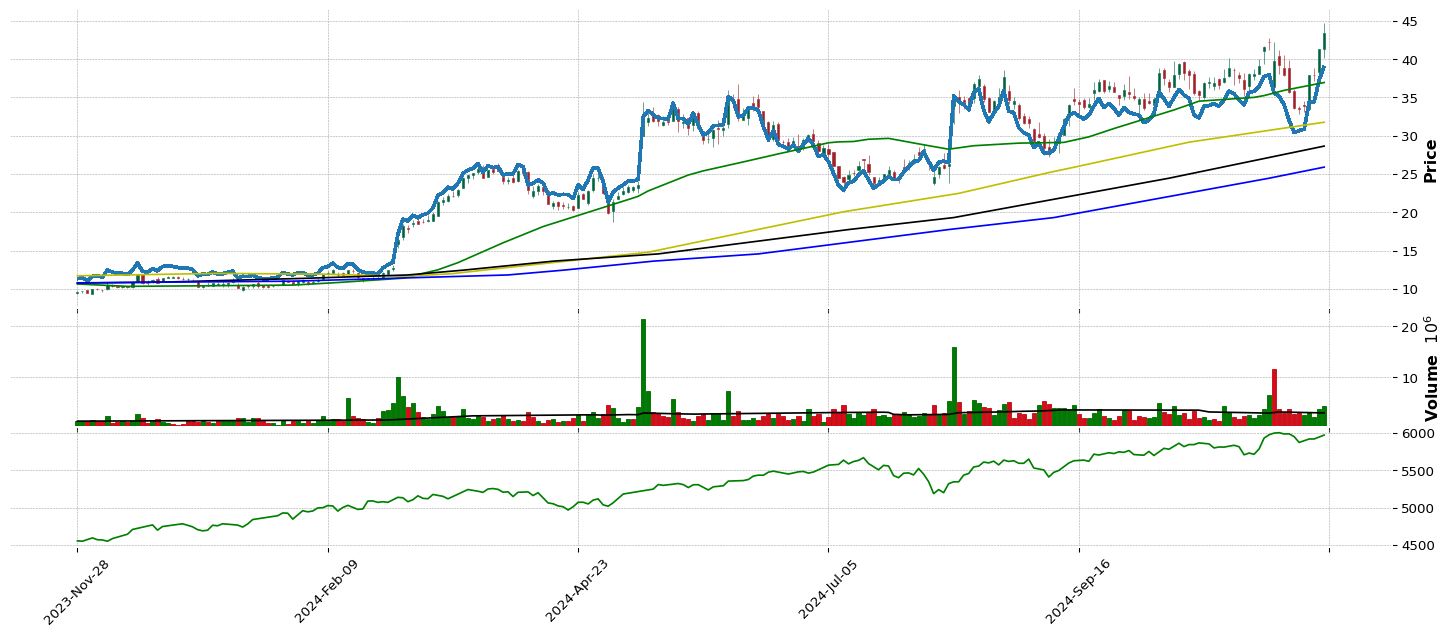

| 1.0 |

SEZL |

100.0 |

100.0 |

0.0 |

0.0 |

Financial |

Credit Services |

32 |

94.86 |

86.39 |

92.41 |

73.7 |

1.0 |

1.0 |

219.3 |

1.0 |

1.0 |

| 2.0 |

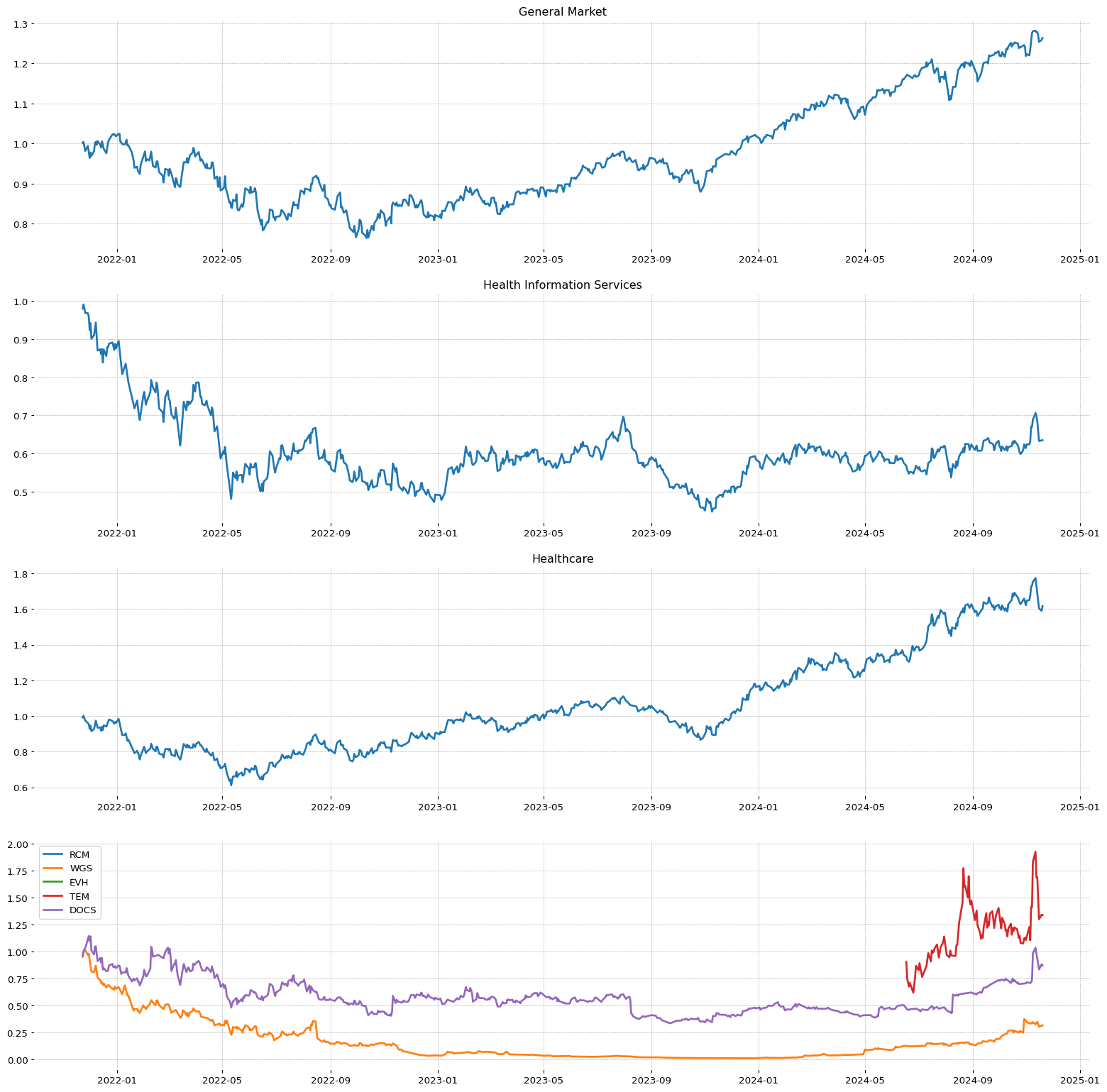

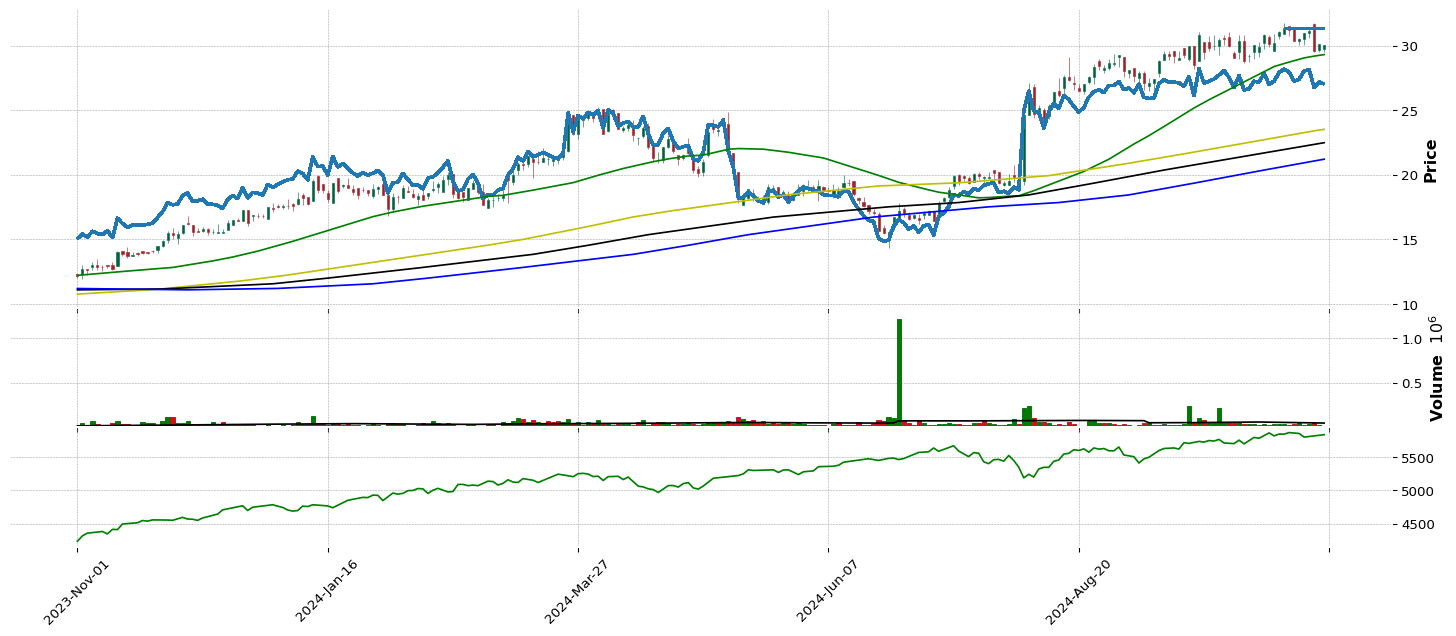

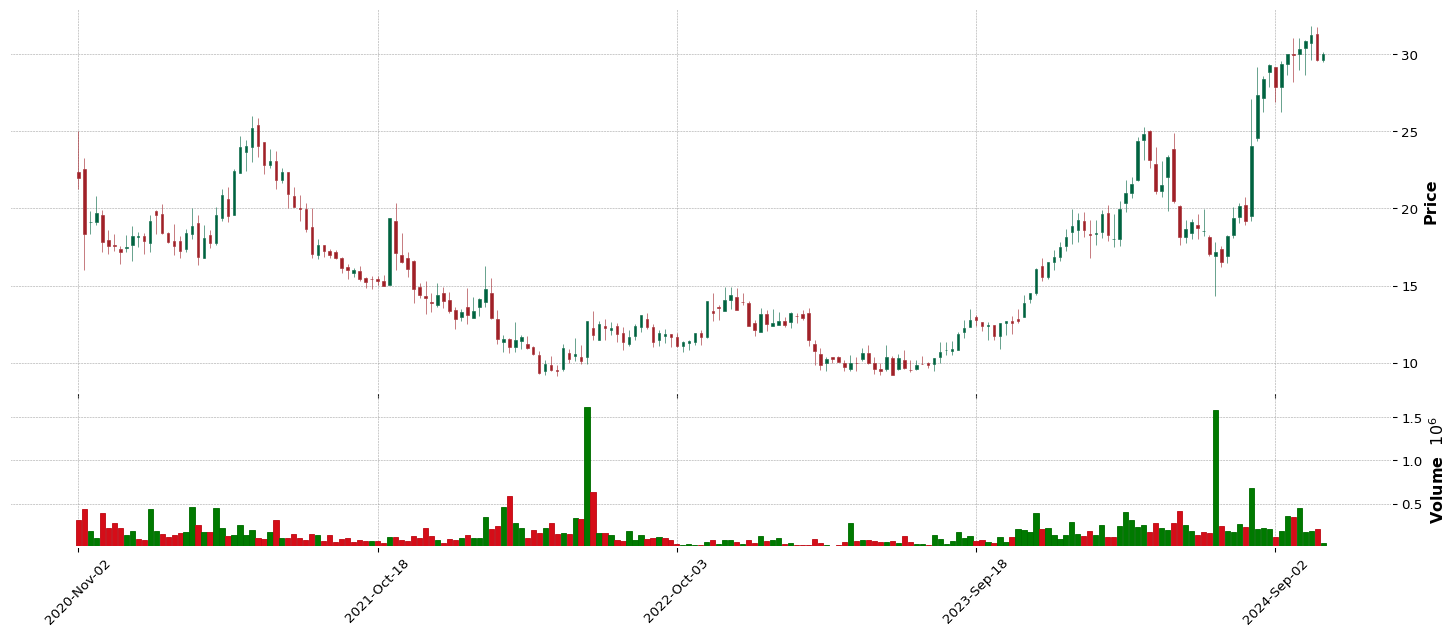

WGS |

99.96 |

99.93 |

99.93 |

44.13 |

Healthcare |

Health Information Services |

72 |

97.33 |

96.88 |

88.88 |

40.24 |

1.0 |

1.0 |

59.11 |

1.0 |

1.0 |

| 3.0 |

LBPH |

99.93 |

99.81 |

99.84 |

97.43 |

Healthcare |

Biotechnology |

14 |

0.0 |

0.0 |

60.01 |

0.0 |

1.0 |

2.0 |

59.27 |

1.0 |

1.0 |

| 4.0 |

RNA |

99.84 |

99.9 |

99.87 |

80.66 |

Healthcare |

Biotechnology |

14 |

11.72 |

35.8 |

74.04 |

36.49 |

3.0 |

4.0 |

49.61 |

1.0 |

1.0 |

| 5.0 |

CVNA |

99.69 |

99.54 |

98.43 |

99.9 |

Consumer Cyclical |

Auto & Truck Dealerships |

20 |

77.54 |

76.45 |

99.02 |

83.04 |

1.0 |

1.0 |

191.6 |

1.0 |

1.0 |

| 6.0 |

NRIX |

99.63 |

98.47 |

98.25 |

74.58 |

Healthcare |

Biotechnology |

14 |

8.72 |

52.87 |

17.31 |

21.88 |

8.0 |

9.0 |

25.37 |

1.0 |

1.0 |

| 7.0 |

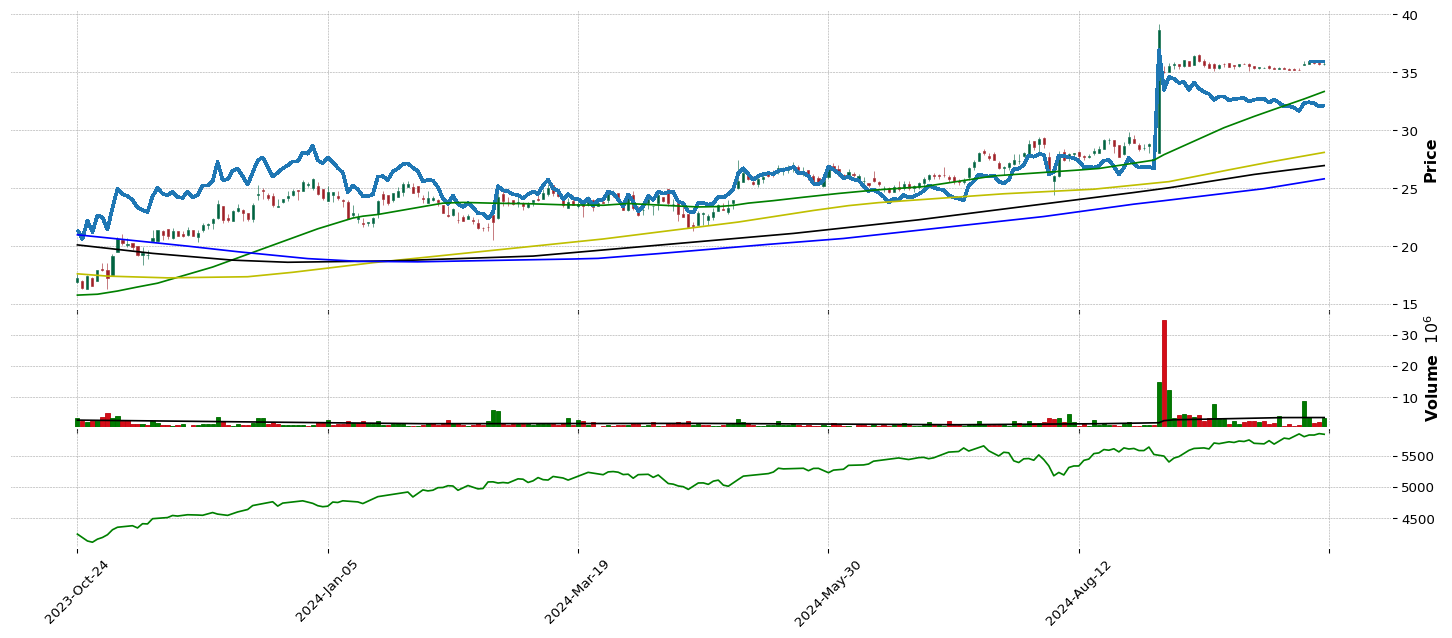

SMR |

99.6 |

95.16 |

65.13 |

5.15 |

Industrials |

Specialty Industrial Machinery |

66 |

6.55 |

11.22 |

79.22 |

18.29 |

1.0 |

1.0 |

18.57 |

1.0 |

1.0 |

| 8.0 |

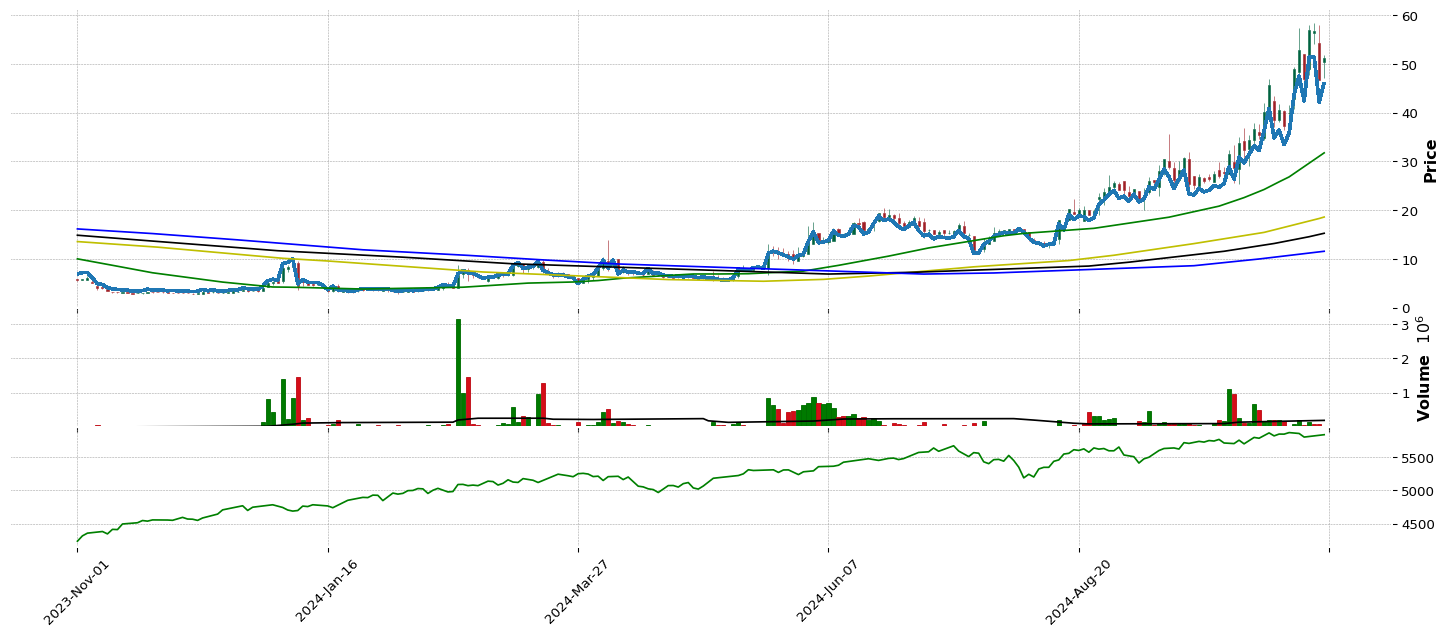

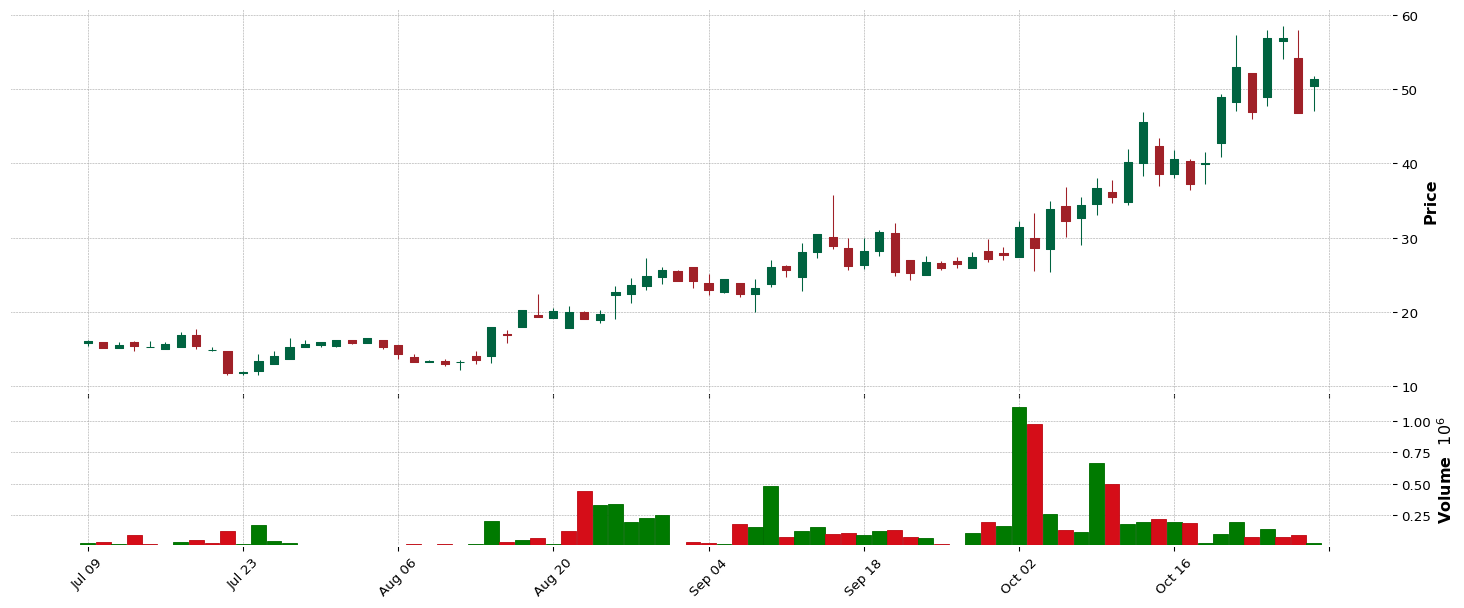

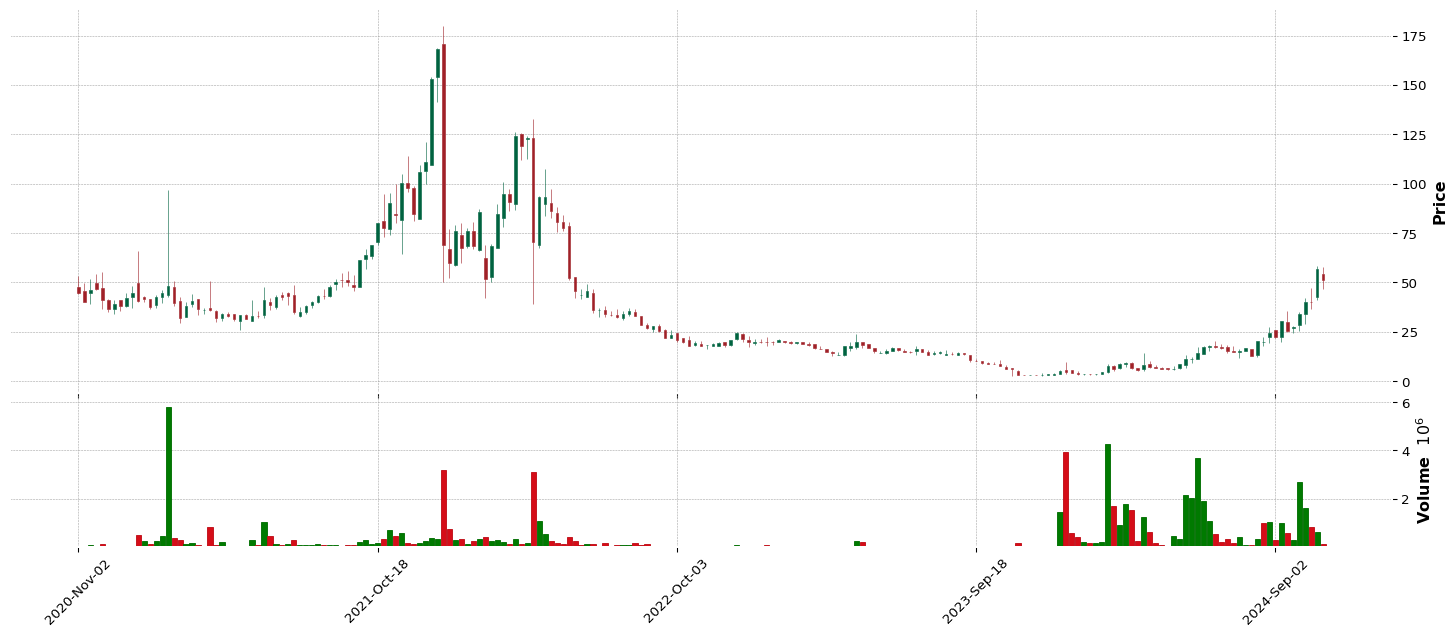

DOGZ |

99.53 |

97.88 |

96.71 |

1.54 |

Consumer Cyclical |

Leisure |

4 |

45.8 |

0.28 |

76.44 |

37.28 |

1.0 |

2.0 |

37.72 |

1.0 |

1.0 |

| 9.0 |

EWTX |

99.5 |

99.57 |

98.49 |

94.17 |

Healthcare |

Biotechnology |

14 |

9.68 |

0.0 |

93.73 |

0.0 |

10.0 |

11.0 |

35.16 |

1.0 |

1.0 |

| 10.0 |

TREE |

99.44 |

99.26 |

99.35 |

87.16 |

Financial |

Financial Conglomerates |

12 |

68.11 |

40.48 |

87.59 |

55.09 |

1.0 |

2.0 |

60.0 |

1.0 |

1.0 |

| 11.0 |

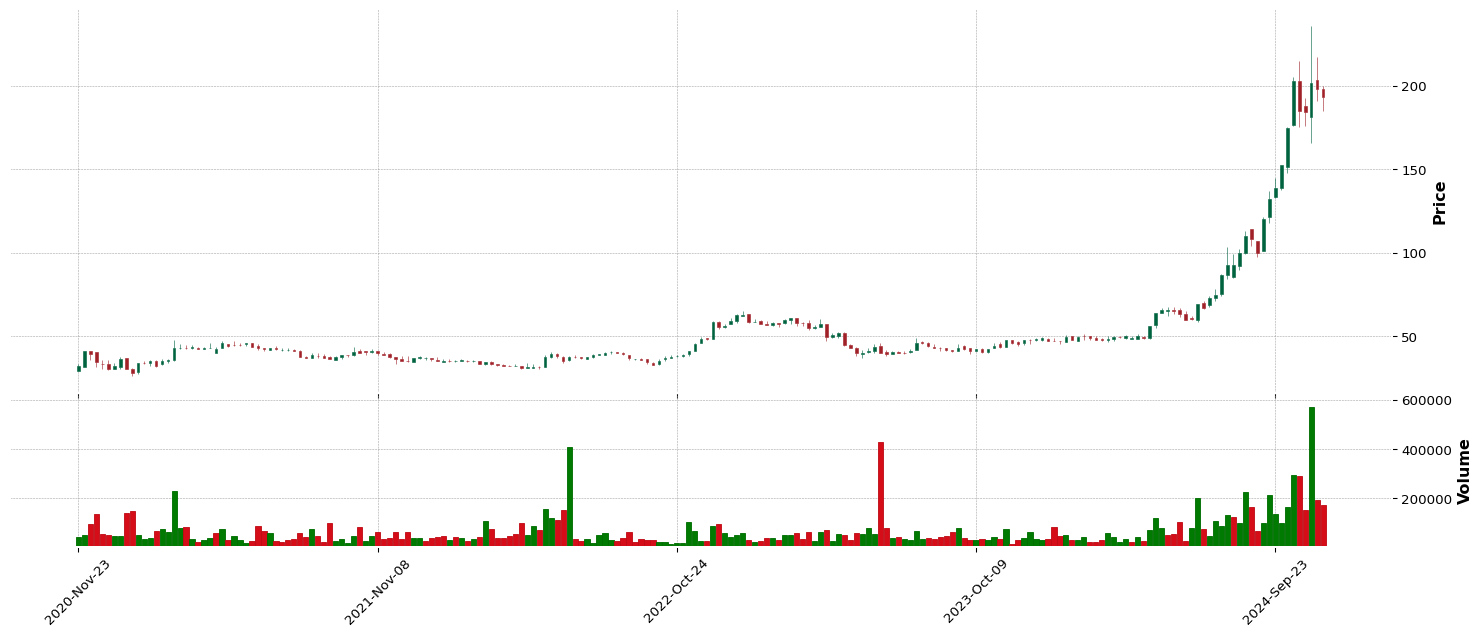

WLFC |

99.41 |

98.99 |

98.16 |

35.22 |

Industrials |

Rental & Leasing Services |

34 |

98.51 |

97.52 |

90.34 |

86.73 |

1.0 |

2.0 |

202.5 |

1.0 |

1.0 |

| 12.0 |

SPRY |

99.32 |

99.02 |

88.74 |

68.69 |

Healthcare |

Biotechnology |

14 |

26.35 |

58.29 |

49.29 |

15.81 |

13.0 |

14.0 |

16.2 |

1.0 |

1.0 |

| 13.0 |

PI |

99.17 |

99.38 |

98.55 |

22.85 |

Technology |

Communication Equipment |

1 |

72.9 |

66.37 |

98.1 |

88.52 |

2.0 |

3.0 |

231.41 |

1.0 |

1.0 |

| 14.0 |

PRAX |

99.07 |

95.31 |

98.83 |

98.67 |

Healthcare |

Biotechnology |

14 |

87.78 |

0.0 |

82.4 |

0.0 |

16.0 |

20.0 |

73.61 |

1.0 |

1.0 |

| 15.0 |

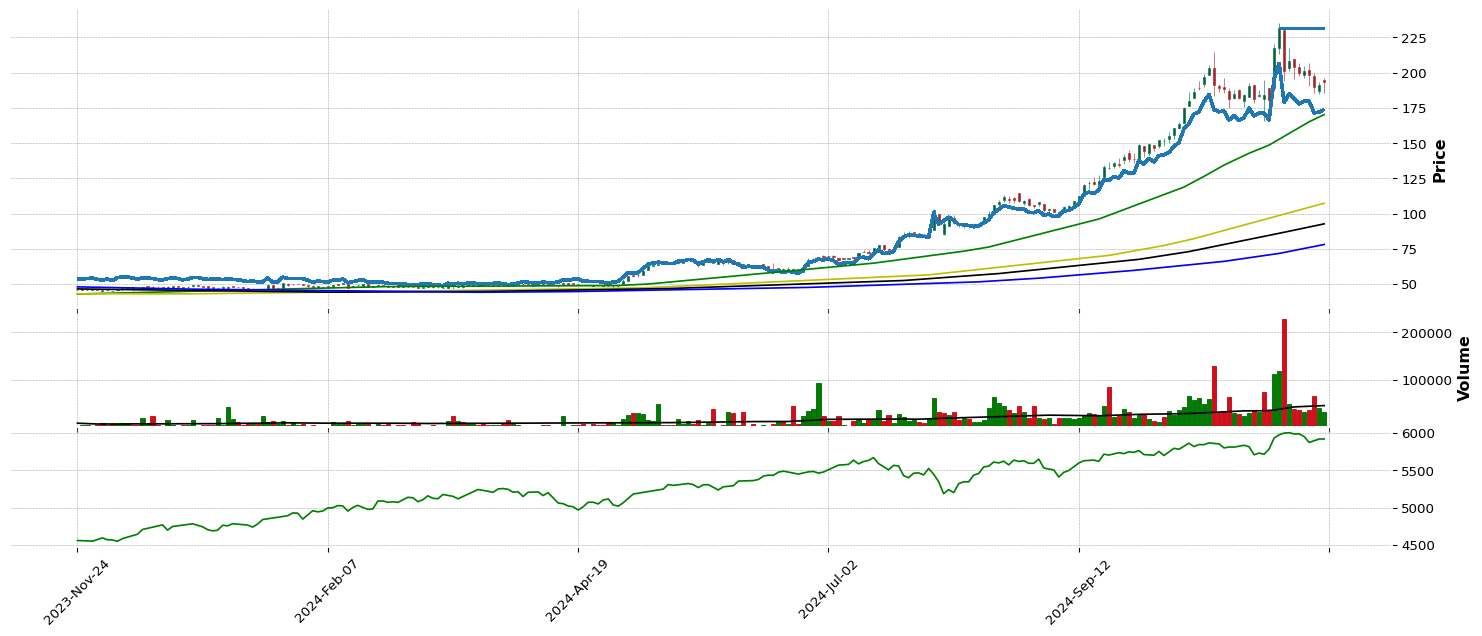

FTAI |

98.95 |

99.2 |

99.01 |

97.62 |

Industrials |

Rental & Leasing Services |

34 |

0.0 |

0.0 |

86.04 |

0.0 |

2.0 |

3.0 |

141.72 |

1.0 |

1.0 |

| 16.0 |

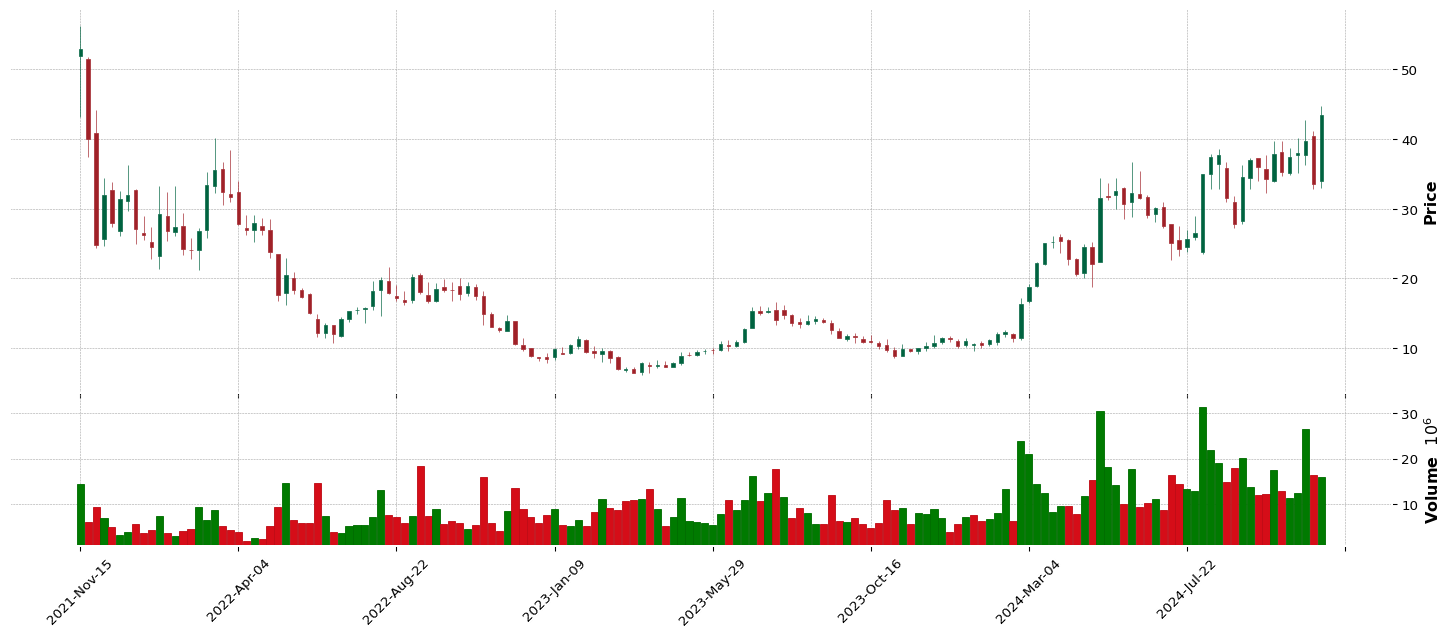

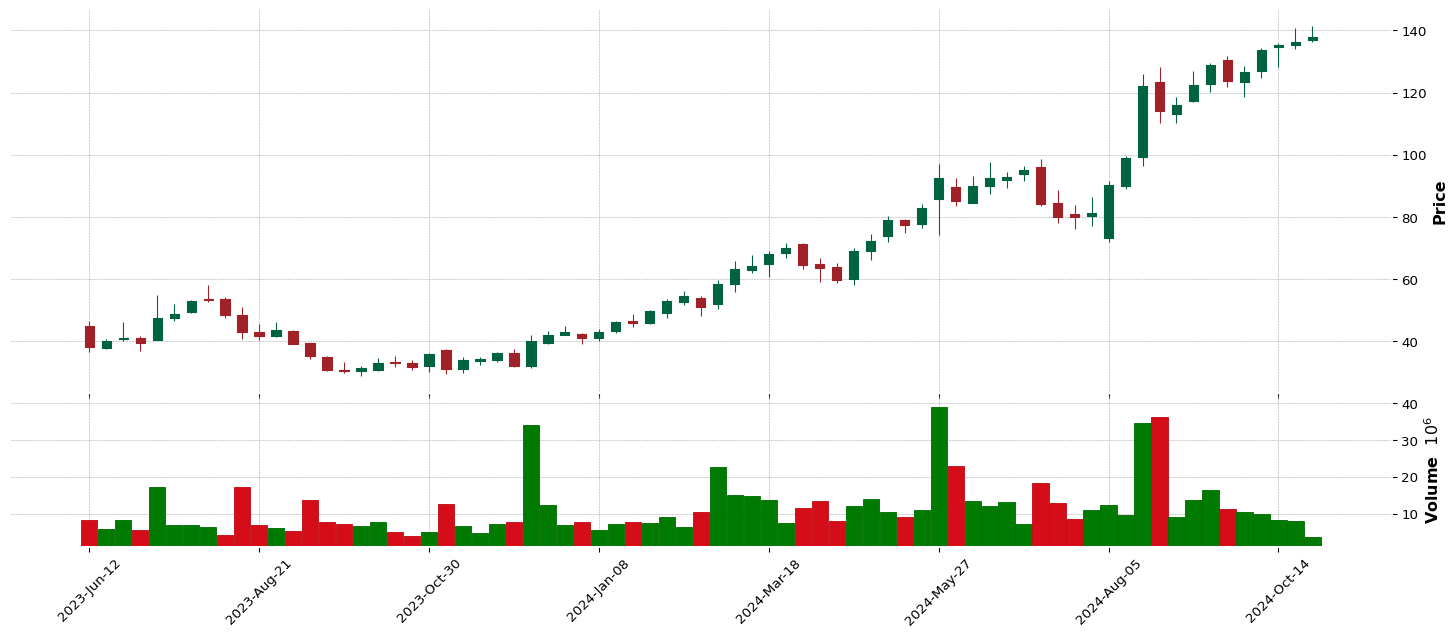

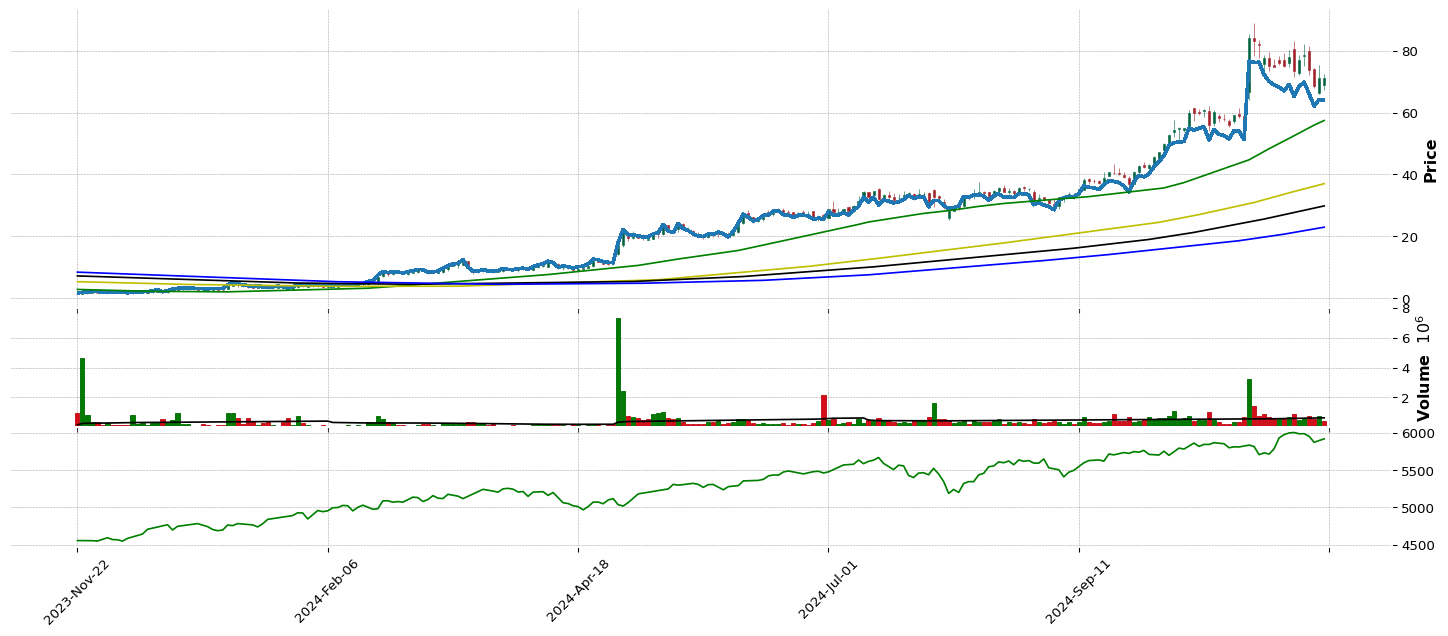

CAVA |

98.65 |

99.29 |

99.26 |

0.0 |

Consumer Cyclical |

Restaurants |

107 |

0.0 |

98.71 |

85.04 |

0.0 |

1.0 |

4.0 |

135.11 |

1.0 |

1.0 |

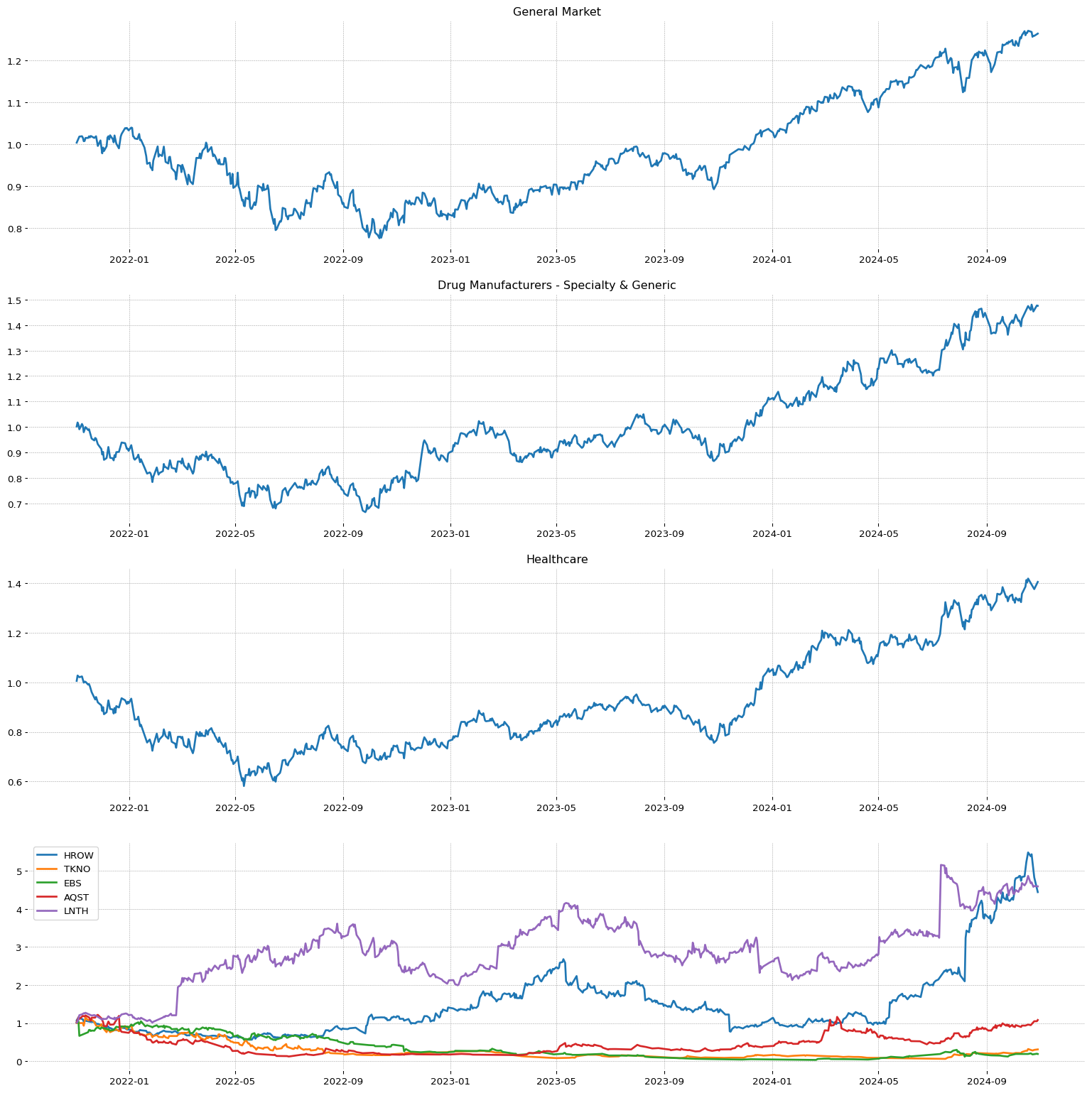

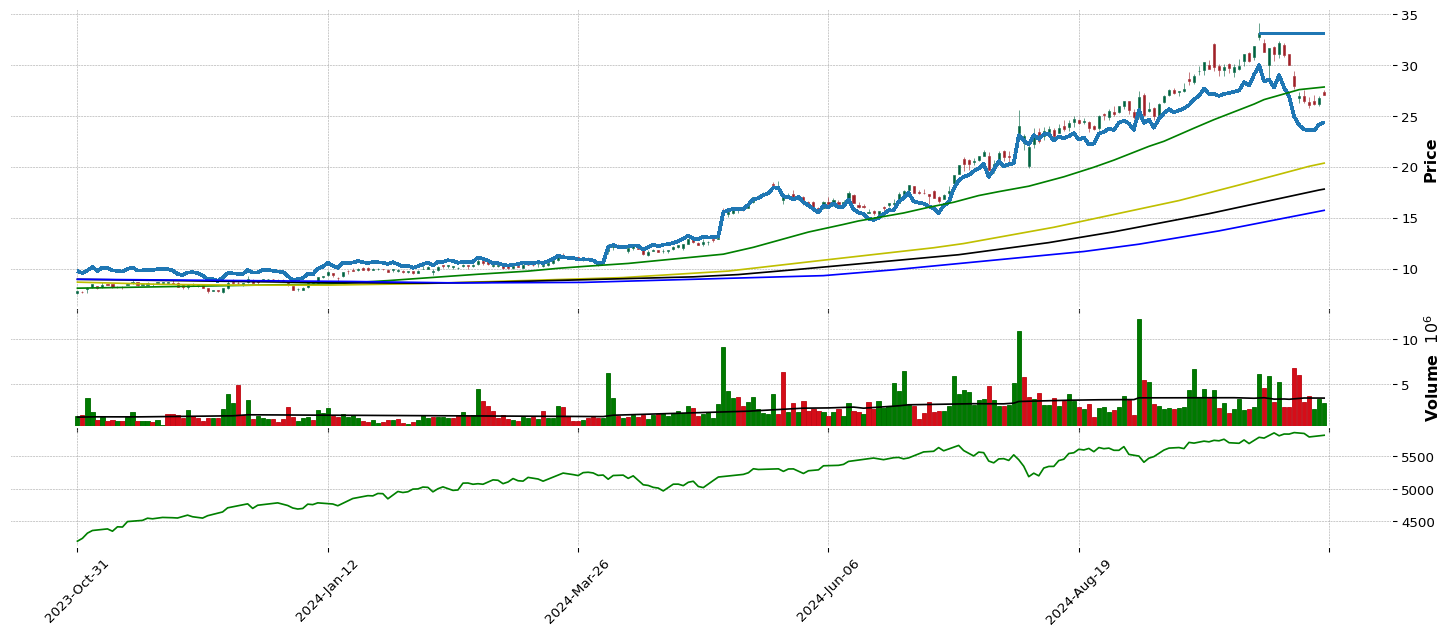

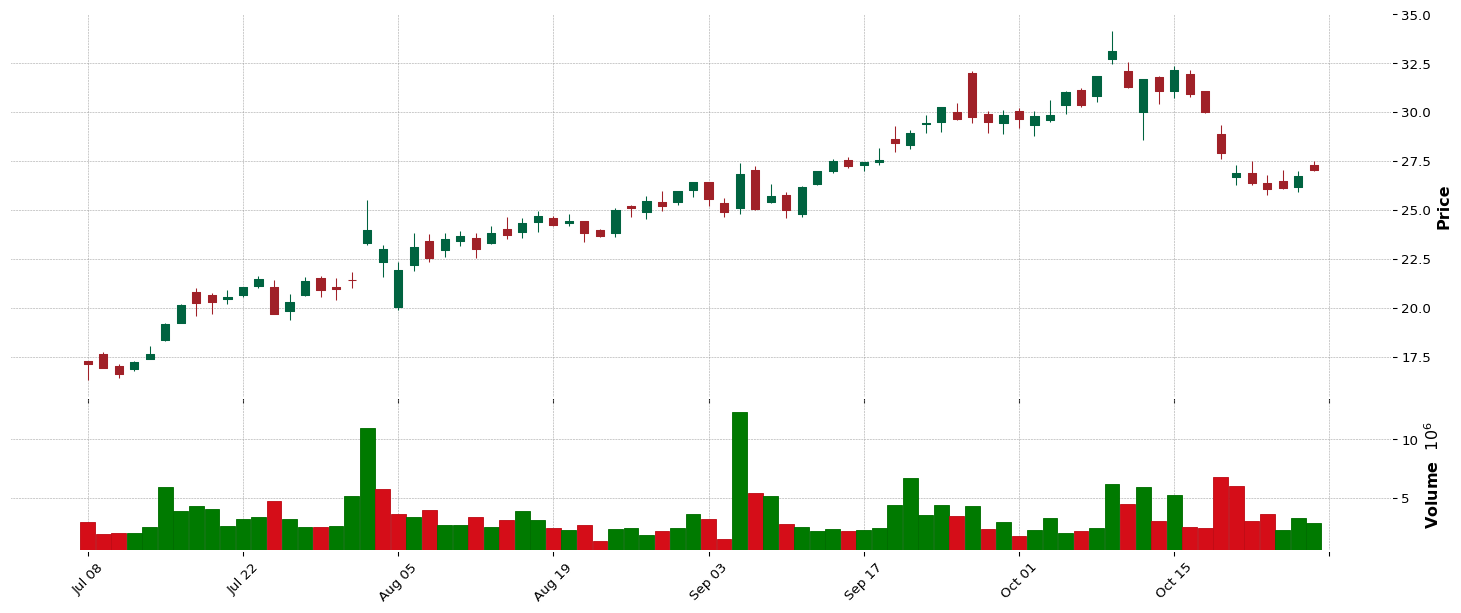

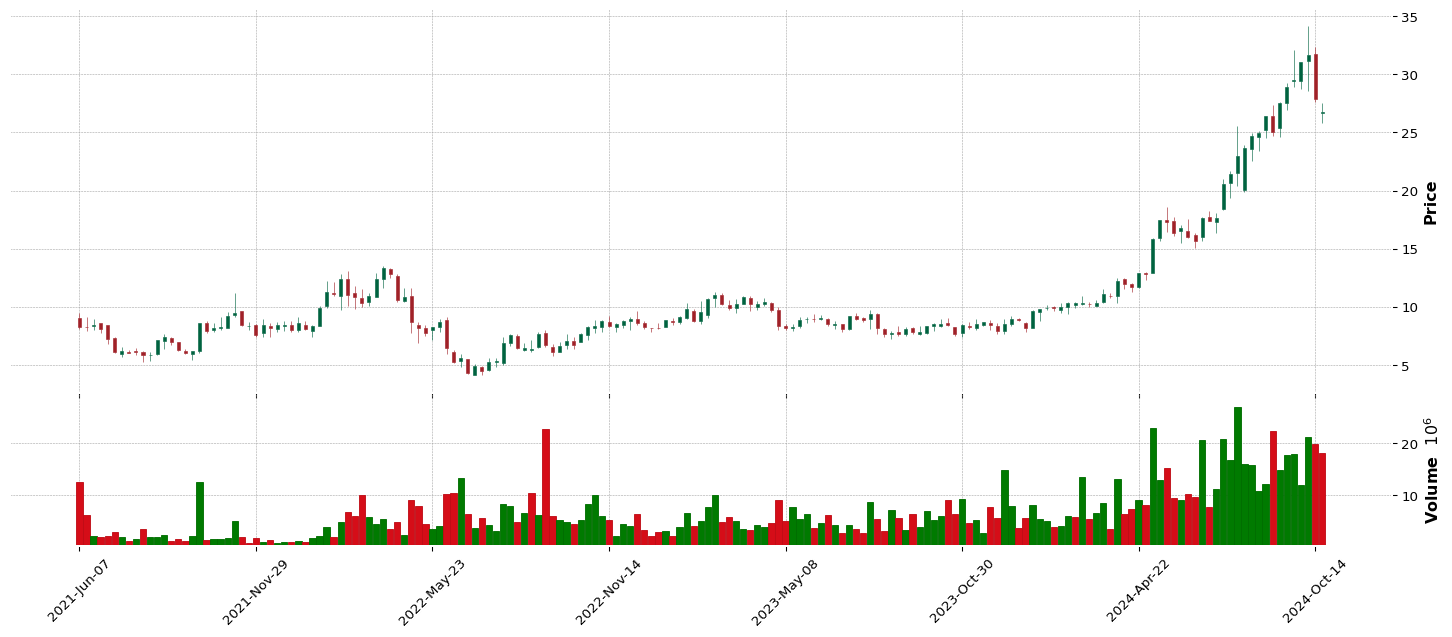

| 17.0 |

HROW |

98.61 |

98.5 |

97.73 |

2.49 |

Healthcare |

Drug Manufacturers - Specialty & Generic |

21 |

2.53 |

69.13 |

92.41 |

54.96 |

2.0 |

28.0 |

57.35 |

1.0 |

1.0 |

| 18.0 |

NGNE |

98.58 |

96.72 |

97.82 |

92.31 |

Healthcare |

Biotechnology |

14 |

0.46 |

0.0 |

85.04 |

0.0 |

19.0 |

29.0 |

53.4 |

1.0 |

1.0 |

| 19.0 |

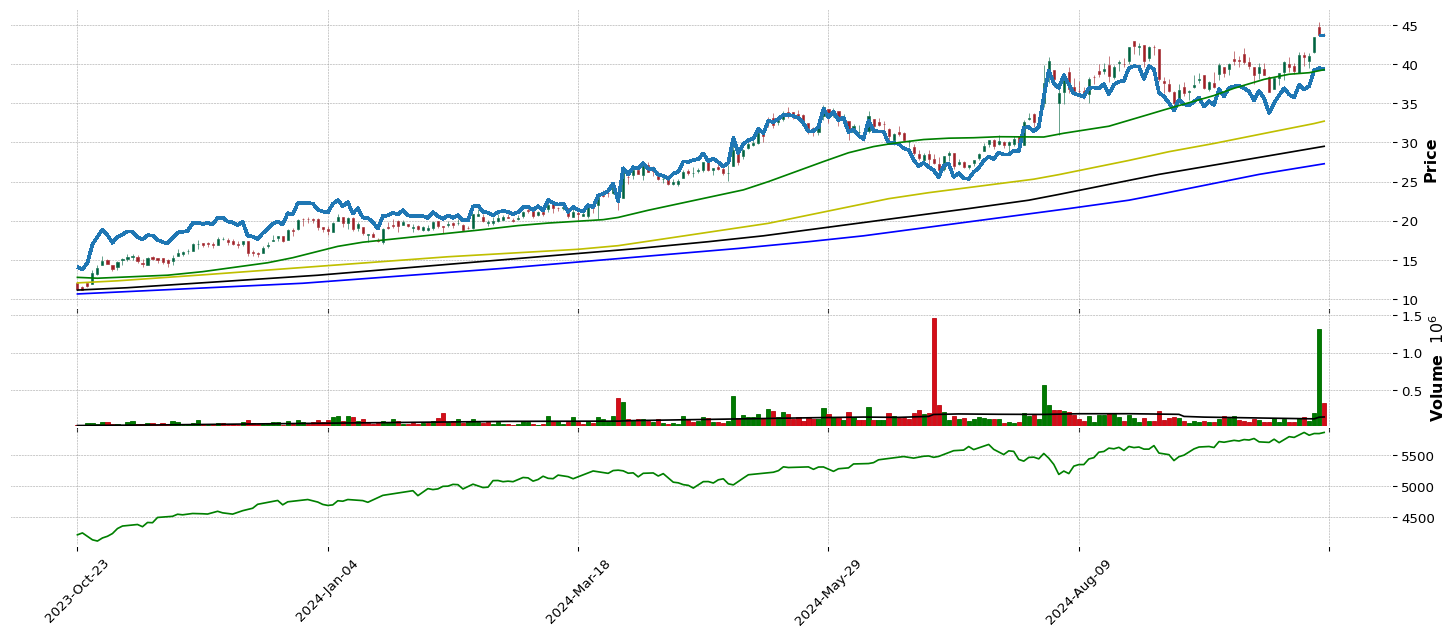

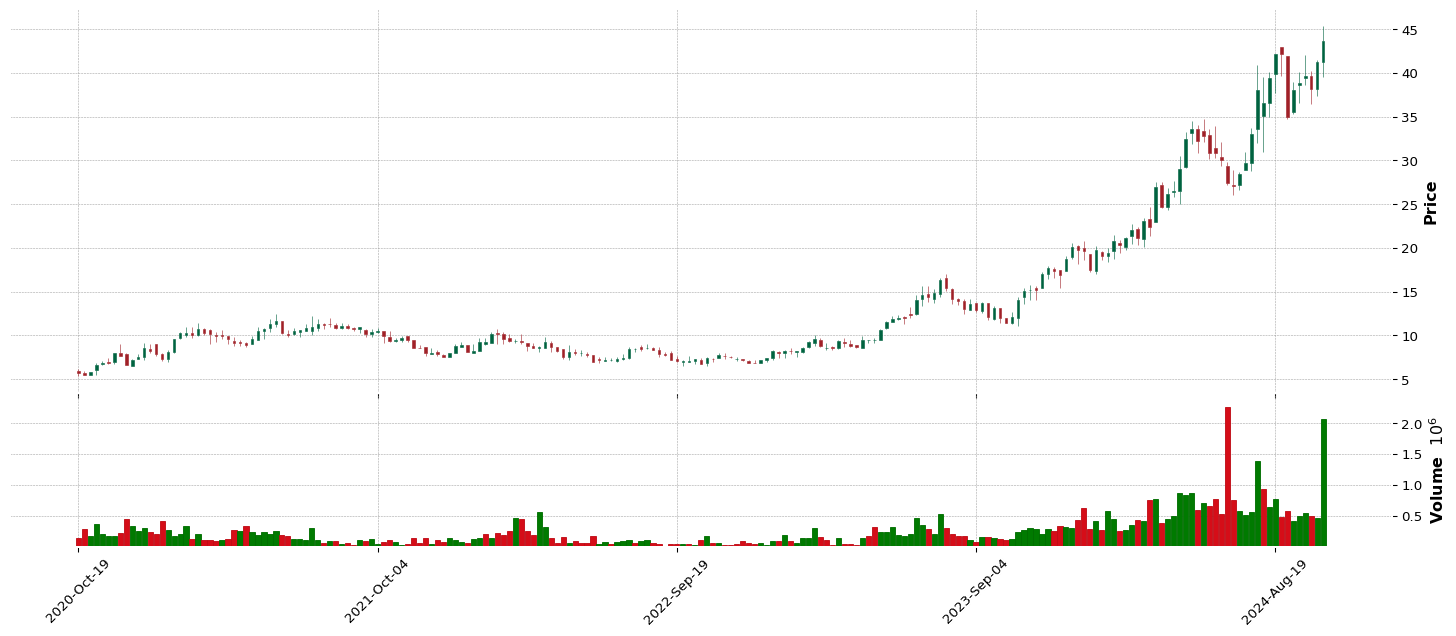

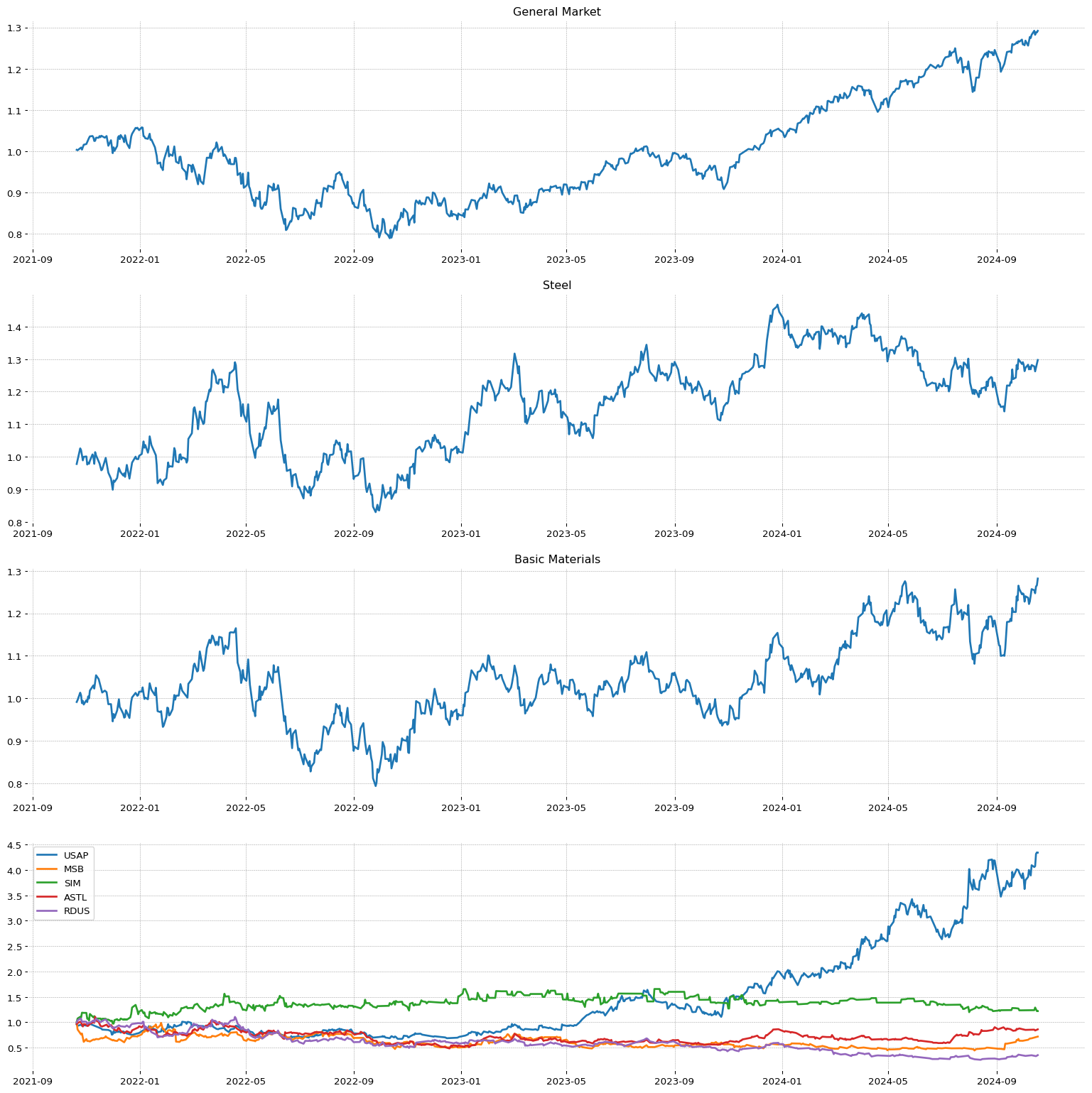

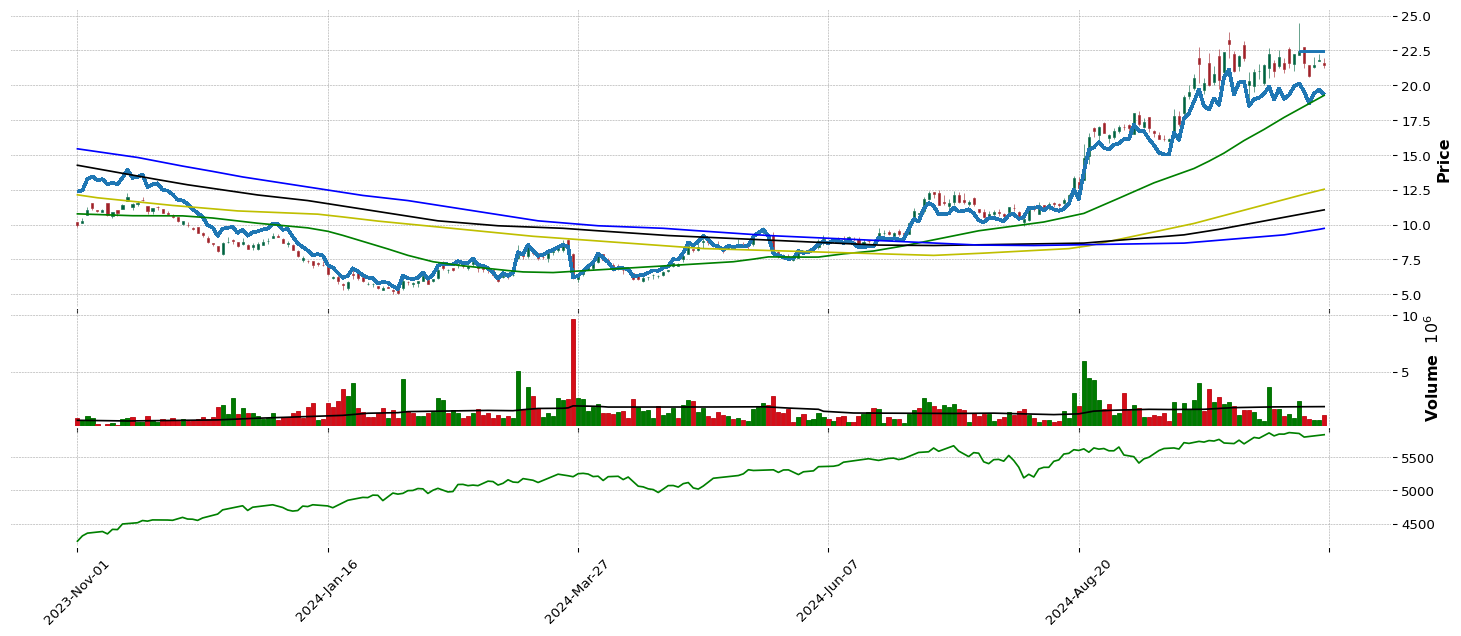

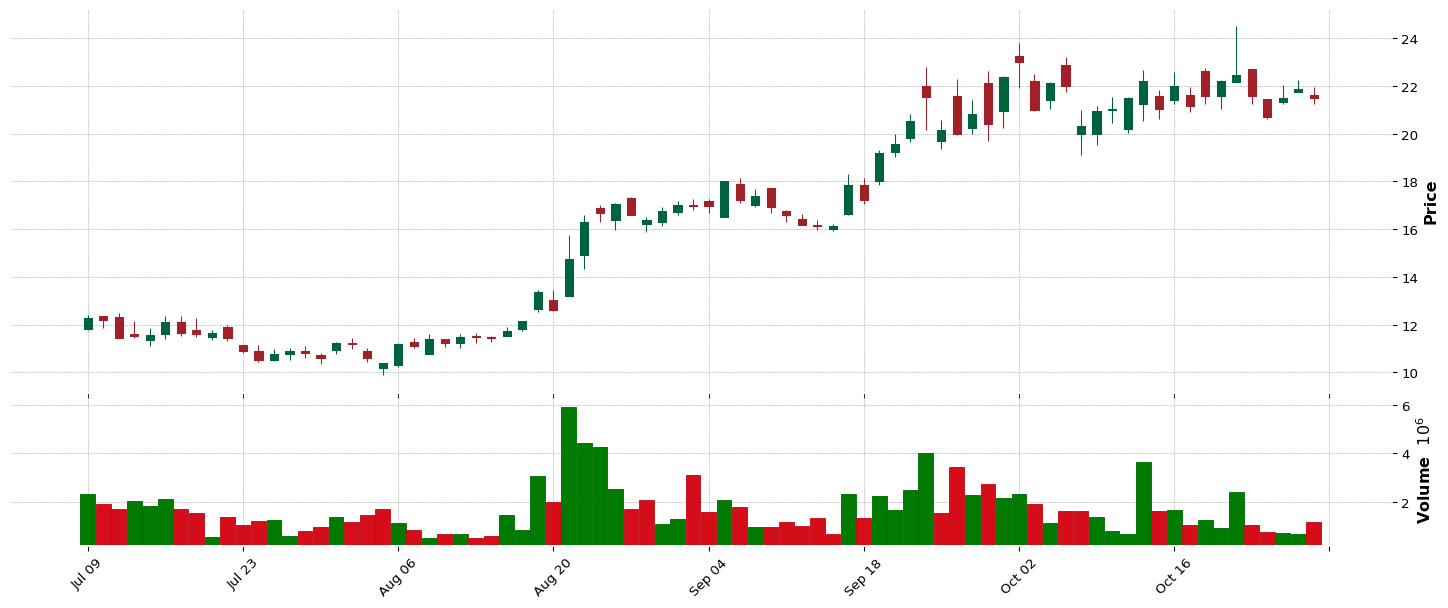

USAP |

98.46 |

98.34 |

98.92 |

98.73 |

Basic Materials |

Steel |

121 |

91.21 |

99.61 |

22.73 |

50.96 |

1.0 |

2.0 |

43.68 |

1.0 |

1.0 |

| 20.0 |

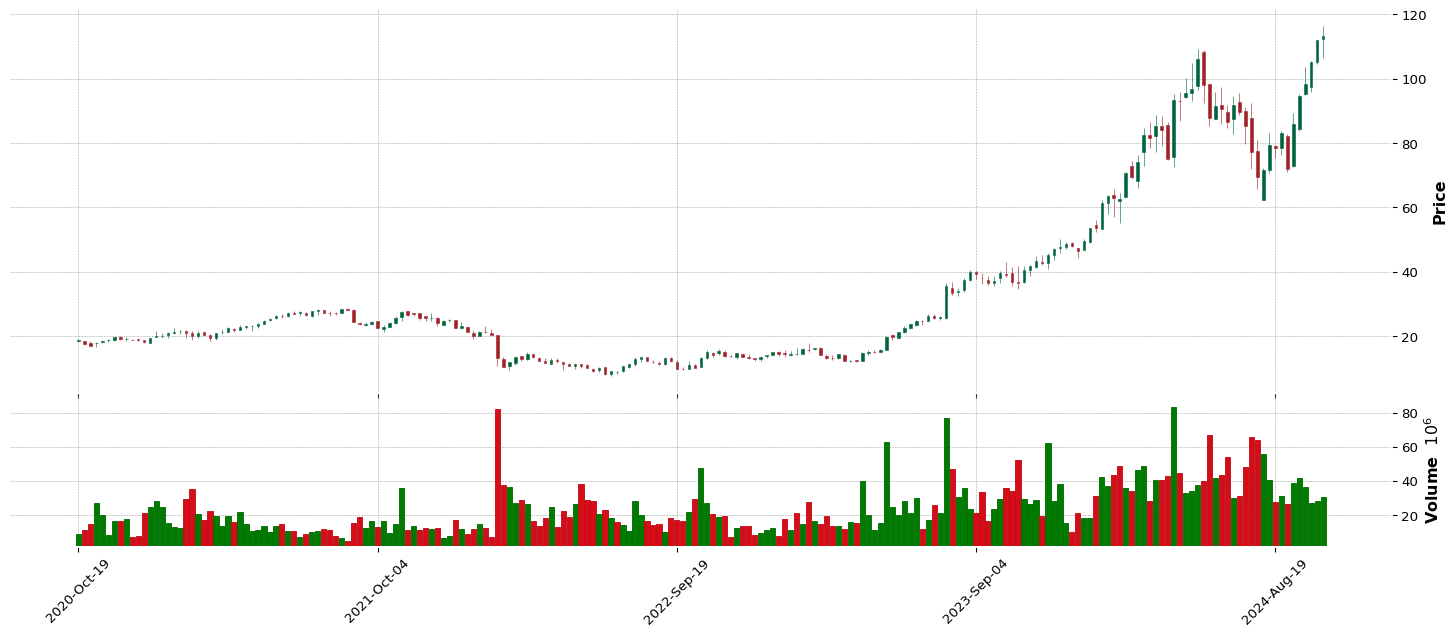

POWL |

98.28 |

97.33 |

94.38 |

99.01 |

Industrials |

Electrical Equipment & Parts |

8 |

99.35 |

100.0 |

92.41 |

92.93 |

1.0 |

6.0 |

276.01 |

1.0 |

1.0 |

| 21.0 |

TPC |

98.25 |

98.92 |

98.71 |

97.4 |

Industrials |

Engineering & Construction |

10 |

0.0 |

0.0 |

97.65 |

0.0 |

1.0 |

7.0 |

26.88 |

1.0 |

1.0 |

| 22.0 |

BMA |

98.22 |

98.77 |

98.58 |

98.48 |

Financial |

Banks - Regional |

24 |

84.93 |

92.01 |

57.1 |

65.19 |

3.0 |

7.0 |

70.61 |

1.0 |

1.0 |

| 23.0 |

IESC |

98.12 |

98.04 |

95.49 |

97.96 |

Industrials |

Engineering & Construction |

10 |

94.77 |

99.0 |

74.04 |

90.35 |

2.0 |

8.0 |

226.36 |

1.0 |

1.0 |

| 24.0 |

GATO |

97.94 |

98.25 |

96.41 |

85.65 |

Basic Materials |

Other Precious Metals & Mining |

27 |

93.53 |

21.88 |

87.59 |

25.05 |

1.0 |

3.0 |

17.62 |

1.0 |

1.0 |

| 25.0 |

PTGX |

97.66 |

97.43 |

97.63 |

56.41 |

Healthcare |

Biotechnology |

14 |

75.4 |

0.0 |

6.58 |

0.0 |

31.0 |

43.0 |

46.99 |

1.0 |

1.0 |

| 26.0 |

MOD |

97.54 |

98.01 |

96.74 |

99.38 |

Consumer Cyclical |

Auto Parts |

120 |

65.97 |

56.88 |

98.44 |

80.94 |

2.0 |

6.0 |

132.63 |

1.0 |

1.0 |

| 27.0 |

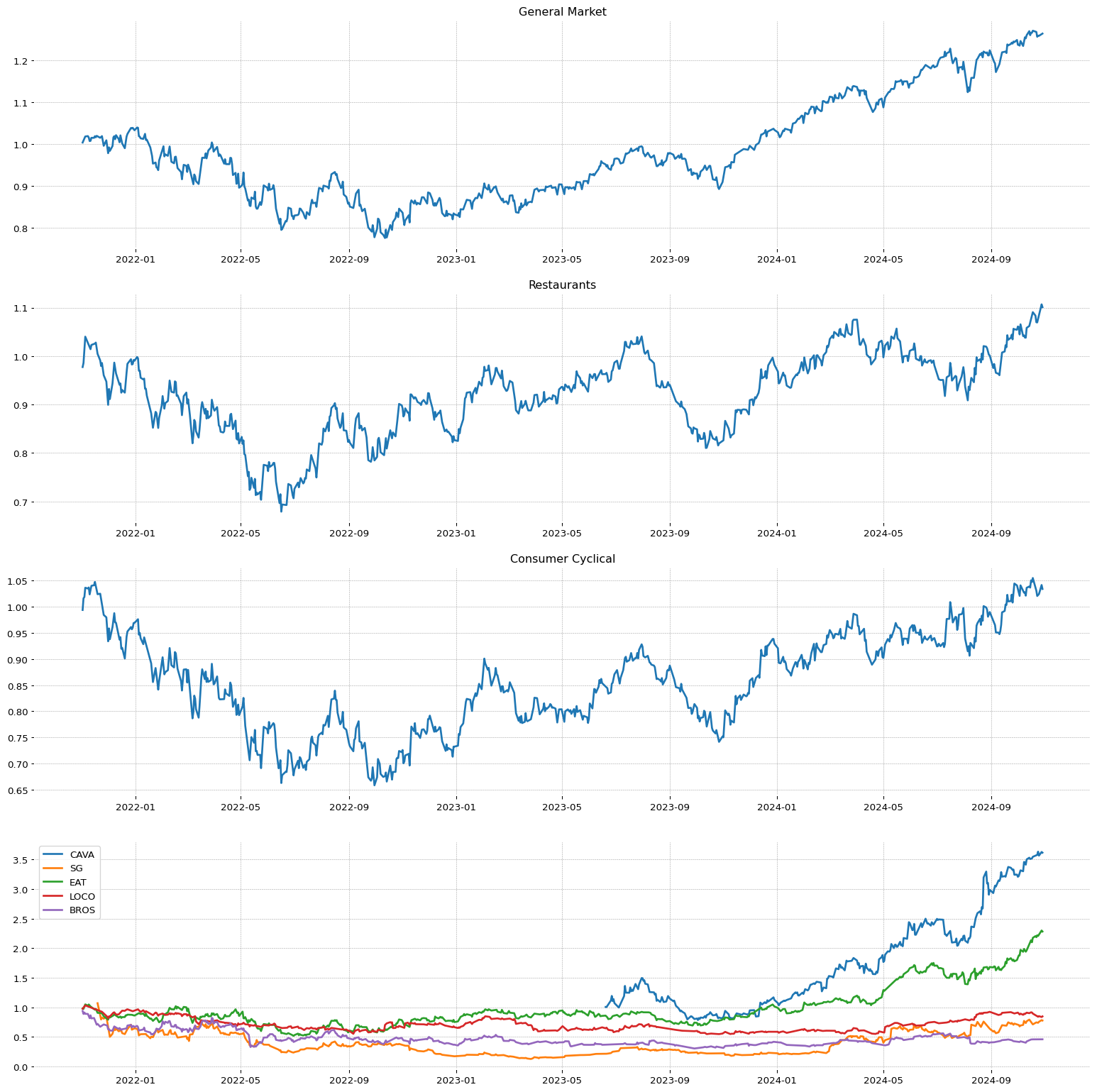

SG |

97.51 |

98.4 |

96.47 |

97.74 |

Consumer Cyclical |

Restaurants |

107 |

53.85 |

70.67 |

68.07 |

45.07 |

2.0 |

7.0 |

35.36 |

1.0 |

1.0 |

| 28.0 |

NVDA |

97.36 |

97.49 |

97.66 |

98.64 |

Technology |

Semiconductors |

80 |

98.76 |

99.9 |

6.58 |

80.84 |

1.0 |

8.0 |

137.85 |

1.0 |

1.0 |

| 29.0 |

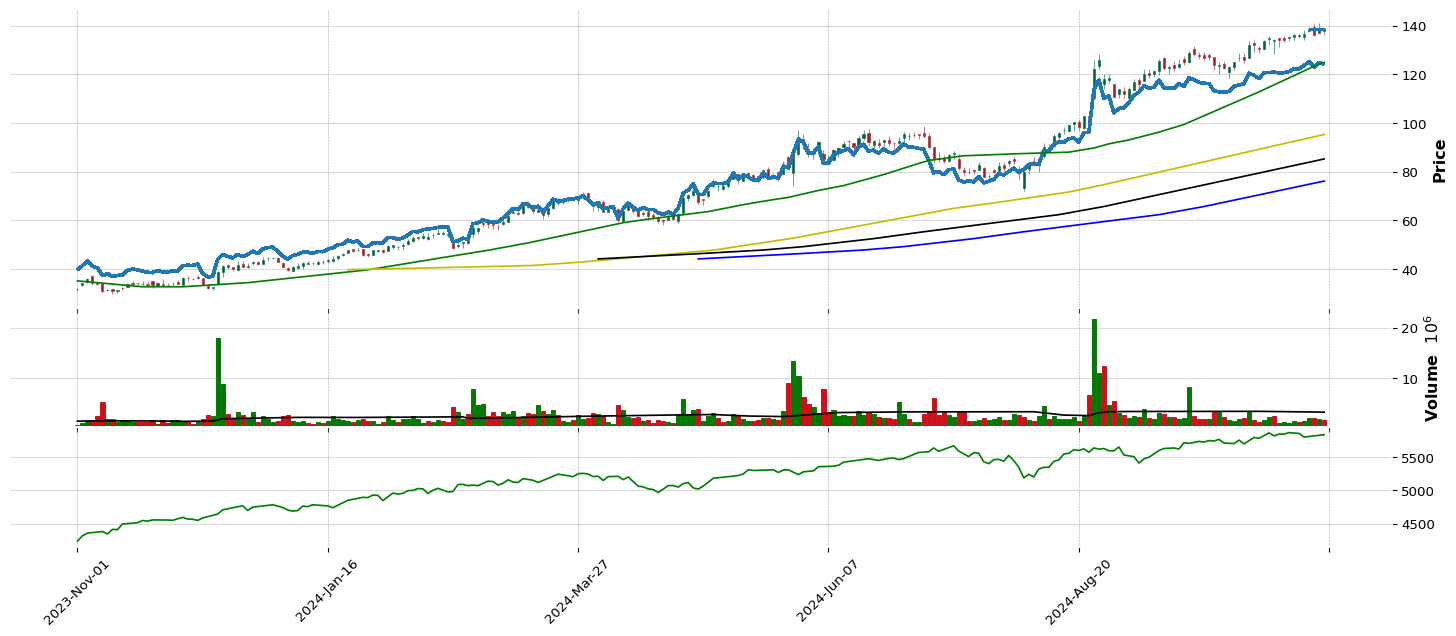

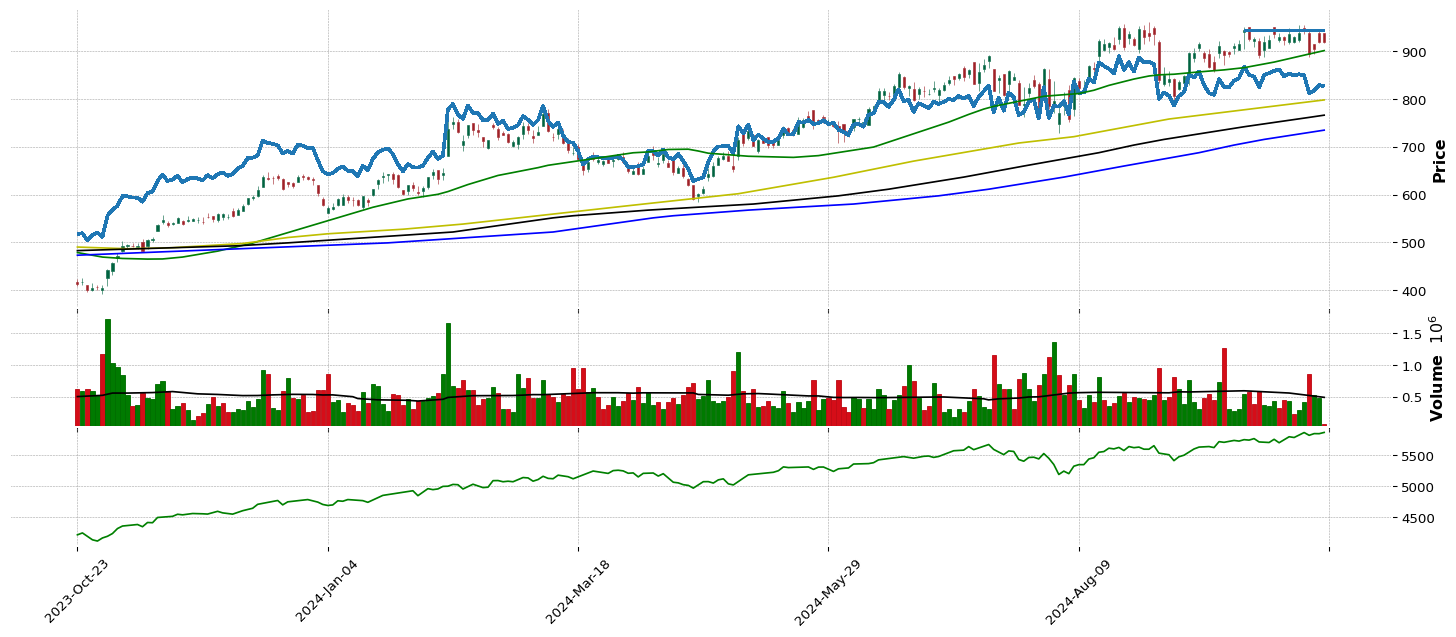

VRT |

97.08 |

97.27 |

95.09 |

99.72 |

Industrials |

Electrical Equipment & Parts |

8 |

81.0 |

93.26 |

92.41 |

79.77 |

2.0 |

11.0 |

113.63 |

1.0 |

1.0 |

| 30.0 |

VHI |

96.93 |

96.75 |

96.38 |

31.58 |

Basic Materials |

Chemicals |

100 |

68.07 |

80.87 |

57.1 |

47.58 |

1.0 |

4.0 |

36.15 |

1.0 |

1.0 |

| 31.0 |

ACLX |

96.71 |

95.96 |

96.44 |

69.21 |

Healthcare |

Biotechnology |

14 |

0.0 |

0.0 |

82.4 |

0.0 |

38.0 |

57.0 |

95.45 |

1.0 |

1.0 |

| 32.0 |

HOOD |

96.68 |

96.08 |

93.62 |

93.49 |

Financial |

Capital Markets |

5 |

86.82 |

93.16 |

94.58 |

42.0 |

2.0 |

8.0 |

26.96 |

1.0 |

1.0 |

| 33.0 |

AGX |

96.65 |

94.58 |

96.16 |

85.84 |

Industrials |

Engineering & Construction |

10 |

82.74 |

57.0 |

91.17 |

81.66 |

3.0 |

14.0 |

129.08 |

1.0 |

1.0 |

| 34.0 |

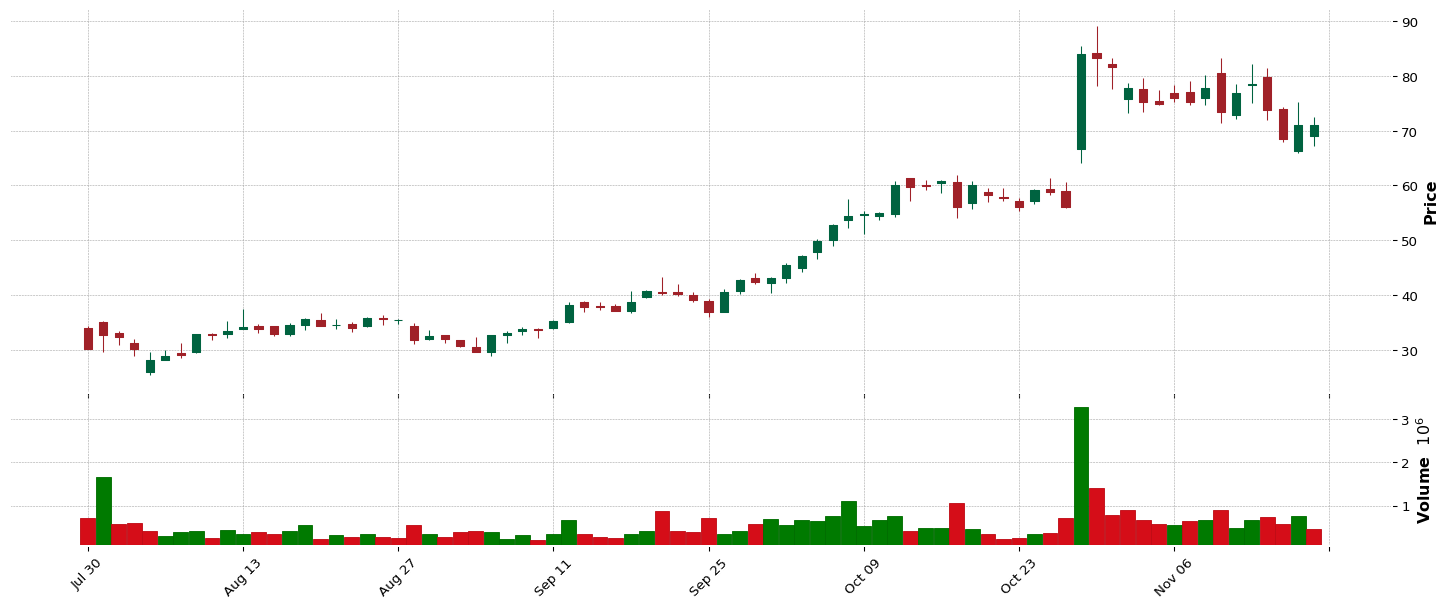

EAT |

96.38 |

96.69 |

97.36 |

63.32 |

Consumer Cyclical |

Restaurants |

107 |

30.34 |

24.18 |

79.22 |

70.77 |

3.0 |

9.0 |

92.58 |

1.0 |

1.0 |

| 35.0 |

LMB |

96.34 |

97.0 |

95.46 |

97.28 |

Industrials |

Building Products & Equipment |

50 |

81.87 |

88.48 |

83.7 |

72.19 |

3.0 |

16.0 |

81.25 |

1.0 |

1.0 |

| 36.0 |

VRNA |

96.25 |

89.69 |

78.84 |

9.5 |

Healthcare |

Biotechnology |

14 |

21.06 |

0.0 |

79.22 |

0.0 |

40.0 |

61.0 |

35.0 |

1.0 |

1.0 |

| 37.0 |

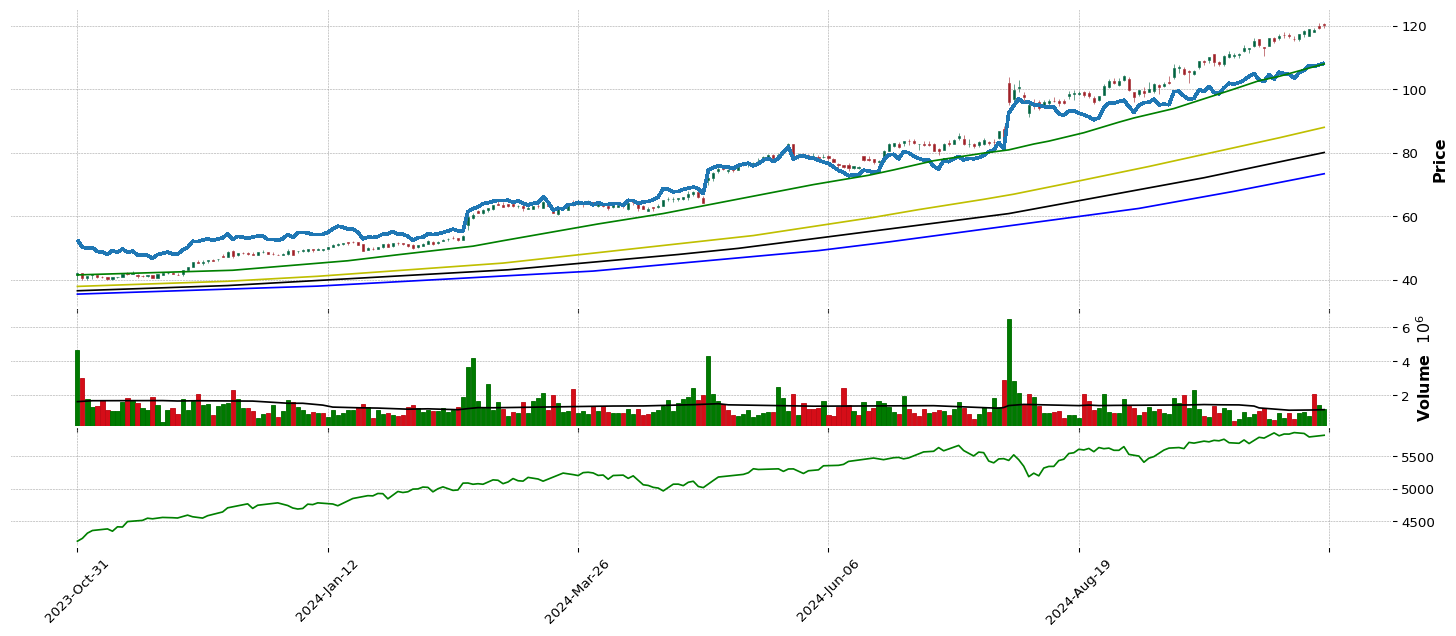

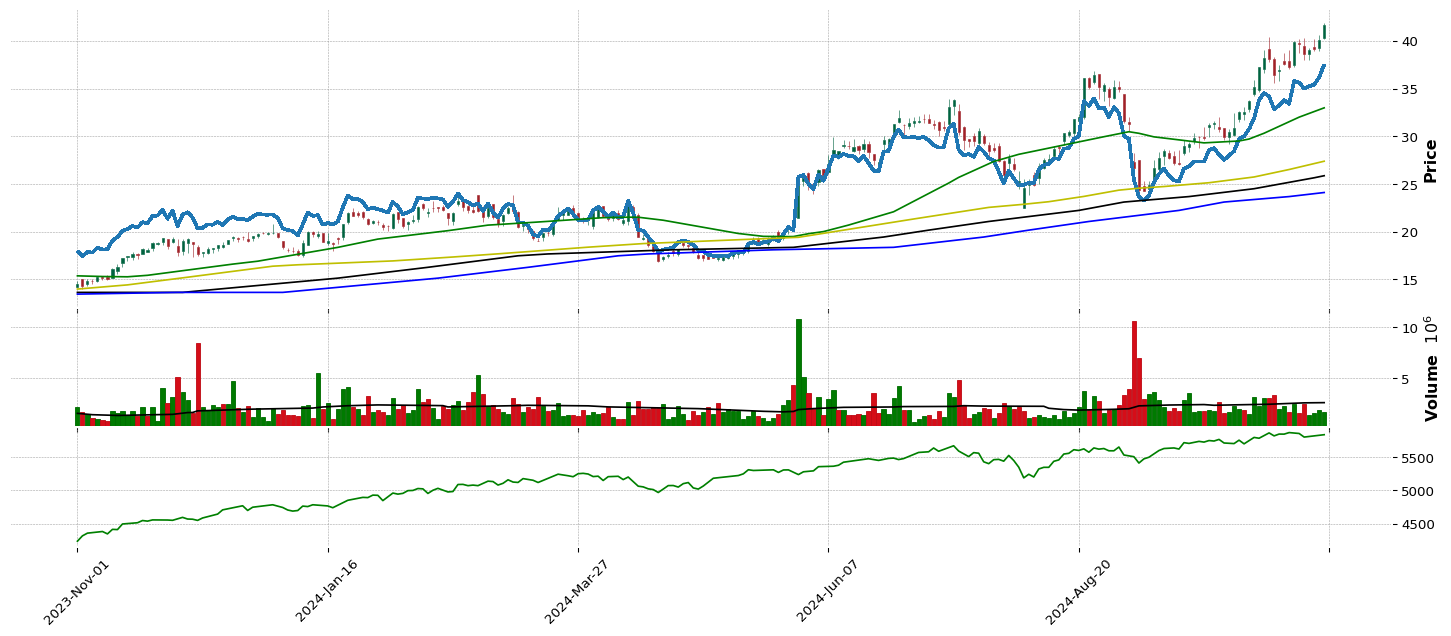

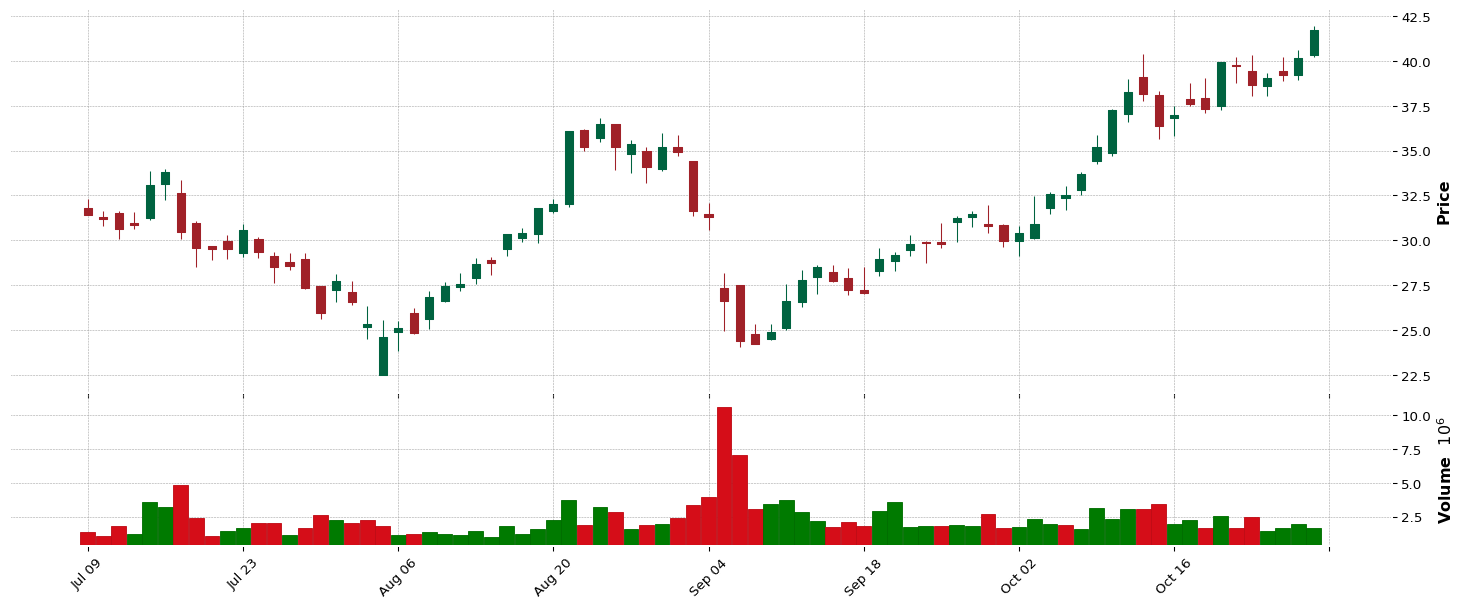

SFM |

95.92 |

97.09 |

98.06 |

94.35 |

Consumer Defensive |

Grocery Stores |

42 |

0.0 |

0.0 |

50.73 |

0.0 |

1.0 |

4.0 |

116.31 |

1.0 |

1.0 |

| 38.0 |

FIX |

95.76 |

95.35 |

90.49 |

96.29 |

Industrials |

Engineering & Construction |

10 |

90.87 |

92.65 |

35.62 |

96.58 |

4.0 |

18.0 |

413.78 |

1.0 |

1.0 |

| 39.0 |

CLBT |

95.73 |

94.61 |

96.9 |

93.61 |

Technology |

Software - Infrastructure |

63 |

53.41 |

44.17 |

87.59 |

29.91 |

3.0 |

14.0 |

18.56 |

1.0 |

1.0 |

| 40.0 |

QTWO |

95.52 |

96.84 |

96.56 |

96.39 |

Technology |

Software - Application |

84 |

40.33 |

70.0 |

47.97 |

70.33 |

6.0 |

18.0 |

82.19 |

1.0 |

1.0 |

| 41.0 |

LE |

95.42 |

94.89 |

94.69 |

93.27 |

Consumer Cyclical |

Apparel Retail |

75 |

6.77 |

15.49 |

69.64 |

22.91 |

1.0 |

12.0 |

17.56 |

1.0 |

1.0 |

| 42.0 |

AKRO |

95.27 |

3.88 |

4.29 |

2.8 |

Healthcare |

Biotechnology |

14 |

6.0 |

0.0 |

72.59 |

0.0 |

48.0 |

69.0 |

31.83 |

1.0 |

1.0 |

| 43.0 |

QTTB |

95.15 |

94.06 |

96.78 |

79.88 |

Healthcare |

Biotechnology |

14 |

56.72 |

0.0 |

72.59 |

0.0 |

50.0 |

71.0 |

48.31 |

1.0 |

1.0 |

| 44.0 |

BWIN |

95.03 |

94.52 |

91.87 |

50.92 |

Financial |

Insurance Brokers |

15 |

38.84 |

73.01 |

68.07 |

60.95 |

1.0 |

15.0 |

54.45 |

1.0 |

1.0 |

| 45.0 |

CSTL |

94.87 |

88.28 |

89.14 |

21.28 |

Healthcare |

Diagnostics & Research |

33 |

0.0 |

0.0 |

24.76 |

0.0 |

4.0 |

74.0 |

32.84 |

1.0 |

1.0 |

| 46.0 |

TVTX |

94.84 |

81.67 |

26.89 |

0.7 |

Healthcare |

Biotechnology |

14 |

27.55 |

13.92 |

50.73 |

23.5 |

52.0 |

75.0 |

18.04 |

1.0 |

1.0 |

| 47.0 |

SKYW |

94.75 |

93.51 |

92.54 |

98.61 |

Industrials |

Airlines |

104 |

86.57 |

89.44 |

45.97 |

76.39 |

1.0 |

22.0 |

95.57 |

1.0 |

1.0 |

| 48.0 |

WLDN |

94.63 |

92.96 |

93.86 |

92.84 |

Industrials |

Engineering & Construction |

10 |

99.13 |

89.95 |

71.86 |

60.71 |

5.0 |

23.0 |

46.06 |

1.0 |

1.0 |

| 49.0 |

DBD |

94.6 |

95.87 |

97.27 |

0.0 |

Technology |

Software - Application |

84 |

85.92 |

53.99 |

62.88 |

56.75 |

9.0 |

26.0 |

45.75 |

1.0 |

1.0 |

| 50.0 |

KKR |

94.47 |

94.34 |

93.92 |

92.87 |

Financial |

Asset Management |

70 |

0.0 |

0.0 |

85.04 |

0.0 |

1.0 |

16.0 |

138.38 |

1.0 |

1.0 |

| 51.0 |

SLG |

94.44 |

92.32 |

86.75 |

96.11 |

Real Estate |

REIT - Office |

23 |

43.02 |

18.6 |

94.05 |

69.15 |

1.0 |

4.0 |

77.52 |

1.0 |

1.0 |

| 52.0 |

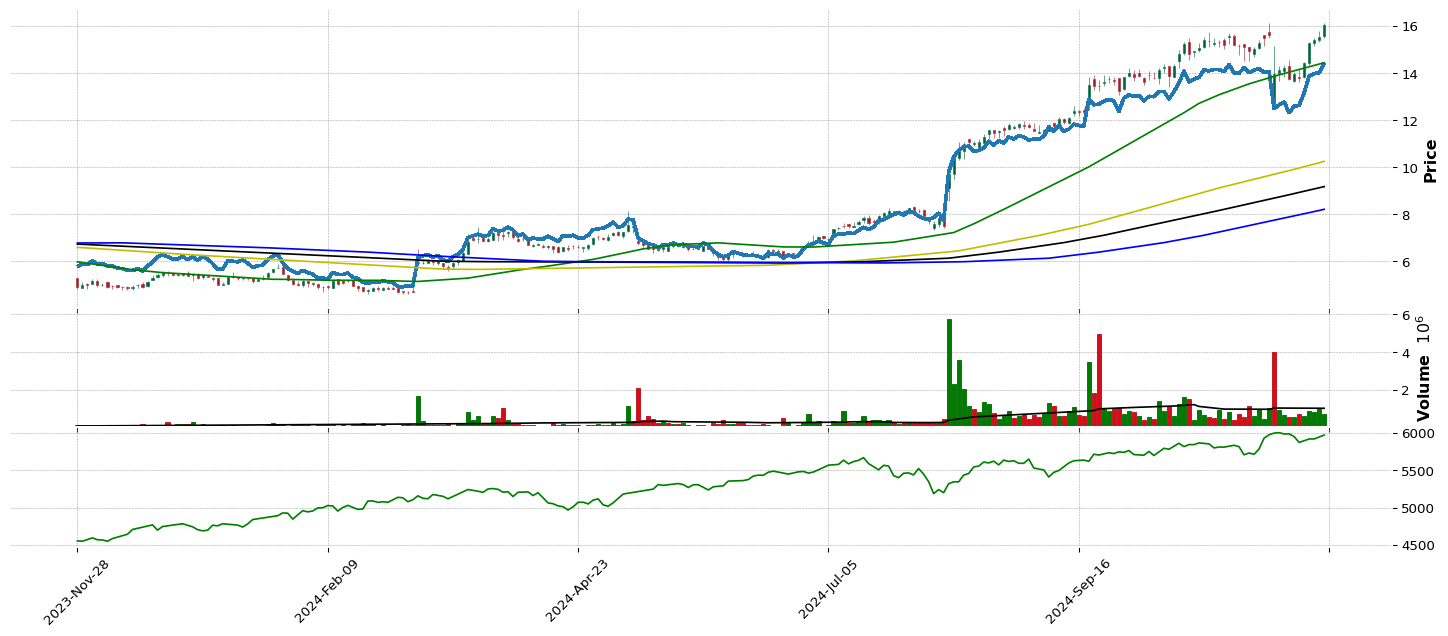

CMPO |

94.41 |

94.4 |

93.98 |

25.94 |

Industrials |

Metal Fabrication |

28 |

48.65 |

26.72 |

86.4 |

23.46 |

2.0 |

25.0 |

15.03 |

1.0 |

1.0 |

| 53.0 |

JXN |

94.38 |

96.14 |

95.82 |

93.67 |

Financial |

Insurance - Life |

43 |

78.1 |

63.23 |

35.62 |

75.63 |

1.0 |

17.0 |

98.8 |

1.0 |

1.0 |

| 54.0 |

HBB |

94.35 |

96.26 |

95.7 |

96.82 |

Consumer Cyclical |

Furnishings, Fixtures & Appliances |

44 |

72.74 |

86.65 |

95.92 |

47.34 |

2.0 |

17.0 |

30.84 |

1.0 |

1.0 |

| 55.0 |

TGLS |

94.23 |

93.6 |

91.1 |

64.71 |

Basic Materials |

Building Materials |

76 |

62.6 |

6.64 |

97.08 |

69.67 |

1.0 |

11.0 |

76.93 |

1.0 |

1.0 |

| 56.0 |

ACIW |

94.17 |

96.05 |

95.67 |

73.9 |

Technology |

Software - Infrastructure |

63 |

88.64 |

64.67 |

72.59 |

62.16 |

6.0 |

27.0 |

51.04 |

1.0 |

1.0 |

| 57.0 |

CLMB |

94.14 |

95.74 |

96.19 |

81.89 |

Technology |

Electronics & Computer Distribution |

46 |

86.79 |

73.14 |

89.1 |

80.32 |

1.0 |

28.0 |

107.7 |

1.0 |

1.0 |

| 58.0 |

PCVX |

94.11 |

95.68 |

97.02 |

79.7 |

Healthcare |

Biotechnology |

14 |

1.57 |

0.0 |

55.05 |

0.0 |

55.0 |

81.0 |

115.18 |

1.0 |

1.0 |

| 59.0 |

RCL |

94.07 |

92.56 |

89.63 |

96.05 |

Consumer Cyclical |

Travel Services |

38 |

98.7 |

92.23 |

55.05 |

91.0 |

2.0 |

18.0 |

199.28 |

1.0 |

1.0 |

| 60.0 |

FRPT |

93.83 |

94.43 |

94.35 |

87.93 |

Consumer Defensive |

Packaged Foods |

116 |

47.63 |

98.68 |

69.64 |

84.52 |

1.0 |

5.0 |

138.88 |

1.0 |

1.0 |

| 61.0 |

HWM |

93.8 |

94.24 |

94.97 |

82.29 |

Industrials |

Aerospace & Defense |

31 |

95.7 |

89.76 |

35.62 |

78.94 |

5.0 |

27.0 |

105.41 |

1.0 |

1.0 |

| 62.0 |

TPG |

93.65 |

91.92 |

90.43 |

84.39 |

Financial |

Asset Management |

70 |

39.8 |

93.64 |

62.88 |

67.33 |

2.0 |

20.0 |

65.87 |

1.0 |

1.0 |

| 63.0 |

PSFE |

93.49 |

92.01 |

89.81 |

40.99 |

Technology |

Software - Infrastructure |

63 |

54.28 |

67.56 |

79.22 |

39.38 |

7.0 |

29.0 |

23.13 |

1.0 |

1.0 |

| 64.0 |

GVA |

93.4 |

94.12 |

93.71 |

79.95 |

Industrials |

Engineering & Construction |

10 |

89.17 |

77.06 |

58.13 |

73.67 |

6.0 |

29.0 |

82.62 |

1.0 |

1.0 |

| 65.0 |

PWP |

93.28 |

91.12 |

91.62 |

93.18 |

Financial |

Capital Markets |

5 |

16.26 |

51.52 |

97.65 |

35.04 |

5.0 |

22.0 |

22.06 |

1.0 |

1.0 |

| 66.0 |

BV |

93.25 |

92.81 |

91.99 |

95.8 |

Industrials |

Specialty Business Services |

108 |

29.35 |

18.28 |

45.97 |

22.84 |

1.0 |

31.0 |

16.57 |

1.0 |

1.0 |

| 67.0 |

EME |

93.22 |

93.48 |

90.7 |

95.43 |

Industrials |

Engineering & Construction |

10 |

98.45 |

96.43 |

87.59 |

98.0 |

7.0 |

32.0 |

446.91 |

1.0 |

1.0 |

| 68.0 |

DY |

93.15 |

94.79 |

93.59 |

85.68 |

Industrials |

Engineering & Construction |

10 |

91.74 |

42.82 |

82.4 |

90.11 |

8.0 |

33.0 |

196.94 |

1.0 |

1.0 |

| 69.0 |

MCY |

93.12 |

94.67 |

95.89 |

92.65 |

Financial |

Insurance - Property & Casualty |

102 |

62.38 |

97.88 |

65.61 |

69.84 |

2.0 |

23.0 |

67.73 |

1.0 |

1.0 |

| 70.0 |

VRDN |

93.0 |

80.81 |

16.86 |

3.57 |

Healthcare |

Biotechnology |

14 |

78.31 |

18.44 |

69.64 |

39.97 |

64.0 |

92.0 |

25.29 |

1.0 |

1.0 |

| 71.0 |

TOL |

92.97 |

94.21 |

92.36 |

92.72 |

Consumer Cyclical |

Residential Construction |

22 |

89.48 |

72.31 |

79.22 |

87.93 |

3.0 |

21.0 |

157.97 |

1.0 |

1.0 |

| 72.0 |

HWKN |

92.94 |

93.94 |

95.58 |

92.16 |

Basic Materials |

Specialty Chemicals |

110 |

77.32 |

75.87 |

35.62 |

82.21 |

2.0 |

14.0 |

127.09 |

1.0 |

1.0 |

| 73.0 |

PIPR |

92.91 |

92.26 |

93.06 |

79.61 |

Financial |

Capital Markets |

5 |

80.14 |

92.1 |

97.65 |

95.79 |

6.0 |

25.0 |

303.86 |

1.0 |

1.0 |

| 74.0 |

GE |

92.85 |

94.18 |

93.37 |

93.8 |

Industrials |

Aerospace & Defense |

31 |

85.95 |

88.73 |

92.41 |

91.28 |

7.0 |

34.0 |

192.3 |

1.0 |

1.0 |

| 75.0 |

MHO |

92.82 |

93.97 |

91.5 |

90.62 |

Consumer Cyclical |

Residential Construction |

22 |

80.82 |

64.03 |

79.22 |

88.83 |

4.0 |

22.0 |

173.63 |

1.0 |

1.0 |

| 76.0 |

CSWI |

92.69 |

93.57 |

92.64 |

90.12 |

Industrials |

Specialty Industrial Machinery |

66 |

84.07 |

64.58 |

92.41 |

97.03 |

3.0 |

35.0 |

391.42 |

1.0 |

1.0 |

| 77.0 |

SE |

92.66 |

94.31 |

95.33 |

15.33 |

Consumer Cyclical |

Internet Retail |

37 |

27.03 |

36.41 |

88.88 |

76.11 |

2.0 |

23.0 |

100.09 |

1.0 |

1.0 |

| 78.0 |

STRL |

92.63 |

92.29 |

82.61 |

97.68 |

Industrials |

Engineering & Construction |

10 |

93.38 |

87.13 |

22.73 |

87.31 |

9.0 |

36.0 |

159.97 |

1.0 |

1.0 |

| 79.0 |

HLNE |

92.57 |

90.66 |

90.73 |

85.04 |

Financial |

Asset Management |

70 |

30.28 |

52.19 |

97.65 |

88.49 |

3.0 |

26.0 |

180.86 |

1.0 |

1.0 |

| 80.0 |

TSM |

92.48 |

92.38 |

93.28 |

87.1 |

Technology |

Semiconductors |

80 |

67.58 |

38.27 |

19.71 |

88.76 |

6.0 |

34.0 |

203.16 |

1.0 |

1.0 |

| 81.0 |

AMAL |

92.39 |

89.84 |

92.27 |

76.95 |

Financial |

Banks - Regional |

24 |

79.39 |

64.19 |

85.04 |

52.82 |

7.0 |

27.0 |

35.04 |

1.0 |

1.0 |

| 82.0 |

ELVN |

92.3 |

88.03 |

79.73 |

23.65 |

Healthcare |

Biotechnology |

14 |

35.78 |

0.0 |

95.05 |

0.0 |

66.0 |

94.0 |

28.21 |

1.0 |

1.0 |

| 83.0 |

TILE |

92.26 |

91.64 |

94.05 |

94.66 |

Industrials |

Building Products & Equipment |

50 |

96.5 |

91.24 |

68.07 |

37.0 |

4.0 |

38.0 |

19.87 |

1.0 |

1.0 |

| 84.0 |

FICO |

92.17 |

95.01 |

95.21 |

88.37 |

Technology |

Software - Application |

84 |

73.58 |

73.27 |

14.55 |

99.79 |

10.0 |

35.0 |

2026.67 |

1.0 |

1.0 |

| 85.0 |

EVR |

91.96 |

90.91 |

91.75 |

88.06 |

Financial |

Capital Markets |

5 |

49.7 |

62.49 |

85.04 |

94.58 |

7.0 |

28.0 |

284.19 |

1.0 |

1.0 |

| 86.0 |

NVEI |

91.9 |

94.73 |

94.48 |

15.91 |

Technology |

Software - Infrastructure |

63 |

14.32 |

34.35 |

45.97 |

43.21 |

9.0 |

37.0 |

33.59 |

1.0 |

1.0 |

| 87.0 |

GWRE |

91.84 |

93.39 |

93.52 |

82.6 |

Technology |

Software - Application |

84 |

83.08 |

95.25 |

79.22 |

91.24 |

11.0 |

38.0 |

189.01 |

1.0 |

1.0 |

| 88.0 |

CVLT |

91.8 |

94.86 |

96.07 |

89.04 |

Technology |

Software - Application |

84 |

96.44 |

92.36 |

35.62 |

86.52 |

12.0 |

39.0 |

142.42 |

0.0 |

1.0 |

| 89.0 |

UI |

91.71 |

81.09 |

59.24 |

2.62 |

Technology |

Communication Equipment |

1 |

10.67 |

8.82 |

92.41 |

91.38 |

6.0 |

42.0 |

251.05 |

1.0 |

1.0 |

| 90.0 |

VNO |

91.65 |

89.99 |

74.73 |

91.82 |

Real Estate |

REIT - Office |

23 |

52.83 |

47.93 |

52.56 |

54.82 |

2.0 |

6.0 |

42.79 |

1.0 |

1.0 |

| 91.0 |

SPXC |

91.62 |

91.71 |

93.16 |

91.98 |

Industrials |

Building Products & Equipment |

50 |

51.96 |

89.25 |

19.71 |

87.11 |

5.0 |

39.0 |

169.21 |

1.0 |

1.0 |

| 92.0 |

YPF |

91.59 |

88.25 |

94.17 |

93.3 |

Energy |

Oil & Gas Integrated |

127 |

30.9 |

31.28 |

88.88 |

39.52 |

1.0 |

1.0 |

24.76 |

1.0 |

1.0 |

| 93.0 |

STEP |

91.56 |

90.02 |

91.04 |

87.66 |

Financial |

Asset Management |

70 |

17.63 |

80.39 |

98.1 |

66.67 |

4.0 |

29.0 |

60.86 |

1.0 |

1.0 |

| 94.0 |

UPST |

91.47 |

76.41 |

50.38 |

84.91 |

Financial |

Credit Services |

32 |

16.45 |

33.75 |

93.73 |

61.33 |

4.0 |

30.0 |

52.29 |

1.0 |

1.0 |

| 95.0 |

TT |

91.34 |

91.61 |

90.76 |

88.55 |

Industrials |

Building Products & Equipment |

50 |

89.57 |

86.23 |

85.04 |

97.51 |

6.0 |

41.0 |

400.0 |

1.0 |

1.0 |

| 96.0 |

IRM |

91.25 |

93.08 |

92.48 |

78.43 |

Real Estate |

REIT - Specialty |

45 |

61.76 |

32.4 |

95.92 |

82.77 |

1.0 |

8.0 |

125.37 |

1.0 |

1.0 |

| 97.0 |

CALM |

91.19 |

79.22 |

82.55 |

62.33 |

Consumer Defensive |

Farm Products |

65 |

96.99 |

43.11 |

94.91 |

78.8 |

2.0 |

9.0 |

94.45 |

1.0 |

1.0 |

| 98.0 |

GRBK |

91.16 |

93.02 |

90.37 |

80.81 |

Consumer Cyclical |

Residential Construction |

22 |

90.44 |

77.28 |

22.73 |

73.15 |

5.0 |

28.0 |

82.41 |

1.0 |

1.0 |

| 99.0 |

RBB |

91.07 |

90.11 |

88.83 |

80.44 |

Financial |

Banks - Regional |

24 |

21.31 |

30.15 |

92.41 |

38.59 |

8.0 |

33.0 |

24.13 |

1.0 |

1.0 |

| 100.0 |

YOU |

90.98 |

90.45 |

82.24 |

11.56 |

Technology |

Software - Application |

84 |

80.48 |

91.36 |

86.4 |

55.51 |

14.0 |

46.0 |

36.46 |

1.0 |

1.0 |

| 101.0 |

VCTR |

90.88 |

85.46 |

86.26 |

88.77 |

Financial |

Asset Management |

70 |

47.38 |

73.72 |

92.41 |

67.64 |

5.0 |

34.0 |

60.75 |

1.0 |

1.0 |

| 102.0 |

UAL |

90.79 |

67.91 |

36.95 |

69.37 |

Industrials |

Airlines |

104 |

95.97 |

52.83 |

97.32 |

73.29 |

2.0 |

42.0 |

74.32 |

1.0 |

1.0 |

| 103.0 |

HTLF |

90.73 |

91.74 |

92.33 |

53.67 |

Financial |

Banks - Regional |

24 |

12.0 |

25.18 |

55.05 |

61.13 |

9.0 |

35.0 |

59.43 |

1.0 |

1.0 |

| 104.0 |

CRNX |

90.7 |

89.56 |

91.72 |

96.94 |

Healthcare |

Biotechnology |

14 |

9.52 |

0.03 |

43.62 |

56.4 |

71.0 |

102.0 |

59.18 |

1.0 |

1.0 |

| 105.0 |

JEF |

90.67 |

86.47 |

86.87 |

79.36 |

Financial |

Capital Markets |

5 |

34.89 |

60.5 |

53.25 |

66.95 |

9.0 |

36.0 |

67.01 |

1.0 |

1.0 |

| 106.0 |

PRIM |

90.55 |

90.51 |

82.67 |

92.38 |

Industrials |

Engineering & Construction |

10 |

68.2 |

78.44 |

74.04 |

68.5 |

10.0 |

44.0 |

62.71 |

1.0 |

1.0 |

| 107.0 |

MNDY |

90.52 |

88.46 |

83.04 |

85.22 |

Technology |

Software - Application |

84 |

95.23 |

96.98 |

79.22 |

95.52 |

15.0 |

48.0 |

286.85 |

1.0 |

1.0 |

| 108.0 |

TYRA |

90.49 |

84.21 |

83.96 |

66.16 |

Healthcare |

Biotechnology |

14 |

2.9 |

0.0 |

82.4 |

0.0 |

72.0 |

104.0 |

26.7 |

1.0 |

1.0 |

| 109.0 |

AXON |

90.46 |

93.14 |

91.93 |

73.62 |

Industrials |

Aerospace & Defense |

31 |

85.7 |

81.0 |

47.97 |

97.76 |

8.0 |

45.0 |

437.06 |

1.0 |

1.0 |

| 110.0 |

MLI |

90.42 |

92.41 |

93.89 |

84.6 |

Industrials |

Metal Fabrication |

28 |

63.13 |

12.25 |

24.76 |

66.29 |

3.0 |

46.0 |

72.86 |

1.0 |

1.0 |

| 111.0 |

WAL |

90.39 |

92.78 |

90.83 |

86.27 |

Financial |

Banks - Regional |

24 |

43.58 |

36.15 |

79.22 |

74.91 |

10.0 |

37.0 |

86.54 |

1.0 |

1.0 |

| 112.0 |

PRMW |

90.33 |

89.96 |

89.51 |

65.23 |

Consumer Defensive |

Beverages - Non-Alcoholic |

97 |

92.08 |

65.12 |

75.08 |

46.0 |

1.0 |

10.0 |

27.45 |

1.0 |

1.0 |

| 113.0 |

HASI |

90.21 |

93.3 |

75.0 |

25.23 |

Real Estate |

Real Estate Services |

16 |

88.43 |

99.48 |

90.67 |

56.09 |

6.0 |

11.0 |

35.4 |

1.0 |

1.0 |

| 114.0 |

WIX |

90.18 |

90.48 |

90.4 |

78.59 |

Technology |

Software - Infrastructure |

63 |

74.26 |

73.3 |

67.1 |

89.45 |

12.0 |

50.0 |

173.86 |

1.0 |

1.0 |

| 115.0 |

TRAK |

90.06 |

93.27 |

97.11 |

96.97 |

Technology |

Software - Application |

84 |

61.98 |

63.42 |

79.22 |

35.87 |

16.0 |

51.0 |

19.79 |

1.0 |

1.0 |

| 116.0 |

CNS |

90.03 |

80.39 |

79.3 |

57.55 |

Financial |

Asset Management |

70 |

33.99 |

46.26 |

55.05 |

77.46 |

6.0 |

38.0 |

105.83 |

1.0 |

1.0 |

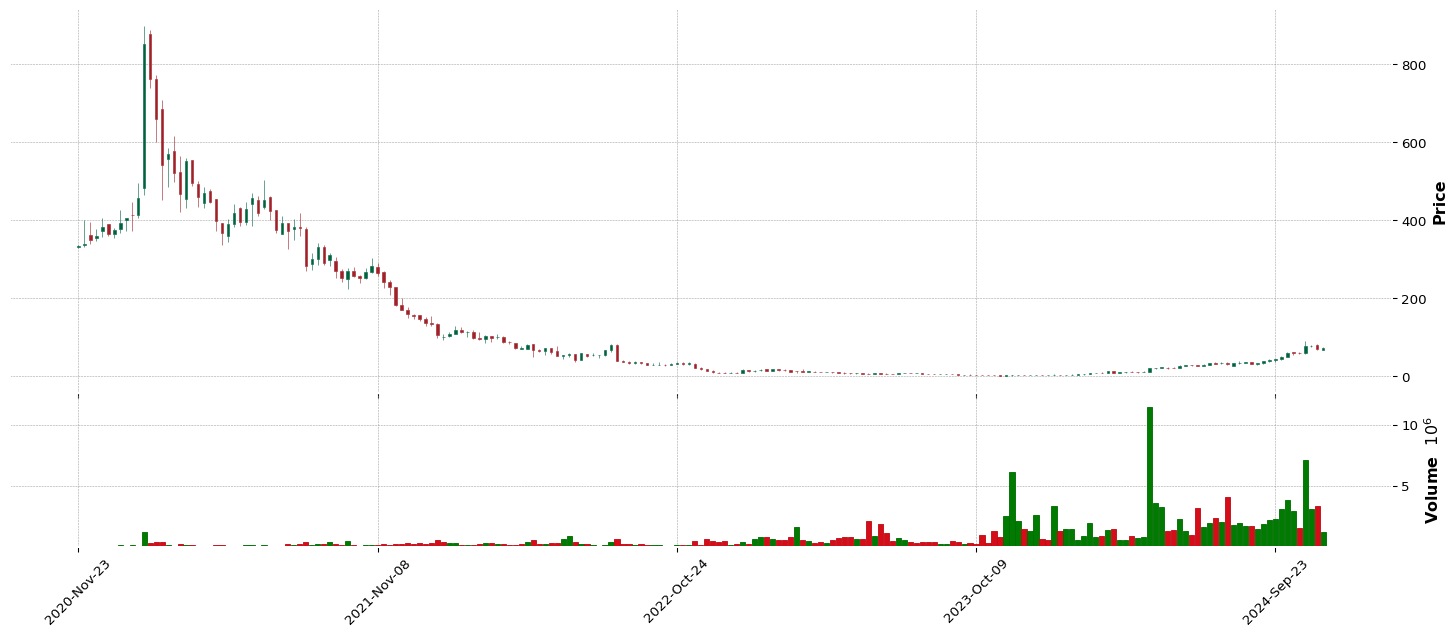

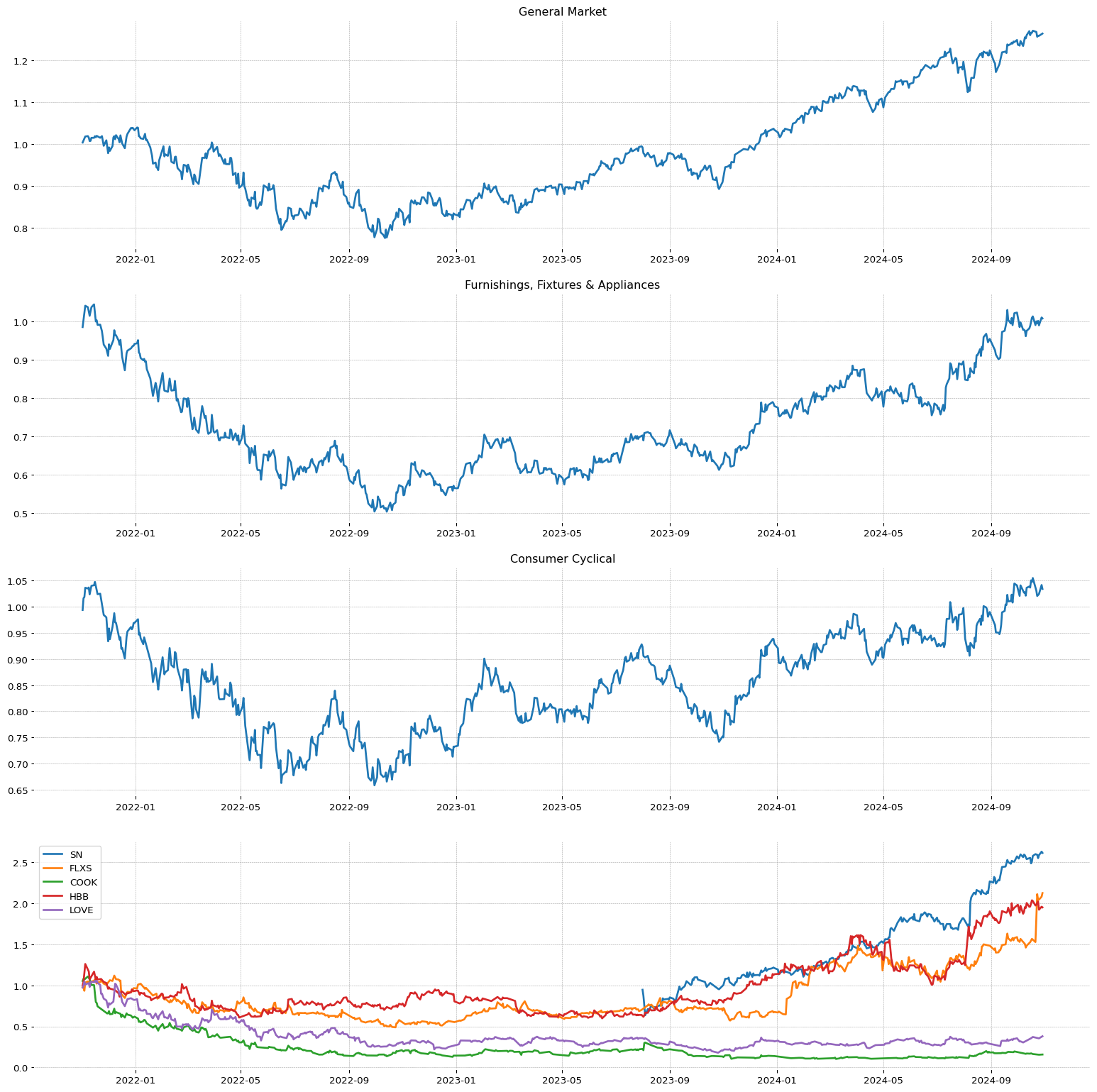

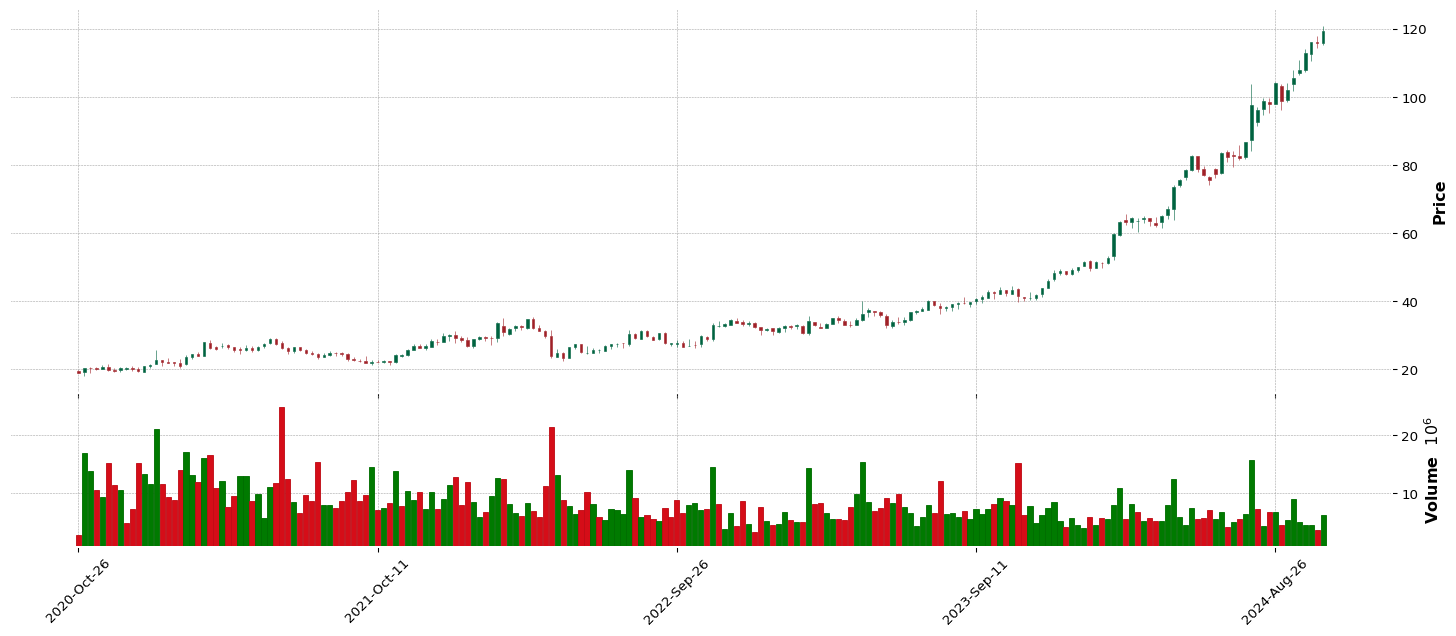

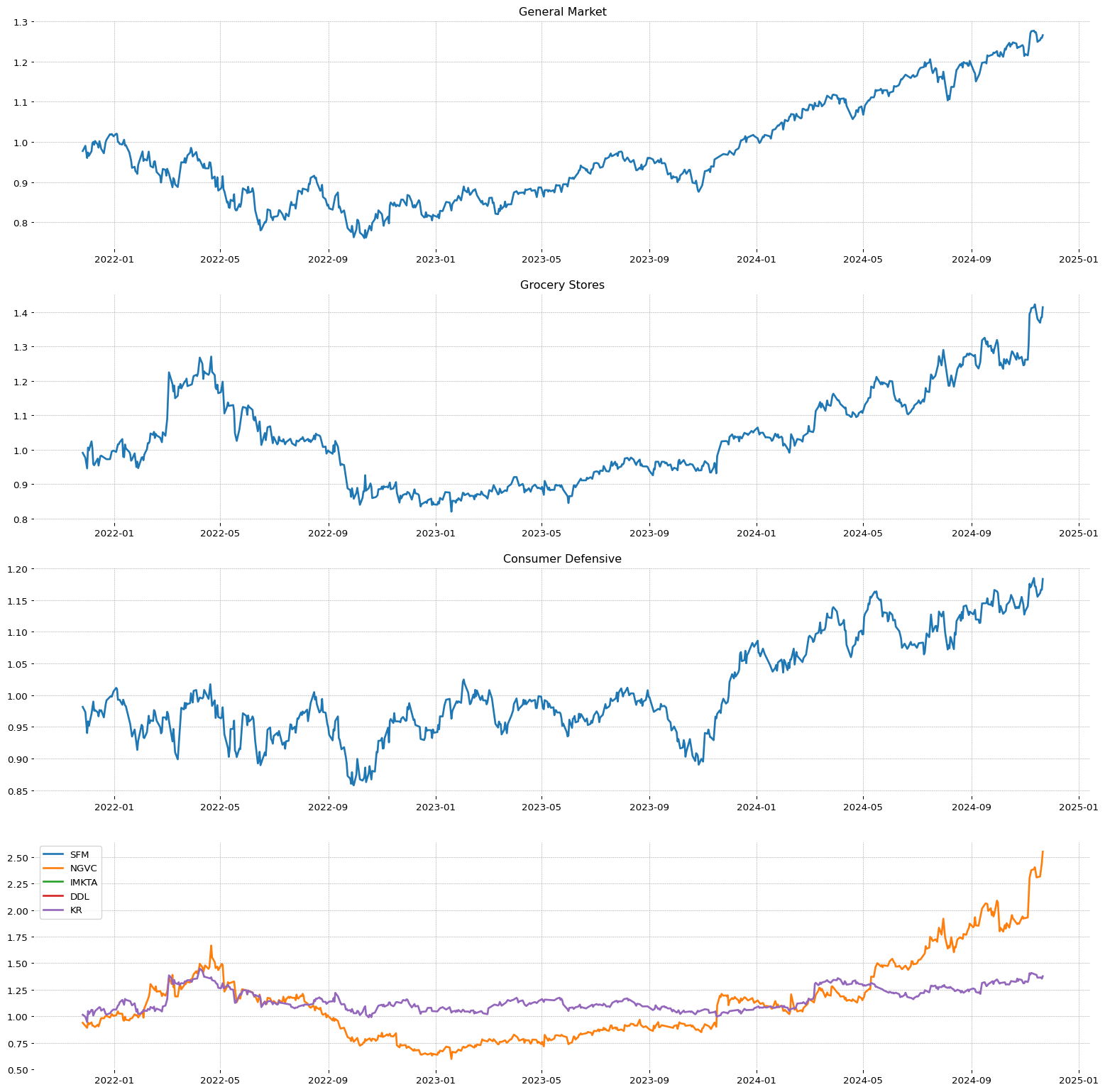

DOGZ

DOGZ

SG

SG

UPST

UPST

WGS

WGS

HBB

HBB

USAP

USAP

CLBT

CLBT

WLFC

WLFC

FYBR

FYBR

HROW

HROW

ZETA

ZETA

SMR

SMR

SFM

SFM

SEZL

SEZL

VHI

VHI

FTAI

FTAI

CLMB

CLMB

LBPH

LBPH

NGVC

NGVC

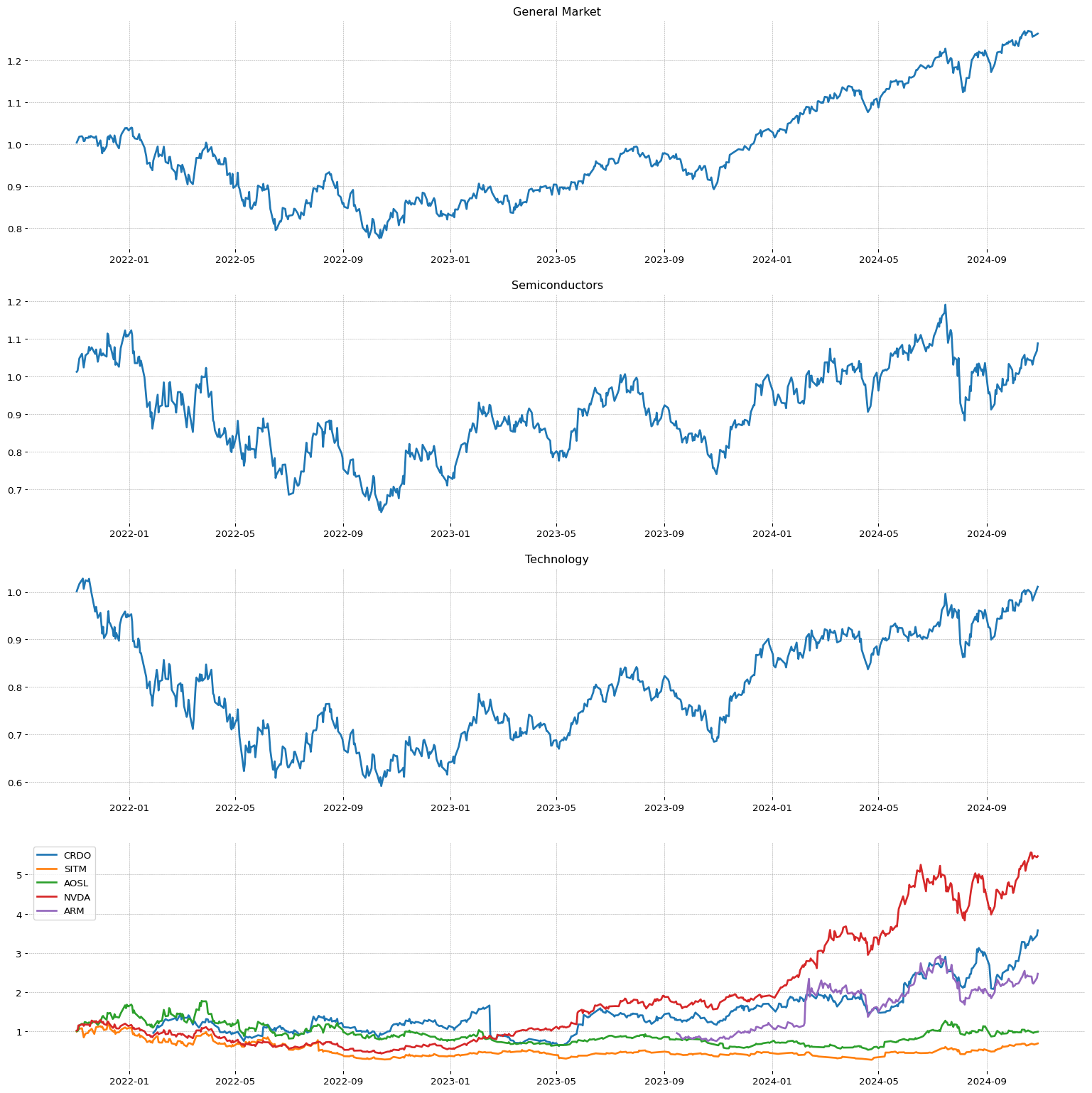

CRDO

CRDO

BWIN

BWIN

GDS

GDS

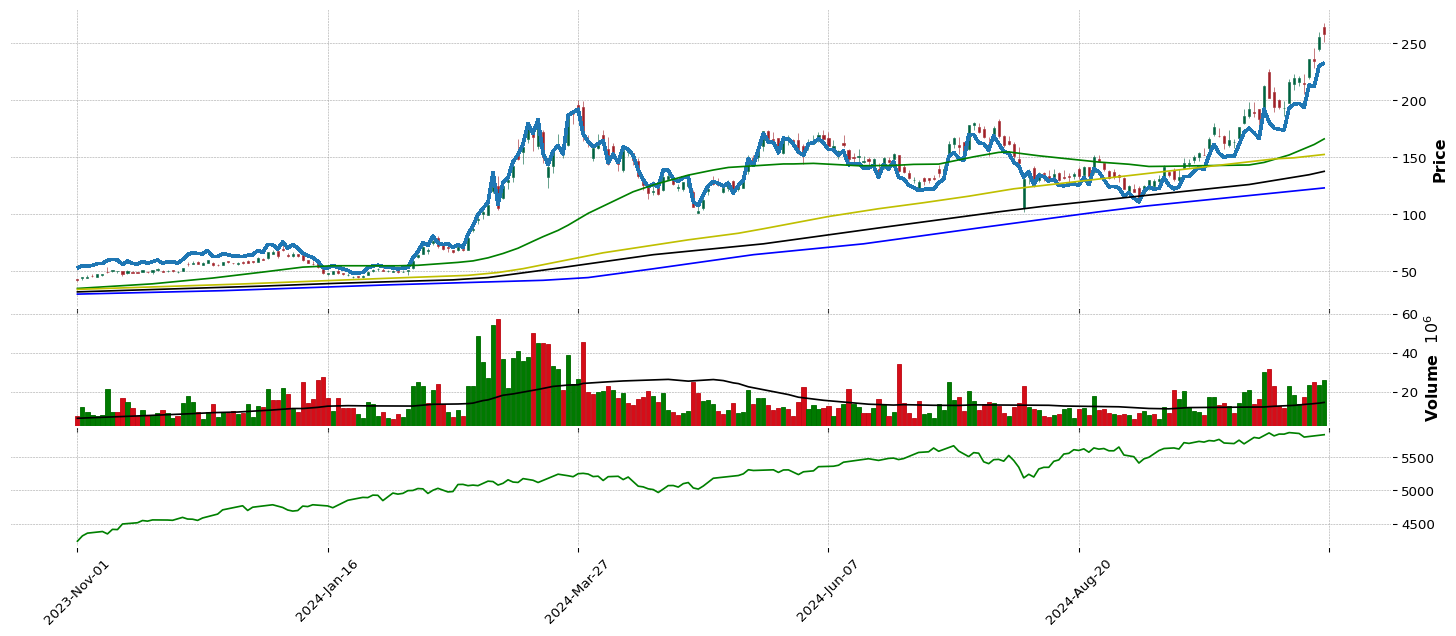

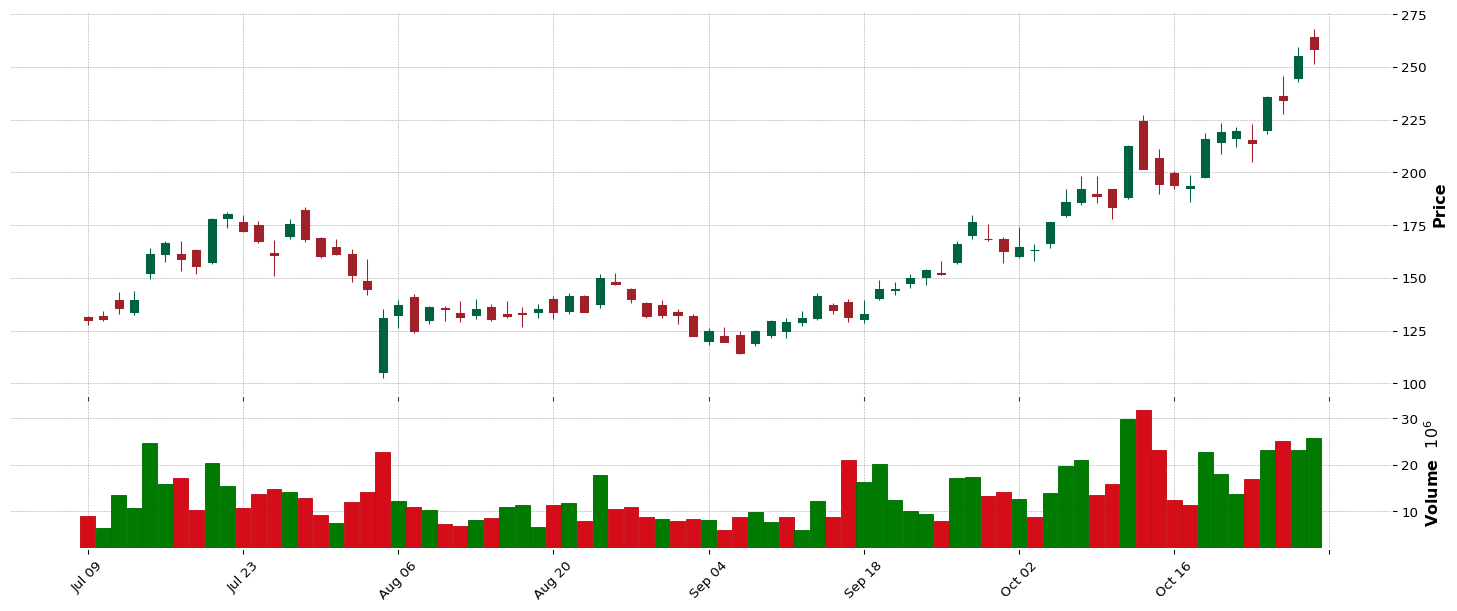

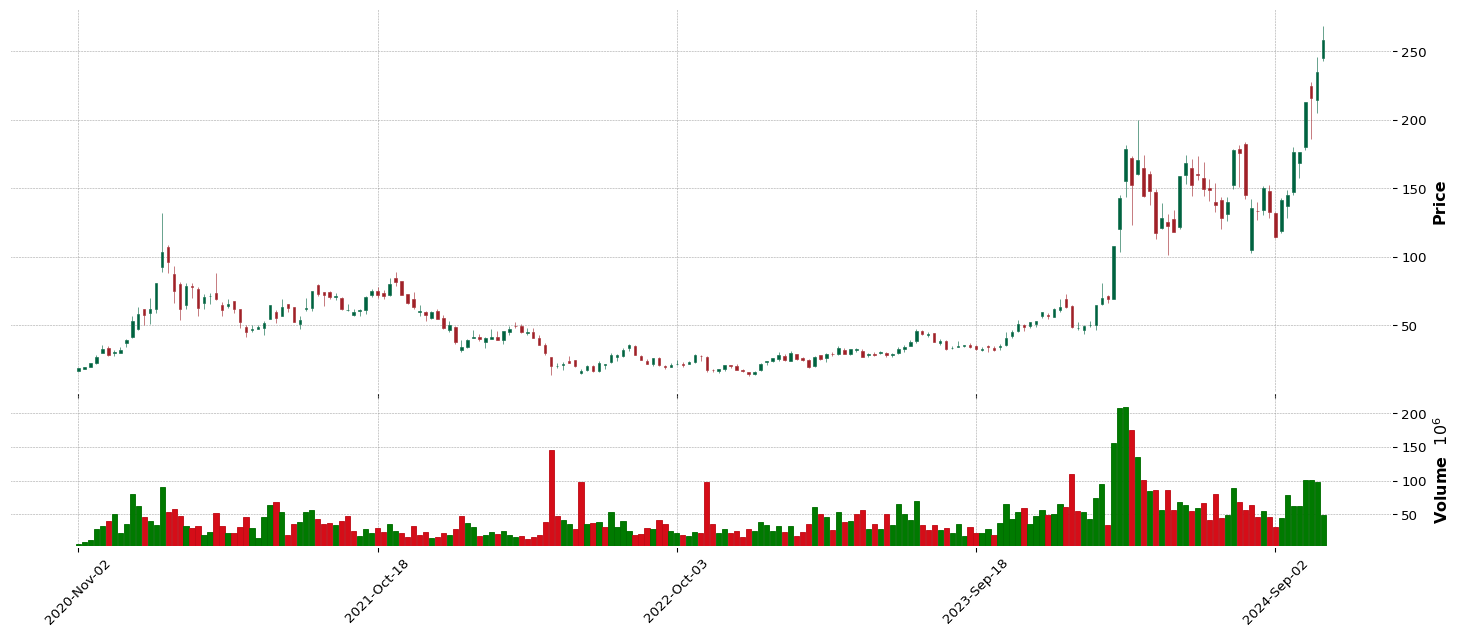

CRS

CRS

MSTR

MSTR

WWW

WWW

UPST

UPST

MPWR

MPWR

COHR

COHR

BMA

BMA