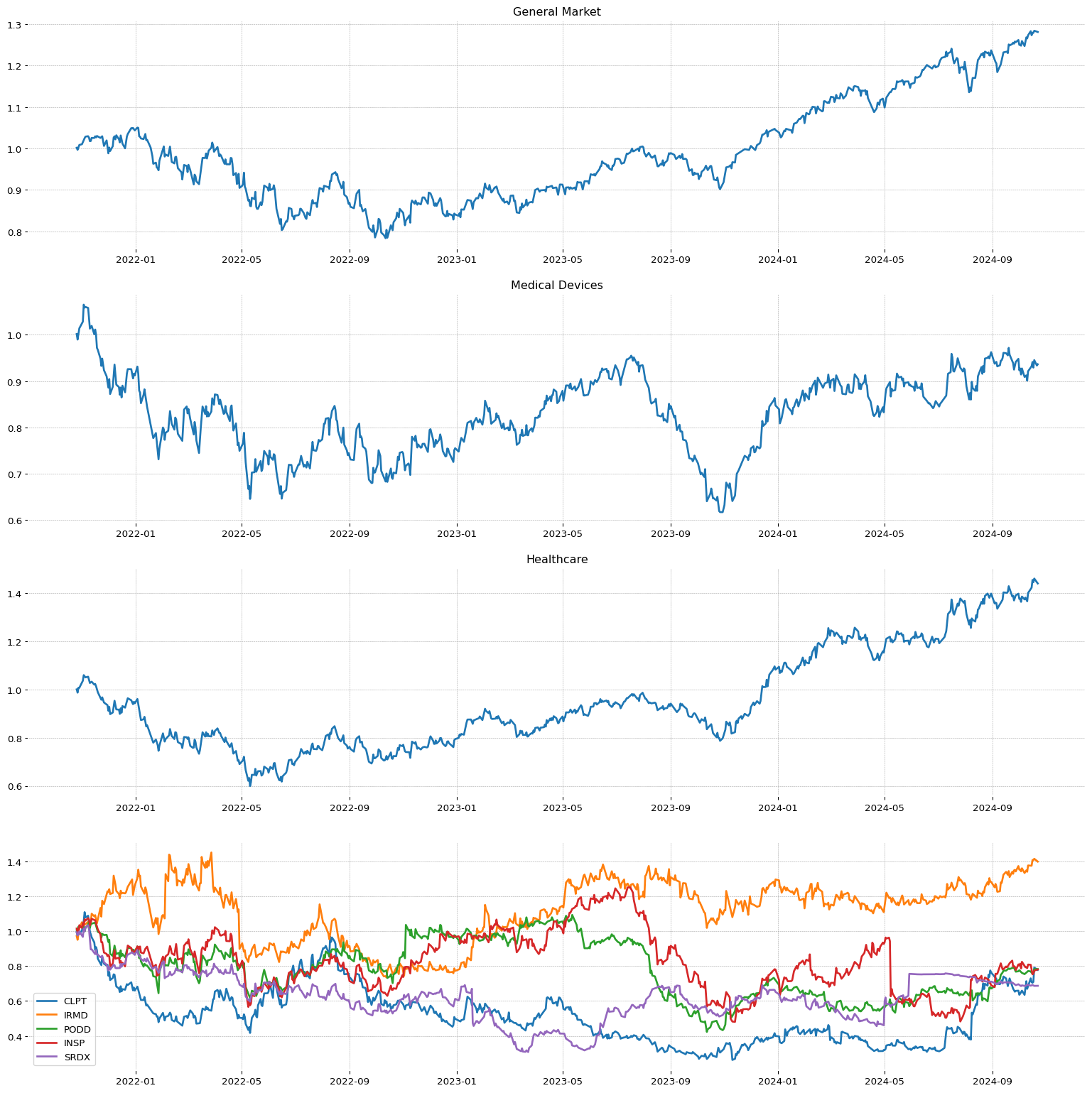

| Industry Name | Valore |

| Biotechnology | 18 |

| Drug Manufacturers - Specialty & Generic | 3 |

| Medical Devices | 2 |

| Specialty Industrial Machinery | 2 |

| Banks - Regional | 2 |

| Software - Infrastructure | 2 |

| Healthcare Plans | 2 |

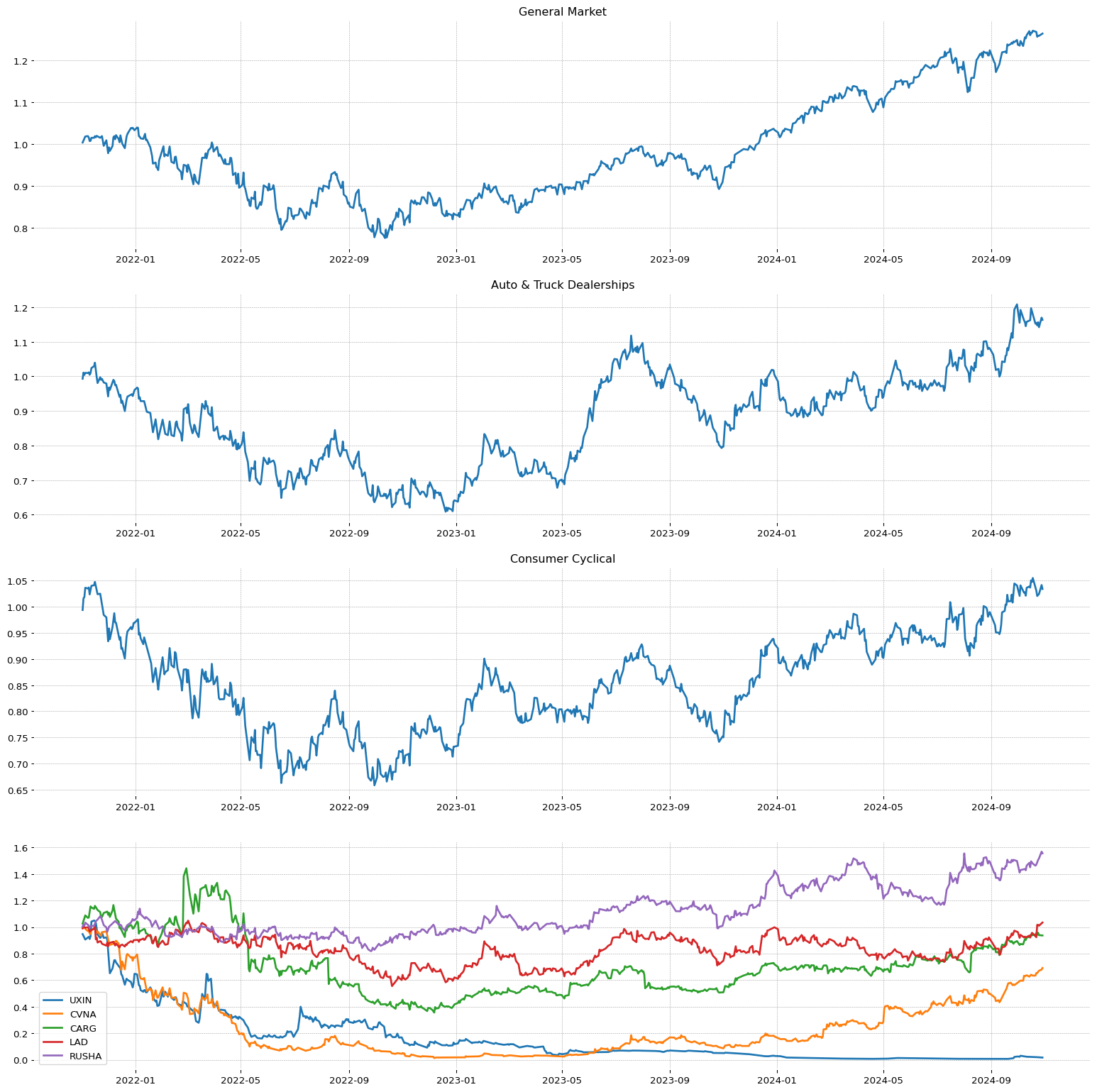

| Auto & Truck Dealerships | 1 |

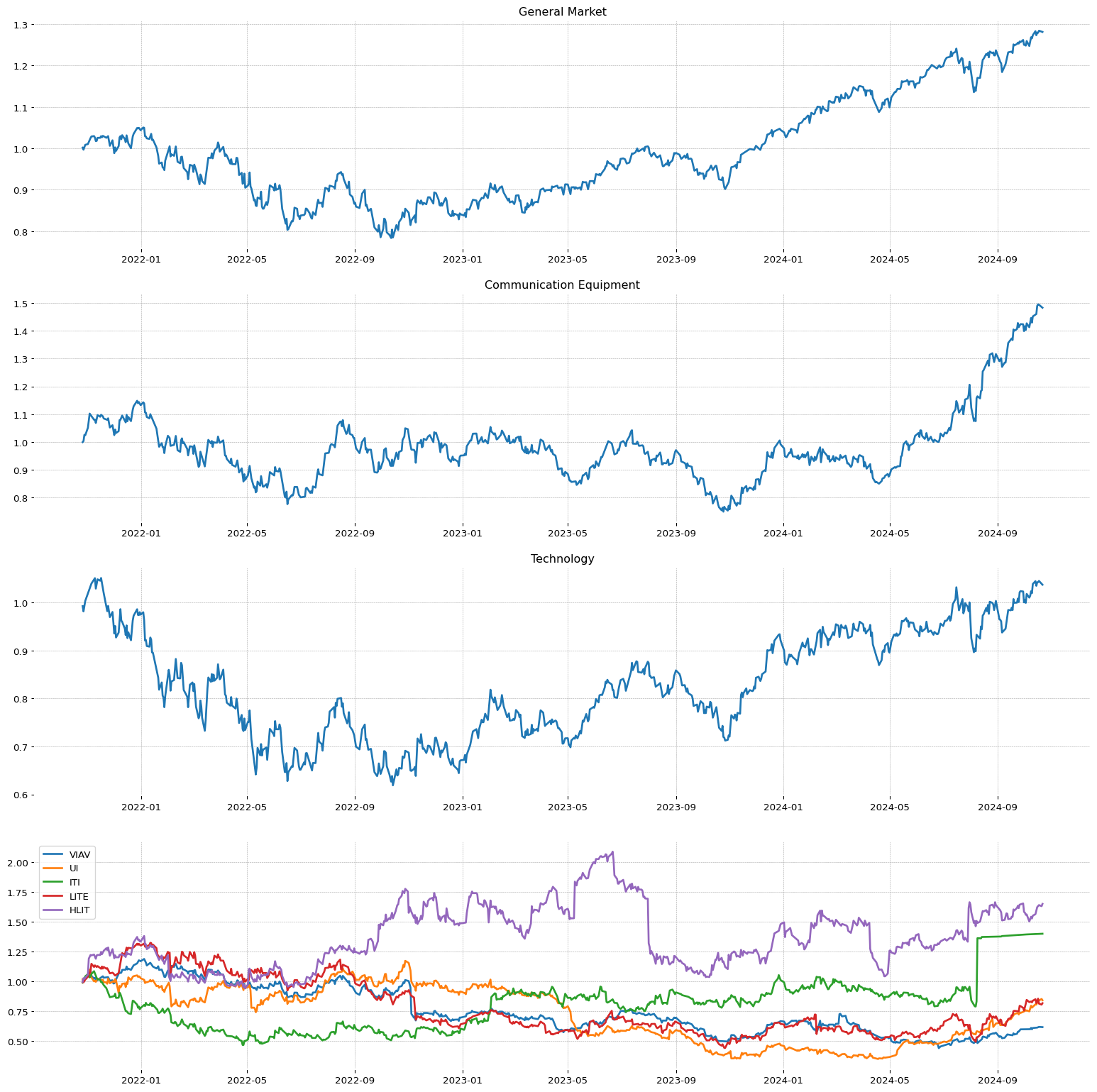

| Communication Equipment | 1 |

| Aerospace & Defense | 1 |

| Restaurants | 1 |

| Rental & Leasing Services | 1 |

| Health Information Services | 1 |

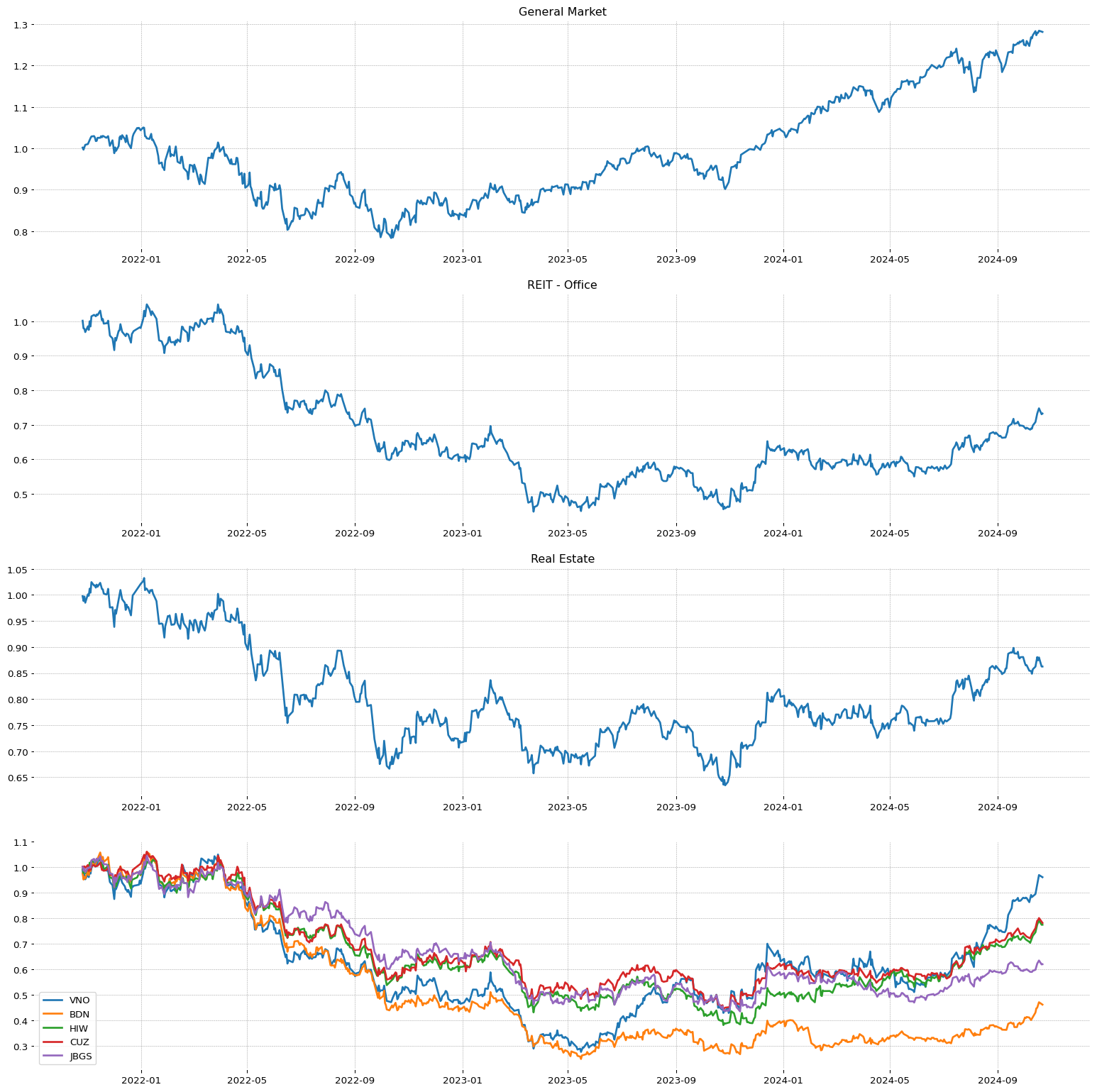

| Real Estate Services | 1 |

| Gambling | 1 |

| Financial Conglomerates | 1 |

| Medical Instruments & Supplies | 1 |

| Specialty Chemicals | 1 |

| Telecom Services | 1 |

| Building Products & Equipment | 1 |

| Insurance - Property & Casualty | 1 |

| Other Precious Metals & Mining | 1 |

| Utilities - Independent Power Producers | 1 |

| Diagnostics & Research | 1 |

| Specialty Retail | 1 |

| Chemicals | 1 |

| Pos. | |

Name | |

Today | |

3 weeks | |

6 weeks | |

26 weeks | |

1DAY | |

Ytoday | |

1YEAR | |

|| |

Pos. | |

Name | |

Today | |

3 weeks | |

6 weeks | |

26 weeks | |

1DAY | |

7DAY | |

30DAY | |

Ytoday | |

1YEAR | |

Ratio_GP | |

Ratio_NI | |

ROE | |

| 1.0 |

Paper & Paper Products |

100.0 |

4.0 |

4.0 |

59.0 |

-1.69 |

128.66 |

198.97 |

24.44 |

-0.22 |

13.17 |

|| |

26.0 |

Insurance - Specialty |

82.0 |

69.0 |

74.0 |

46.0 |

-0.66 |

24.16 |

43.01% |

80.53 |

22.14 |

5.37 |

| 2.0 |

Healthcare Plans |

99.0 |

99.0 |

99.0 |

72.0 |

-0.03 |

66.81 |

120.73 |

43.1 |

-0.1 |

-7.78 |

|| |

27.0 |

Telecom Services |

82.0 |

89.0 |

81.0 |

11.0 |

-0.52 |

14.9 |

31.57% |

46.21 |

1.41 |

-5.22 |

| 3.0 |

Health Information Services |

98.0 |

68.0 |

41.0 |

81.0 |

-0.47 |

95.65 |

114.88 |

48.01 |

-17.1 |

-7.61 |

|| |

28.0 |

Gold |

81.0 |

88.0 |

95.0 |

61.0 |

0.62 |

23.91 |

46.87% |

29.0 |

4.75 |

0.06 |

| 4.0 |

Electronic Components |

97.0 |

67.0 |

76.0 |

89.0 |

-0.52 |

35.41 |

63.21 |

30.44 |

7.1 |

13.67 |

|| |

29.0 |

Pollution & Treatment Controls |

80.0 |

90.0 |

89.0 |

71.0 |

-0.99 |

40.75 |

57.12% |

36.49 |

9.13 |

17.02 |

| 5.0 |

Utilities - Independent Power Producers |

97.0 |

98.0 |

98.0 |

99.0 |

-1.35 |

77.46 |

103.84 |

26.67 |

15.74 |

16.99 |

|| |

30.0 |

Real Estate Services |

80.0 |

93.0 |

86.0 |

69.0 |

0.0 |

17.12 |

52.39% |

31.34 |

1.19 |

-3.8 |

| 6.0 |

Conglomerates |

96.0 |

52.0 |

62.0 |

49.0 |

-0.53 |

26.48 |

39.29 |

30.99 |

6.08 |

3.41 |

|| |

31.0 |

Food Distribution |

79.0 |

87.0 |

46.0 |

48.0 |

-0.19 |

11.37 |

28.12% |

13.63 |

0.9 |

15.55 |

| 7.0 |

Capital Markets |

95.0 |

91.0 |

82.0 |

94.0 |

-0.59 |

22.06 |

55.29 |

49.13 |

11.0 |

3.52 |

|| |

32.0 |

Tobacco |

78.0 |

85.0 |

79.0 |

23.0 |

2.15 |

13.53 |

32.78% |

45.54 |

8.77 |

-32.24 |

| 8.0 |

Personal Services |

95.0 |

95.0 |

95.0 |

73.0 |

-0.36 |

30.77 |

71.03 |

39.27 |

11.19 |

120.74 |

|| |

33.0 |

Gambling |

78.0 |

65.0 |

85.0 |

78.0 |

0.04 |

26.92 |

41.81% |

52.61 |

2.41 |

-2.89 |

| 9.0 |

Other Precious Metals & Mining |

94.0 |

78.0 |

93.0 |

85.0 |

2.54 |

65.5 |

79.98 |

11.84 |

-6.04 |

-6.69 |

|| |

34.0 |

Household & Personal Products |

77.0 |

12.0 |

9.0 |

48.0 |

-0.97 |

14.04 |

27.02% |

55.3 |

3.36 |

34.82 |

| 10.0 |

Communication Equipment |

93.0 |

100.0 |

100.0 |

77.0 |

-0.19 |

27.62 |

61.21 |

34.39 |

-9.53 |

4.92 |

|| |

35.0 |

Home Improvement Retail |

76.0 |

18.0 |

5.0 |

88.0 |

0.94 |

2.04 |

24.9% |

41.09 |

6.91 |

237.5 |

| 11.0 |

Drug Manufacturers - Specialty & Generic |

93.0 |

74.0 |

91.0 |

75.0 |

0.46 |

19.36 |

48.85 |

53.27 |

-10.42 |

135.04 |

|| |

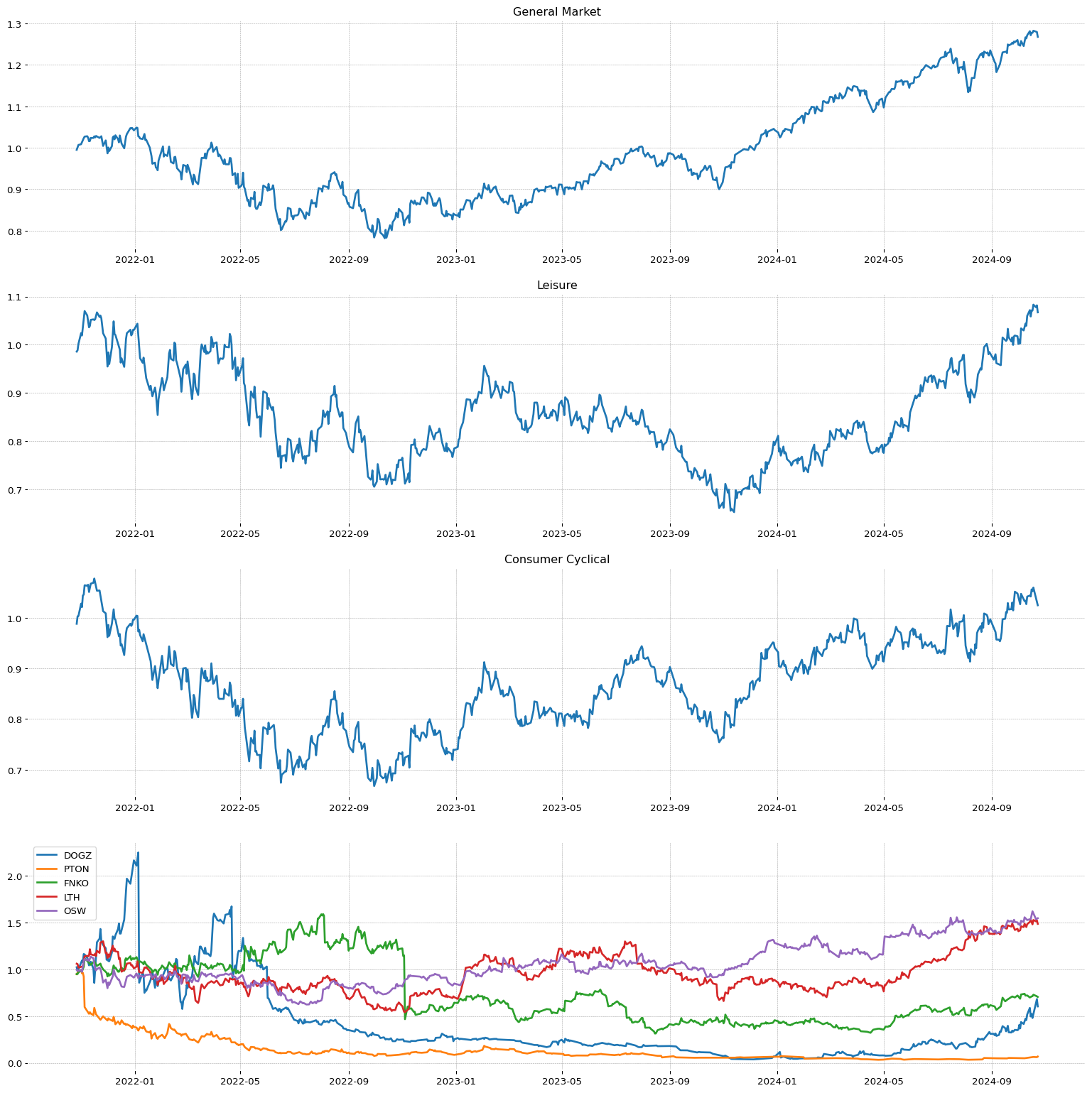

36.0 |

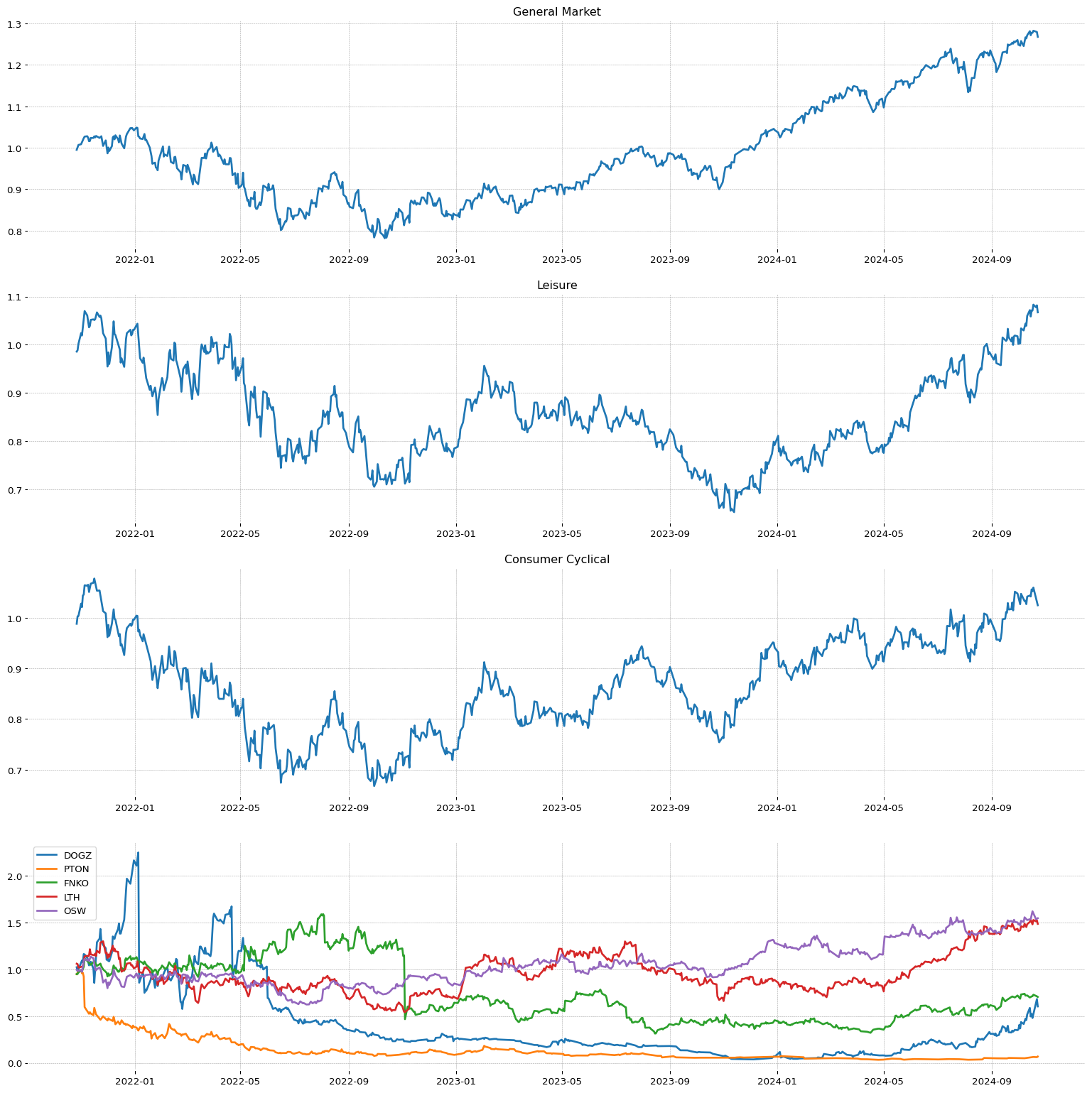

Leisure |

76.0 |

93.0 |

91.0 |

46.0 |

-0.54 |

14.56 |

32.17% |

42.88 |

-2.75 |

1.2 |

| 12.0 |

Silver |

92.0 |

55.0 |

89.0 |

67.0 |

1.97 |

63.09 |

78.91 |

16.13 |

2.14 |

2.31 |

|| |

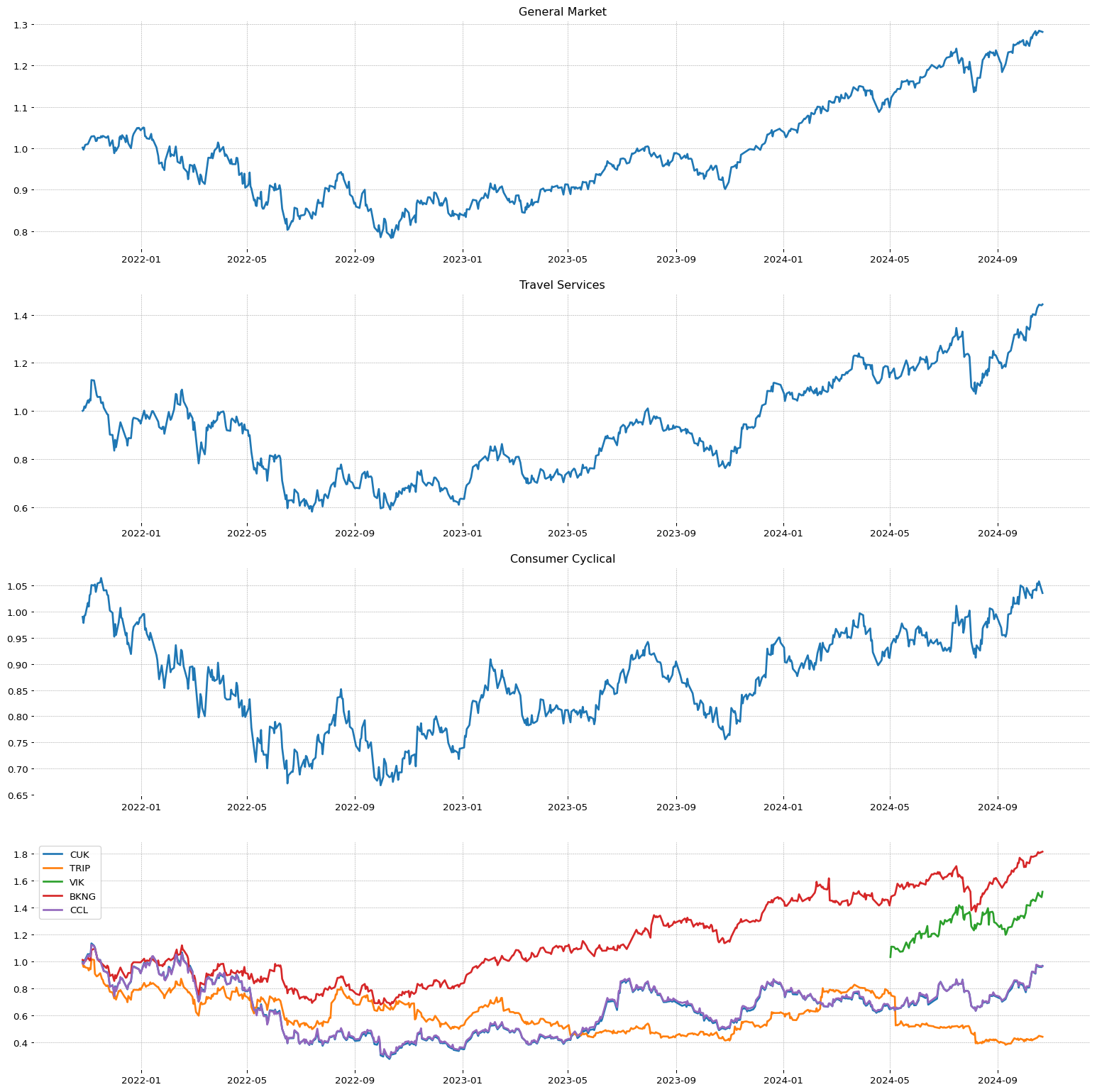

37.0 |

Integrated Freight & Logistics |

75.0 |

48.0 |

53.0 |

12.0 |

-0.7 |

16.59 |

41.95% |

27.91 |

-5.14 |

24.13 |

| 13.0 |

Aluminum |

91.0 |

7.0 |

23.0 |

98.0 |

0.06 |

24.5 |

70.98 |

5.78 |

2.39 |

0.18 |

|| |

38.0 |

REIT - Diversified |

74.0 |

82.0 |

90.0 |

38.0 |

0.27 |

14.57 |

23.29% |

63.98 |

23.55 |

4.35 |

| 14.0 |

Electrical Equipment & Parts |

91.0 |

80.0 |

51.0 |

51.0 |

0.15 |

8.15 |

10.76 |

4.38 |

-20.18 |

3.56 |

|| |

39.0 |

Specialty Retail |

74.0 |

38.0 |

21.0 |

32.0 |

-0.54 |

1.46 |

24.3% |

38.96 |

1.46 |

1.35 |

| 15.0 |

Closed-End Fund - Foreign |

90.0 |

58.0 |

61.0 |

47.0 |

-0.62 |

14.11 |

34.84 |

81.68 |

279.3 |

12.88 |

|| |

40.0 |

Medical Care Facilities |

73.0 |

61.0 |

78.0 |

68.0 |

-0.23 |

17.96 |

42.04% |

25.96 |

-1.22 |

37.16 |

| 16.0 |

Information Technology Services |

89.0 |

81.0 |

70.0 |

31.0 |

-0.55 |

16.19 |

36.01 |

28.73 |

-1.5 |

29.02 |

|| |

41.0 |

Aerospace & Defense |

72.0 |

72.0 |

70.0 |

63.0 |

-0.94 |

20.03 |

46.72% |

26.24 |

-2.87 |

5.12 |

| 17.0 |

Thermal Coal |

89.0 |

96.0 |

35.0 |

2.0 |

0.41 |

36.07 |

59.55 |

37.86 |

45.64 |

27.18 |

|| |

42.0 |

Biotechnology |

72.0 |

59.0 |

68.0 |

97.0 |

-0.26 |

26.82 |

71.11% |

42.86 |

463.66 |

23.04 |

| 18.0 |

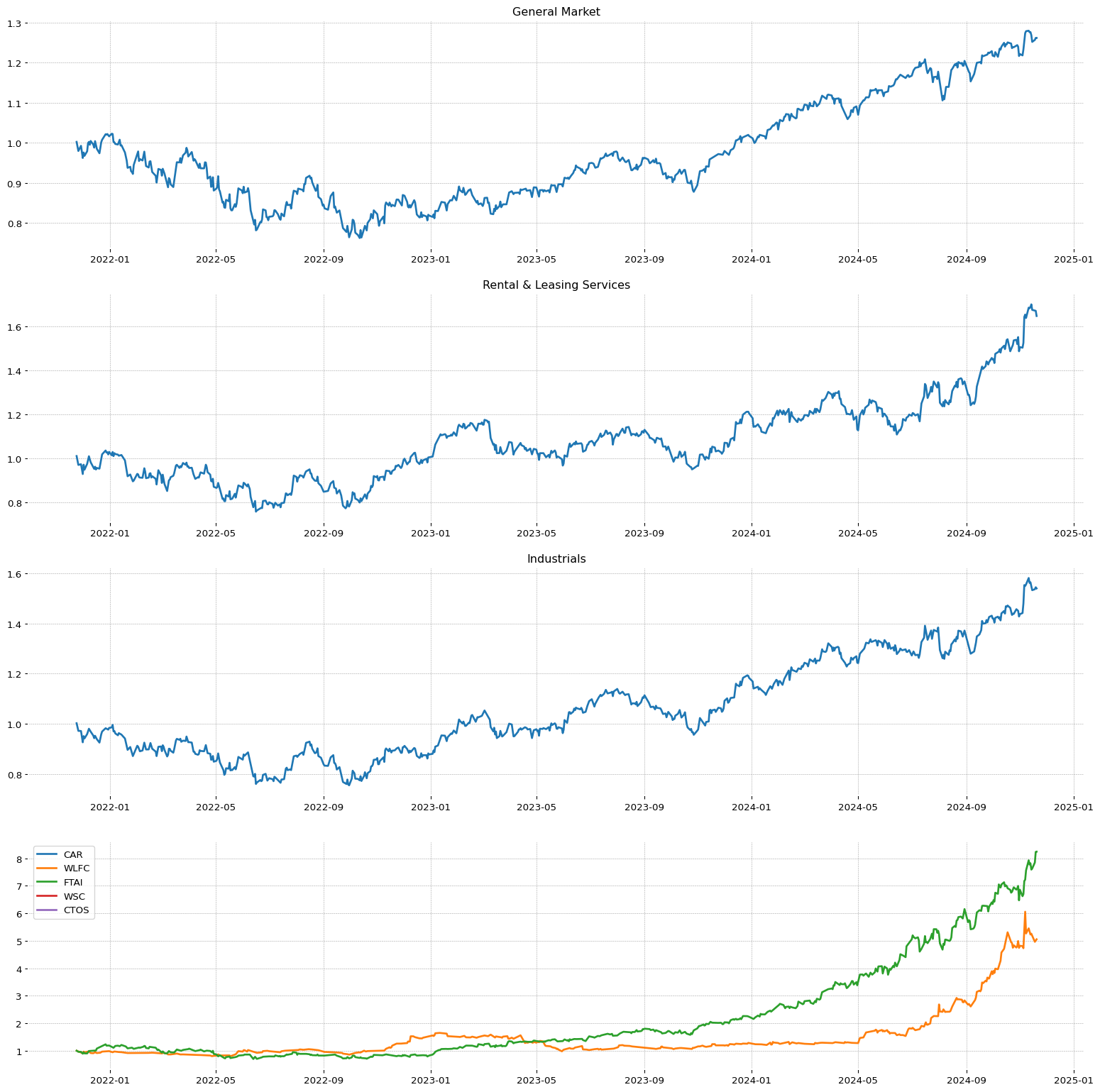

Rental & Leasing Services |

88.0 |

68.0 |

60.0 |

55.0 |

1.24 |

31.34 |

67.01 |

41.41 |

12.82 |

12.24 |

|| |

43.0 |

Banks - Regional |

71.0 |

76.0 |

87.0 |

40.0 |

0.34 |

14.45 |

44.78% |

89.79 |

16.78 |

10.41 |

| 19.0 |

Utilities - Regulated Water |

87.0 |

54.0 |

69.0 |

19.0 |

0.0 |

22.42 |

34.69 |

46.64 |

17.88 |

8.56 |

|| |

44.0 |

REIT - Healthcare Facilities |

70.0 |

95.0 |

96.0 |

29.0 |

0.06 |

12.15 |

27.73% |

51.08 |

3.2 |

1.61 |

| 20.0 |

Uranium |

87.0 |

26.0 |

14.0 |

17.0 |

-0.75 |

17.91 |

41.65 |

543.5 |

-28.55 |

-4.85 |

|| |

45.0 |

Farm Products |

70.0 |

70.0 |

87.0 |

79.0 |

-0.35 |

18.26 |

34.92% |

17.28 |

9.37 |

13.91 |

| 21.0 |

Financial Conglomerates |

86.0 |

92.0 |

88.0 |

100.0 |

-0.61 |

39.99 |

160.54 |

73.49 |

2.54 |

-19.86 |

|| |

46.0 |

Specialty Industrial Machinery |

69.0 |

39.0 |

31.0 |

65.0 |

-0.99 |

19.06 |

38.92% |

31.17 |

0.98 |

16.34 |

| 22.0 |

Grocery Stores |

85.0 |

86.0 |

76.0 |

21.0 |

0.26 |

38.4 |

52.33 |

29.63 |

3.57 |

12.7 |

|| |

47.0 |

Internet Content & Information |

68.0 |

35.0 |

17.0 |

70.0 |

-0.14 |

27.16 |

53.97% |

62.11 |

-2.35 |

2.87 |

| 23.0 |

Real Estate - Diversified |

85.0 |

59.0 |

54.0 |

13.0 |

1.07 |

-5.14 |

27.6 |

37.67 |

-15.59 |

-2.6 |

|| |

48.0 |

Real Estate - Development |

68.0 |

25.0 |

22.0 |

23.0 |

-2.92 |

49.71 |

64.36% |

36.9 |

48.06 |

-3.13 |

| 24.0 |

Diagnostics & Research |

84.0 |

91.0 |

92.0 |

84.0 |

-0.61 |

17.98 |

61.74 |

39.95 |

-14.15 |

-4.74 |

|| |

49.0 |

REIT - Specialty |

67.0 |

61.0 |

59.0 |

24.0 |

-0.88 |

8.74 |

37.25% |

47.87 |

17.58 |

5.55 |

| 25.0 |

Metal Fabrication |

83.0 |

87.0 |

93.0 |

62.0 |

2.14 |

28.1 |

53.09 |

22.64 |

6.29 |

14.22 |

|| |

50.0 |

Utilities - Renewable |

66.0 |

76.0 |

53.0 |

34.0 |

-0.69 |

11.42 |

25.43% |

43.56 |

9.03 |

1.52 |

| Pos. | |

Name | |

RS Today | |

RS 3Wk | |

RS 6Wk | |

RS 26wk | |

Secotr | |

Industry | |

Pos Ind | |

EPS | |

SMR | |

A/C | |

CR | |

Ind Pos. | |

Sec Pos. | |

Close. | |

10wk | |

26wk | |

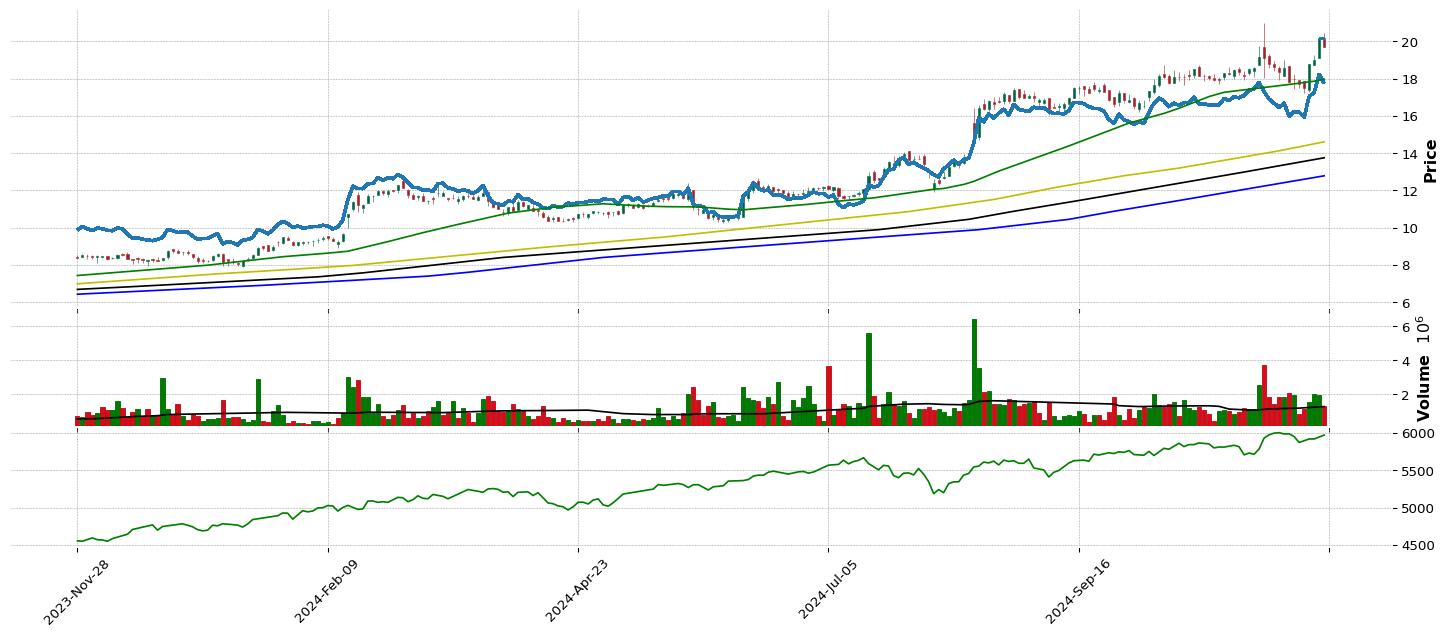

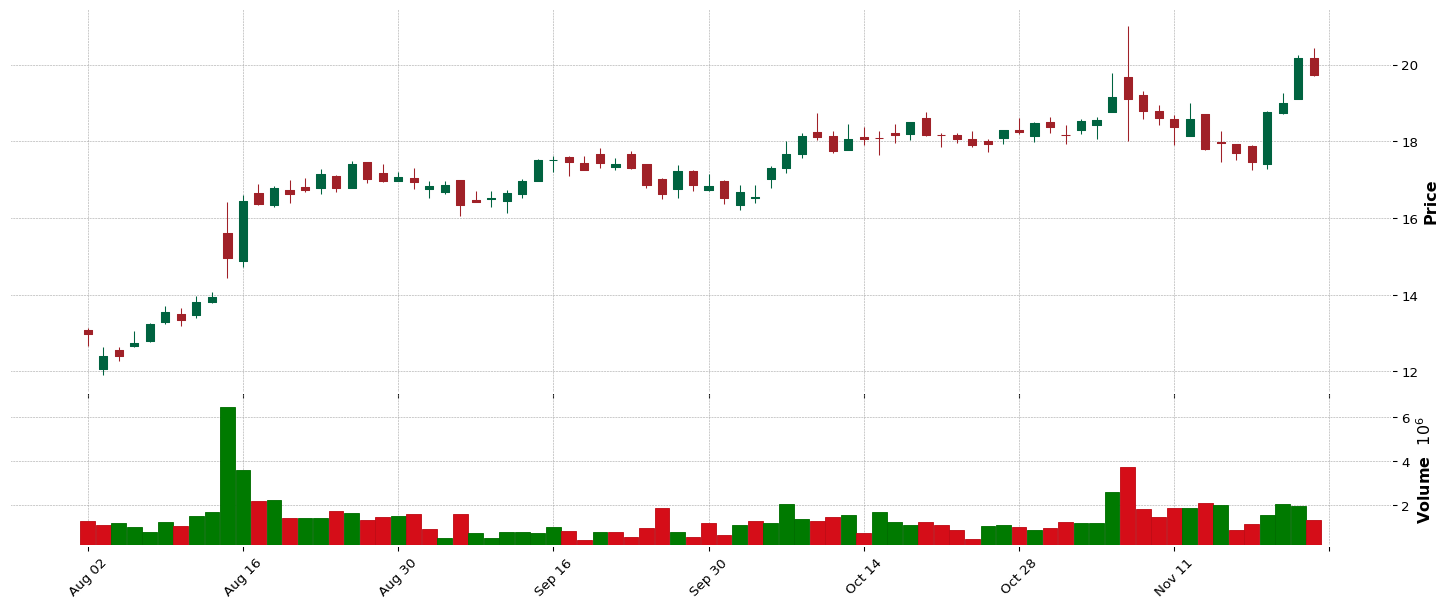

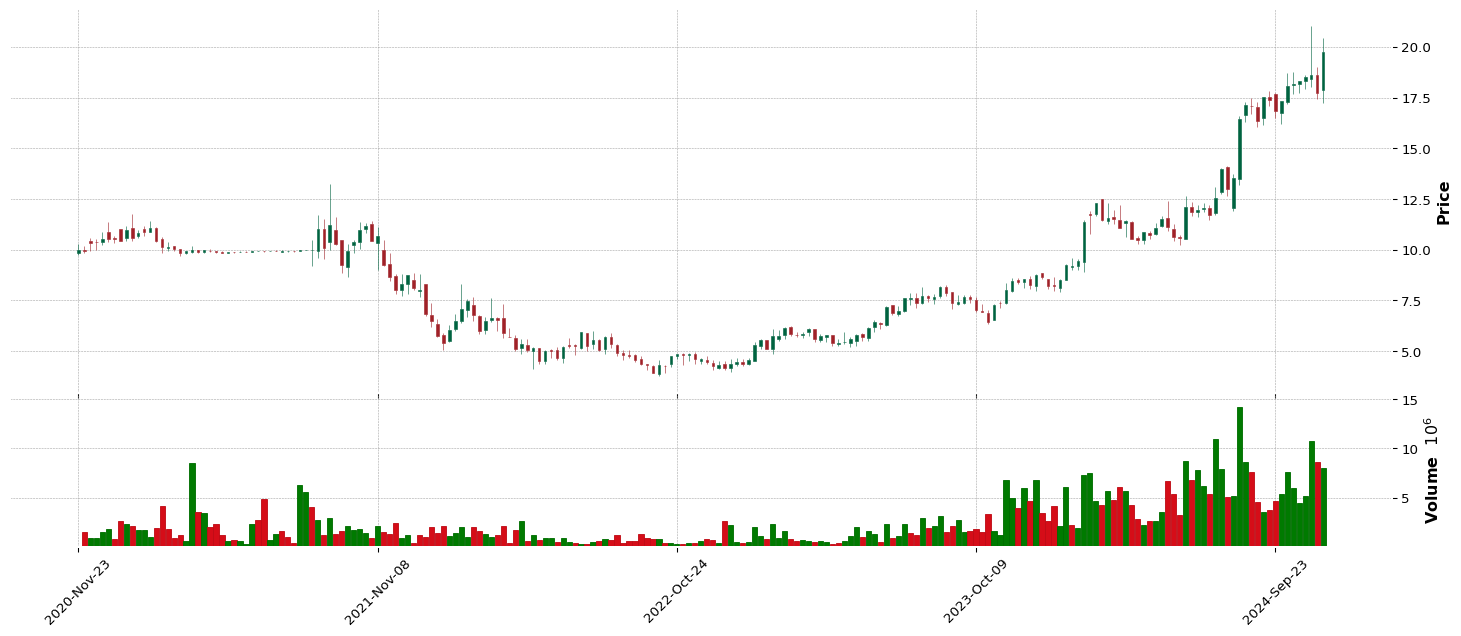

| 1.0 |

WGS |

100.0 |

99.96 |

99.87 |

72.87 |

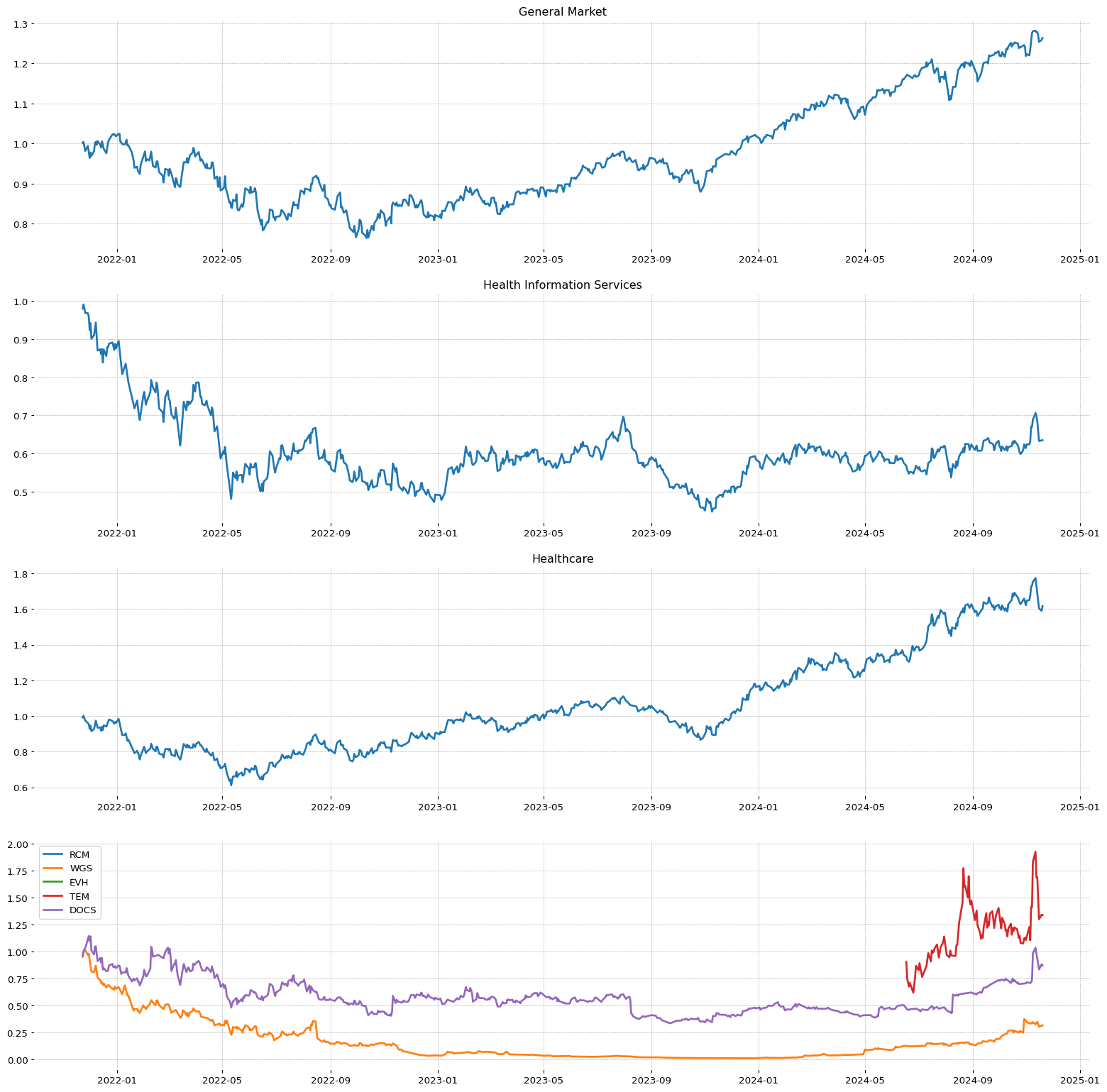

Healthcare |

Health Information Services |

3 |

97.33 |

96.88 |

91.54 |

39.08 |

1.0 |

1.0 |

57.79 |

1.0 |

1.0 |

| 2.0 |

LBPH |

99.93 |

99.87 |

99.81 |

97.17 |

Healthcare |

Biotechnology |

42 |

0.0 |

0.0 |

76.82 |

0.0 |

1.0 |

2.0 |

59.4 |

1.0 |

1.0 |

| 3.0 |

LENZ |

99.87 |

99.9 |

99.93 |

99.56 |

Healthcare |

Biotechnology |

42 |

23.1 |

0.0 |

36.26 |

0.0 |

2.0 |

3.0 |

24.67 |

1.0 |

1.0 |

| 4.0 |

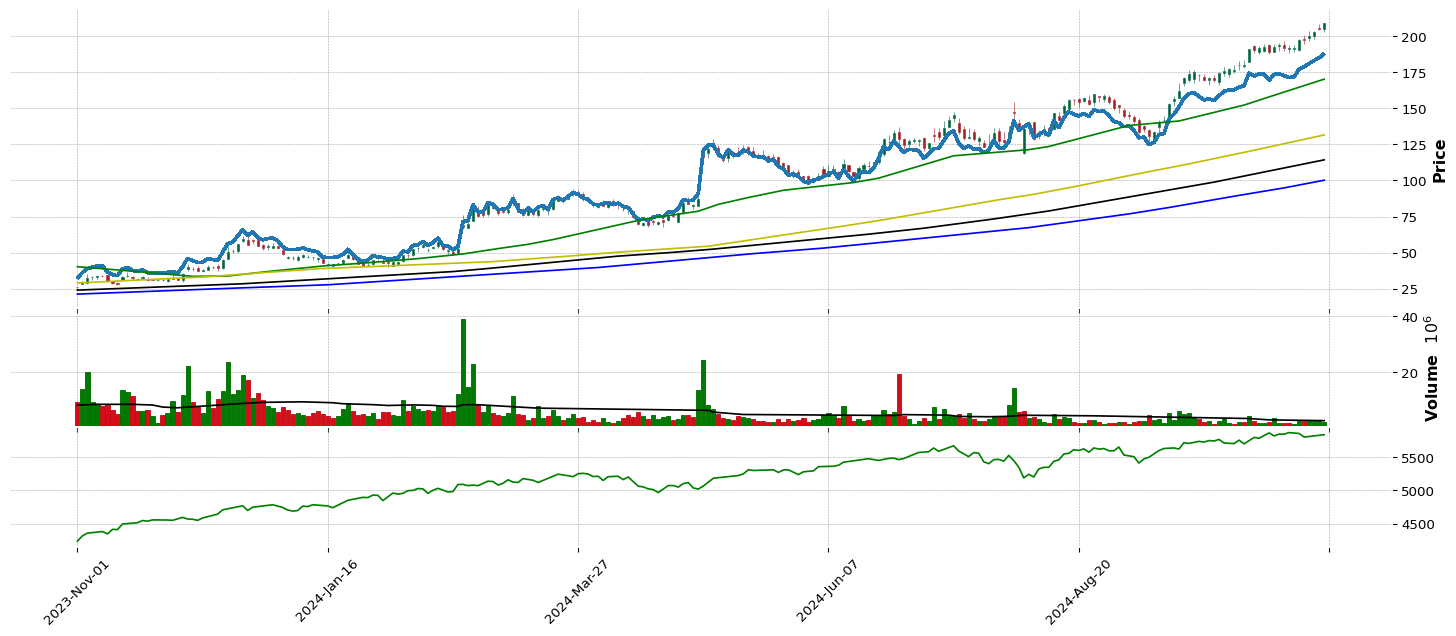

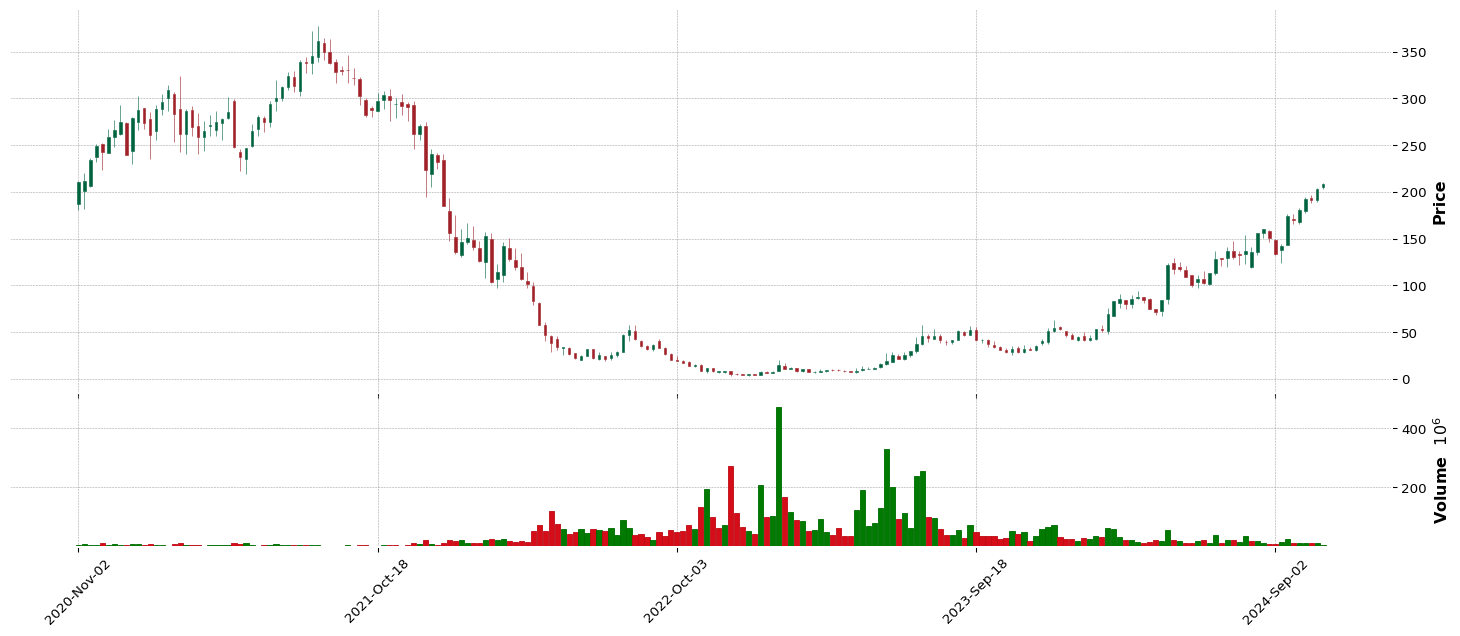

CVNA |

99.75 |

99.63 |

97.47 |

99.9 |

Consumer Cyclical |

Auto and Truck Dealerships |

65 |

77.54 |

76.45 |

98.95 |

83.76 |

1.0 |

1.0 |

197.35 |

1.0 |

1.0 |

| 5.0 |

VKTX |

99.69 |

99.75 |

99.66 |

98.97 |

Healthcare |

Biotechnology |

42 |

8.69 |

0.0 |

72.81 |

0.0 |

4.0 |

5.0 |

62.02 |

0.0 |

0.0 |

| 6.0 |

KRRO |

99.63 |

96.21 |

95.01 |

98.88 |

Healthcare |

Biotechnology |

42 |

0.0 |

0.0 |

45.72 |

0.0 |

5.0 |

6.0 |

70.01 |

1.0 |

1.0 |

| 7.0 |

TREE |

99.57 |

99.53 |

99.35 |

88.77 |

Financial |

Financial Conglomerates |

21 |

68.11 |

40.48 |

70.09 |

51.9 |

1.0 |

1.0 |

56.0 |

1.0 |

1.0 |

| 8.0 |

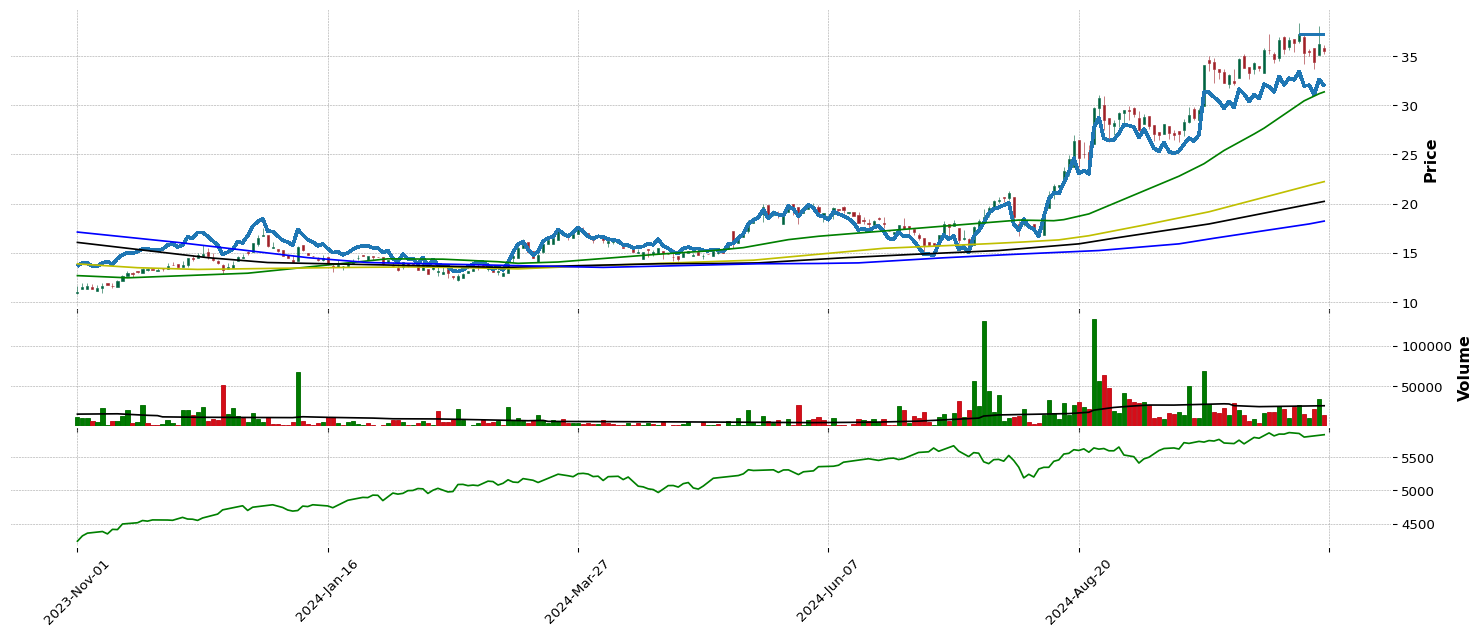

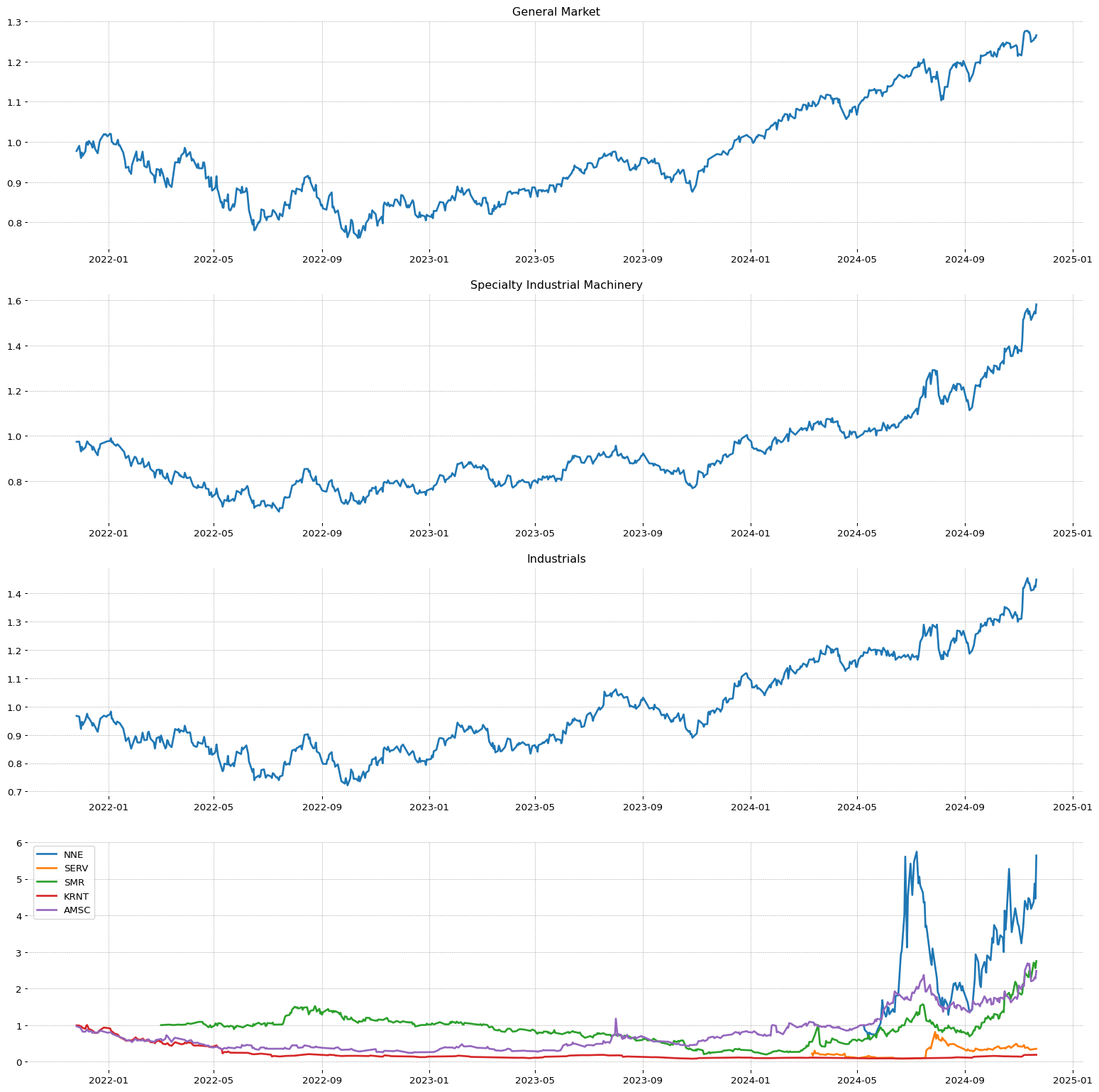

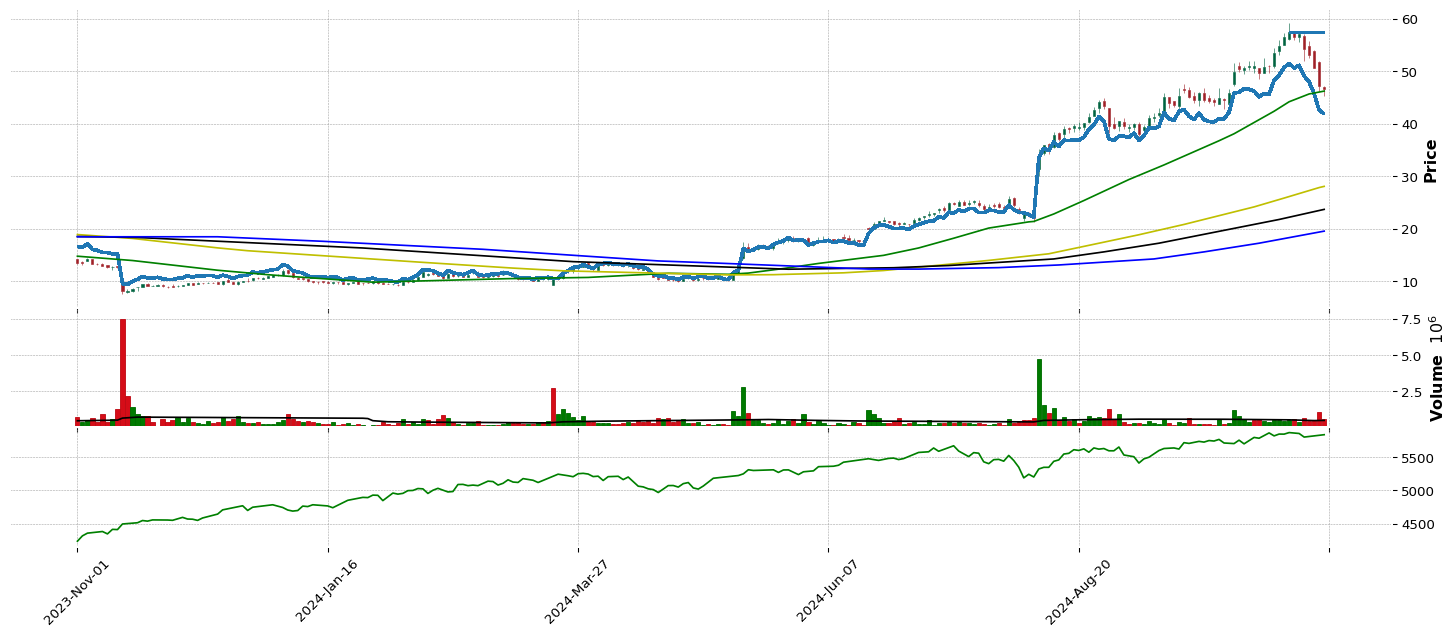

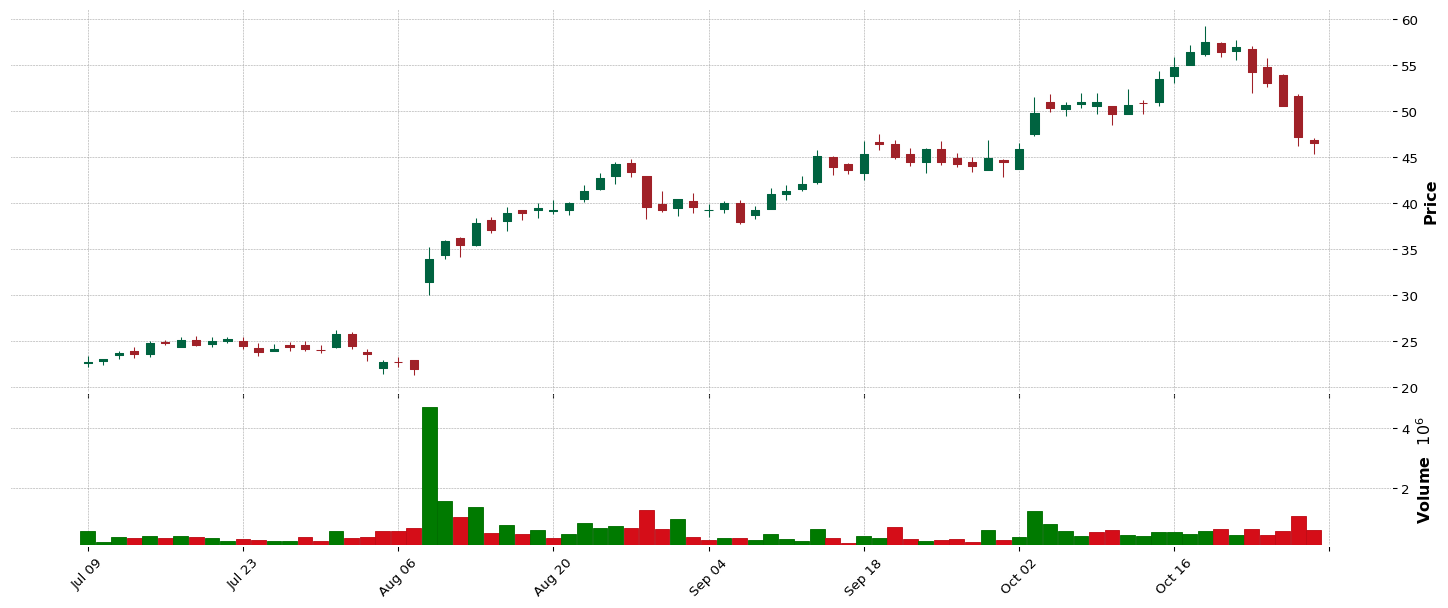

SMR |

99.51 |

97.07 |

81.19 |

7.0 |

Industrials |

Specialty Industrial Machinery |

46 |

6.55 |

11.22 |

76.43 |

15.75 |

1.0 |

1.0 |

17.8 |

1.0 |

1.0 |

| 9.0 |

DYN |

99.45 |

99.16 |

99.44 |

97.48 |

Healthcare |

Biotechnology |

42 |

29.72 |

0.0 |

36.26 |

0.0 |

6.0 |

7.0 |

33.38 |

0.0 |

0.0 |

| 10.0 |

SPRY |

99.32 |

99.04 |

90.33 |

71.76 |

Healthcare |

Biotechnology |

42 |

26.35 |

58.29 |

51.97 |

17.18 |

8.0 |

9.0 |

16.79 |

1.0 |

1.0 |

| 11.0 |

CDNA |

99.2 |

99.56 |

99.41 |

41.07 |

Healthcare |

Diagnostics and Research |

24 |

30.74 |

20.4 |

11.08 |

20.87 |

1.0 |

11.0 |

23.13 |

0.0 |

1.0 |

| 12.0 |

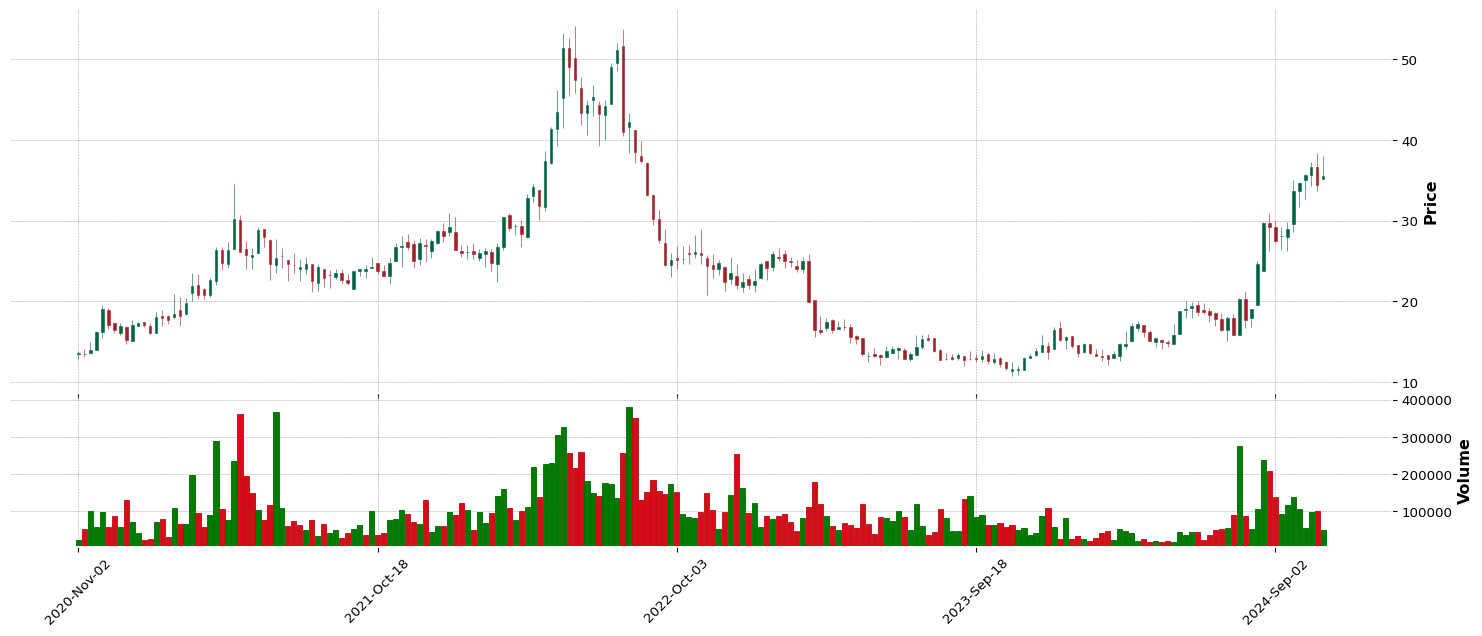

WLFC |

99.14 |

99.01 |

98.36 |

37.44 |

Industrials |

Rental and Leasing Services |

18 |

98.51 |

97.52 |

87.24 |

86.49 |

1.0 |

2.0 |

189.21 |

1.0 |

1.0 |

| 13.0 |

PI |

98.9 |

99.41 |

98.52 |

81.68 |

Technology |

Communication Equipment |

10 |

72.9 |

66.37 |

96.56 |

88.13 |

1.0 |

1.0 |

223.5 |

1.0 |

1.0 |

| 14.0 |

ROOT |

98.83 |

99.5 |

99.23 |

99.96 |

Financial |

Insurance - Property and Casualty |

71 |

74.6 |

60.12 |

79.92 |

45.7 |

1.0 |

2.0 |

39.72 |

0.0 |

0.0 |

| 15.0 |

KYMR |

98.59 |

97.69 |

97.13 |

53.31 |

Healthcare |

Biotechnology |

42 |

22.91 |

75.68 |

49.38 |

48.77 |

10.0 |

16.0 |

48.36 |

1.0 |

1.0 |

| 16.0 |

GATO |

98.53 |

98.55 |

96.52 |

88.22 |

Basic Materials |

Other Precious Metals and Mining |

9 |

93.53 |

21.88 |

91.15 |

27.01 |

1.0 |

2.0 |

19.95 |

1.0 |

1.0 |

| 17.0 |

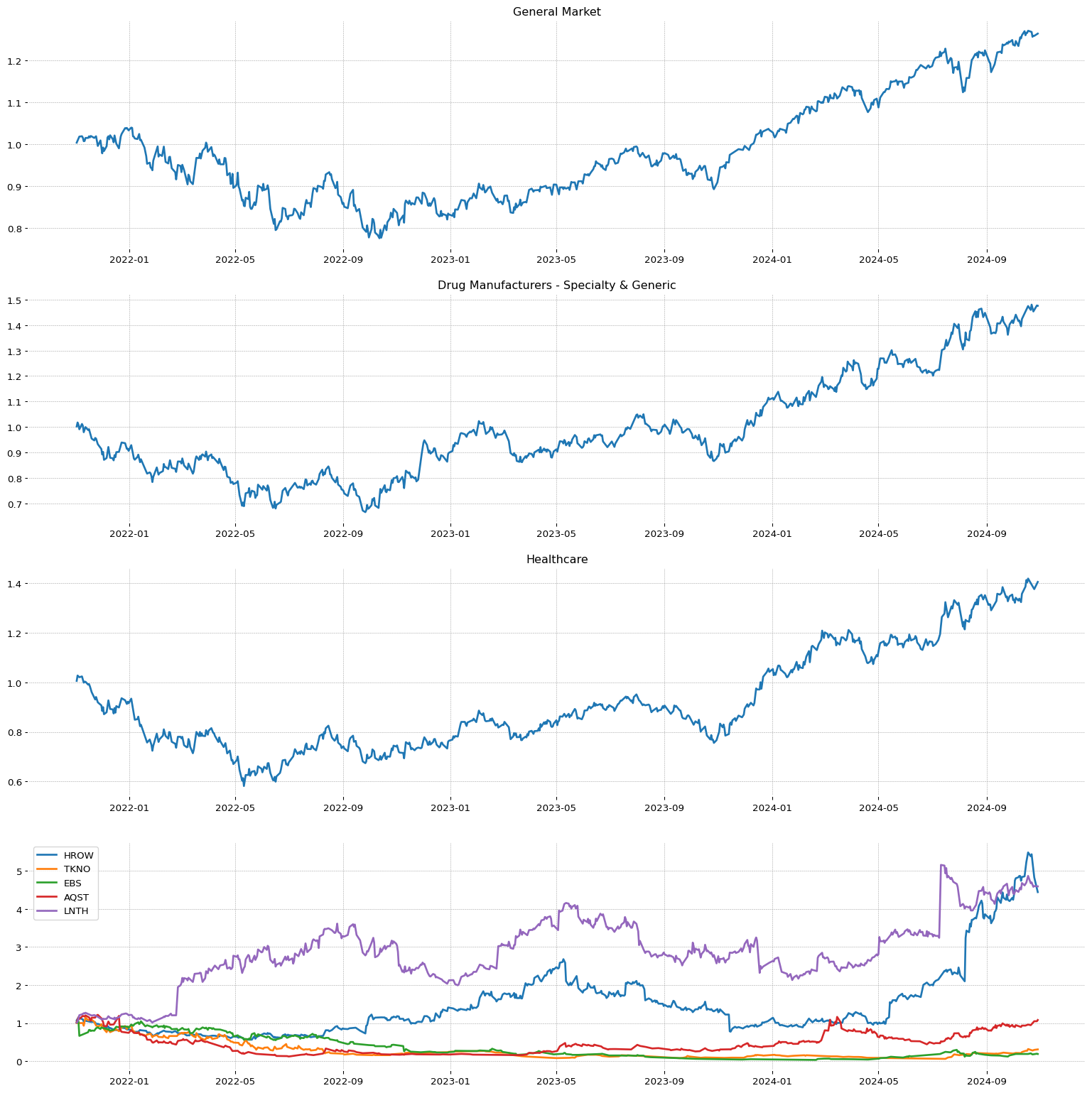

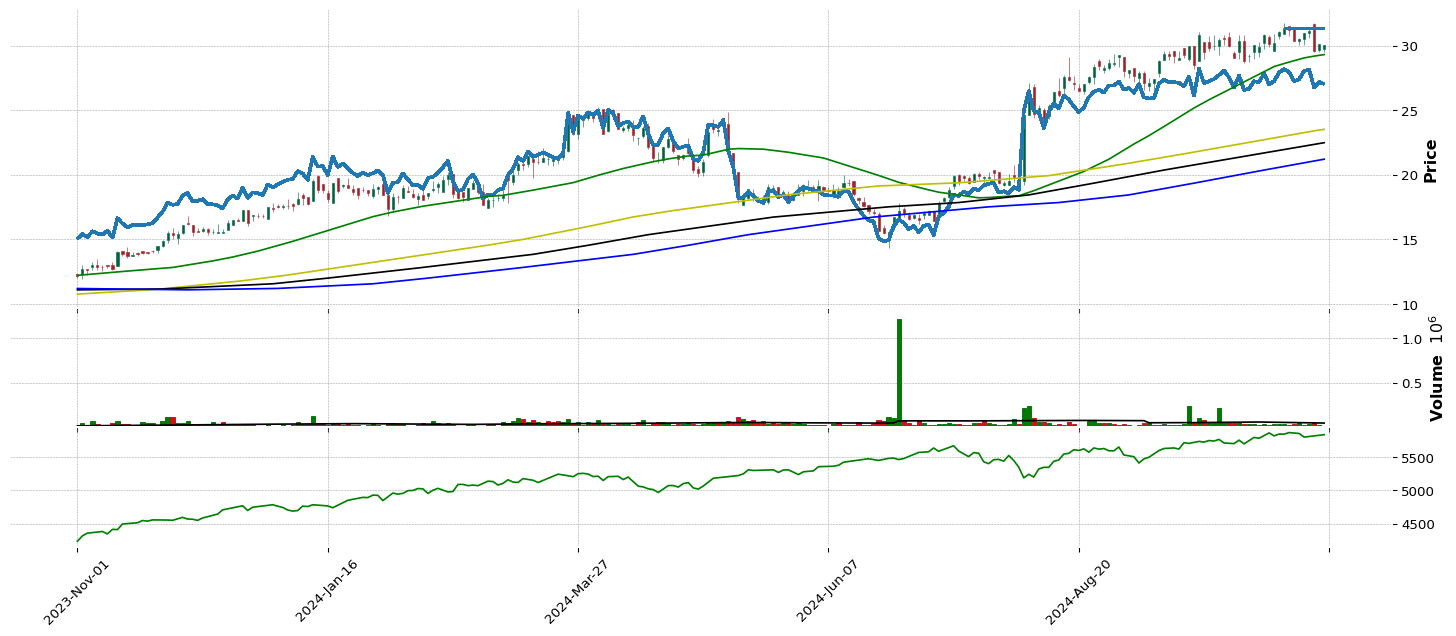

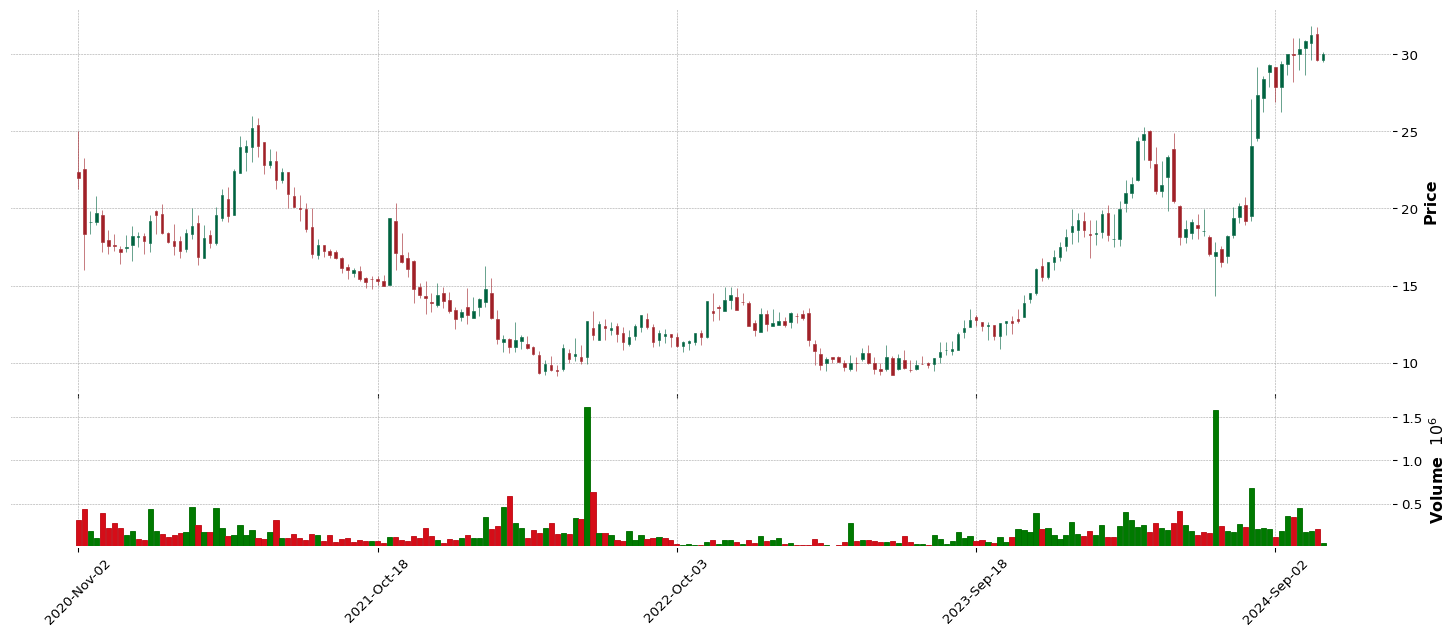

HROW |

98.47 |

98.43 |

98.46 |

2.01 |

Healthcare |

Drug Manufacturers - Specialty and Generic |

11 |

2.53 |

69.13 |

92.91 |

54.77 |

2.0 |

17.0 |

56.97 |

1.0 |

1.0 |

| 18.0 |

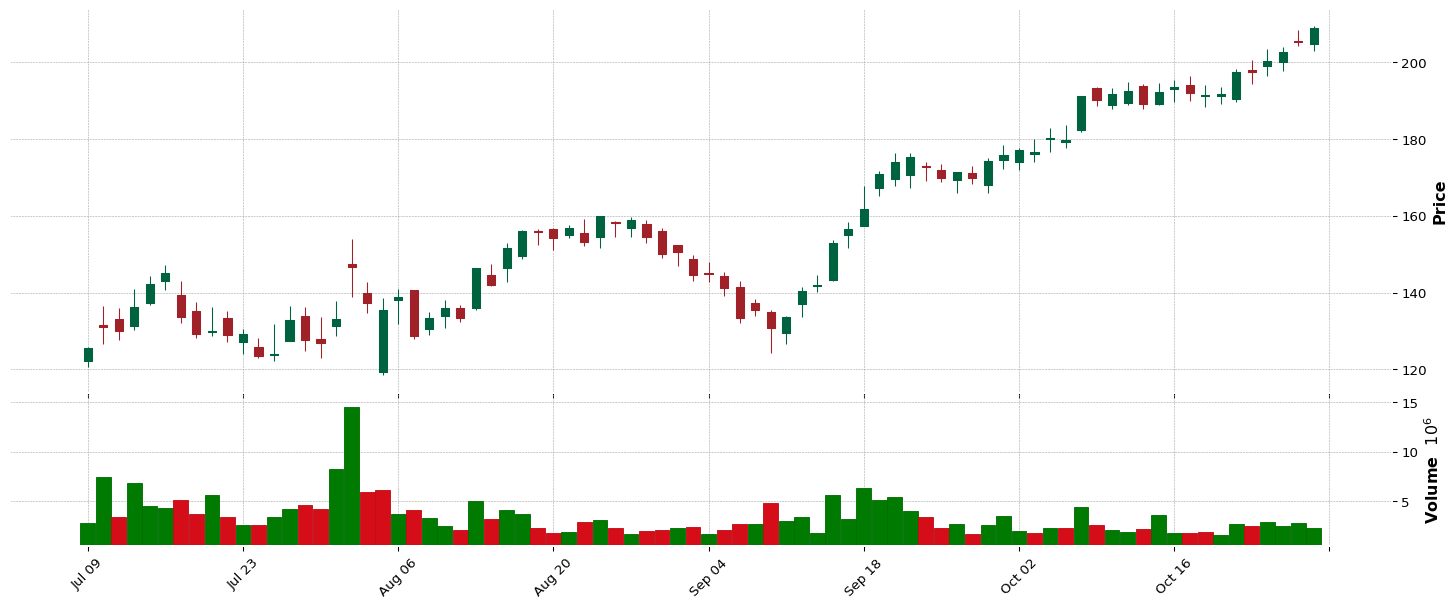

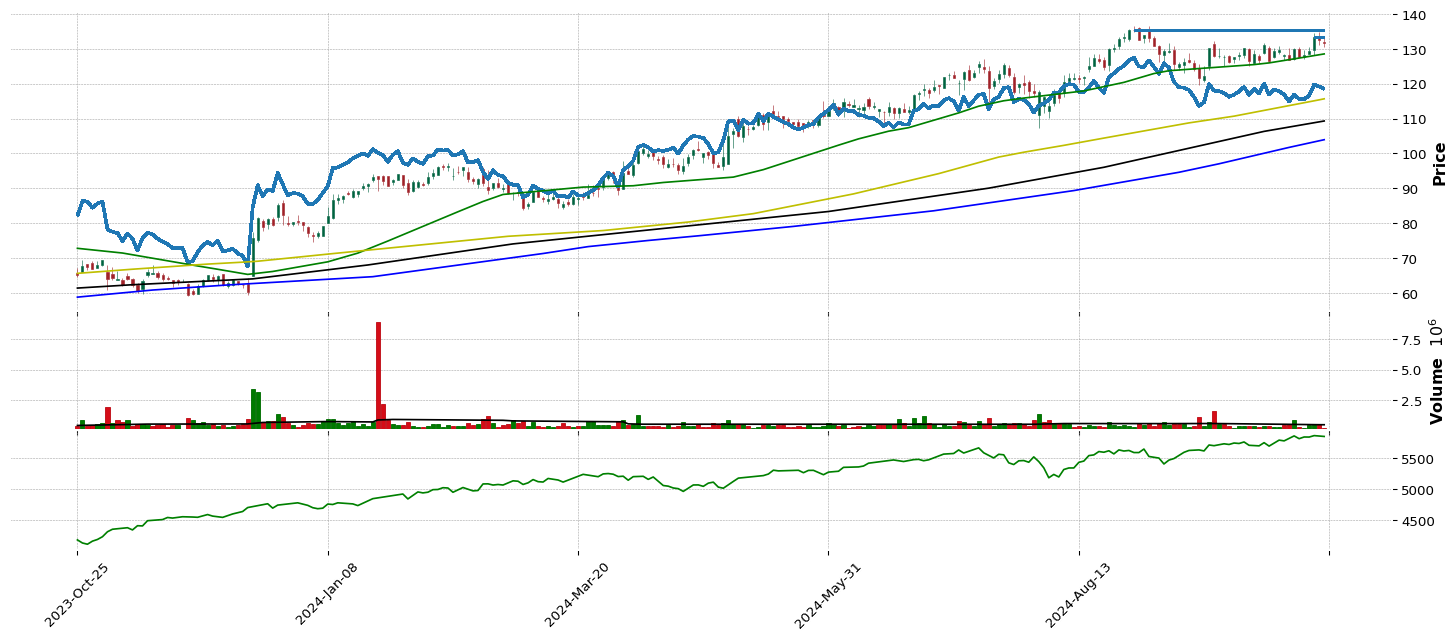

VST |

98.28 |

99.26 |

97.63 |

98.76 |

Utilities |

Utilities - Independent Power Producers |

5 |

13.67 |

29.29 |

88.8 |

73.66 |

1.0 |

1.0 |

125.04 |

1.0 |

1.0 |

| 19.0 |

BMA |

98.22 |

98.83 |

98.33 |

98.14 |

Financial |

Banks - Regional |

43 |

84.93 |

92.01 |

51.97 |

64.66 |

2.0 |

4.0 |

72.41 |

1.0 |

1.0 |

| 20.0 |

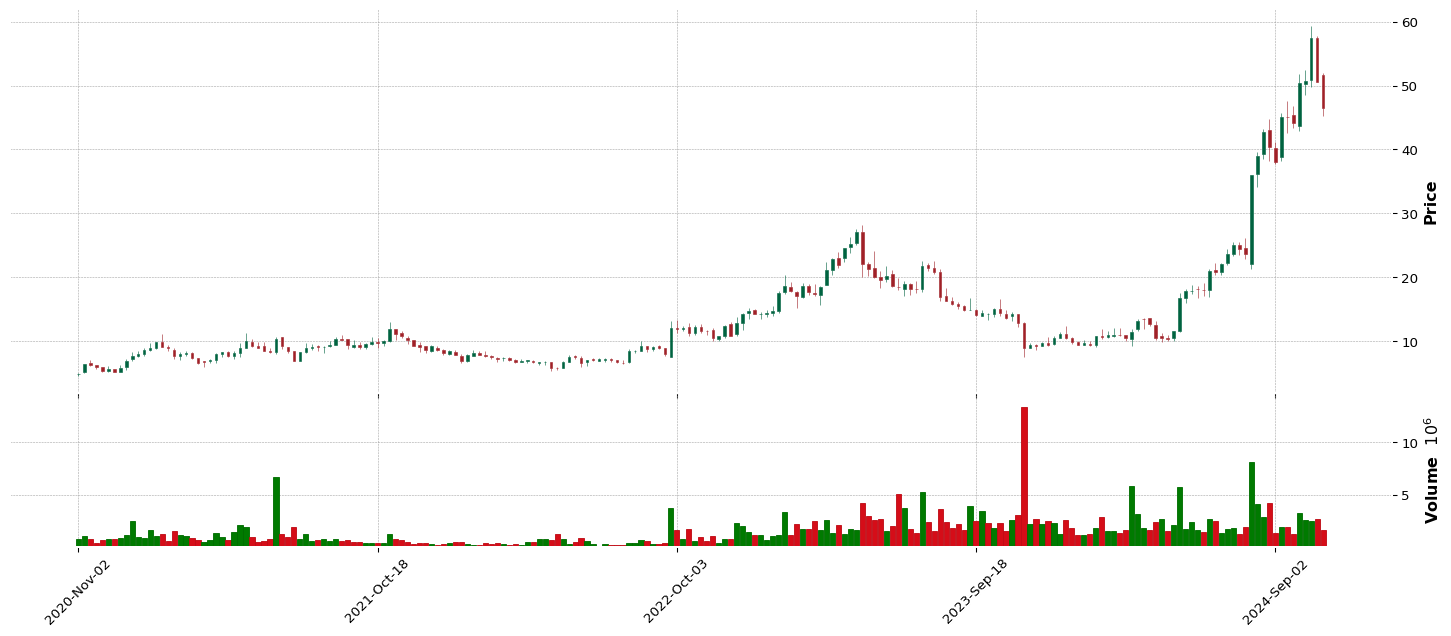

AMSC |

98.1 |

98.4 |

98.67 |

98.51 |

Industrials |

Specialty Industrial Machinery |

46 |

70.55 |

99.1 |

24.09 |

31.44 |

2.0 |

3.0 |

23.36 |

1.0 |

1.0 |

| 21.0 |

SG |

97.92 |

98.09 |

98.27 |

98.35 |

Consumer Cyclical |

Restaurants |

91 |

53.85 |

70.67 |

71.77 |

46.11 |

1.0 |

3.0 |

36.95 |

1.0 |

1.0 |

| 22.0 |

NGNE |

97.86 |

96.86 |

98.15 |

90.6 |

Healthcare |

Biotechnology |

42 |

0.46 |

0.0 |

79.92 |

0.0 |

13.0 |

20.0 |

49.97 |

1.0 |

1.0 |

| 23.0 |

BYRN |

97.8 |

99.81 |

99.69 |

97.24 |

Industrials |

Aerospace and Defense |

41 |

65.48 |

74.3 |

30.58 |

19.44 |

1.0 |

4.0 |

15.52 |

1.0 |

1.0 |

| 24.0 |

ZETA |

97.67 |

98.95 |

99.26 |

66.39 |

Technology |

Software - Infrastructure |

80 |

37.14 |

76.83 |

91.15 |

37.58 |

1.0 |

2.0 |

26.39 |

0.0 |

1.0 |

| 25.0 |

TGTX |

97.61 |

97.66 |

96.95 |

5.76 |

Healthcare |

Biotechnology |

42 |

94.64 |

76.0 |

79.92 |

36.49 |

14.0 |

22.0 |

24.25 |

1.0 |

1.0 |

| 26.0 |

APGE |

97.55 |

97.01 |

97.75 |

0.0 |

Healthcare |

Biotechnology |

42 |

0.0 |

0.0 |

36.26 |

0.0 |

15.0 |

23.0 |

51.79 |

0.0 |

1.0 |

| 27.0 |

PTGX |

97.49 |

97.44 |

97.84 |

54.92 |

Healthcare |

Biotechnology |

42 |

75.4 |

0.0 |

6.87 |

0.0 |

16.0 |

24.0 |

46.43 |

1.0 |

1.0 |

| 28.0 |

GCT |

97.37 |

98.21 |

86.98 |

99.75 |

Technology |

Software - Infrastructure |

80 |

0.0 |

0.0 |

54.43 |

0.0 |

2.0 |

3.0 |

26.79 |

1.0 |

0.0 |

| 29.0 |

SRRK |

97.31 |

24.68 |

79.53 |

96.62 |

Healthcare |

Biotechnology |

42 |

20.78 |

0.0 |

29.95 |

0.0 |

17.0 |

25.0 |

29.1 |

1.0 |

1.0 |

| 30.0 |

OSCR |

97.25 |

99.1 |

99.19 |

98.1 |

Healthcare |

Healthcare Plans |

2 |

83.17 |

92.71 |

47.34 |

24.55 |

2.0 |

26.0 |

16.03 |

0.0 |

0.0 |

| Pos. | |

Name | |

RS Today | |

RS 3Wk | |

RS 6Wk | |

RS 26wk | |

Secotr | |

Industry | |

Pos Ind | |

EPS | |

SMR | |

A/C | |

CR | |

Ind Pos. | |

Sec Pos. | |

Close. | |

10wk | |

26wk | |

| 1.0 |

LDP |

50.27 |

58.25 |

58.6 |

51.92 |

Financial |

Closed-End Fund - Debt |

93 |

63.06 |

37.27 |

95.74 |

41.74 |

14.0 |

213.0 |

21.34 |

1.0 |

1.0 |

| 2.0 |

KDP |

48.5 |

50.13 |

47.58 |

31.8 |

Consumer Defensive |

Beverages - Non-Alcoholic |

122 |

53.94 |

72.34 |

47.34 |

56.2 |

2.0 |

25.0 |

36.91 |

1.0 |

1.0 |

| 3.0 |

FFA |

48.19 |

44.72 |

48.72 |

50.83 |

Financial |

Closed-End Fund - Equity |

78 |

89.66 |

88.25 |

29.39 |

41.95 |

24.0 |

226.0 |

20.64 |

1.0 |

1.0 |

| 4.0 |

PAYX |

47.58 |

50.1 |

50.6 |

55.36 |

Technology |

Software - Application |

74 |

50.01 |

53.89 |

9.69 |

85.74 |

36.0 |

133.0 |

141.33 |

1.0 |

1.0 |

| 5.0 |

VOYA |

47.28 |

49.18 |

44.9 |

25.82 |

Financial |

Financial Conglomerates |

21 |

87.47 |

77.09 |

79.92 |

80.08 |

2.0 |

231.0 |

82.34 |

1.0 |

1.0 |

| 6.0 |

PTA |

47.09 |

49.27 |

54.41 |

50.86 |

Financial |

Closed-End Fund - Debt |

93 |

0.0 |

0.0 |

86.29 |

0.0 |

24.0 |

233.0 |

20.79 |

1.0 |

1.0 |

| 7.0 |

BUI |

46.24 |

54.62 |

51.76 |

28.08 |

Financial |

Closed-End Fund - Equity |

78 |

7.82 |

52.51 |

28.67 |

37.44 |

25.0 |

239.0 |

23.73 |

1.0 |

1.0 |

| 8.0 |

TBLD |

45.99 |

50.35 |

56.23 |

37.01 |

Financial |

Closed-End Fund - Equity |

78 |

0.0 |

0.0 |

67.39 |

0.0 |

27.0 |

241.0 |

17.34 |

1.0 |

1.0 |

| 9.0 |

REG |

45.75 |

49.92 |

56.75 |

35.64 |

Real Estate |

REIT - Retail |

66 |

97.18 |

59.35 |

36.26 |

74.55 |

12.0 |

52.0 |

71.87 |

1.0 |

1.0 |

| 10.0 |

OSBC |

45.38 |

33.26 |

55.64 |

58.95 |

Financial |

Banks - Regional |

43 |

50.51 |

43.27 |

90.42 |

34.92 |

94.0 |

247.0 |

16.55 |

1.0 |

1.0 |

| 11.0 |

COR |

44.89 |

46.41 |

75.86 |

78.92 |

Healthcare |

Medical Distribution |

146 |

68.04 |

29.13 |

18.42 |

92.7 |

1.0 |

119.0 |

234.16 |

1.0 |

1.0 |

| 12.0 |

PDX |

44.53 |

58.93 |

77.53 |

81.33 |

Financial |

Closed-End Fund - Equity |

78 |

0.0 |

0.0 |

74.43 |

0.0 |

28.0 |

250.0 |

23.39 |

1.0 |

1.0 |

| 13.0 |

QQQX |

44.34 |

39.71 |

46.99 |

31.74 |

Financial |

Closed-End Fund - Equity |

78 |

72.71 |

61.56 |

29.39 |

45.08 |

29.0 |

252.0 |

25.38 |

1.0 |

1.0 |

| 14.0 |

LNT |

44.1 |

56.4 |

53.09 |

25.51 |

Utilities |

Utilities - Regulated Electric |

56 |

0.0 |

0.0 |

53.77 |

0.0 |

11.0 |

22.0 |

61.04 |

1.0 |

1.0 |

| 15.0 |

NIE |

43.61 |

41.0 |

49.7 |

51.67 |

Financial |

Closed-End Fund - Equity |

78 |

68.82 |

0.0 |

67.39 |

0.0 |

30.0 |

256.0 |

23.62 |

1.0 |

1.0 |

| 16.0 |

FE |

42.94 |

59.57 |

61.28 |

27.92 |

Utilities |

Utilities - Regulated Electric |

56 |

21.65 |

45.74 |

36.26 |

55.52 |

12.0 |

24.0 |

43.84 |

1.0 |

1.0 |

| 17.0 |

IIIV |

42.63 |

31.84 |

33.82 |

40.79 |

Technology |

Software - Infrastructure |

80 |

25.82 |

62.78 |

45.72 |

40.58 |

36.0 |

138.0 |

22.73 |

1.0 |

1.0 |

| 18.0 |

MPLX |

42.15 |

56.71 |

65.22 |

62.12 |

Energy |

Oil and Gas Midstream |

111 |

90.34 |

71.31 |

63.56 |

64.18 |

13.0 |

29.0 |

44.13 |

1.0 |

1.0 |

| 19.0 |

GNTY |

41.96 |

41.43 |

54.69 |

65.8 |

Financial |

Banks - Regional |

43 |

16.54 |

34.71 |

98.11 |

51.56 |

97.0 |

267.0 |

33.75 |

1.0 |

1.0 |

| 20.0 |

EIG |

41.78 |

44.69 |

54.78 |

46.49 |

Financial |

Insurance - Specialty |

26 |

47.07 |

65.92 |

4.31 |

59.54 |

10.0 |

268.0 |

48.02 |

1.0 |

1.0 |

| 21.0 |

ARW |

41.23 |

32.58 |

31.45 |

55.3 |

Technology |

Electronics and Computer Distribution |

103 |

31.73 |

5.0 |

1.79 |

76.6 |

1.0 |

141.0 |

133.5 |

1.0 |

1.0 |

| 22.0 |

INCY |

40.62 |

39.93 |

33.91 |

9.7 |

Healthcare |

Biotechnology |

42 |

78.41 |

77.83 |

19.82 |

71.69 |

66.0 |

126.0 |

65.58 |

1.0 |

1.0 |

| 23.0 |

CHH |

40.56 |

32.73 |

29.76 |

29.32 |

Consumer Cyclical |

Lodging |

116 |

58.89 |

11.48 |

36.26 |

84.31 |

4.0 |

82.0 |

136.08 |

1.0 |

1.0 |

| 24.0 |

SR |

39.52 |

40.94 |

43.18 |

24.42 |

Utilities |

Utilities - Regulated Gas |

129 |

77.72 |

47.89 |

74.43 |

73.26 |

5.0 |

26.0 |

66.38 |

1.0 |

1.0 |

| 25.0 |

UGI |

37.26 |

39.62 |

31.73 |

12.95 |

Utilities |

Utilities - Regulated Gas |

129 |

65.26 |

46.39 |

68.42 |

45.02 |

6.0 |

27.0 |

24.95 |

1.0 |

1.0 |

| 26.0 |

RLI |

37.08 |

39.56 |

46.53 |

44.14 |

Financial |

Insurance - Property and Casualty |

71 |

75.81 |

52.48 |

74.43 |

90.24 |

11.0 |

286.0 |

159.05 |

1.0 |

1.0 |

| 27.0 |

SOR |

36.77 |

39.1 |

51.86 |

54.12 |

Financial |

Closed-End Fund - Equity |

78 |

94.8 |

82.96 |

48.38 |

64.59 |

37.0 |

288.0 |

44.09 |

1.0 |

1.0 |

| 28.0 |

UNF |

36.34 |

54.38 |

39.91 |

38.9 |

Industrials |

Specialty Business Services |

94 |

40.82 |

51.42 |

6.87 |

88.74 |

9.0 |

125.0 |

189.92 |

1.0 |

1.0 |

| 29.0 |

CPZ |

36.04 |

31.93 |

39.79 |

39.89 |

Financial |

Closed-End Fund - Equity |

78 |

0.0 |

0.0 |

86.29 |

0.0 |

38.0 |

291.0 |

15.73 |

1.0 |

1.0 |

| 30.0 |

KVUE |

35.67 |

39.34 |

42.28 |

0.0 |

Consumer Defensive |

Household and Personal Products |

34 |

35.38 |

42.18 |

95.23 |

42.97 |

3.0 |

33.0 |

22.93 |

1.0 |

1.0 |

| 31.0 |

EA |

35.24 |

44.38 |

57.46 |

39.58 |

Communication Services |

Electronic Gaming and Multimedia |

57 |

71.69 |

74.07 |

70.09 |

89.56 |

4.0 |

41.0 |

145.72 |

1.0 |

1.0 |

| 32.0 |

CII |

34.33 |

30.52 |

37.02 |

44.35 |

Financial |

Closed-End Fund - Equity |

78 |

90.31 |

74.75 |

79.92 |

43.58 |

41.0 |

300.0 |

19.85 |

1.0 |

1.0 |

| 33.0 |

AEE |

33.65 |

45.61 |

38.35 |

17.82 |

Utilities |

Utilities - Regulated Electric |

56 |

32.81 |

19.12 |

60.56 |

74.14 |

13.0 |

28.0 |

87.76 |

1.0 |

1.0 |

| 34.0 |

FTS |

32.92 |

43.77 |

44.93 |

23.15 |

Utilities |

Utilities - Regulated Electric |

56 |

36.74 |

29.96 |

36.26 |

56.54 |

14.0 |

29.0 |

44.75 |

1.0 |

1.0 |

| 35.0 |

WABC |

32.43 |

32.98 |

48.56 |

61.87 |

Financial |

Banks - Regional |

43 |

48.19 |

41.22 |

36.26 |

62.48 |

102.0 |

307.0 |

51.7 |

1.0 |

1.0 |

| 36.0 |

AON |

30.54 |

30.15 |

36.5 |

27.37 |

Financial |

Insurance Brokers |

52 |

40.73 |

48.37 |

12.51 |

95.77 |

5.0 |

313.0 |

356.14 |

1.0 |

1.0 |

| 37.0 |

KMT |

30.36 |

27.6 |

31.14 |

29.66 |

Industrials |

Tools and Accessories |

59 |

35.84 |

22.1 |

91.54 |

44.2 |

3.0 |

134.0 |

25.45 |

1.0 |

1.0 |

| 38.0 |

XOM |

30.11 |

35.9 |

26.68 |

42.46 |

Energy |

Oil and Gas Integrated |

133 |

71.75 |

8.05 |

29.39 |

81.78 |

3.0 |

36.0 |

120.69 |

1.0 |

1.0 |

| 39.0 |

ITRN |

28.16 |

15.89 |

26.13 |

66.3 |

Technology |

Scientific and Technical Instruments |

108 |

84.53 |

66.08 |

36.26 |

49.86 |

9.0 |

175.0 |

27.62 |

1.0 |

1.0 |

| 40.0 |

IDA |

27.61 |

31.97 |

40.13 |

18.87 |

Utilities |

Utilities - Regulated Electric |

56 |

31.36 |

27.91 |

9.69 |

73.8 |

15.0 |

30.0 |

103.81 |

1.0 |

1.0 |

| 41.0 |

MKL |

27.3 |

30.03 |

35.51 |

51.61 |

Financial |

Insurance - Property and Casualty |

71 |

82.27 |

74.43 |

36.26 |

99.79 |

13.0 |

318.0 |

1585.93 |

1.0 |

1.0 |

| 42.0 |

PEP |

26.26 |

29.2 |

31.33 |

28.39 |

Consumer Defensive |

Beverages - Non-Alcoholic |

122 |

45.25 |

61.88 |

43.69 |

90.31 |

5.0 |

46.0 |

174.36 |

1.0 |

1.0 |

| 43.0 |

GBLI |

18.99 |

22.59 |

28.1 |

55.95 |

Financial |

Insurance - Property and Casualty |

71 |

95.76 |

78.82 |

45.72 |

59.14 |

15.0 |

332.0 |

34.0 |

1.0 |

1.0 |

| Pos. | |

Name | |

RS Today | |

RS 3Wk | |

RS 6Wk | |

RS 26wk | |

Secotr | |

Industry | |

Pos Ind | |

EPS | |

SMR | |

A/C | |

CR | |

Ind Pos. | |

Sec Pos. | |

Close. | |

10wk | |

26wk | |

| 1.0 |

WGS |

100.0 |

99.96 |

99.87 |

72.87 |

Healthcare |

Health Information Services |

3 |

97.33 |

96.88 |

91.54 |

39.08 |

1.0 |

1.0 |

57.79 |

1.0 |

1.0 |

| 2.0 |

LBPH |

99.93 |

99.87 |

99.81 |

97.17 |

Healthcare |

Biotechnology |

42 |

0.0 |

0.0 |

76.82 |

0.0 |

1.0 |

2.0 |

59.4 |

1.0 |

1.0 |

| 3.0 |

LENZ |

99.87 |

99.9 |

99.93 |

99.56 |

Healthcare |

Biotechnology |

42 |

23.1 |

0.0 |

36.26 |

0.0 |

2.0 |

3.0 |

24.67 |

1.0 |

1.0 |

| 4.0 |

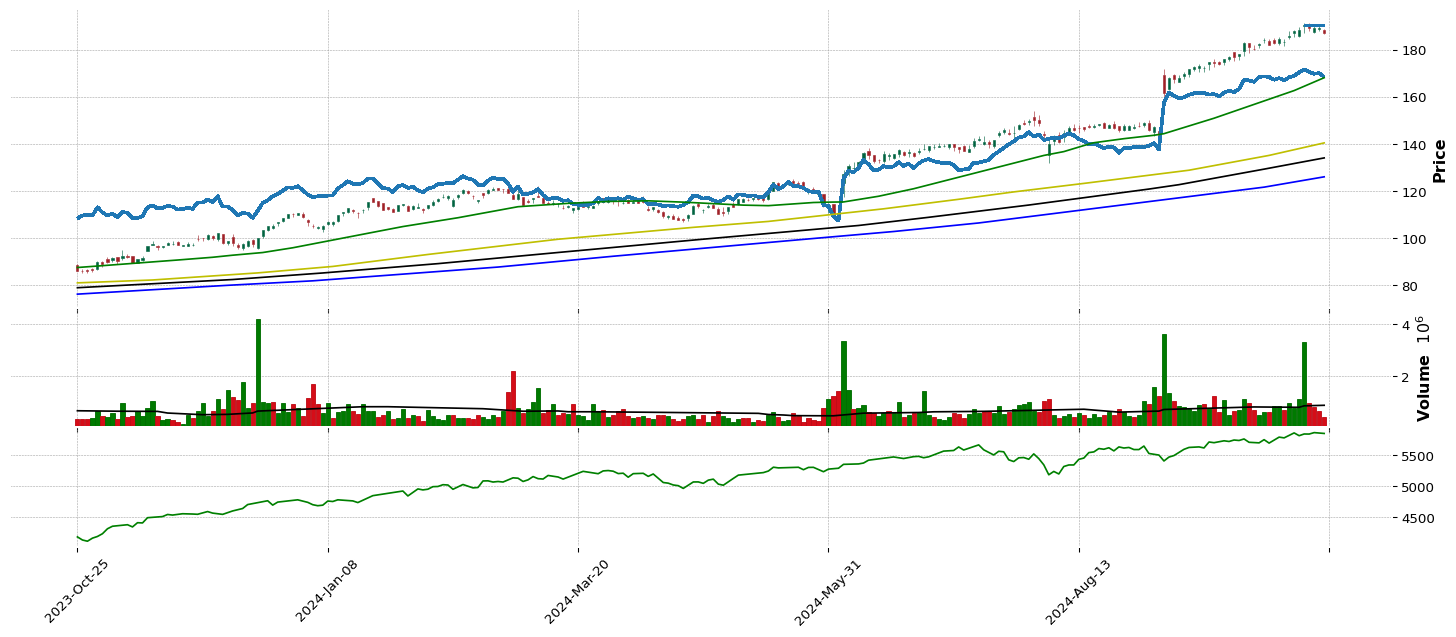

CVNA |

99.75 |

99.63 |

97.47 |

99.9 |

Consumer Cyclical |

Auto & Truck Dealerships |

65 |

77.54 |

76.45 |

98.95 |

83.76 |

1.0 |

1.0 |

197.35 |

1.0 |

1.0 |

| 5.0 |

TREE |

99.57 |

99.53 |

99.35 |

88.77 |

Financial |

Financial Conglomerates |

21 |

68.11 |

40.48 |

70.09 |

51.9 |

1.0 |

1.0 |

56.0 |

1.0 |

1.0 |

| 6.0 |

SMR |

99.51 |

97.07 |

81.19 |

7.0 |

Industrials |

Specialty Industrial Machinery |

46 |

6.55 |

11.22 |

76.43 |

15.75 |

1.0 |

1.0 |

17.8 |

1.0 |

1.0 |

| 7.0 |

SPRY |

99.32 |

99.04 |

90.33 |

71.76 |

Healthcare |

Biotechnology |

42 |

26.35 |

58.29 |

51.97 |

17.18 |

8.0 |

9.0 |

16.79 |

1.0 |

1.0 |

| 8.0 |

WLFC |

99.14 |

99.01 |

98.36 |

37.44 |

Industrials |

Rental & Leasing Services |

18 |

98.51 |

97.52 |

87.24 |

86.49 |

1.0 |

2.0 |

189.21 |

1.0 |

1.0 |

| 9.0 |

GATO |

98.53 |

98.55 |

96.52 |

88.22 |

Basic Materials |

Other Precious Metals & Mining |

9 |

93.53 |

21.88 |

91.15 |

27.01 |

1.0 |

2.0 |

19.95 |

1.0 |

1.0 |

| 10.0 |

HROW |

98.47 |

98.43 |

98.46 |

2.01 |

Healthcare |

Drug Manufacturers - Specialty & Generic |

11 |

2.53 |

69.13 |

92.91 |

54.77 |

2.0 |

17.0 |

56.97 |

1.0 |

1.0 |

| 11.0 |

NGNE |

97.86 |

96.86 |

98.15 |

90.6 |

Healthcare |

Biotechnology |

42 |

0.46 |

0.0 |

79.92 |

0.0 |

13.0 |

20.0 |

49.97 |

1.0 |

1.0 |

| 12.0 |

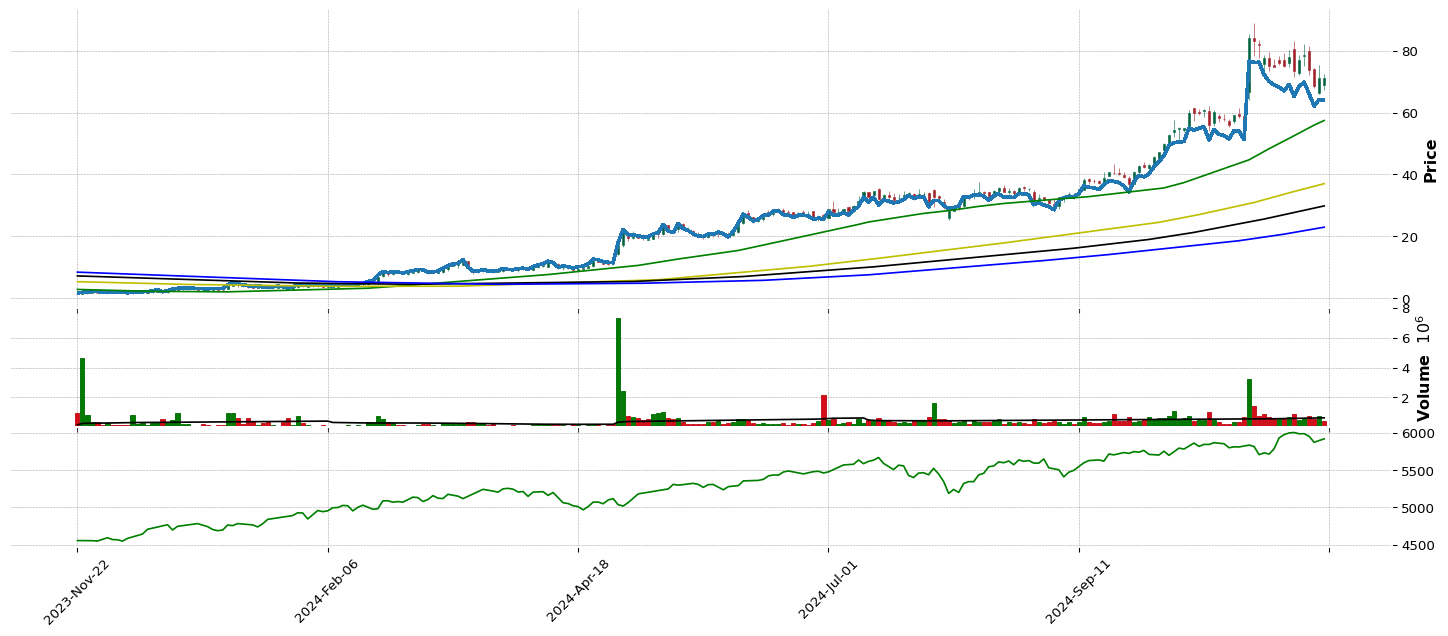

VHI |

97.18 |

97.23 |

95.81 |

29.35 |

Basic Materials |

Chemicals |

67 |

68.07 |

80.87 |

58.4 |

47.95 |

1.0 |

3.0 |

37.25 |

1.0 |

1.0 |

| 13.0 |

FIX |

96.02 |

95.97 |

92.95 |

95.28 |

Industrials |

Engineering & Construction |

72 |

90.87 |

92.65 |

36.26 |

96.58 |

1.0 |

7.0 |

414.79 |

1.0 |

1.0 |

| 14.0 |

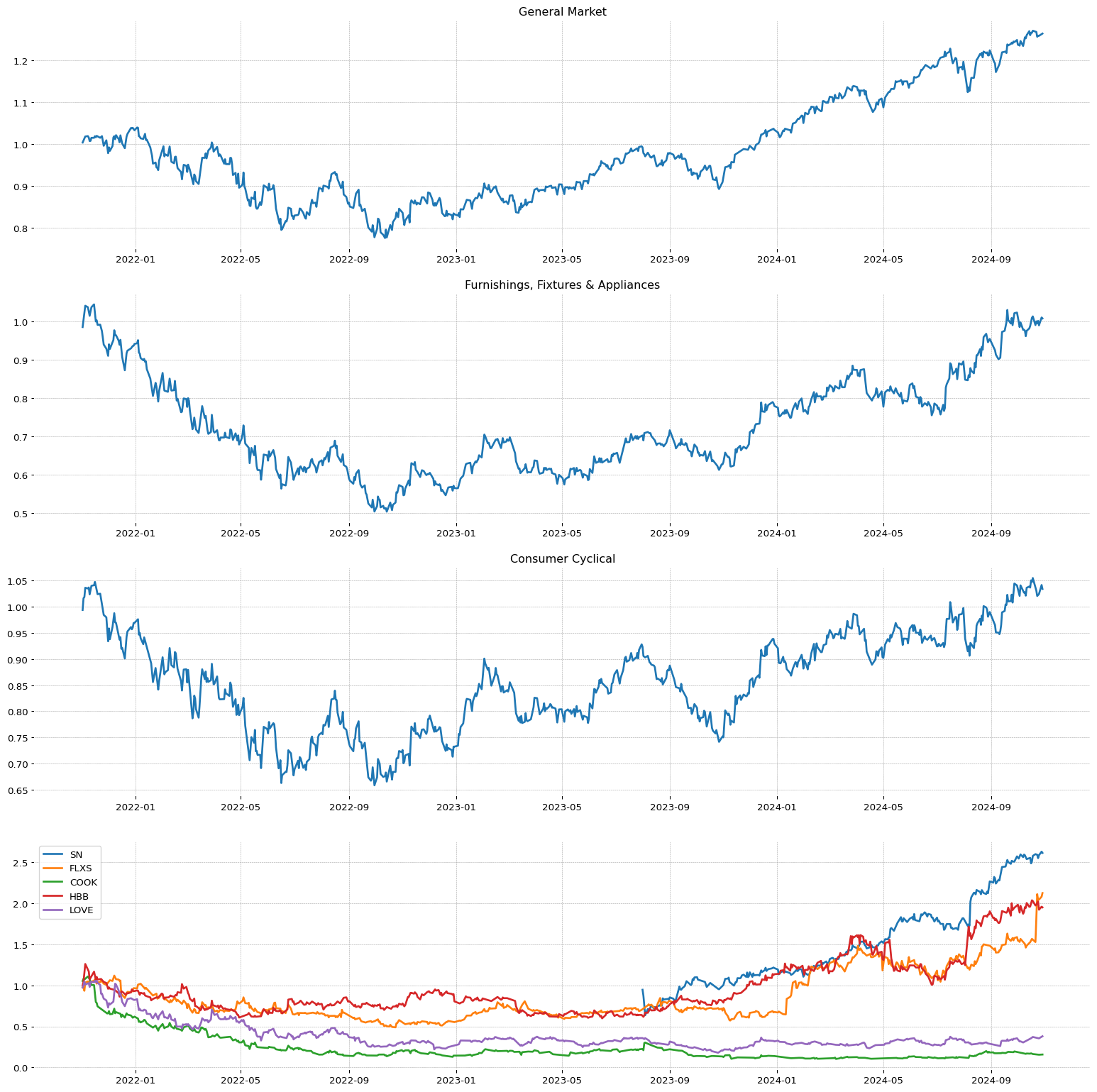

SN |

95.78 |

96.06 |

97.78 |

0.0 |

Consumer Cyclical |

Furnishings, Fixtures & Appliances |

51 |

46.08 |

95.5 |

70.09 |

78.44 |

1.0 |

5.0 |

109.48 |

1.0 |

1.0 |

| 15.0 |

SFM |

95.72 |

96.98 |

97.81 |

93.08 |

Consumer Defensive |

Grocery Stores |

22 |

0.0 |

0.0 |

51.97 |

0.0 |

1.0 |

1.0 |

118.26 |

1.0 |

1.0 |

| 16.0 |

CLBT |

95.66 |

94.74 |

97.07 |

94.91 |

Technology |

Software - Infrastructure |

80 |

53.41 |

44.17 |

88.8 |

29.8 |

3.0 |

5.0 |

18.04 |

1.0 |

1.0 |

| 17.0 |

USLM |

95.35 |

94.55 |

94.52 |

93.14 |

Basic Materials |

Building Materials |

84 |

89.01 |

89.86 |

51.97 |

78.03 |

1.0 |

10.0 |

103.01 |

1.0 |

1.0 |

| 18.0 |

WLDN |

95.11 |

94.12 |

92.7 |

93.95 |

Industrials |

Engineering & Construction |

72 |

99.13 |

89.95 |

82.79 |

59.95 |

2.0 |

10.0 |

45.31 |

1.0 |

1.0 |

| 19.0 |

JXN |

95.05 |

96.58 |

95.35 |

94.57 |

Financial |

Insurance - Life |

61 |

78.1 |

63.23 |

19.82 |

74.62 |

1.0 |

6.0 |

98.91 |

1.0 |

1.0 |

| 20.0 |

KKR |

94.99 |

94.18 |

93.99 |

93.21 |

Financial |

Asset Management |

100 |

0.0 |

0.0 |

92.91 |

0.0 |

1.0 |

7.0 |

140.16 |

1.0 |

1.0 |

| 21.0 |

QTTB |

94.8 |

93.29 |

97.29 |

86.36 |

Healthcare |

Biotechnology |

42 |

56.72 |

0.0 |

72.81 |

0.0 |

24.0 |

40.0 |

46.7 |

1.0 |

1.0 |

| 22.0 |

HBB |

94.68 |

96.64 |

95.66 |

96.9 |

Consumer Cyclical |

Furnishings, Fixtures & Appliances |

51 |

72.74 |

86.65 |

98.11 |

47.47 |

2.0 |

7.0 |

30.53 |

1.0 |

1.0 |

| 23.0 |

TRUP |

94.56 |

83.09 |

82.51 |

9.95 |

Financial |

Insurance - Specialty |

26 |

38.32 |

91.04 |

53.77 |

61.05 |

1.0 |

9.0 |

52.59 |

1.0 |

1.0 |

| 24.0 |

TPG |

94.5 |

91.57 |

90.64 |

85.46 |

Financial |

Asset Management |

100 |

39.8 |

93.64 |

84.7 |

68.62 |

2.0 |

10.0 |

67.5 |

1.0 |

1.0 |

| 25.0 |

ENVA |

94.44 |

82.78 |

85.28 |

81.49 |

Financial |

Credit Services |

64 |

25.11 |

41.7 |

79.92 |

74.28 |

1.0 |

11.0 |

89.87 |

1.0 |

1.0 |

| 26.0 |

TYRA |

94.37 |

78.6 |

78.23 |

58.92 |

Healthcare |

Biotechnology |

42 |

2.9 |

0.0 |

79.92 |

0.0 |

26.0 |

42.0 |

28.15 |

1.0 |

1.0 |

| 27.0 |

GVA |

94.07 |

93.66 |

93.9 |

80.65 |

Industrials |

Engineering & Construction |

72 |

89.17 |

77.06 |

74.43 |

74.21 |

3.0 |

12.0 |

82.76 |

1.0 |

1.0 |

| 28.0 |

SPOT |

93.95 |

95.88 |

96.33 |

95.87 |

Communication Services |

Internet Content & Information |

47 |

56.41 |

90.95 |

86.29 |

96.52 |

1.0 |

3.0 |

387.63 |

1.0 |

1.0 |

| 29.0 |

NVEI |

93.89 |

94.34 |

95.04 |

15.74 |

Technology |

Software - Infrastructure |

80 |

14.32 |

34.35 |

36.26 |

42.7 |

5.0 |

9.0 |

33.49 |

1.0 |

1.0 |

| 30.0 |

HWM |

93.76 |

94.62 |

95.26 |

82.61 |

Industrials |

Aerospace & Defense |

41 |

95.7 |

89.76 |

25.15 |

78.37 |

3.0 |

14.0 |

102.65 |

1.0 |

1.0 |

| 31.0 |

PWP |

93.28 |

91.69 |

89.41 |

94.6 |

Financial |

Capital Markets |

7 |

16.26 |

51.52 |

98.11 |

35.26 |

2.0 |

13.0 |

21.64 |

1.0 |

1.0 |

| 32.0 |

TSM |

93.03 |

92.46 |

94.05 |

87.19 |

Technology |

Semiconductors |

104 |

67.58 |

38.27 |

11.08 |

87.78 |

1.0 |

11.0 |

198.47 |

1.0 |

1.0 |

| 33.0 |

PIPR |

92.85 |

91.54 |

91.16 |

81.18 |

Financial |

Capital Markets |

7 |

80.14 |

92.1 |

79.92 |

95.36 |

3.0 |

14.0 |

296.39 |

1.0 |

1.0 |

| 34.0 |

PAHC |

92.73 |

84.9 |

88.02 |

16.7 |

Healthcare |

Drug Manufacturers - Specialty & Generic |

11 |

1.91 |

17.06 |

82.7 |

35.33 |

5.0 |

50.0 |

24.18 |

1.0 |

1.0 |

| 35.0 |

PSFE |

92.6 |

92.0 |

90.15 |

47.95 |

Technology |

Software - Infrastructure |

80 |

54.28 |

67.56 |

92.91 |

38.4 |

6.0 |

12.0 |

22.18 |

1.0 |

1.0 |

| 36.0 |

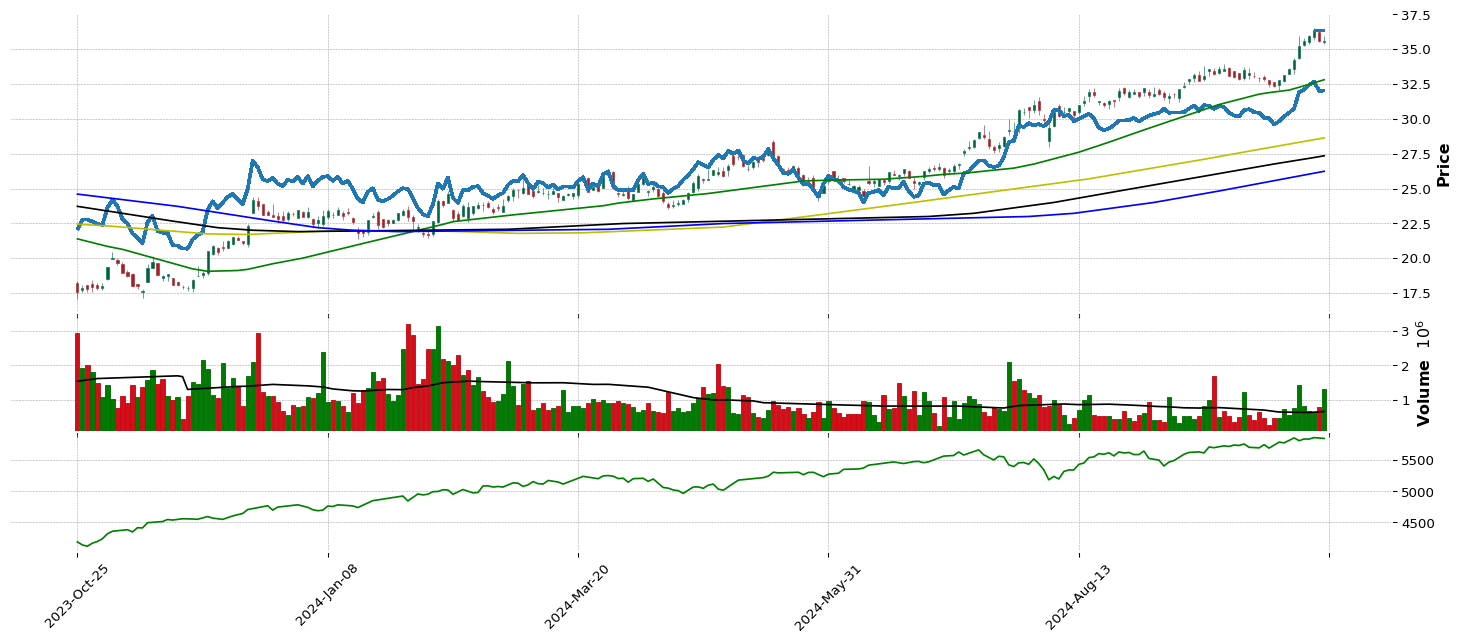

UI |

92.42 |

89.2 |

66.38 |

2.88 |

Technology |

Communication Equipment |

10 |

10.67 |

8.82 |

96.56 |

91.88 |

2.0 |

14.0 |

251.58 |

1.0 |

1.0 |

| 37.0 |

MLI |

92.18 |

91.91 |

93.32 |

88.25 |

Industrials |

Metal Fabrication |

25 |

63.13 |

12.25 |

19.82 |

67.32 |

2.0 |

16.0 |

82.22 |

1.0 |

1.0 |

| 38.0 |

GWRE |

91.99 |

92.59 |

93.93 |

83.29 |

Technology |

Software - Application |

74 |

83.08 |

95.25 |

79.92 |

91.6 |

5.0 |

17.0 |

187.17 |

1.0 |

1.0 |

| 39.0 |

STEP |

91.93 |

91.23 |

90.3 |

88.59 |

Financial |

Asset Management |

100 |

17.63 |

80.39 |

98.11 |

66.09 |

3.0 |

15.0 |

60.61 |

1.0 |

1.0 |

| 40.0 |

URI |

91.5 |

90.62 |

87.28 |

92.37 |

Industrials |

Rental & Leasing Services |

18 |

86.05 |

42.66 |

72.81 |

99.24 |

2.0 |

17.0 |

847.46 |

1.0 |

1.0 |

| 41.0 |

DASH |

91.32 |

91.33 |

87.68 |

96.24 |

Communication Services |

Internet Content & Information |

47 |

46.58 |

89.73 |

88.8 |

87.51 |

2.0 |

4.0 |

152.53 |

1.0 |

1.0 |

| 42.0 |

PRIM |

91.2 |

90.47 |

87.53 |

92.18 |

Industrials |

Engineering & Construction |

72 |

68.2 |

78.44 |

83.9 |

69.16 |

5.0 |

20.0 |

62.38 |

1.0 |

1.0 |

| 43.0 |

ALKT |

91.14 |

90.16 |

91.84 |

95.1 |

Technology |

Software - Application |

74 |

43.39 |

83.28 |

56.29 |

52.52 |

6.0 |

19.0 |

38.04 |

1.0 |

1.0 |

| 44.0 |

TILE |

91.08 |

89.6 |

93.59 |

96.06 |

Industrials |

Building Products & Equipment |

53 |

96.5 |

91.24 |

76.43 |

36.9 |

2.0 |

21.0 |

18.54 |

1.0 |

1.0 |

| 45.0 |

WIX |

90.83 |

88.93 |

89.9 |

77.74 |

Technology |

Software - Infrastructure |

80 |

74.26 |

73.3 |

56.29 |

88.67 |

8.0 |

21.0 |

166.92 |

1.0 |

1.0 |

| 46.0 |

JEF |

90.71 |

87.61 |

84.11 |

76.1 |

Financial |

Capital Markets |

7 |

34.89 |

60.5 |

65.89 |

66.98 |

4.0 |

16.0 |

65.5 |

1.0 |

1.0 |

| 47.0 |

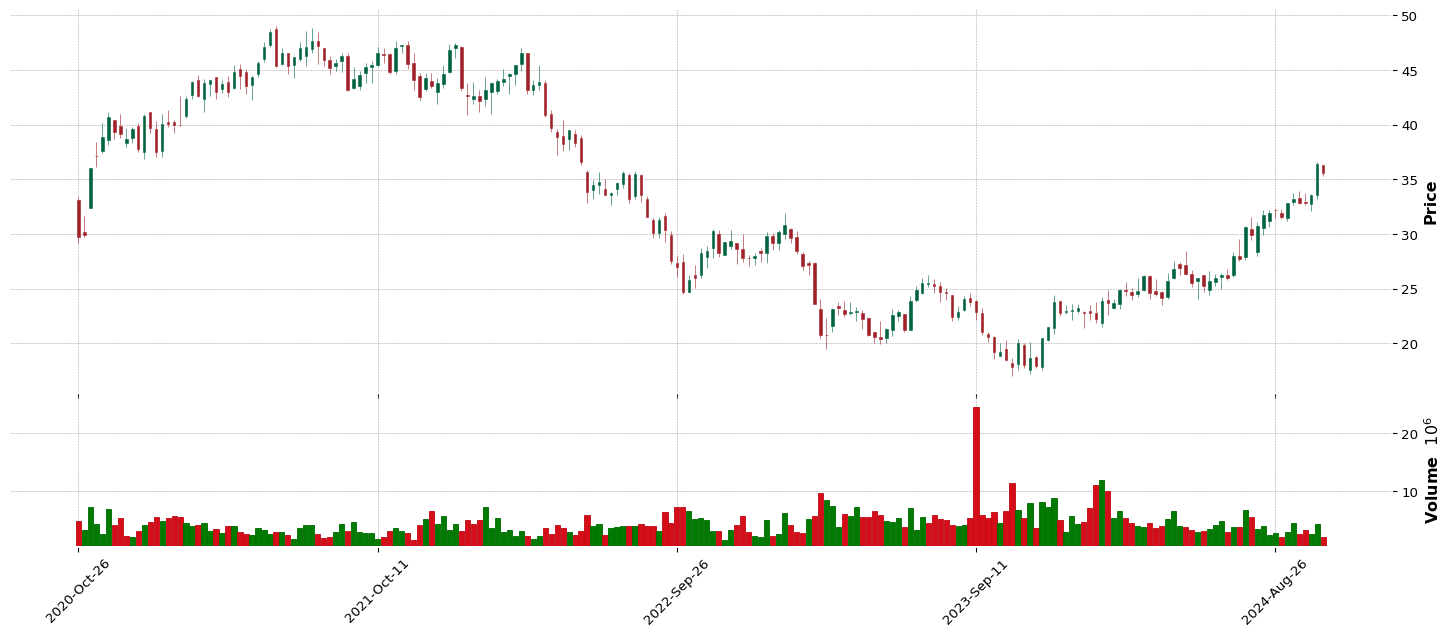

HIW |

90.65 |

85.27 |

80.54 |

56.57 |

Real Estate |

REIT - Office |

70 |

48.22 |

55.59 |

97.3 |

52.72 |

1.0 |

6.0 |

35.59 |

1.0 |

1.0 |

| 48.0 |

BSVN |

90.16 |

85.02 |

87.19 |

58.02 |

Financial |

Banks - Regional |

43 |

63.0 |

50.65 |

63.56 |

57.43 |

4.0 |

18.0 |

42.95 |

1.0 |

1.0 |

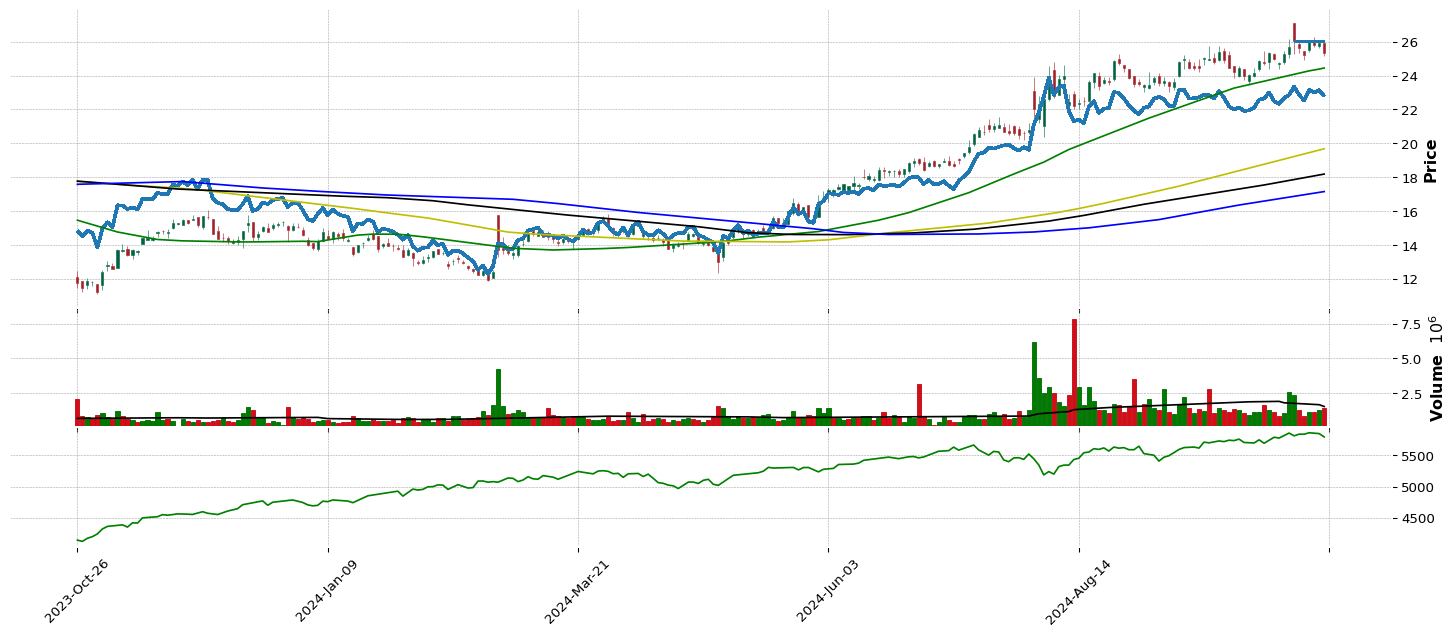

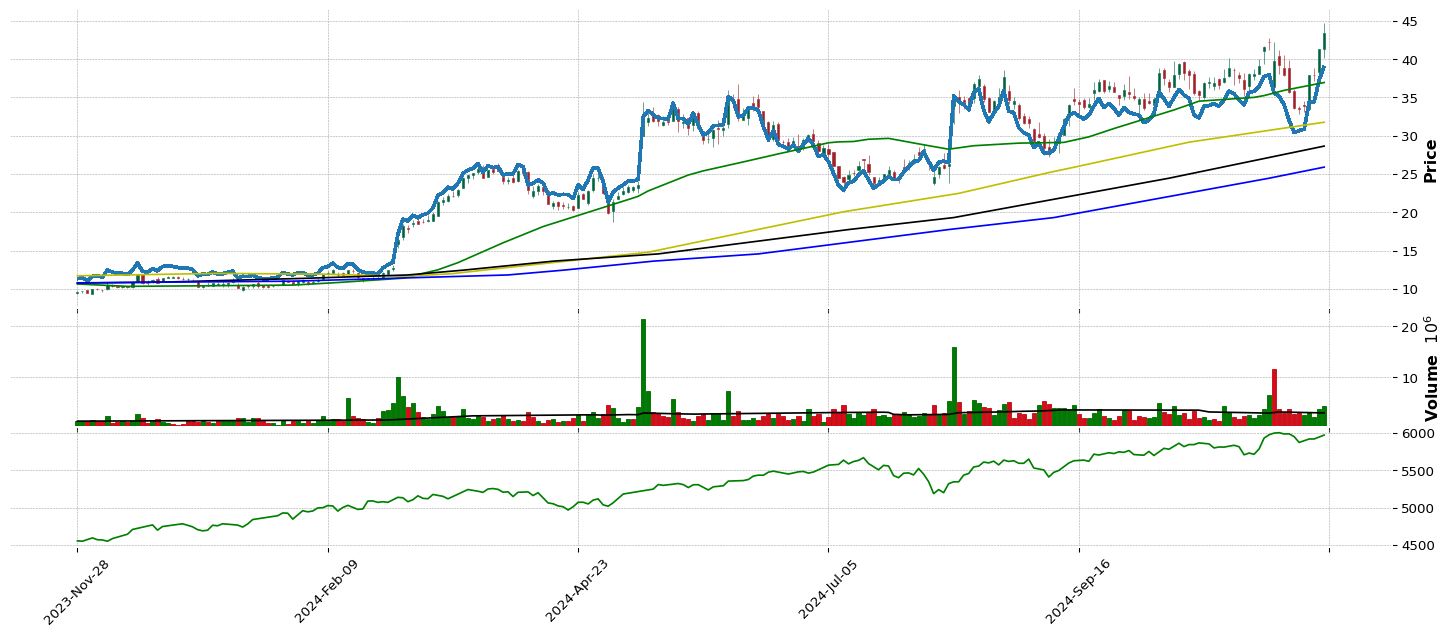

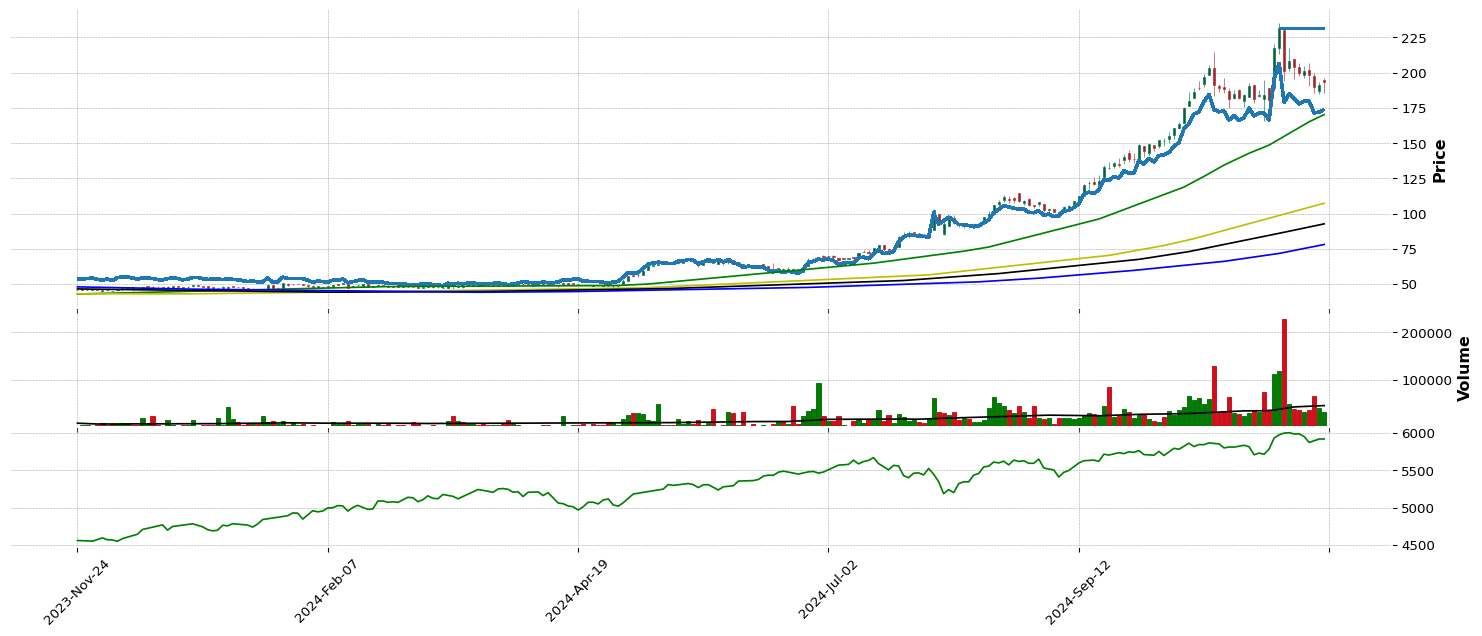

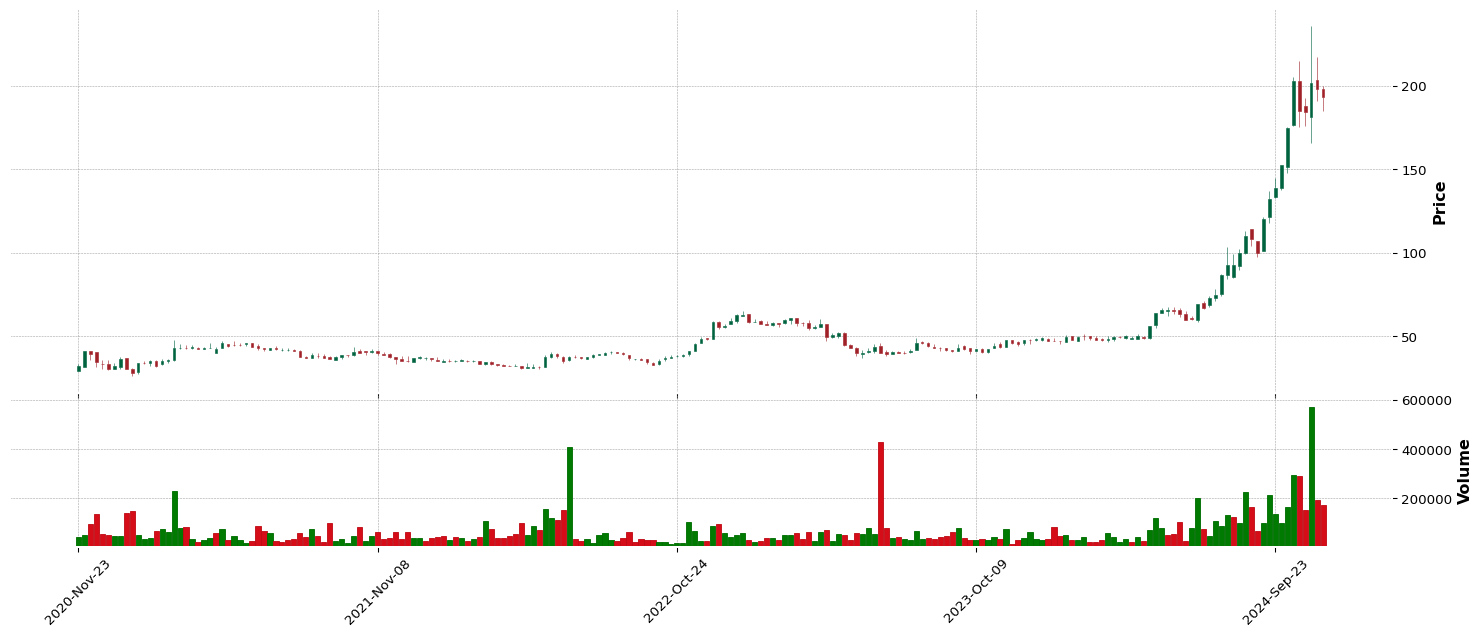

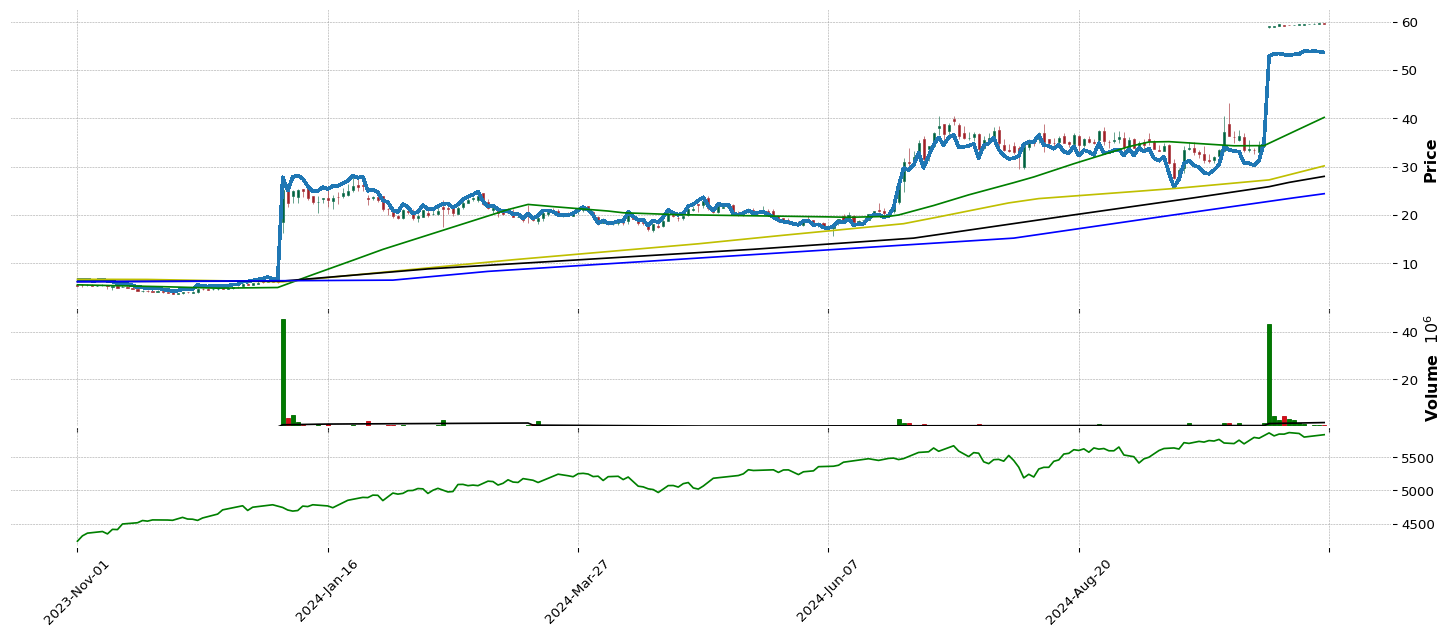

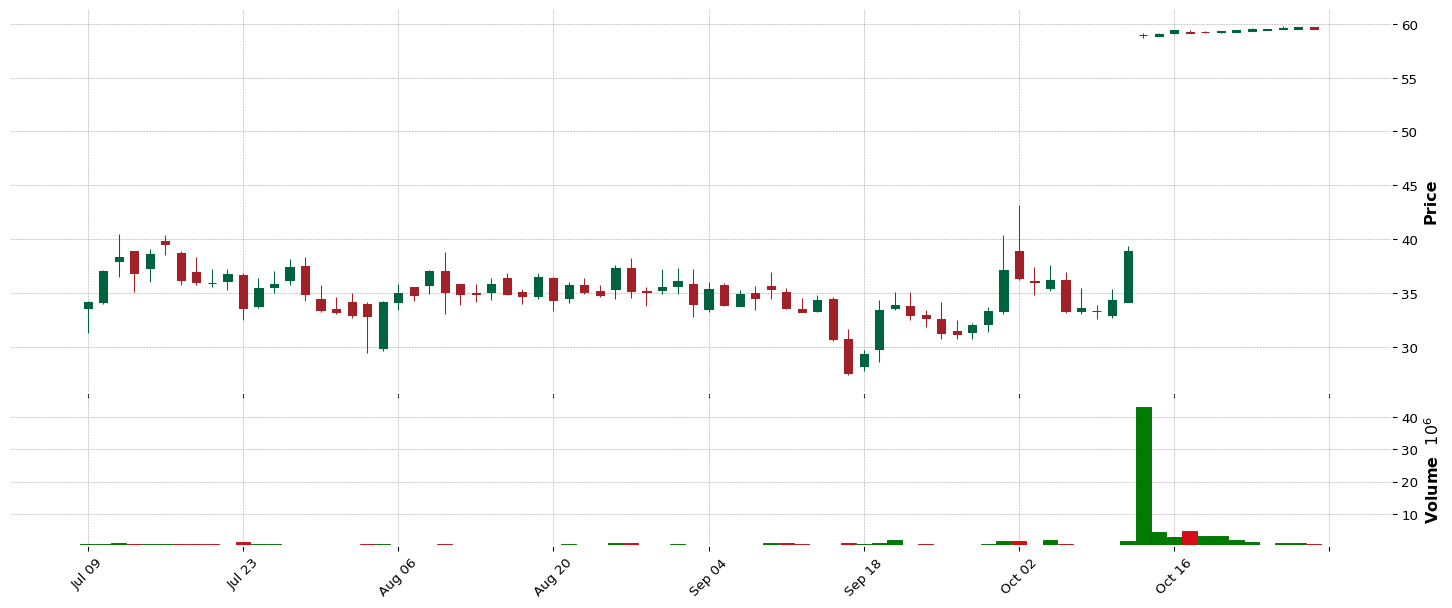

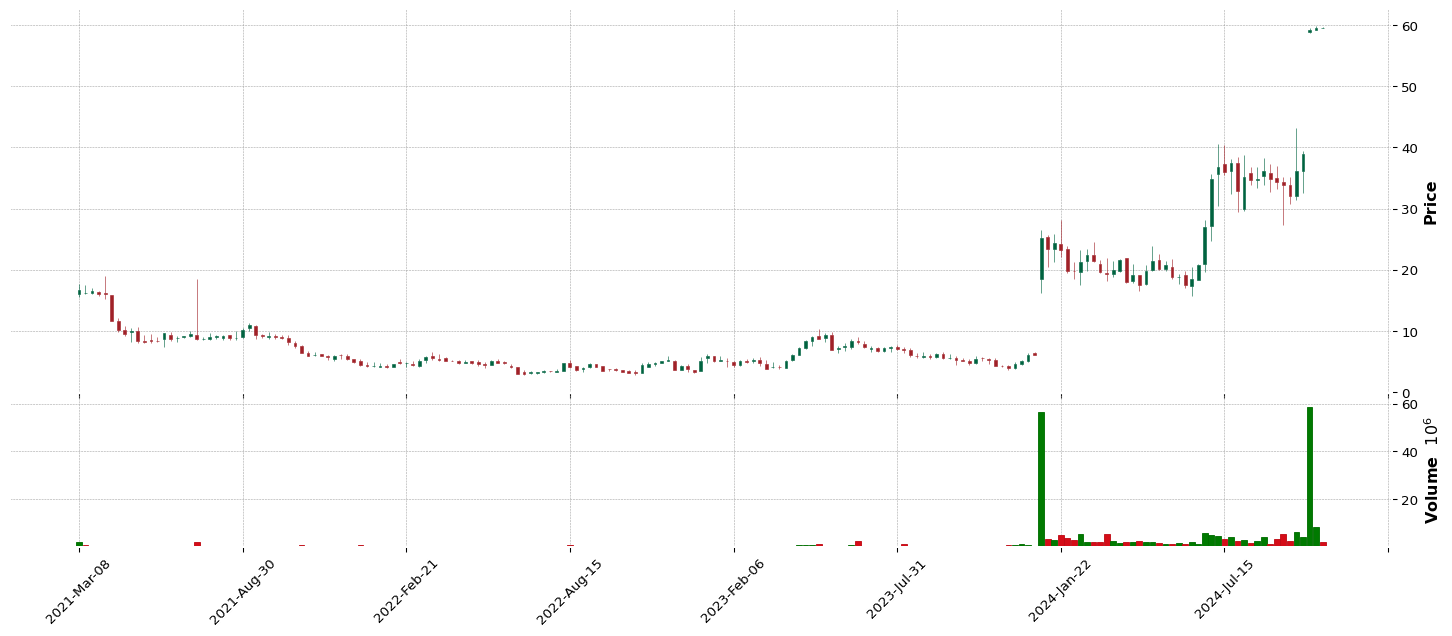

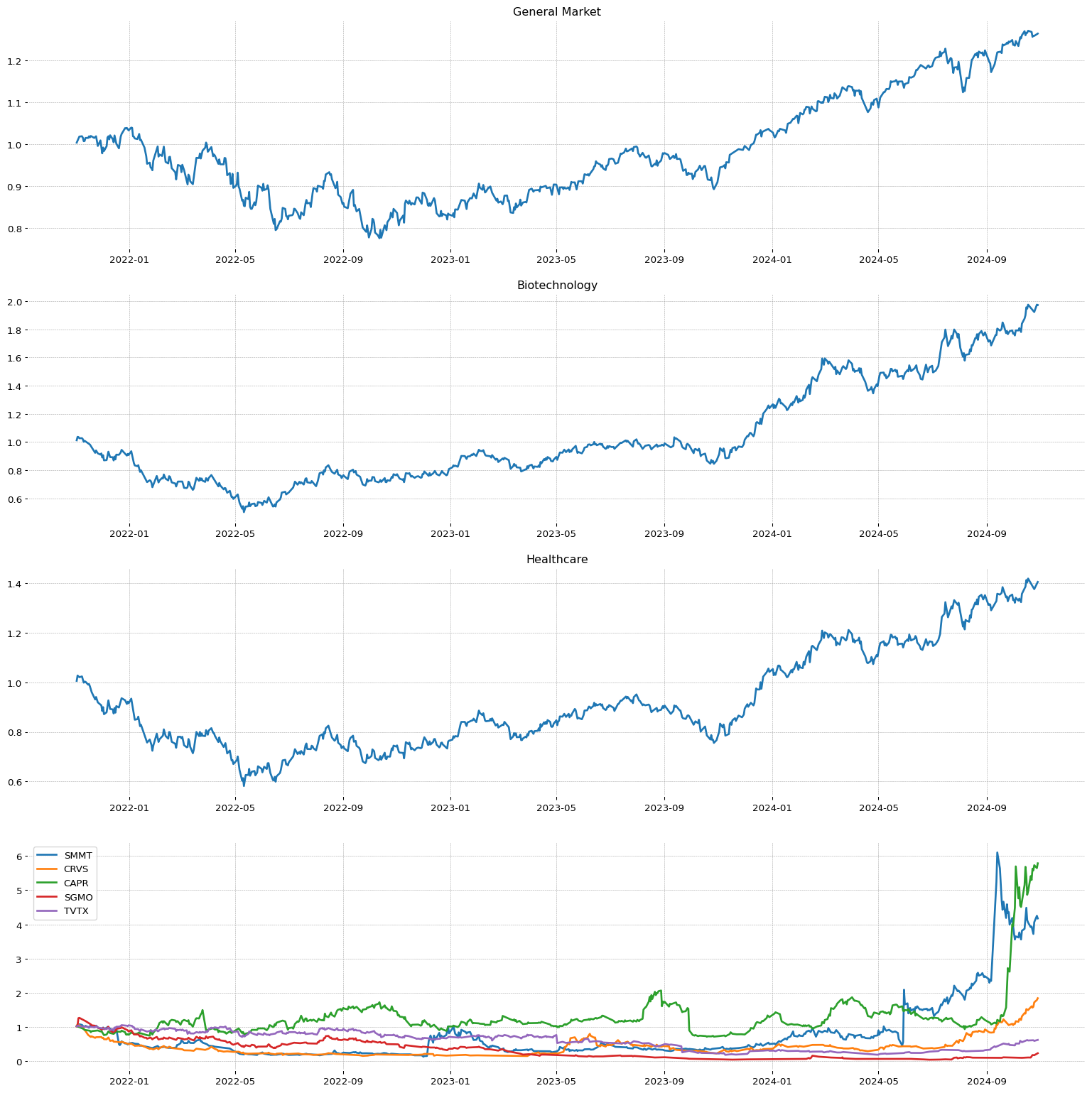

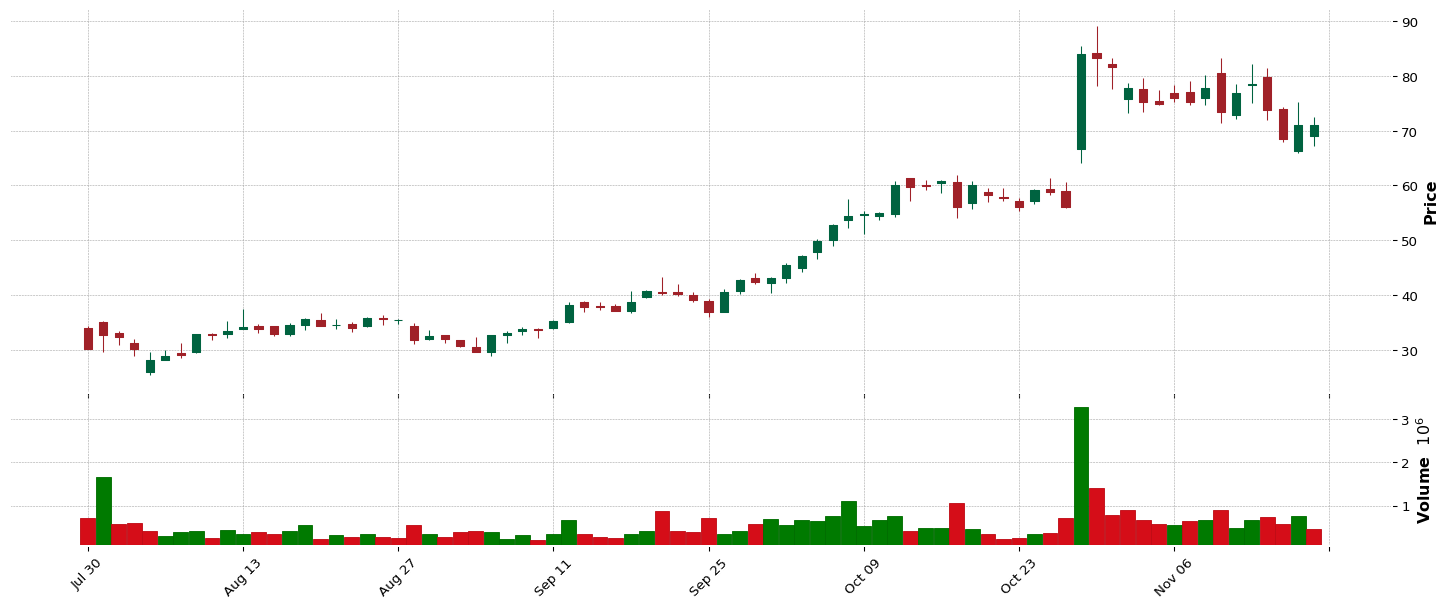

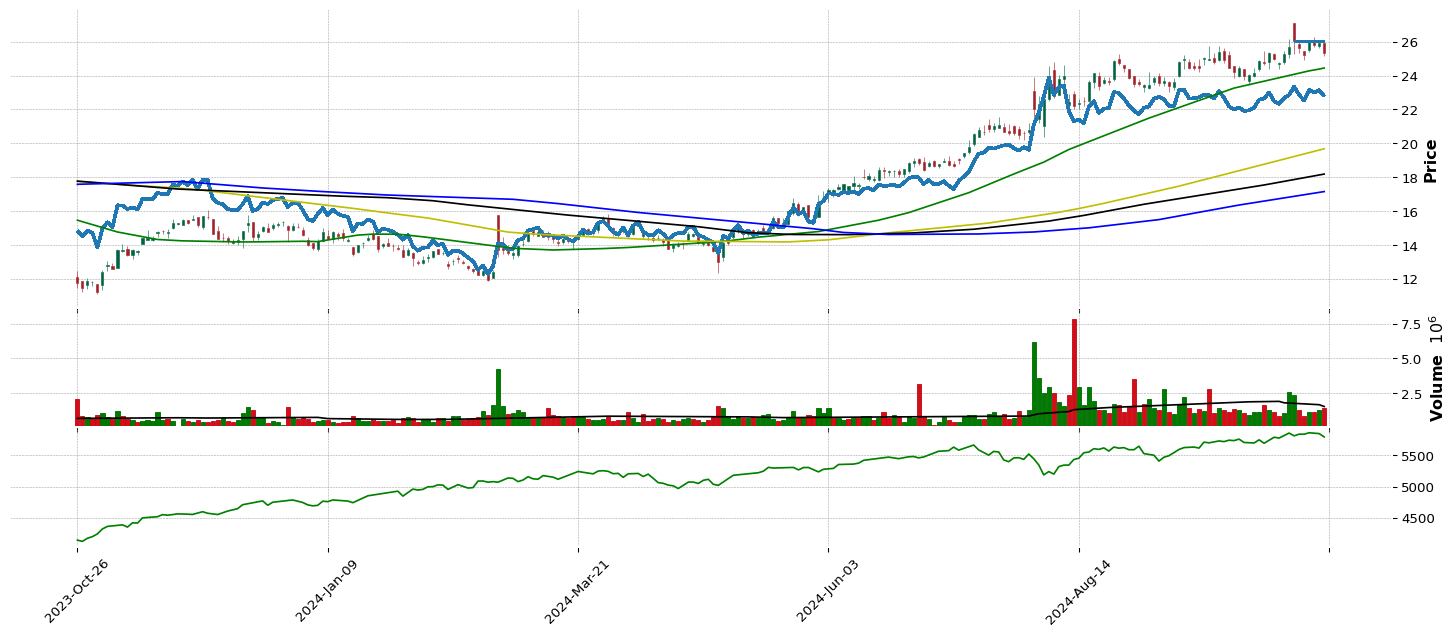

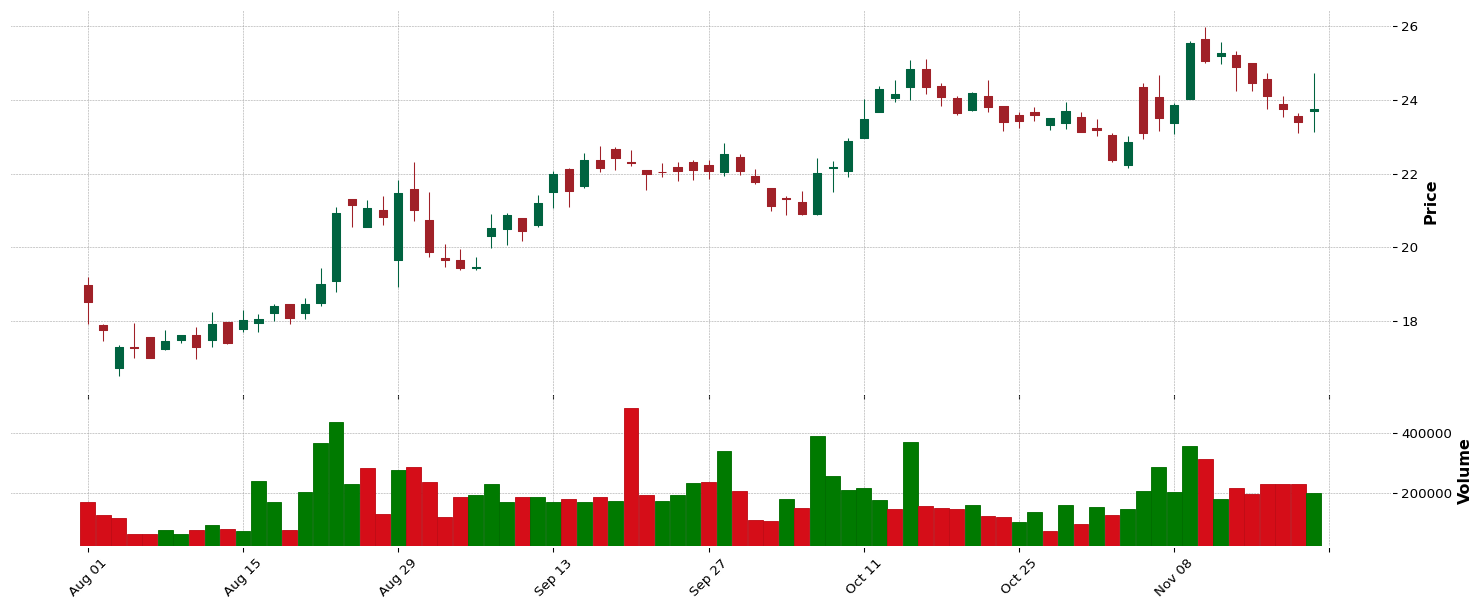

WLFC

WLFC

LBPH

LBPH

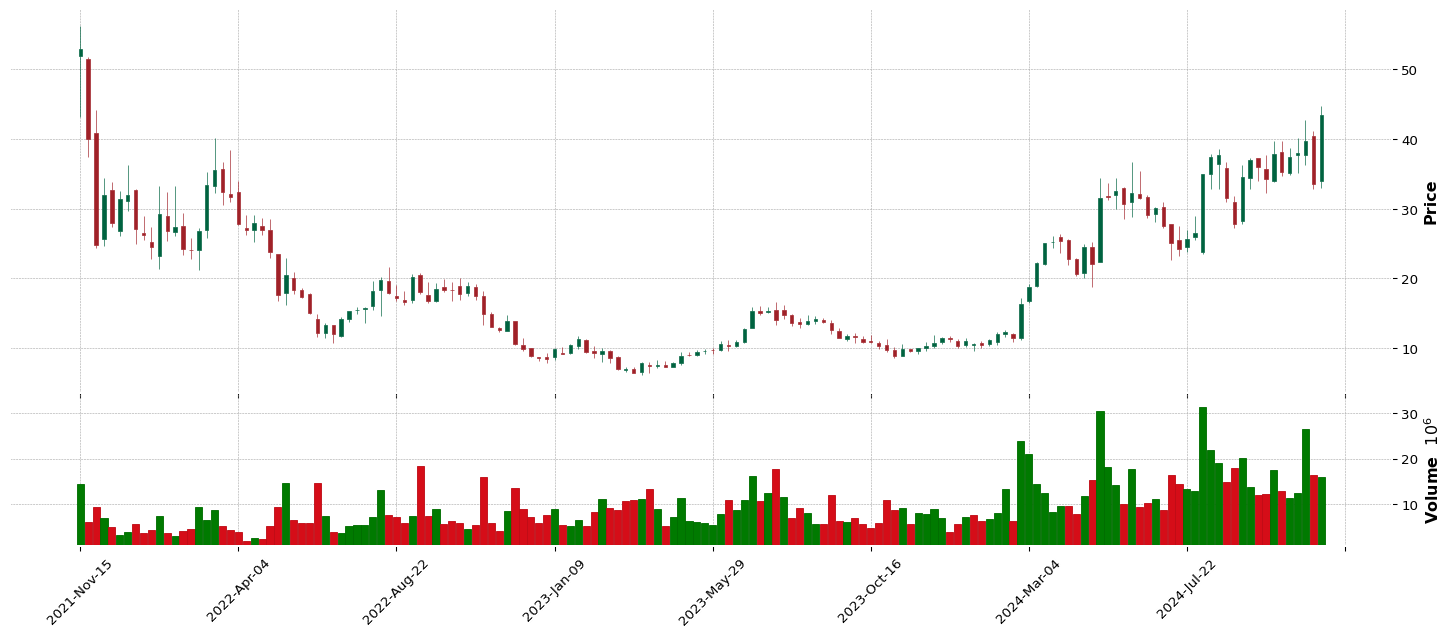

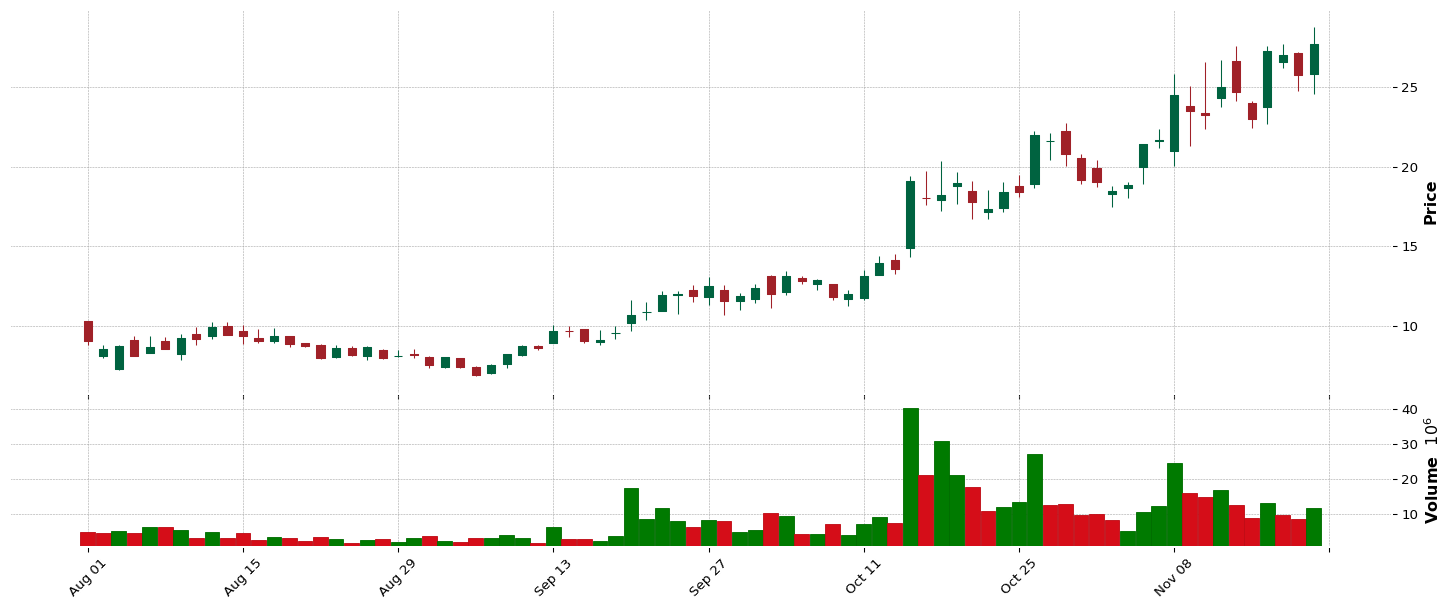

CVNA

CVNA

TRUP

TRUP

WGS

WGS

CLBT

CLBT

LENZ

LENZ

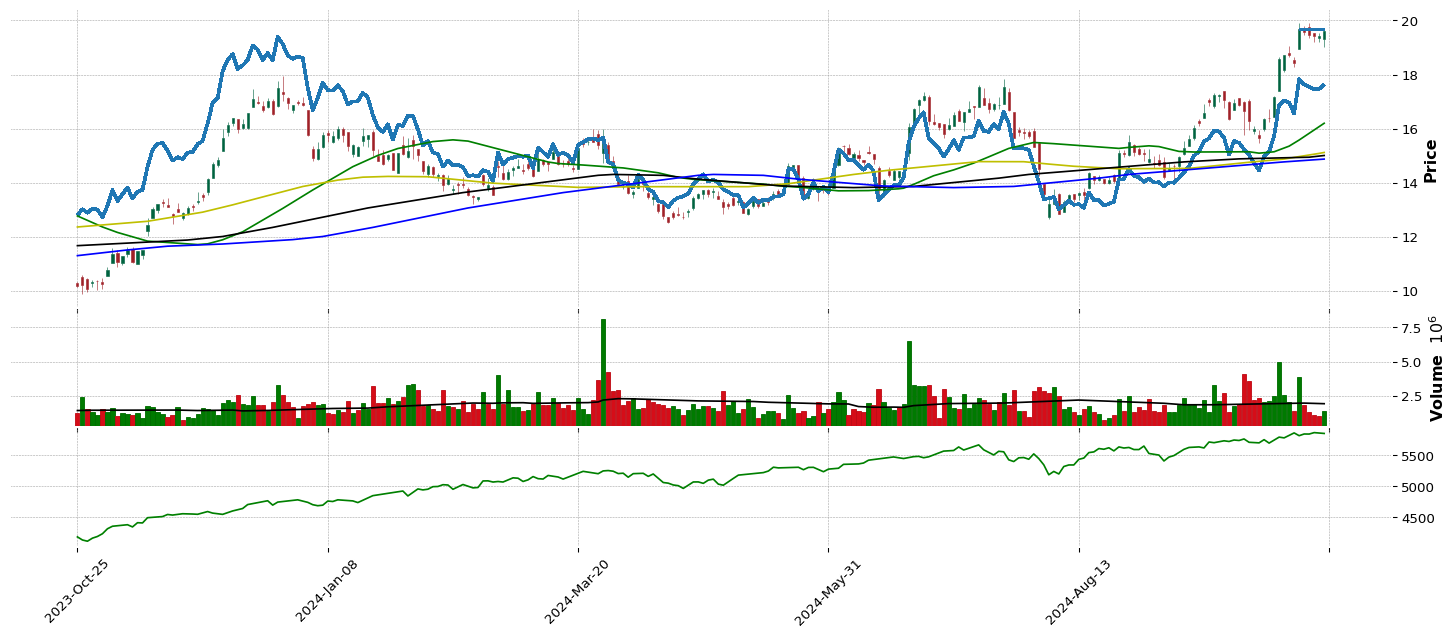

LTH

LTH

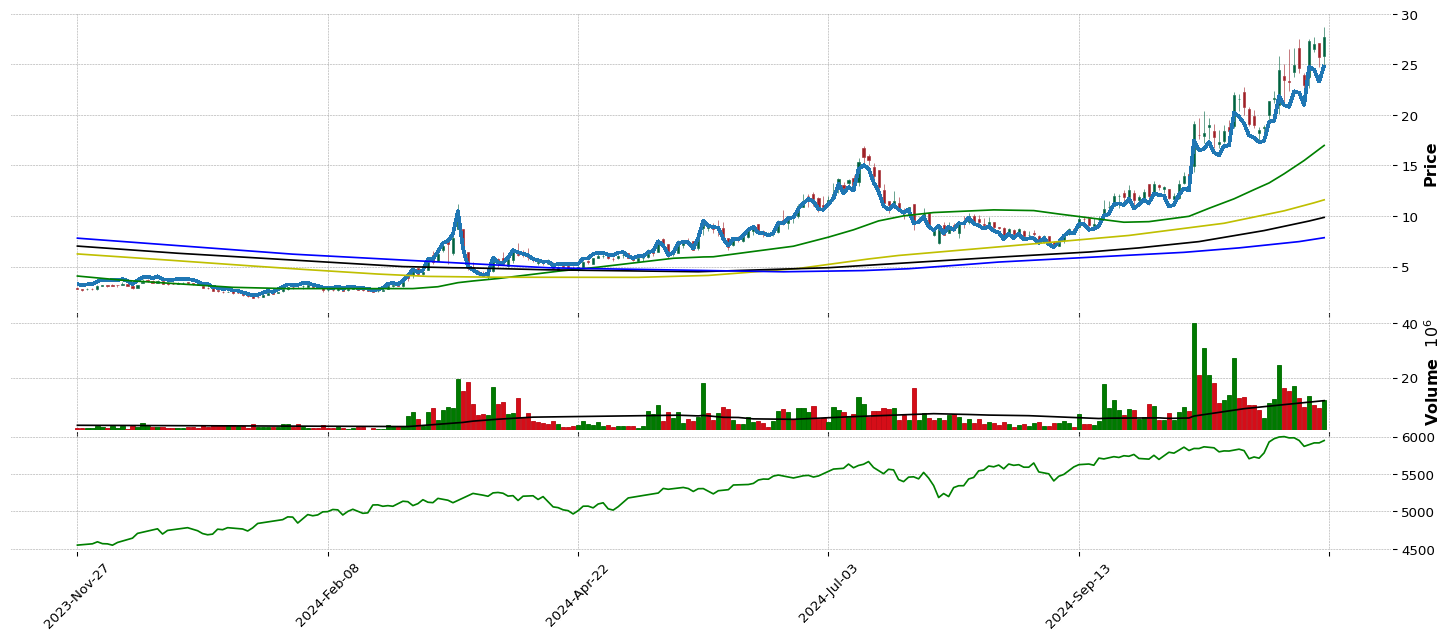

SMR

SMR

HROW

HROW

HBB

HBB

IBP

IBP

JEF

JEF

NVEI

NVEI

NTGR

NTGR

HIW

HIW

ENVA

ENVA

PAHC

PAHC

BSVN

BSVN

GWRE

GWRE

LTH

LTH