| Pos. | |

Name | |

Today | |

3 weeks | |

6 weeks | |

26 weeks | |

1DAY | |

Ytoday | |

1YEAR | |

|| |

Pos. | |

Name | |

Today | |

3 weeks | |

6 weeks | |

26 weeks | |

1DAY | |

7DAY | |

30DAY | |

Ytoday | |

1YEAR | |

Ratio_GP | |

Ratio_NI | |

ROE | |

| 1.0 |

Communication Equipment |

100.0 |

100.0 |

100.0 |

73.0 |

-1.19 |

47.62 |

95.73 |

35.53 |

-12.18 |

4.55 |

|| |

26.0 |

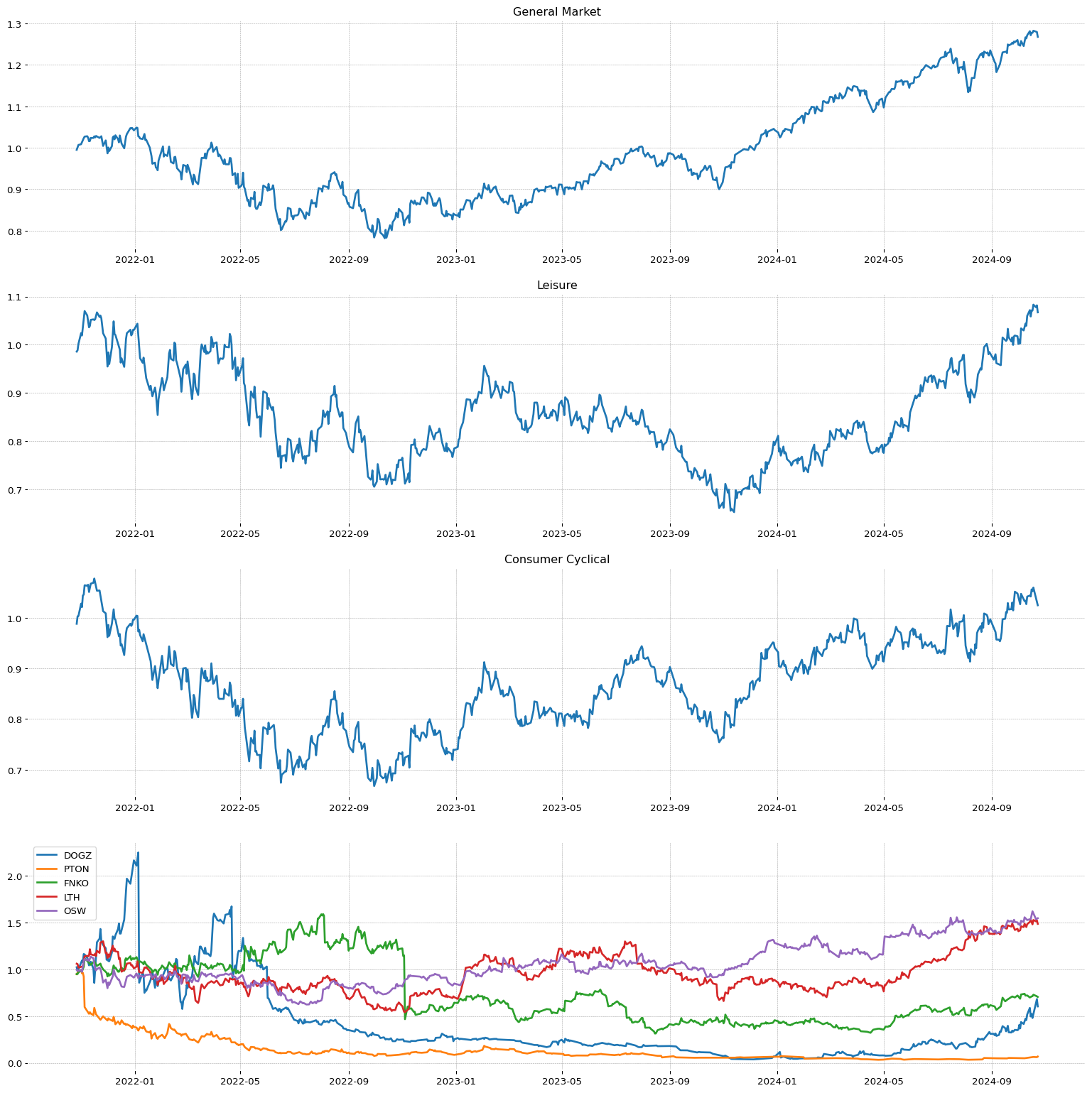

Electronic Gaming & Multimedia |

82.0 |

97.0 |

63.0 |

39.0 |

0.39 |

24.85 |

30.77% |

58.61 |

-1.71 |

-19.3 |

| 2.0 |

Leisure |

99.0 |

93.0 |

92.0 |

57.0 |

-1.34 |

46.94 |

55.43 |

43.44 |

-0.7 |

1.33 |

|| |

27.0 |

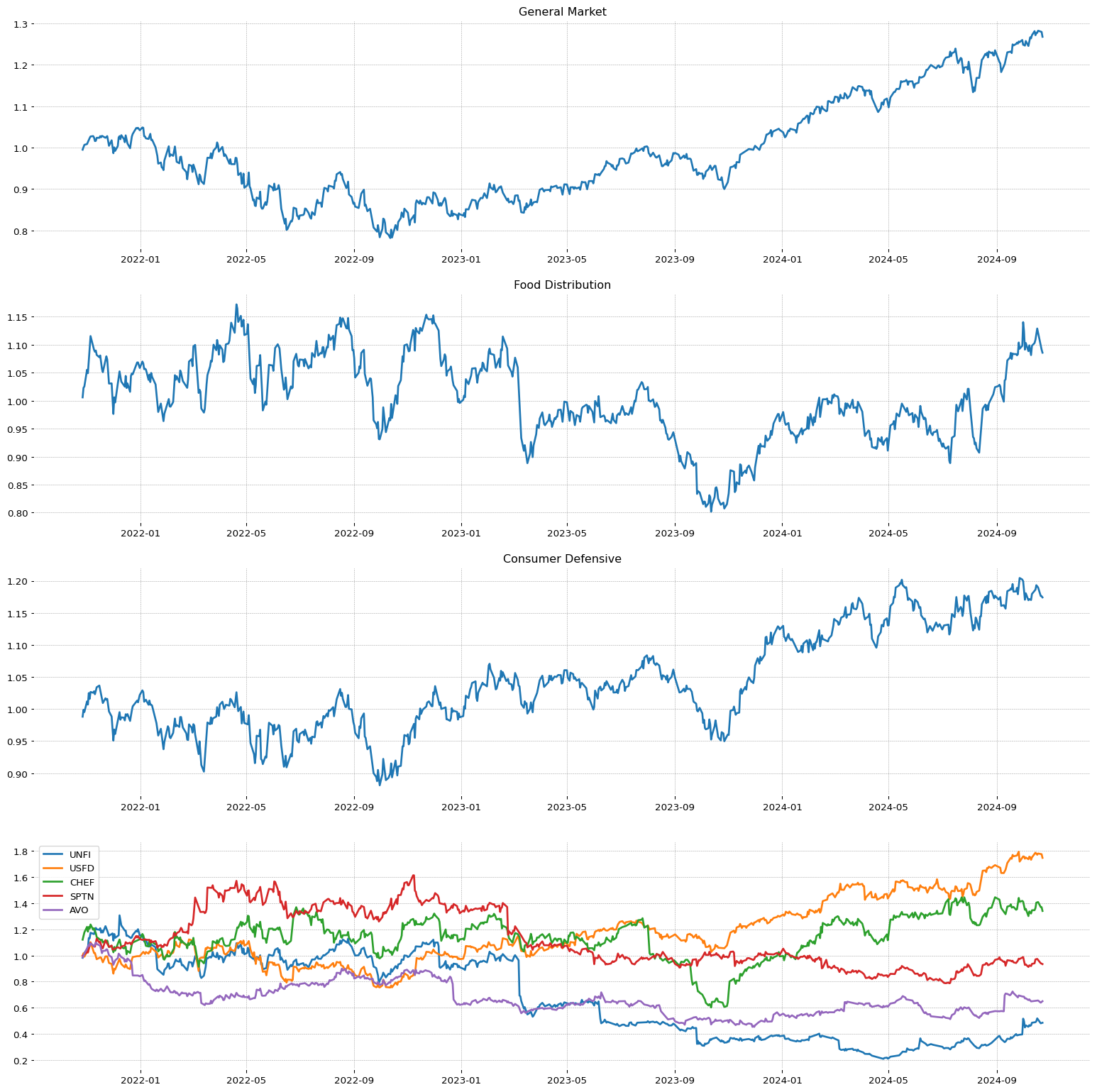

Food Distribution |

82.0 |

80.0 |

54.0 |

40.0 |

-0.51 |

10.86 |

32.37% |

14.18 |

0.86 |

14.85 |

| 3.0 |

Utilities - Independent Power Producers |

98.0 |

98.0 |

97.0 |

98.0 |

-0.16 |

91.46 |

130.93 |

30.83 |

16.36 |

20.5 |

|| |

28.0 |

Travel Services |

81.0 |

51.0 |

45.0 |

86.0 |

-1.51 |

25.76 |

73.51% |

52.87 |

24.21 |

17.93 |

| 4.0 |

Healthcare Plans |

97.0 |

99.0 |

99.0 |

69.0 |

-1.52 |

28.2 |

48.31 |

47.73 |

0.29 |

-5.42 |

|| |

29.0 |

Financial Conglomerates |

80.0 |

86.0 |

91.0 |

100.0 |

-3.13 |

34.66 |

145.93% |

73.49 |

2.54 |

-19.86 |

| 5.0 |

Silver |

97.0 |

88.0 |

98.0 |

75.0 |

-1.99 |

76.25 |

90.5 |

20.47 |

10.84 |

8.45 |

|| |

30.0 |

REIT - Diversified |

80.0 |

81.0 |

87.0 |

26.0 |

-0.1 |

8.72 |

31.94% |

62.32 |

18.74 |

3.11 |

| 6.0 |

Medical Care Facilities |

96.0 |

82.0 |

89.0 |

63.0 |

-0.76 |

22.16 |

52.86 |

26.04 |

-1.32 |

38.6 |

|| |

31.0 |

Tobacco |

79.0 |

89.0 |

74.0 |

25.0 |

-0.43 |

8.68 |

27.31% |

45.54 |

8.77 |

-32.24 |

| 7.0 |

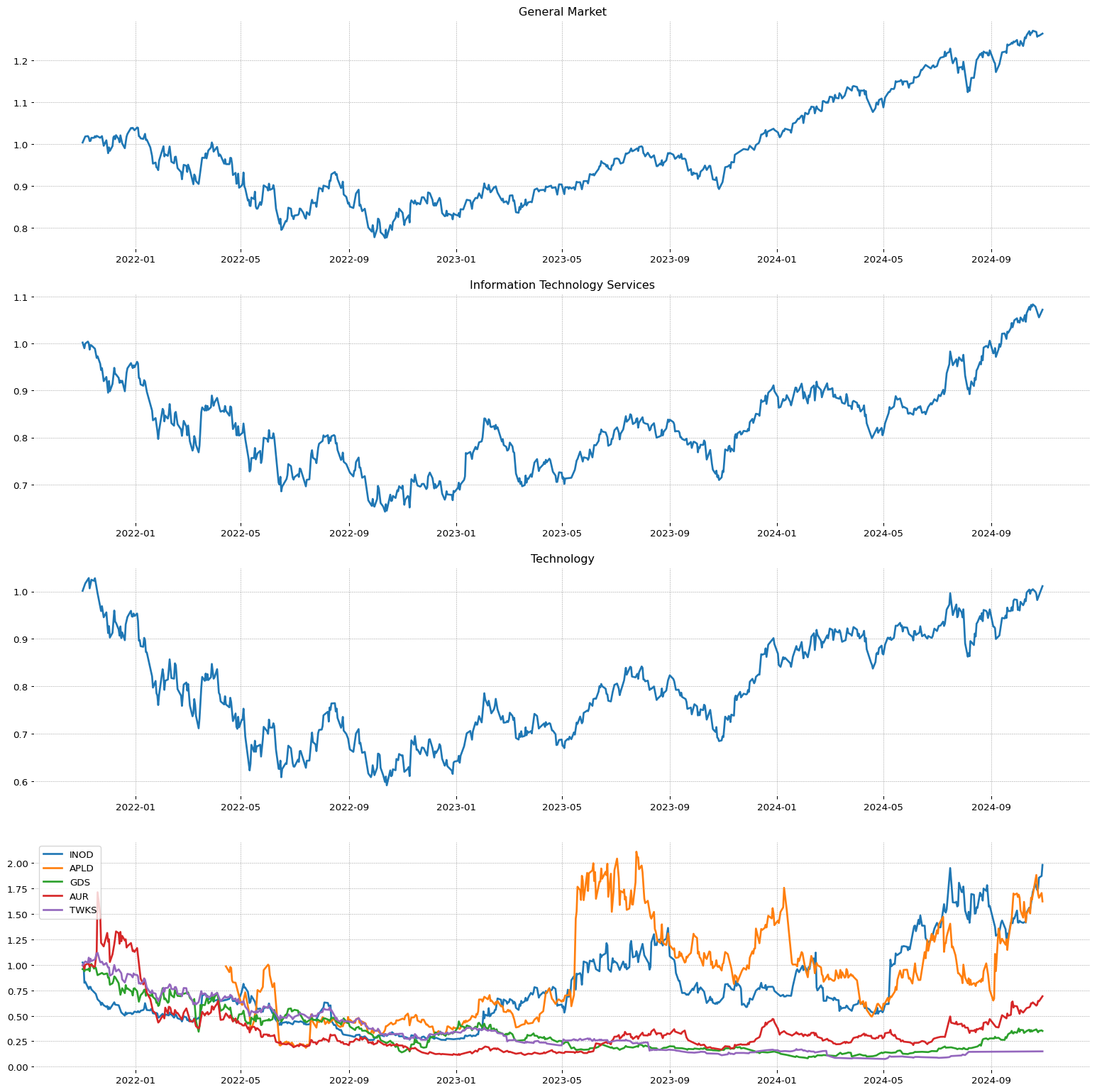

Information Technology Services |

95.0 |

92.0 |

74.0 |

27.0 |

-0.97 |

13.43 |

39.09 |

30.3 |

-3.68 |

25.11 |

|| |

32.0 |

REIT - Industrial |

78.0 |

66.0 |

78.0 |

42.0 |

0.71 |

0.51 |

33.83% |

56.5 |

25.47 |

5.6 |

| 8.0 |

Capital Markets |

95.0 |

94.0 |

86.0 |

96.0 |

-2.64 |

24.76 |

76.1 |

49.55 |

11.06 |

2.57 |

|| |

33.0 |

Diagnostics & Research |

78.0 |

82.0 |

89.0 |

81.0 |

-1.04 |

8.54 |

46.89% |

41.2 |

-13.65 |

-2.97 |

| 9.0 |

Pollution & Treatment Controls |

94.0 |

90.0 |

91.0 |

65.0 |

-0.44 |

45.74 |

59.92 |

37.88 |

8.89 |

9.09 |

|| |

34.0 |

Credit Services |

77.0 |

74.0 |

51.0 |

88.0 |

-1.37 |

36.84 |

103.66% |

71.1 |

13.02 |

14.15 |

| 10.0 |

Personal Services |

93.0 |

96.0 |

96.0 |

70.0 |

0.67 |

30.01 |

57.52 |

36.95 |

10.59 |

137.71 |

|| |

35.0 |

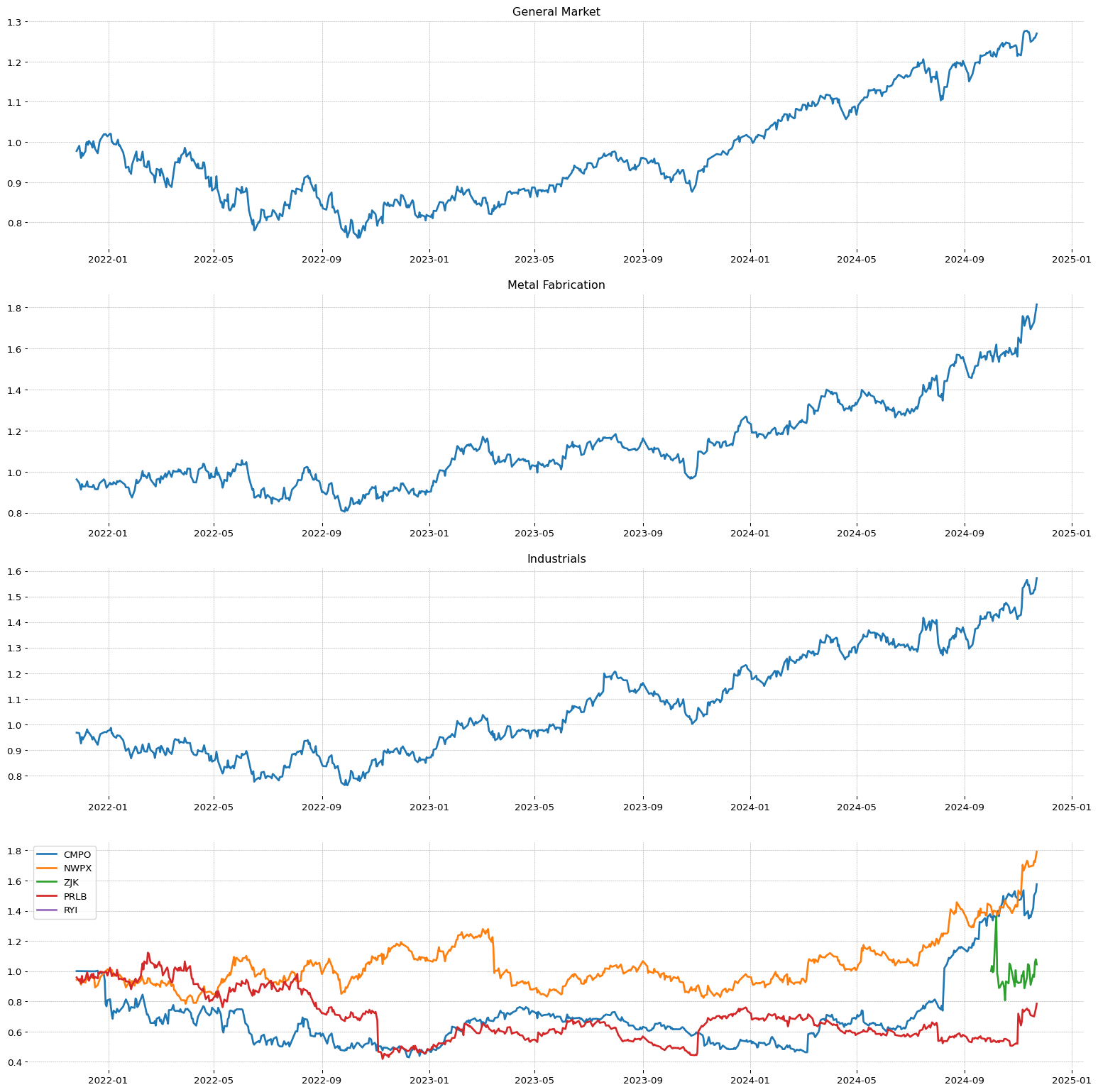

Metal Fabrication |

76.0 |

74.0 |

85.0 |

64.0 |

-0.99 |

29.45 |

56.03% |

23.76 |

4.15 |

7.6 |

| 11.0 |

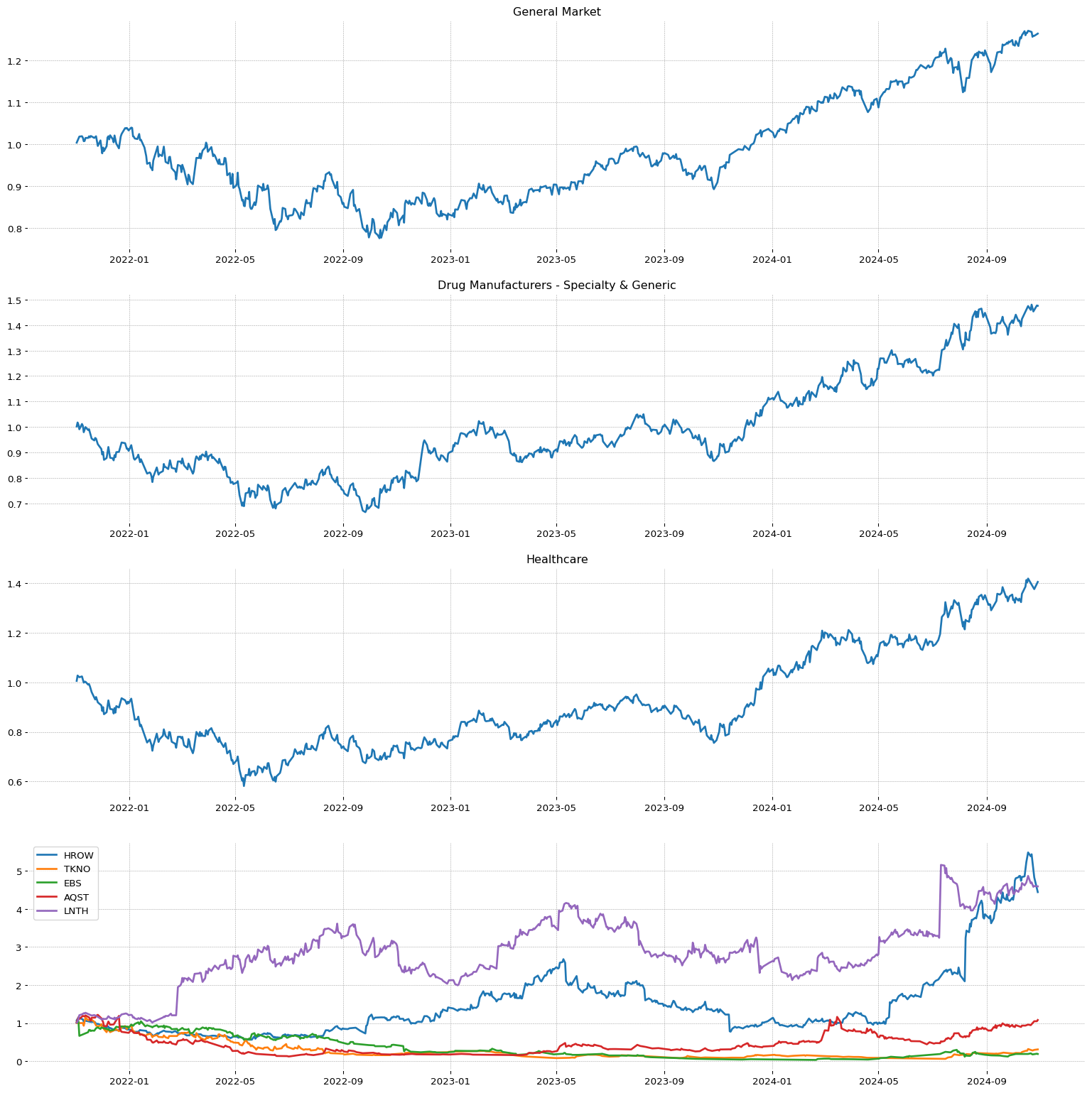

Drug Manufacturers - Specialty & Generic |

93.0 |

70.0 |

85.0 |

74.0 |

-1.1 |

25.71 |

55.11 |

54.95 |

-9.43 |

126.04 |

|| |

36.0 |

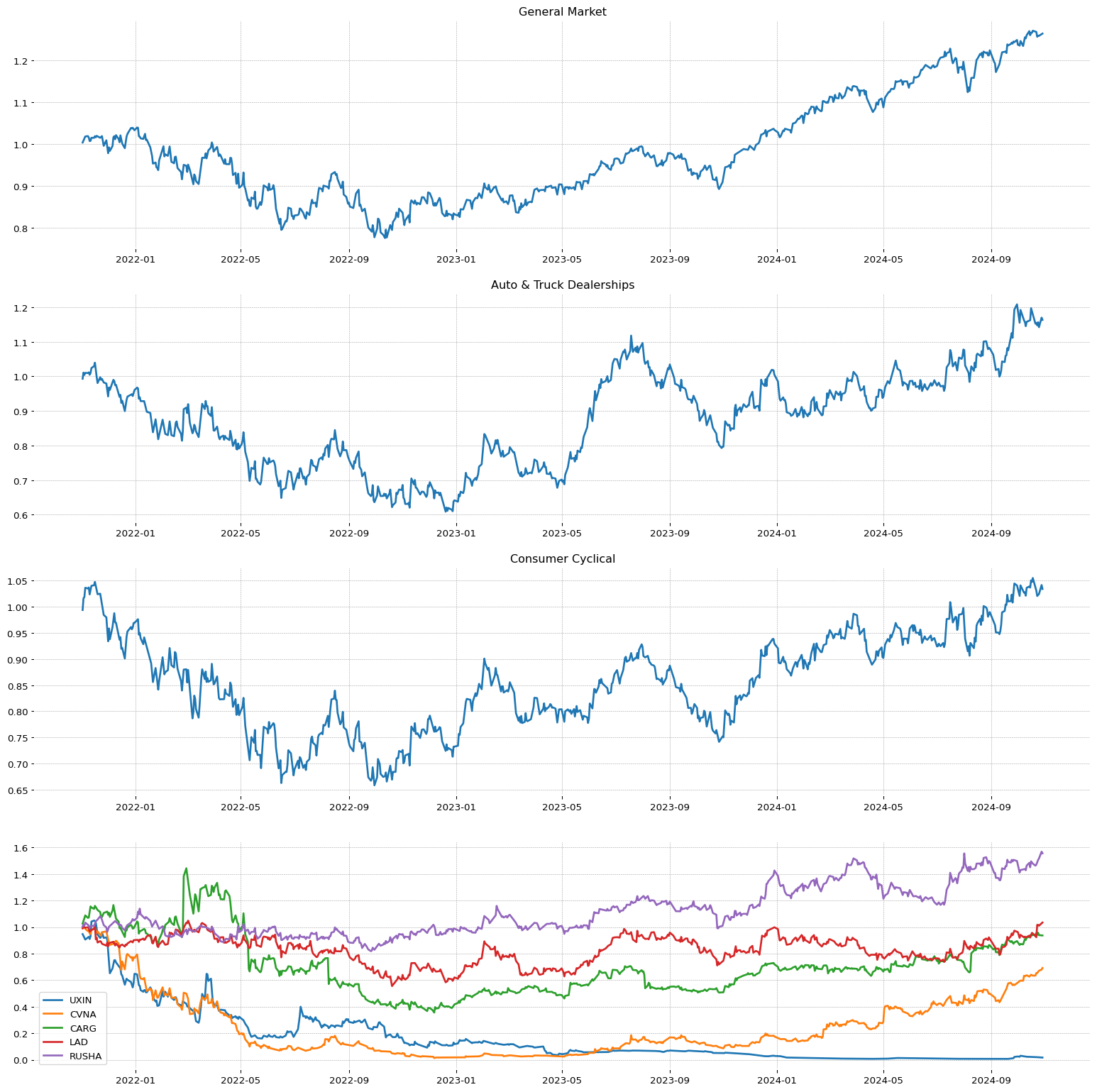

Auto & Truck Dealerships |

76.0 |

87.0 |

60.0 |

63.0 |

-0.69 |

13.62 |

49.88% |

28.4 |

-2.31 |

-0.3 |

| 12.0 |

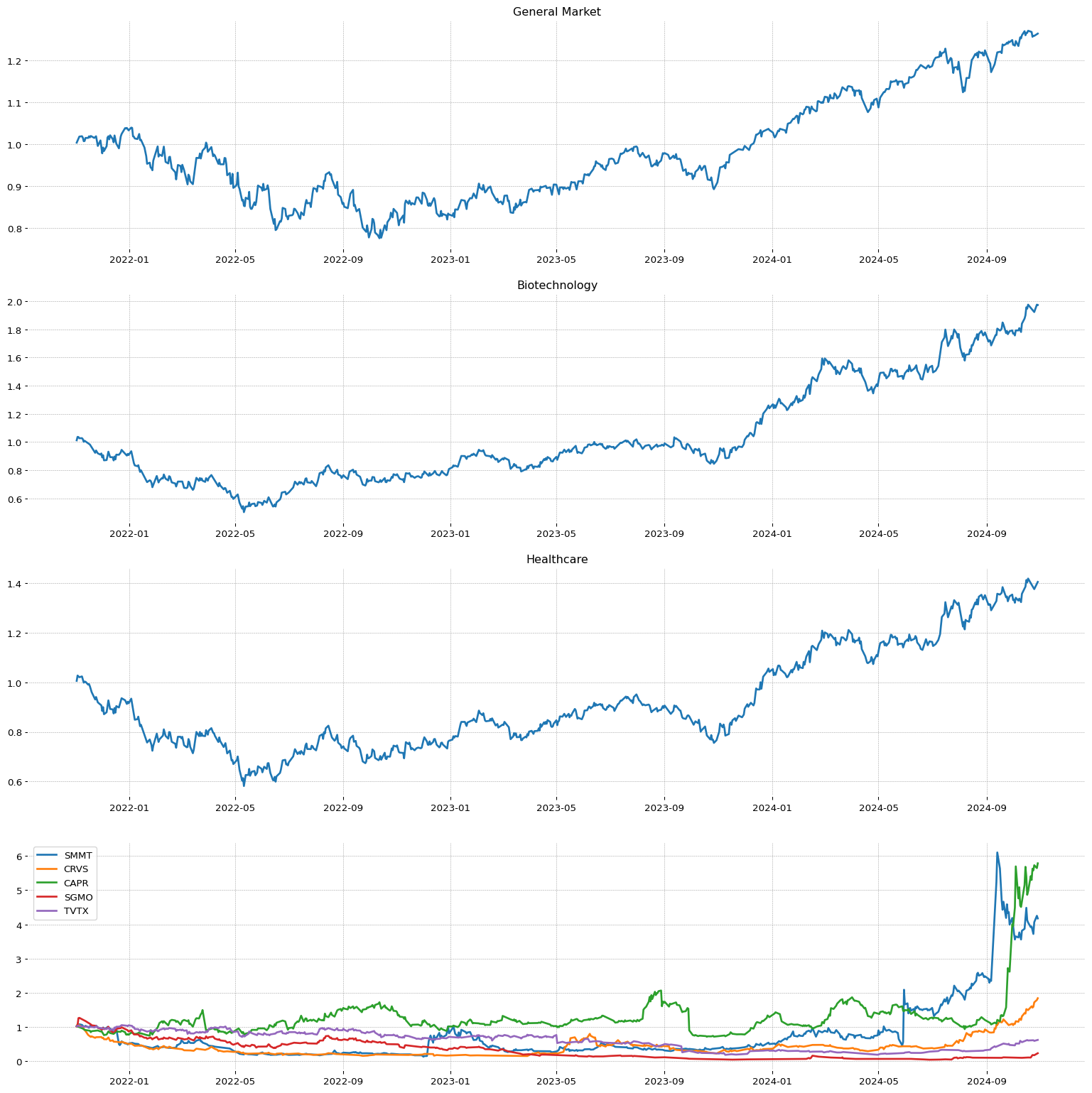

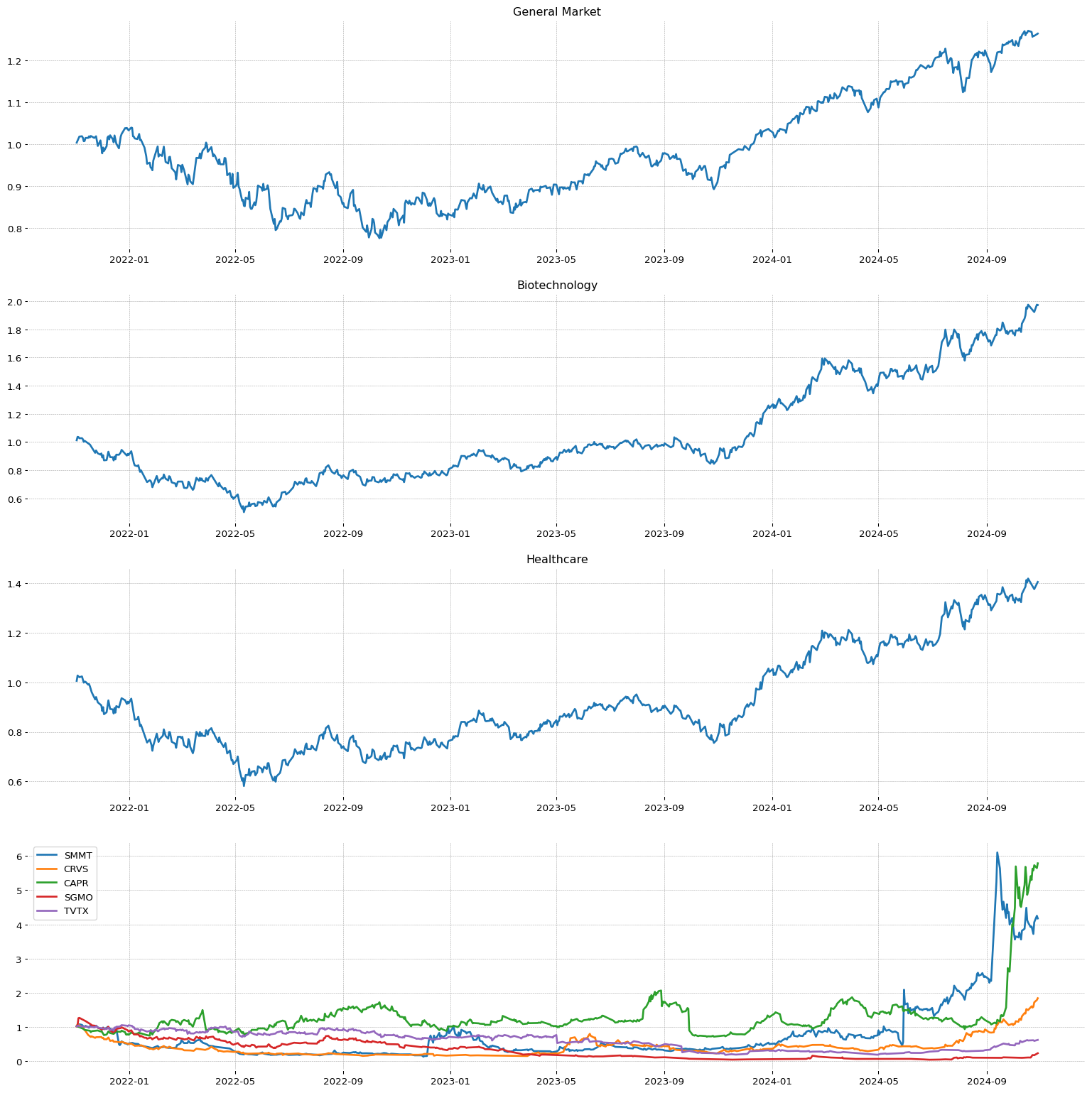

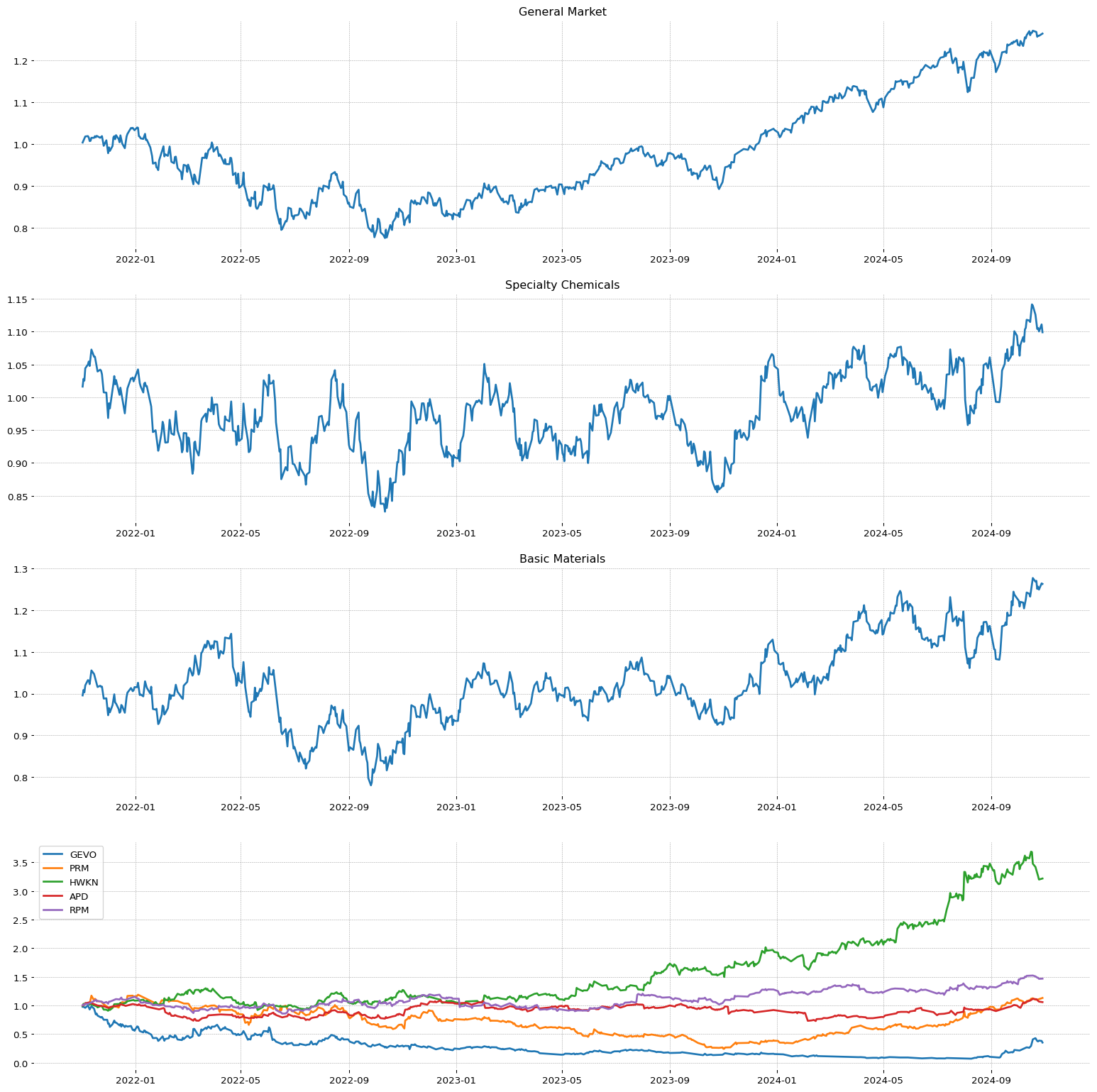

Biotechnology |

92.0 |

58.0 |

70.0 |

97.0 |

-1.11 |

39.19 |

94.49 |

40.54 |

164.46 |

21.68 |

|| |

37.0 |

Gambling |

75.0 |

57.0 |

76.0 |

87.0 |

-0.57 |

42.33 |

56.58% |

52.45 |

0.8 |

-13.03 |

| 13.0 |

Engineering & Construction |

91.0 |

91.0 |

88.0 |

91.0 |

-1.37 |

54.3 |

80.36 |

22.95 |

4.06 |

11.42 |

|| |

38.0 |

Aerospace & Defense |

74.0 |

68.0 |

69.0 |

60.0 |

-0.56 |

28.44 |

49.8% |

25.39 |

-3.82 |

4.49 |

| 14.0 |

Insurance Brokers |

91.0 |

93.0 |

95.0 |

59.0 |

-0.54 |

29.35 |

46.35 |

40.46 |

7.12 |

4.73 |

|| |

39.0 |

REIT - Specialty |

74.0 |

69.0 |

67.0 |

21.0 |

0.53 |

10.43 |

32.64% |

49.92 |

18.33 |

5.3 |

| 15.0 |

Thermal Coal |

90.0 |

97.0 |

37.0 |

4.0 |

-0.86 |

6.4 |

5.7 |

37.86 |

45.64 |

27.18 |

|| |

40.0 |

Financial Data & Stock Exchanges |

73.0 |

65.0 |

58.0 |

79.0 |

-0.6 |

17.22 |

53.51% |

62.33 |

23.2 |

3.16 |

| 16.0 |

REIT - Office |

89.0 |

87.0 |

82.0 |

34.0 |

-1.29 |

17.84 |

49.62 |

41.65 |

-0.73 |

-3.09 |

|| |

41.0 |

Grocery Stores |

72.0 |

77.0 |

80.0 |

21.0 |

0.45 |

20.35 |

26.19% |

29.63 |

3.57 |

12.7 |

| 17.0 |

Publishing |

89.0 |

95.0 |

93.0 |

56.0 |

0.83 |

35.32 |

42.48 |

36.84 |

-9.99 |

26.06 |

|| |

42.0 |

REIT - Retail |

72.0 |

72.0 |

83.0 |

31.0 |

0.17 |

10.48 |

34.35% |

58.01 |

22.52 |

5.98 |

| 18.0 |

REIT - Healthcare Facilities |

88.0 |

95.0 |

94.0 |

23.0 |

0.69 |

11.09 |

27.32 |

49.02 |

1.43 |

1.48 |

|| |

43.0 |

Insurance - Life |

71.0 |

56.0 |

49.0 |

47.0 |

-0.32 |

18.27 |

41.94% |

88.64 |

9.87 |

7.78 |

| 19.0 |

Gold |

87.0 |

73.0 |

97.0 |

50.0 |

-2.08 |

39.33 |

58.92 |

28.62 |

1.67 |

-0.05 |

|| |

44.0 |

Electronic Components |

70.0 |

67.0 |

70.0 |

82.0 |

-0.14 |

20.55 |

42.7% |

28.42 |

5.23 |

11.9 |

| 20.0 |

Telecom Services |

87.0 |

89.0 |

79.0 |

10.0 |

0.25 |

9.71 |

23.13 |

45.3 |

0.52 |

57.82 |

|| |

45.0 |

Consulting Services |

70.0 |

71.0 |

71.0 |

52.0 |

-0.18 |

27.25 |

37.1% |

38.78 |

10.53 |

26.4 |

| 21.0 |

Banks - Regional |

86.0 |

80.0 |

87.0 |

36.0 |

0.28 |

15.01 |

47.93 |

90.67 |

16.88 |

10.82 |

|| |

46.0 |

Insurance - Diversified |

69.0 |

70.0 |

62.0 |

46.0 |

-0.37 |

26.84 |

40.75% |

63.89 |

27.93 |

11.13 |

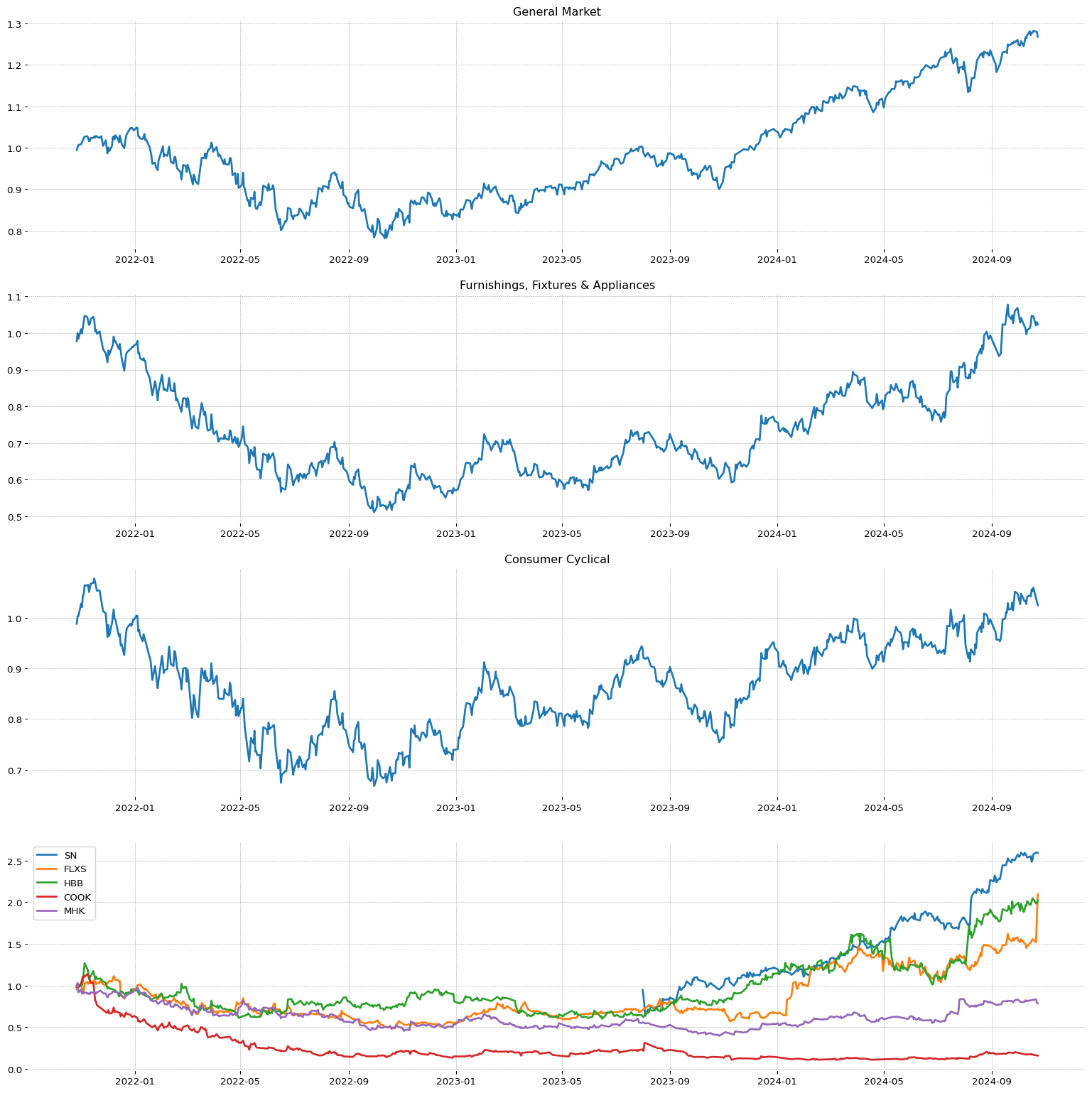

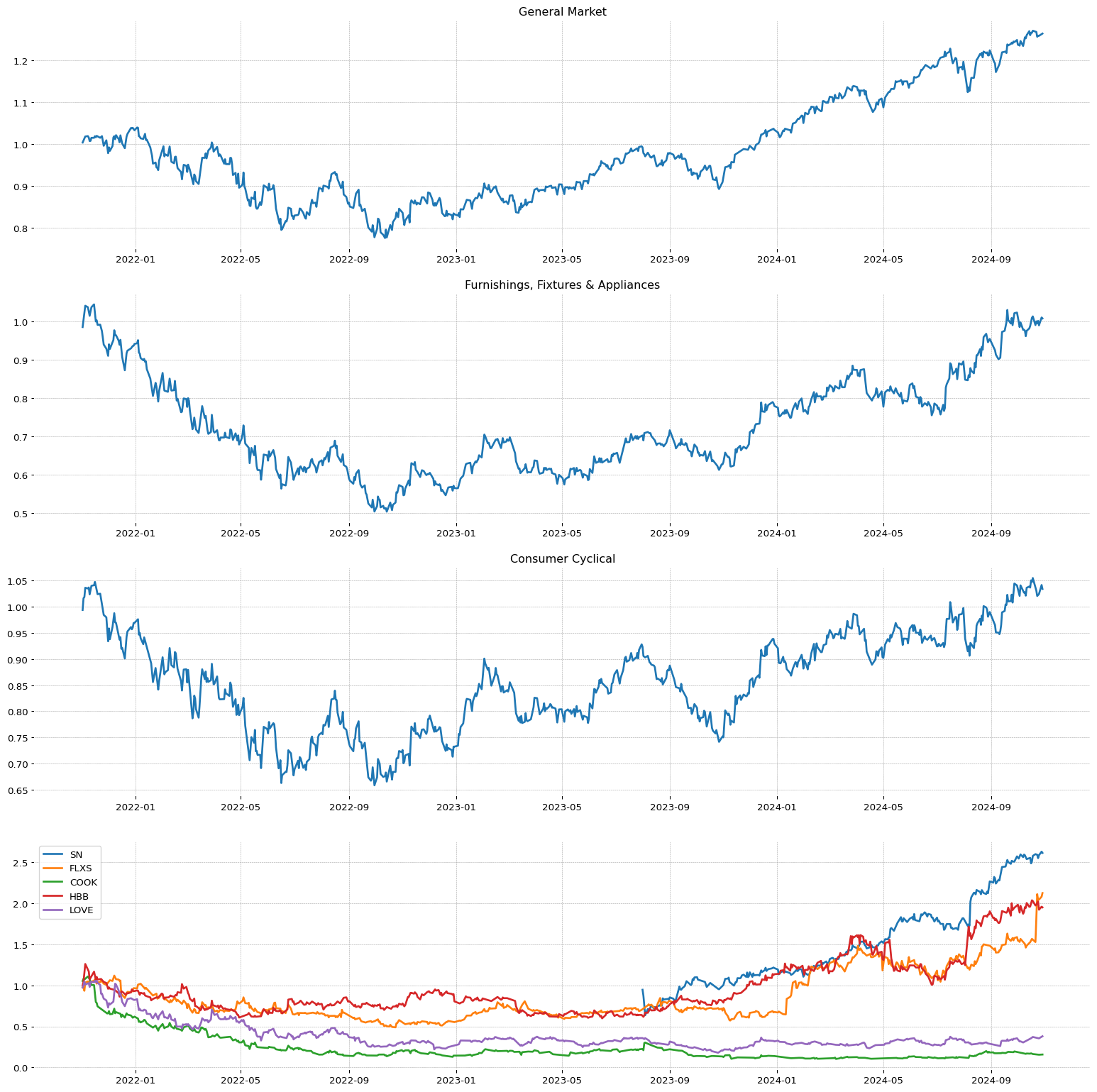

| 22.0 |

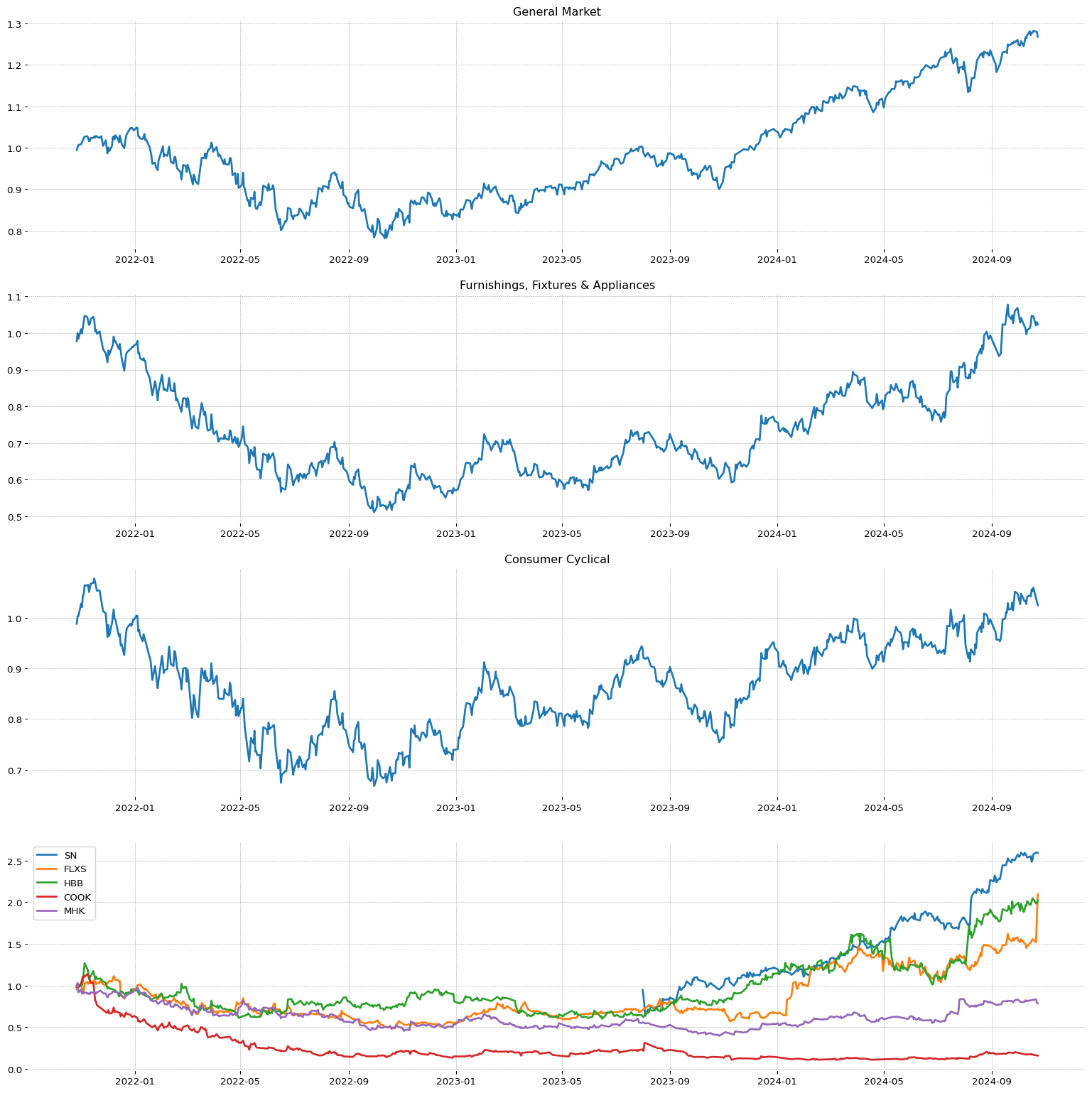

Furnishings, Fixtures & Appliances |

85.0 |

76.0 |

77.0 |

71.0 |

-0.62 |

36.12 |

66.54 |

38.38 |

1.09 |

18.85 |

|| |

47.0 |

Utilities - Regulated Electric |

68.0 |

72.0 |

80.0 |

16.0 |

0.56 |

17.06 |

26.23% |

35.15 |

10.92 |

11.96 |

| 23.0 |

Real Estate Services |

85.0 |

91.0 |

90.0 |

61.0 |

-1.24 |

16.19 |

56.41 |

31.12 |

-2.72 |

-1.62 |

|| |

48.0 |

Insurance - Specialty |

68.0 |

63.0 |

73.0 |

48.0 |

-0.47 |

26.56 |

44.08% |

85.98 |

25.76 |

7.42 |

| 24.0 |

Other Precious Metals & Mining |

84.0 |

76.0 |

95.0 |

84.0 |

-3.23 |

64.04 |

83.35 |

11.84 |

-6.04 |

-6.69 |

|| |

49.0 |

Insurance - Reinsurance |

67.0 |

78.0 |

78.0 |

29.0 |

-0.5 |

22.67 |

28.22% |

91.77 |

15.94 |

16.99 |

| 25.0 |

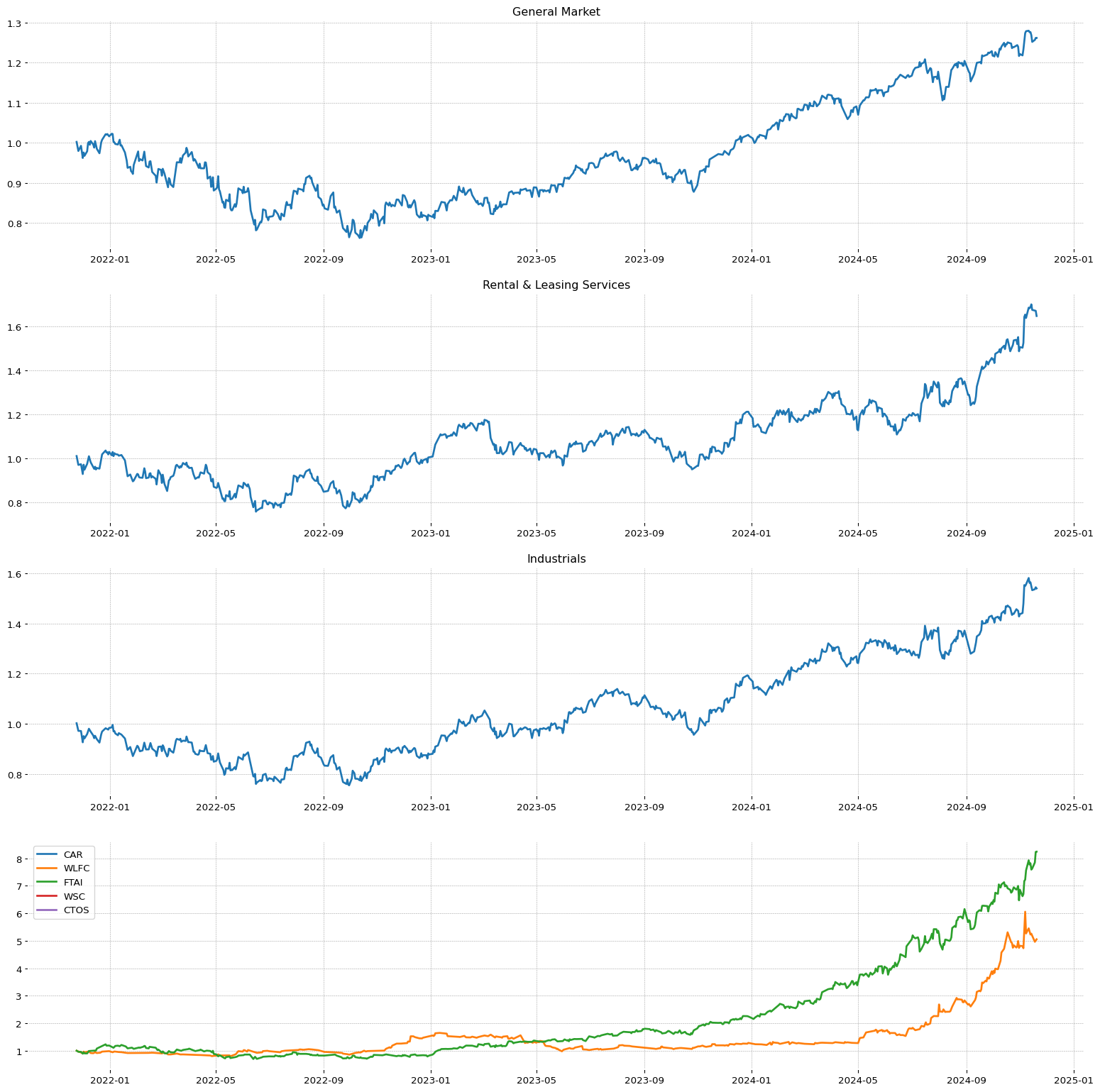

Rental & Leasing Services |

83.0 |

61.0 |

61.0 |

51.0 |

-0.75 |

27.56 |

59.13 |

40.43 |

12.54 |

10.33 |

|| |

50.0 |

Uranium |

66.0 |

19.0 |

12.0 |

17.0 |

-4.06 |

12.94 |

24.07% |

472.0 |

-36.49 |

-9.38 |

| Pos. | |

Name | |

RS Today | |

RS 3Wk | |

RS 6Wk | |

RS 26wk | |

Secotr | |

Industry | |

Pos Ind | |

EPS | |

SMR | |

A/C | |

CR | |

Ind Pos. | |

Sec Pos. | |

Close. | |

10wk | |

26wk | |

| 1.0 |

VERA |

98.46 |

98.49 |

95.59 |

99.65 |

Healthcare |

Biotechnology |

12 |

34.61 |

0.0 |

32.87 |

0.0 |

20.0 |

30.0 |

39.88 |

0.0 |

1.0 |

| 2.0 |

OSCR |

97.6 |

98.67 |

99.22 |

97.95 |

Healthcare |

Healthcare Plans |

4 |

83.17 |

92.71 |

39.16 |

24.89 |

2.0 |

41.0 |

15.93 |

0.0 |

0.0 |

| 3.0 |

INSM |

96.46 |

97.84 |

98.48 |

70.67 |

Healthcare |

Biotechnology |

12 |

11.5 |

84.98 |

59.16 |

65.87 |

36.0 |

54.0 |

71.94 |

0.0 |

1.0 |

| 4.0 |

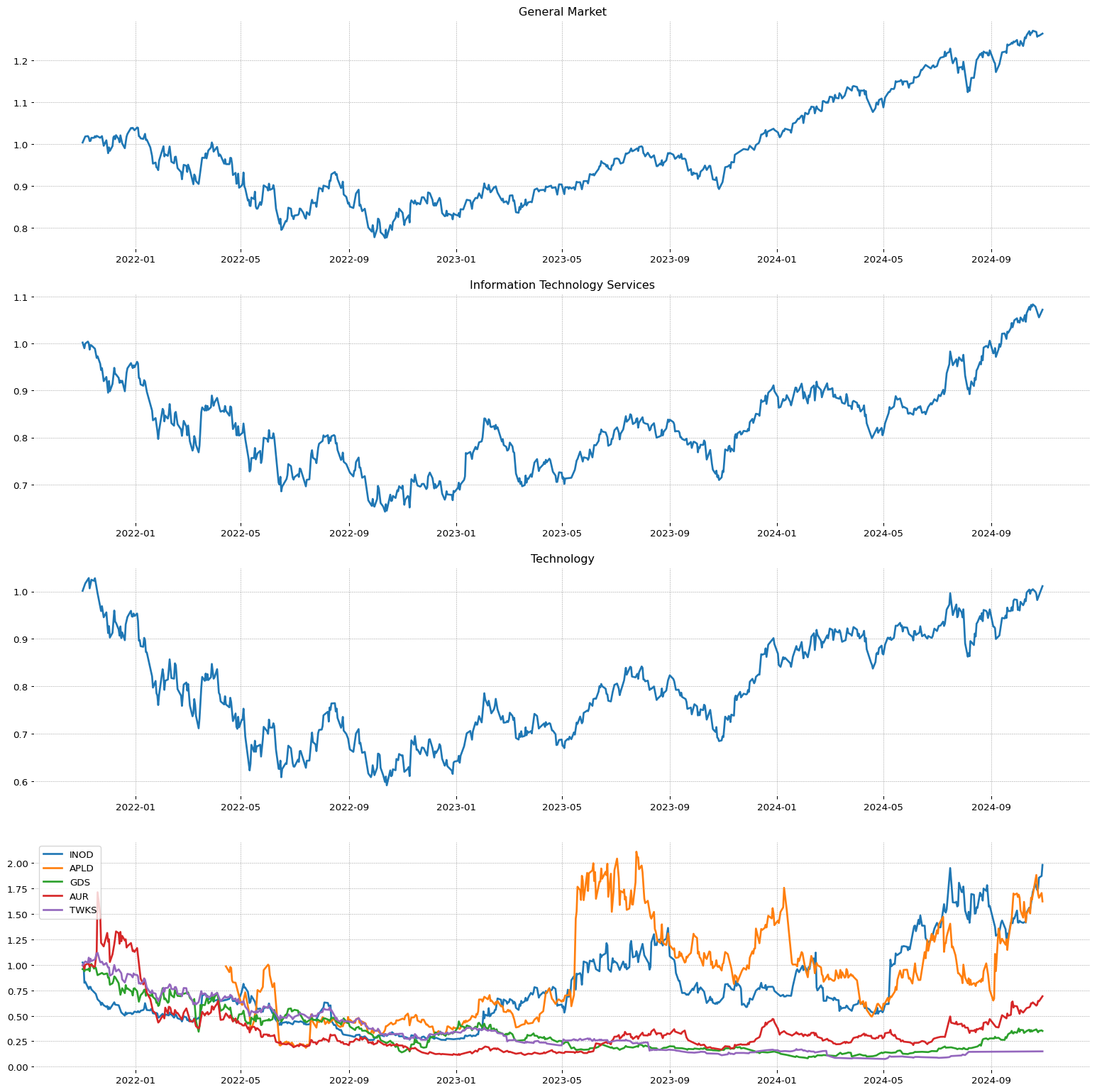

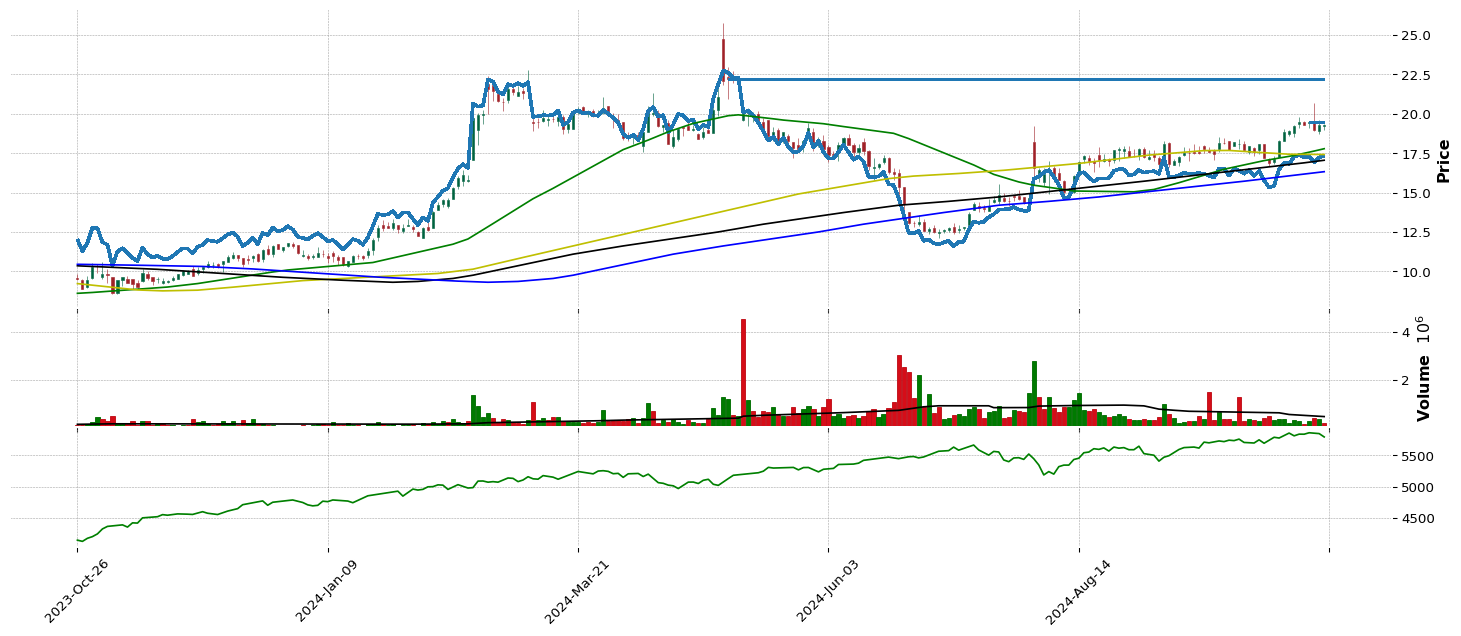

INOD |

96.12 |

90.21 |

94.54 |

21.72 |

Technology |

Information Technology Services |

7 |

46.95 |

95.92 |

30.22 |

29.56 |

2.0 |

18.0 |

18.96 |

1.0 |

1.0 |

| 5.0 |

CLS |

94.86 |

91.87 |

94.88 |

99.19 |

Technology |

Electronic Components |

44 |

99.22 |

96.63 |

63.95 |

67.8 |

1.0 |

20.0 |

57.47 |

1.0 |

1.0 |

| 6.0 |

DNTH |

93.45 |

95.38 |

95.92 |

100.0 |

Healthcare |

Biotechnology |

12 |

74.85 |

38.94 |

54.98 |

41.83 |

59.0 |

82.0 |

26.94 |

0.0 |

1.0 |

| 7.0 |

INBK |

93.01 |

89.56 |

93.55 |

95.49 |

Financial |

Banks - Regional |

21 |

0.0 |

0.0 |

13.25 |

0.0 |

6.0 |

24.0 |

36.52 |

1.0 |

1.0 |

| 8.0 |

GDDY |

92.74 |

93.75 |

95.15 |

89.04 |

Technology |

Software - Infrastructure |

60 |

99.87 |

38.24 |

66.67 |

87.82 |

10.0 |

37.0 |

161.88 |

1.0 |

1.0 |

| 9.0 |

MPWR |

92.4 |

91.84 |

94.29 |

80.57 |

Technology |

Semiconductors |

106 |

52.95 |

24.35 |

27.41 |

99.2 |

6.0 |

41.0 |

883.64 |

0.0 |

1.0 |

| 10.0 |

AORT |

91.75 |

85.25 |

89.85 |

82.65 |

Healthcare |

Medical Devices |

69 |

41.97 |

45.1 |

62.56 |

41.87 |

7.0 |

95.0 |

26.86 |

1.0 |

1.0 |

| 11.0 |

BURL |

91.63 |

94.18 |

93.52 |

28.36 |

Consumer Cyclical |

Apparel Retail |

84 |

96.47 |

76.77 |

60.92 |

94.39 |

4.0 |

26.0 |

255.66 |

0.0 |

1.0 |

| 12.0 |

AGIO |

91.57 |

85.87 |

91.02 |

77.71 |

Healthcare |

Biotechnology |

12 |

10.45 |

22.36 |

16.88 |

48.02 |

66.0 |

96.0 |

44.33 |

0.0 |

1.0 |

| 13.0 |

WING |

91.26 |

96.21 |

96.91 |

92.73 |

Consumer Cyclical |

Restaurants |

102 |

96.41 |

85.43 |

8.02 |

96.47 |

4.0 |

28.0 |

366.6 |

0.0 |

0.0 |

| 14.0 |

LGND |

91.05 |

88.11 |

89.36 |

27.87 |

Healthcare |

Biotechnology |

12 |

76.12 |

66.66 |

98.28 |

81.77 |

67.0 |

98.0 |

106.88 |

1.0 |

1.0 |

| 15.0 |

NVMI |

90.03 |

89.38 |

92.72 |

93.1 |

Technology |

Semiconductor Equipment and Materials |

134 |

86.66 |

57.52 |

20.83 |

89.48 |

1.0 |

54.0 |

182.88 |

0.0 |

0.0 |

| 16.0 |

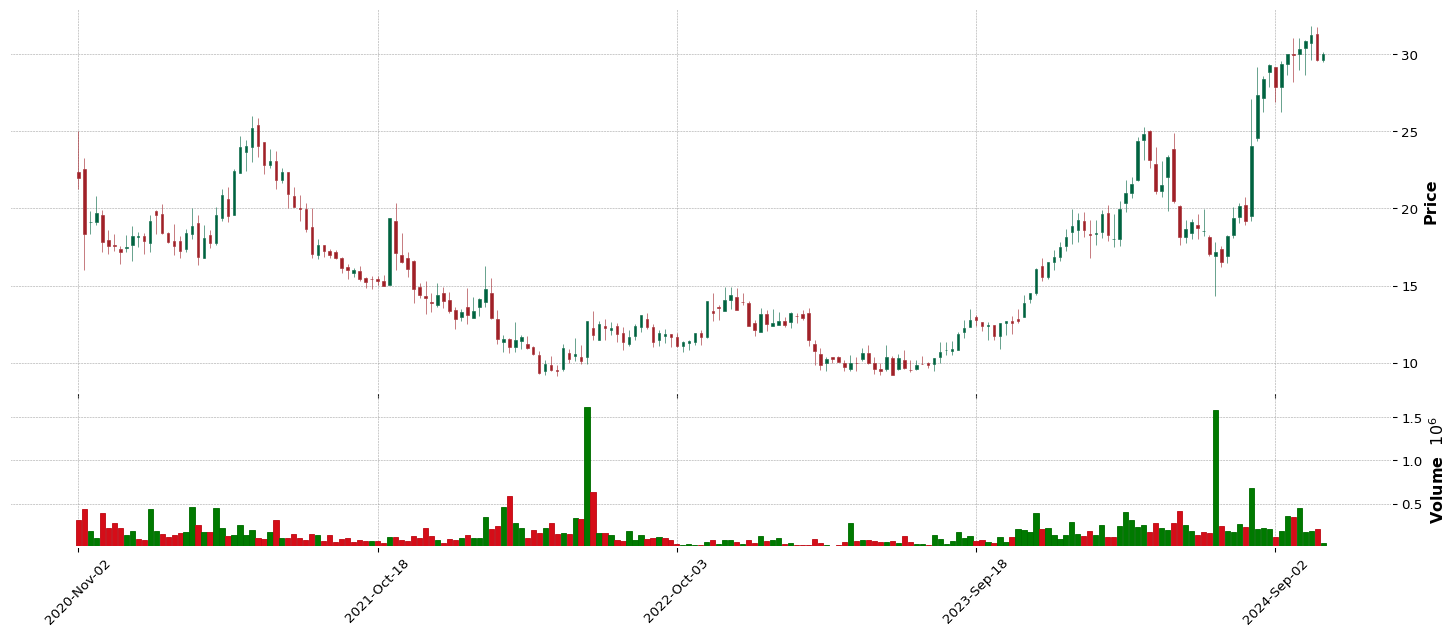

LOVE |

89.54 |

75.25 |

59.82 |

19.08 |

Consumer Cyclical |

Furnishings, Fixtures and Appliances |

22 |

11.75 |

22.26 |

92.95 |

42.66 |

4.0 |

31.0 |

28.65 |

1.0 |

1.0 |

| 17.0 |

DKS |

89.29 |

92.82 |

93.61 |

79.45 |

Consumer Cyclical |

Specialty Retail |

51 |

0.0 |

0.0 |

10.68 |

0.0 |

2.0 |

32.0 |

205.69 |

0.0 |

0.0 |

| 18.0 |

GHM |

88.65 |

87.22 |

93.77 |

96.15 |

Industrials |

Specialty Industrial Machinery |

65 |

92.76 |

94.64 |

66.67 |

51.38 |

6.0 |

56.0 |

29.7 |

0.0 |

1.0 |

| 19.0 |

MHK |

88.43 |

91.75 |

87.51 |

45.25 |

Consumer Cyclical |

Furnishings, Fixtures and Appliances |

22 |

33.68 |

49.95 |

81.76 |

86.58 |

5.0 |

35.0 |

151.69 |

0.0 |

1.0 |

| 20.0 |

GKOS |

88.13 |

88.21 |

90.13 |

95.74 |

Healthcare |

Medical Devices |

69 |

5.22 |

53.44 |

14.57 |

78.9 |

10.0 |

113.0 |

129.94 |

1.0 |

1.0 |

| 21.0 |

UTI |

88.03 |

89.65 |

94.51 |

95.81 |

Consumer Defensive |

Education and Training Services |

123 |

98.2 |

79.65 |

16.88 |

30.11 |

1.0 |

14.0 |

16.09 |

0.0 |

1.0 |

| 22.0 |

ULH |

87.76 |

88.7 |

85.44 |

71.44 |

Industrials |

Trucking |

94 |

0.0 |

0.0 |

29.01 |

0.0 |

1.0 |

58.0 |

42.36 |

1.0 |

1.0 |

| 23.0 |

SMC |

87.63 |

91.93 |

98.14 |

92.42 |

Energy |

Oil and Gas Midstream |

93 |

19.48 |

0.0 |

45.16 |

0.0 |

2.0 |

3.0 |

35.15 |

0.0 |

1.0 |

| 24.0 |

DECK |

87.2 |

91.07 |

91.76 |

89.91 |

Consumer Cyclical |

Footwear and Accessories |

82 |

89.79 |

93.51 |

30.22 |

88.03 |

3.0 |

43.0 |

150.96 |

0.0 |

0.0 |

| 25.0 |

REVG |

85.97 |

85.74 |

92.59 |

95.03 |

Industrials |

Farm and Heavy Construction Machinery |

130 |

92.45 |

86.1 |

1.99 |

44.6 |

2.0 |

64.0 |

26.96 |

0.0 |

1.0 |

| 26.0 |

BHE |

85.14 |

88.51 |

90.22 |

80.01 |

Technology |

Electronic Components |

44 |

86.51 |

52.77 |

52.43 |

59.3 |

3.0 |

79.0 |

42.95 |

1.0 |

1.0 |

| Pos. | |

Name | |

RS Today | |

RS 3Wk | |

RS 6Wk | |

RS 26wk | |

Secotr | |

Industry | |

Pos Ind | |

EPS | |

SMR | |

A/C | |

CR | |

Ind Pos. | |

Sec Pos. | |

Close. | |

10wk | |

26wk | |

| 1.0 |

RVT |

52.15 |

50.53 |

51.74 |

51.3 |

Financial |

Closed-End Fund - Equity |

73 |

0.0 |

0.0 |

86.79 |

0.0 |

33.0 |

405.0 |

15.43 |

1.0 |

1.0 |

| 2.0 |

EIG |

51.1 |

45.73 |

57.13 |

52.57 |

Financial |

Insurance - Specialty |

48 |

47.07 |

65.92 |

4.94 |

61.34 |

13.0 |

414.0 |

48.02 |

1.0 |

1.0 |

| 3.0 |

BR |

51.07 |

48.16 |

51.37 |

75.26 |

Technology |

Information Technology Services |

7 |

36.0 |

61.05 |

69.15 |

92.94 |

24.0 |

229.0 |

216.36 |

1.0 |

1.0 |

| 4.0 |

LDP |

51.04 |

59.89 |

57.75 |

51.21 |

Financial |

Closed-End Fund - Debt |

91 |

63.06 |

37.27 |

98.63 |

42.15 |

25.0 |

415.0 |

21.12 |

1.0 |

1.0 |

| 5.0 |

HPE |

50.89 |

49.95 |

31.45 |

62.13 |

Technology |

Communication Equipment |

1 |

72.44 |

43.05 |

74.11 |

39.41 |

17.0 |

230.0 |

19.3 |

1.0 |

1.0 |

| 6.0 |

WTW |

50.64 |

69.31 |

79.34 |

53.94 |

Financial |

Insurance Brokers |

14 |

66.62 |

81.48 |

75.87 |

96.26 |

6.0 |

419.0 |

291.92 |

1.0 |

1.0 |

| 7.0 |

WSBC |

50.55 |

45.7 |

60.62 |

45.62 |

Financial |

Banks - Regional |

21 |

20.13 |

51.65 |

26.35 |

44.84 |

174.0 |

420.0 |

30.76 |

1.0 |

1.0 |

| 8.0 |

NPFD |

50.24 |

57.8 |

56.73 |

49.44 |

Financial |

Closed-End Fund - Equity |

73 |

0.0 |

0.0 |

81.76 |

0.0 |

35.0 |

424.0 |

18.93 |

1.0 |

1.0 |

| 9.0 |

IRMD |

50.15 |

46.01 |

35.67 |

38.33 |

Healthcare |

Medical Devices |

69 |

93.34 |

82.03 |

52.43 |

68.29 |

29.0 |

244.0 |

50.49 |

1.0 |

1.0 |

| 10.0 |

BGH |

49.96 |

50.66 |

53.68 |

49.06 |

Financial |

Closed-End Fund - Debt |

91 |

41.91 |

87.29 |

84.64 |

34.12 |

30.0 |

427.0 |

15.3 |

1.0 |

1.0 |

| 11.0 |

FMS |

49.9 |

25.76 |

23.62 |

19.39 |

Healthcare |

Medical Care Facilities |

6 |

9.89 |

32.94 |

48.55 |

34.95 |

16.0 |

245.0 |

21.04 |

1.0 |

1.0 |

| 12.0 |

PAYX |

49.41 |

46.9 |

54.2 |

54.0 |

Technology |

Software - Application |

87 |

50.01 |

53.89 |

11.67 |

85.85 |

64.0 |

233.0 |

141.42 |

1.0 |

1.0 |

| 13.0 |

GD |

49.38 |

67.31 |

74.43 |

73.02 |

Industrials |

Aerospace and Defense |

38 |

41.63 |

50.43 |

94.17 |

96.3 |

24.0 |

216.0 |

304.39 |

1.0 |

1.0 |

| 14.0 |

L |

49.32 |

53.24 |

61.97 |

74.48 |

Financial |

Insurance - Property and Casualty |

77 |

85.27 |

73.78 |

45.59 |

77.86 |

22.0 |

432.0 |

80.94 |

1.0 |

1.0 |

| 15.0 |

WTM |

48.98 |

42.62 |

43.78 |

68.34 |

Financial |

Insurance - Property and Casualty |

77 |

49.73 |

71.7 |

48.55 |

99.79 |

23.0 |

438.0 |

1831.97 |

1.0 |

1.0 |

| 16.0 |

EVRG |

48.92 |

54.72 |

47.7 |

20.39 |

Utilities |

Utilities - Regulated Electric |

47 |

27.83 |

34.58 |

39.16 |

65.9 |

18.0 |

37.0 |

61.95 |

1.0 |

1.0 |

| 17.0 |

NODK |

48.89 |

45.24 |

60.68 |

52.85 |

Financial |

Insurance - Property and Casualty |

77 |

32.19 |

80.75 |

81.76 |

33.47 |

24.0 |

439.0 |

15.6 |

1.0 |

1.0 |

| 18.0 |

PAXS |

47.41 |

52.57 |

55.16 |

47.39 |

Financial |

Closed-End Fund - Debt |

91 |

0.0 |

0.0 |

86.79 |

0.0 |

46.0 |

468.0 |

16.28 |

1.0 |

1.0 |

| 19.0 |

BKH |

47.38 |

54.01 |

41.41 |

19.02 |

Utilities |

Utilities - Regulated Gas |

108 |

24.15 |

52.96 |

81.76 |

69.39 |

6.0 |

38.0 |

61.06 |

1.0 |

1.0 |

| 20.0 |

COR |

46.95 |

48.69 |

73.85 |

81.12 |

Healthcare |

Medical Distribution |

140 |

68.04 |

29.13 |

20.83 |

92.42 |

1.0 |

253.0 |

234.52 |

1.0 |

1.0 |

| 21.0 |

BERY |

46.27 |

46.75 |

36.44 |

36.03 |

Consumer Cyclical |

Packaging and Containers |

116 |

33.18 |

14.14 |

11.67 |

64.07 |

11.0 |

165.0 |

68.12 |

1.0 |

1.0 |

| 22.0 |

ES |

46.15 |

46.04 |

38.94 |

15.05 |

Utilities |

Utilities - Regulated Electric |

47 |

41.38 |

33.62 |

59.16 |

70.29 |

20.0 |

41.0 |

67.08 |

1.0 |

1.0 |

| 23.0 |

HOLX |

45.78 |

40.47 |

48.75 |

23.43 |

Healthcare |

Medical Instruments and Supplies |

71 |

39.83 |

41.45 |

2.73 |

71.3 |

16.0 |

257.0 |

81.34 |

1.0 |

1.0 |

| 24.0 |

NIE |

45.38 |

40.62 |

49.86 |

50.99 |

Financial |

Closed-End Fund - Equity |

73 |

68.82 |

0.0 |

70.26 |

0.0 |

47.0 |

494.0 |

23.27 |

1.0 |

1.0 |

| 25.0 |

IIIV |

45.35 |

32.44 |

32.68 |

38.14 |

Technology |

Software - Infrastructure |

60 |

25.82 |

62.78 |

39.16 |

40.49 |

56.0 |

248.0 |

22.75 |

1.0 |

1.0 |

| 26.0 |

FE |

44.68 |

57.61 |

58.92 |

34.72 |

Utilities |

Utilities - Regulated Electric |

47 |

21.65 |

45.74 |

39.16 |

57.08 |

21.0 |

43.0 |

44.27 |

1.0 |

1.0 |

| 27.0 |

FWONK |

44.55 |

36.9 |

49.49 |

34.88 |

Communication Services |

Entertainment |

83 |

73.16 |

23.53 |

2.73 |

72.13 |

15.0 |

74.0 |

79.23 |

1.0 |

1.0 |

| 28.0 |

VOYA |

44.49 |

47.36 |

43.41 |

24.02 |

Financial |

Financial Conglomerates |

29 |

87.47 |

77.09 |

81.76 |

80.01 |

2.0 |

507.0 |

81.58 |

1.0 |

1.0 |

| 29.0 |

SPXX |

44.24 |

38.44 |

51.27 |

35.5 |

Financial |

Closed-End Fund - Equity |

73 |

0.0 |

0.0 |

69.15 |

0.0 |

52.0 |

513.0 |

16.82 |

1.0 |

1.0 |

| 30.0 |

OSBC |

44.09 |

33.82 |

54.57 |

58.72 |

Financial |

Banks - Regional |

21 |

50.51 |

43.27 |

91.81 |

34.71 |

188.0 |

515.0 |

16.62 |

1.0 |

1.0 |

| 31.0 |

MPLX |

43.72 |

59.0 |

64.81 |

63.53 |

Energy |

Oil and Gas Midstream |

93 |

90.34 |

71.31 |

54.98 |

64.55 |

16.0 |

40.0 |

43.84 |

1.0 |

1.0 |

| 32.0 |

KVUE |

43.66 |

37.3 |

44.09 |

0.0 |

Consumer Defensive |

Household and Personal Products |

129 |

35.38 |

42.18 |

96.04 |

43.6 |

6.0 |

54.0 |

22.76 |

1.0 |

1.0 |

| 33.0 |

AMH |

43.57 |

38.78 |

47.27 |

49.5 |

Real Estate |

REIT - Residential |

52 |

67.67 |

35.77 |

86.79 |

60.85 |

13.0 |

101.0 |

39.04 |

1.0 |

1.0 |

| 34.0 |

GNTY |

42.65 |

38.25 |

56.95 |

65.79 |

Financial |

Banks - Regional |

21 |

16.54 |

34.71 |

98.28 |

53.21 |

193.0 |

532.0 |

34.34 |

1.0 |

1.0 |

| 35.0 |

ET |

42.37 |

50.38 |

56.61 |

67.41 |

Energy |

Oil and Gas Midstream |

93 |

73.61 |

34.0 |

81.76 |

35.16 |

17.0 |

43.0 |

16.37 |

1.0 |

1.0 |

| 36.0 |

PFIS |

42.28 |

38.13 |

33.17 |

30.57 |

Financial |

Banks - Regional |

21 |

6.74 |

44.52 |

66.67 |

60.47 |

196.0 |

537.0 |

47.2 |

1.0 |

1.0 |

| 37.0 |

IVT |

42.06 |

51.18 |

60.53 |

55.52 |

Real Estate |

REIT - Retail |

42 |

57.65 |

23.99 |

76.59 |

49.48 |

17.0 |

106.0 |

29.47 |

1.0 |

1.0 |

| 38.0 |

ED |

41.91 |

49.06 |

50.35 |

32.8 |

Utilities |

Utilities - Regulated Electric |

47 |

41.57 |

68.91 |

77.83 |

83.67 |

23.0 |

47.0 |

107.4 |

1.0 |

1.0 |

| 39.0 |

POR |

41.78 |

42.22 |

41.13 |

21.35 |

Utilities |

Utilities - Regulated Electric |

47 |

91.27 |

44.3 |

66.67 |

66.45 |

24.0 |

48.0 |

49.0 |

1.0 |

1.0 |

| 40.0 |

INCY |

41.69 |

44.47 |

34.25 |

9.99 |

Healthcare |

Biotechnology |

12 |

78.41 |

77.83 |

22.28 |

72.23 |

144.0 |

270.0 |

65.16 |

1.0 |

1.0 |

| 41.0 |

AEIS |

41.45 |

29.3 |

25.13 |

50.31 |

Industrials |

Electrical Equipment and Parts |

92 |

8.62 |

4.71 |

30.22 |

72.64 |

8.0 |

232.0 |

106.0 |

1.0 |

1.0 |

| 42.0 |

FELE |

41.23 |

42.75 |

37.34 |

58.47 |

Industrials |

Specialty Industrial Machinery |

65 |

49.45 |

42.76 |

39.16 |

79.66 |

31.0 |

233.0 |

102.02 |

1.0 |

1.0 |

| 43.0 |

GTY |

41.14 |

41.3 |

41.72 |

17.53 |

Real Estate |

REIT - Retail |

42 |

38.75 |

29.09 |

94.17 |

52.59 |

18.0 |

108.0 |

32.25 |

1.0 |

1.0 |

| 44.0 |

DGX |

40.95 |

51.67 |

63.3 |

35.59 |

Healthcare |

Diagnostics and Research |

33 |

17.56 |

37.11 |

88.16 |

87.75 |

15.0 |

275.0 |

157.11 |

1.0 |

1.0 |

| 45.0 |

WTRG |

40.86 |

44.01 |

34.93 |

21.5 |

Utilities |

Utilities - Regulated Water |

75 |

51.65 |

30.83 |

39.16 |

55.91 |

5.0 |

51.0 |

40.29 |

1.0 |

1.0 |

| 46.0 |

AVA |

40.8 |

46.16 |

42.64 |

17.34 |

Utilities |

Utilities - Diversified |

74 |

53.04 |

45.52 |

39.16 |

55.84 |

3.0 |

52.0 |

38.45 |

1.0 |

1.0 |

| 47.0 |

ALE |

40.68 |

49.49 |

49.89 |

32.71 |

Utilities |

Utilities - Diversified |

74 |

31.11 |

31.21 |

22.28 |

65.11 |

4.0 |

53.0 |

64.27 |

1.0 |

1.0 |

| 48.0 |

GSBC |

40.46 |

39.27 |

48.62 |

44.97 |

Financial |

Banks - Regional |

21 |

21.55 |

49.66 |

75.12 |

67.46 |

199.0 |

552.0 |

58.18 |

1.0 |

1.0 |

| 49.0 |

ABR |

40.43 |

36.62 |

21.73 |

51.58 |

Real Estate |

REIT - Mortgage |

114 |

0.0 |

0.0 |

90.23 |

0.0 |

11.0 |

110.0 |

15.27 |

1.0 |

1.0 |

| 50.0 |

OGE |

40.28 |

56.04 |

48.28 |

27.52 |

Utilities |

Utilities - Regulated Electric |

47 |

0.0 |

0.0 |

66.67 |

0.0 |

26.0 |

55.0 |

41.02 |

1.0 |

1.0 |

| 51.0 |

CHH |

39.94 |

34.44 |

30.24 |

29.42 |

Consumer Cyclical |

Lodging |

76 |

58.89 |

11.48 |

8.02 |

81.32 |

7.0 |

179.0 |

131.92 |

1.0 |

1.0 |

| 52.0 |

SR |

39.57 |

40.1 |

41.44 |

26.87 |

Utilities |

Utilities - Regulated Gas |

108 |

77.72 |

47.89 |

66.67 |

72.95 |

7.0 |

57.0 |

65.83 |

1.0 |

1.0 |

| 53.0 |

HSBC |

39.54 |

38.01 |

46.06 |

59.65 |

Financial |

Banks - Diversified |

79 |

83.42 |

51.36 |

27.41 |

62.06 |

15.0 |

564.0 |

44.18 |

1.0 |

1.0 |

| 54.0 |

RLI |

39.2 |

42.07 |

45.17 |

46.98 |

Financial |

Insurance - Property and Casualty |

77 |

75.81 |

52.48 |

81.76 |

91.0 |

27.0 |

567.0 |

159.71 |

1.0 |

1.0 |

| 55.0 |

SDHY |

38.86 |

44.41 |

42.52 |

39.5 |

Financial |

Closed-End Fund - Debt |

91 |

0.0 |

0.0 |

62.56 |

0.0 |

91.0 |

573.0 |

16.48 |

1.0 |

1.0 |

| 56.0 |

ARW |

38.68 |

33.51 |

29.44 |

54.96 |

Technology |

Electronics and Computer Distribution |

86 |

31.73 |

5.0 |

1.84 |

76.62 |

5.0 |

265.0 |

132.36 |

1.0 |

1.0 |

| 57.0 |

AVT |

37.82 |

36.22 |

38.32 |

64.3 |

Technology |

Electronics and Computer Distribution |

86 |

35.04 |

5.71 |

22.28 |

57.91 |

6.0 |

269.0 |

53.9 |

1.0 |

1.0 |

| 58.0 |

OGS |

37.76 |

33.67 |

27.1 |

19.86 |

Utilities |

Utilities - Regulated Gas |

108 |

17.84 |

31.82 |

72.64 |

71.92 |

8.0 |

58.0 |

73.76 |

1.0 |

1.0 |

| 59.0 |

BFC |

37.73 |

34.9 |

49.05 |

58.56 |

Financial |

Banks - Regional |

21 |

66.28 |

79.01 |

98.28 |

82.57 |

203.0 |

578.0 |

93.06 |

1.0 |

1.0 |

| 60.0 |

CII |

37.14 |

31.39 |

36.17 |

43.42 |

Financial |

Closed-End Fund - Equity |

73 |

90.31 |

74.75 |

72.64 |

42.98 |

61.0 |

583.0 |

19.7 |

1.0 |

1.0 |

| 61.0 |

NWE |

37.02 |

41.39 |

40.76 |

20.94 |

Utilities |

Utilities - Regulated Electric |

47 |

0.0 |

0.0 |

52.43 |

0.0 |

28.0 |

59.0 |

55.31 |

1.0 |

1.0 |

| 62.0 |

CPZ |

36.46 |

34.87 |

39.68 |

40.03 |

Financial |

Closed-End Fund - Equity |

73 |

0.0 |

0.0 |

88.16 |

0.0 |

63.0 |

590.0 |

15.64 |

1.0 |

1.0 |

| 63.0 |

PEBO |

34.25 |

39.08 |

52.75 |

59.62 |

Financial |

Banks - Regional |

21 |

60.06 |

65.15 |

96.04 |

54.94 |

207.0 |

604.0 |

30.95 |

1.0 |

1.0 |

| 64.0 |

ARCC |

34.22 |

36.28 |

41.75 |

54.87 |

Financial |

Asset Management |

67 |

80.97 |

88.57 |

39.16 |

43.7 |

47.0 |

605.0 |

21.5 |

1.0 |

1.0 |

| 65.0 |

AON |

32.53 |

31.76 |

37.12 |

30.66 |

Financial |

Insurance Brokers |

14 |

40.73 |

48.37 |

14.57 |

96.02 |

10.0 |

615.0 |

358.29 |

1.0 |

1.0 |

| 66.0 |

FTS |

32.28 |

42.01 |

43.23 |

24.67 |

Utilities |

Utilities - Regulated Electric |

47 |

36.74 |

29.96 |

30.22 |

56.67 |

30.0 |

62.0 |

44.9 |

1.0 |

1.0 |

| 67.0 |

XOM |

32.07 |

41.45 |

28.36 |

42.86 |

Energy |

Oil and Gas Integrated |

126 |

71.75 |

8.05 |

32.12 |

82.01 |

6.0 |

59.0 |

120.26 |

1.0 |

1.0 |

| 68.0 |

OBK |

31.98 |

32.84 |

41.9 |

46.46 |

Financial |

Banks - Regional |

21 |

32.38 |

49.75 |

39.16 |

48.3 |

212.0 |

620.0 |

32.13 |

1.0 |

1.0 |

| 69.0 |

DE |

30.93 |

33.7 |

26.95 |

45.56 |

Industrials |

Farm and Heavy Construction Machinery |

130 |

64.76 |

46.61 |

72.64 |

97.99 |

8.0 |

272.0 |

408.64 |

1.0 |

1.0 |

| 70.0 |

WABC |

29.88 |

31.79 |

48.35 |

60.21 |

Financial |

Banks - Regional |

21 |

48.19 |

41.22 |

52.43 |

64.31 |

215.0 |

635.0 |

51.72 |

1.0 |

1.0 |

| 71.0 |

IDA |

29.85 |

31.88 |

38.23 |

21.07 |

Utilities |

Utilities - Regulated Electric |

47 |

31.36 |

27.91 |

11.67 |

75.13 |

32.0 |

65.0 |

104.98 |

1.0 |

1.0 |

| 72.0 |

ATHM |

28.78 |

42.04 |

24.45 |

20.48 |

Communication Services |

Internet Content and Information |

107 |

16.08 |

48.05 |

91.18 |

49.89 |

23.0 |

89.0 |

29.12 |

1.0 |

1.0 |

| 73.0 |

NWN |

28.5 |

26.5 |

28.39 |

18.34 |

Utilities |

Utilities - Regulated Gas |

108 |

8.9 |

17.29 |

66.67 |

53.56 |

10.0 |

69.0 |

40.56 |

1.0 |

1.0 |

| 74.0 |

AWR |

28.35 |

30.8 |

30.15 |

16.2 |

Utilities |

Utilities - Regulated Water |

75 |

21.0 |

24.15 |

62.56 |

73.68 |

7.0 |

71.0 |

84.41 |

1.0 |

1.0 |

| 75.0 |

MKL |

28.13 |

32.34 |

34.22 |

47.82 |

Financial |

Insurance - Property and Casualty |

77 |

82.27 |

74.43 |

31.28 |

99.75 |

30.0 |

643.0 |

1567.56 |

1.0 |

1.0 |

| 76.0 |

FCN |

26.87 |

46.81 |

58.61 |

63.25 |

Industrials |

Consulting Services |

45 |

69.99 |

87.77 |

85.83 |

94.91 |

7.0 |

294.0 |

229.5 |

1.0 |

1.0 |

| 77.0 |

BKR |

26.29 |

37.61 |

25.34 |

57.66 |

Energy |

Oil and Gas Equipment and Services |

139 |

81.1 |

86.01 |

31.28 |

60.09 |

9.0 |

67.0 |

37.0 |

1.0 |

1.0 |

| 78.0 |

EXC |

24.72 |

32.74 |

28.8 |

23.89 |

Utilities |

Utilities - Regulated Electric |

47 |

50.13 |

56.4 |

77.83 |

61.82 |

35.0 |

74.0 |

40.74 |

1.0 |

1.0 |

| 79.0 |

VTS |

23.61 |

46.5 |

40.45 |

67.38 |

Energy |

Oil and Gas EandP |

137 |

43.92 |

17.26 |

39.16 |

40.31 |

13.0 |

76.0 |

24.86 |

1.0 |

1.0 |

| 80.0 |

TXNM |

22.97 |

25.17 |

28.12 |

13.28 |

Utilities |

Utilities - Regulated Electric |

47 |

8.22 |

0.0 |

92.51 |

0.0 |

36.0 |

76.0 |

44.61 |

1.0 |

1.0 |

| 81.0 |

SPLP |

18.35 |

18.19 |

23.77 |

24.89 |

Industrials |

Conglomerates |

95 |

90.13 |

40.42 |

85.83 |

64.86 |

11.0 |

330.0 |

41.0 |

1.0 |

1.0 |

| 82.0 |

GBLI |

16.69 |

19.23 |

28.21 |

56.14 |

Financial |

Insurance - Property and Casualty |

77 |

95.76 |

78.82 |

48.55 |

59.88 |

34.0 |

682.0 |

33.99 |

1.0 |

1.0 |

| Pos. | |

Name | |

RS Today | |

RS 3Wk | |

RS 6Wk | |

RS 26wk | |

Secotr | |

Industry | |

Pos Ind | |

EPS | |

SMR | |

A/C | |

CR | |

Ind Pos. | |

Sec Pos. | |

Close. | |

10wk | |

26wk | |

| 1.0 |

SEZL |

100.0 |

99.96 |

100.0 |

0.0 |

Financial |

Credit Services |

34 |

94.86 |

86.39 |

78.63 |

70.67 |

1.0 |

1.0 |

190.16 |

1.0 |

1.0 |

| 2.0 |

LBPH |

99.93 |

99.84 |

99.75 |

96.77 |

Healthcare |

Biotechnology |

12 |

0.0 |

0.0 |

79.01 |

0.0 |

1.0 |

2.0 |

59.54 |

1.0 |

1.0 |

| 3.0 |

LENZ |

99.9 |

99.93 |

99.93 |

99.47 |

Healthcare |

Biotechnology |

12 |

23.1 |

0.0 |

46.34 |

0.0 |

2.0 |

3.0 |

25.29 |

1.0 |

1.0 |

| 4.0 |

RNA |

99.87 |

99.9 |

99.81 |

93.69 |

Healthcare |

Biotechnology |

12 |

11.72 |

35.8 |

70.26 |

35.09 |

3.0 |

4.0 |

45.4 |

1.0 |

1.0 |

| 5.0 |

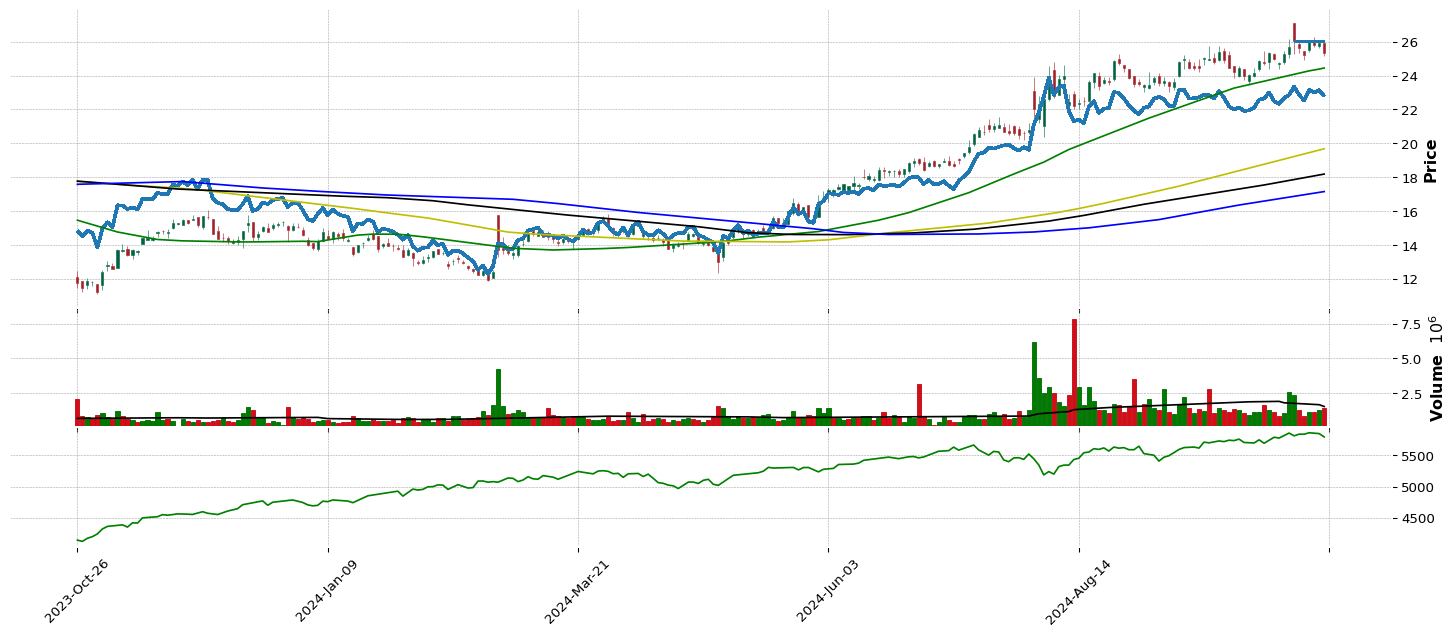

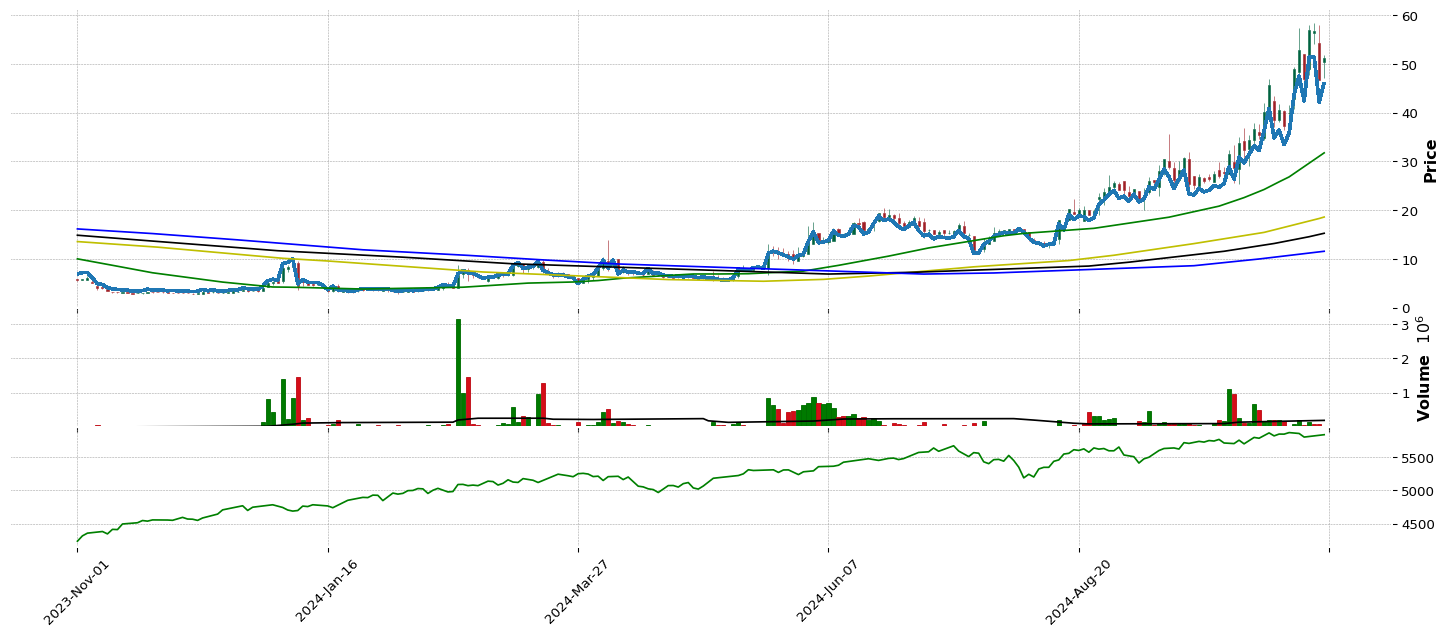

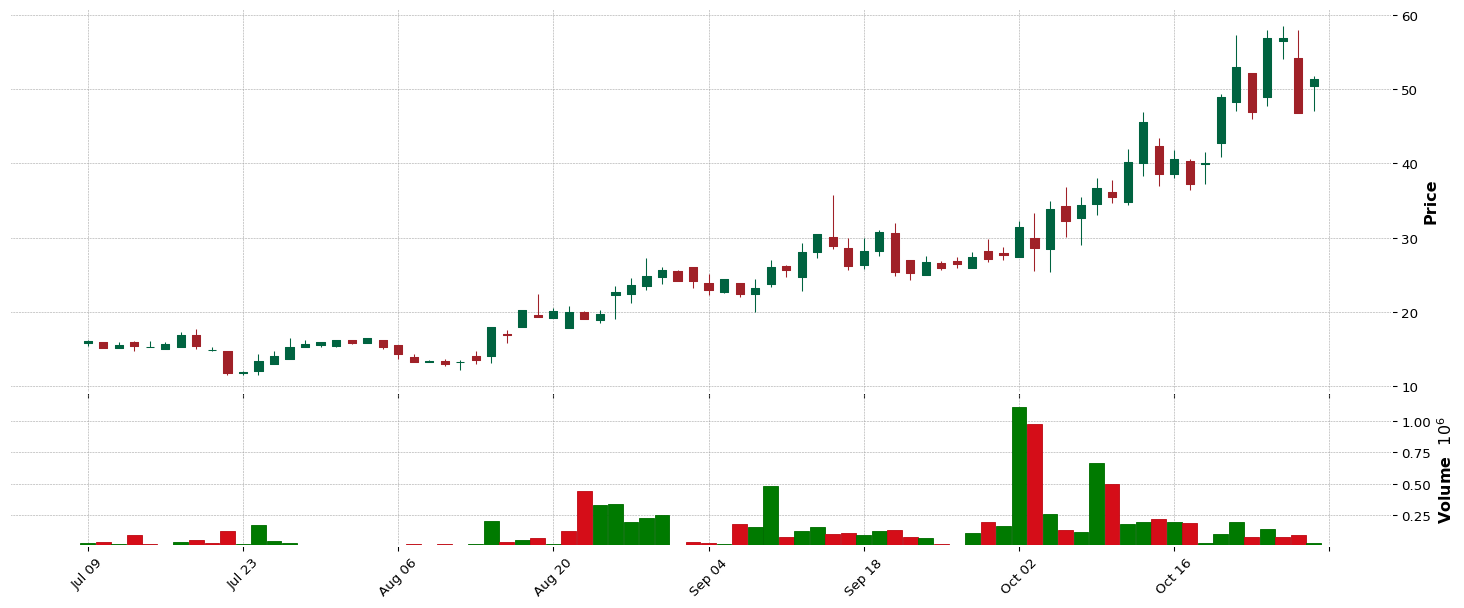

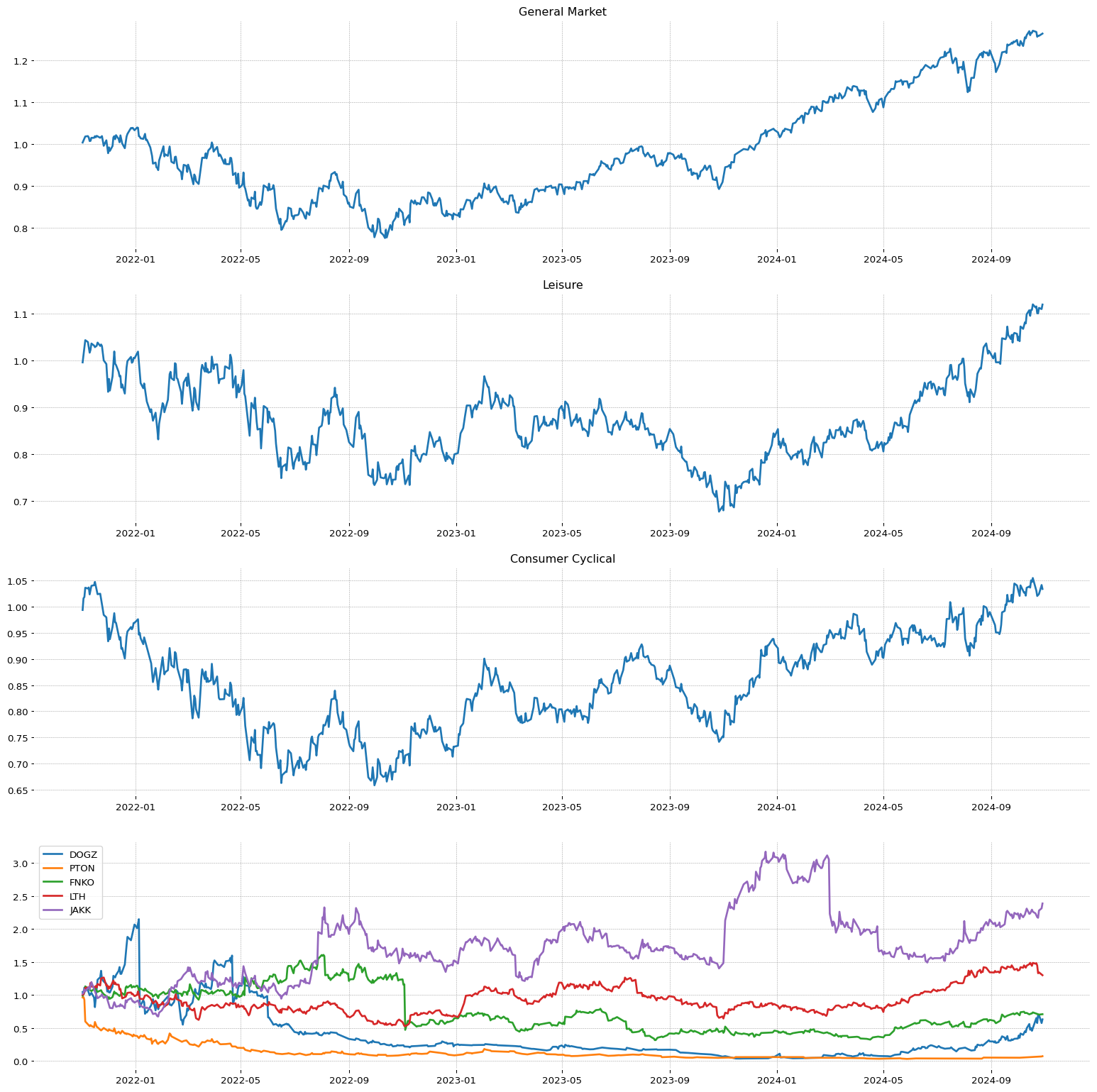

DOGZ |

99.72 |

98.43 |

98.05 |

1.58 |

Consumer Cyclical |

Leisure |

2 |

45.8 |

0.28 |

79.2 |

40.28 |

1.0 |

1.0 |

46.86 |

1.0 |

1.0 |

| 6.0 |

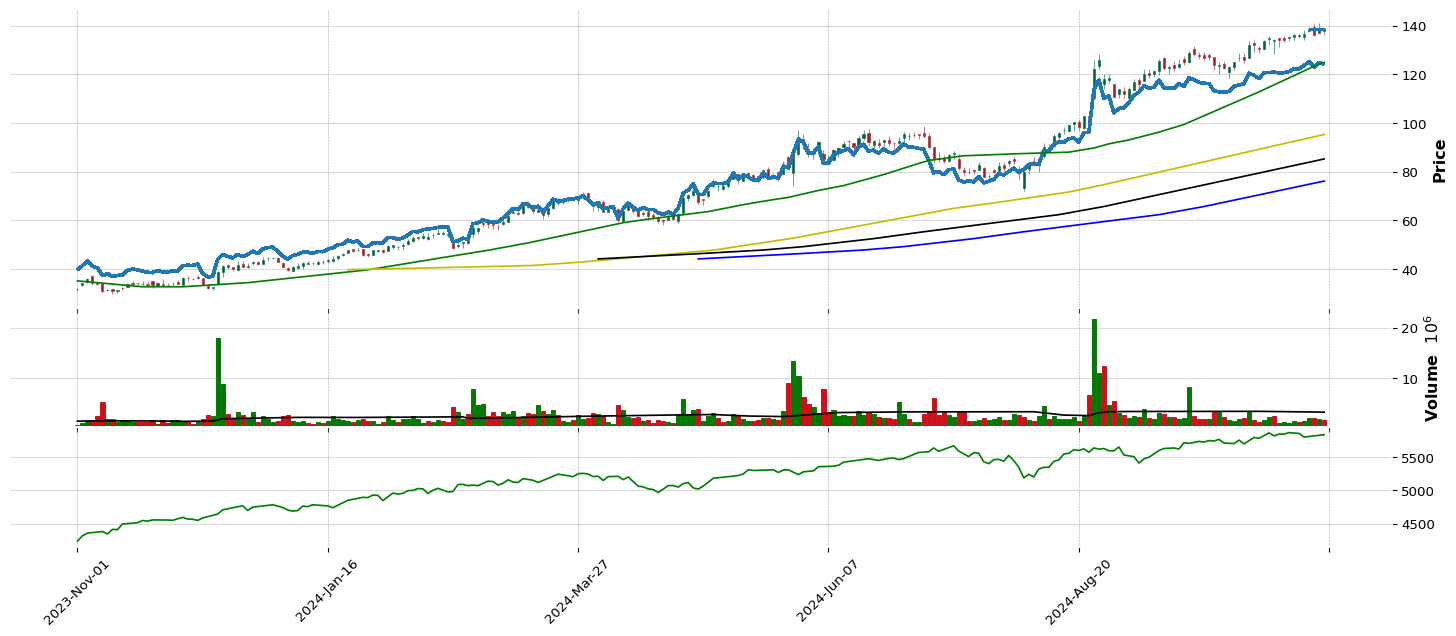

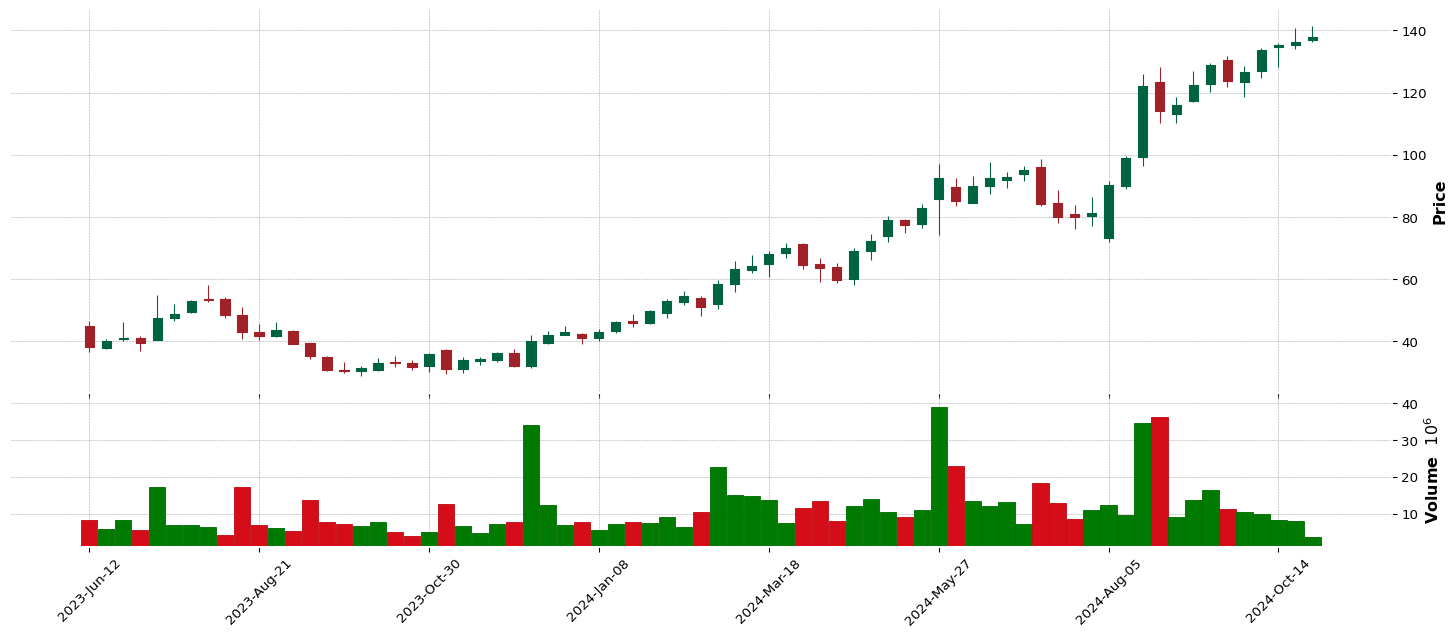

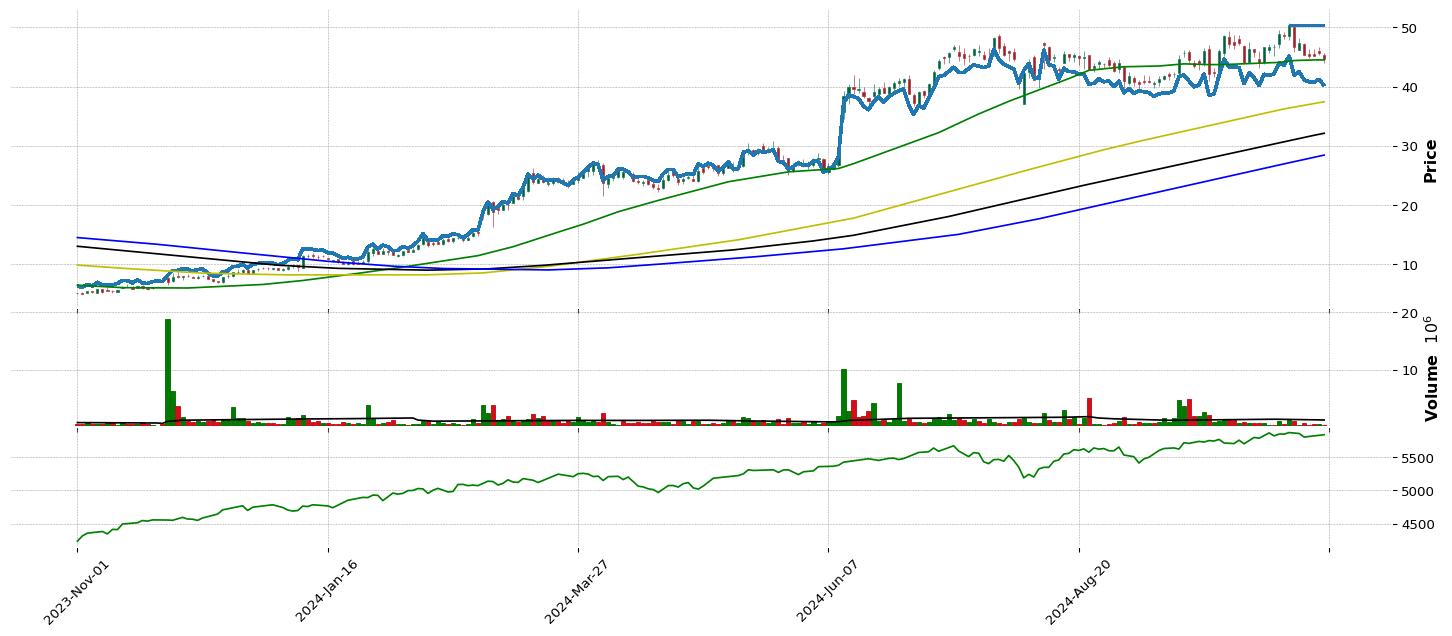

CVNA |

99.69 |

99.59 |

98.11 |

99.93 |

Consumer Cyclical |

Auto & Truck Dealerships |

36 |

77.54 |

76.45 |

98.94 |

83.88 |

1.0 |

2.0 |

197.33 |

1.0 |

1.0 |

| 7.0 |

EWTX |

99.5 |

99.19 |

98.3 |

92.08 |

Healthcare |

Biotechnology |

12 |

9.68 |

0.0 |

95.28 |

0.0 |

10.0 |

11.0 |

34.81 |

1.0 |

1.0 |

| 8.0 |

MSTR |

99.47 |

99.63 |

99.53 |

99.09 |

Technology |

Software - Application |

87 |

1.29 |

24.31 |

79.01 |

81.84 |

2.0 |

3.0 |

213.94 |

1.0 |

1.0 |

| 9.0 |

SPRY |

99.26 |

98.52 |

91.42 |

68.24 |

Healthcare |

Biotechnology |

12 |

26.35 |

58.29 |

47.37 |

16.14 |

13.0 |

15.0 |

16.04 |

1.0 |

1.0 |

| 10.0 |

WLFC |

99.2 |

98.95 |

98.27 |

35.31 |

Industrials |

Rental & Leasing Services |

25 |

98.51 |

97.52 |

88.83 |

86.27 |

1.0 |

2.0 |

188.05 |

1.0 |

1.0 |

| 11.0 |

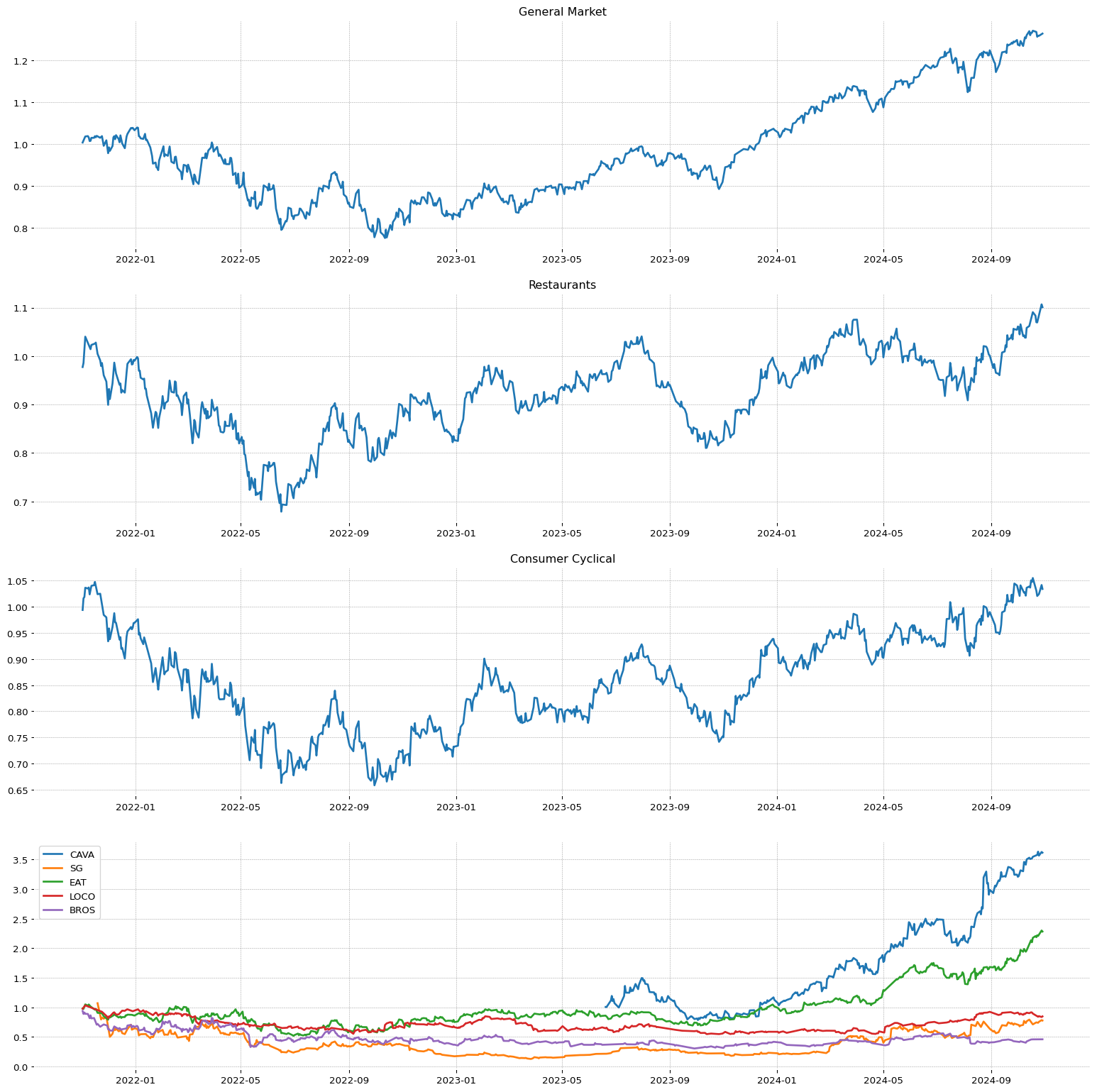

CAVA |

99.1 |

99.32 |

99.35 |

0.0 |

Consumer Cyclical |

Restaurants |

102 |

0.0 |

98.71 |

81.76 |

0.0 |

1.0 |

3.0 |

136.55 |

1.0 |

1.0 |

| 12.0 |

APP |

99.07 |

98.55 |

97.44 |

99.28 |

Technology |

Software - Application |

87 |

95.14 |

99.93 |

92.95 |

84.54 |

3.0 |

4.0 |

159.39 |

1.0 |

1.0 |

| 13.0 |

PRAX |

98.89 |

97.75 |

98.64 |

98.97 |

Healthcare |

Biotechnology |

12 |

87.78 |

0.0 |

85.11 |

0.0 |

16.0 |

22.0 |

72.44 |

1.0 |

1.0 |

| 14.0 |

GGAL |

98.8 |

98.58 |

98.33 |

97.64 |

Financial |

Banks - Regional |

21 |

98.91 |

97.43 |

91.18 |

55.6 |

1.0 |

5.0 |

49.77 |

1.0 |

1.0 |

| 15.0 |

GATO |

98.73 |

98.39 |

97.19 |

90.19 |

Basic Materials |

Other Precious Metals & Mining |

24 |

93.53 |

21.88 |

92.51 |

27.73 |

1.0 |

3.0 |

19.69 |

1.0 |

1.0 |

| 16.0 |

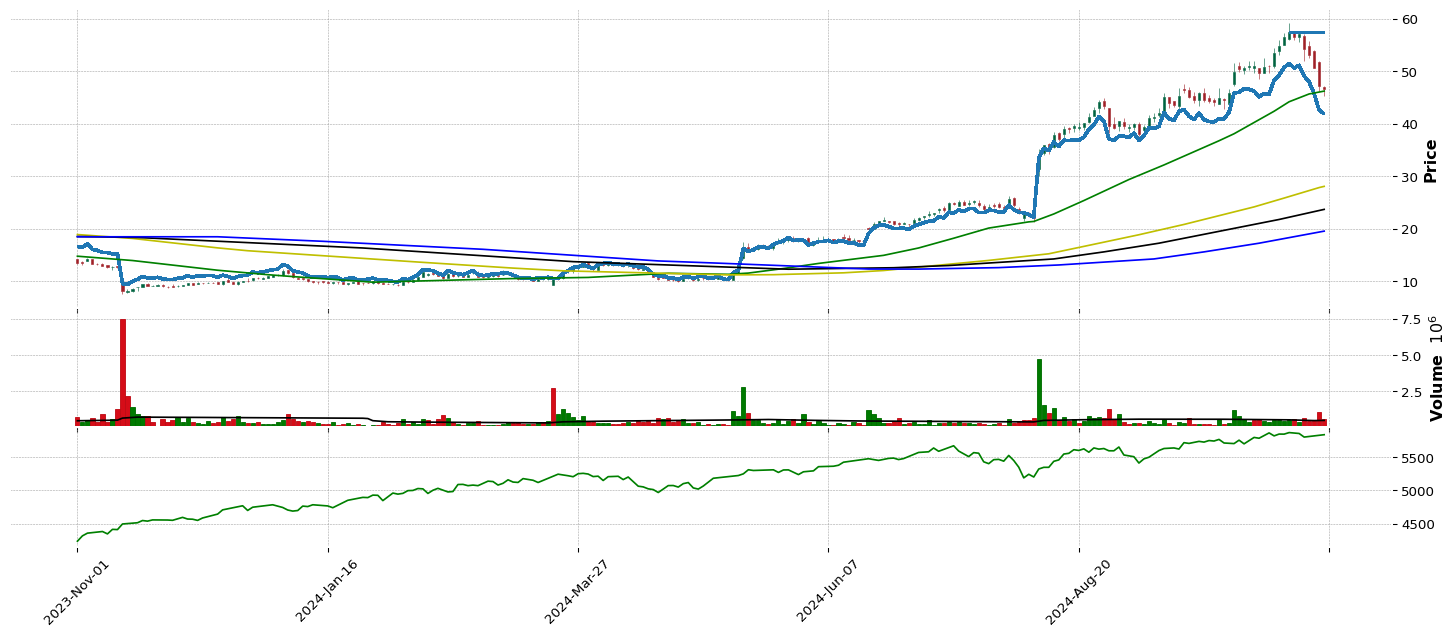

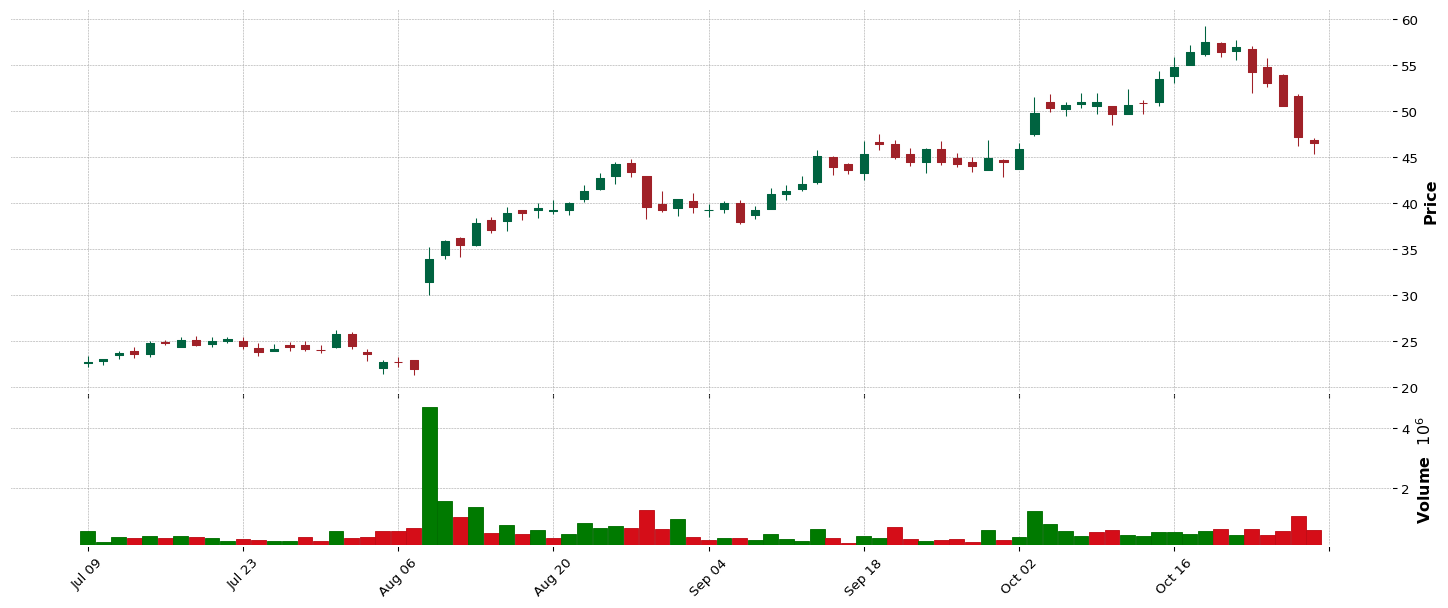

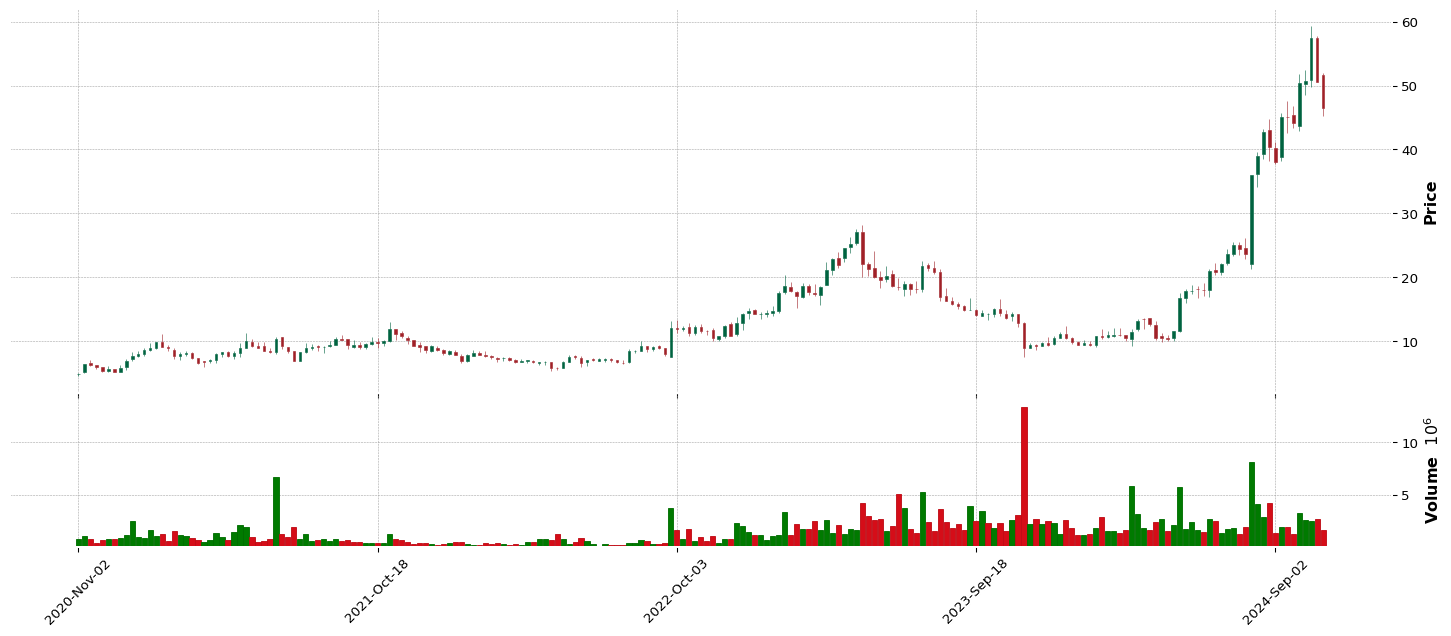

HROW |

98.52 |

98.73 |

98.58 |

2.2 |

Healthcare |

Drug Manufacturers - Specialty & Generic |

11 |

2.53 |

69.13 |

85.83 |

54.49 |

2.0 |

29.0 |

54.22 |

1.0 |

1.0 |

| 17.0 |

TPC |

98.49 |

99.04 |

98.95 |

97.88 |

Industrials |

Engineering & Construction |

13 |

0.0 |

0.0 |

81.76 |

0.0 |

1.0 |

4.0 |

28.25 |

1.0 |

1.0 |

| 18.0 |

NGNE |

98.15 |

97.32 |

98.08 |

89.75 |

Healthcare |

Biotechnology |

12 |

0.46 |

0.0 |

75.12 |

0.0 |

22.0 |

33.0 |

48.54 |

1.0 |

1.0 |

| 19.0 |

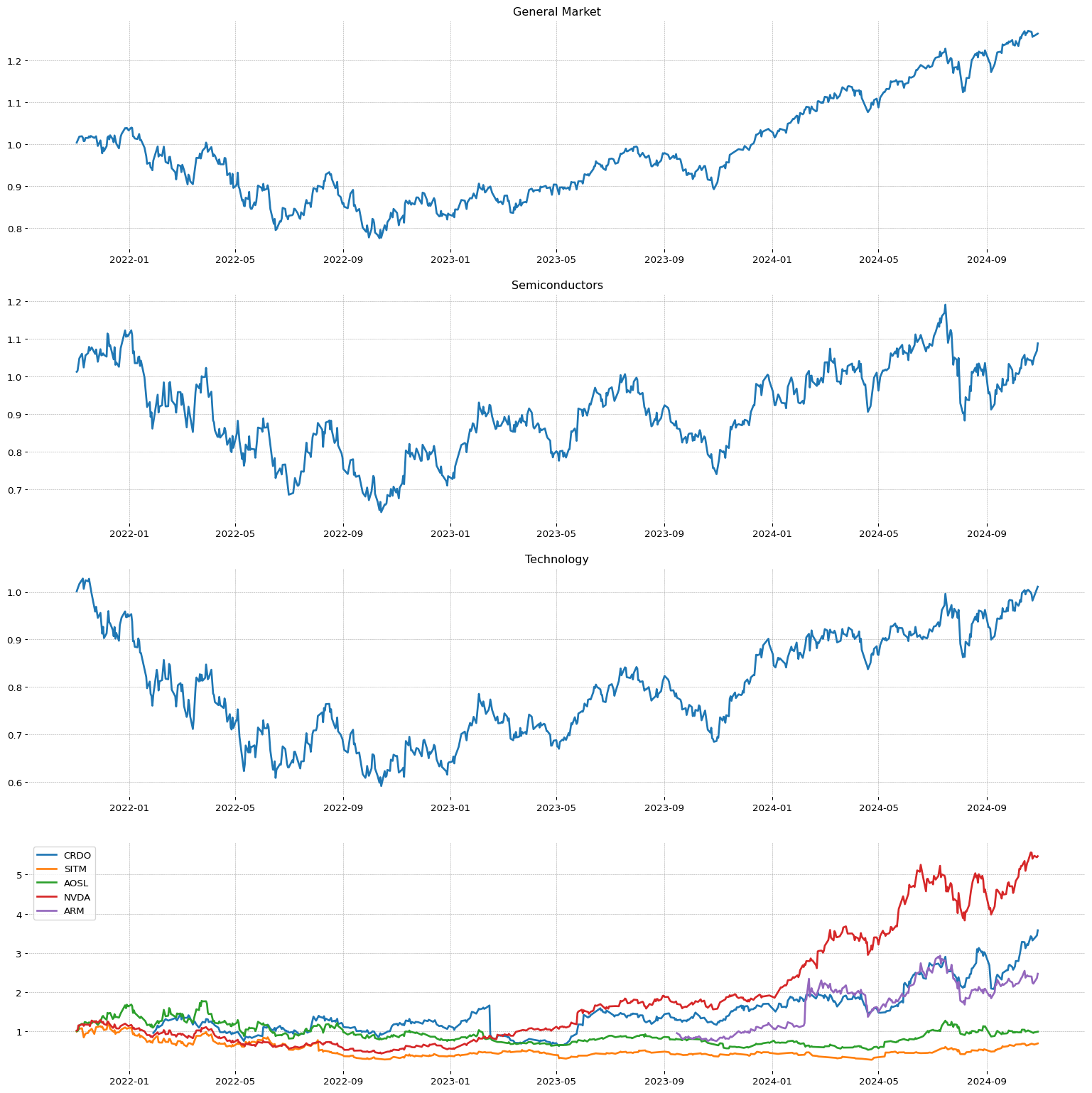

NVDA |

97.93 |

97.35 |

98.21 |

98.57 |

Technology |

Semiconductors |

106 |

98.76 |

99.9 |

8.02 |

81.88 |

1.0 |

6.0 |

139.55 |

1.0 |

1.0 |

| 20.0 |

IESC |

97.87 |

97.69 |

96.88 |

98.47 |

Industrials |

Engineering & Construction |

13 |

94.77 |

99.0 |

56.65 |

89.59 |

2.0 |

6.0 |

210.77 |

1.0 |

1.0 |

| 21.0 |

USAP |

97.5 |

98.12 |

98.24 |

98.13 |

Basic Materials |

Steel |

125 |

91.21 |

99.61 |

19.92 |

50.2 |

1.0 |

4.0 |

43.65 |

1.0 |

1.0 |

| 22.0 |

MOD |

97.41 |

97.44 |

97.37 |

99.41 |

Consumer Cyclical |

Auto Parts |

133 |

65.97 |

56.88 |

94.17 |

80.77 |

2.0 |

8.0 |

128.27 |

1.0 |

1.0 |

| 23.0 |

VRT |

97.2 |

97.04 |

96.6 |

99.68 |

Industrials |

Electrical Equipment & Parts |

92 |

81.0 |

93.26 |

88.16 |

79.84 |

2.0 |

10.0 |

108.36 |

1.0 |

1.0 |

| 24.0 |

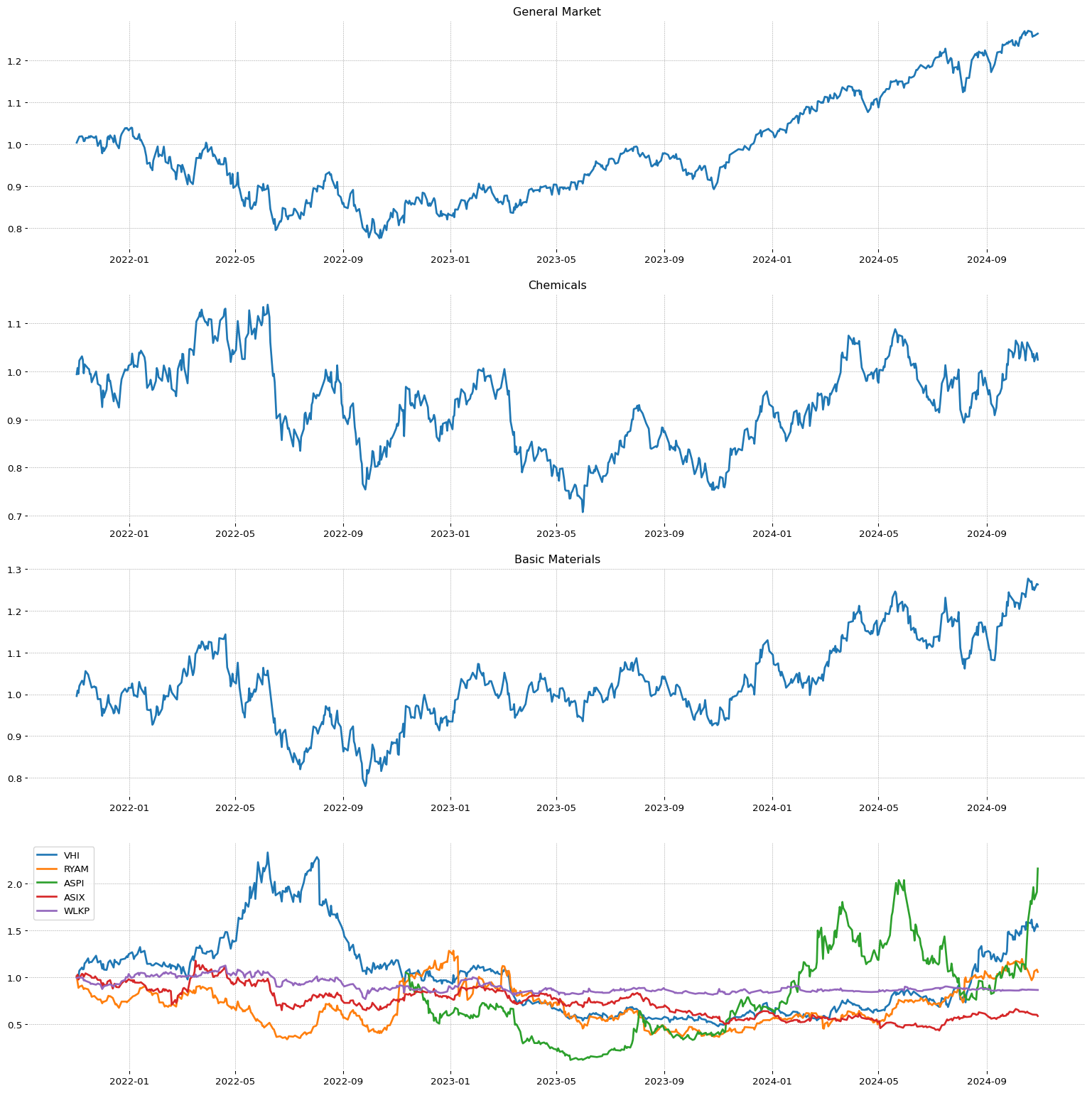

VHI |

97.07 |

96.98 |

95.74 |

28.24 |

Basic Materials |

Chemicals |

81 |

68.07 |

80.87 |

54.98 |

47.85 |

2.0 |

6.0 |

35.31 |

1.0 |

1.0 |

| 25.0 |

HOOD |

96.89 |

95.26 |

95.34 |

93.88 |

Financial |

Capital Markets |

8 |

86.82 |

93.16 |

94.17 |

42.56 |

2.0 |

8.0 |

26.7 |

1.0 |

1.0 |

| 26.0 |

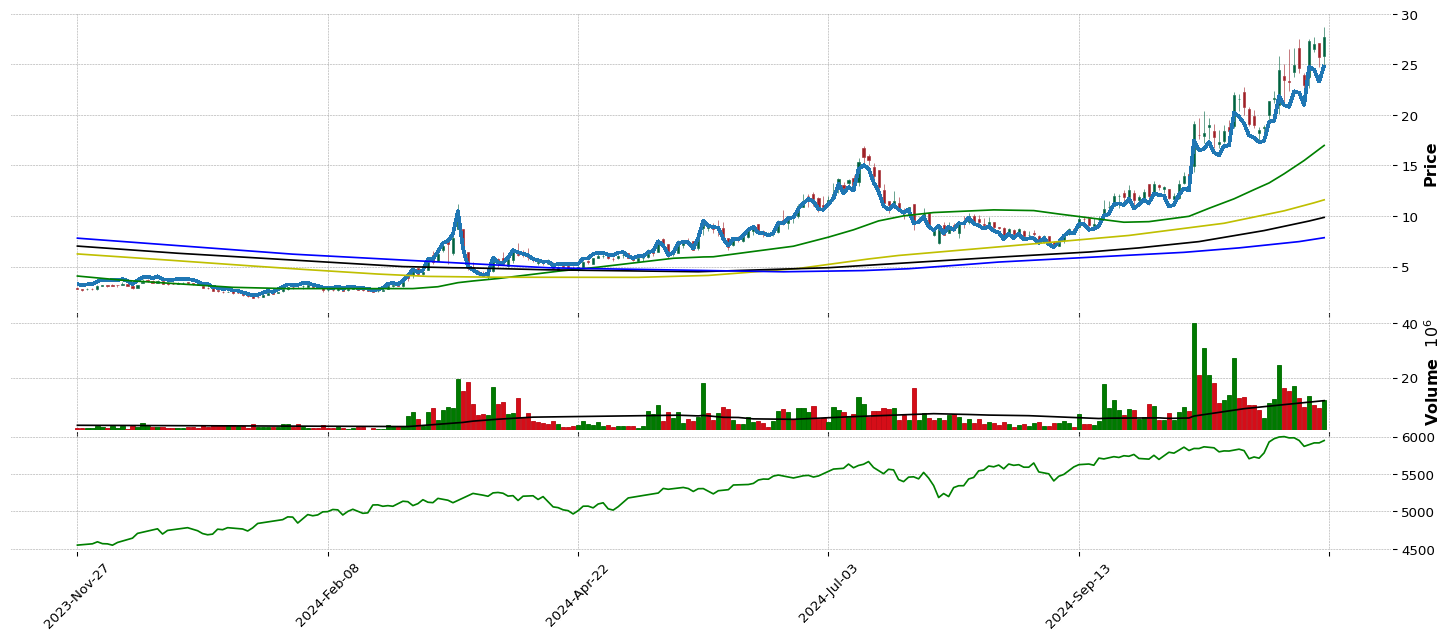

FLXS |

96.83 |

94.61 |

96.2 |

96.39 |

Consumer Cyclical |

Furnishings, Fixtures & Appliances |

22 |

0.0 |

0.0 |

96.04 |

0.0 |

1.0 |

9.0 |

58.88 |

1.0 |

1.0 |

| 27.0 |

EAT |

96.7 |

97.41 |

96.26 |

65.08 |

Consumer Cyclical |

Restaurants |

102 |

30.34 |

24.18 |

59.16 |

70.05 |

3.0 |

10.0 |

94.31 |

1.0 |

1.0 |

| 28.0 |

CRDO |

96.49 |

88.98 |

93.37 |

96.43 |

Technology |

Semiconductors |

106 |

45.37 |

59.67 |

45.59 |

48.89 |

4.0 |

14.0 |

38.66 |

1.0 |

1.0 |

| 29.0 |

ACLX |

96.3 |

94.21 |

96.51 |

64.55 |

Healthcare |

Biotechnology |

12 |

0.0 |

0.0 |

85.11 |

0.0 |

38.0 |

57.0 |

88.19 |

1.0 |

1.0 |

| 30.0 |

QTWO |

96.15 |

96.49 |

96.33 |

96.02 |

Technology |

Software - Application |

87 |

40.33 |

70.0 |

59.16 |

70.95 |

6.0 |

17.0 |

83.01 |

1.0 |

1.0 |

| 31.0 |

SFM |

96.09 |

97.16 |

97.56 |

93.48 |

Consumer Defensive |

Grocery Stores |

41 |

0.0 |

0.0 |

54.98 |

0.0 |

1.0 |

4.0 |

118.84 |

1.0 |

1.0 |

| 32.0 |

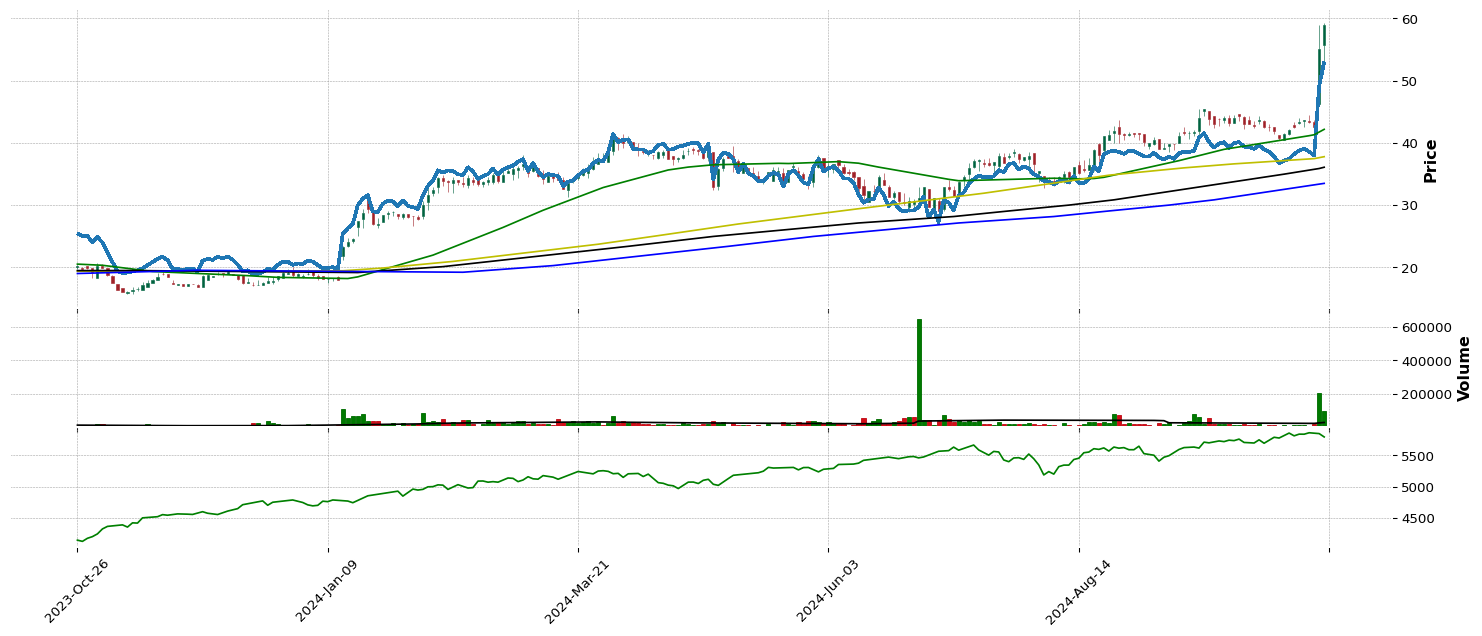

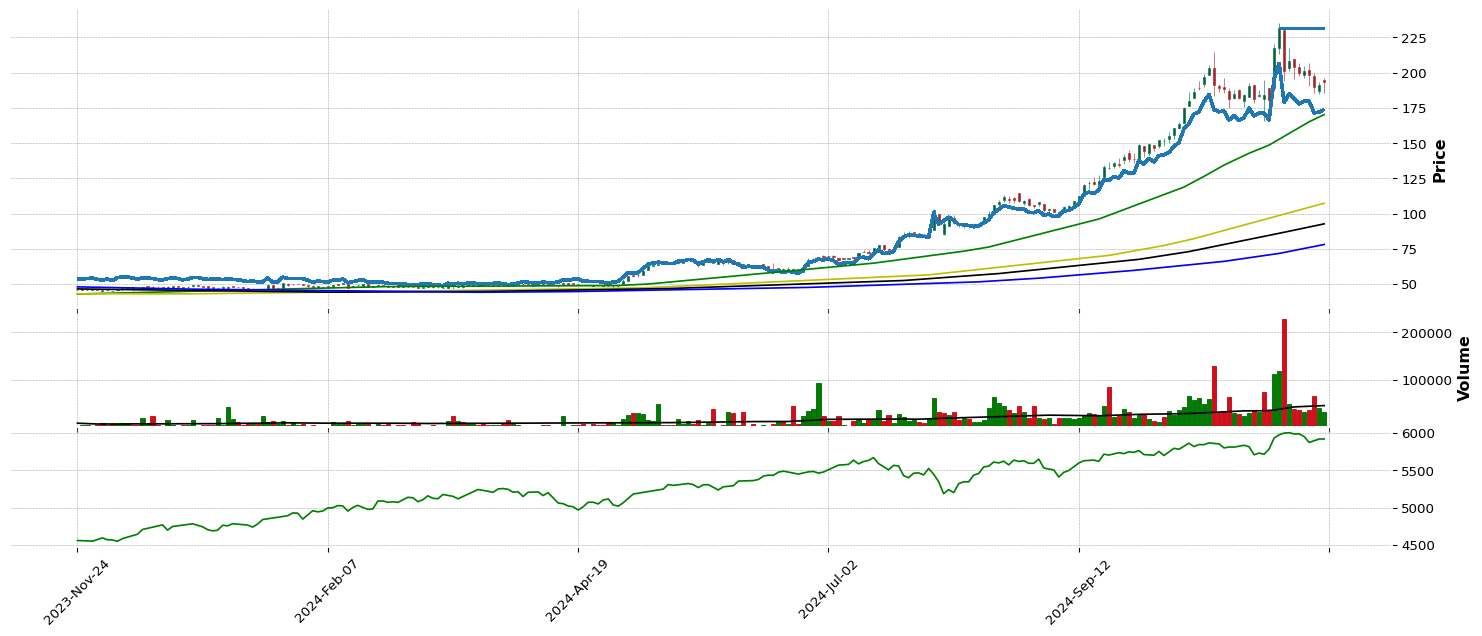

SN |

96.0 |

96.58 |

97.59 |

0.0 |

Consumer Cyclical |

Furnishings, Fixtures & Appliances |

22 |

46.08 |

95.5 |

81.76 |

79.08 |

2.0 |

13.0 |

109.52 |

1.0 |

1.0 |

| 33.0 |

AGX |

95.97 |

94.89 |

95.03 |

85.56 |

Industrials |

Engineering & Construction |

13 |

82.74 |

57.0 |

81.76 |

80.63 |

3.0 |

15.0 |

120.52 |

1.0 |

1.0 |

| 34.0 |

FIX |

95.94 |

95.99 |

92.53 |

95.46 |

Industrials |

Engineering & Construction |

13 |

90.87 |

92.65 |

39.16 |

96.64 |

4.0 |

16.0 |

412.01 |

1.0 |

1.0 |

| 35.0 |

VRNA |

95.87 |

93.5 |

90.56 |

12.07 |

Healthcare |

Biotechnology |

12 |

21.06 |

0.0 |

66.67 |

0.0 |

42.0 |

61.0 |

34.93 |

1.0 |

1.0 |

| 36.0 |

CLBT |

95.81 |

94.92 |

96.79 |

94.44 |

Technology |

Software - Infrastructure |

60 |

53.41 |

44.17 |

86.79 |

29.52 |

4.0 |

19.0 |

17.9 |

1.0 |

1.0 |

| 37.0 |

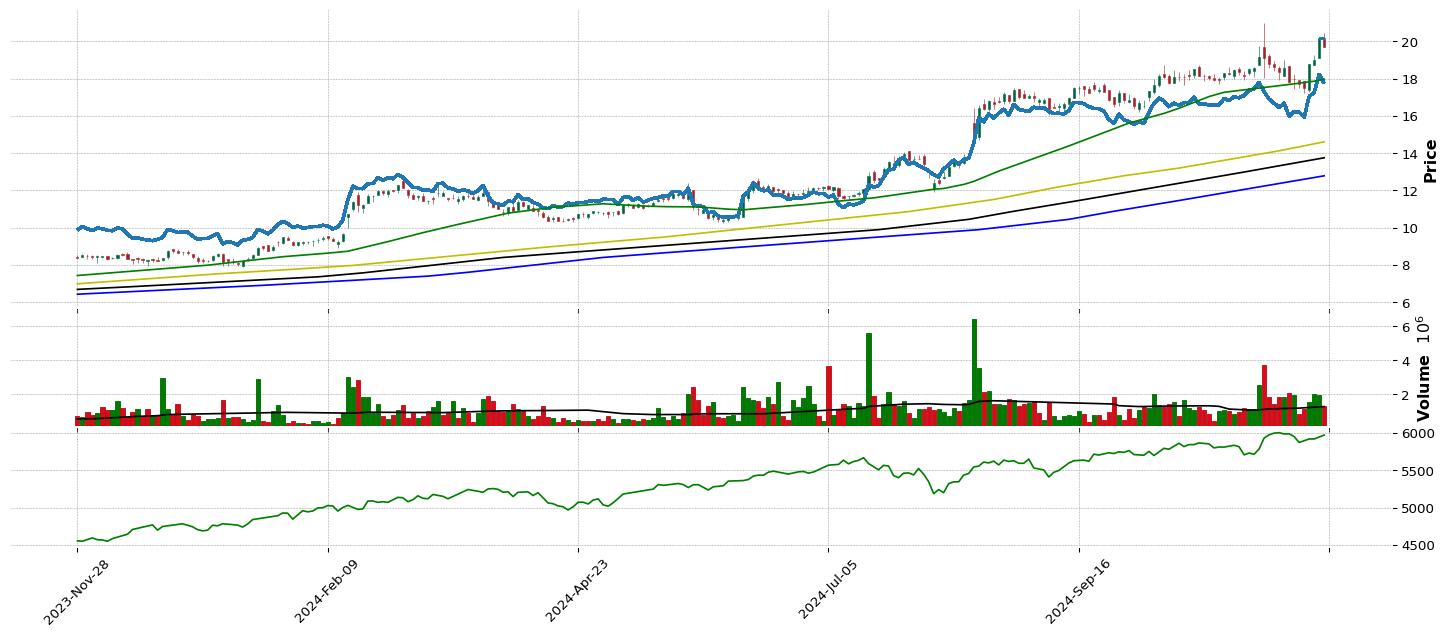

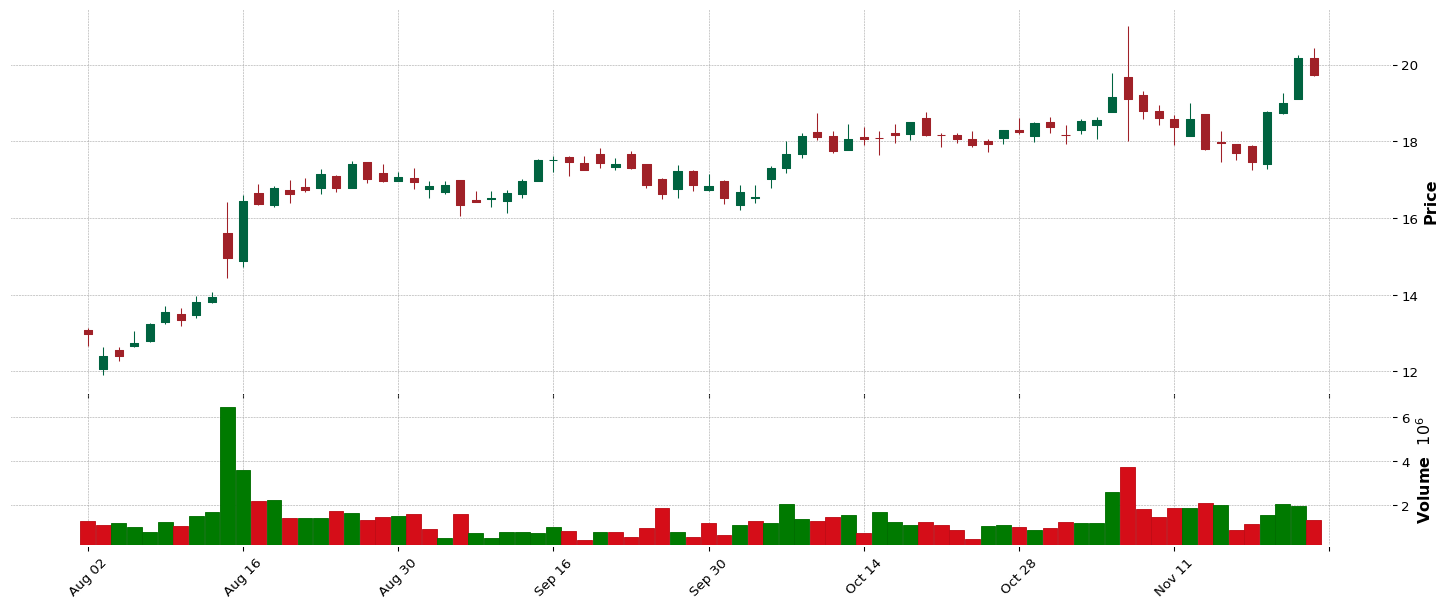

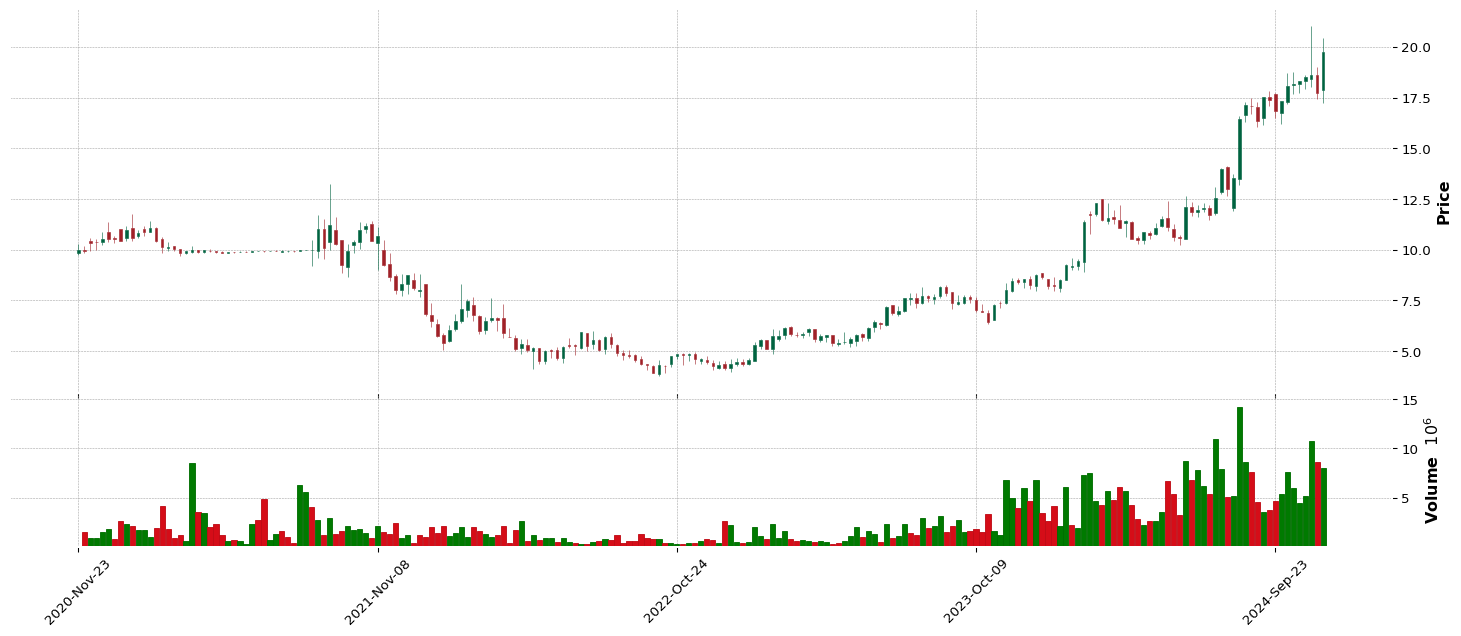

CMPO |

95.44 |

94.85 |

92.78 |

24.36 |

Industrials |

Metal Fabrication |

35 |

48.65 |

26.72 |

81.76 |

23.61 |

1.0 |

17.0 |

15.27 |

1.0 |

1.0 |

| 38.0 |

TVTX |

95.32 |

89.16 |

25.28 |

0.68 |

Healthcare |

Biotechnology |

12 |

27.55 |

13.92 |

54.98 |

24.93 |

46.0 |

67.0 |

17.95 |

1.0 |

1.0 |

| 39.0 |

USLM |

95.29 |

94.79 |

95.0 |

93.17 |

Basic Materials |

Building Materials |

78 |

89.01 |

89.86 |

54.98 |

78.18 |

1.0 |

13.0 |

101.97 |

1.0 |

1.0 |

| 40.0 |

TYRA |

95.14 |

77.28 |

78.32 |

48.38 |

Healthcare |

Biotechnology |

12 |

2.9 |

0.0 |

84.64 |

0.0 |

48.0 |

69.0 |

28.23 |

1.0 |

1.0 |

| 41.0 |

JXN |

95.01 |

96.67 |

95.37 |

93.85 |

Financial |

Insurance - Life |

43 |

78.1 |

63.23 |

22.28 |

75.06 |

1.0 |

15.0 |

97.69 |

1.0 |

1.0 |

| 42.0 |

KKR |

94.92 |

94.3 |

93.74 |

91.65 |

Financial |

Asset Management |

67 |

0.0 |

0.0 |

86.79 |

0.0 |

1.0 |

16.0 |

138.55 |

1.0 |

1.0 |

| 43.0 |

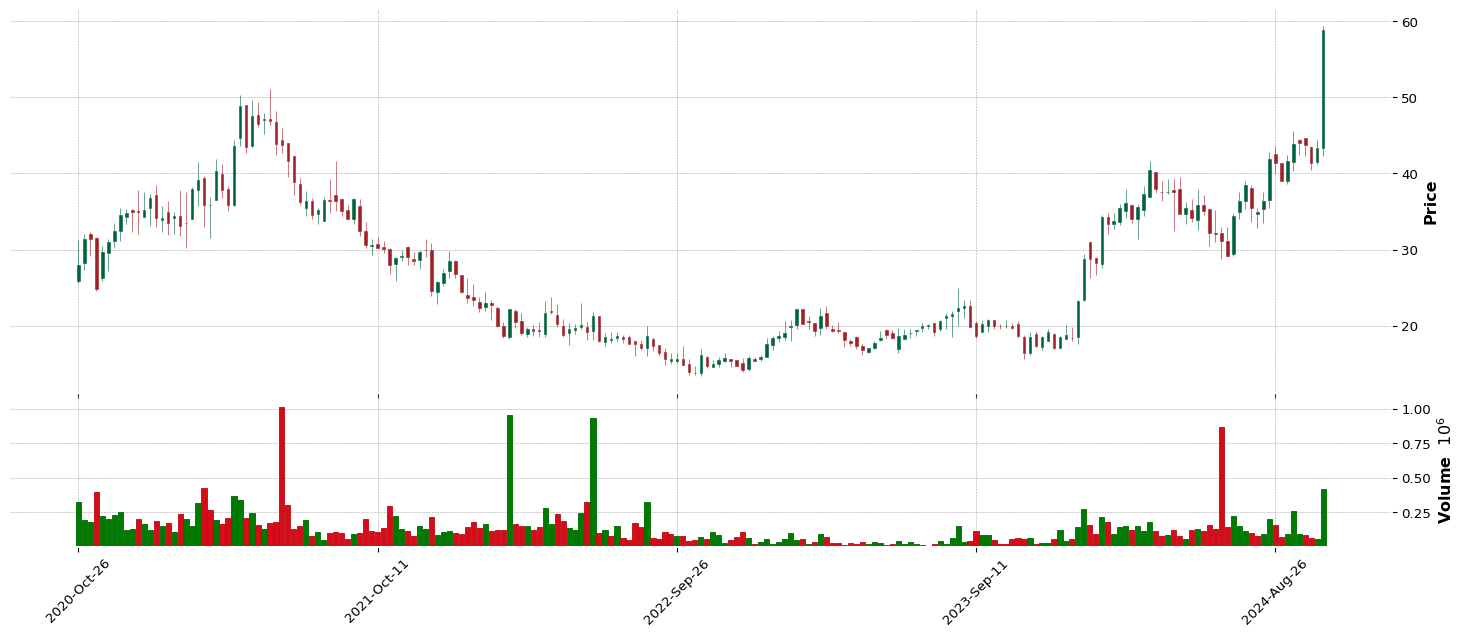

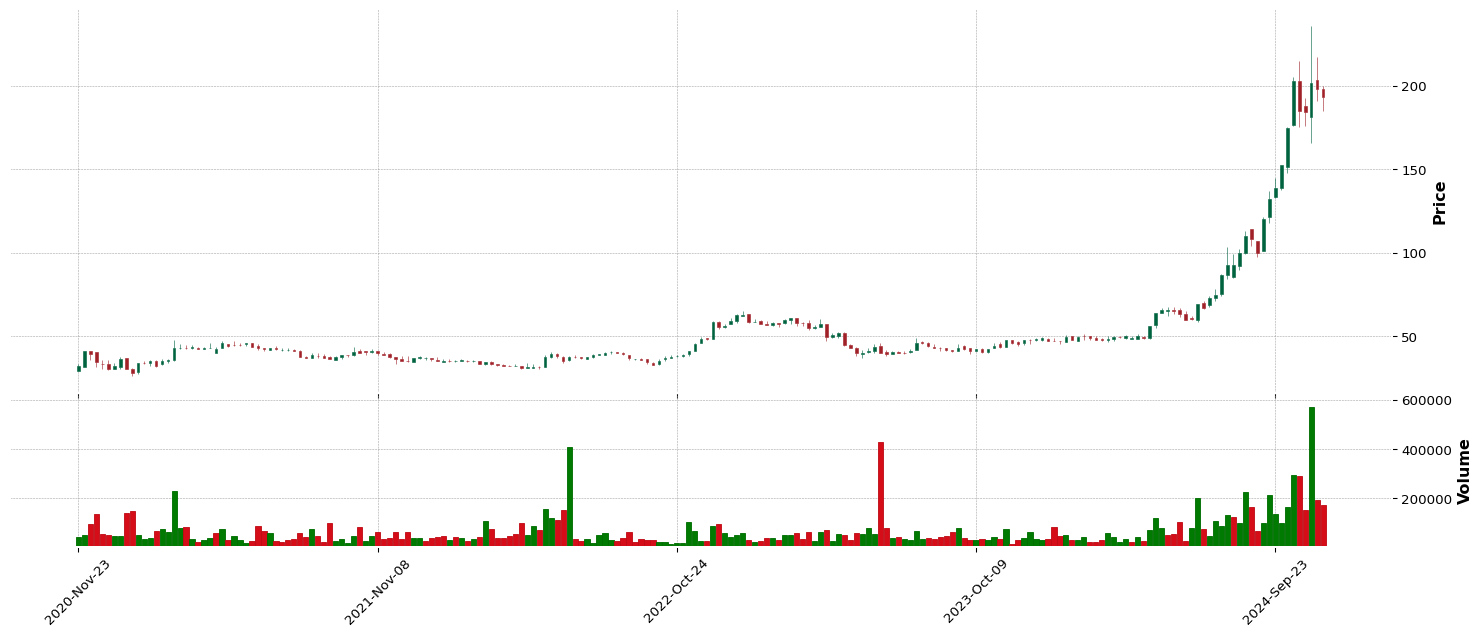

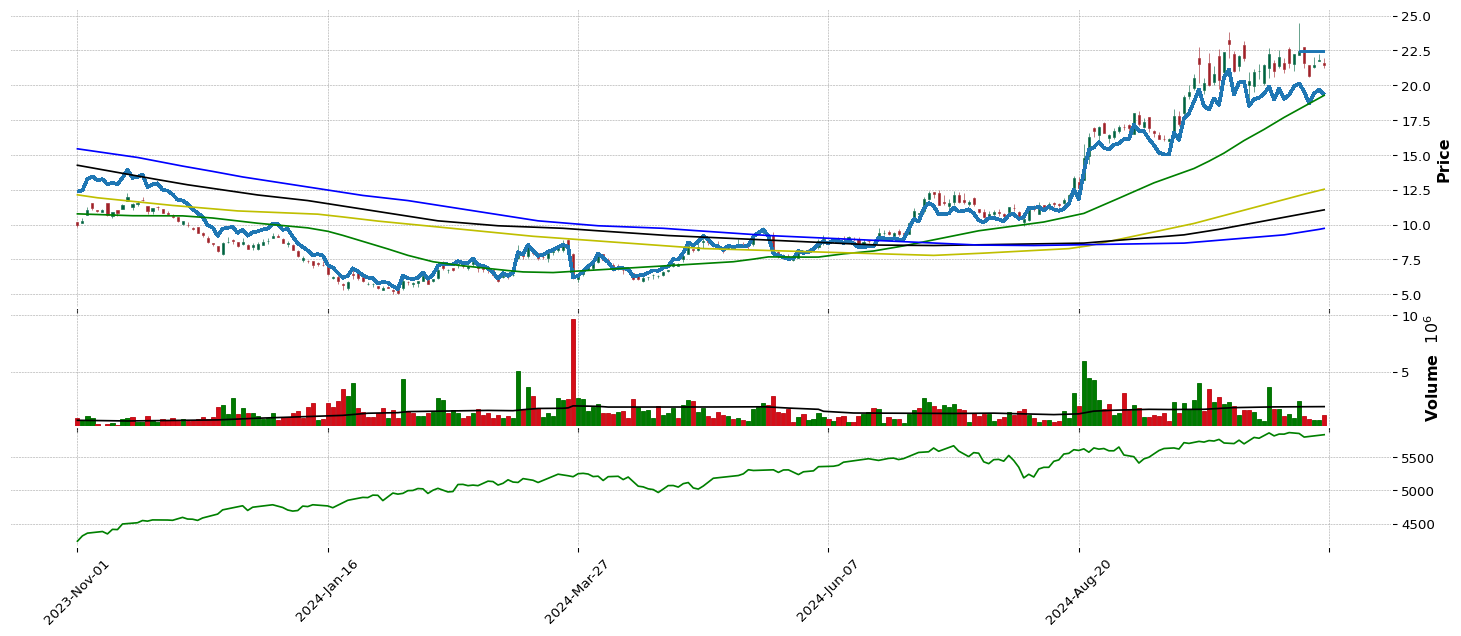

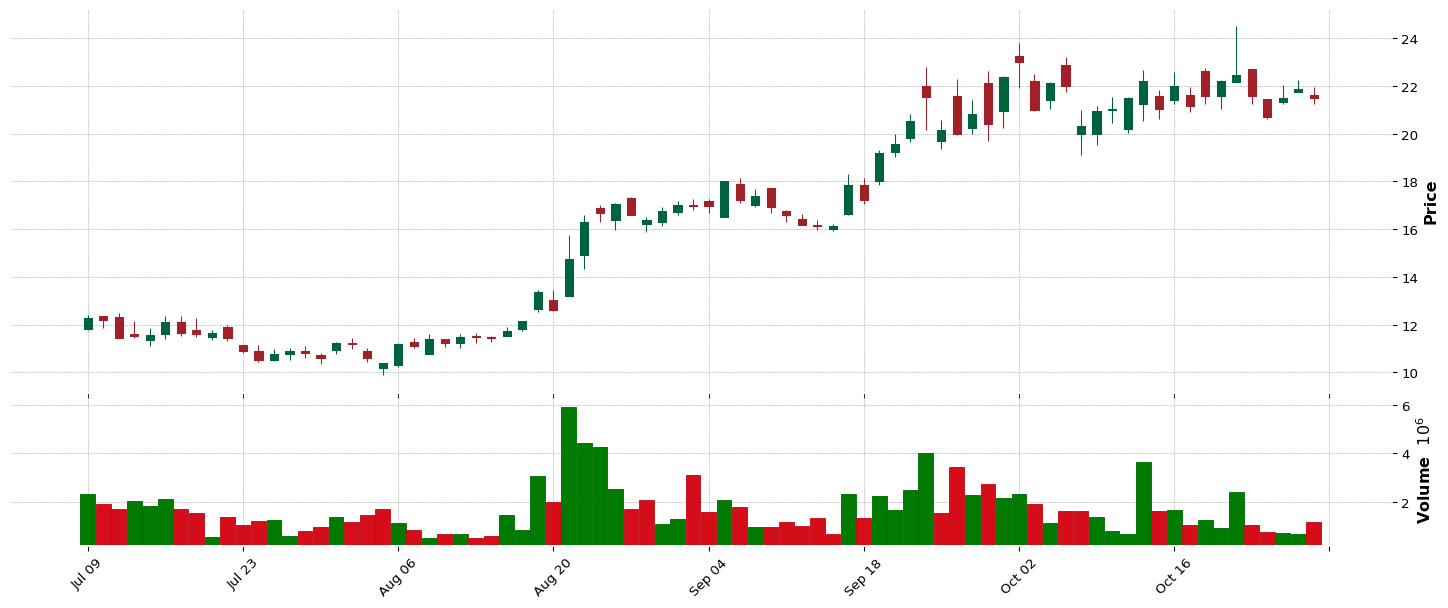

HBB |

94.8 |

95.93 |

96.48 |

95.9 |

Consumer Cyclical |

Furnishings, Fixtures & Appliances |

22 |

72.74 |

86.65 |

98.28 |

47.99 |

3.0 |

17.0 |

30.96 |

1.0 |

1.0 |

| 44.0 |

WLDN |

94.74 |

94.24 |

92.56 |

93.14 |

Industrials |

Engineering & Construction |

13 |

99.13 |

89.95 |

81.76 |

60.44 |

5.0 |

22.0 |

44.45 |

1.0 |

1.0 |

| 45.0 |

TRU |

94.58 |

77.93 |

64.78 |

49.96 |

Financial |

Financial Data & Stock Exchanges |

40 |

29.5 |

13.85 |

81.76 |

76.93 |

2.0 |

18.0 |

108.66 |

1.0 |

1.0 |

| 46.0 |

TPG |

94.55 |

91.96 |

90.53 |

84.29 |

Financial |

Asset Management |

67 |

39.8 |

93.64 |

76.59 |

68.56 |

2.0 |

19.0 |

66.98 |

1.0 |

1.0 |

| 47.0 |

AKRO |

94.49 |

3.2 |

2.92 |

2.51 |

Healthcare |

Biotechnology |

12 |

6.0 |

0.0 |

75.12 |

0.0 |

53.0 |

74.0 |

28.67 |

1.0 |

1.0 |

| 48.0 |

RCL |

94.21 |

91.13 |

90.41 |

95.65 |

Consumer Cyclical |

Travel Services |

28 |

98.7 |

92.23 |

97.02 |

91.77 |

2.0 |

20.0 |

201.13 |

1.0 |

1.0 |

| 49.0 |

GVA |

94.15 |

93.9 |

94.07 |

81.06 |

Industrials |

Engineering & Construction |

13 |

89.17 |

77.06 |

66.67 |

74.27 |

6.0 |

26.0 |

82.62 |

1.0 |

1.0 |

| 50.0 |

ELVN |

94.09 |

91.72 |

77.76 |

23.52 |

Healthcare |

Biotechnology |

12 |

35.78 |

0.0 |

94.17 |

0.0 |

56.0 |

78.0 |

28.96 |

1.0 |

1.0 |

| 51.0 |

NVEI |

94.0 |

94.52 |

94.17 |

16.26 |

Technology |

Software - Infrastructure |

60 |

14.32 |

34.35 |

39.16 |

42.94 |

6.0 |

26.0 |

33.54 |

1.0 |

1.0 |

| 52.0 |

ENVA |

93.88 |

83.96 |

85.75 |

80.1 |

Financial |

Credit Services |

34 |

25.11 |

41.7 |

59.16 |

73.23 |

3.0 |

20.0 |

88.16 |

1.0 |

1.0 |

| 53.0 |

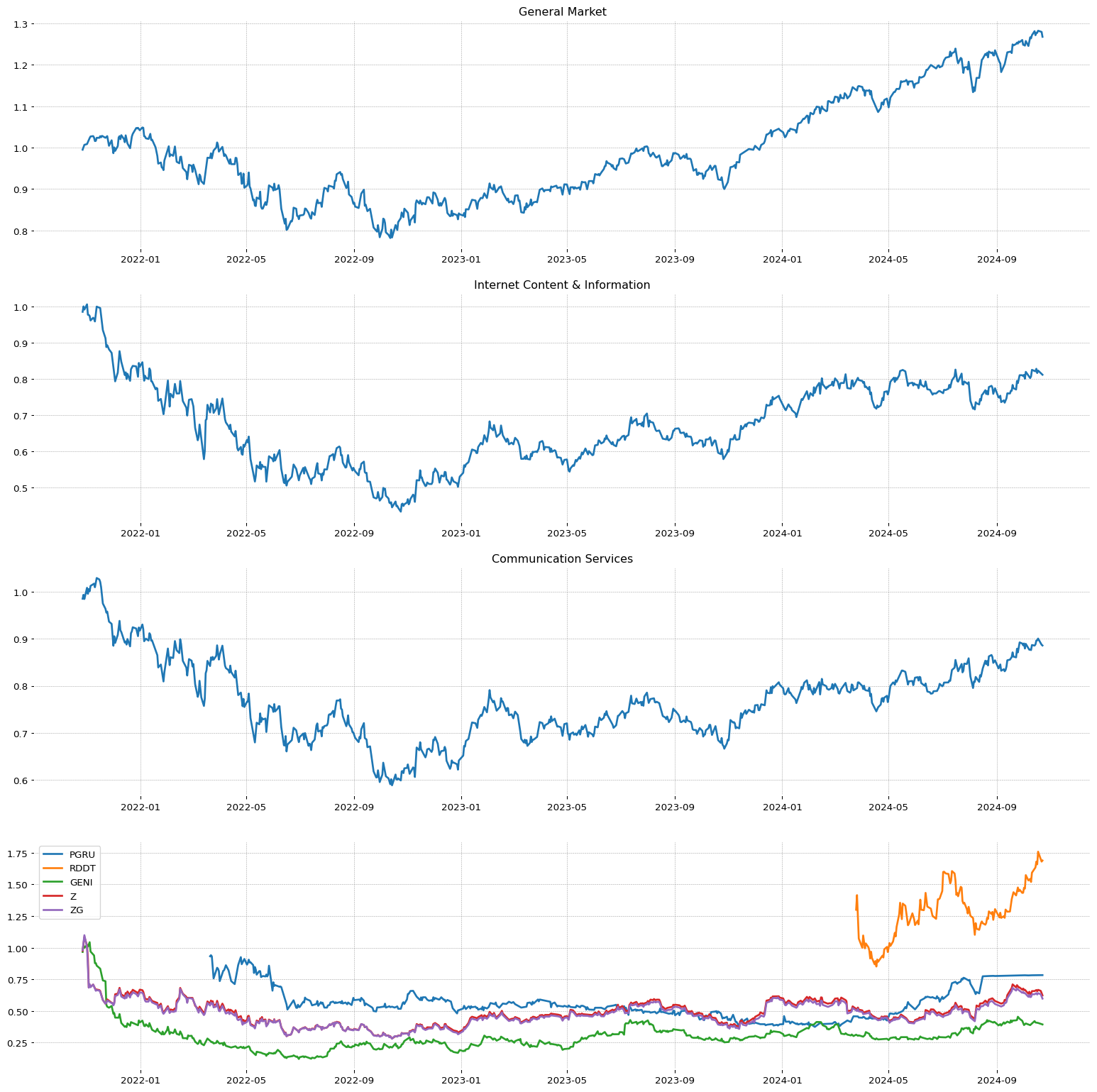

SPOT |

93.84 |

95.78 |

95.89 |

96.18 |

Communication Services |

Internet Content & Information |

107 |

56.41 |

90.95 |

96.04 |

96.81 |

3.0 |

6.0 |

379.83 |

1.0 |

1.0 |

| 54.0 |

BWIN |

93.72 |

94.33 |

92.13 |

47.45 |

Financial |

Insurance Brokers |

14 |

38.84 |

73.01 |

64.75 |

60.65 |

1.0 |

21.0 |

51.86 |

1.0 |

1.0 |

| 55.0 |

HWM |

93.69 |

94.95 |

95.25 |

82.8 |

Industrials |

Aerospace & Defense |

38 |

95.7 |

89.76 |

27.41 |

78.73 |

6.0 |

27.0 |

102.83 |

1.0 |

1.0 |

| 56.0 |

TSM |

93.14 |

92.89 |

94.2 |

88.48 |

Technology |

Semiconductors |

106 |

67.58 |

38.27 |

25.18 |

88.9 |

5.0 |

32.0 |

200.86 |

1.0 |

1.0 |

| 57.0 |

QFIN |

93.05 |

93.13 |

87.23 |

49.0 |

Financial |

Credit Services |

34 |

22.45 |

36.99 |

53.81 |

44.67 |

5.0 |

23.0 |

33.84 |

1.0 |

1.0 |

| 58.0 |

UI |

92.55 |

88.64 |

66.91 |

3.07 |

Technology |

Communication Equipment |

1 |

10.67 |

8.82 |

97.02 |

91.56 |

5.0 |

40.0 |

253.66 |

1.0 |

1.0 |

| 59.0 |

MCY |

92.49 |

95.13 |

94.85 |

91.55 |

Financial |

Insurance - Property & Casualty |

77 |

62.38 |

97.88 |

71.21 |

69.77 |

2.0 |

26.0 |

66.2 |

1.0 |

1.0 |

| 60.0 |

PIPR |

92.34 |

92.18 |

90.9 |

79.85 |

Financial |

Capital Markets |

8 |

80.14 |

92.1 |

59.16 |

95.19 |

5.0 |

27.0 |

288.39 |

1.0 |

1.0 |

| 61.0 |

VNO |

92.31 |

90.82 |

80.41 |

91.09 |

Real Estate |

REIT - Office |

16 |

52.83 |

47.93 |

66.67 |

56.39 |

1.0 |

3.0 |

42.86 |

1.0 |

1.0 |

| 62.0 |

PWP |

92.25 |

92.95 |

89.73 |

94.35 |

Financial |

Capital Markets |

8 |

16.26 |

51.52 |

98.28 |

34.82 |

6.0 |

28.0 |

20.7 |

1.0 |

1.0 |

| 63.0 |

MLI |

92.06 |

92.15 |

93.15 |

88.64 |

Industrials |

Metal Fabrication |

35 |

63.13 |

12.25 |

10.68 |

67.6 |

3.0 |

34.0 |

81.0 |

1.0 |

1.0 |

| 64.0 |

AXON |

92.03 |

93.81 |

93.58 |

81.93 |

Industrials |

Aerospace & Defense |

38 |

85.7 |

81.0 |

75.12 |

97.89 |

7.0 |

35.0 |

442.69 |

1.0 |

1.0 |

| 65.0 |

ROAD |

92.0 |

85.34 |

92.01 |

94.47 |

Industrials |

Engineering & Construction |

13 |

81.53 |

98.23 |

54.98 |

75.44 |

8.0 |

36.0 |

81.76 |

1.0 |

1.0 |

| 66.0 |

EME |

91.97 |

93.93 |

92.75 |

95.12 |

Industrials |

Engineering & Construction |

13 |

98.45 |

96.43 |

90.23 |

97.95 |

9.0 |

37.0 |

445.61 |

1.0 |

1.0 |

| 67.0 |

HLNE |

91.94 |

91.38 |

88.68 |

86.03 |

Financial |

Asset Management |

67 |

30.28 |

52.19 |

98.28 |

88.45 |

3.0 |

29.0 |

175.63 |

1.0 |

1.0 |

| 68.0 |

STEP |

91.72 |

92.02 |

87.78 |

88.45 |

Financial |

Asset Management |

67 |

17.63 |

80.39 |

98.28 |

66.73 |

4.0 |

31.0 |

60.27 |

1.0 |

1.0 |

| 69.0 |

TPB |

91.66 |

89.47 |

88.74 |

60.55 |

Consumer Defensive |

Tobacco |

31 |

81.34 |

87.16 |

92.51 |

62.2 |

1.0 |

8.0 |

44.61 |

1.0 |

1.0 |

| 70.0 |

IRM |

91.45 |

93.22 |

93.21 |

78.7 |

Real Estate |

REIT - Specialty |

39 |

61.76 |

32.4 |

90.23 |

82.98 |

1.0 |

4.0 |

125.54 |

1.0 |

1.0 |

| 71.0 |

DASH |

91.42 |

91.22 |

87.72 |

95.59 |

Communication Services |

Internet Content & Information |

107 |

46.58 |

89.73 |

90.23 |

87.93 |

4.0 |

7.0 |

150.91 |

1.0 |

1.0 |

| 72.0 |

TGLS |

91.38 |

93.53 |

93.0 |

68.65 |

Basic Materials |

Building Materials |

78 |

62.6 |

6.64 |

81.76 |

68.08 |

2.0 |

22.0 |

69.13 |

1.0 |

1.0 |

| 73.0 |

TOL |

91.35 |

94.76 |

93.49 |

92.55 |

Consumer Cyclical |

Residential Construction |

55 |

89.48 |

72.31 |

59.16 |

86.92 |

2.0 |

27.0 |

146.94 |

1.0 |

1.0 |

| 74.0 |

PRMW |

91.23 |

90.15 |

87.29 |

67.69 |

Consumer Defensive |

Beverages - Non-Alcoholic |

100 |

92.08 |

65.12 |

77.83 |

46.78 |

1.0 |

10.0 |

27.67 |

1.0 |

1.0 |

| 75.0 |

UAL |

91.2 |

64.57 |

43.75 |

66.26 |

Industrials |

Airlines |

88 |

95.97 |

52.83 |

96.57 |

73.4 |

2.0 |

40.0 |

73.44 |

1.0 |

1.0 |

| 76.0 |

AMAL |

91.17 |

88.91 |

90.34 |

83.02 |

Financial |

Banks - Regional |

21 |

79.39 |

64.19 |

62.56 |

51.17 |

7.0 |

32.0 |

33.97 |

1.0 |

1.0 |

| 77.0 |

GE |

91.02 |

93.69 |

93.09 |

95.06 |

Industrials |

Aerospace & Defense |

38 |

85.95 |

88.73 |

91.81 |

91.35 |

8.0 |

41.0 |

181.69 |

1.0 |

1.0 |

| 78.0 |

BSVN |

90.92 |

84.64 |

85.59 |

56.48 |

Financial |

Banks - Regional |

21 |

63.0 |

50.65 |

56.65 |

57.19 |

8.0 |

33.0 |

42.9 |

1.0 |

1.0 |

| 79.0 |

URI |

90.74 |

89.78 |

86.61 |

93.6 |

Industrials |

Rental & Leasing Services |

25 |

86.05 |

42.66 |

62.56 |

99.23 |

3.0 |

42.0 |

834.17 |

1.0 |

1.0 |

| 80.0 |

ALKT |

90.68 |

89.1 |

90.62 |

94.63 |

Technology |

Software - Application |

87 |

43.39 |

83.28 |

70.26 |

54.84 |

17.0 |

50.0 |

38.18 |

1.0 |

1.0 |

| 81.0 |

PRIM |

90.62 |

90.48 |

89.08 |

91.83 |

Industrials |

Engineering & Construction |

13 |

68.2 |

78.44 |

85.83 |

69.01 |

10.0 |

43.0 |

61.34 |

1.0 |

1.0 |

| 82.0 |

TILE |

90.59 |

90.88 |

93.7 |

94.1 |

Industrials |

Building Products & Equipment |

57 |

96.5 |

91.24 |

74.11 |

36.72 |

5.0 |

44.0 |

18.3 |

0.0 |

1.0 |

| 83.0 |

WIX |

90.55 |

87.41 |

87.97 |

78.08 |

Technology |

Software - Infrastructure |

60 |

74.26 |

73.3 |

59.16 |

89.0 |

13.0 |

51.0 |

164.11 |

1.0 |

1.0 |

| 84.0 |

EVR |

90.34 |

90.58 |

88.25 |

88.11 |

Financial |

Capital Markets |

8 |

49.7 |

62.49 |

59.16 |

93.56 |

7.0 |

34.0 |

257.73 |

1.0 |

1.0 |

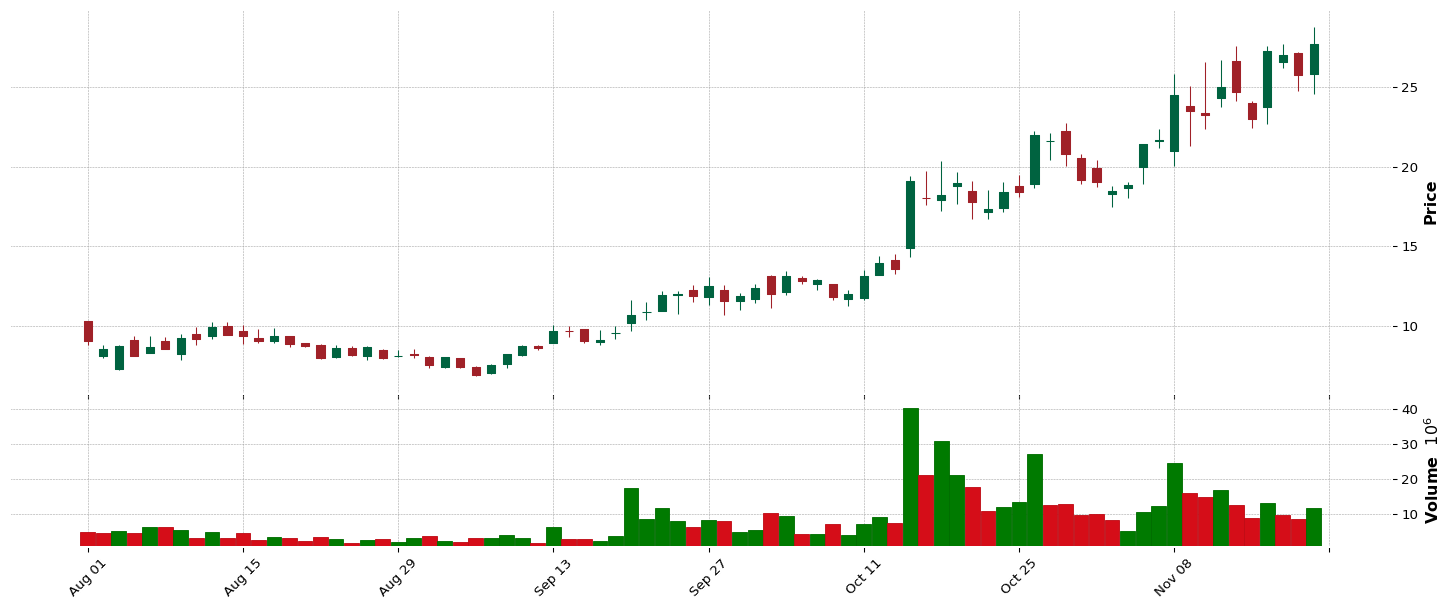

SEZL

SEZL

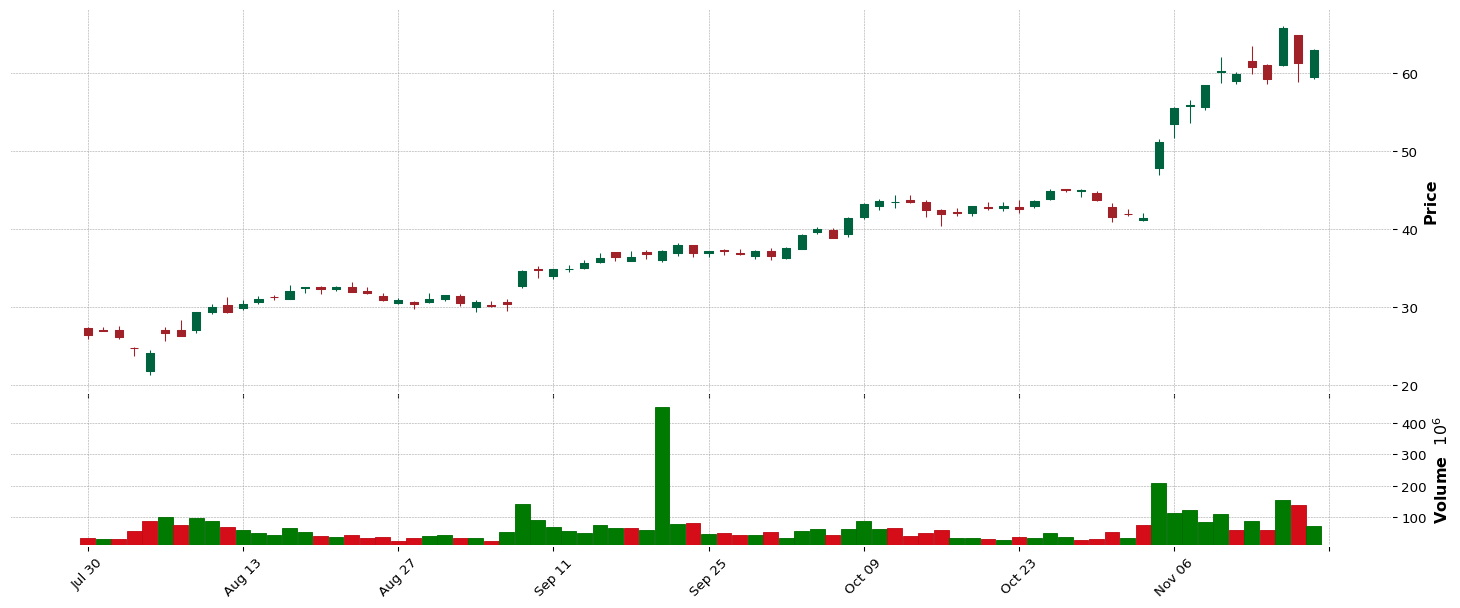

CVNA

CVNA

CAVA

CAVA

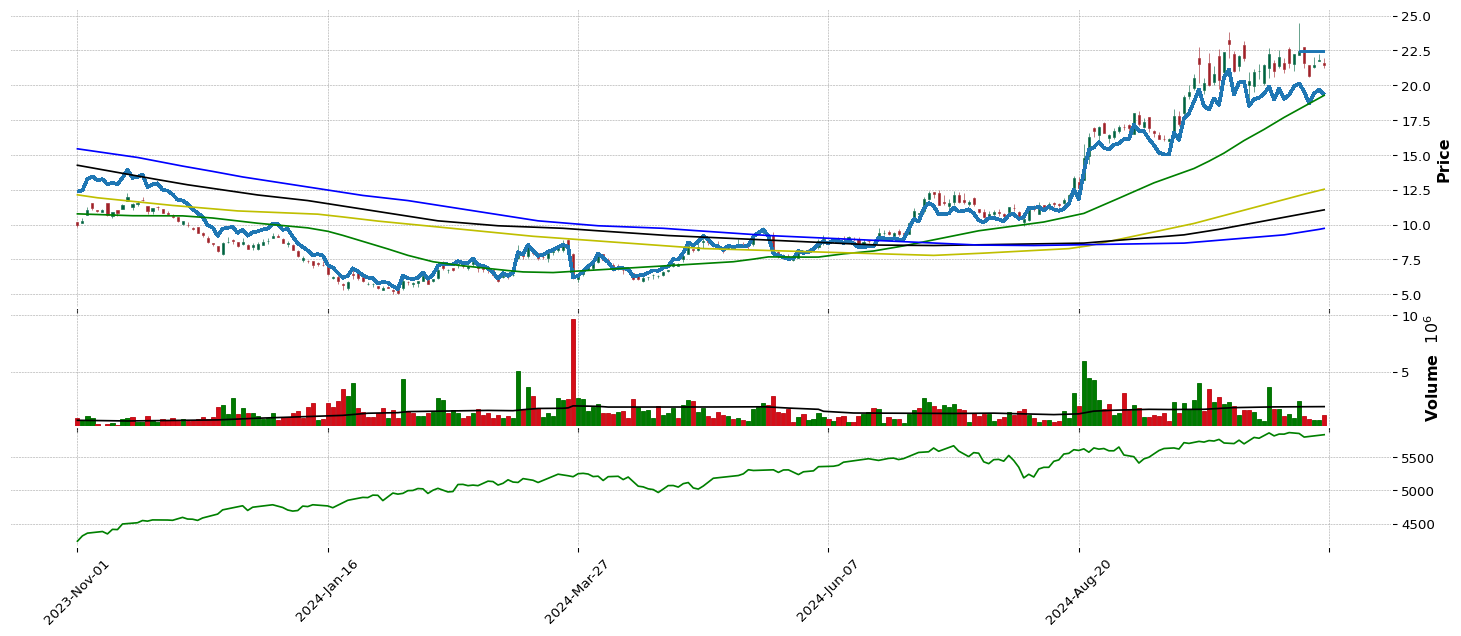

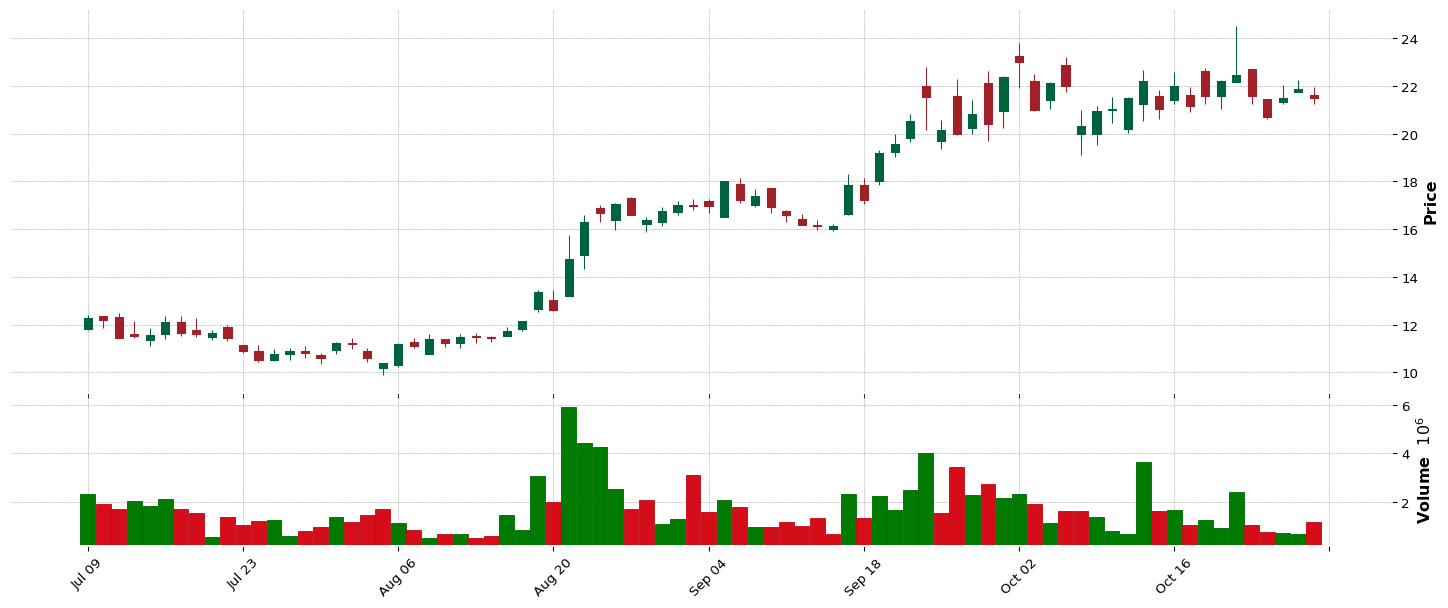

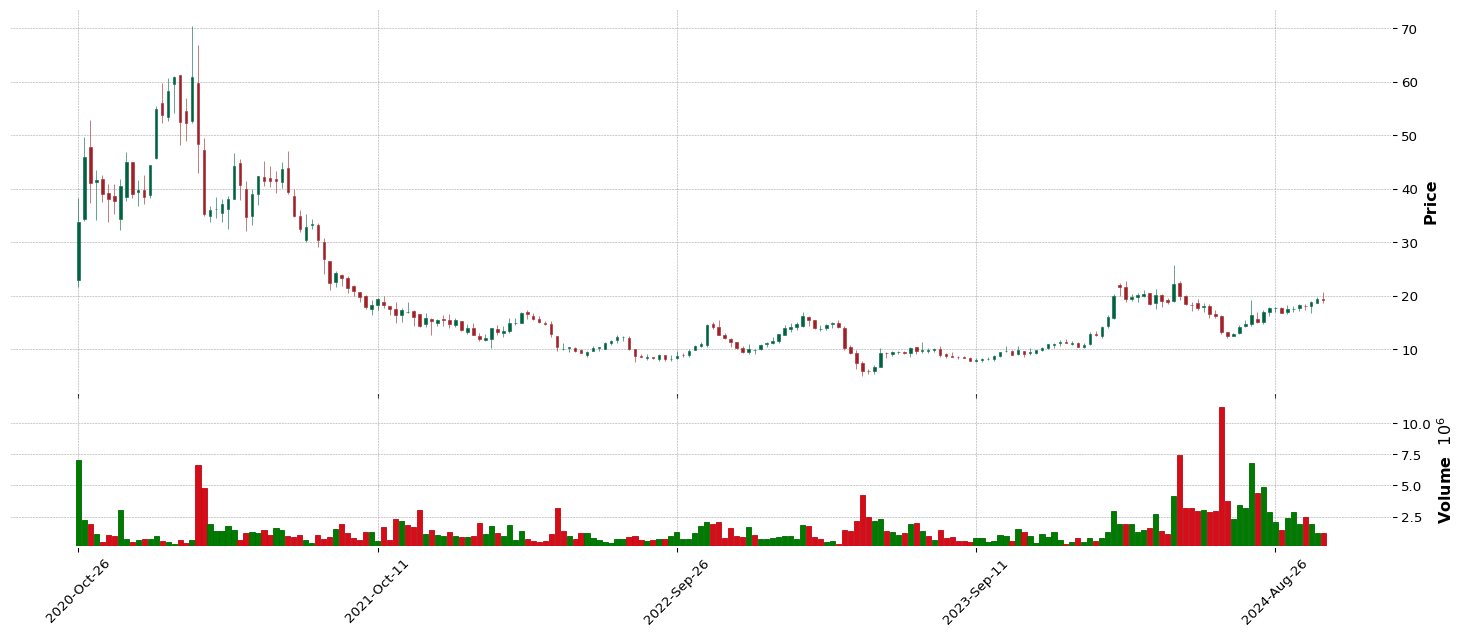

GDS

GDS

LENZ

LENZ

WGS

WGS

HBB

HBB

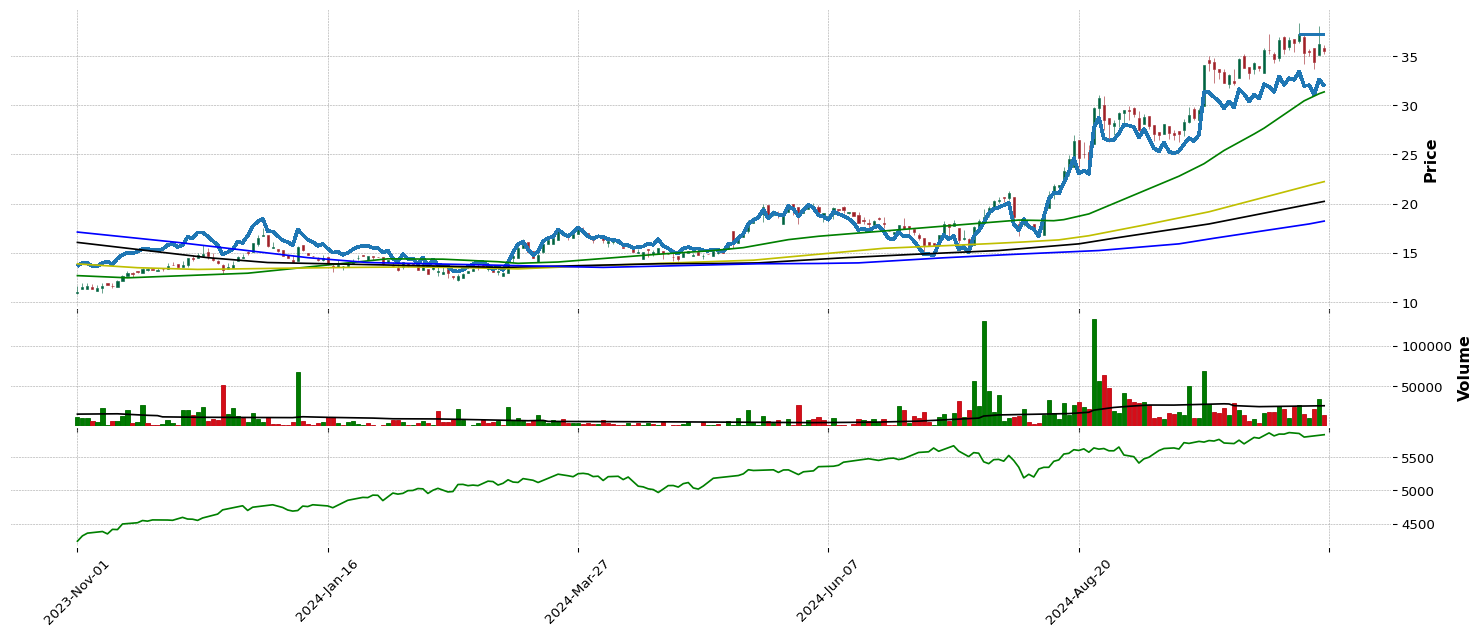

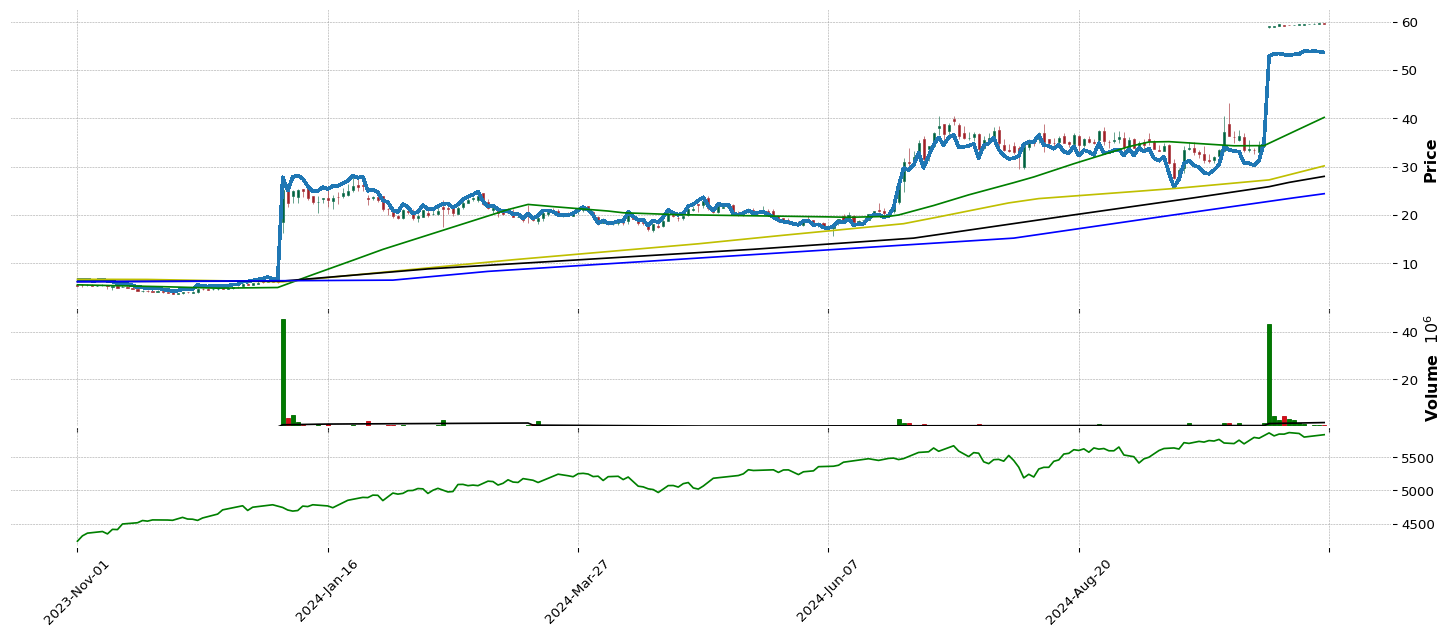

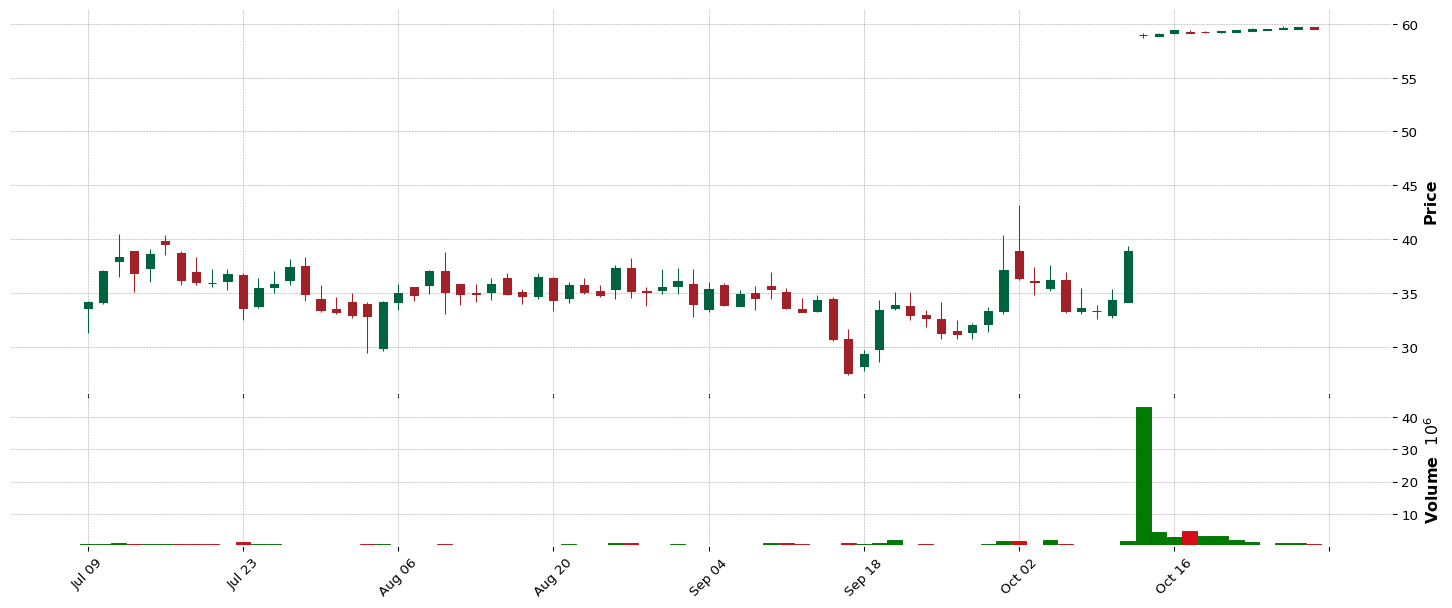

WLFC

WLFC

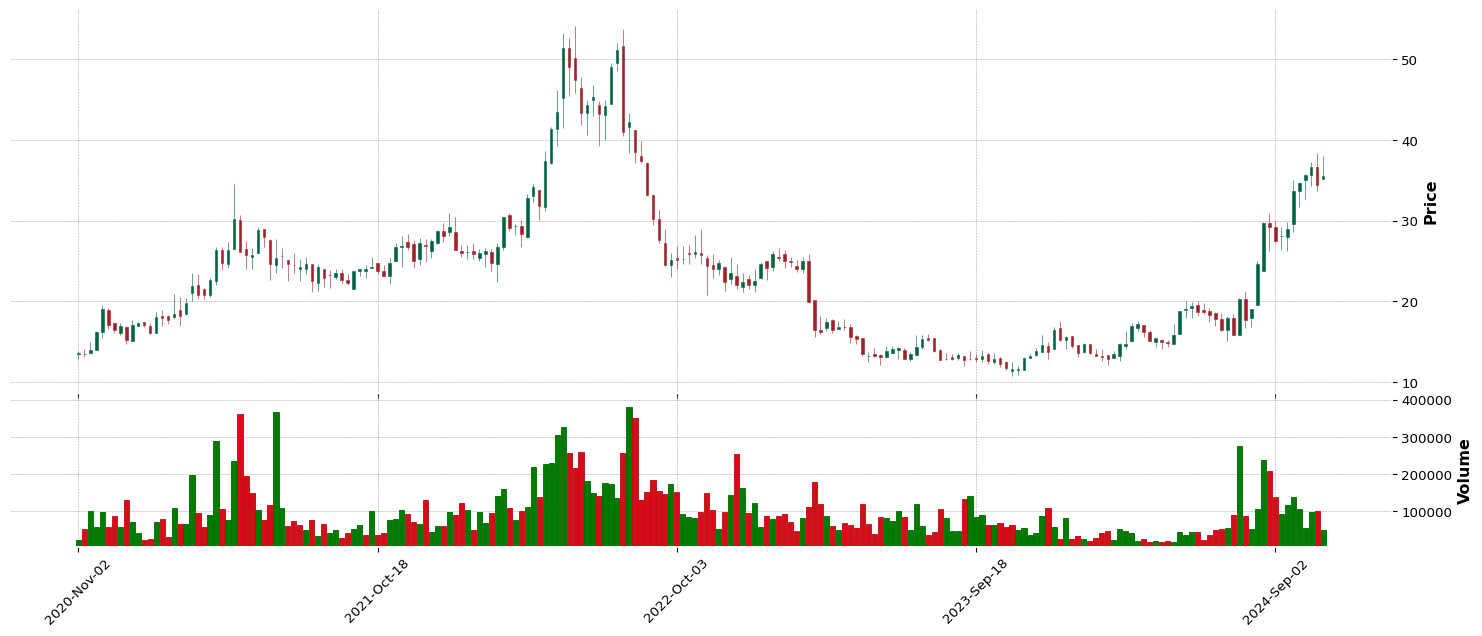

VHI

VHI

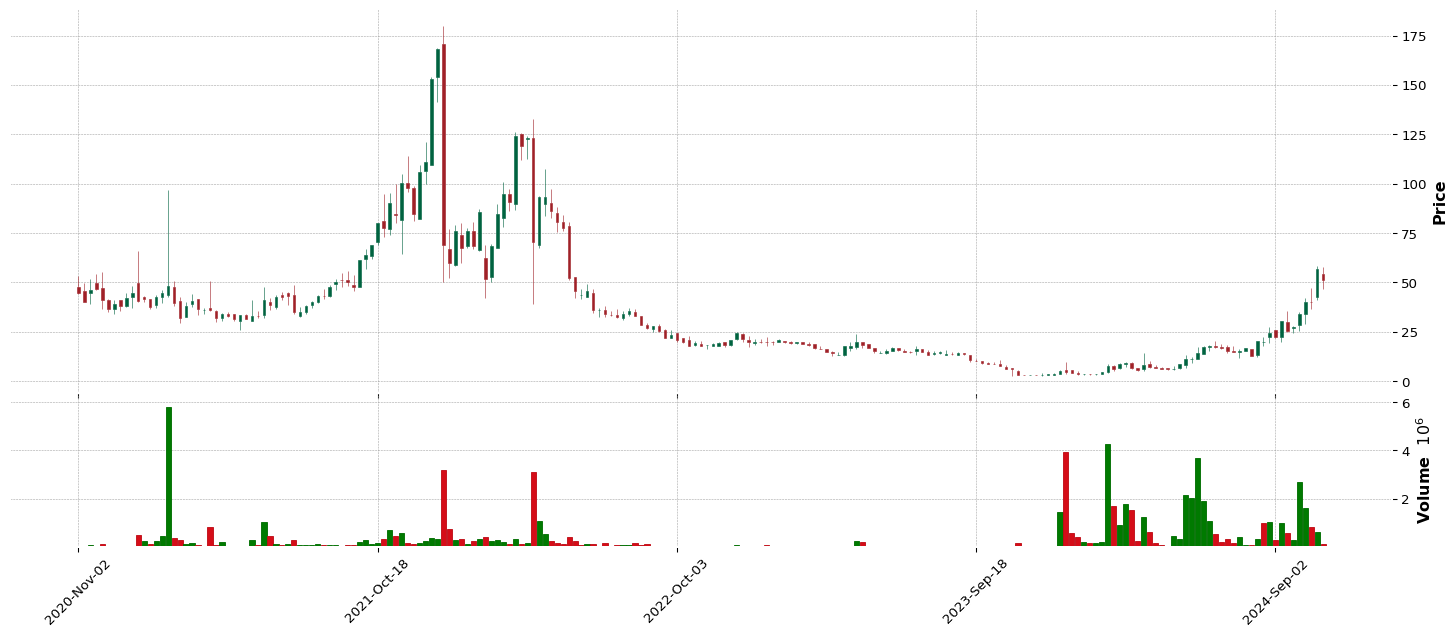

LTH

LTH

BWIN

BWIN

HROW

HROW

DOGZ

DOGZ

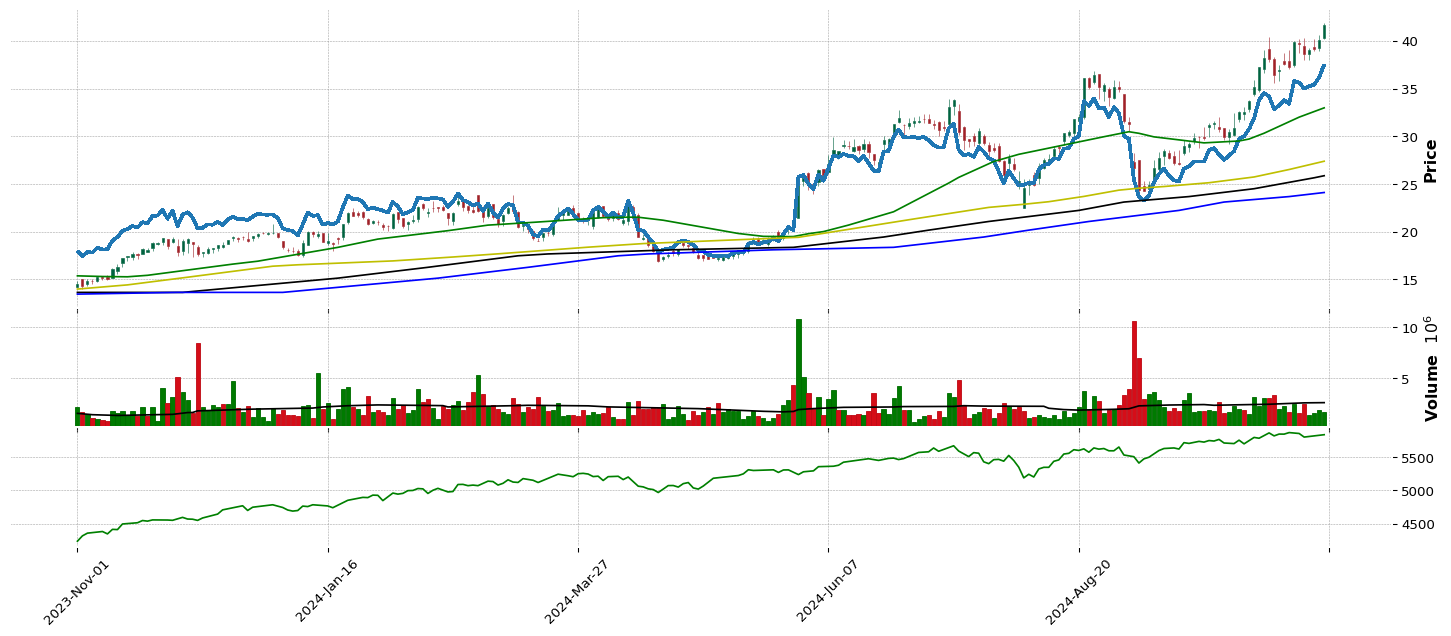

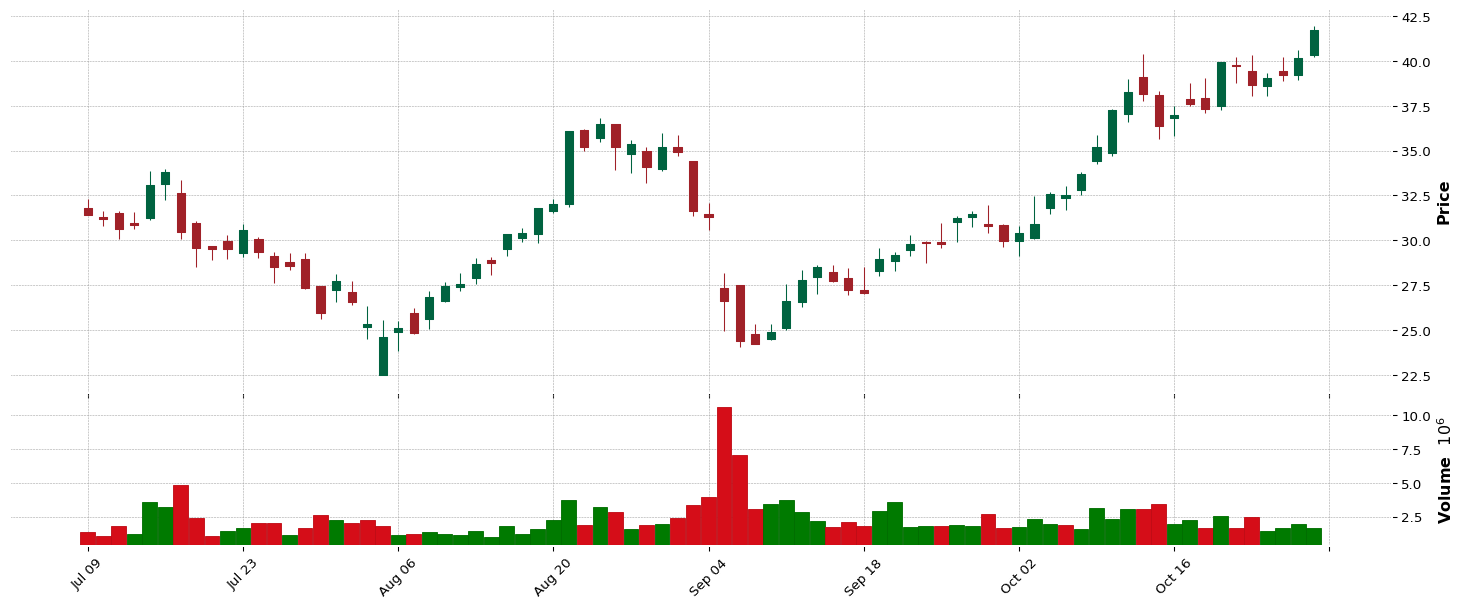

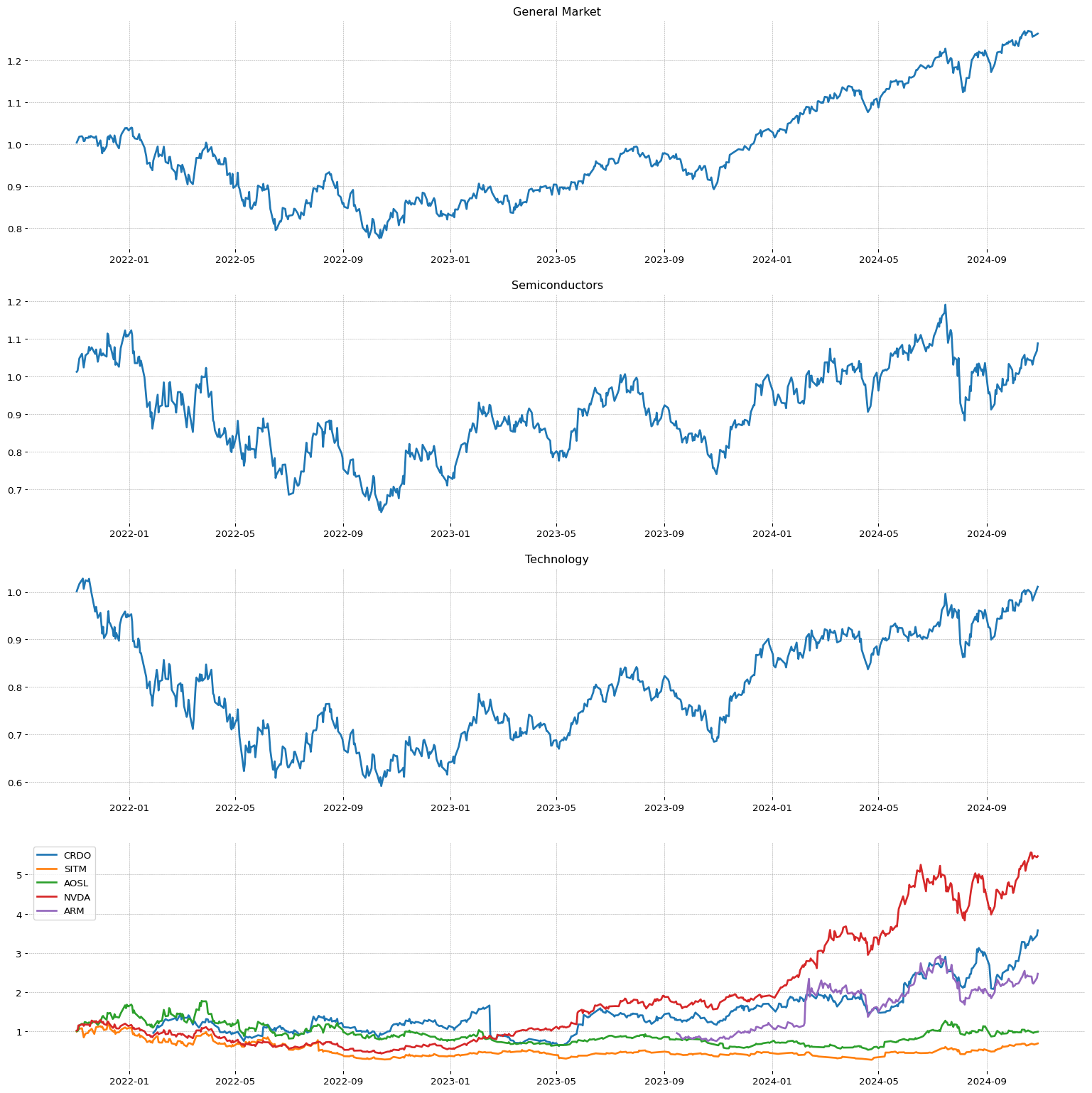

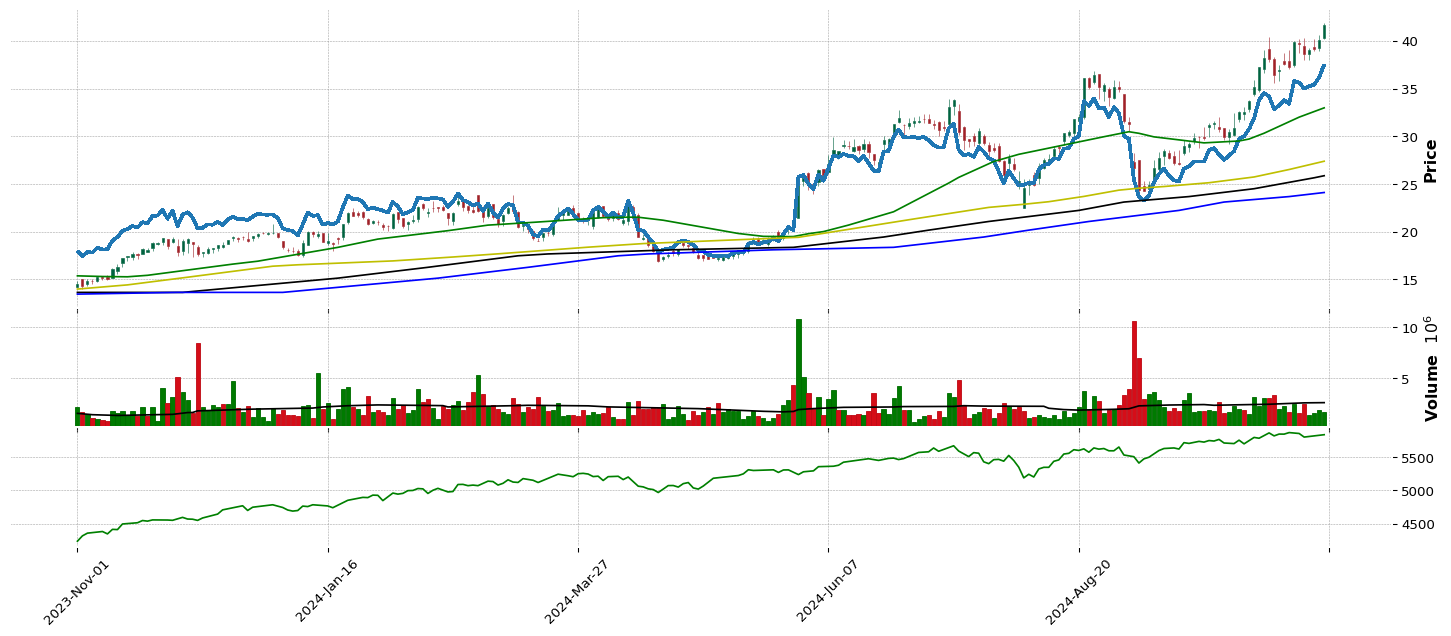

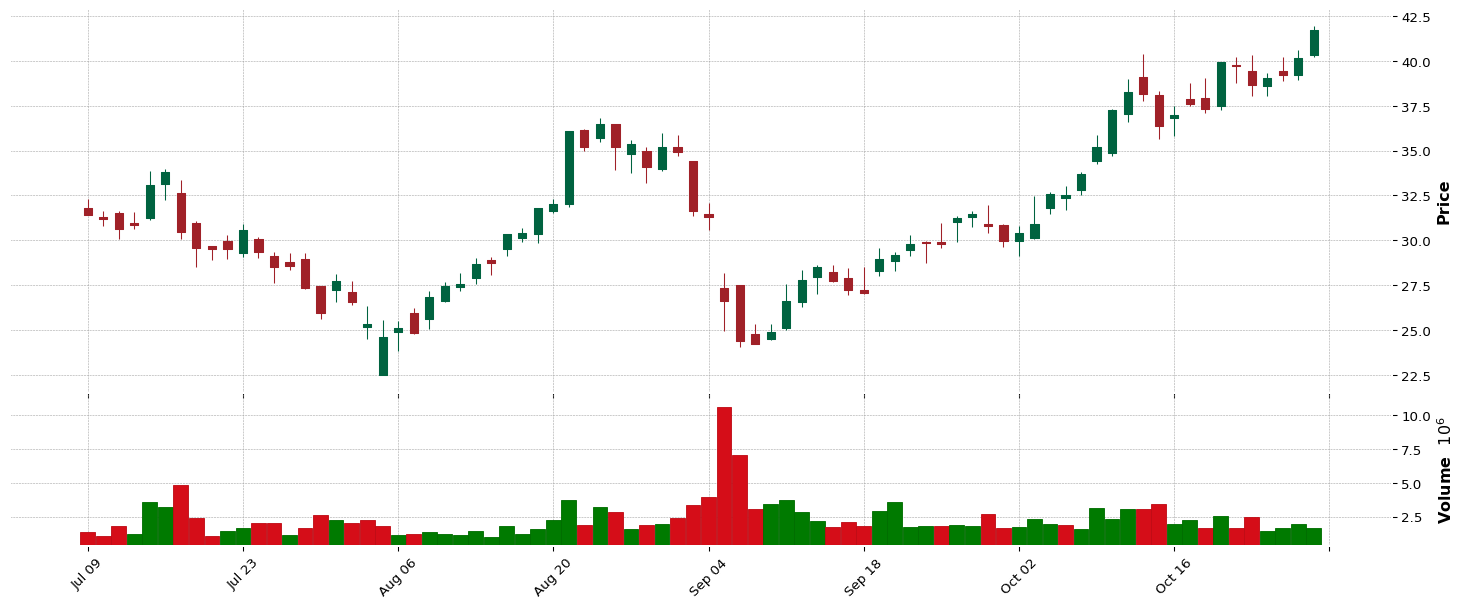

CRDO

CRDO

CMPO

CMPO

CLBT

CLBT

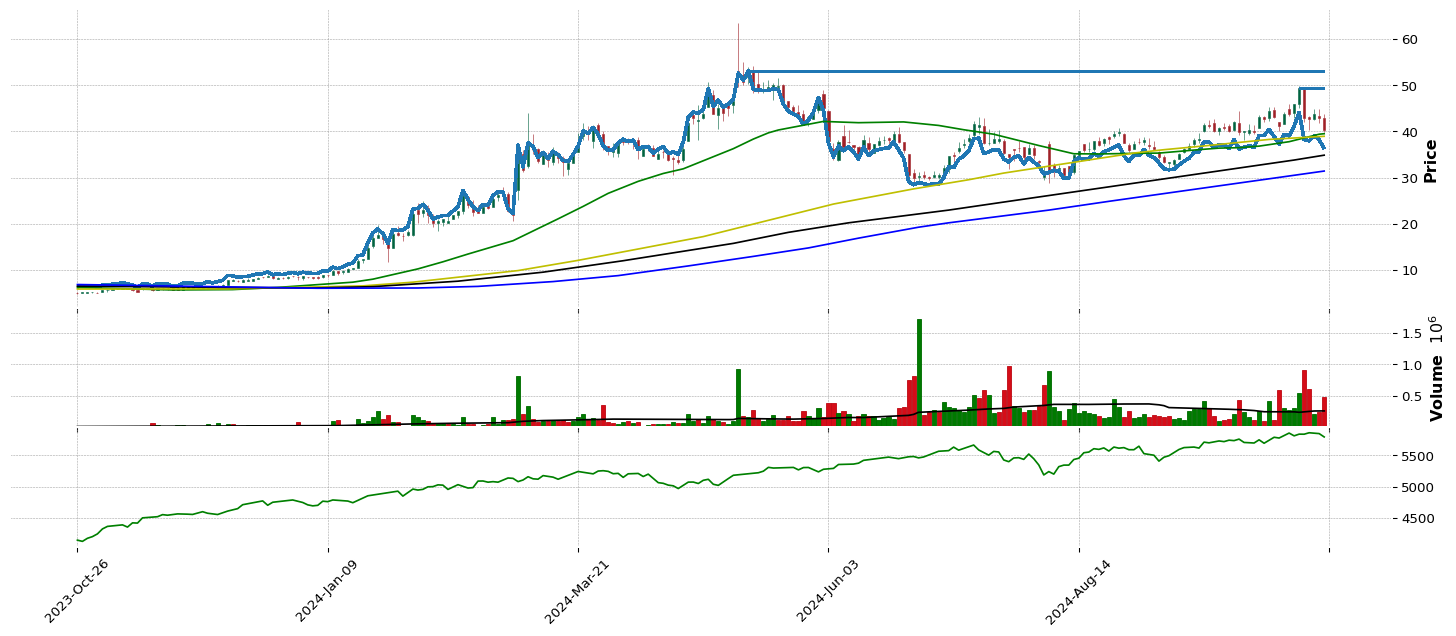

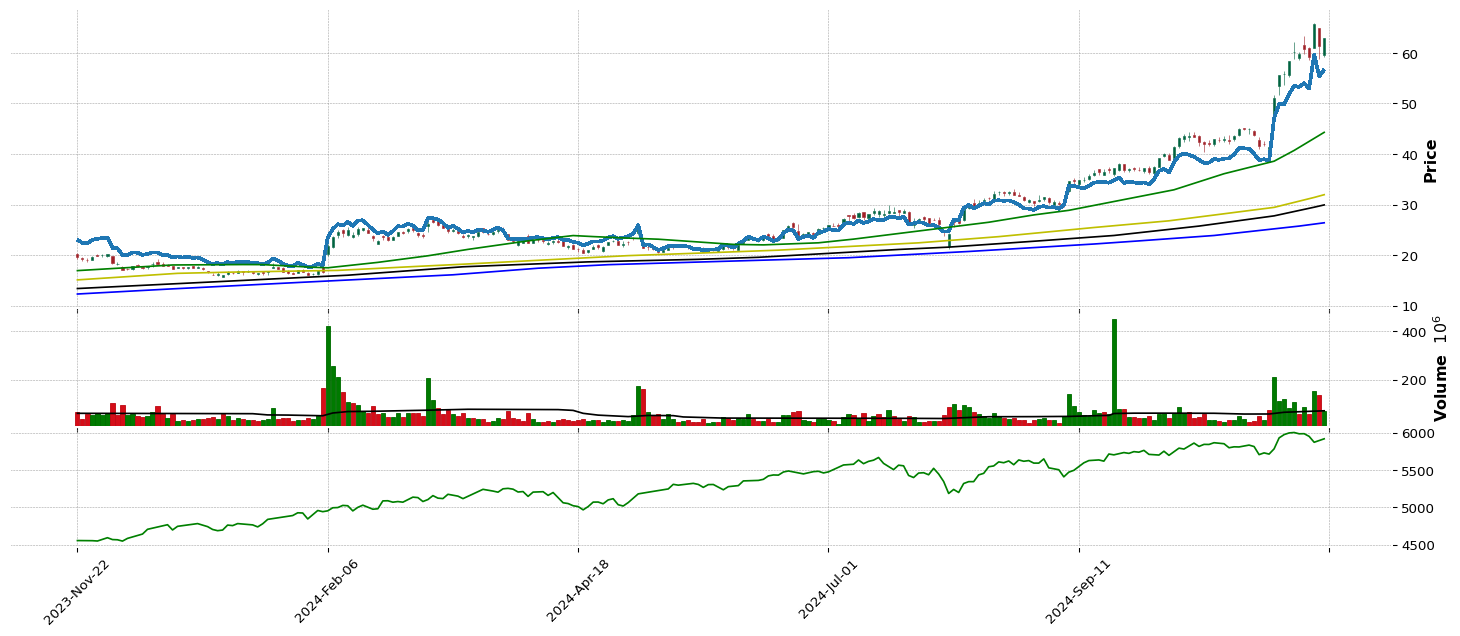

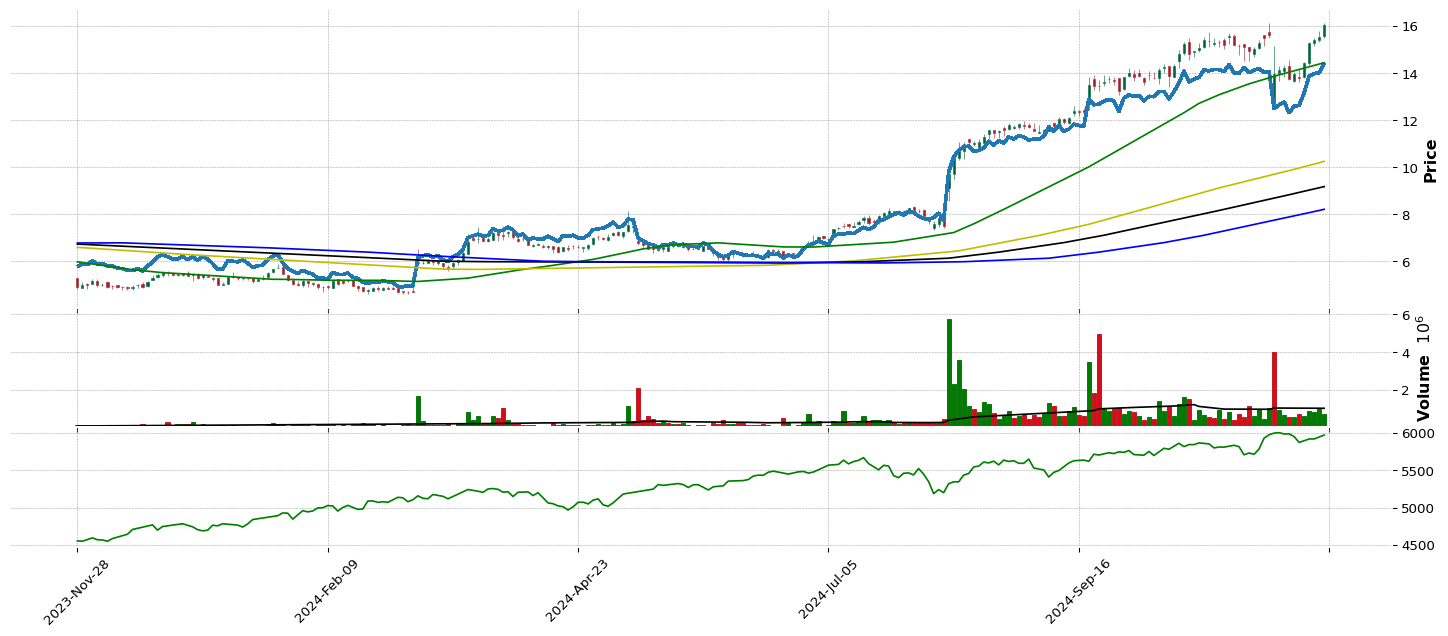

FTAI

FTAI

LBPH

LBPH

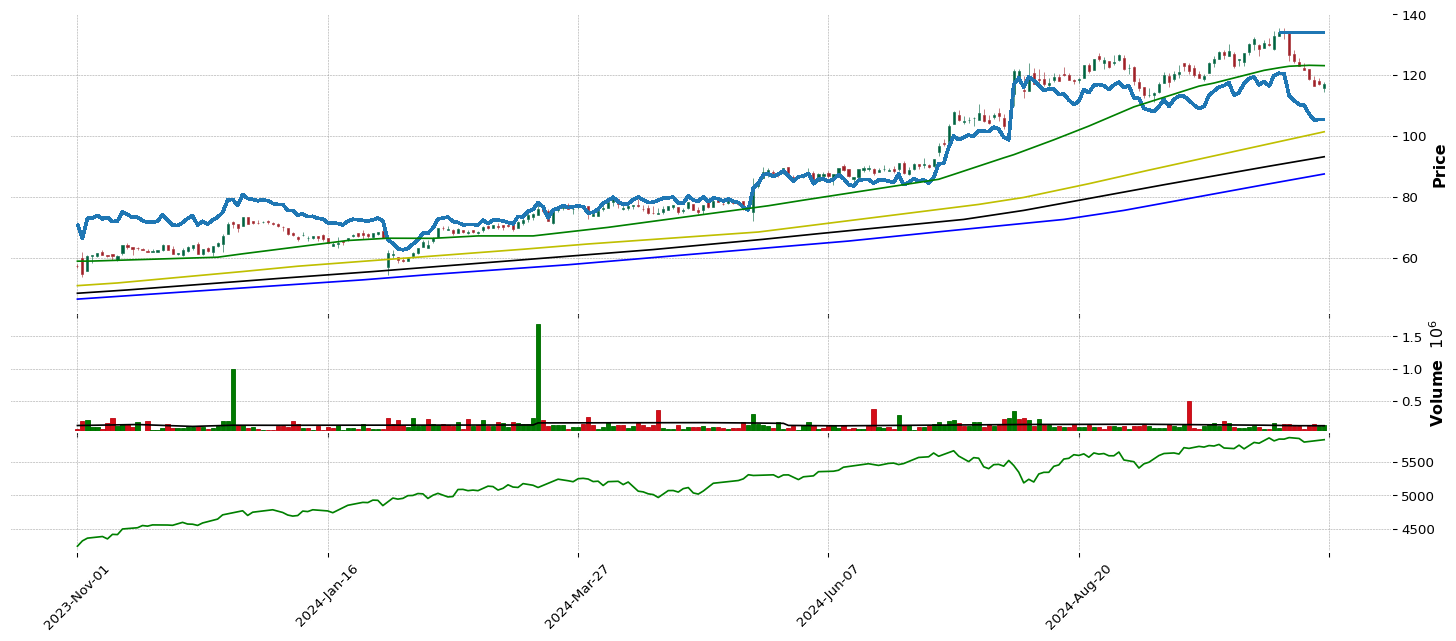

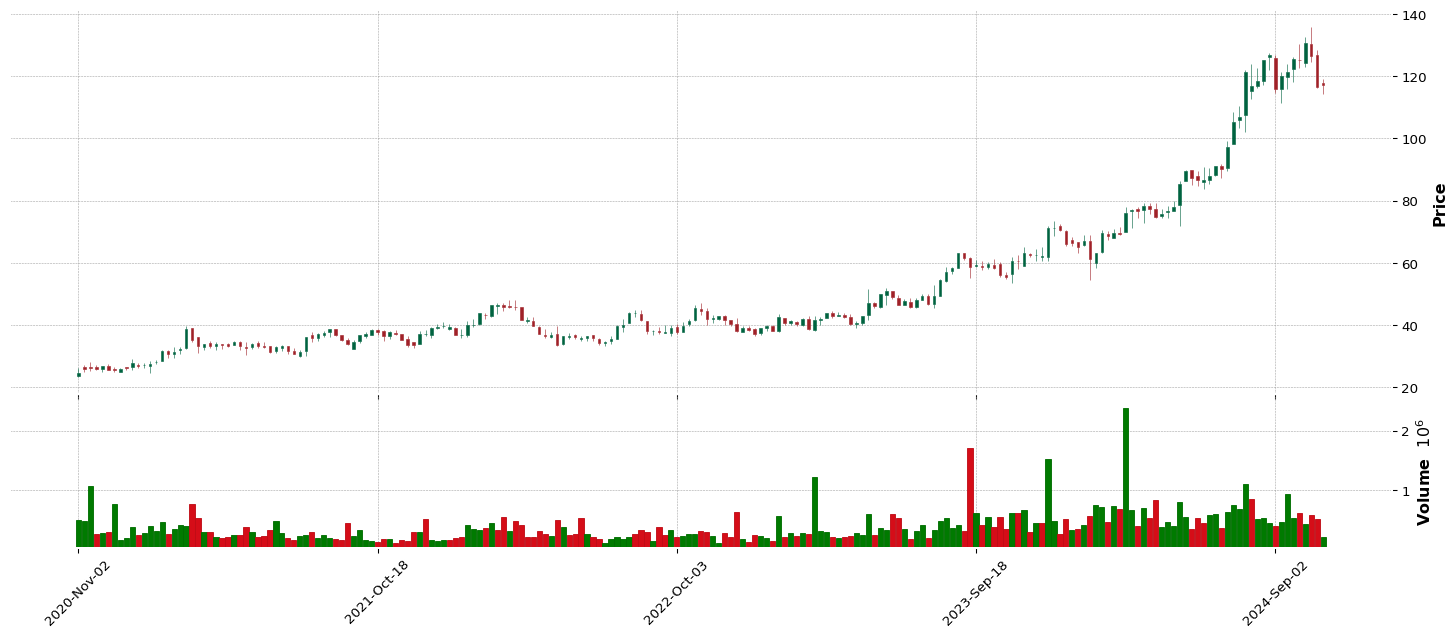

HWKN

HWKN

DAVE

DAVE

FLXS

FLXS

GDS

GDS

MAX

MAX

LWAY

LWAY

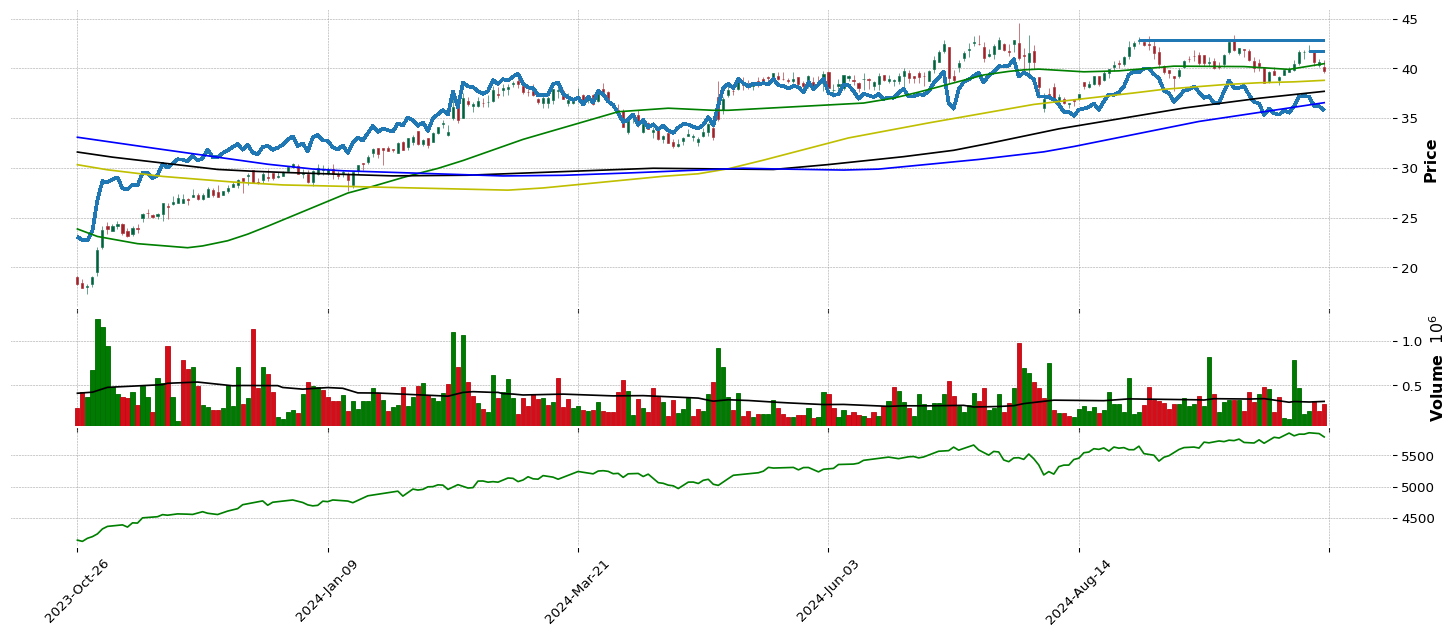

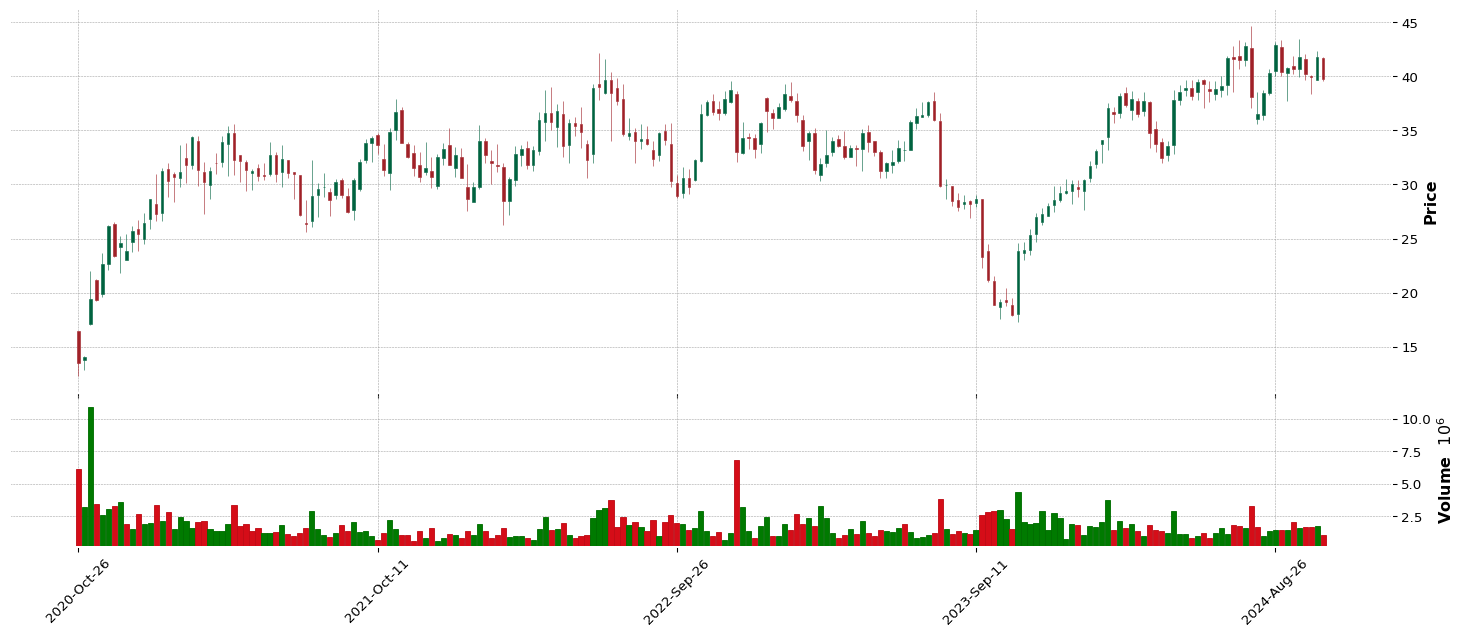

CHEF

CHEF

CRDO

CRDO