***************************

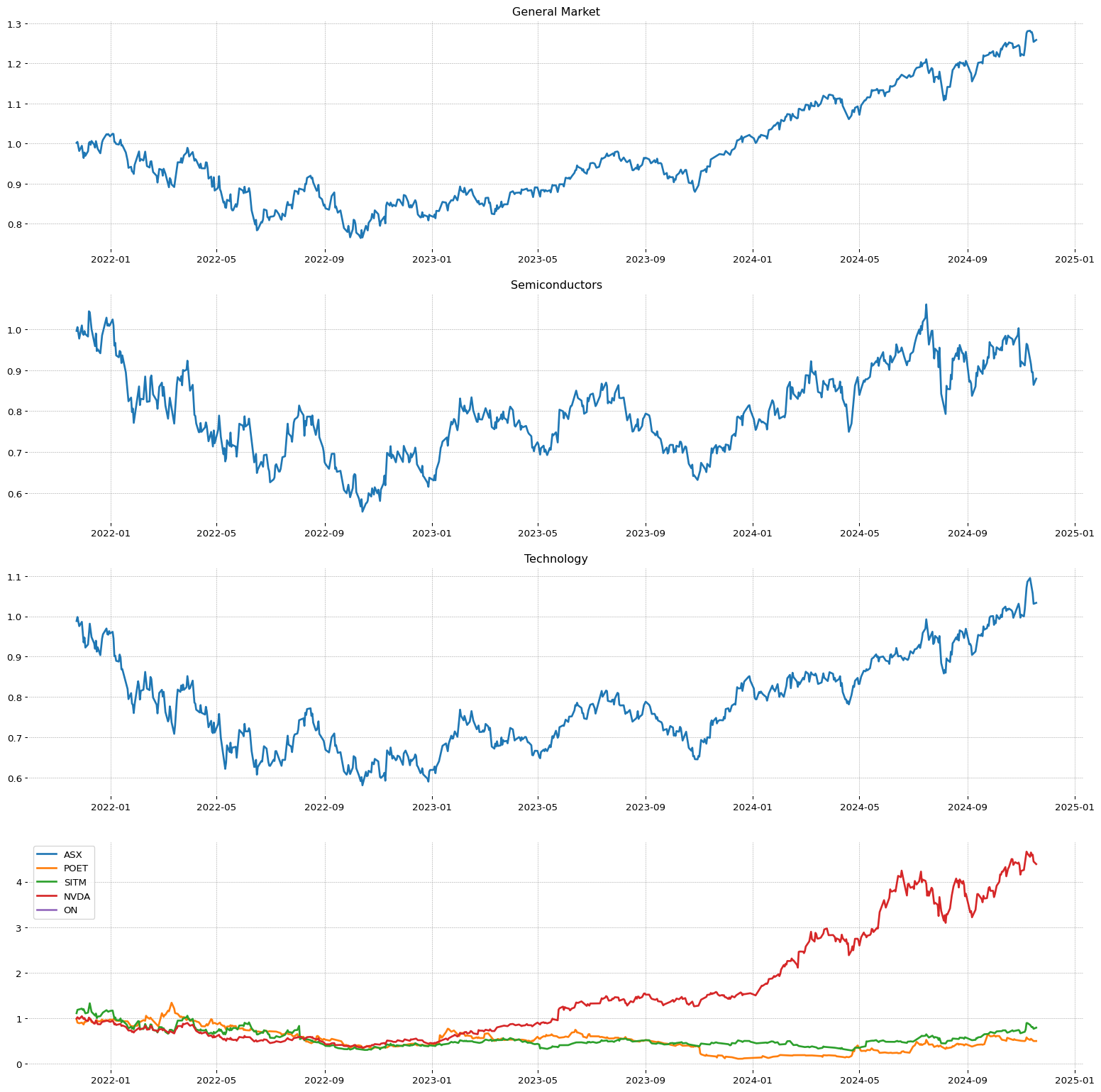

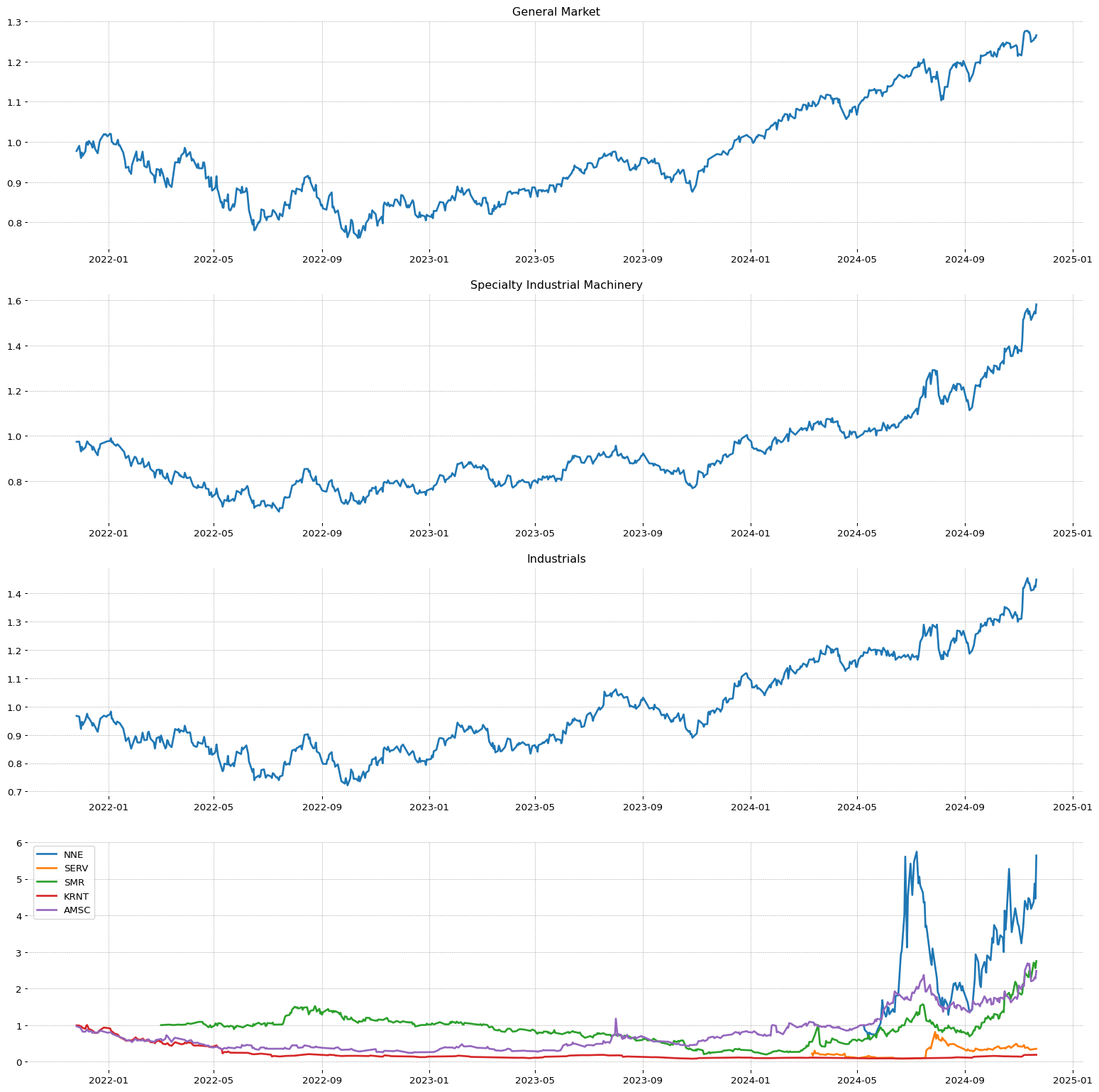

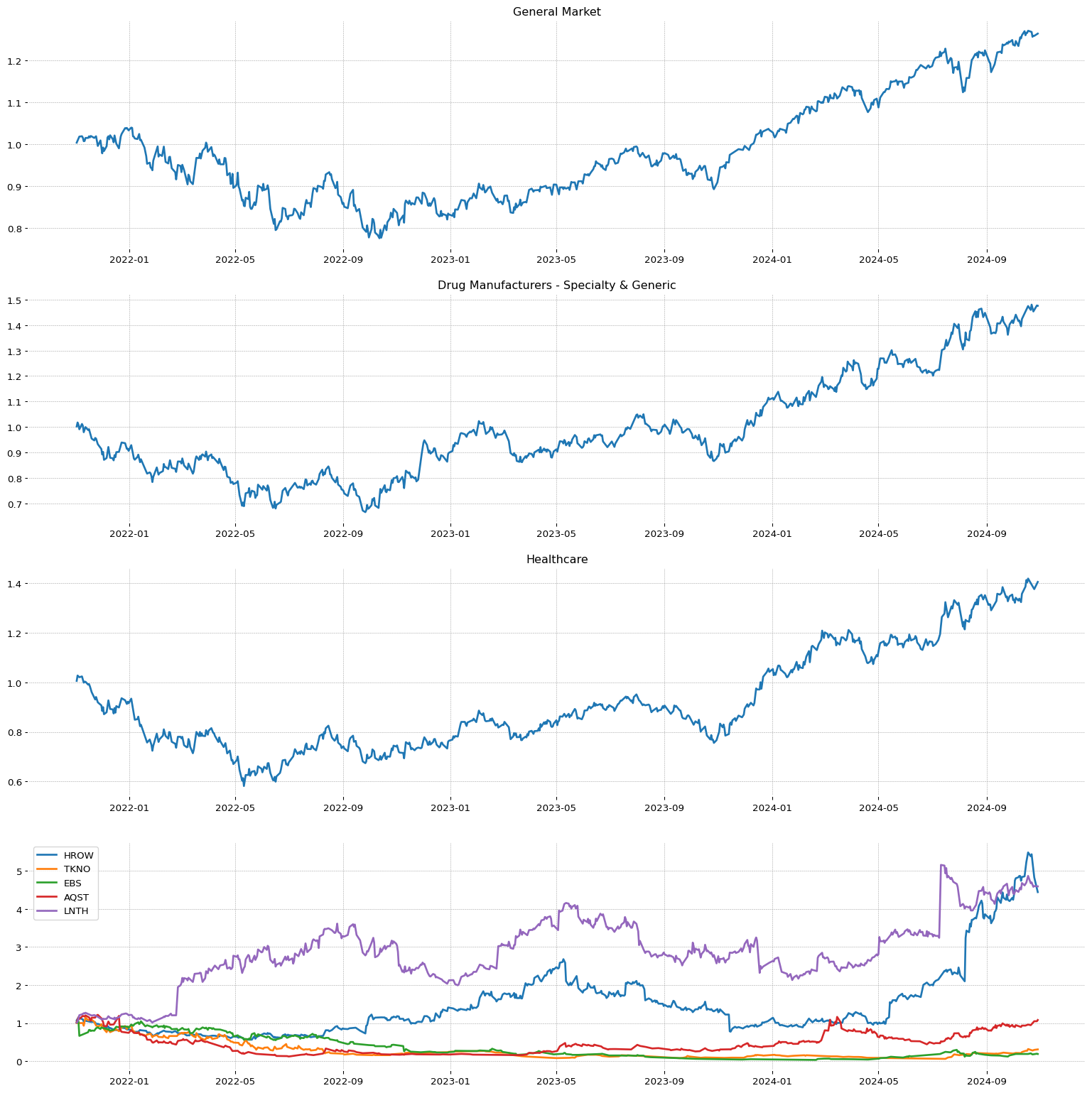

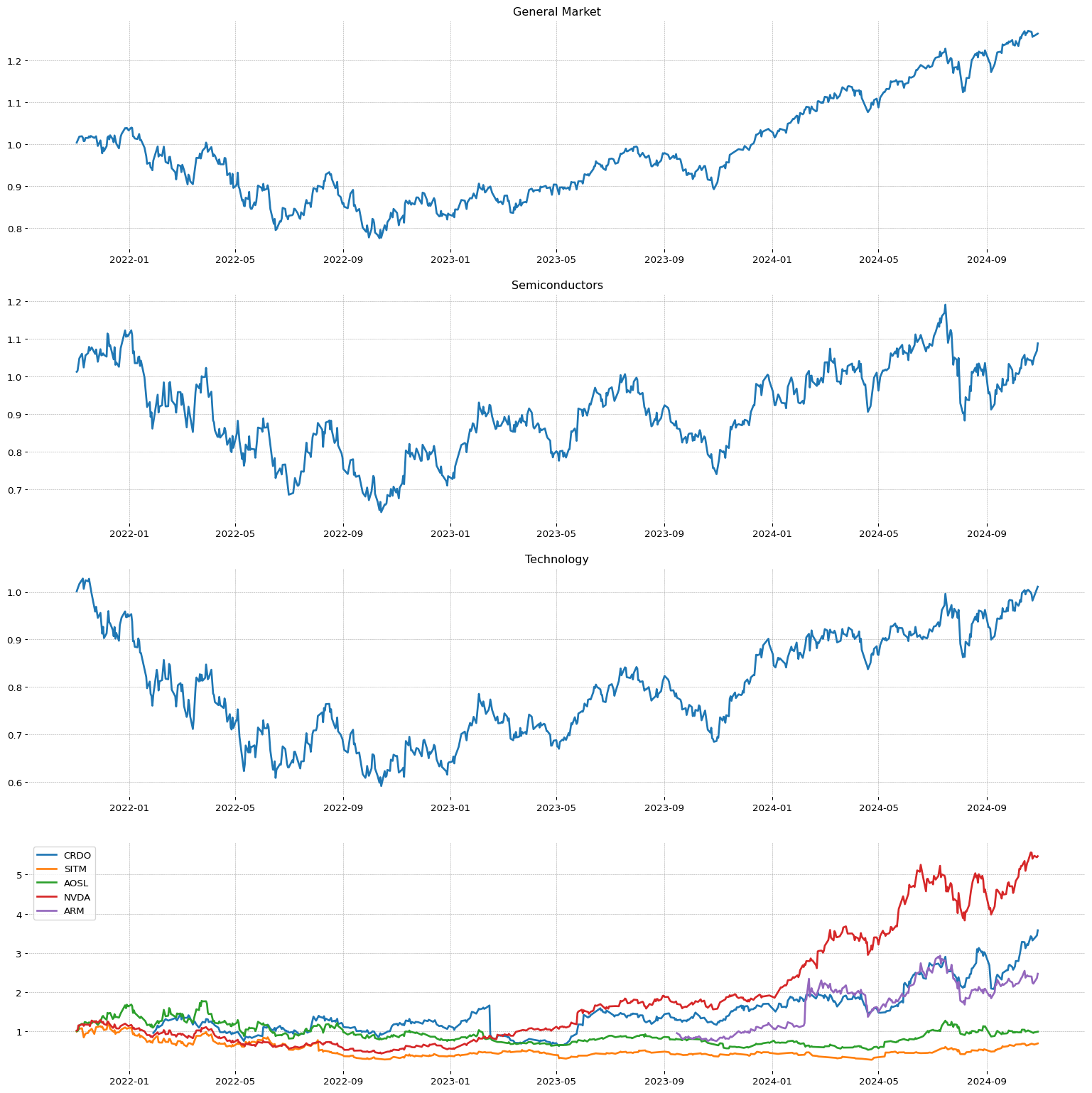

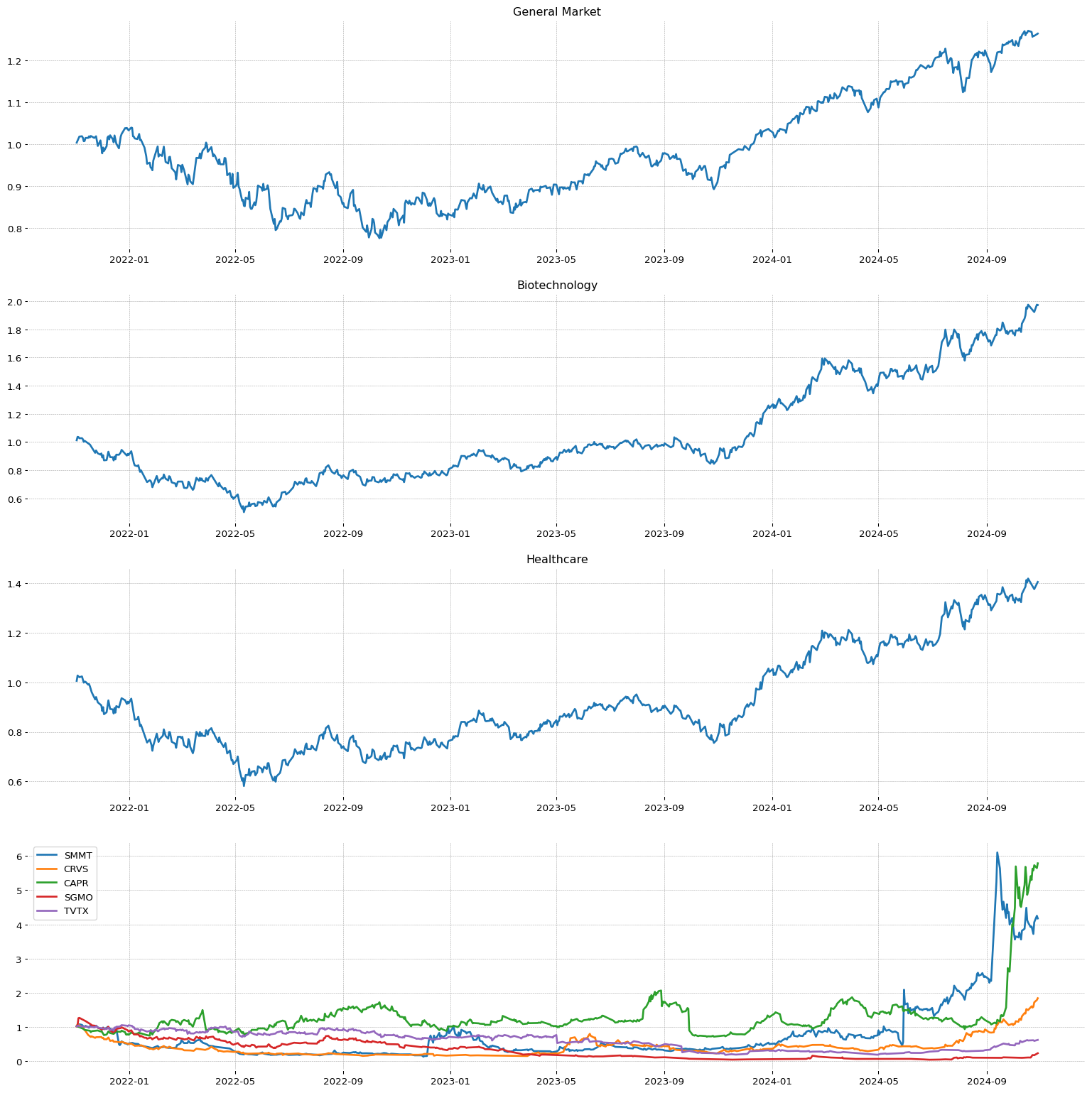

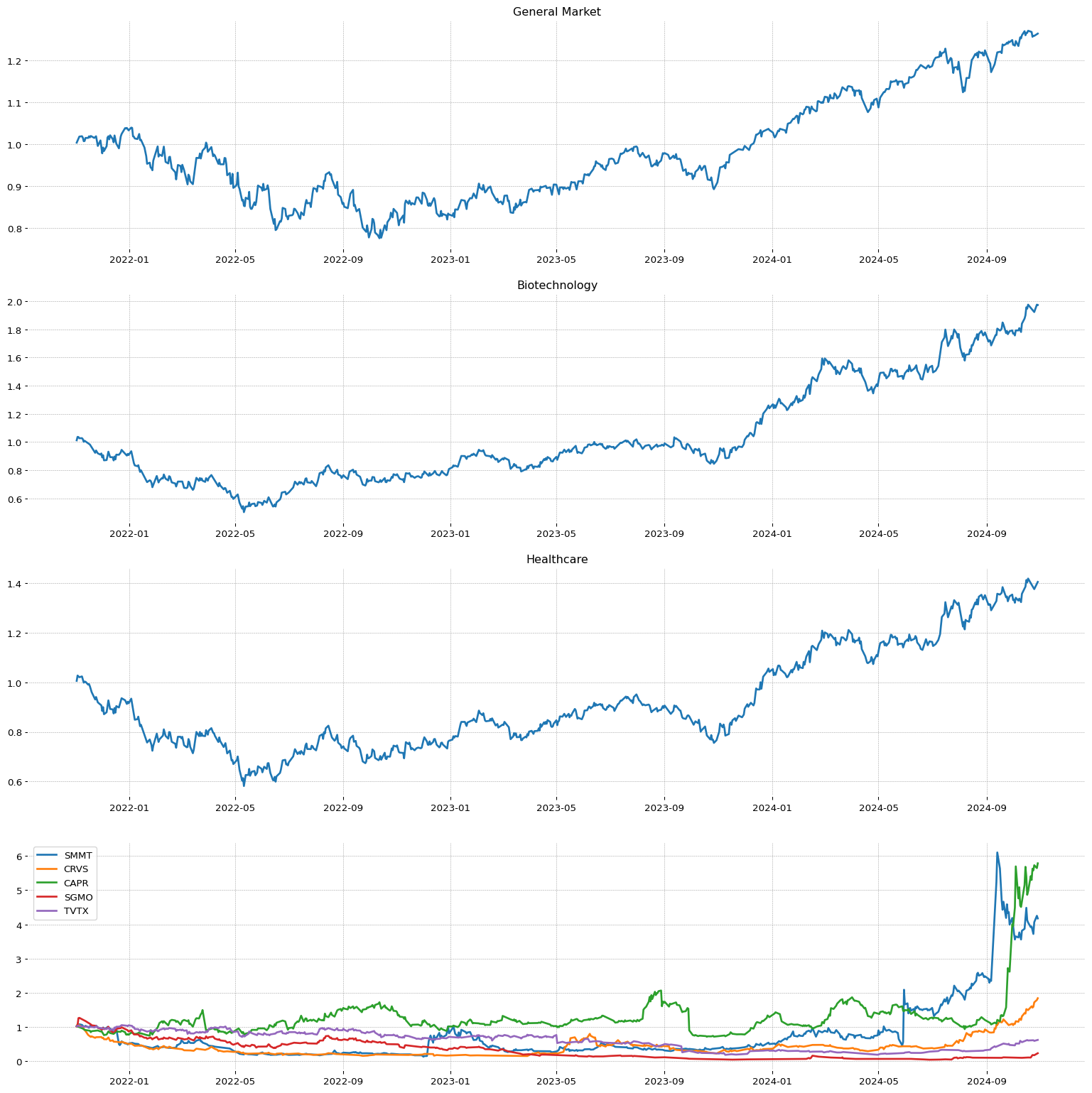

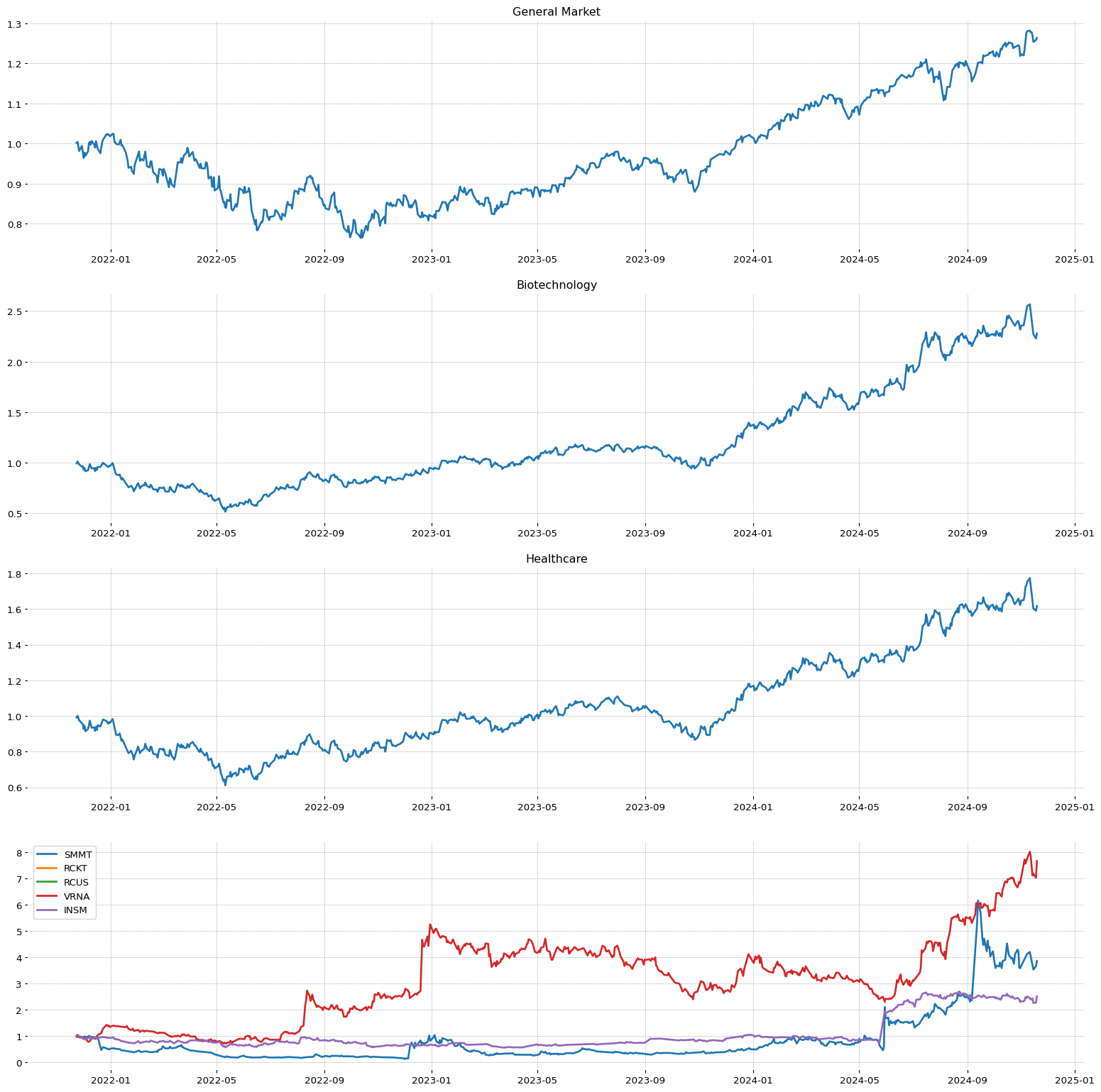

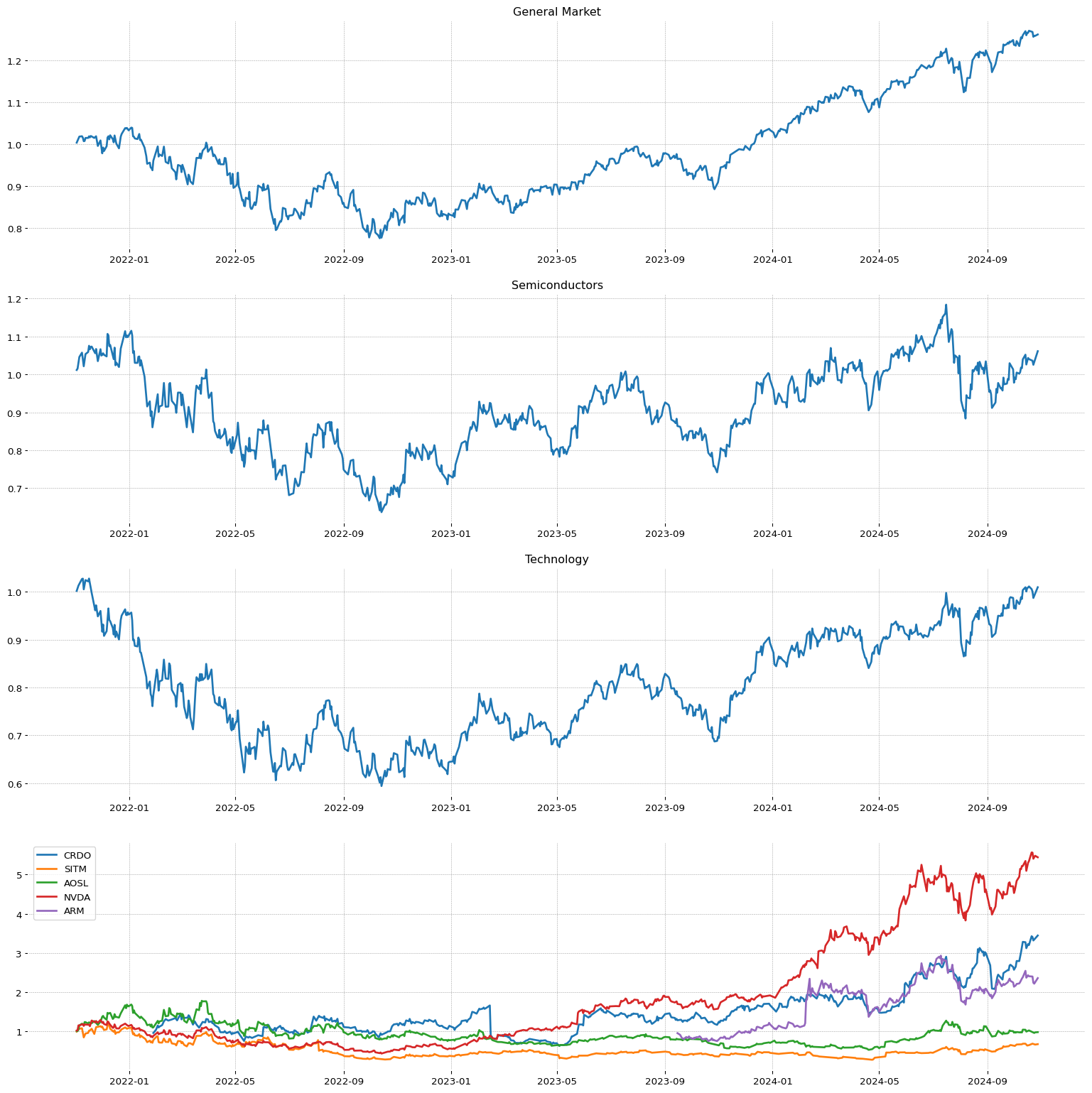

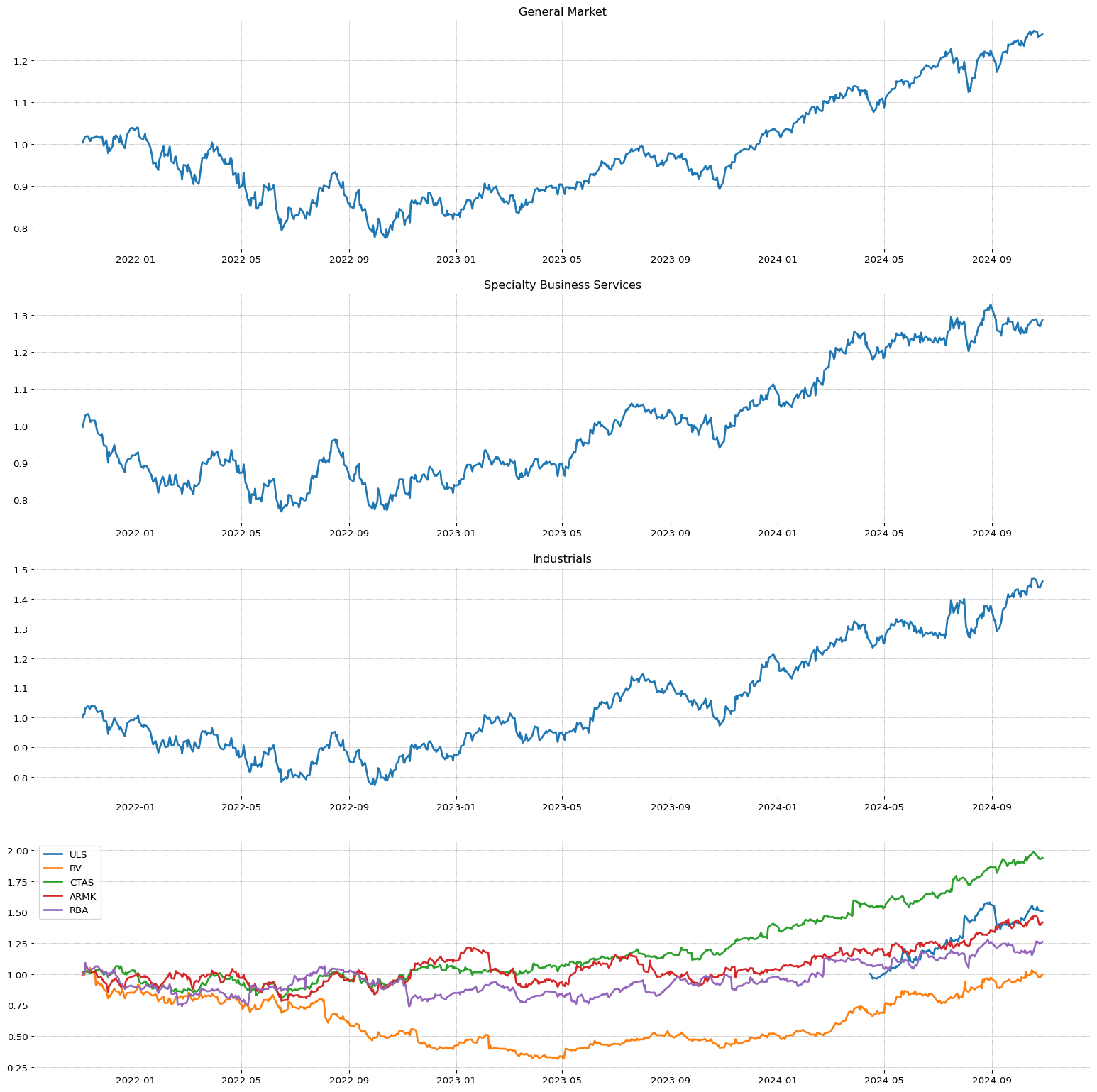

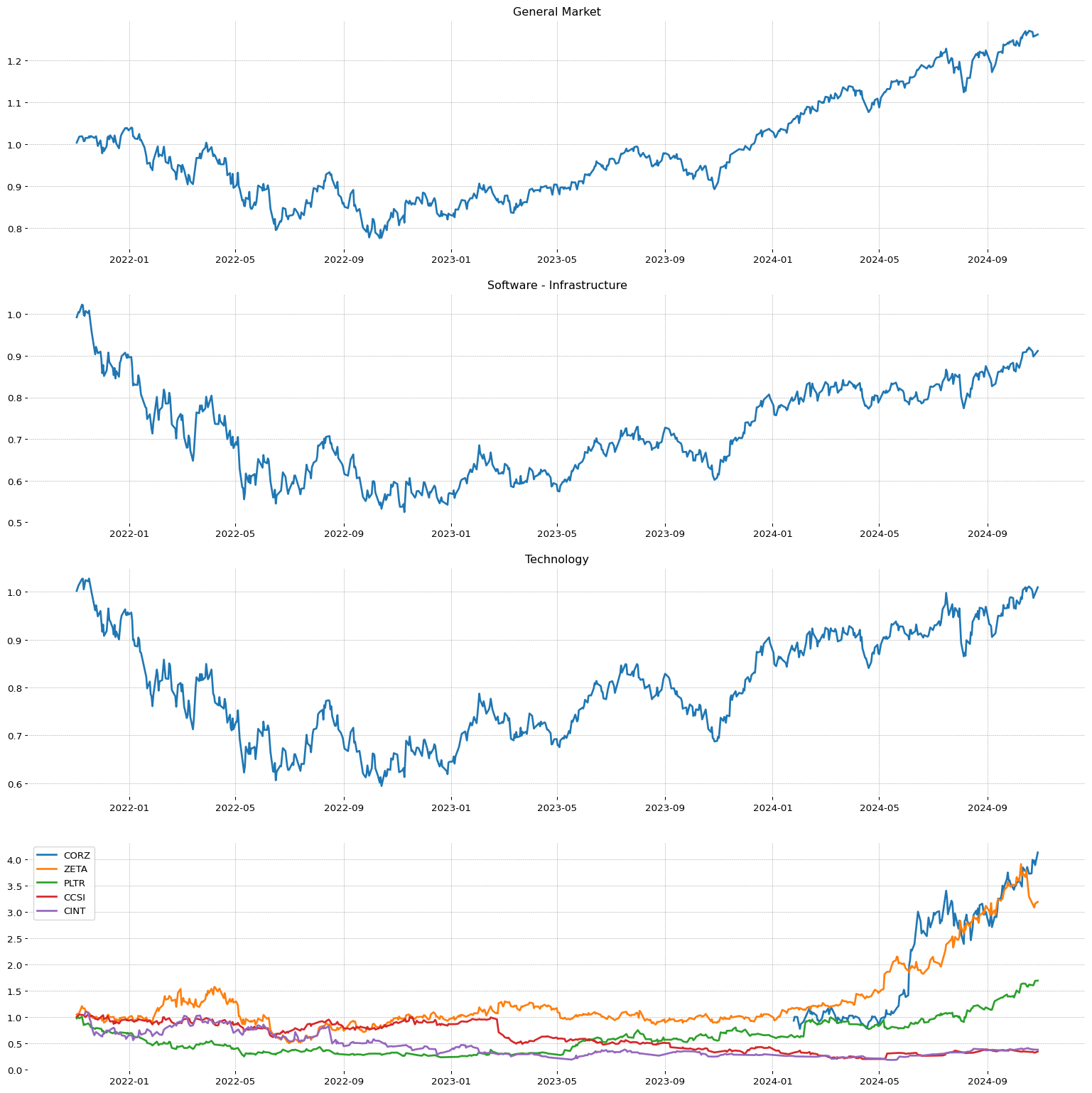

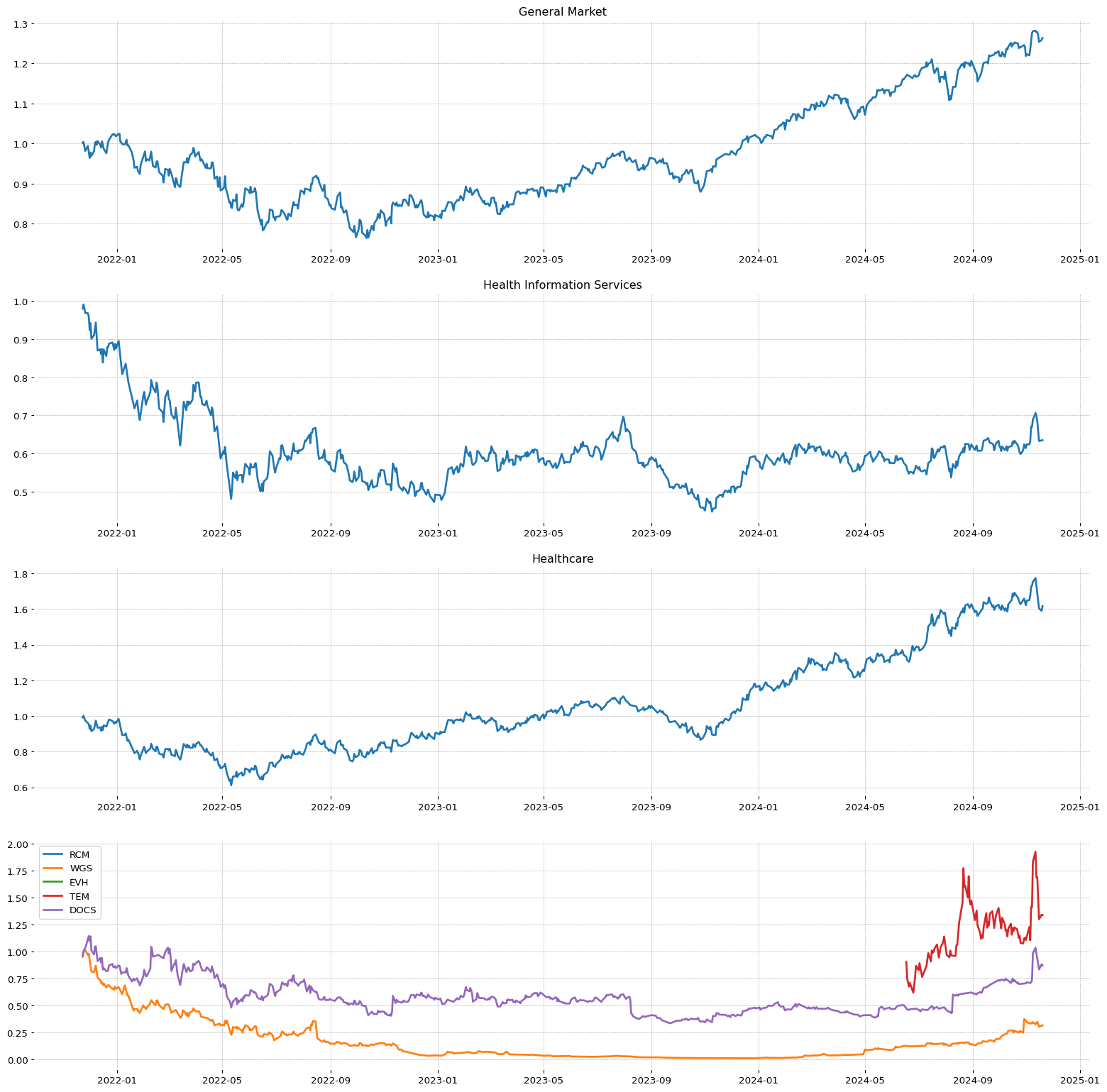

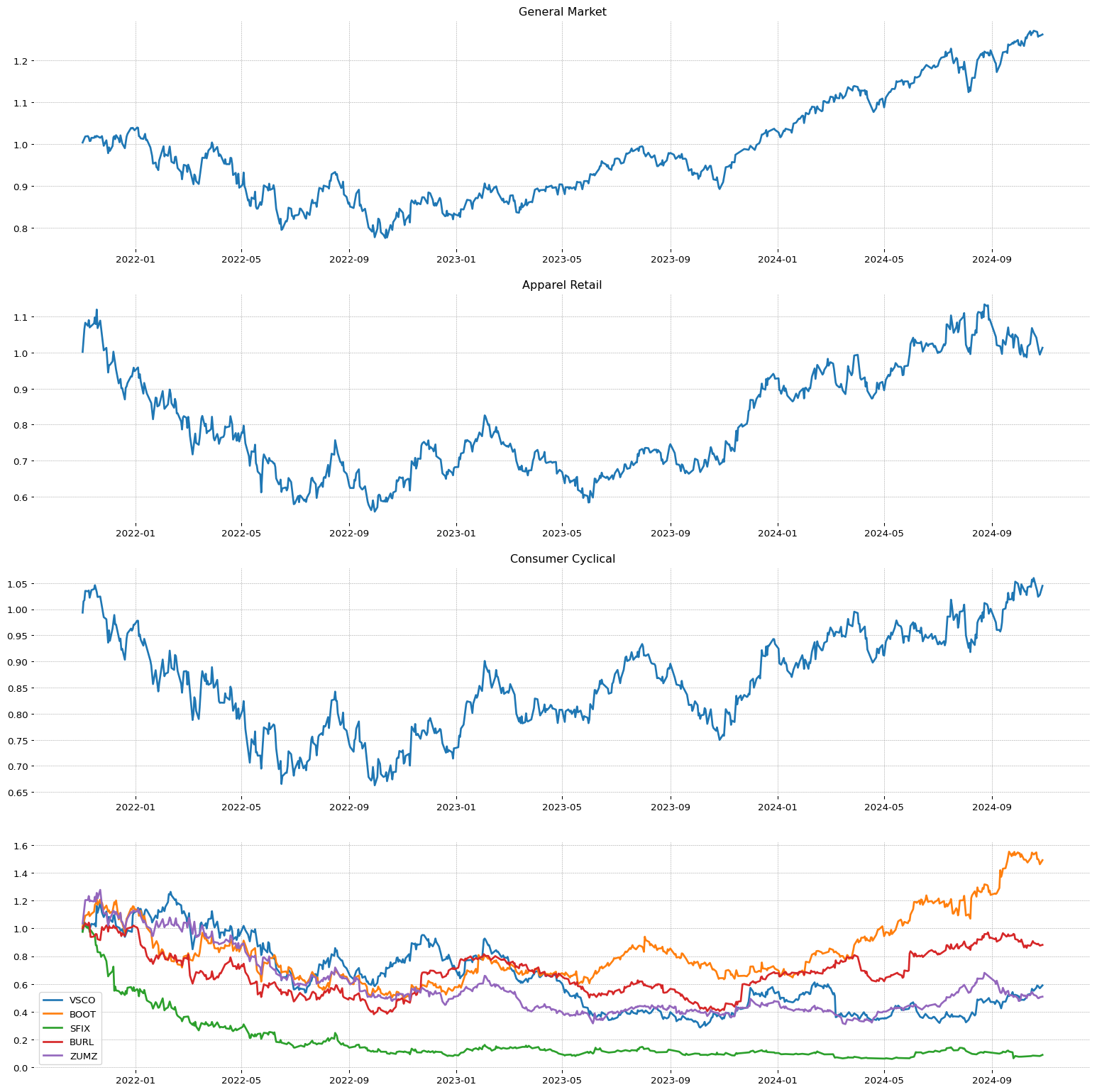

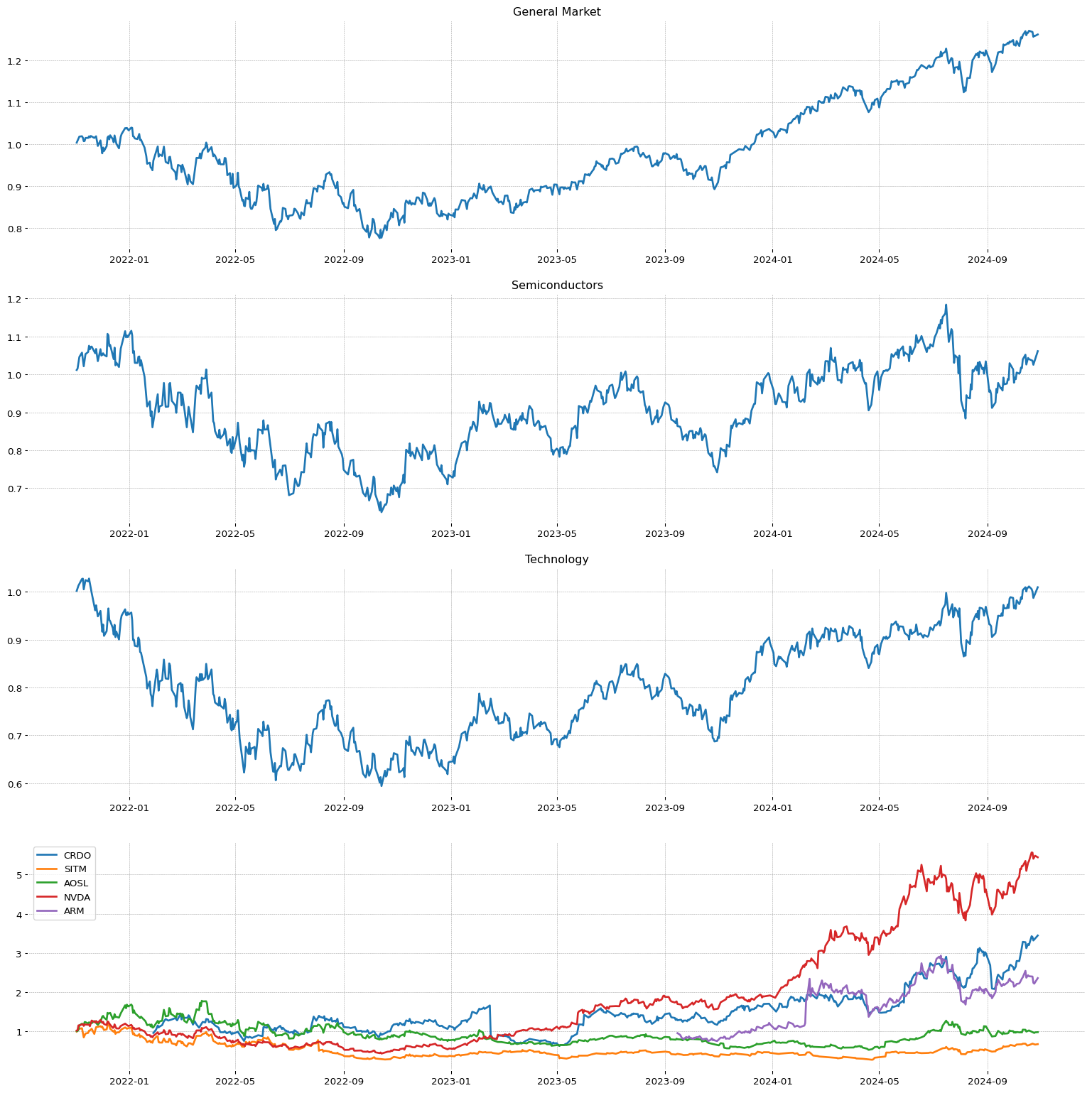

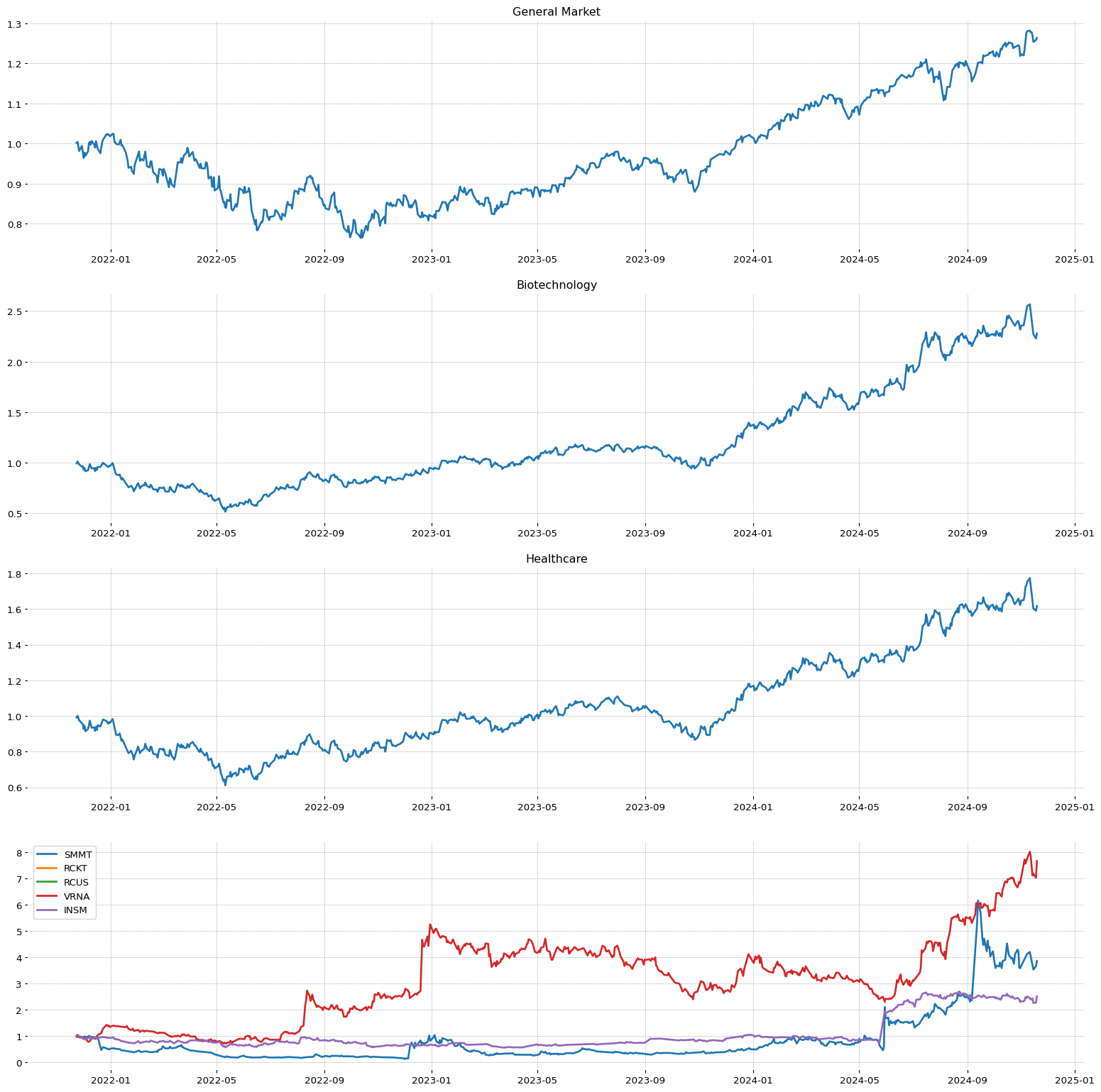

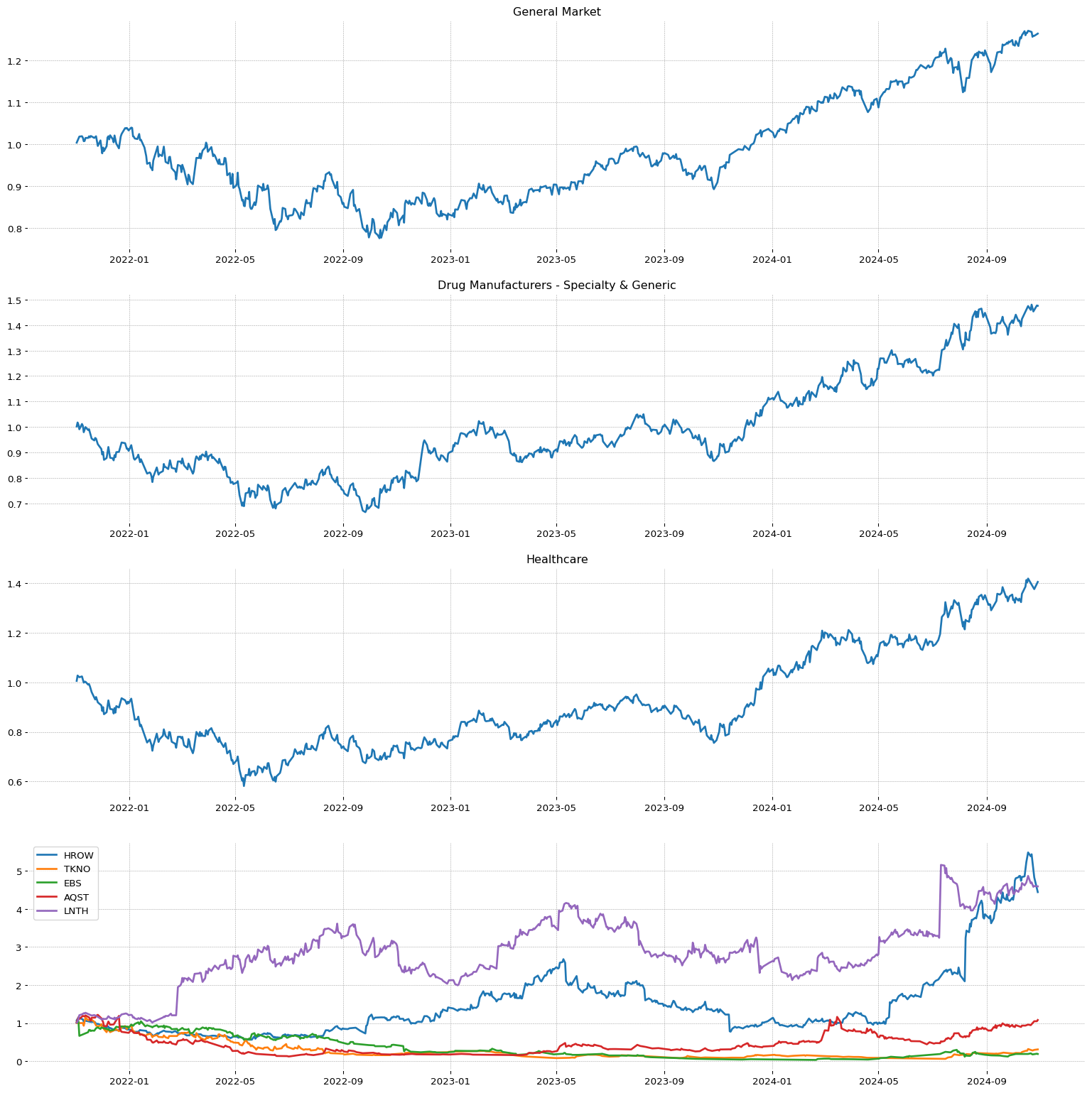

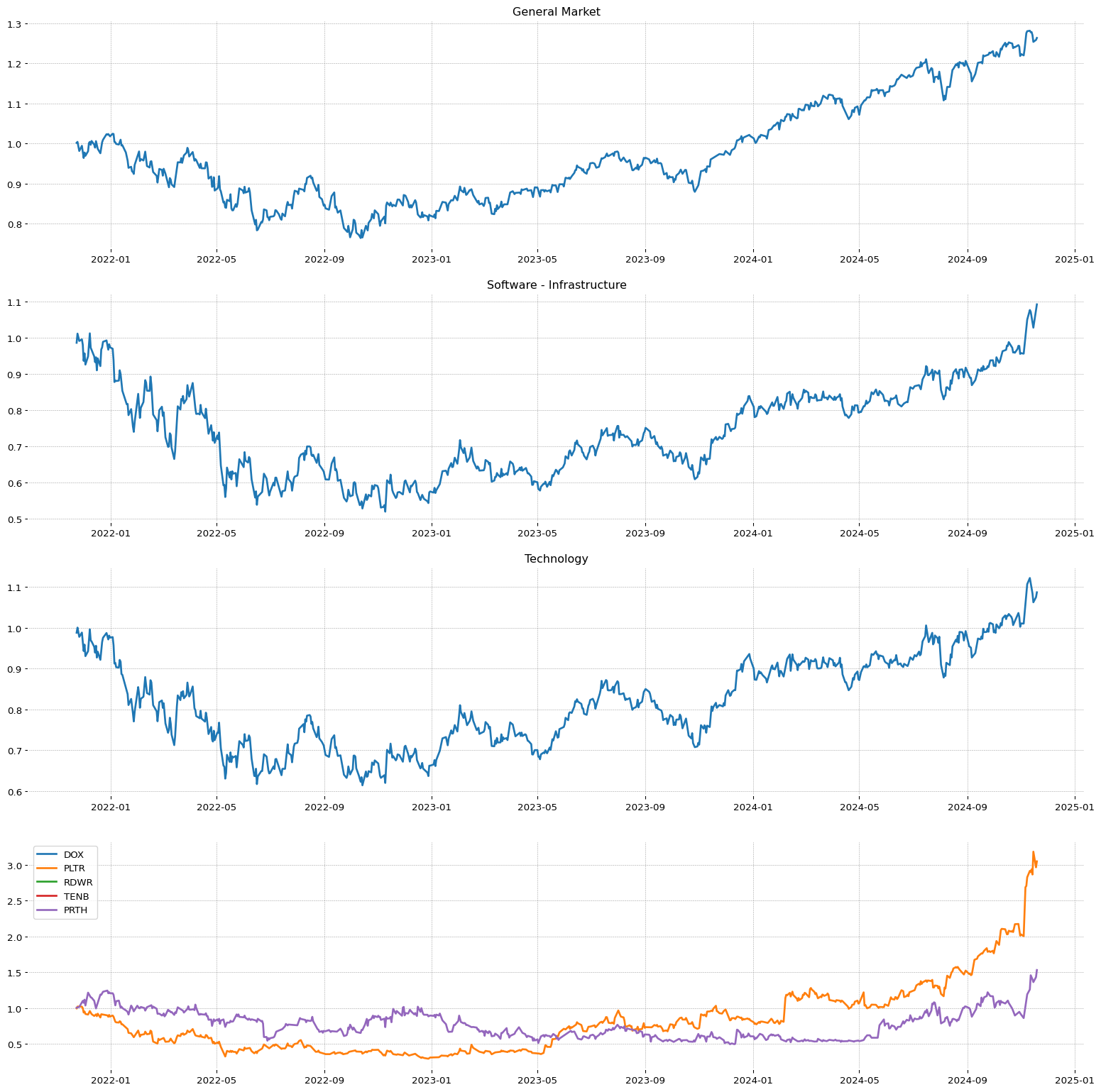

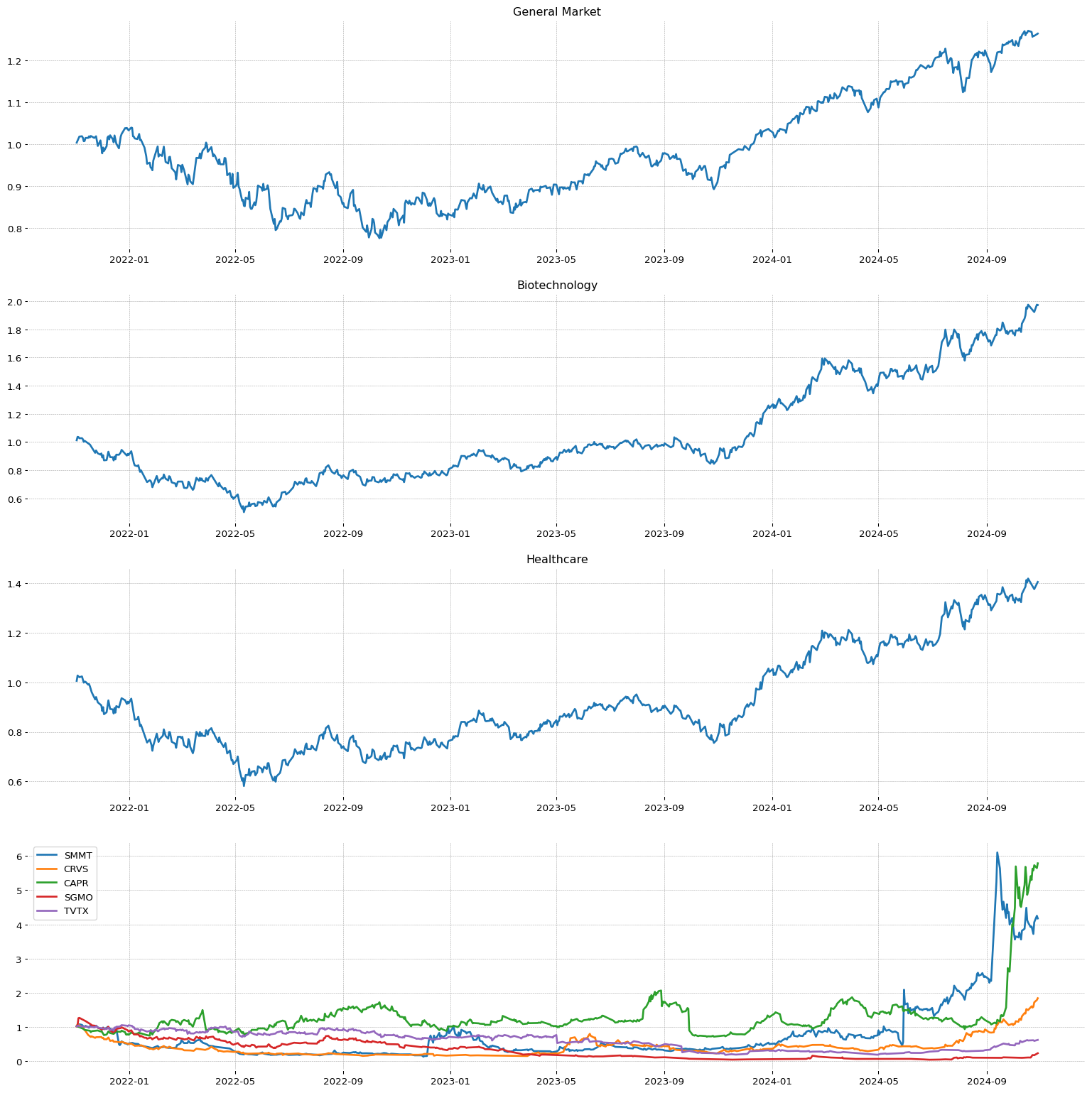

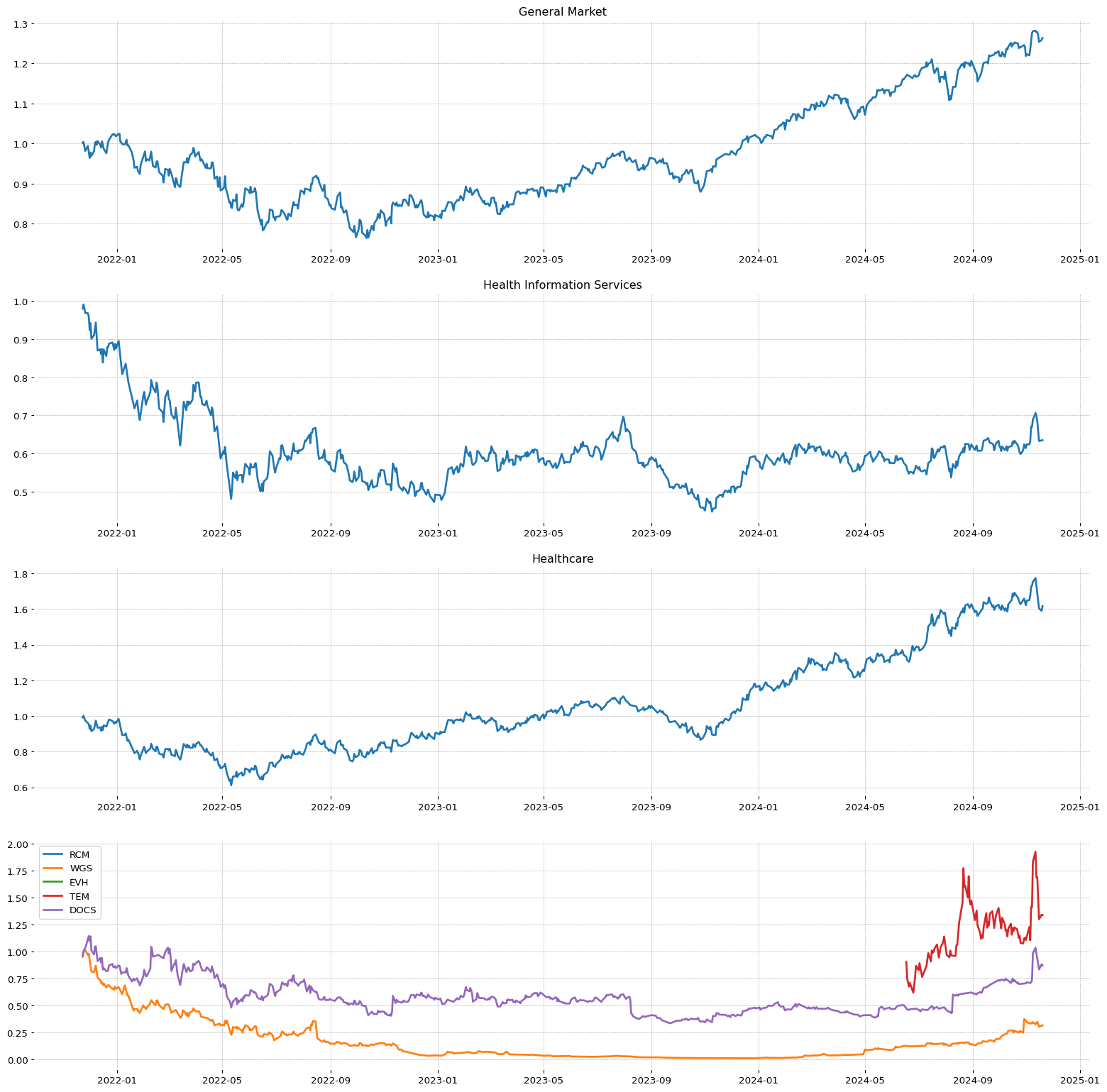

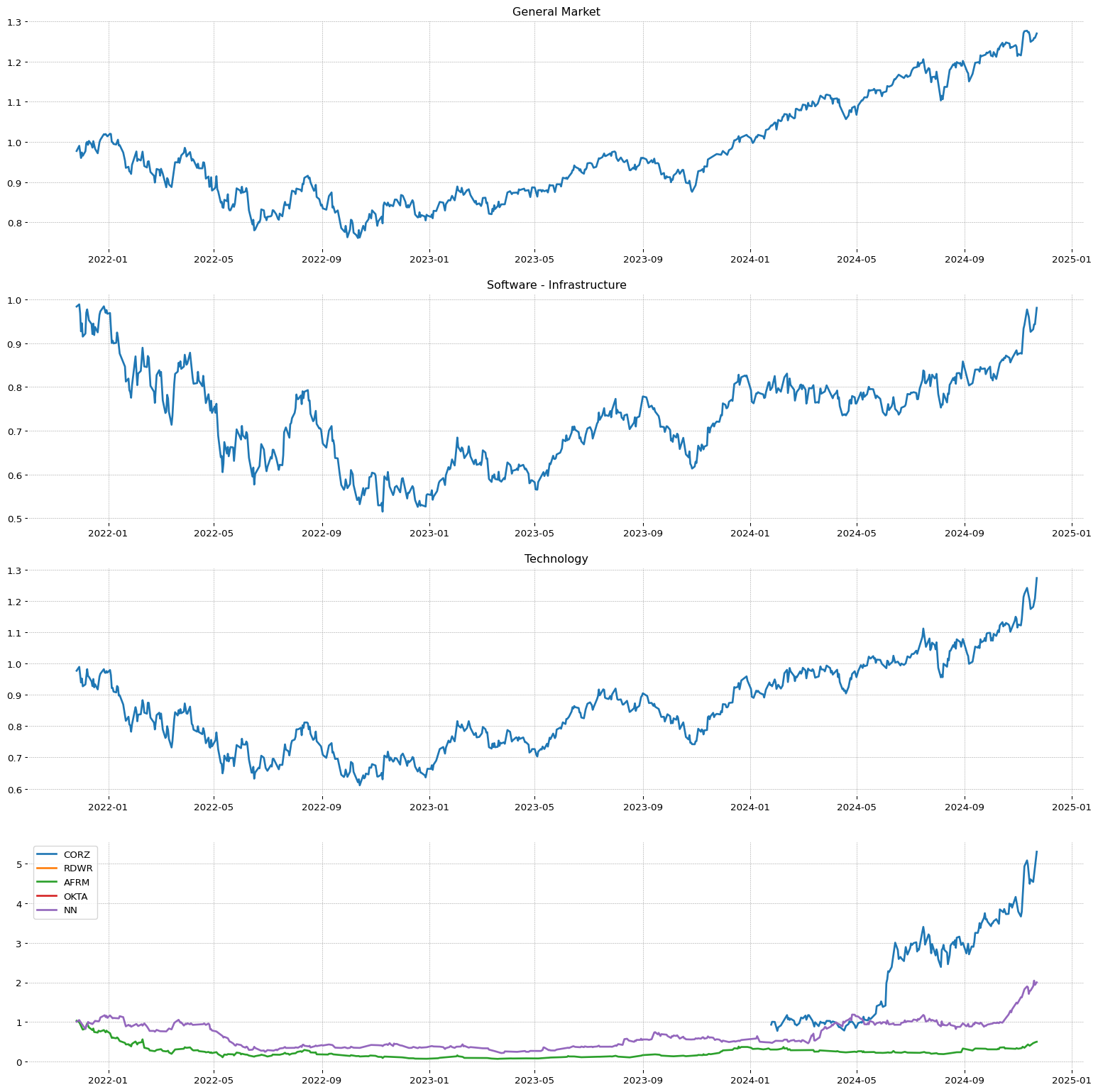

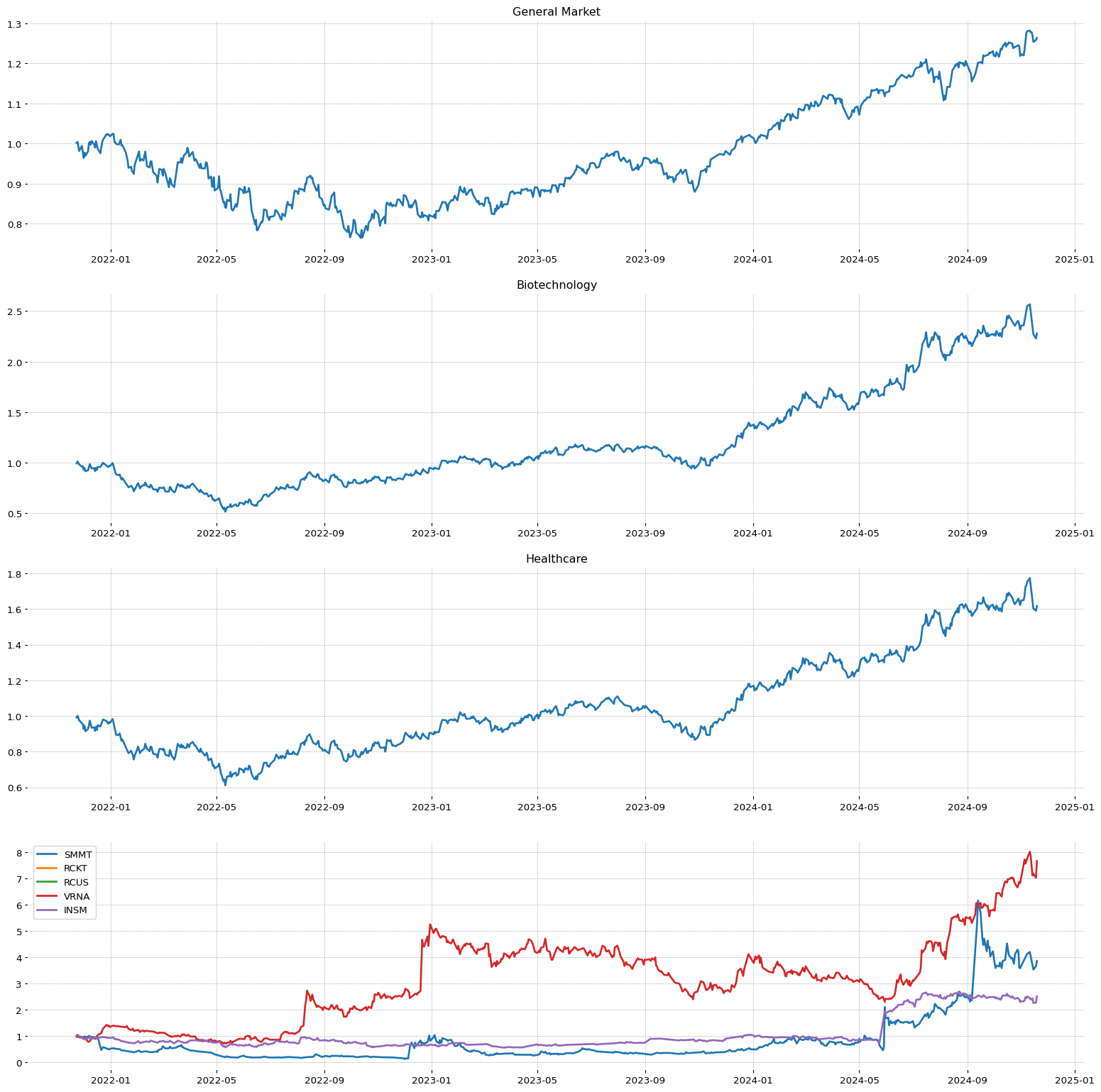

Market view: 5/7 (if value is >7 be careful)

Best 50 stock divided by Sector

| Sector Name | Valore |

| Healthcare | 27 |

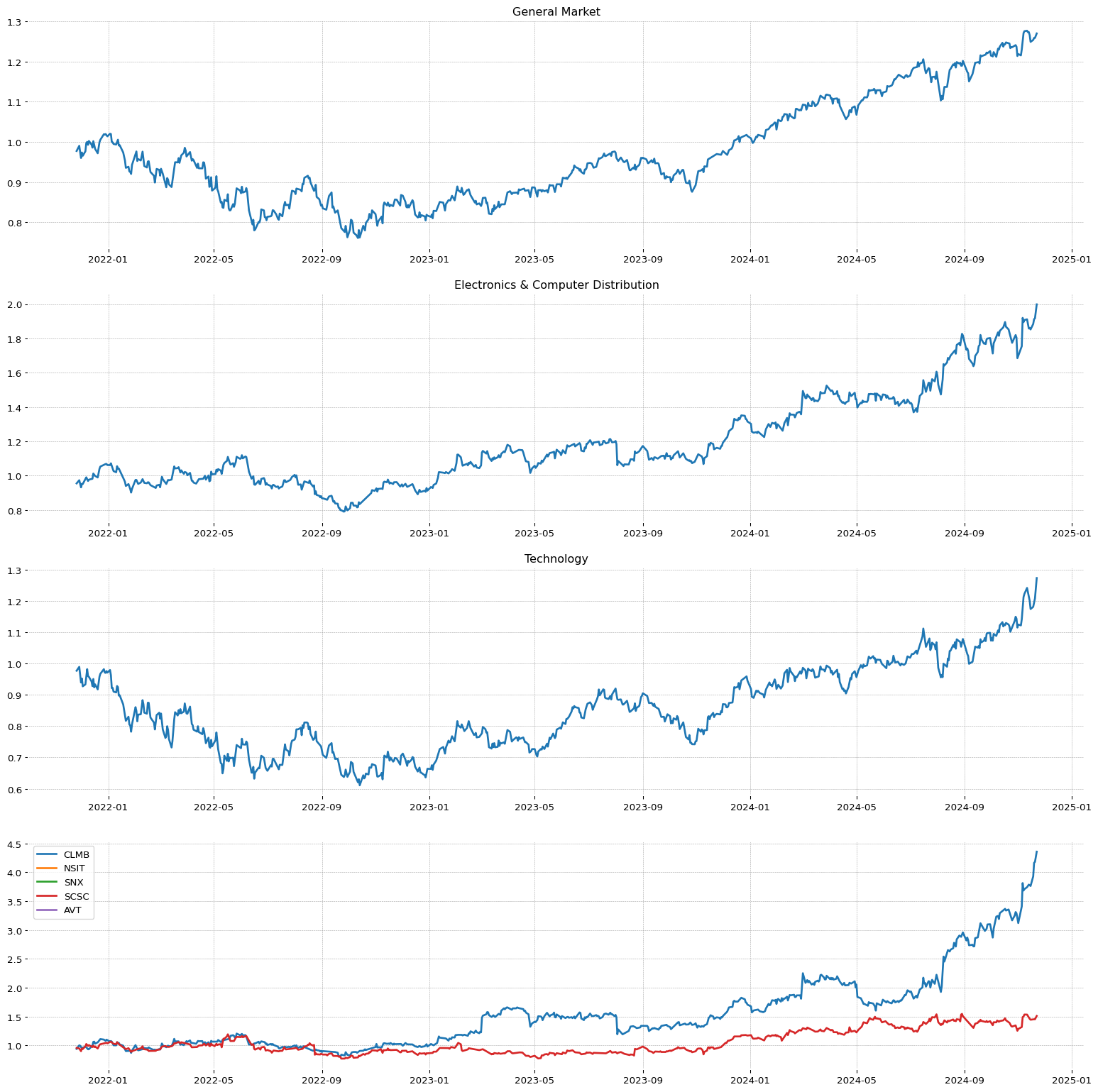

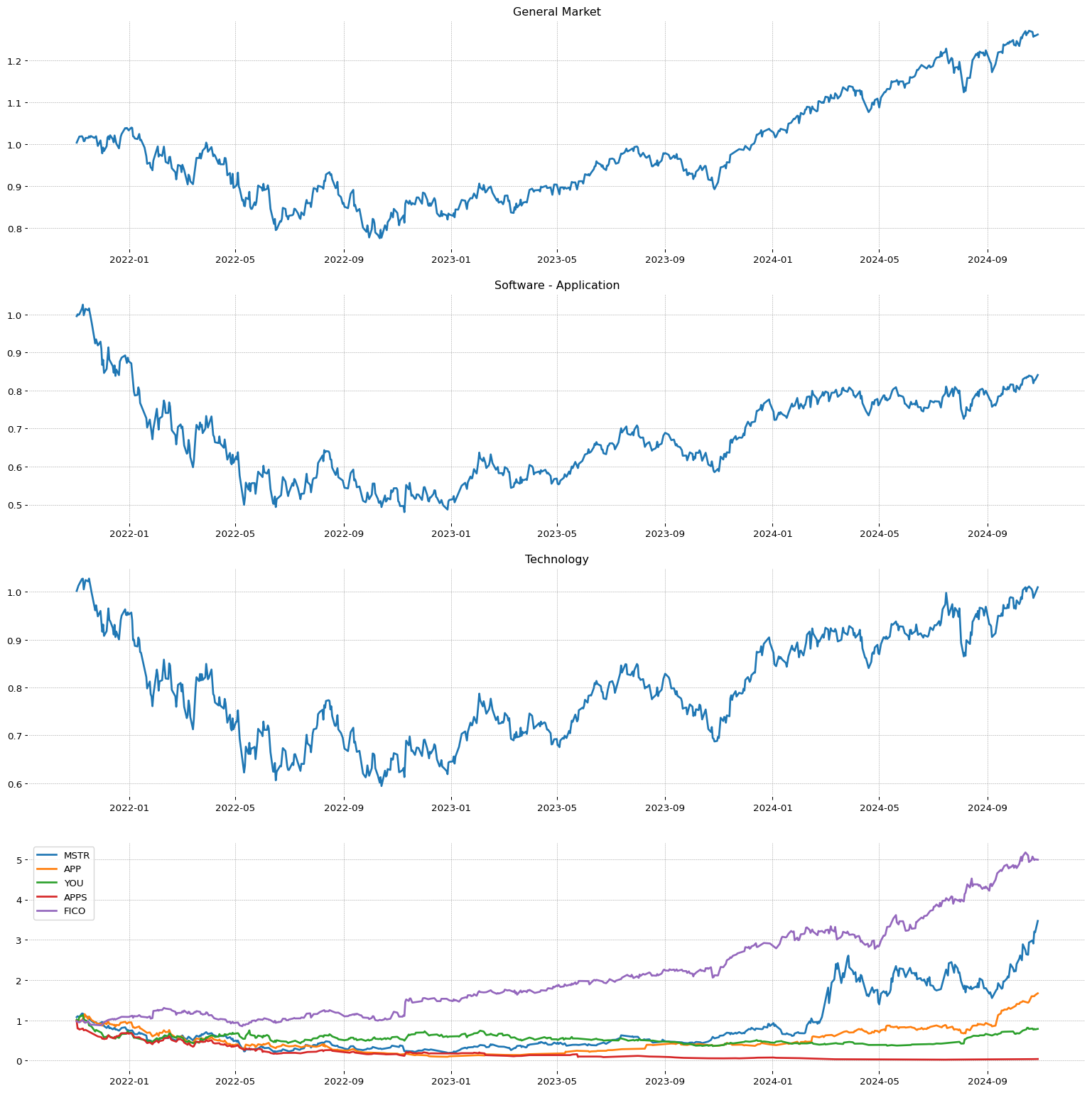

| Technology | 6 |

| Financial | 6 |

| Consumer Cyclical | 6 |

| Basic Materials | 3 |

| Industrials | 1 |

| Communication Services | 1 |

Best 50 stock divided by industry | Industry Name | Valore |

| Biotechnology | 21 |

| Software - Application | 3 |

| Banks - Regional | 3 |

| Communication Equipment | 2 |

| Specialty Retail | 2 |

| Medical Instruments & Supplies | 1 |

| Information Technology Services | 1 |

| Telecom Services | 1 |

| Medical Devices | 1 |

| Leisure | 1 |

| Chemicals | 1 |

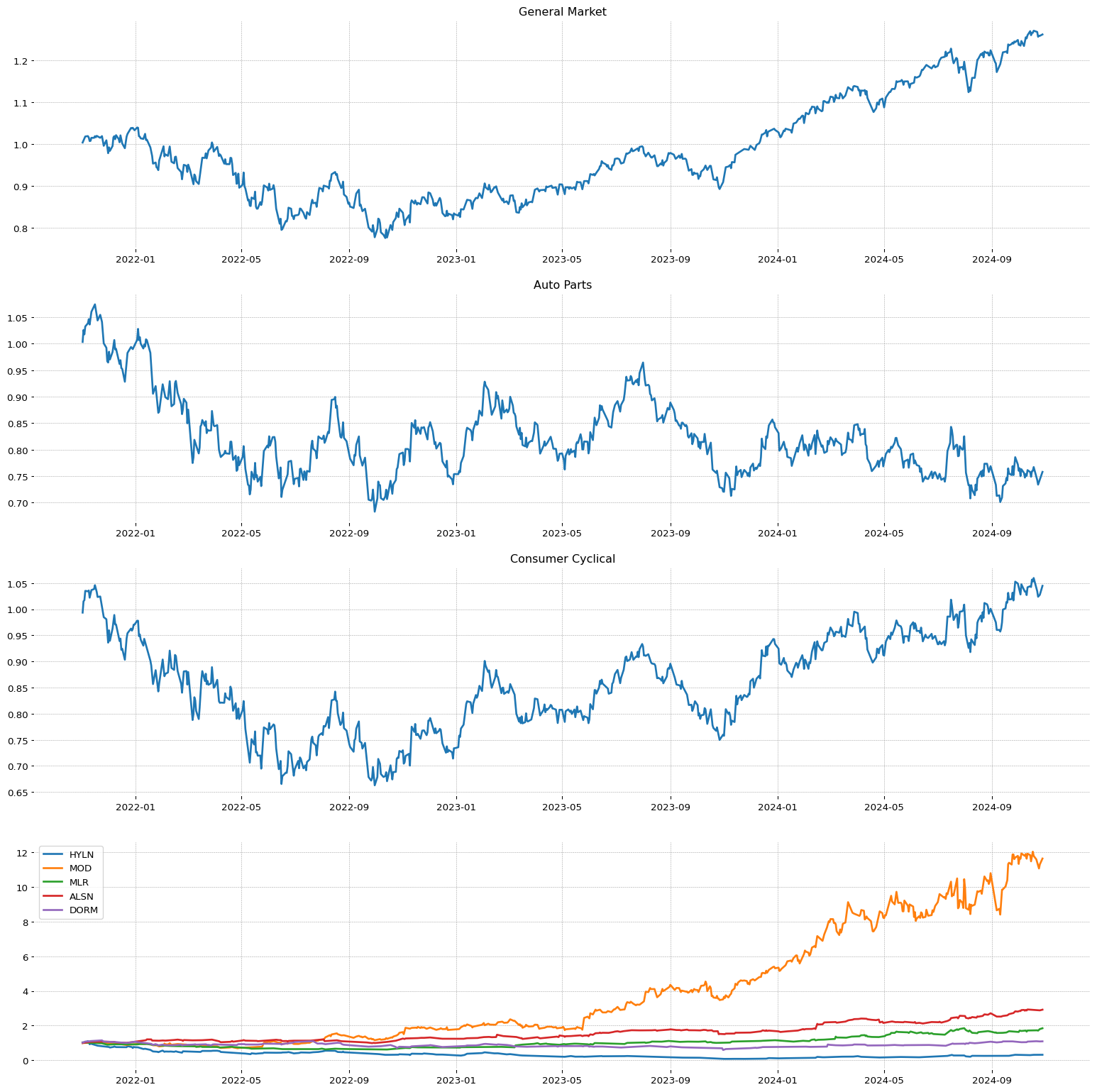

| Auto Parts | 1 |

| Credit Services | 1 |

| Restaurants | 1 |

| Specialty Industrial Machinery | 1 |

| Other Precious Metals & Mining | 1 |

| Healthcare Plans | 1 |

| Diagnostics & Research | 1 |

| Health Information Services | 1 |

| Financial Conglomerates | 1 |

| Specialty Chemicals | 1 |

| Drug Manufacturers - Specialty & Generic | 1 |

| Auto & Truck Dealerships | 1 |

| Insurance - Property & Casualty | 1 |

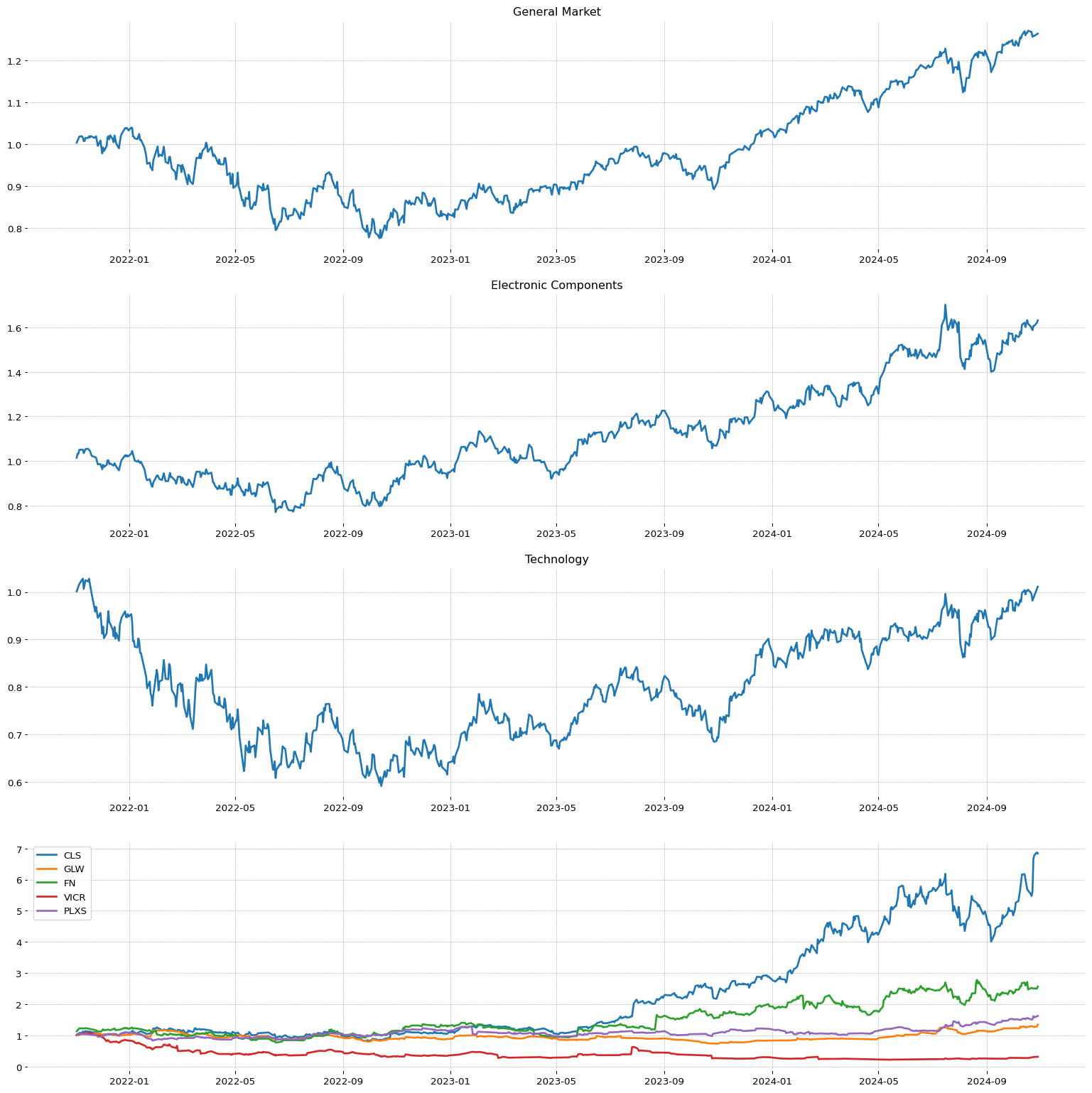

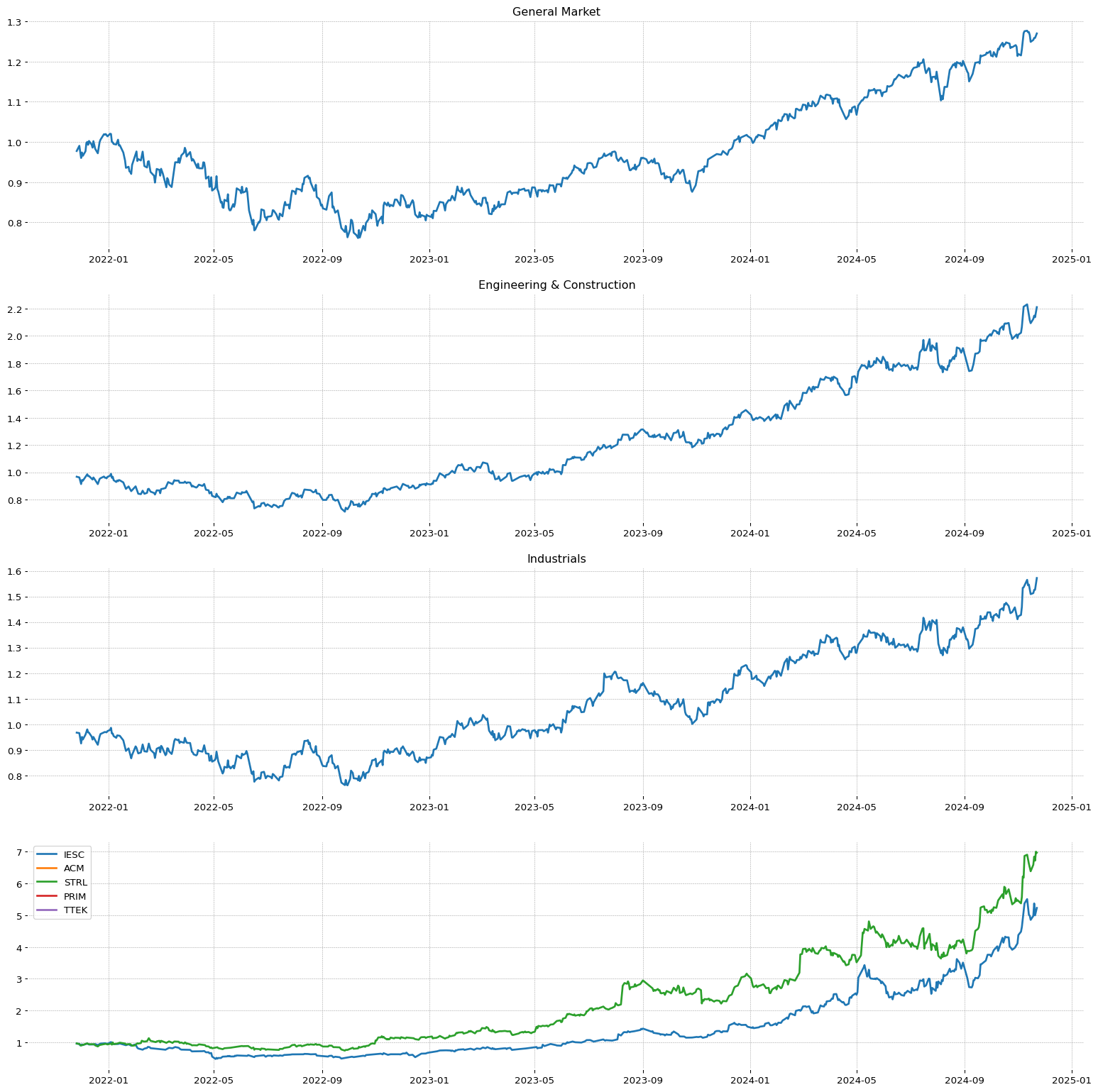

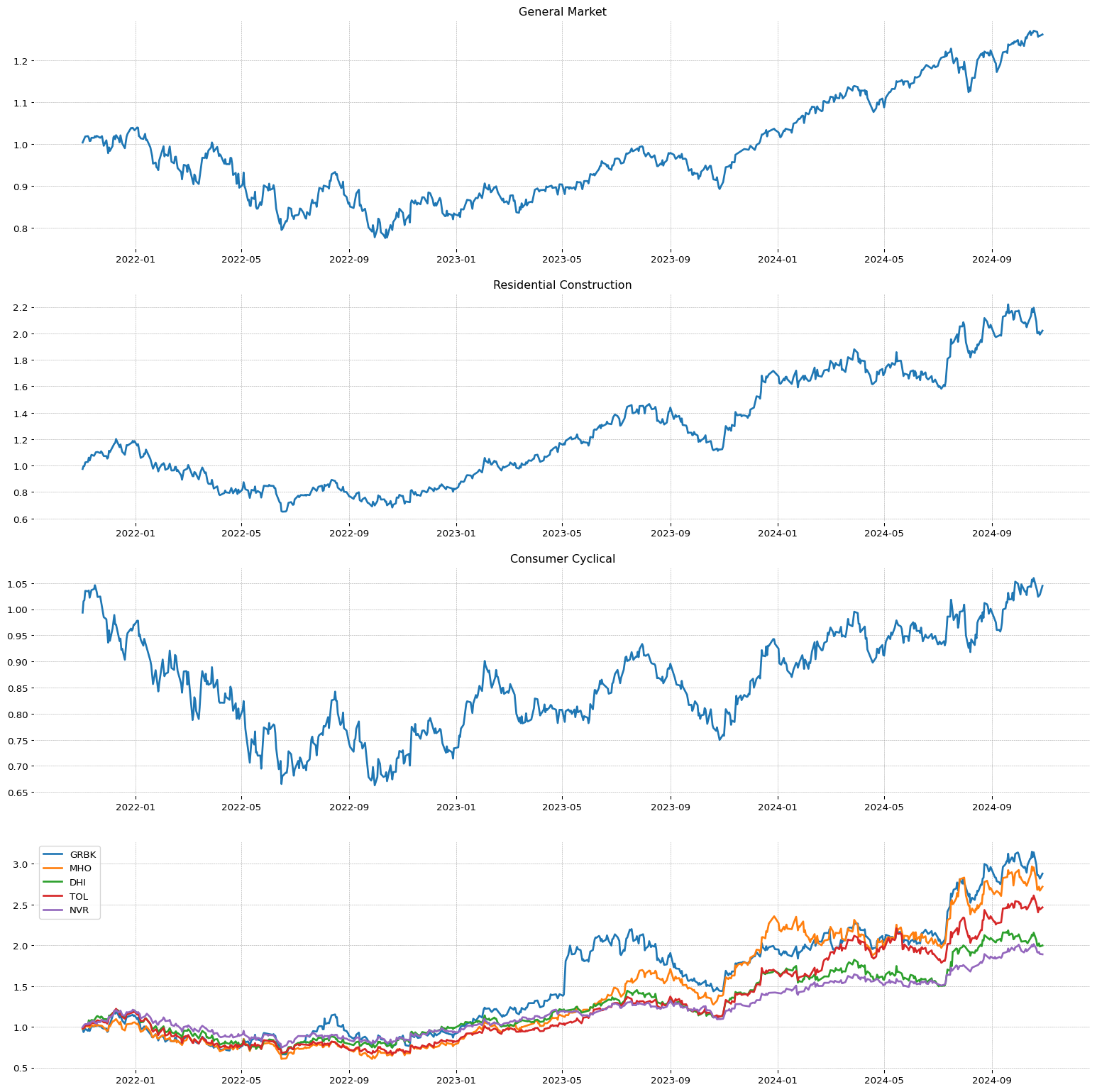

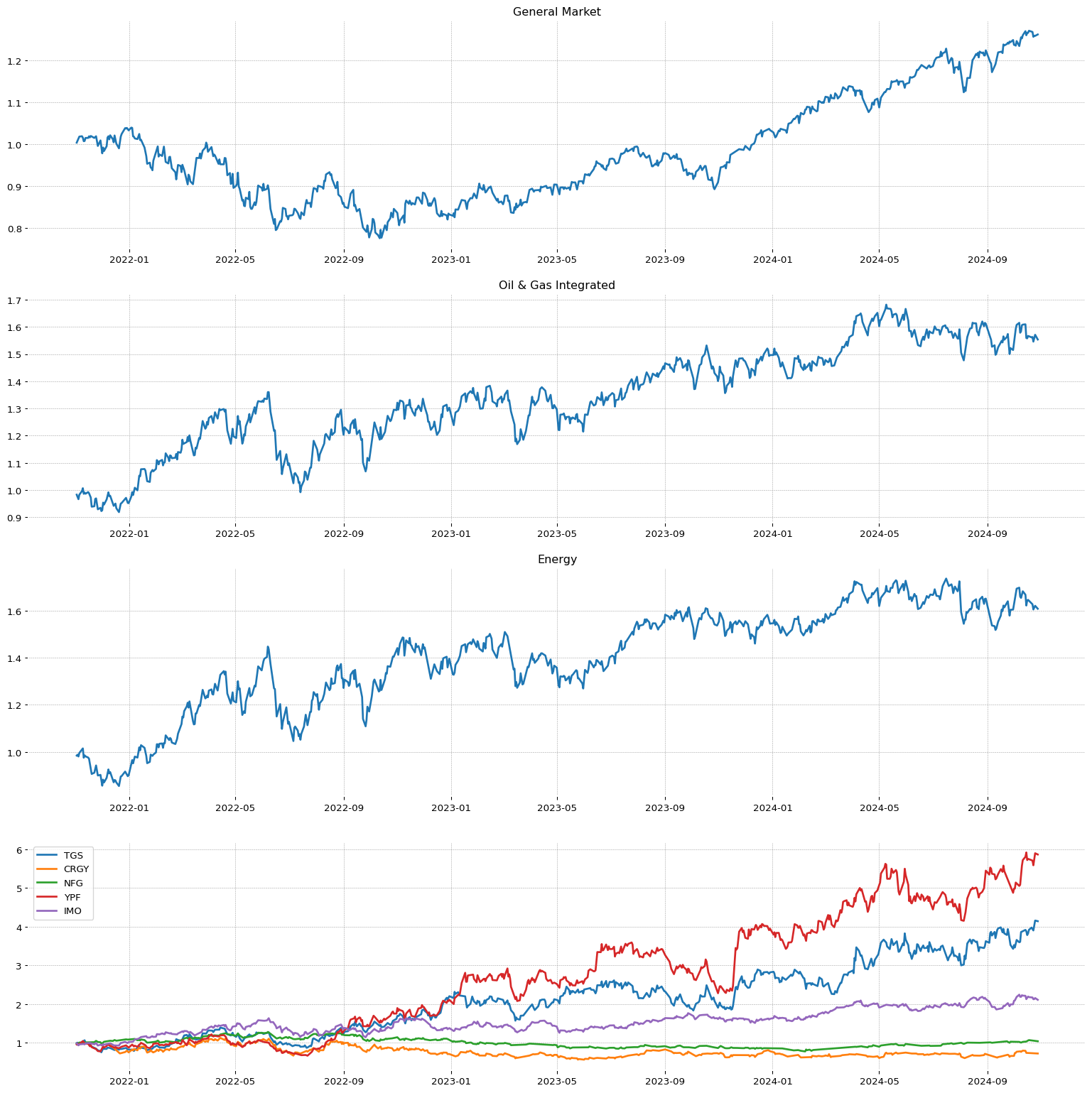

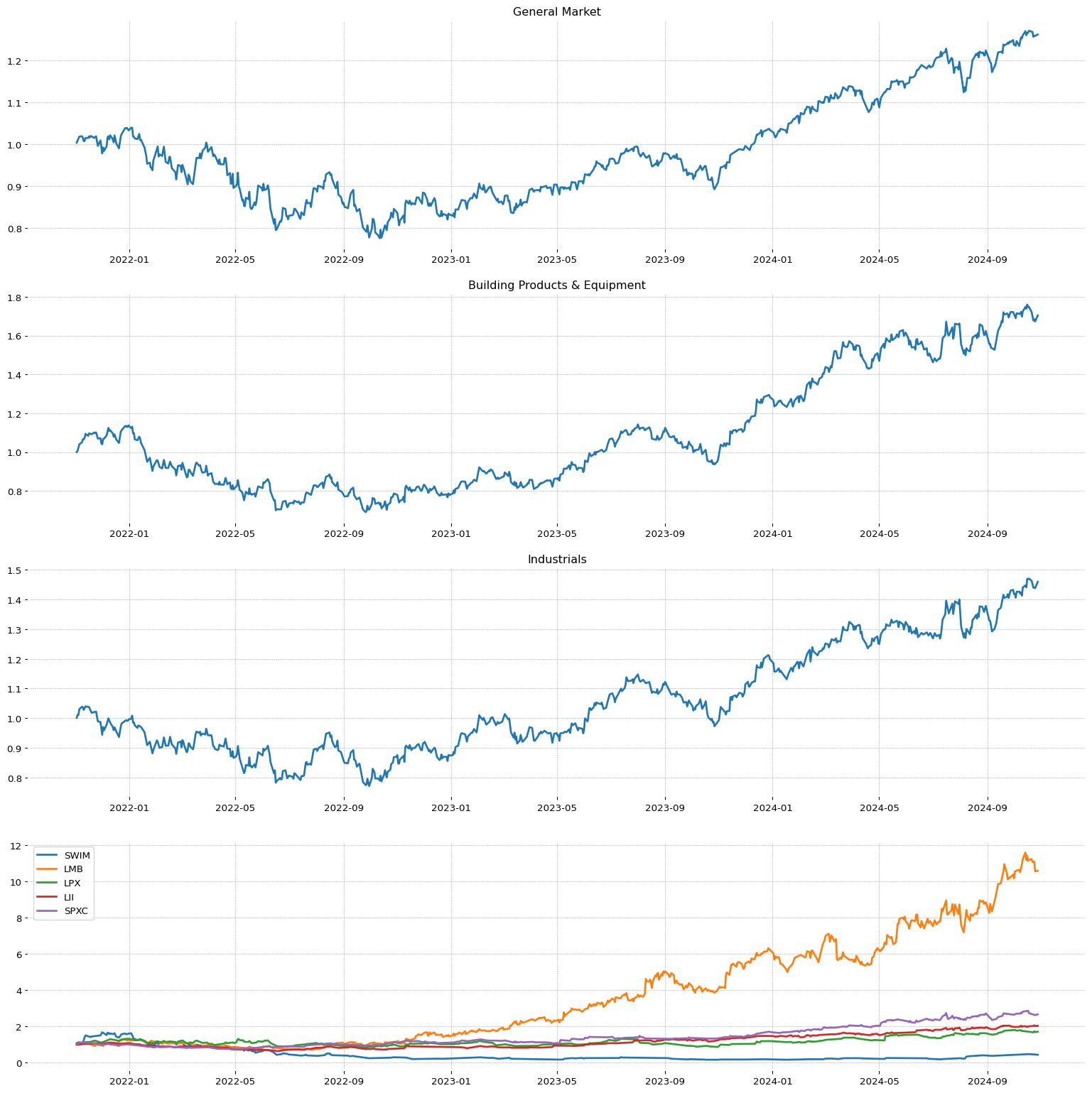

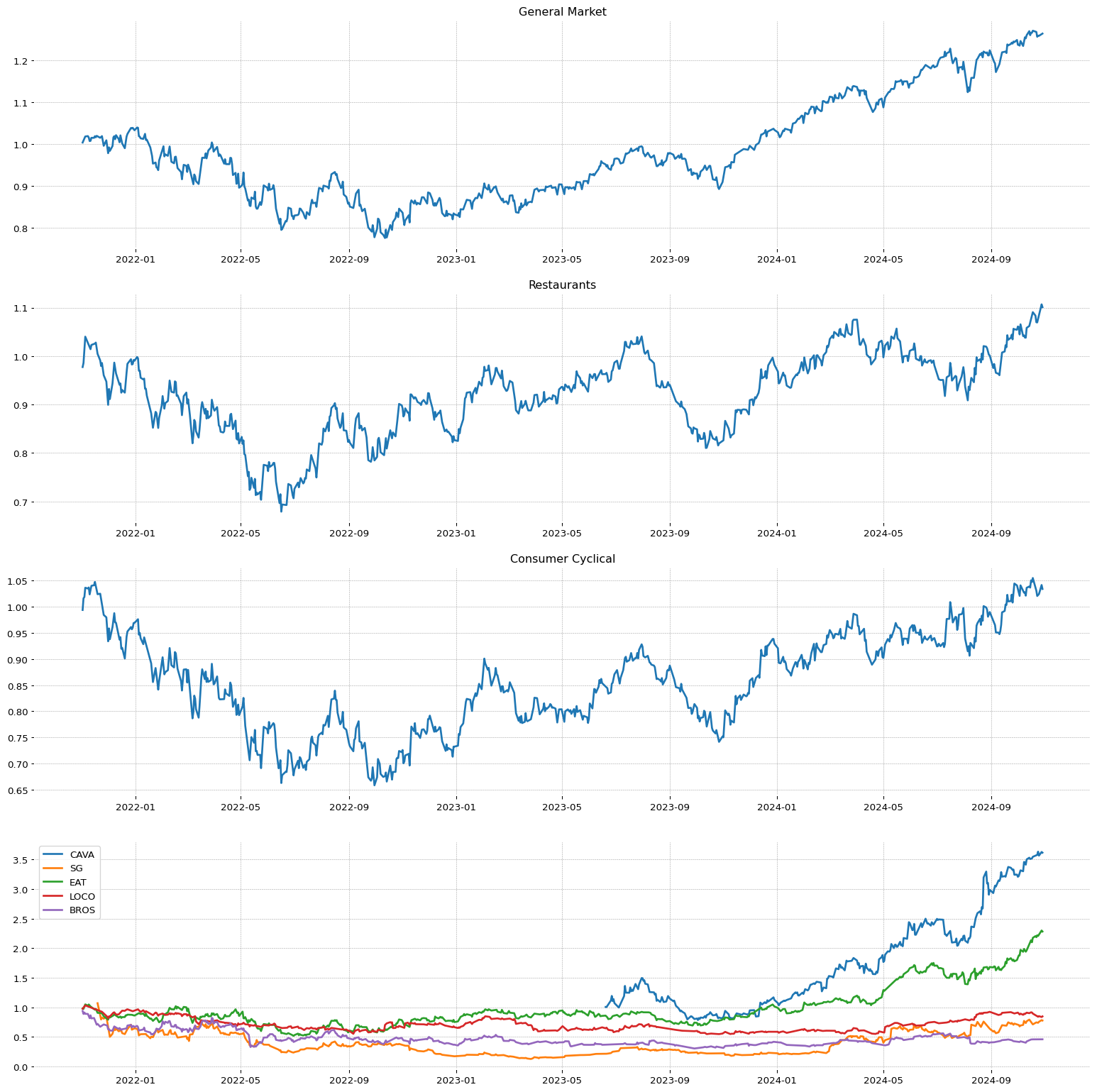

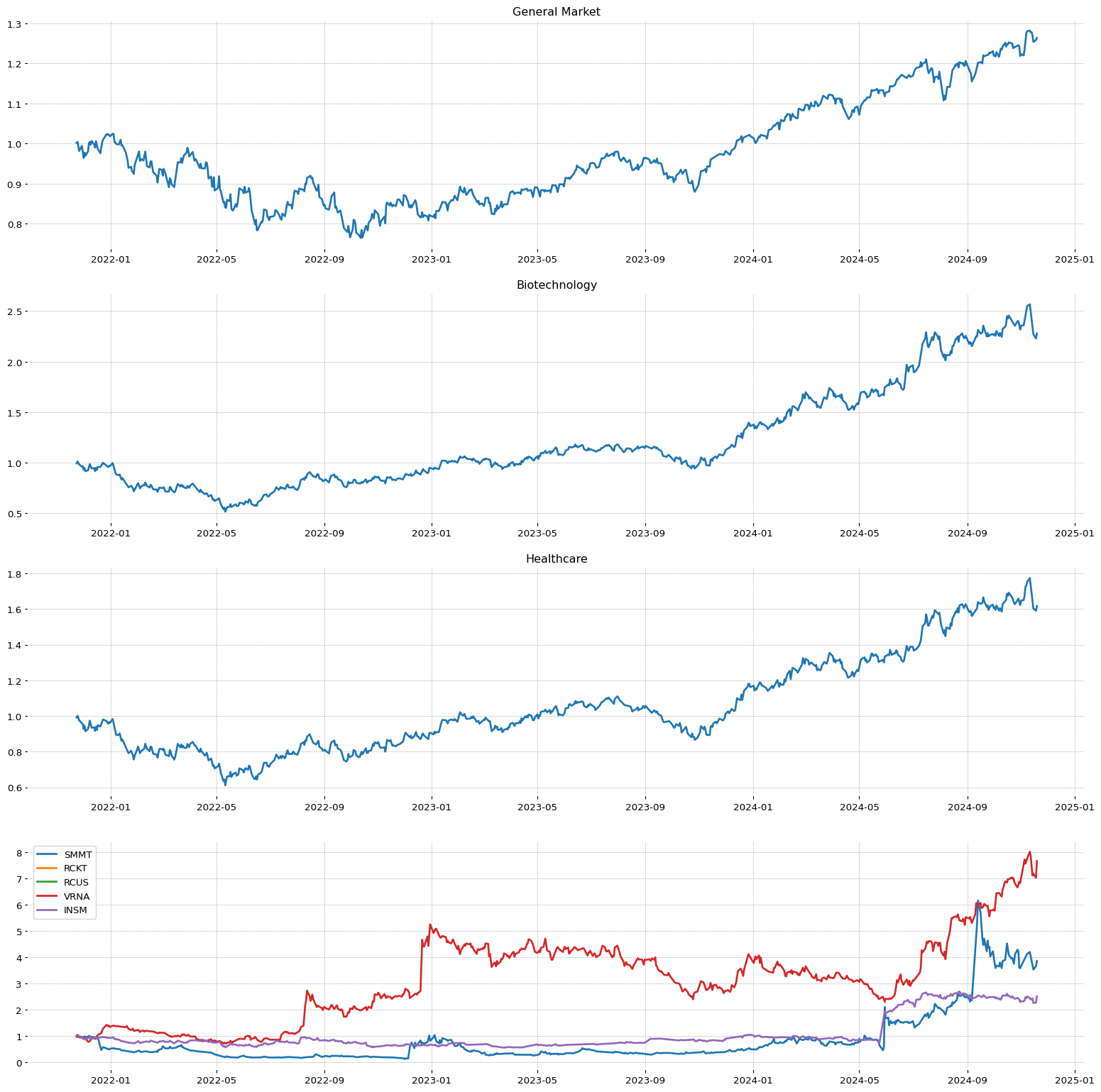

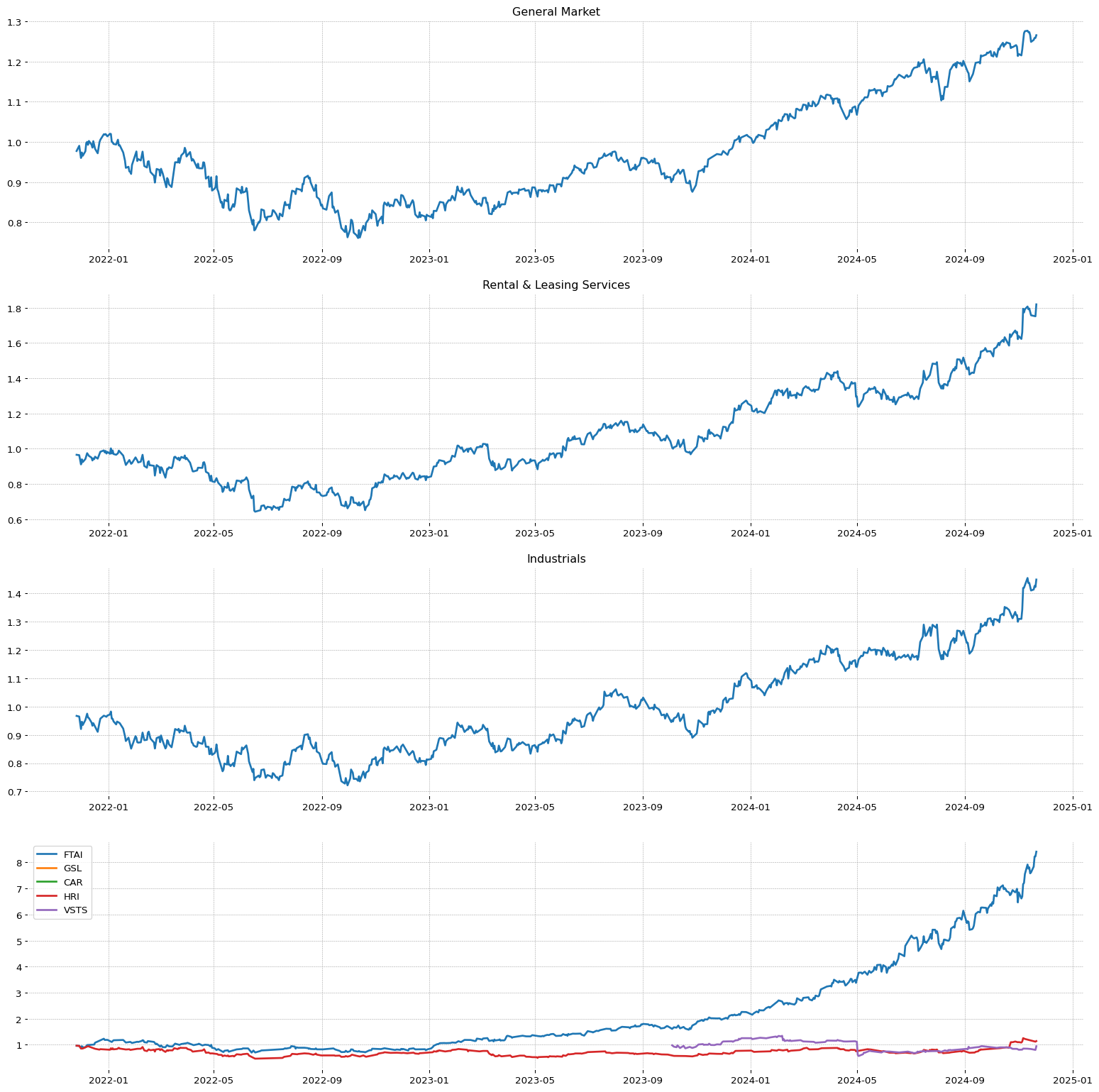

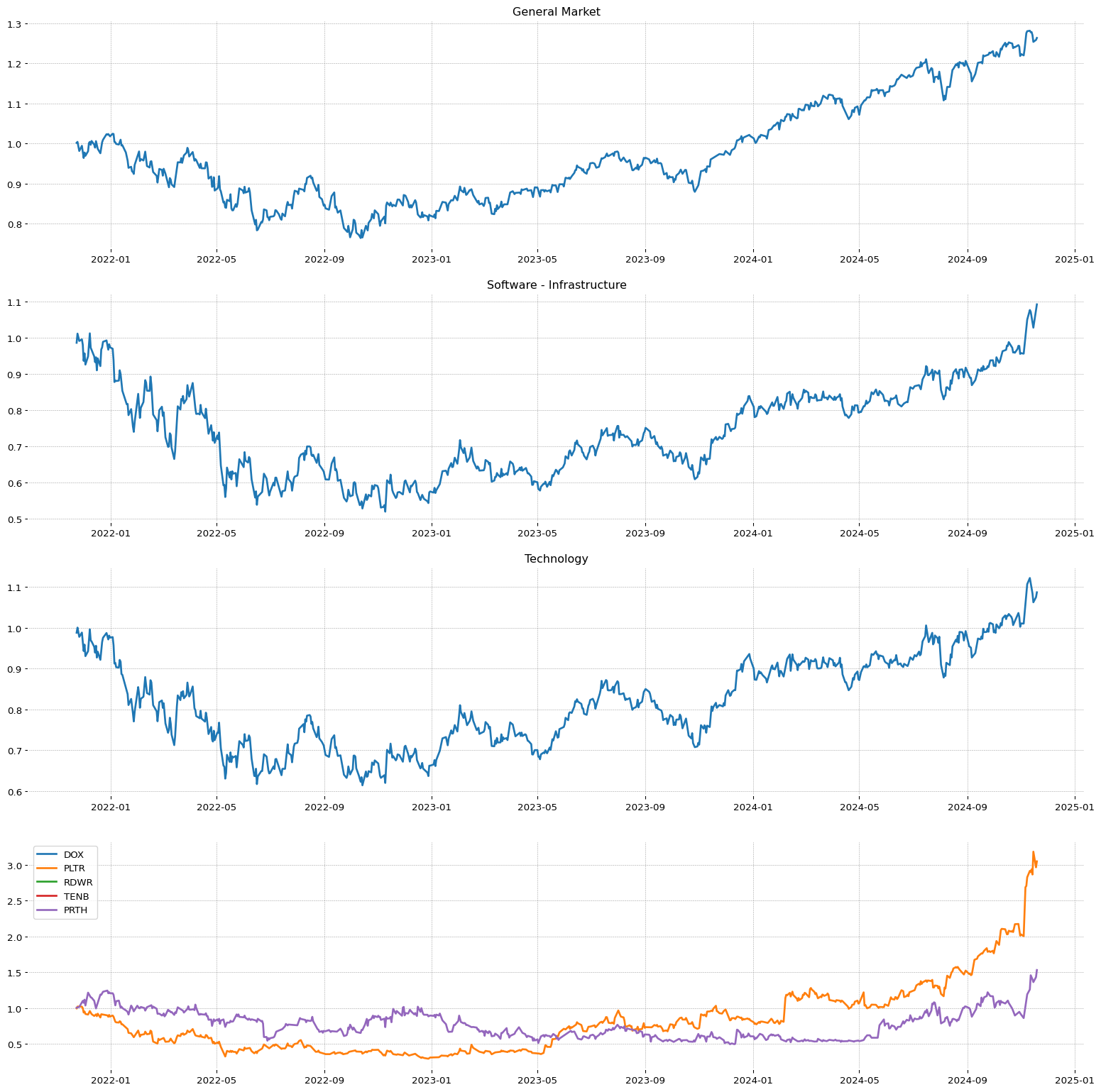

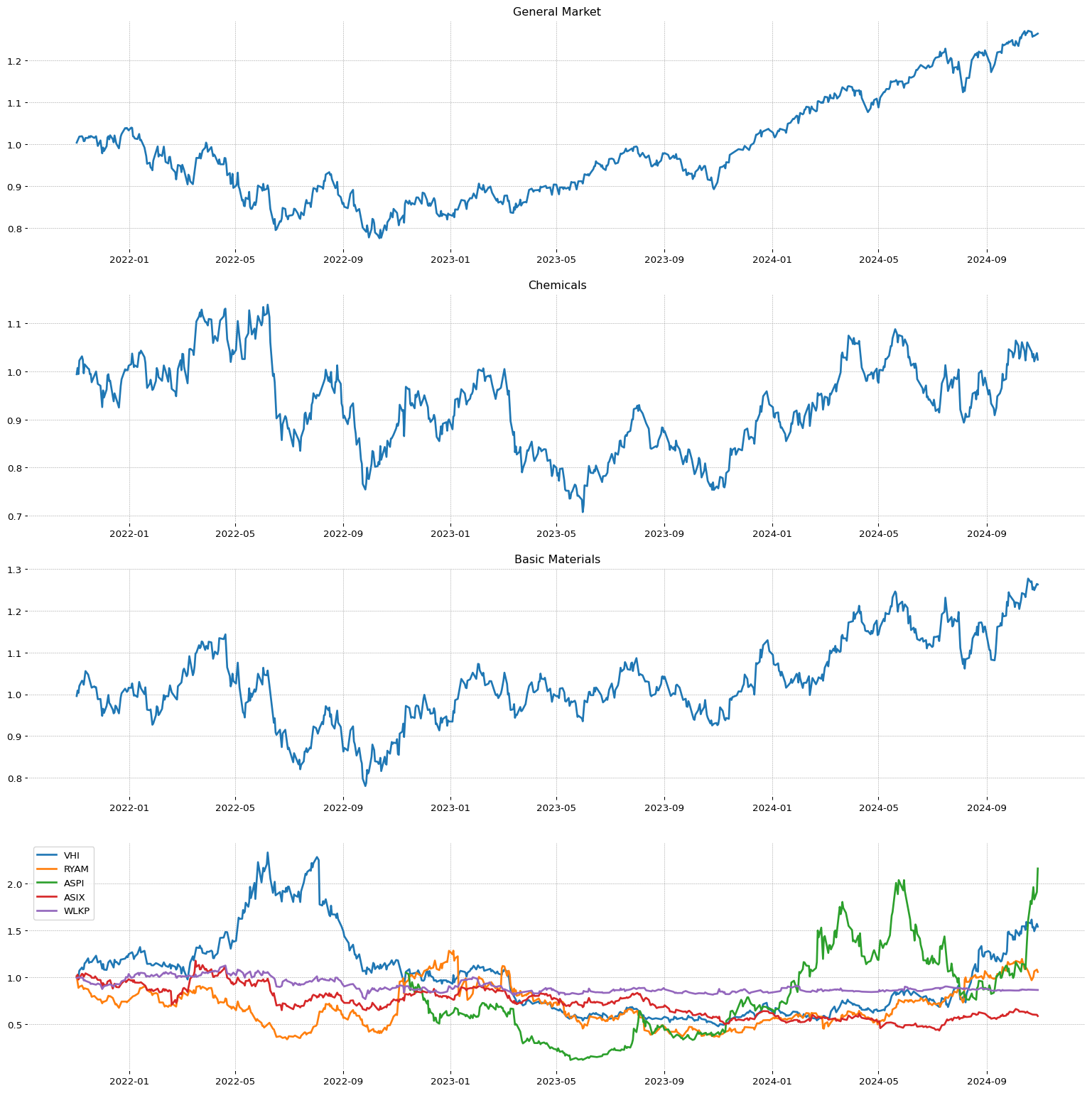

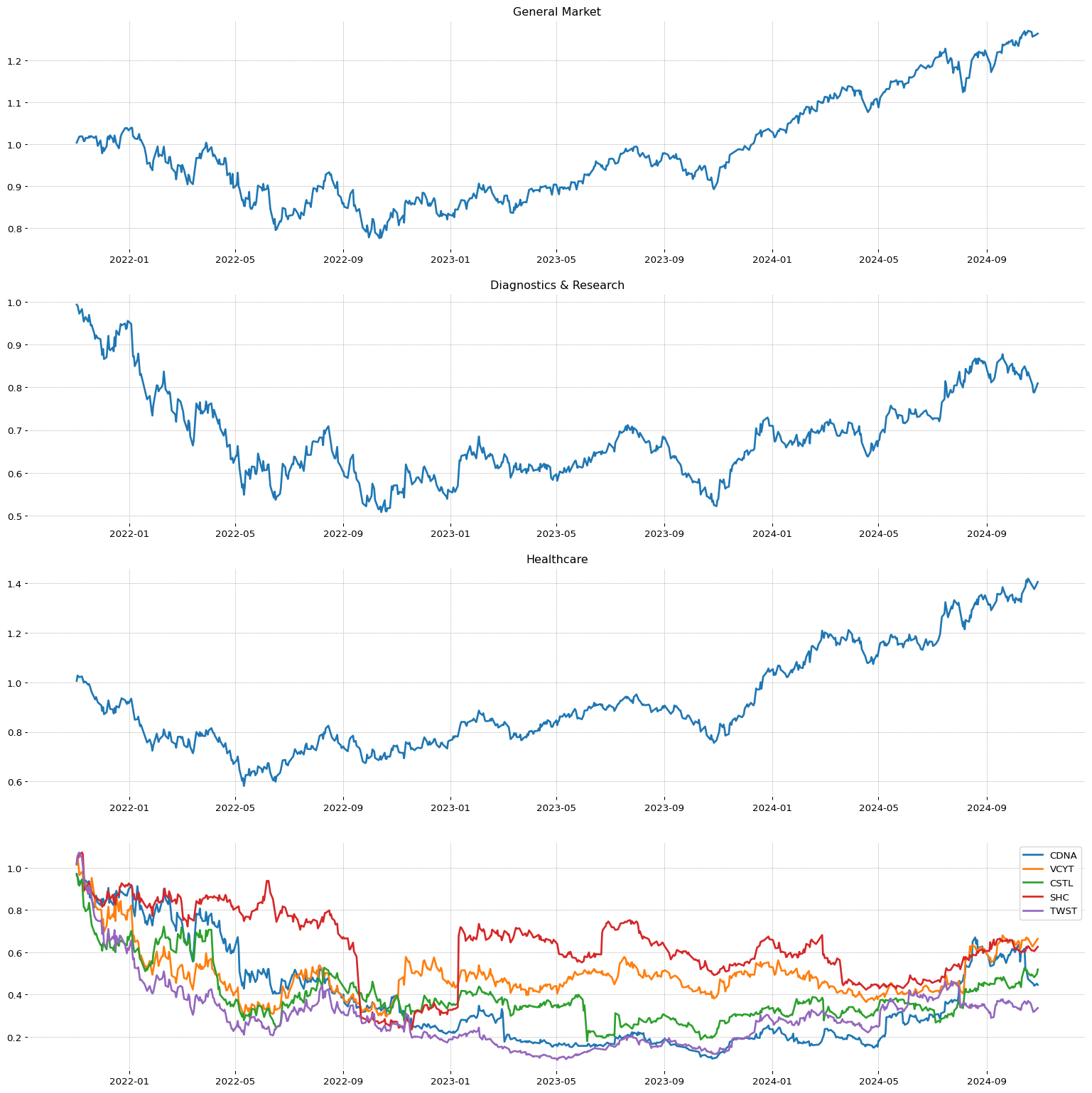

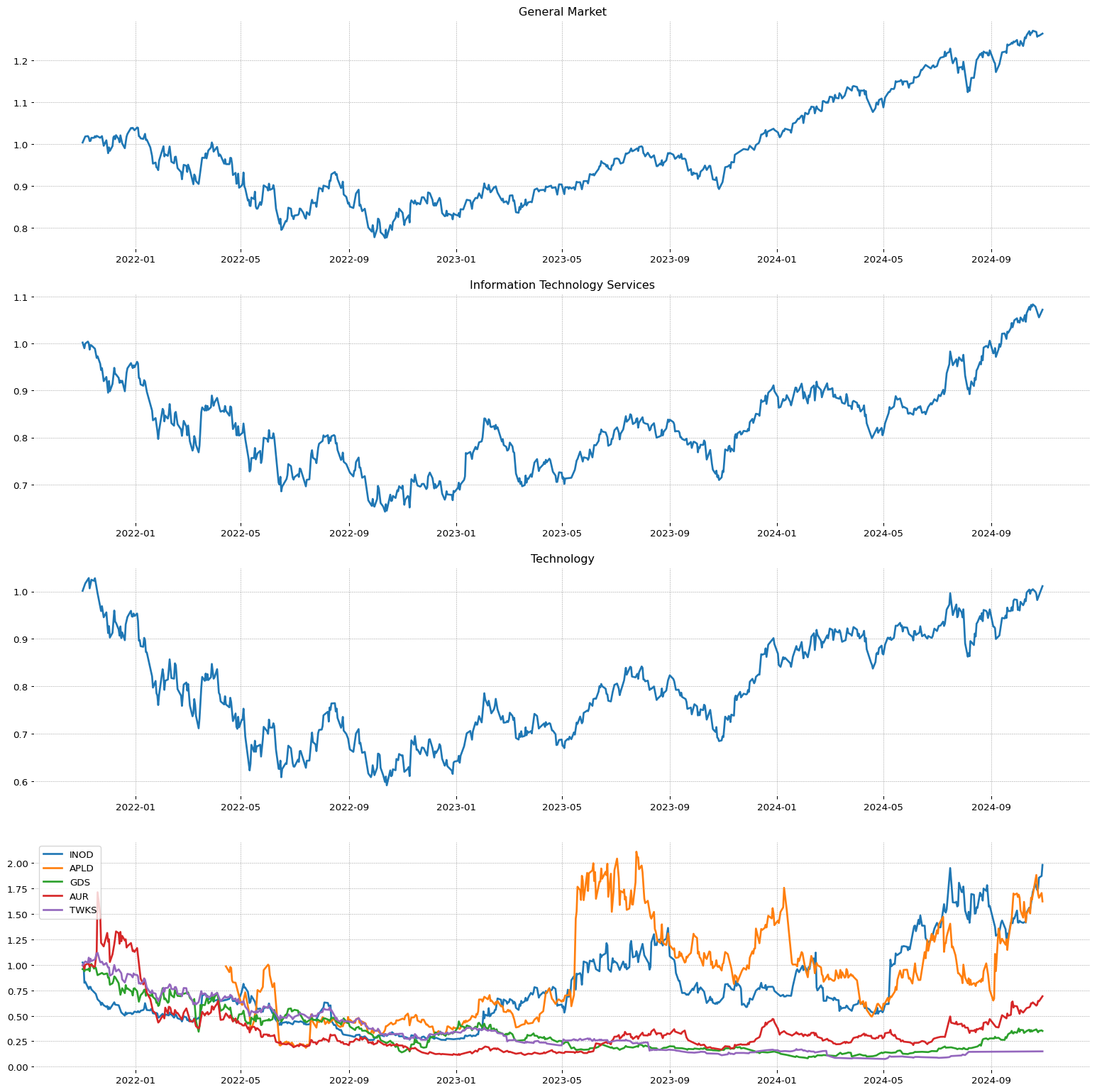

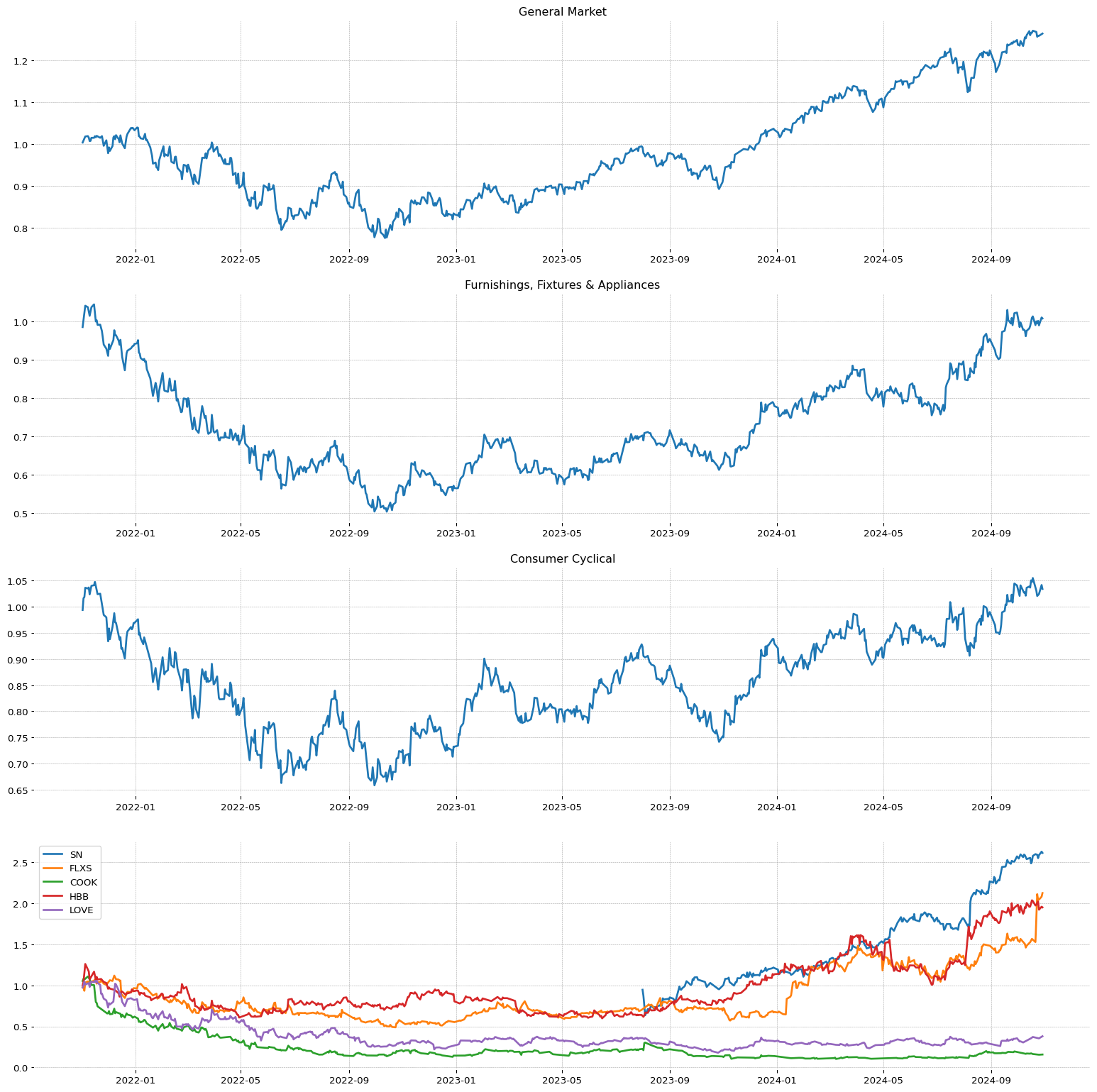

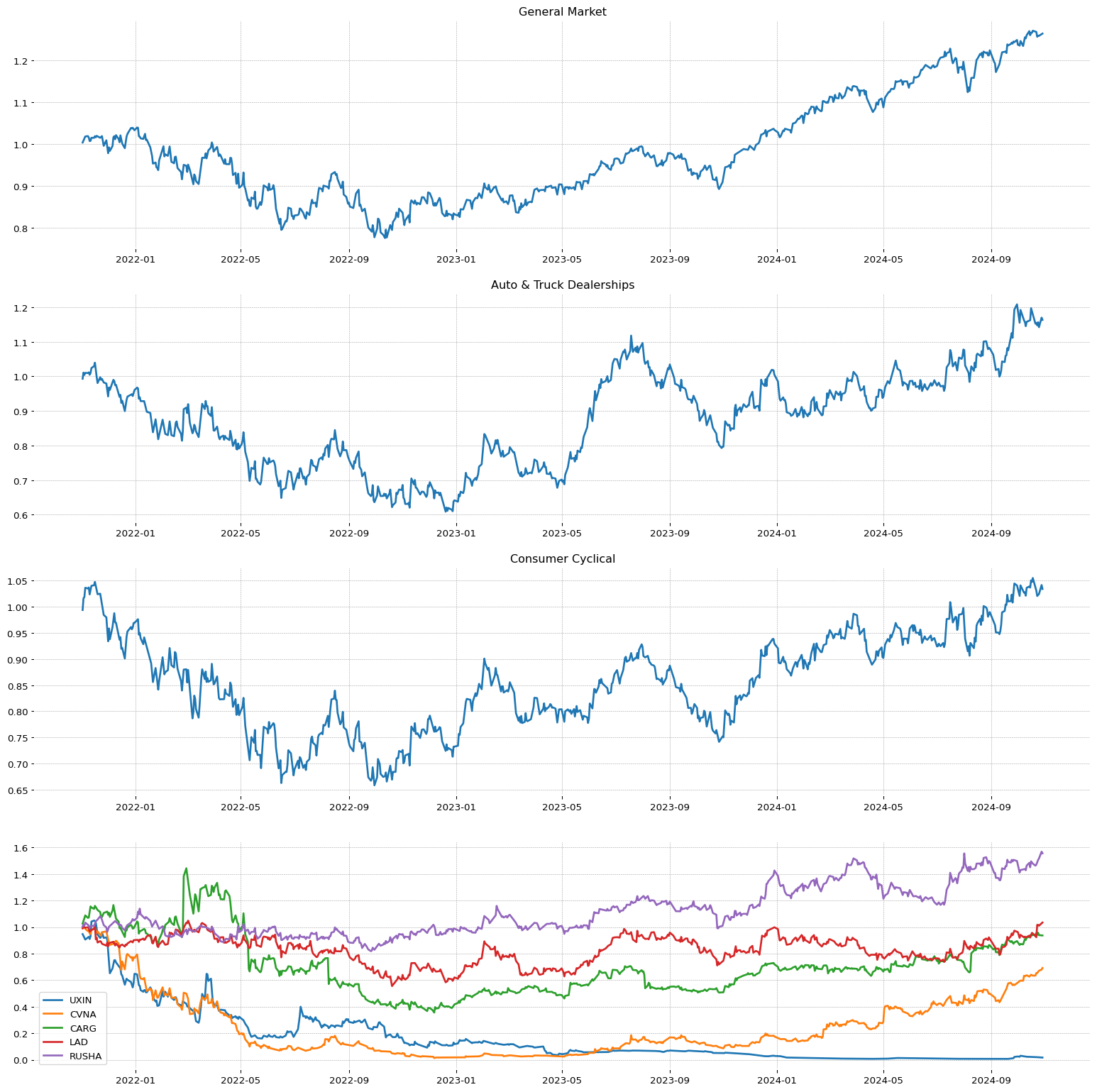

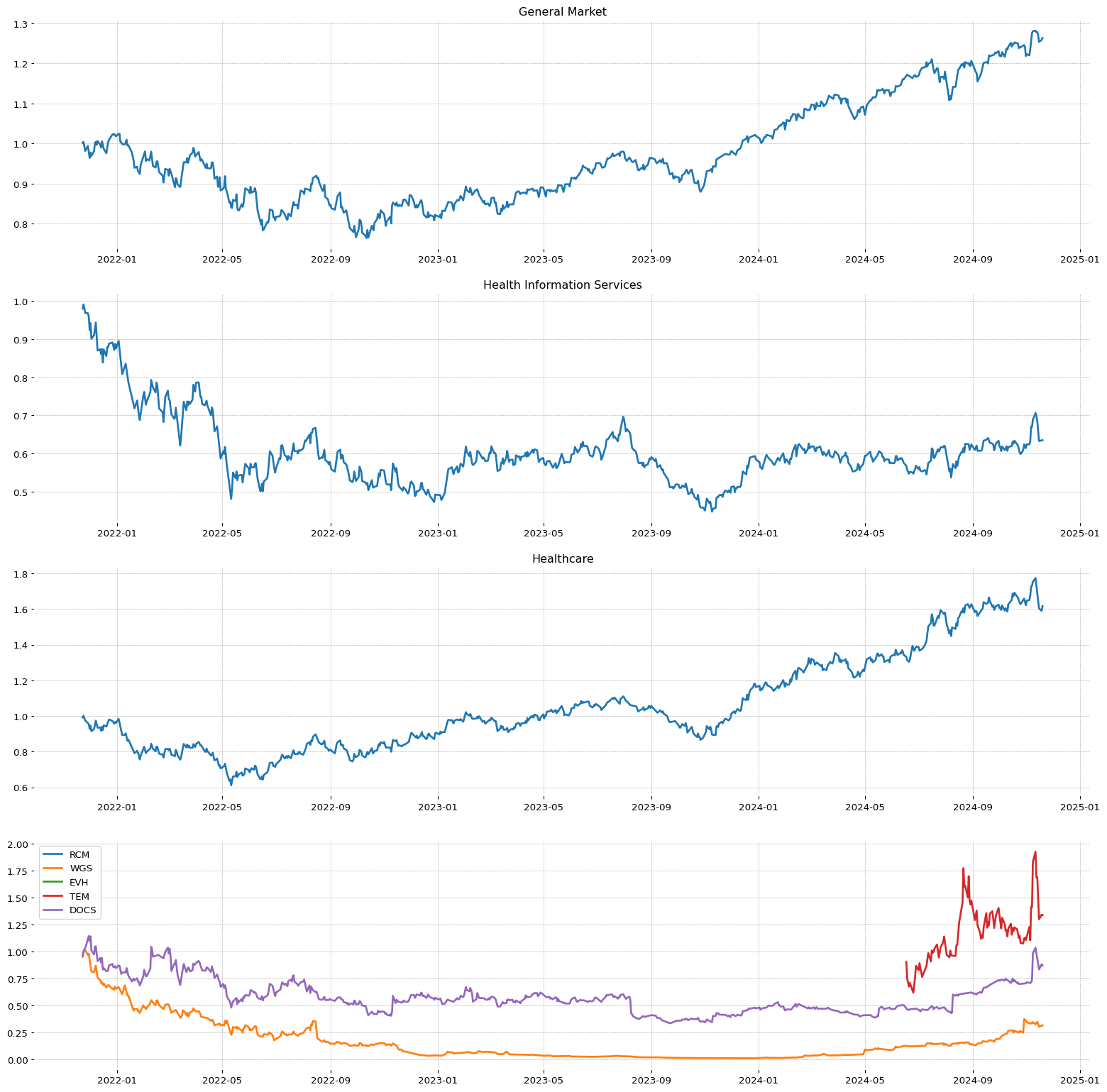

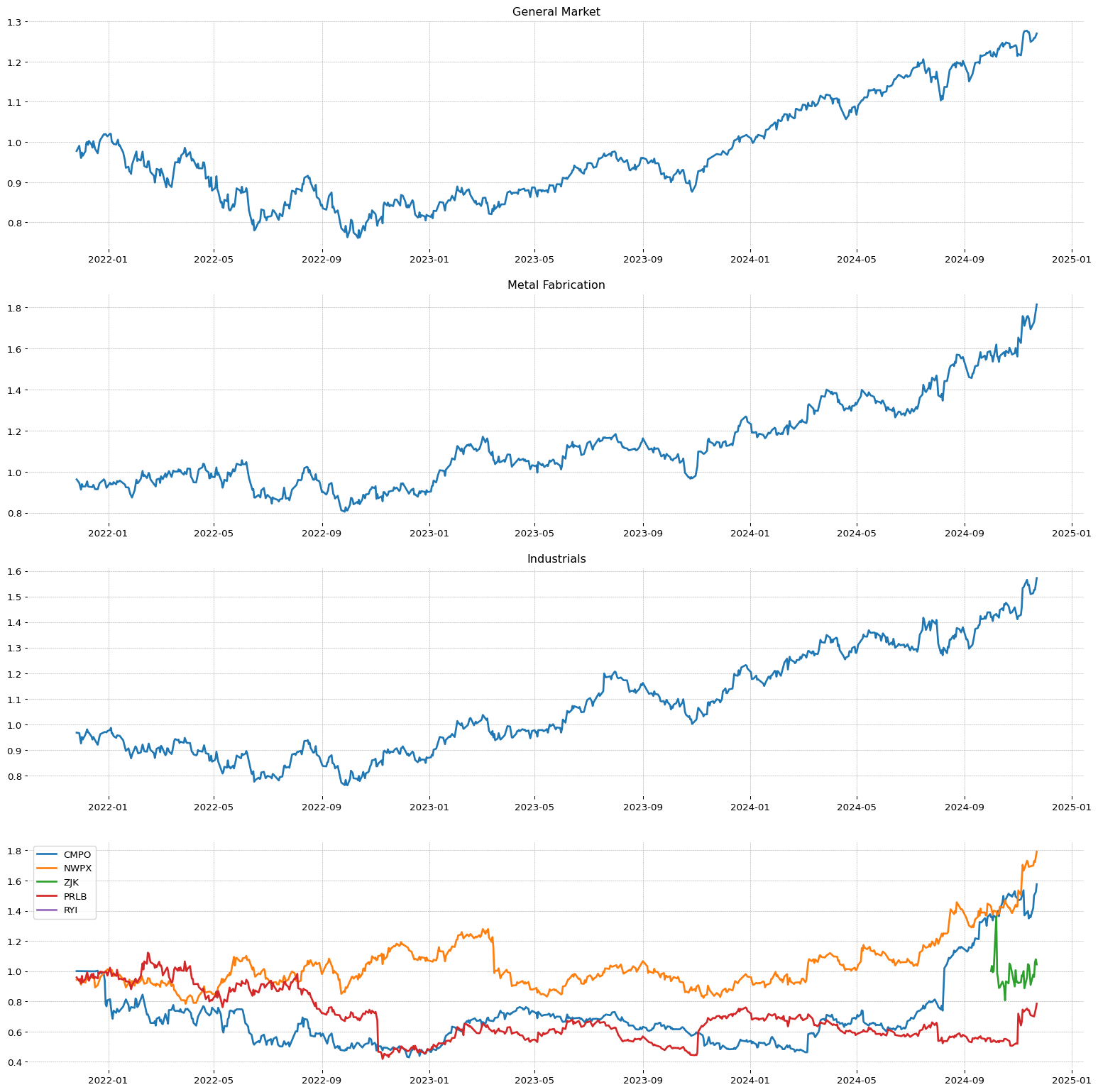

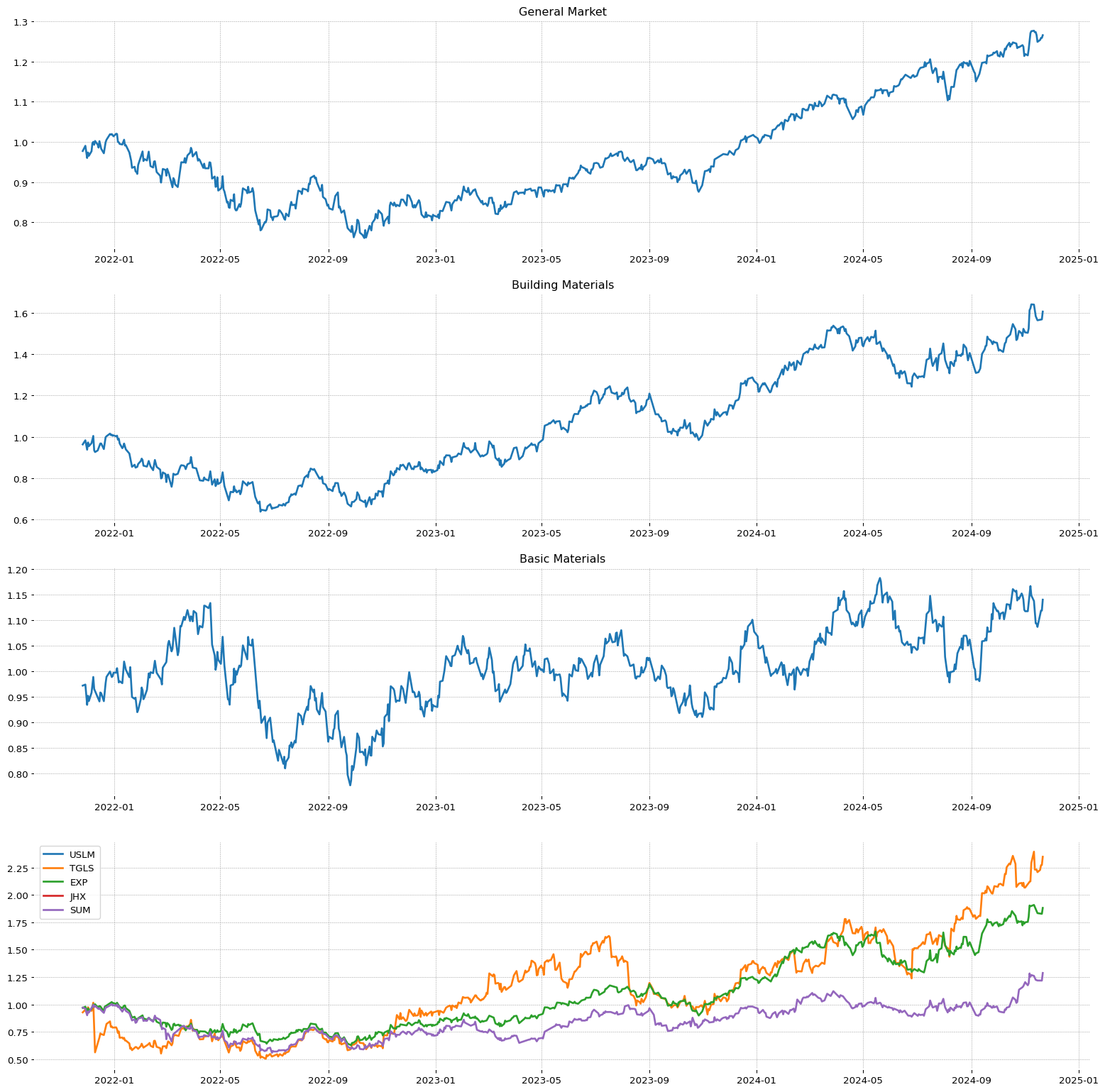

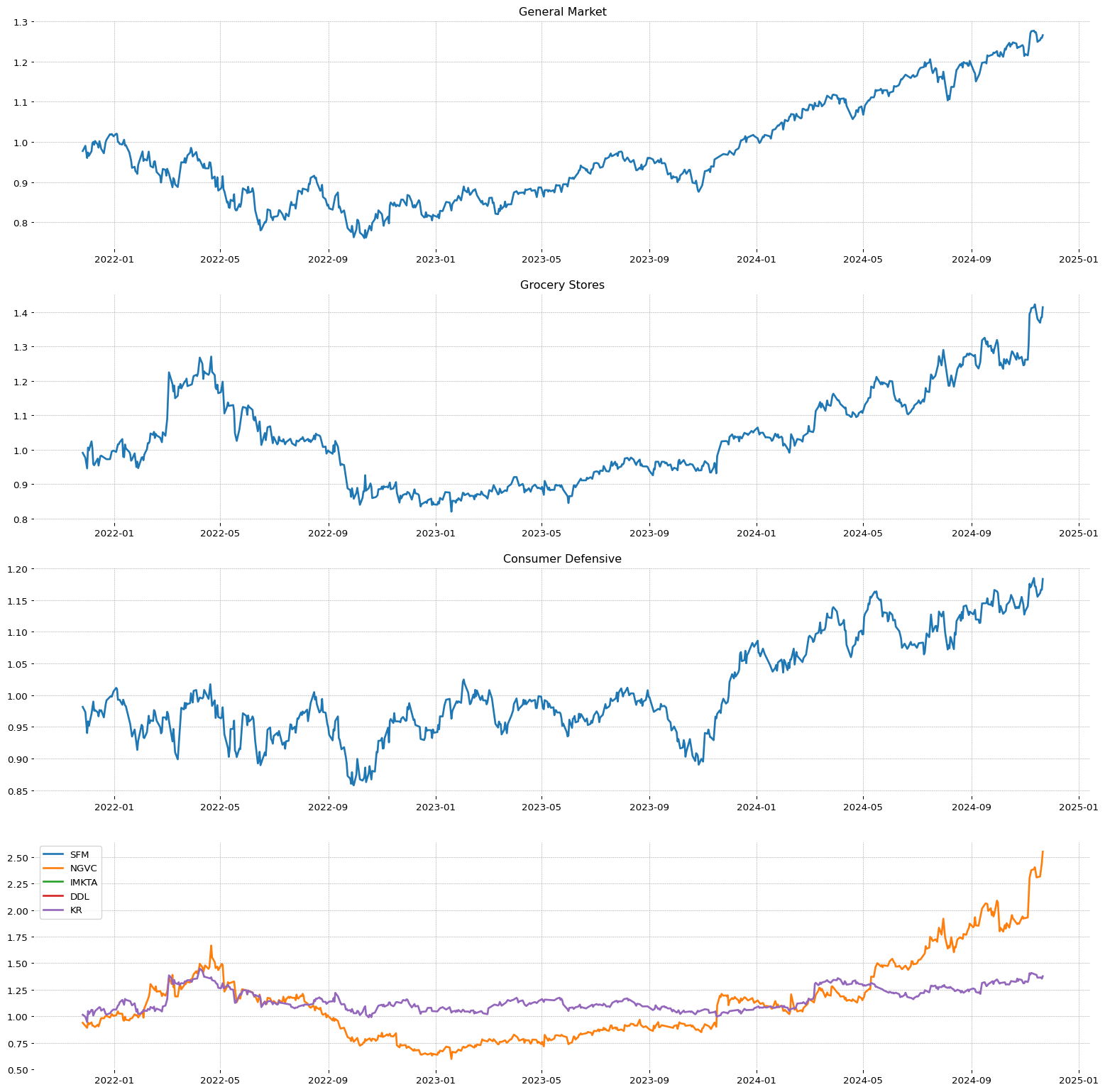

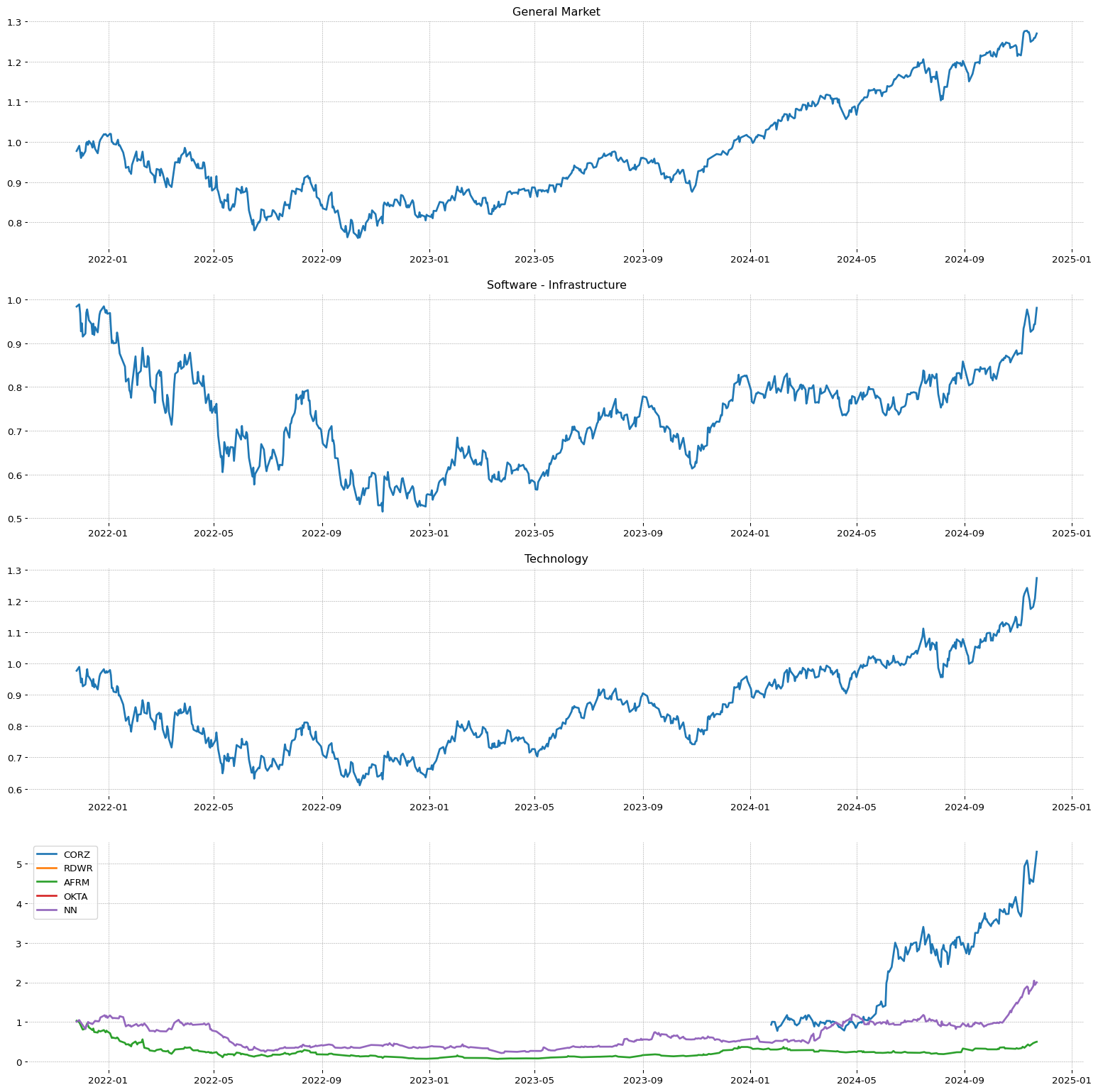

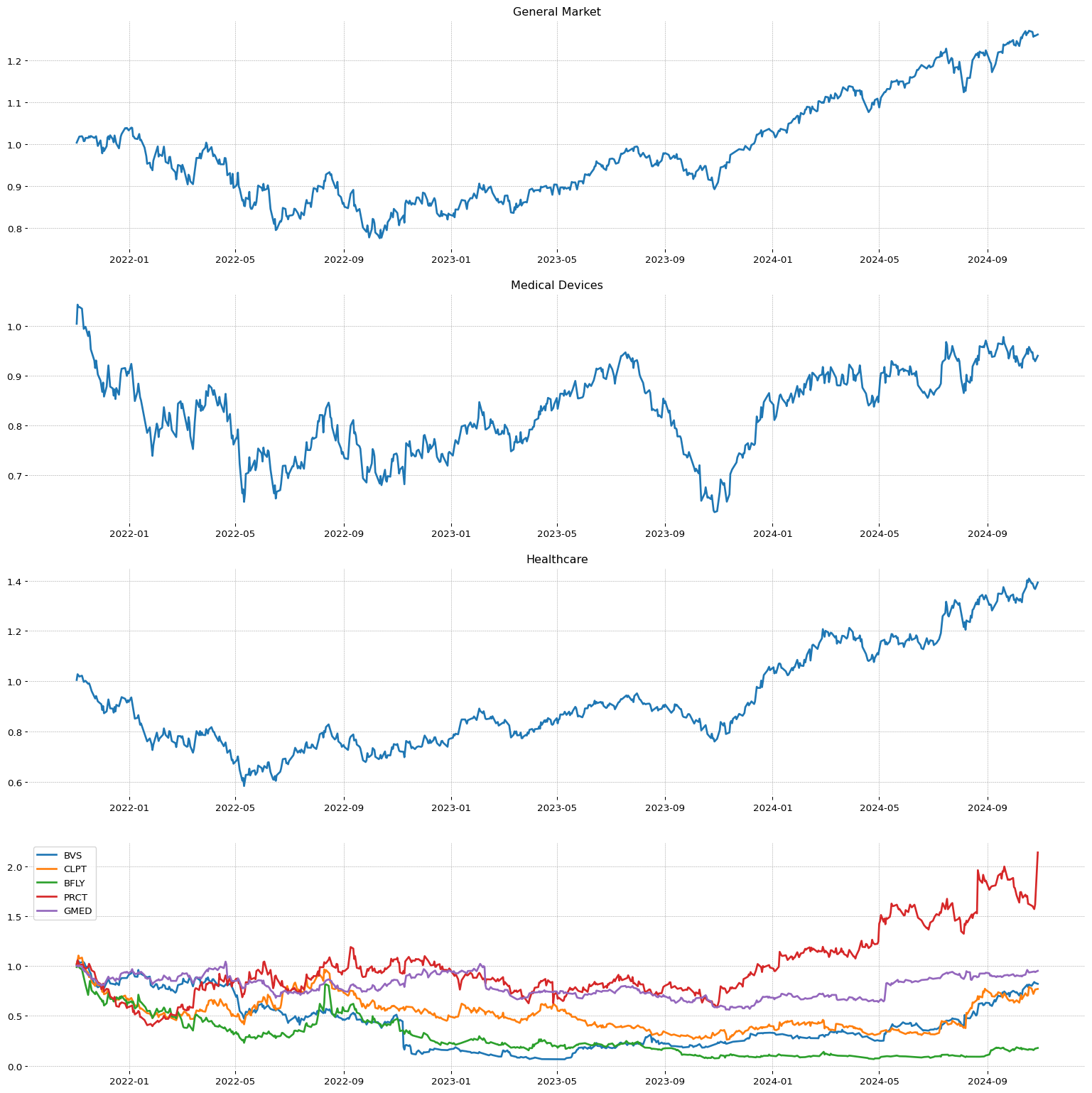

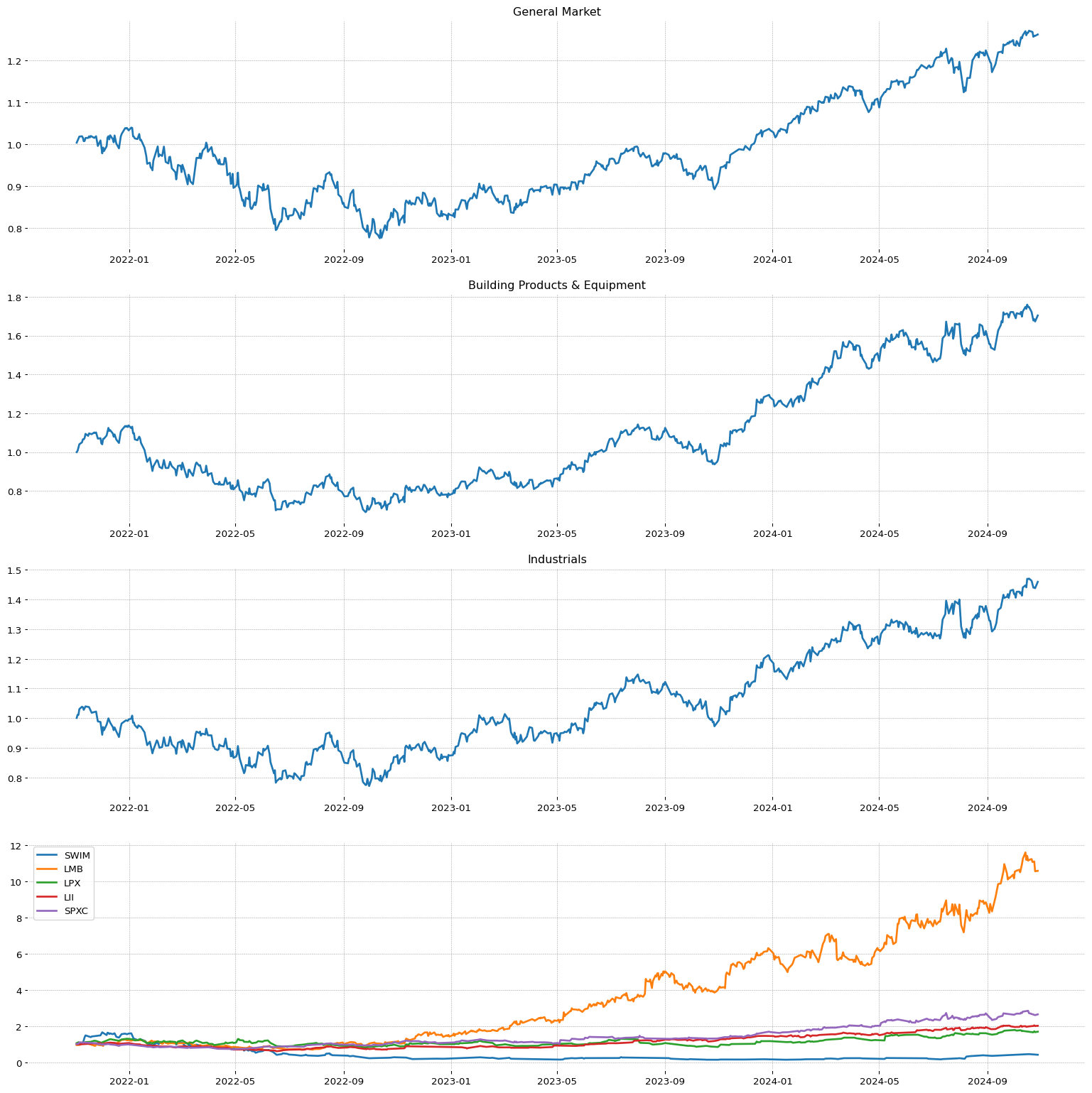

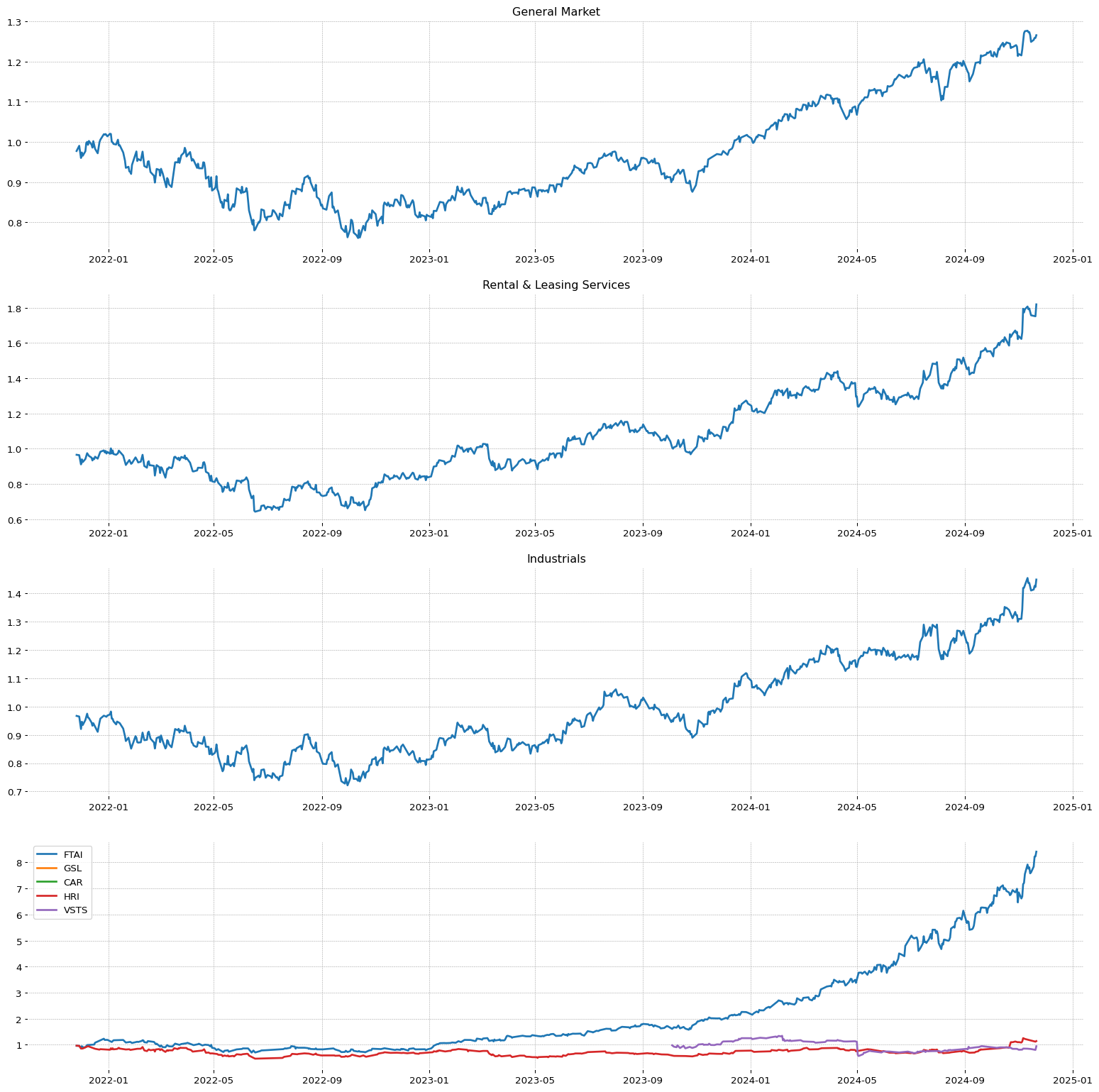

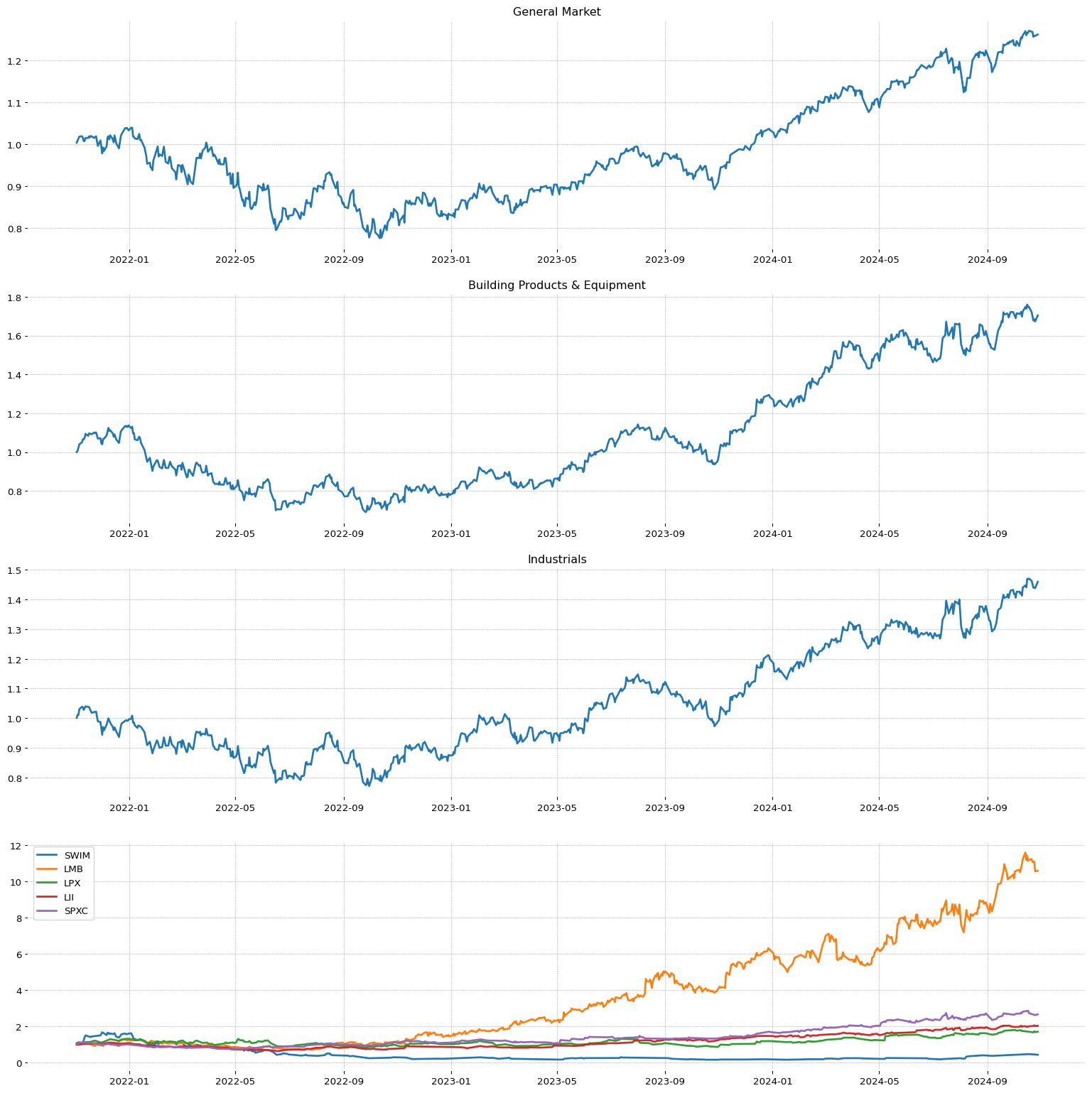

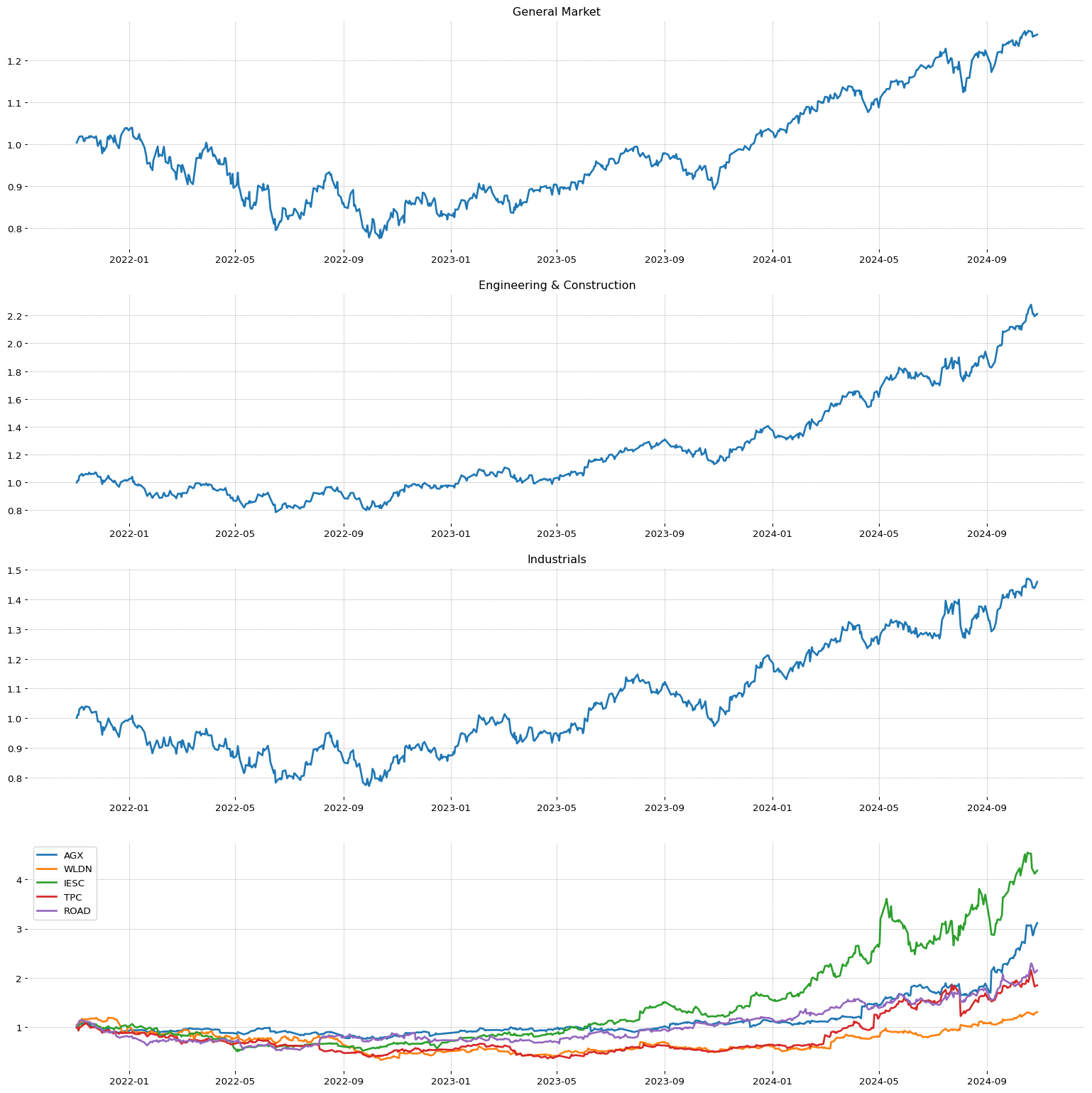

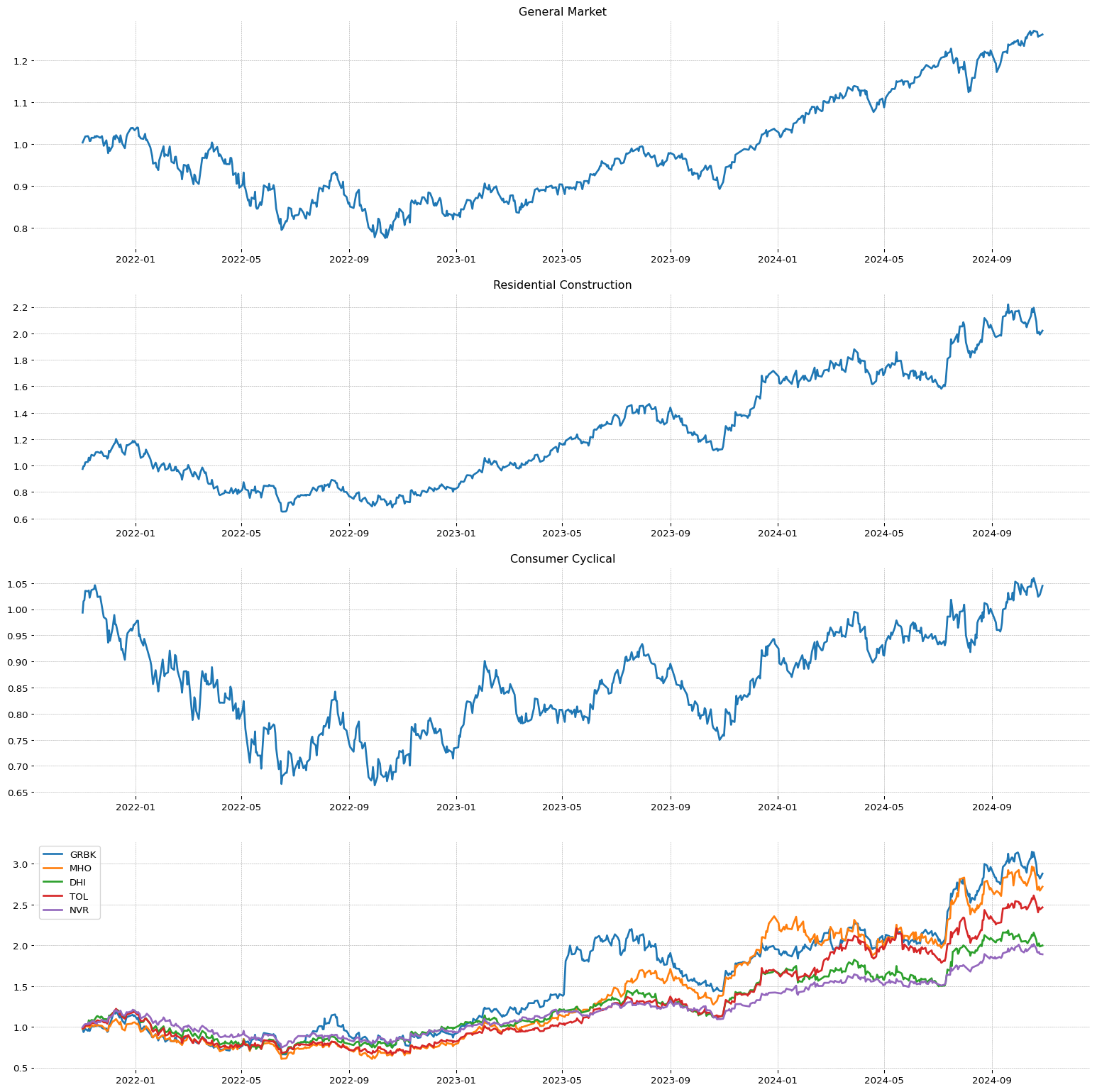

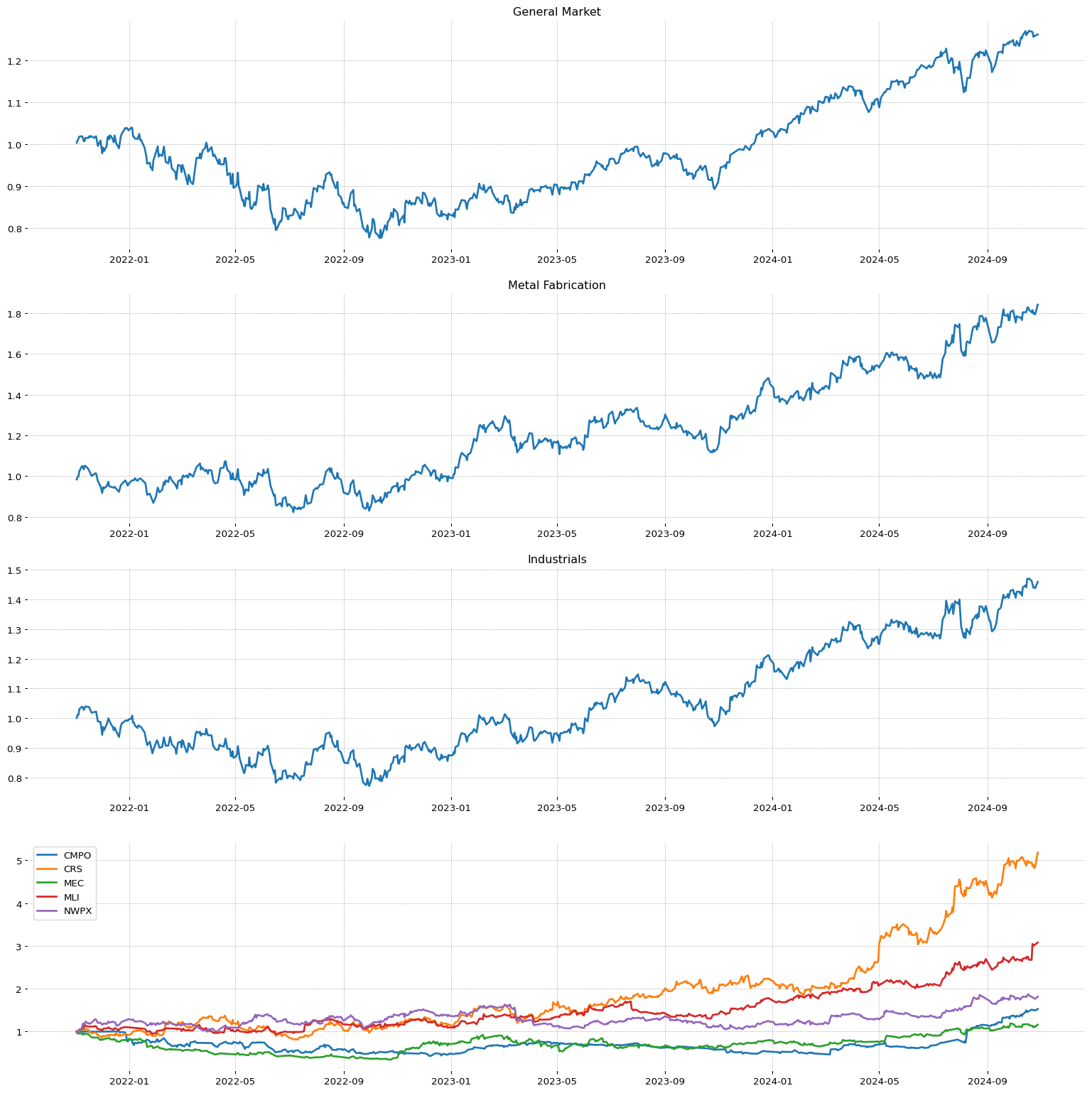

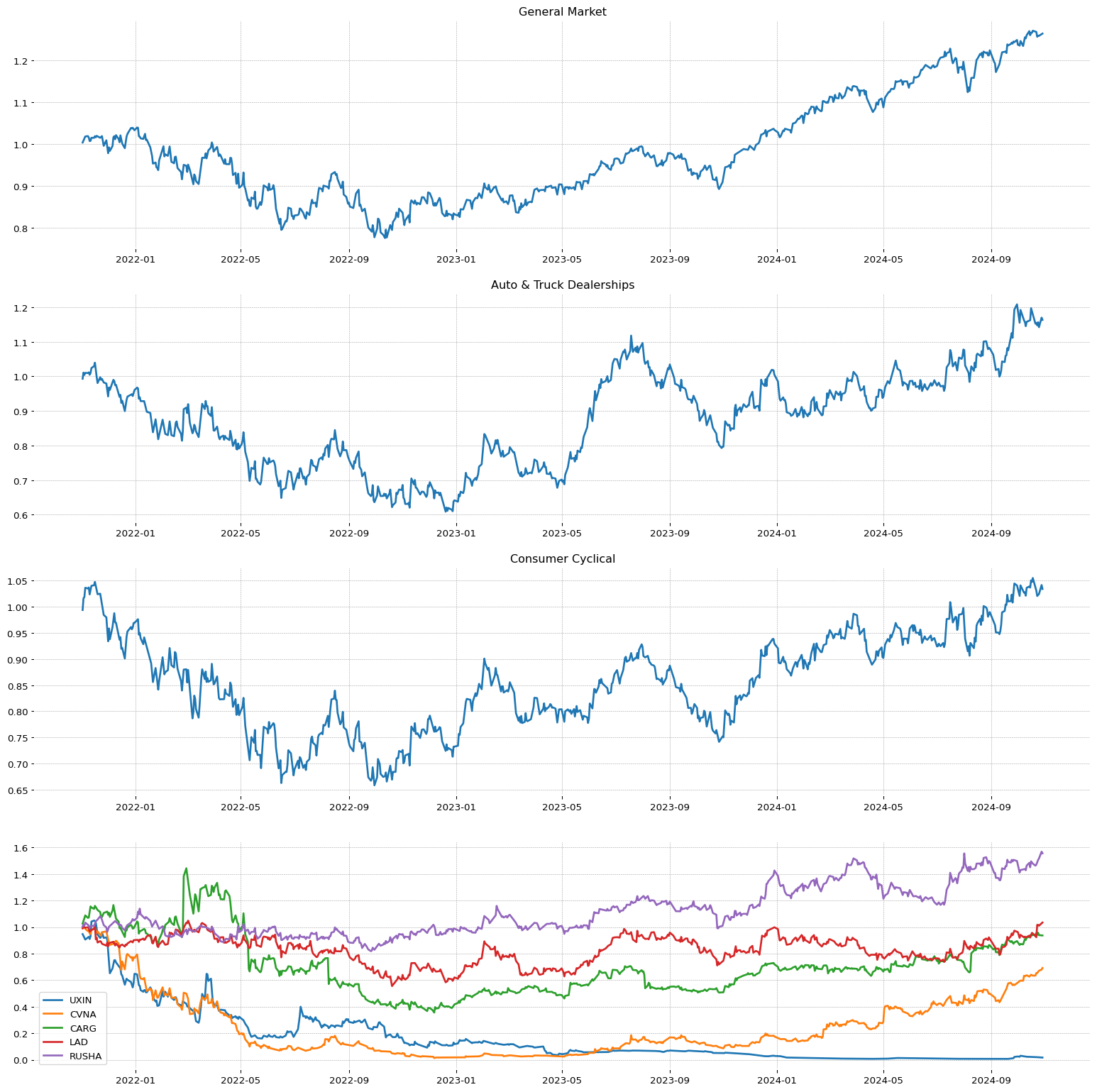

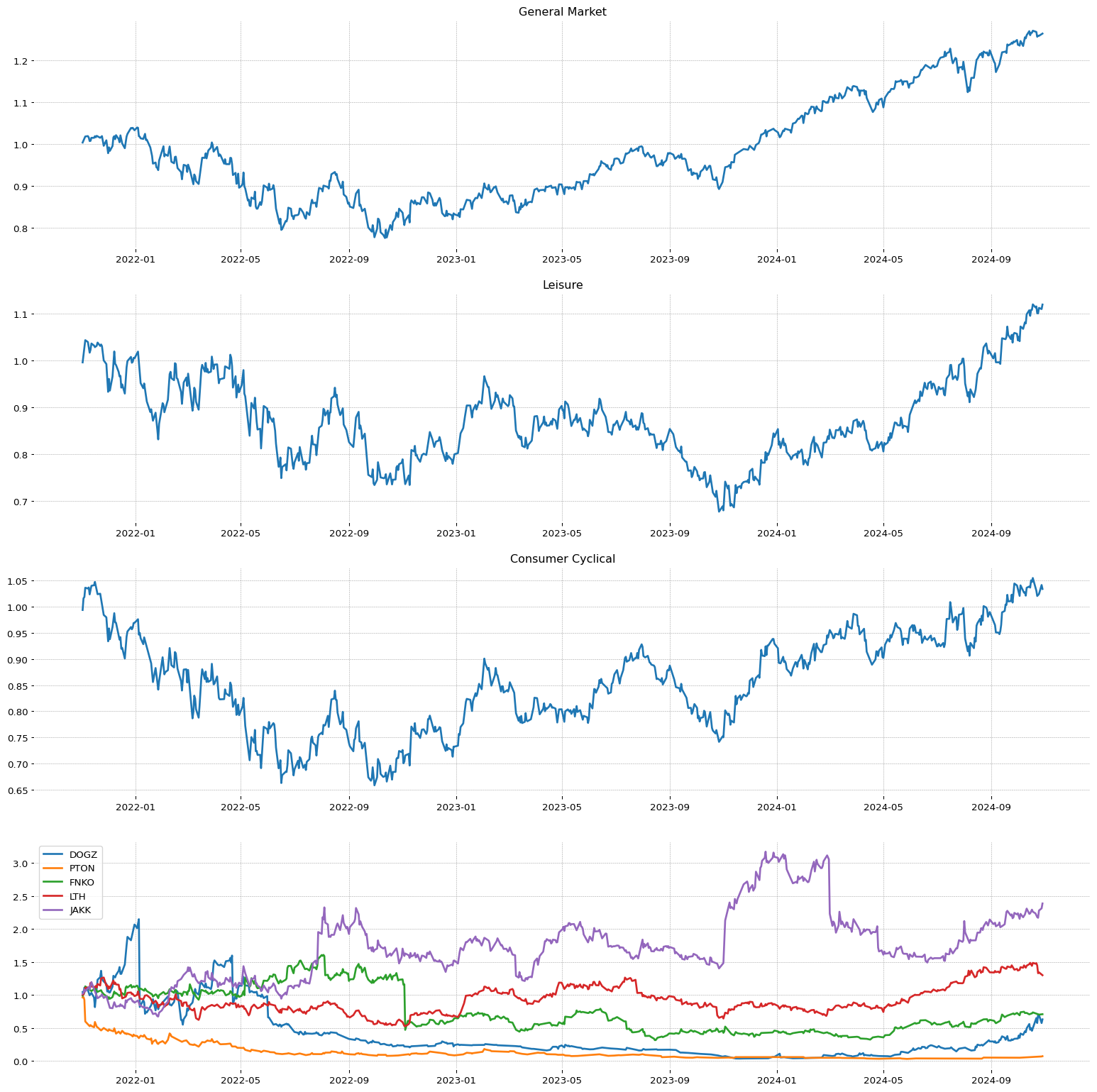

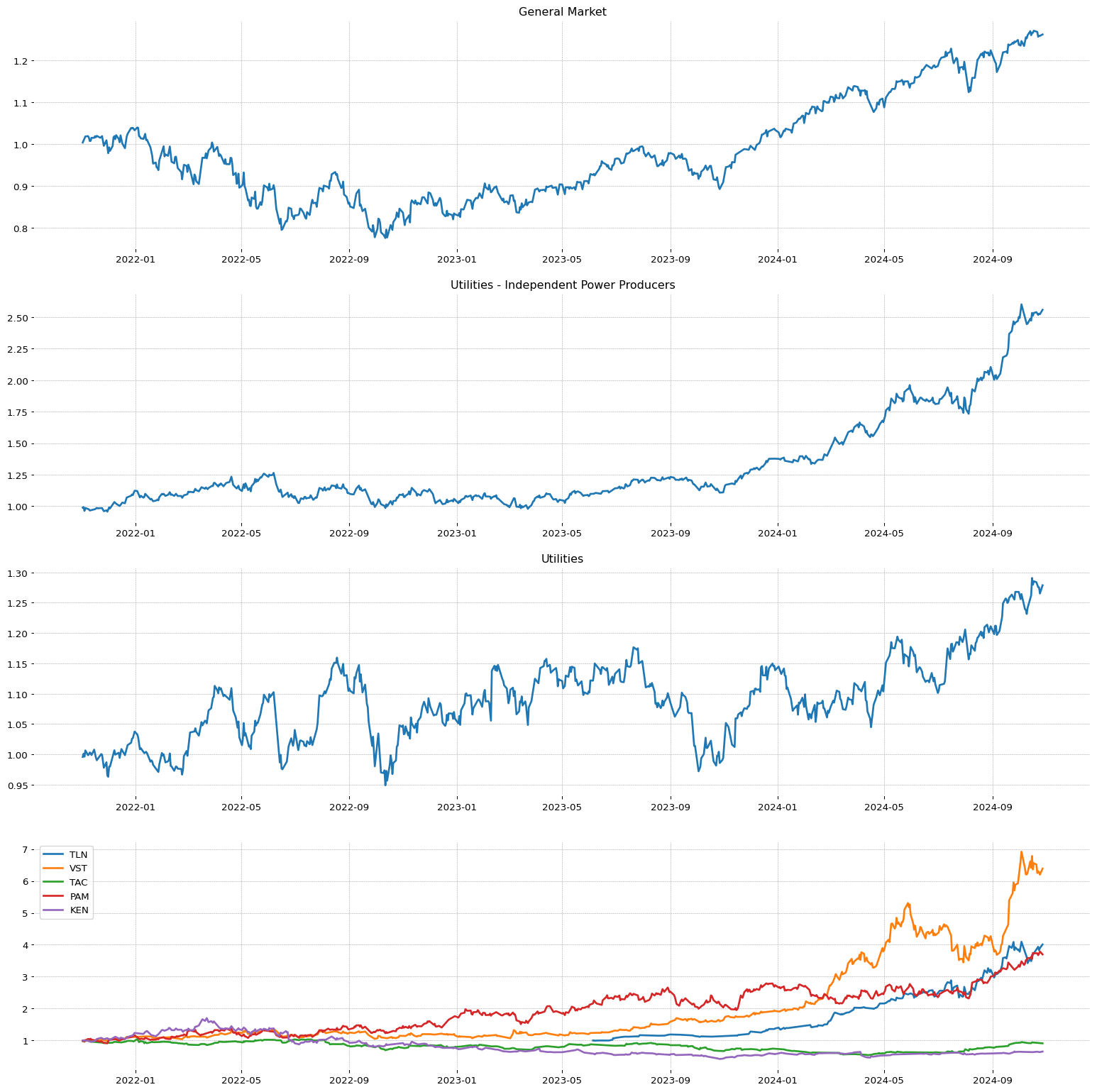

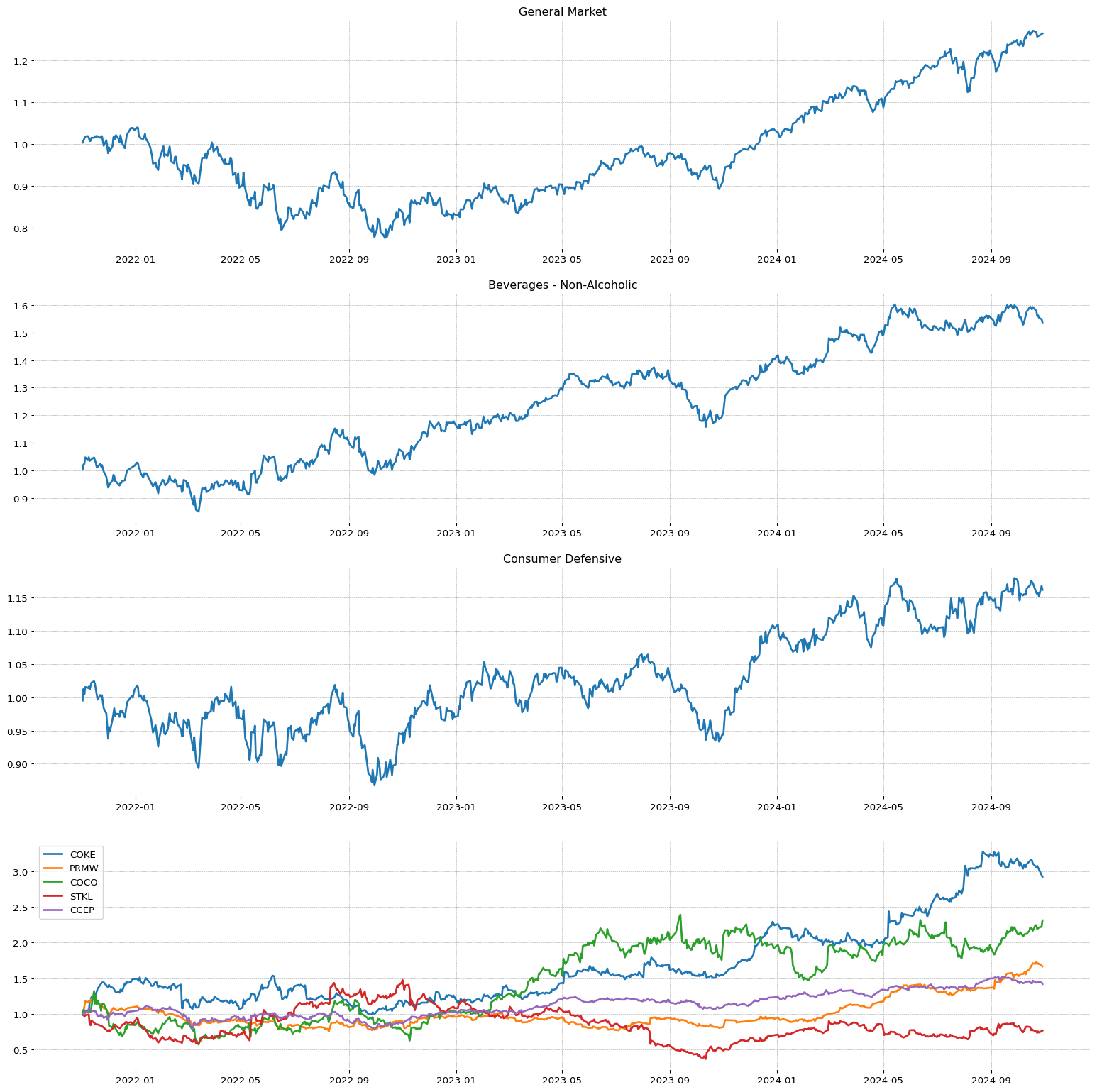

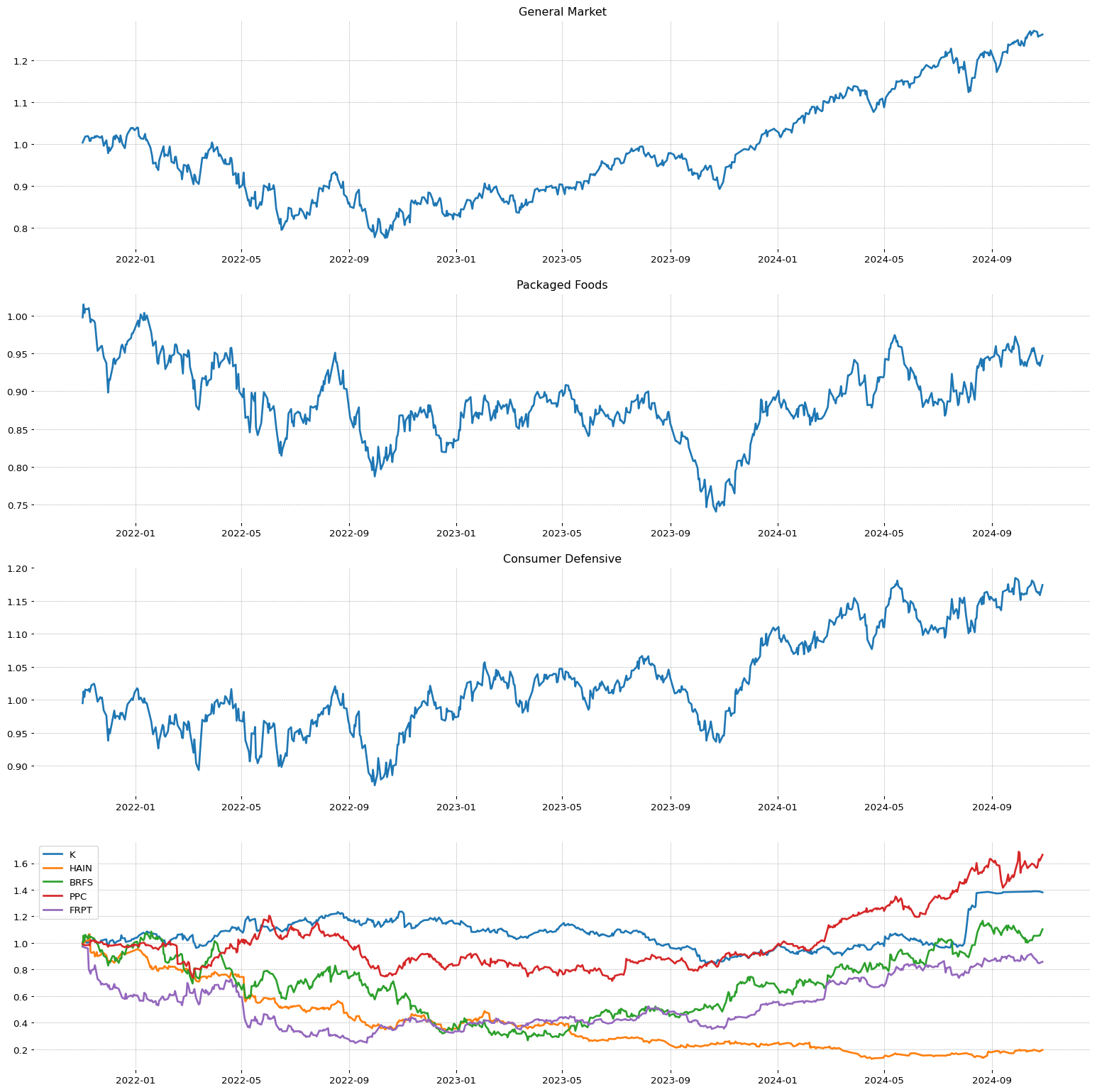

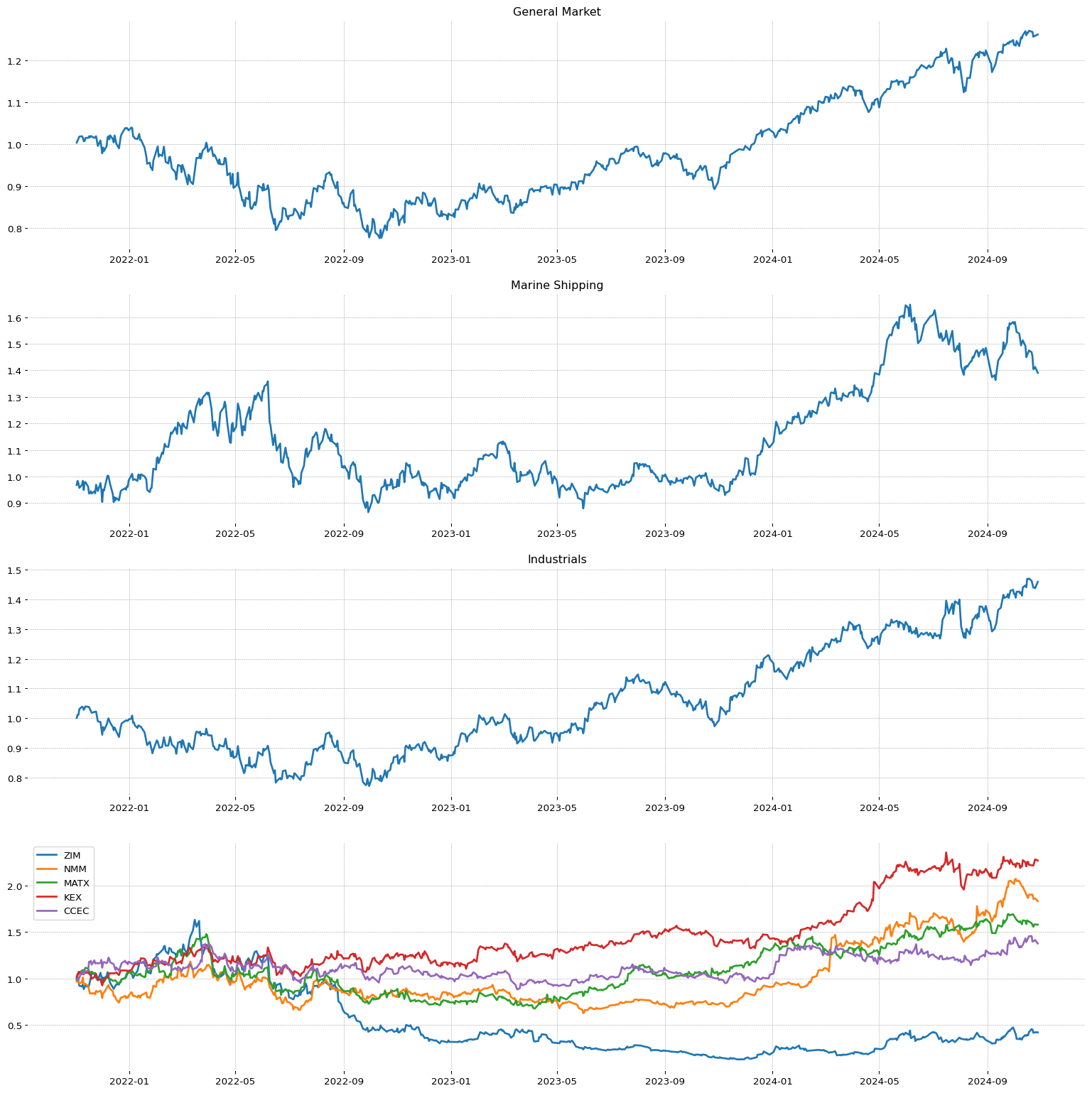

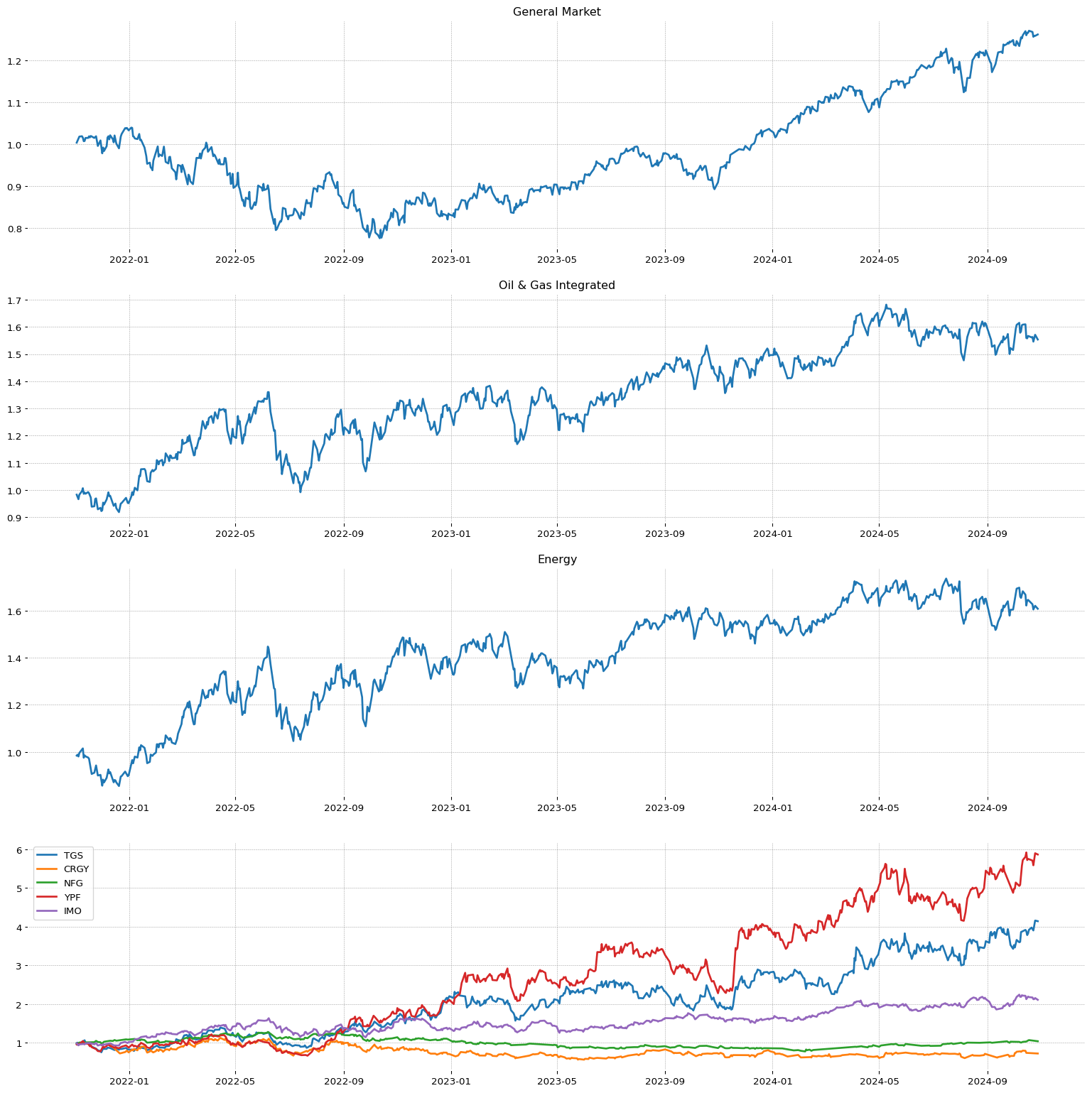

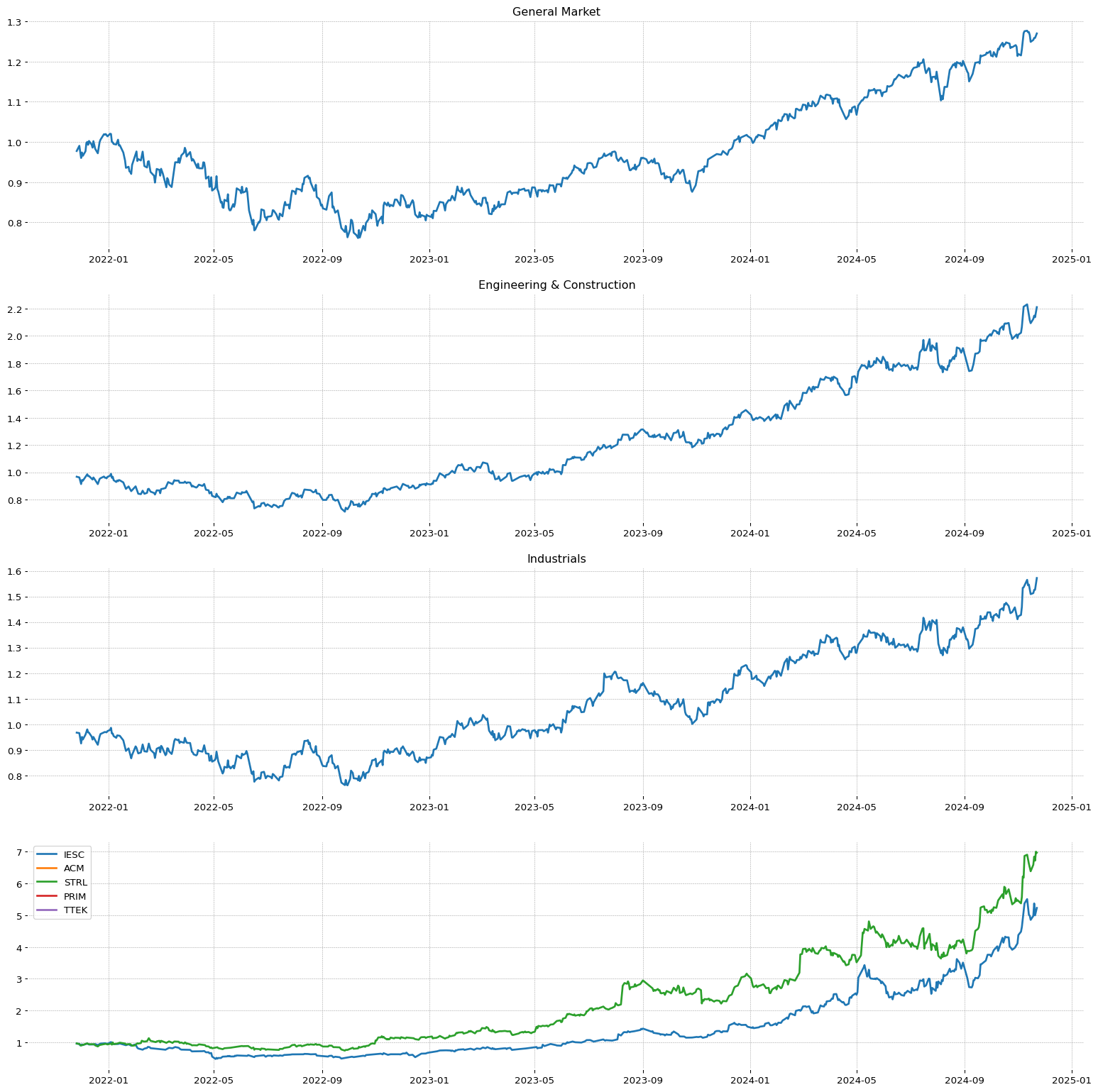

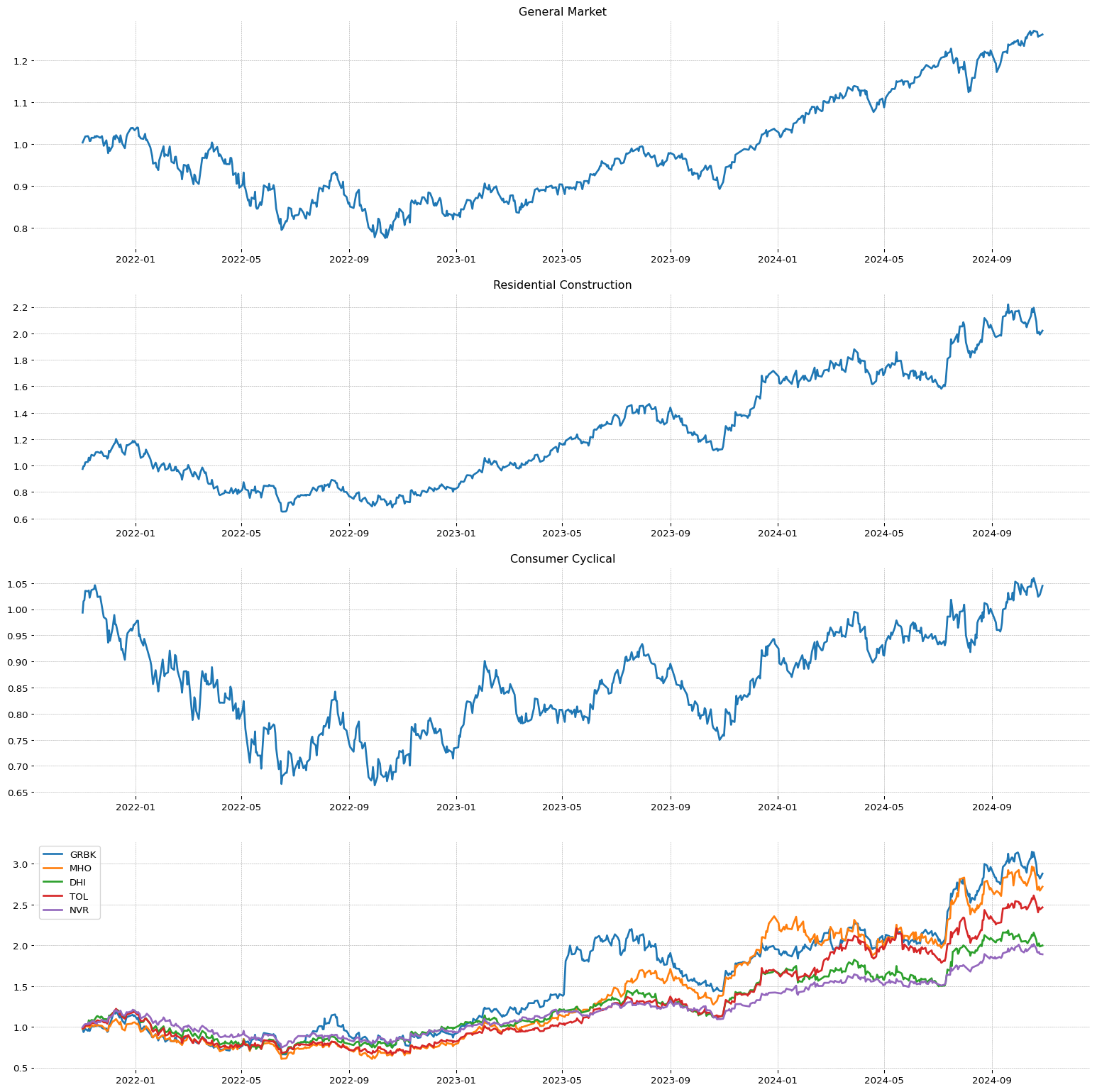

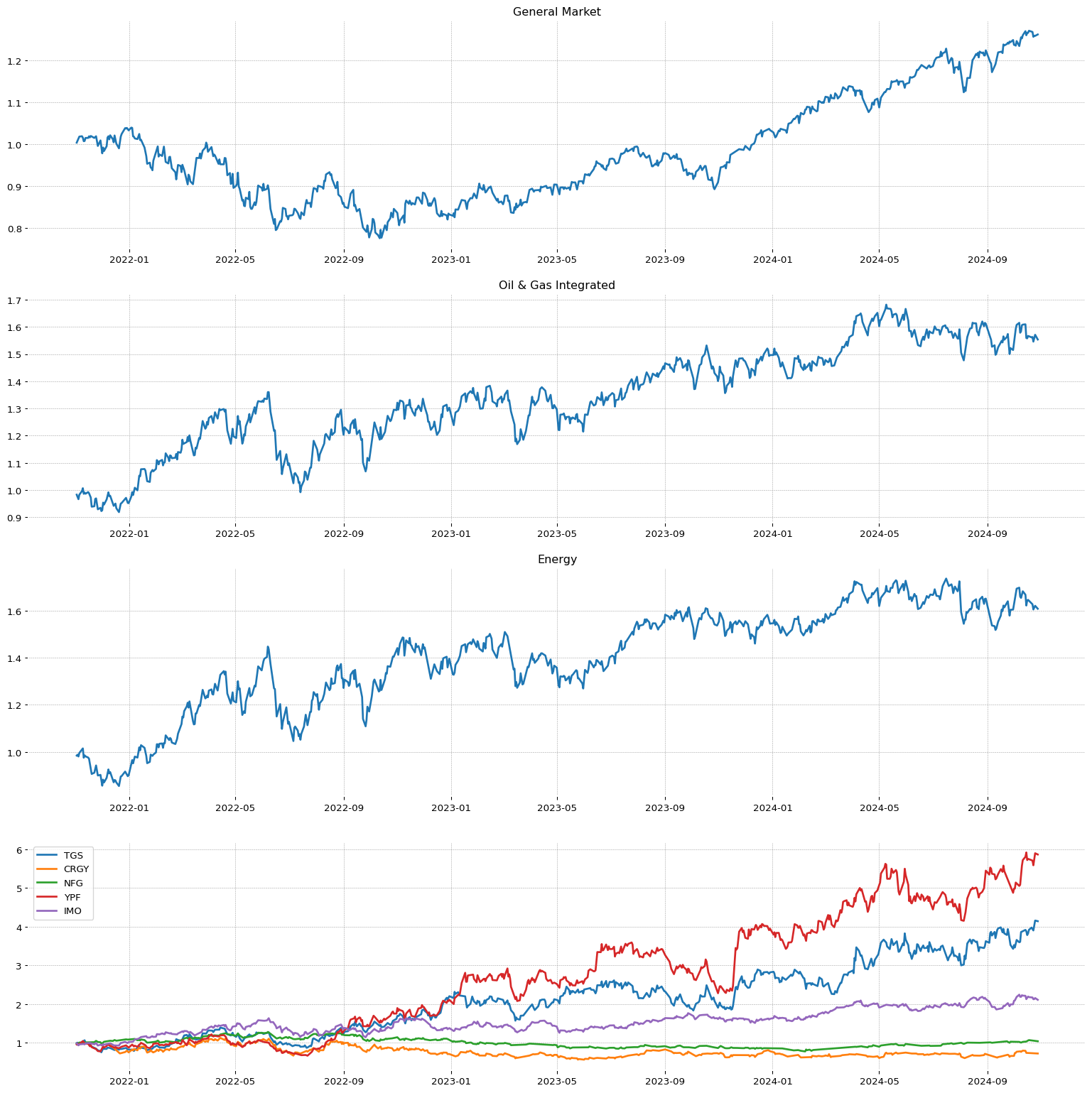

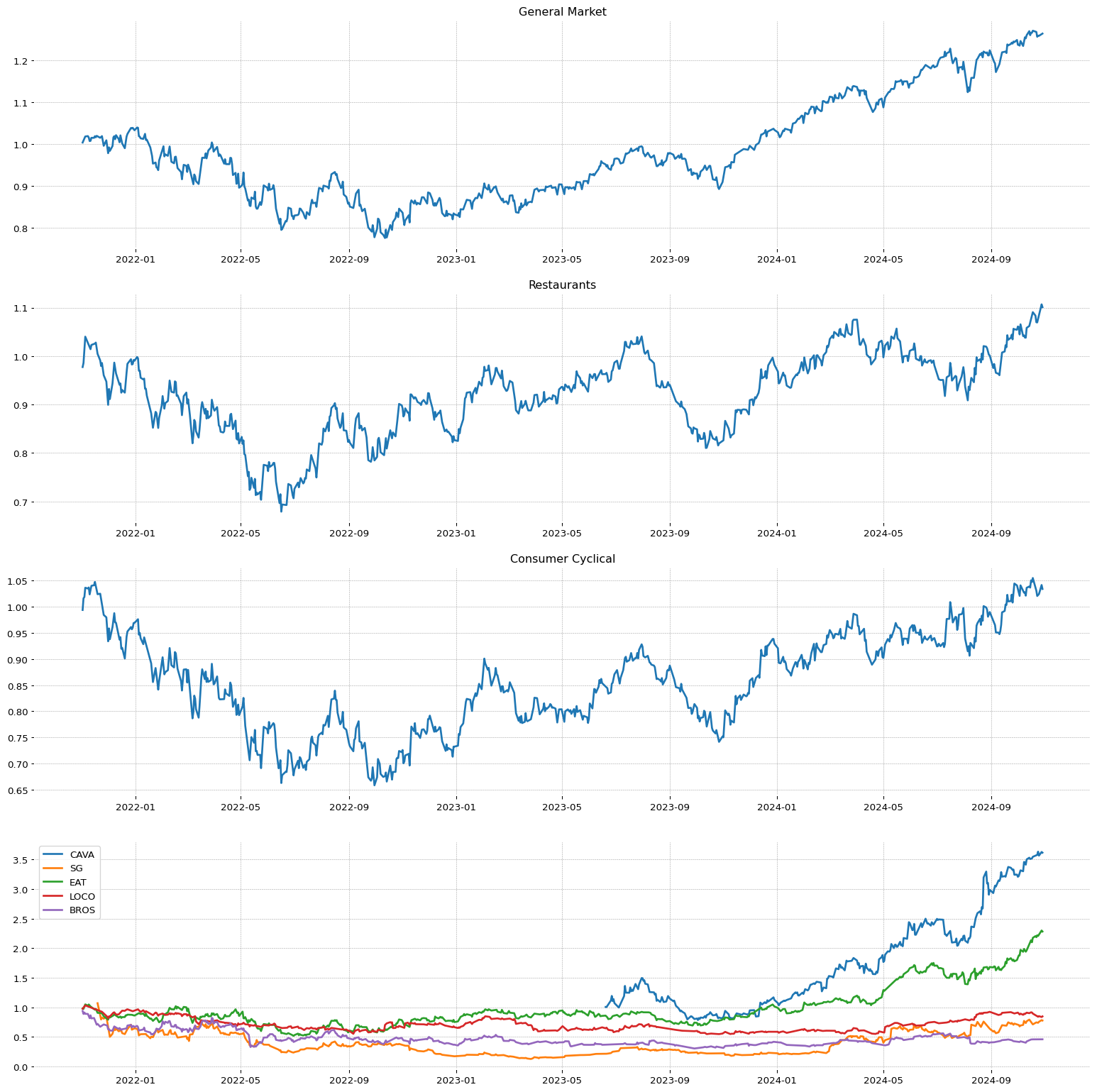

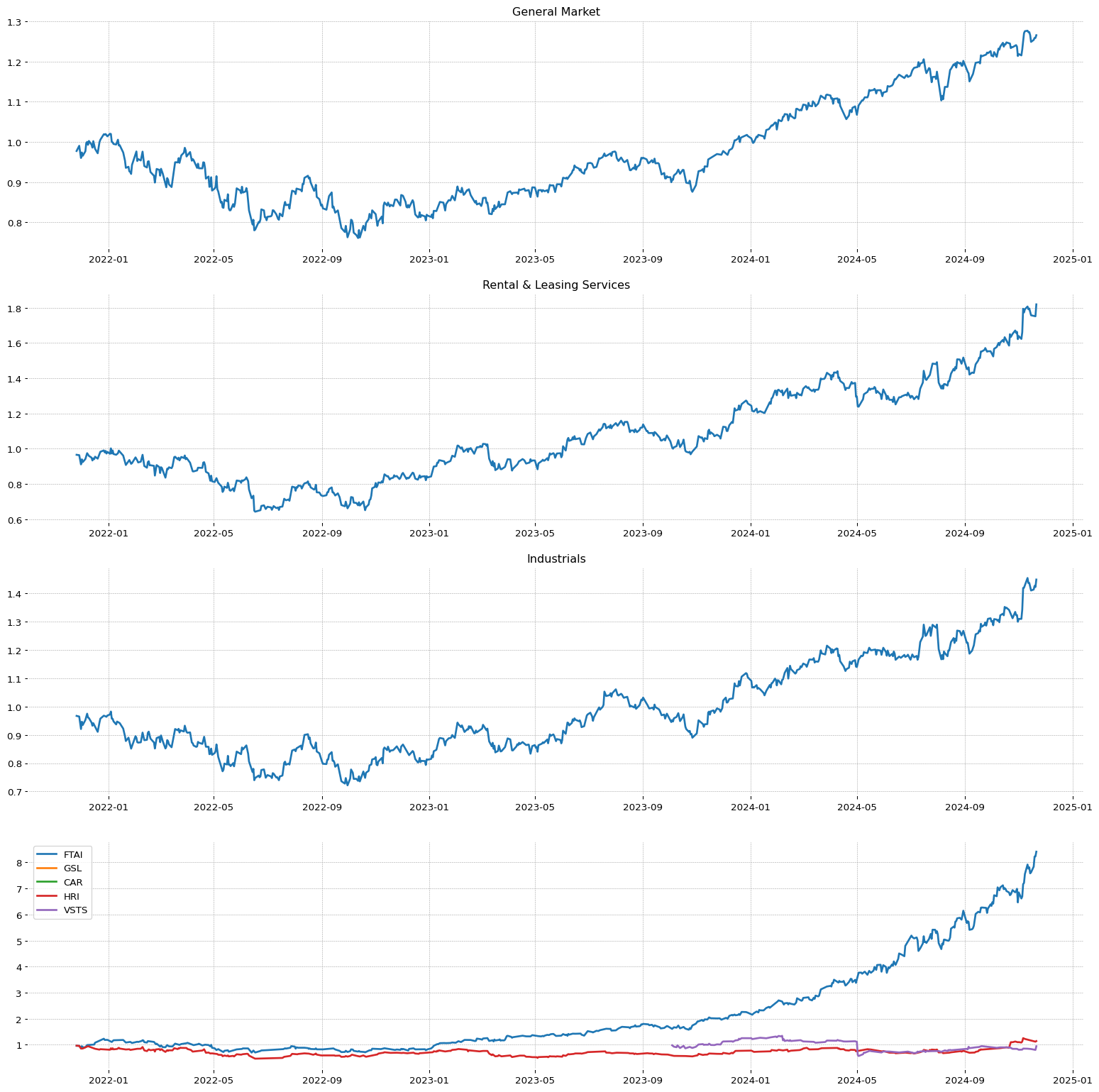

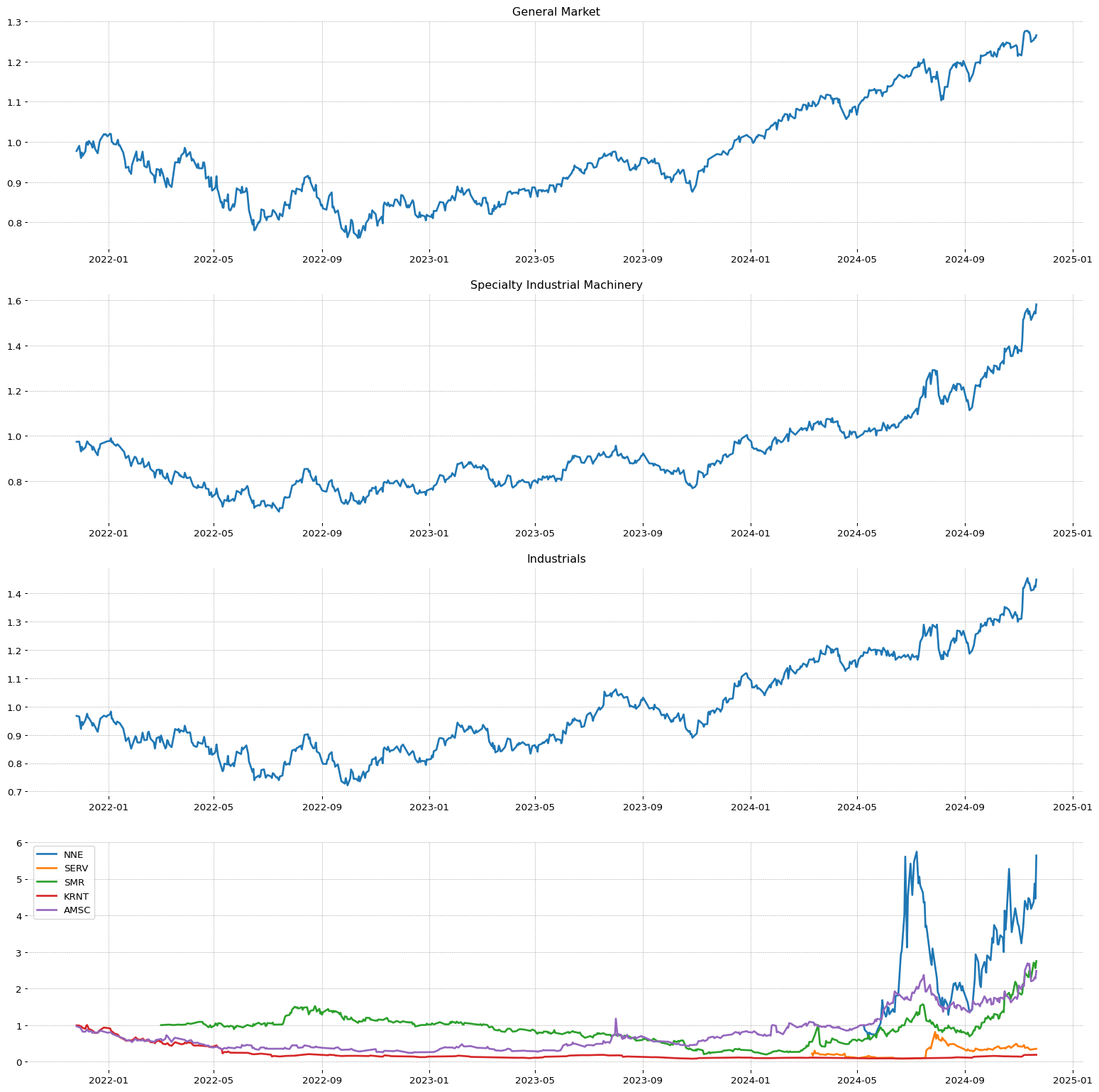

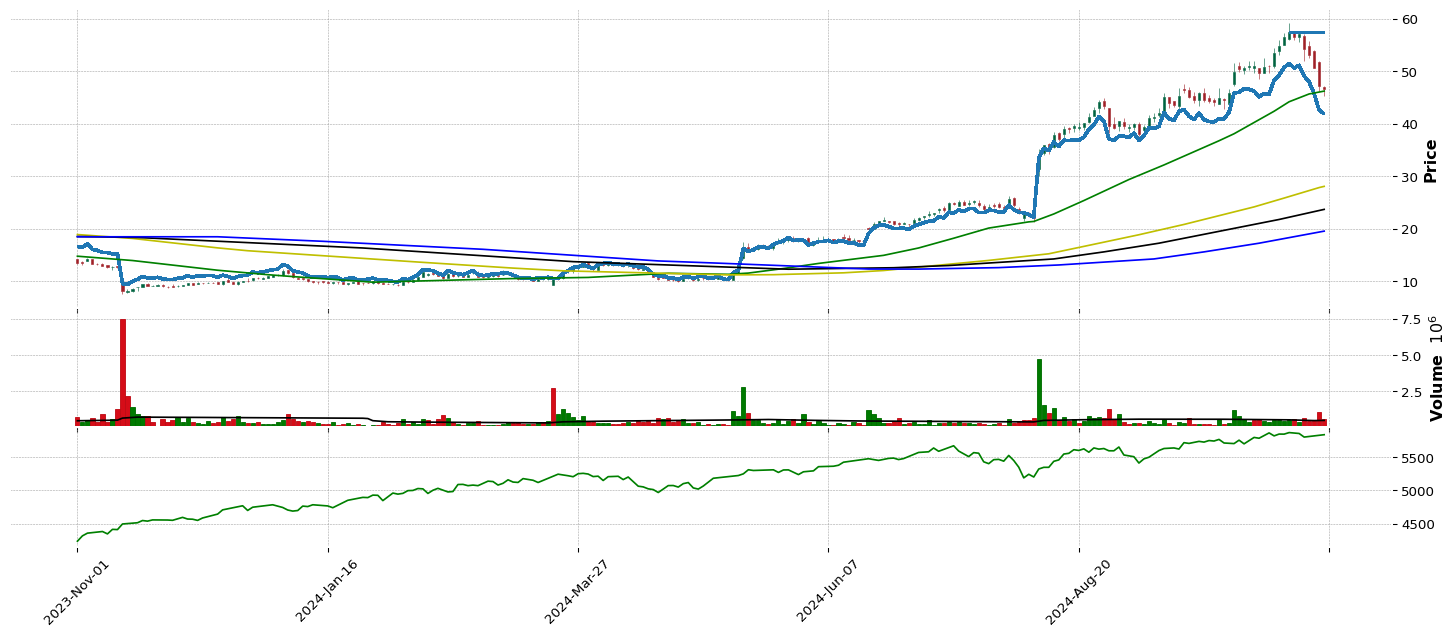

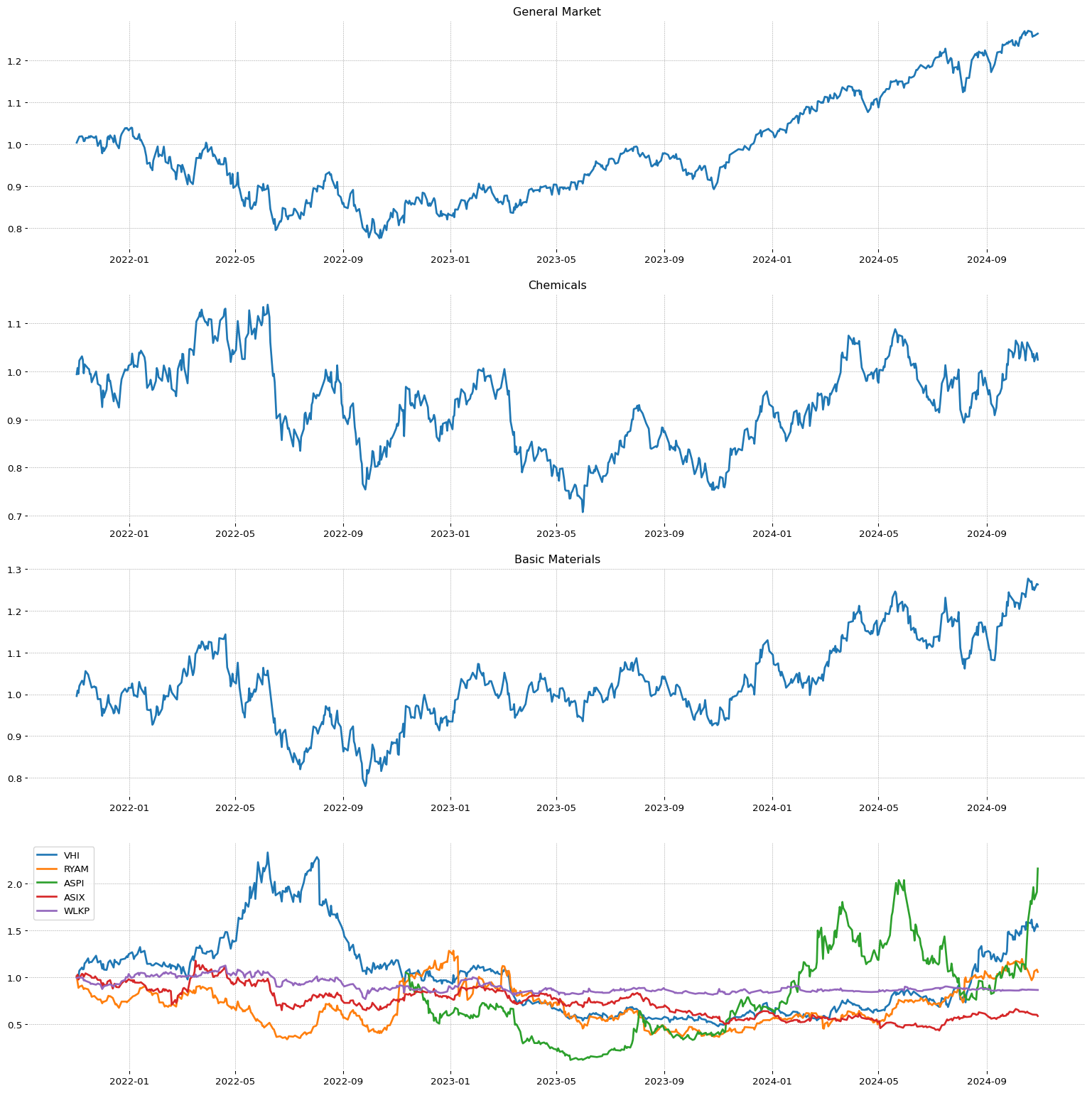

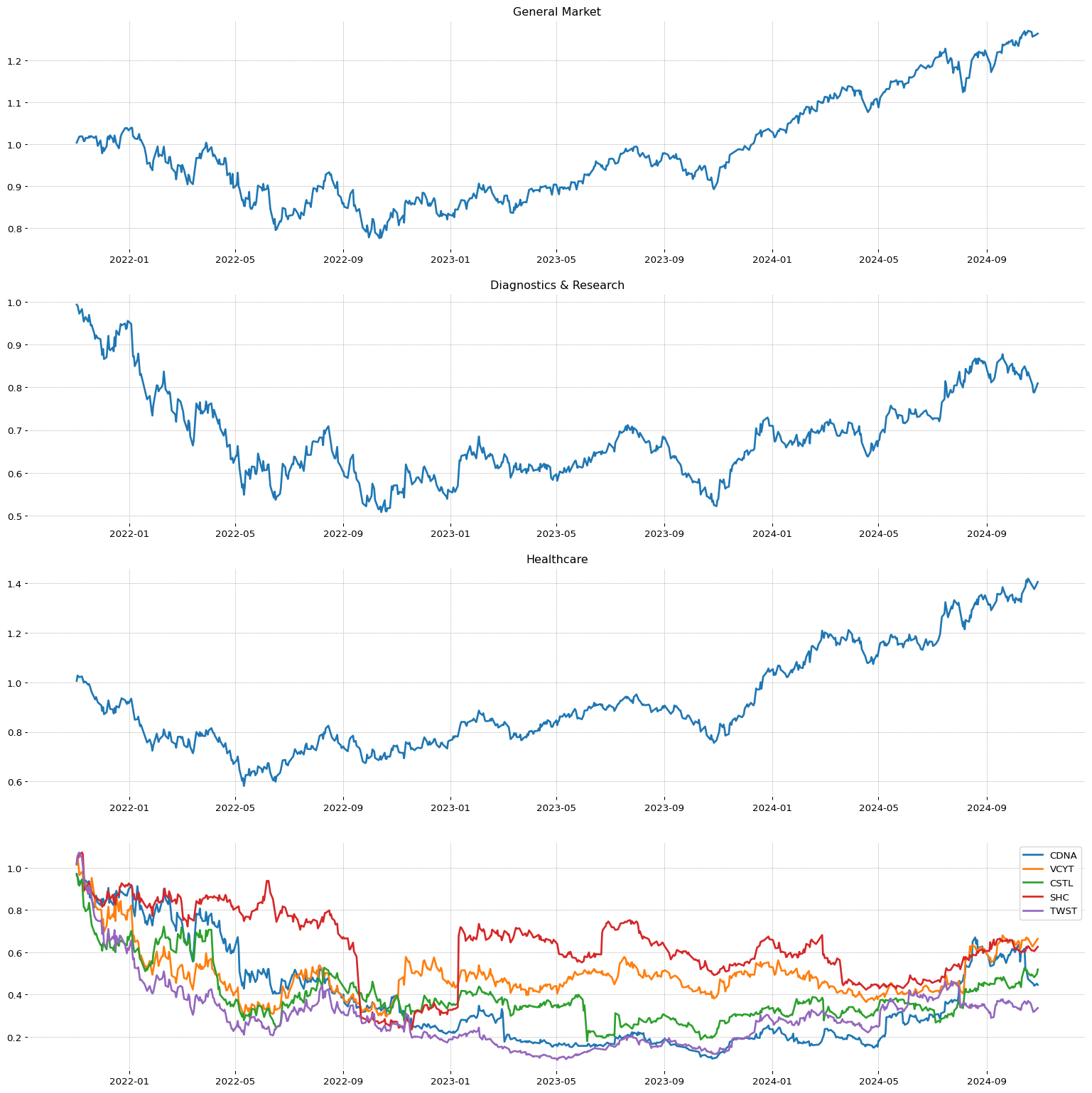

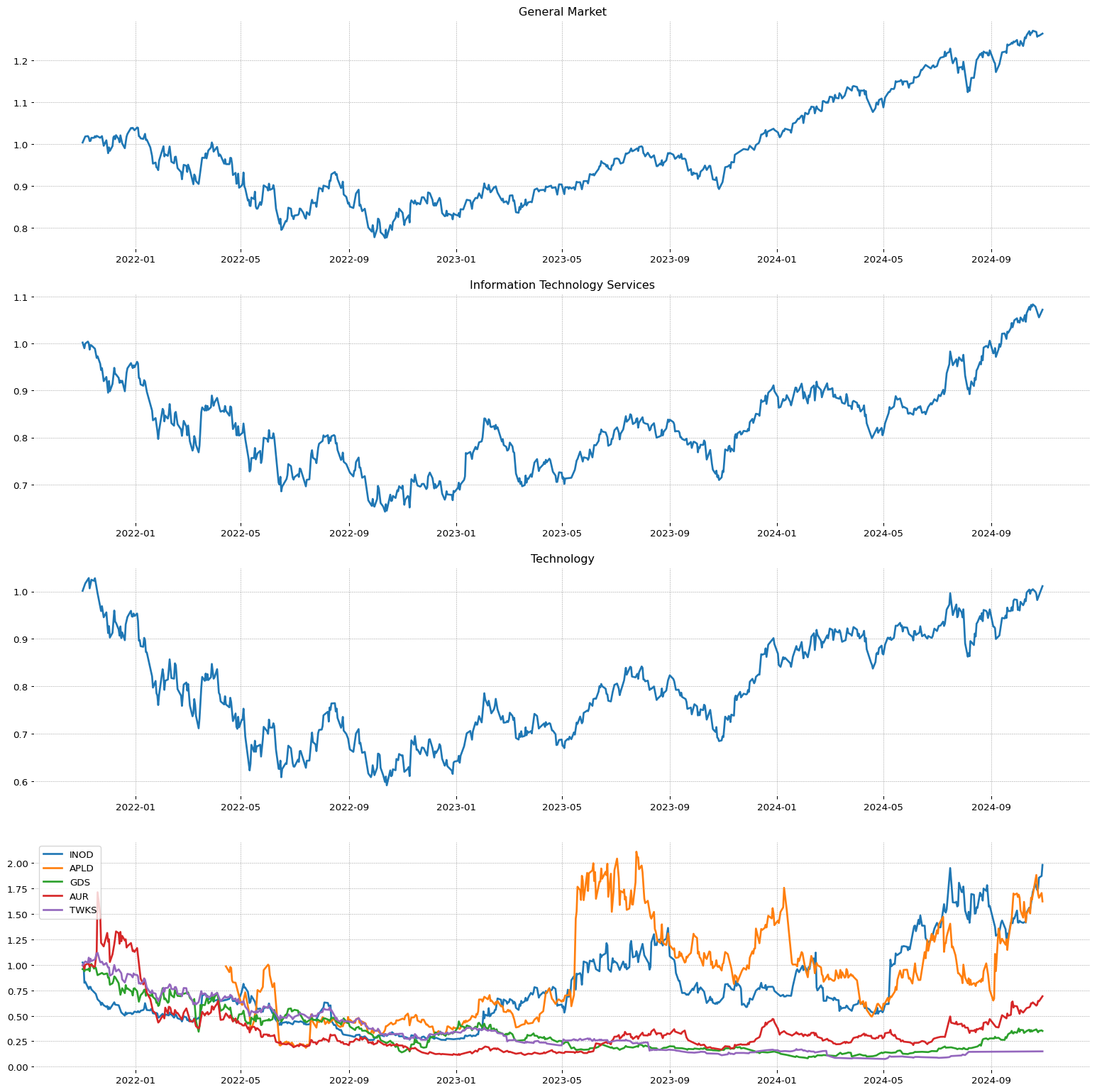

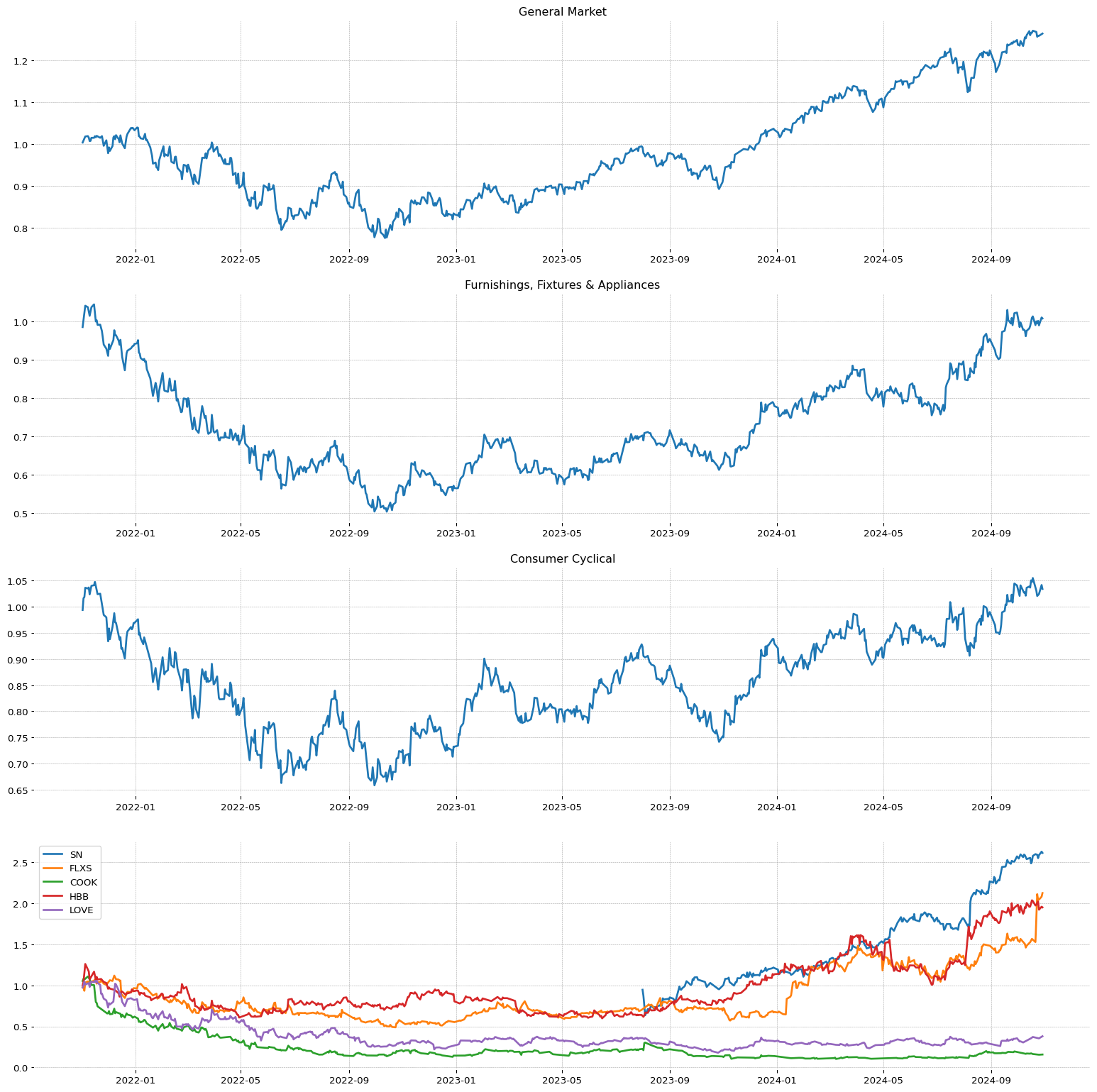

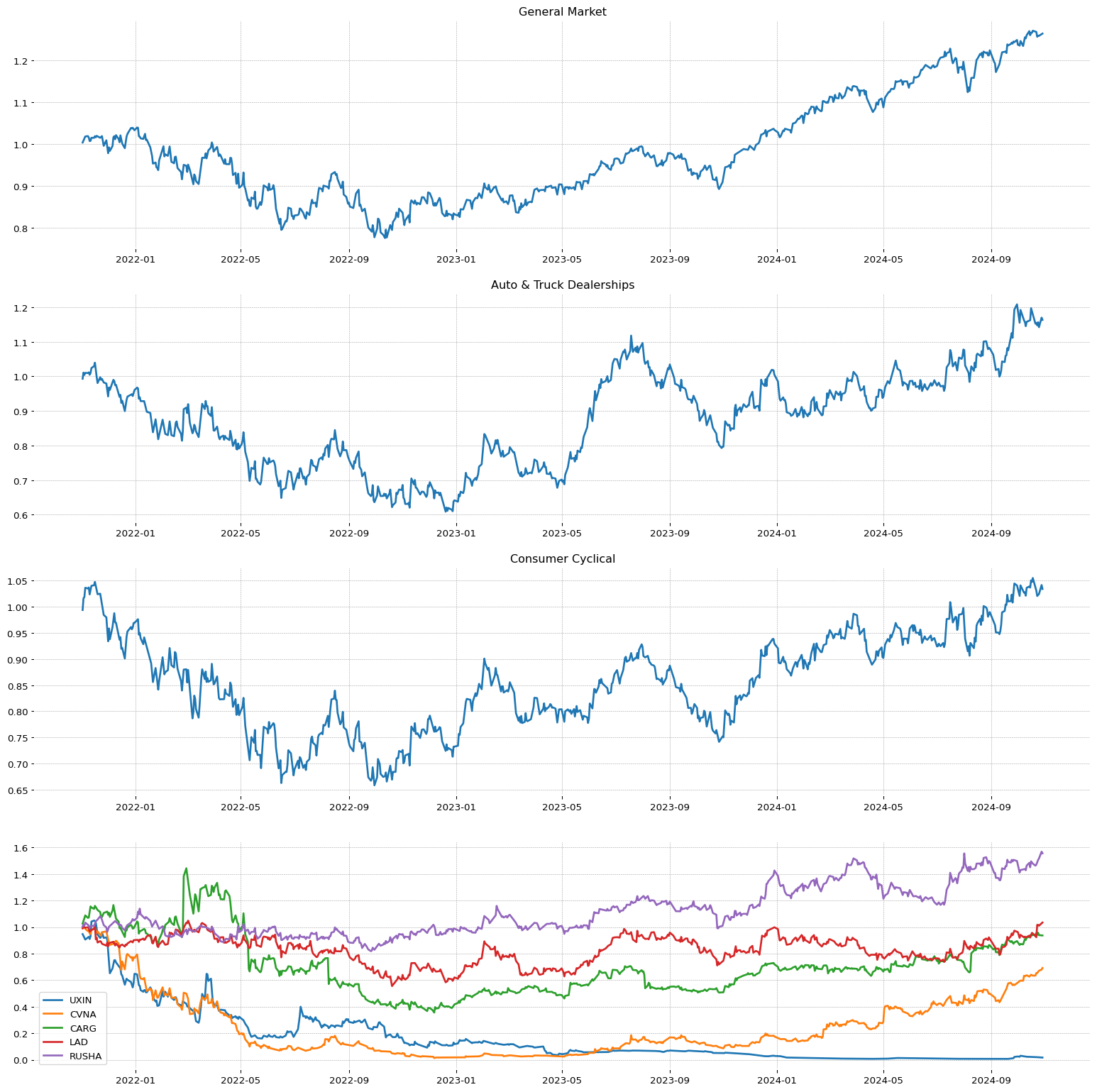

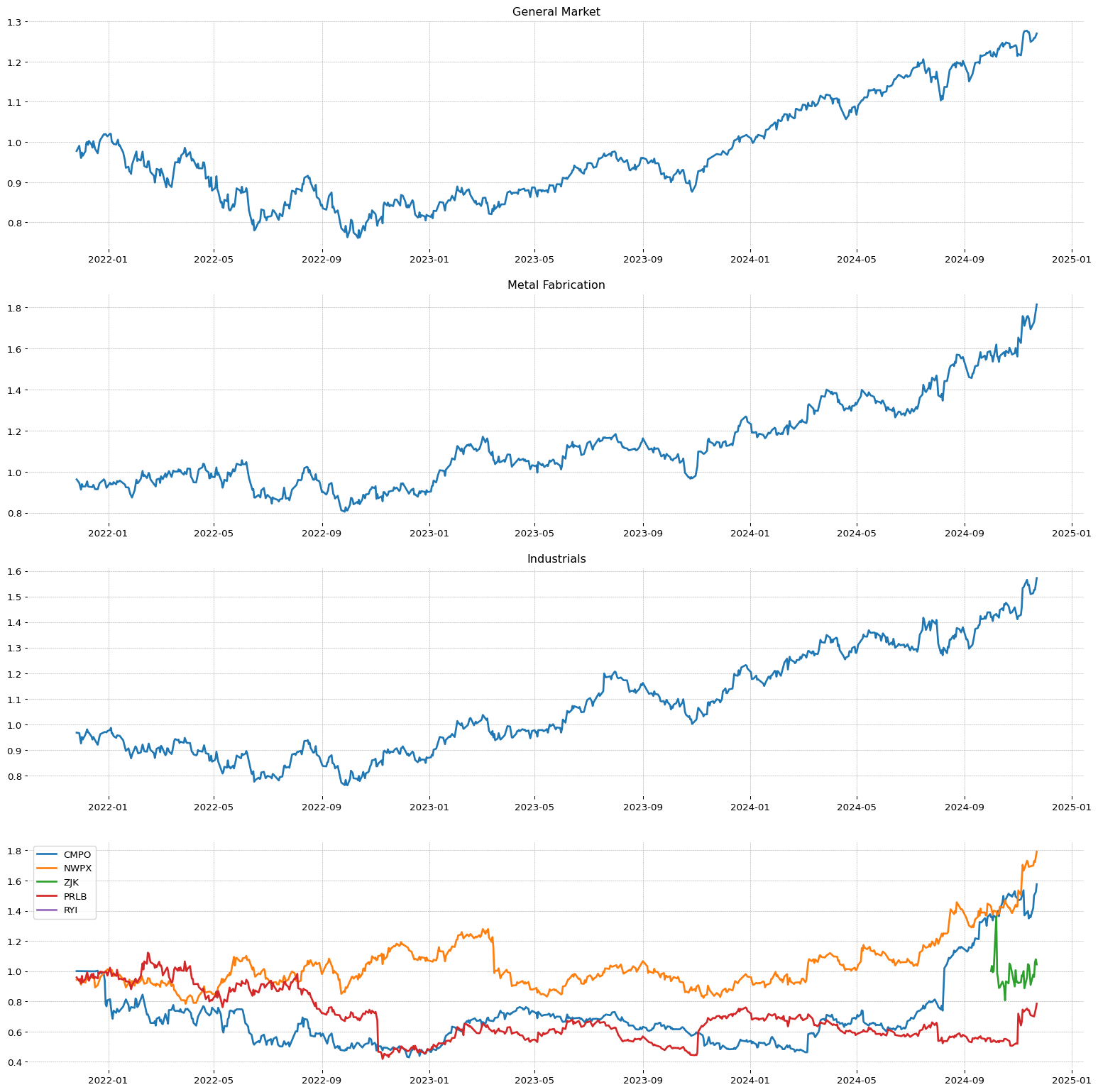

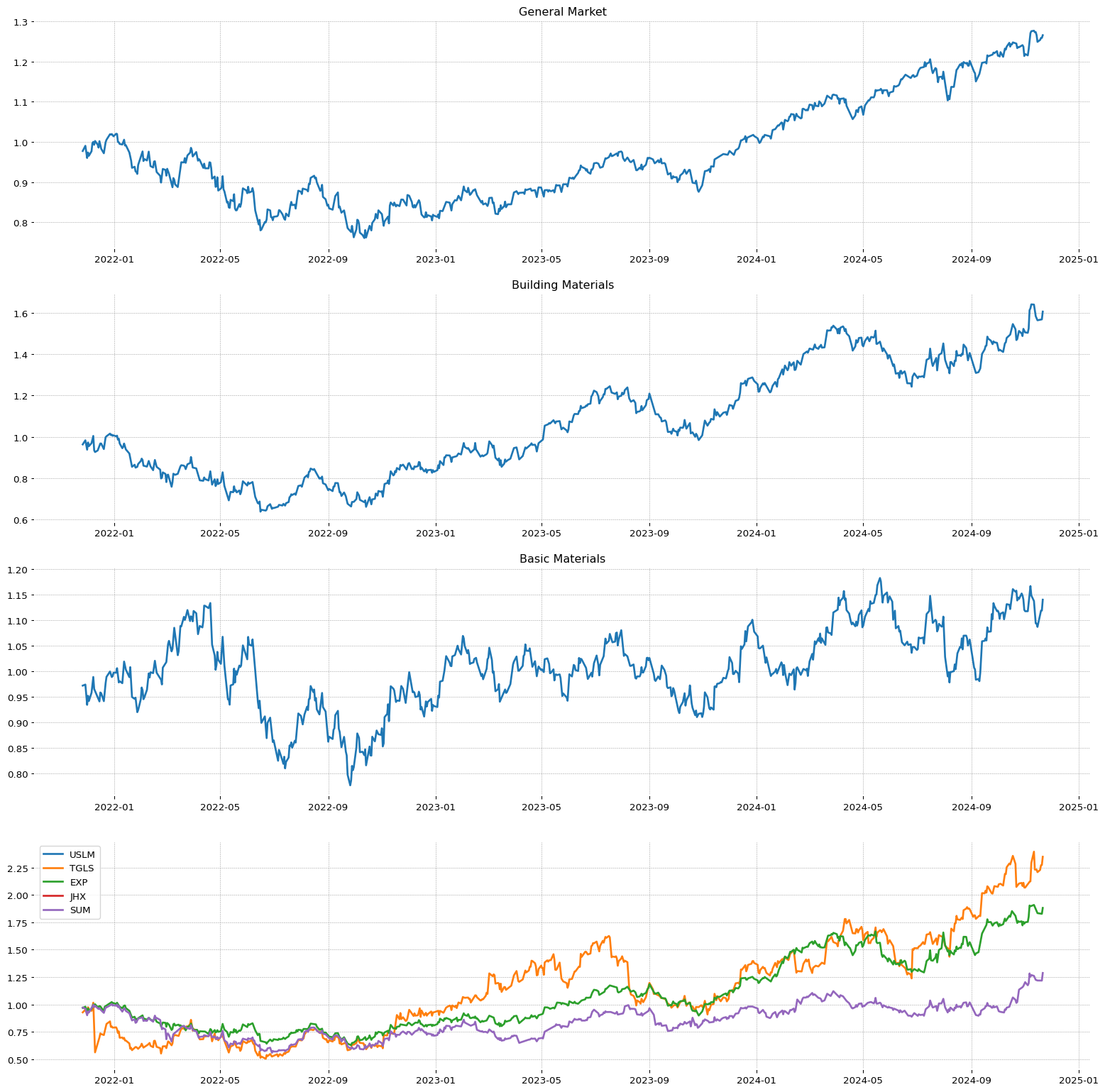

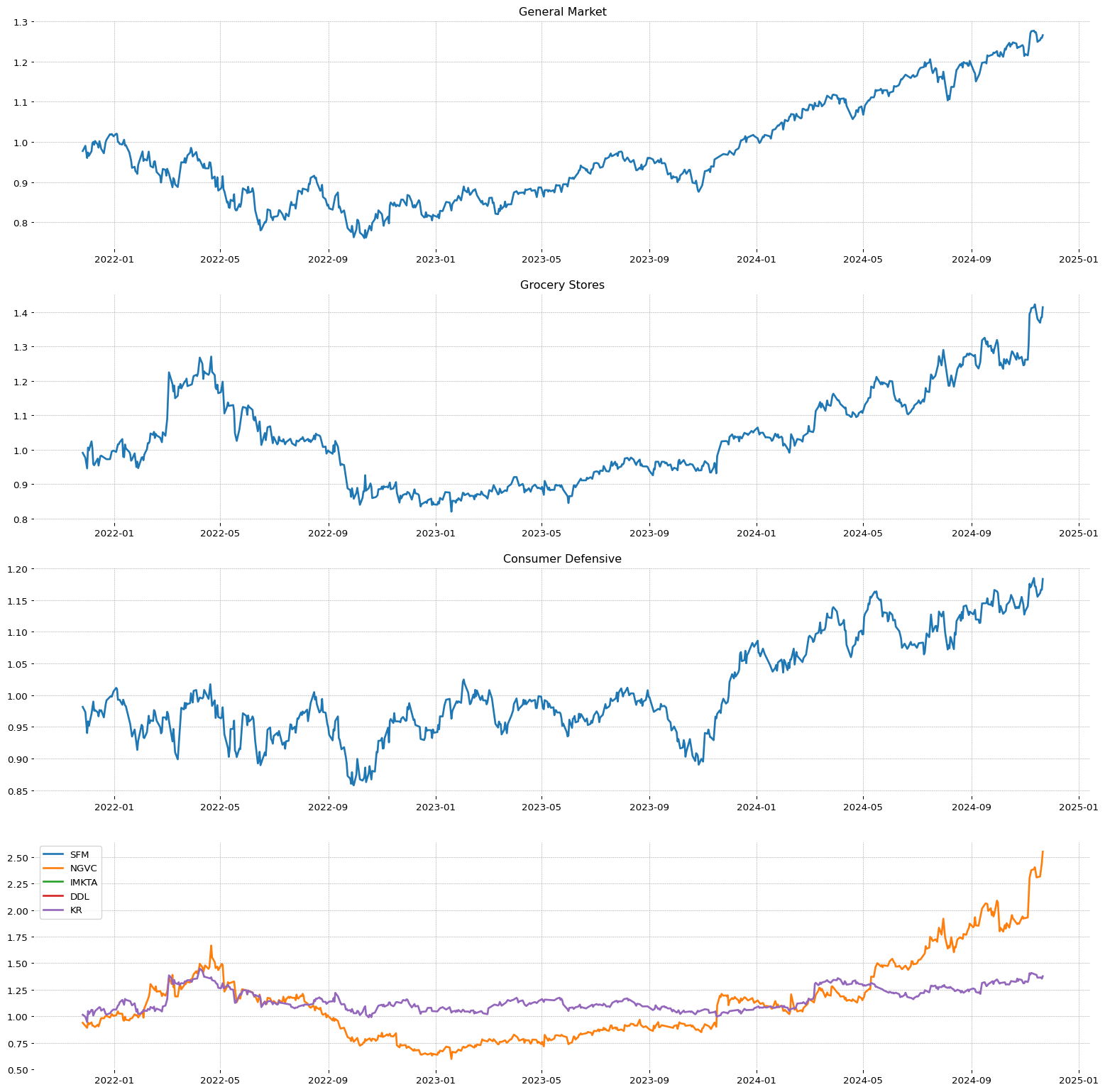

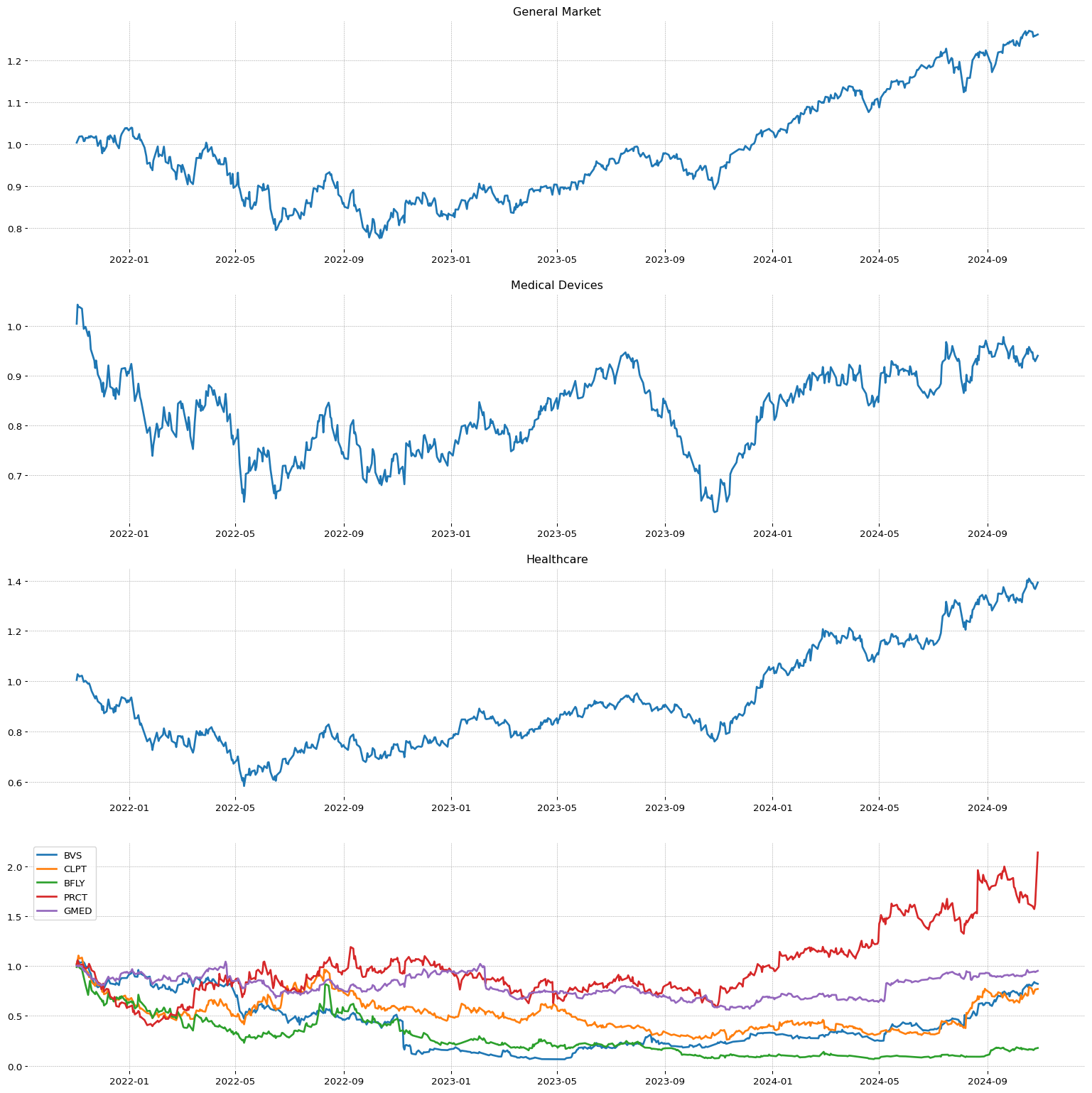

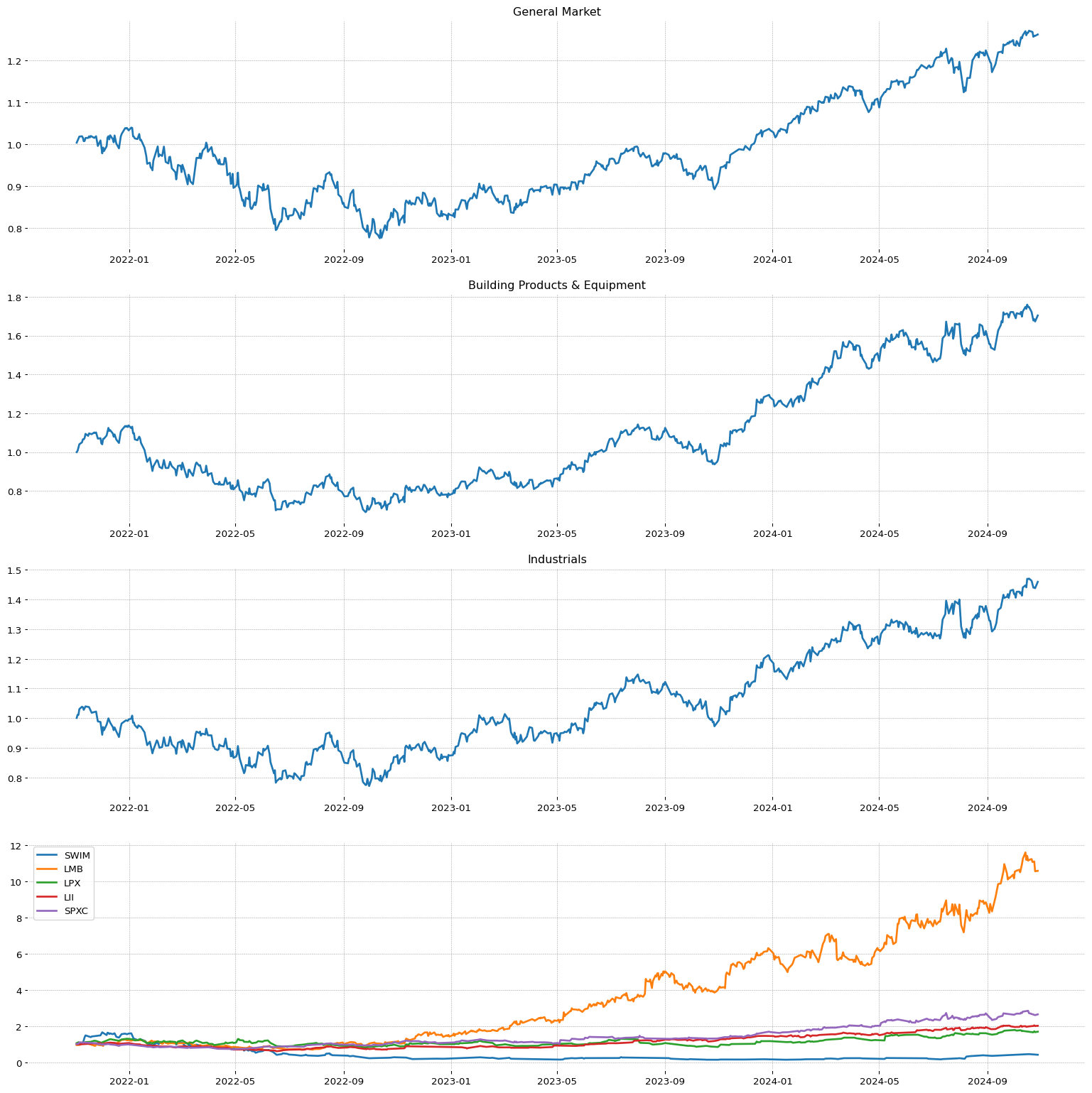

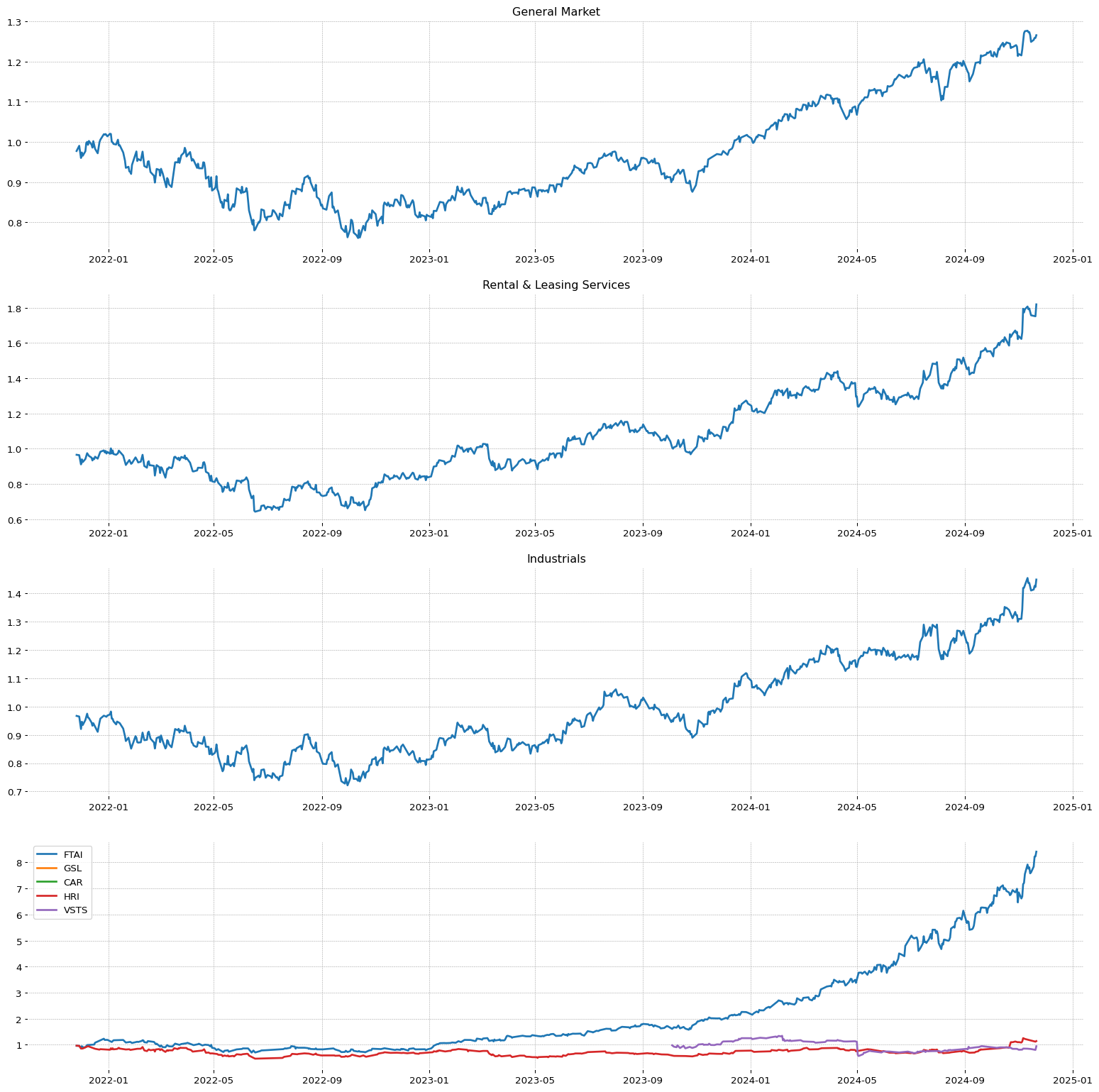

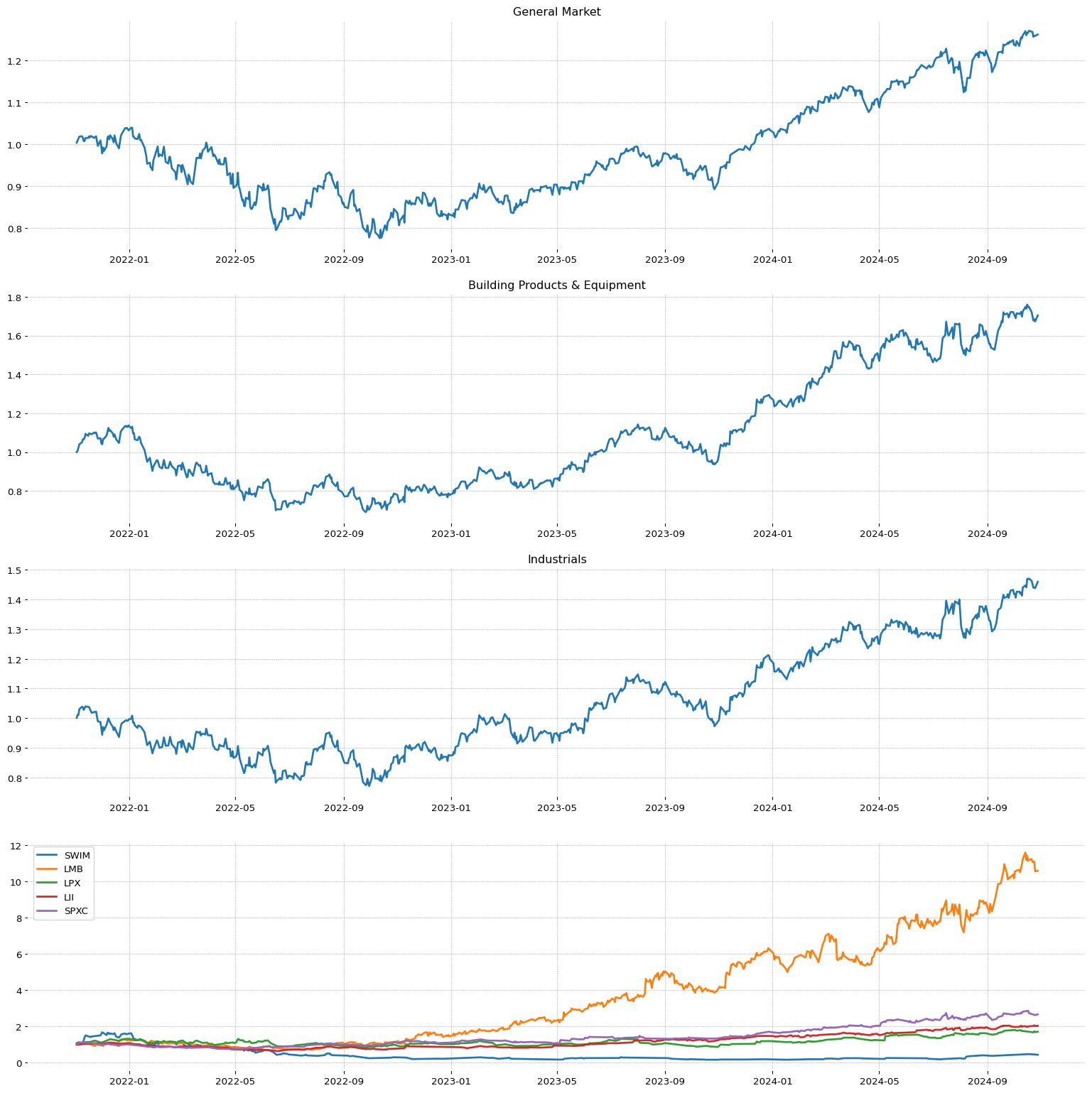

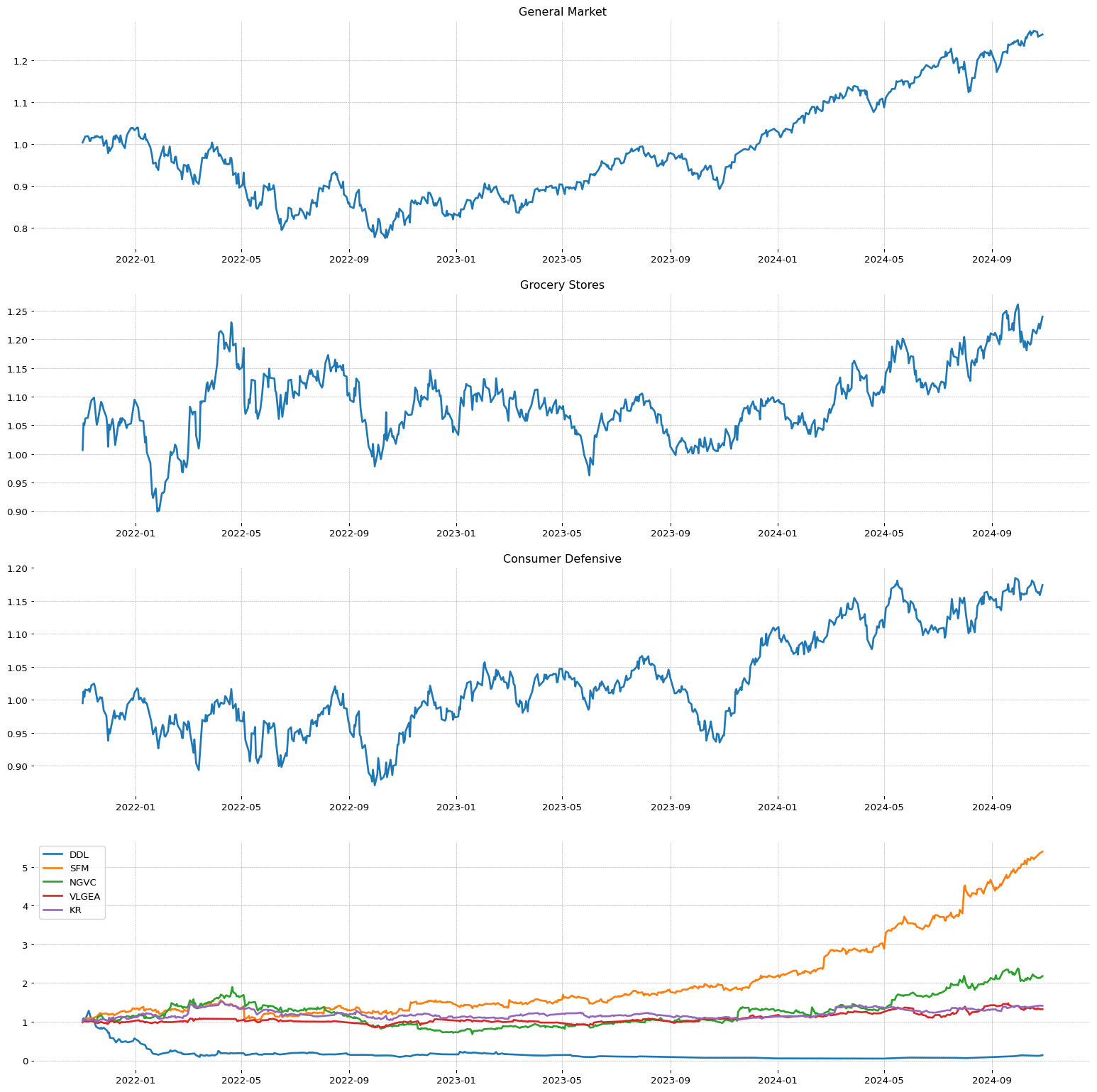

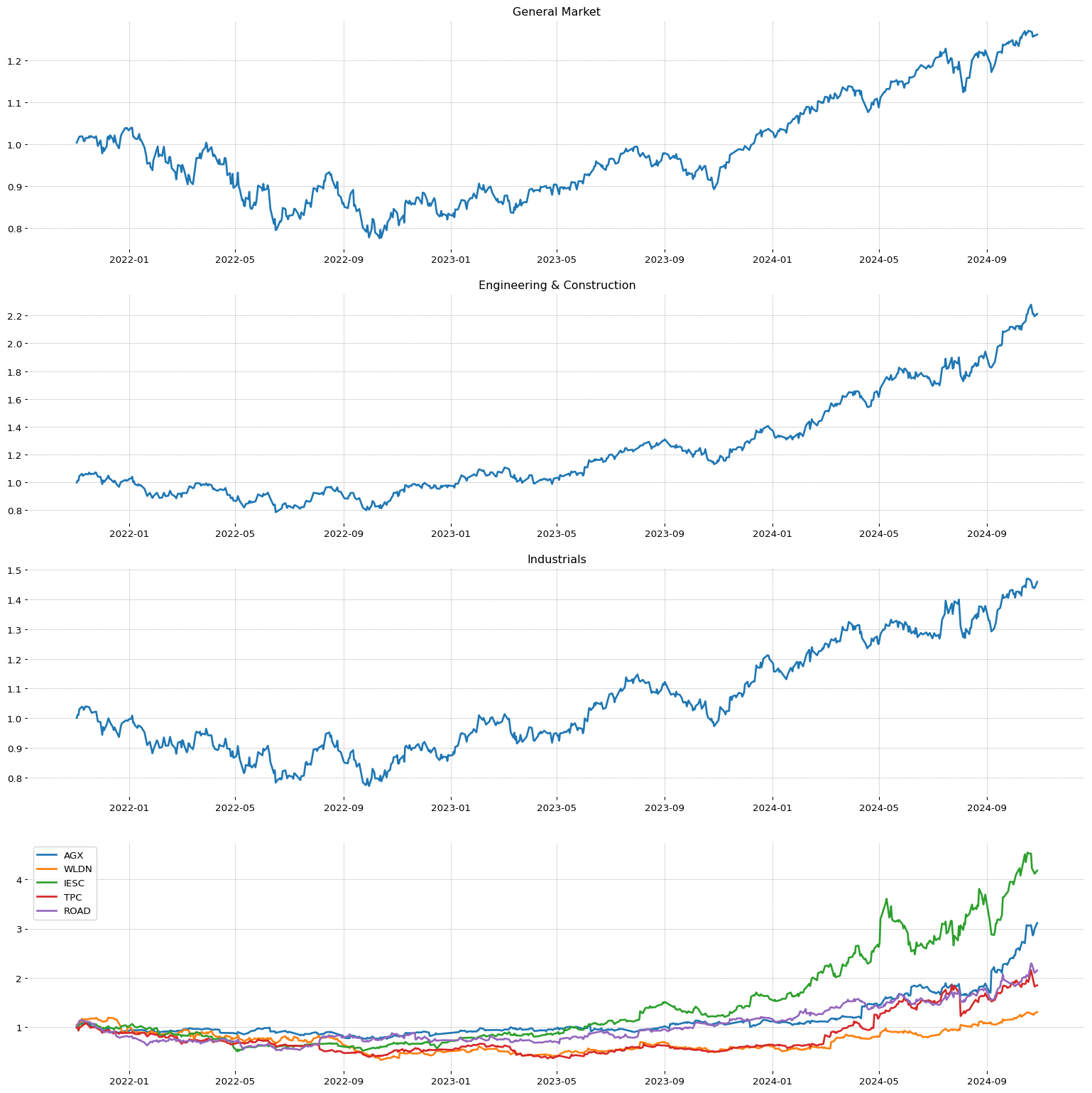

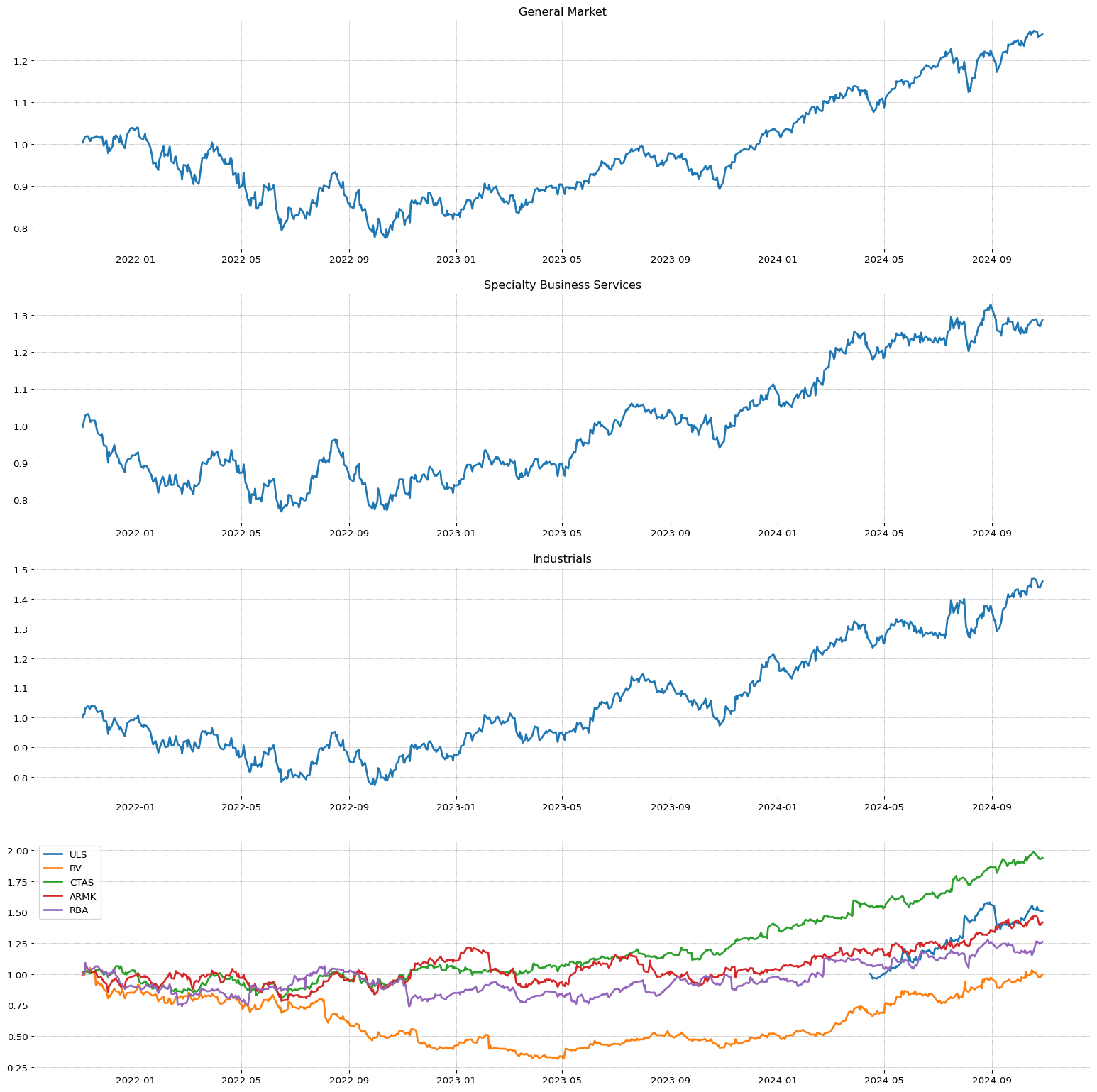

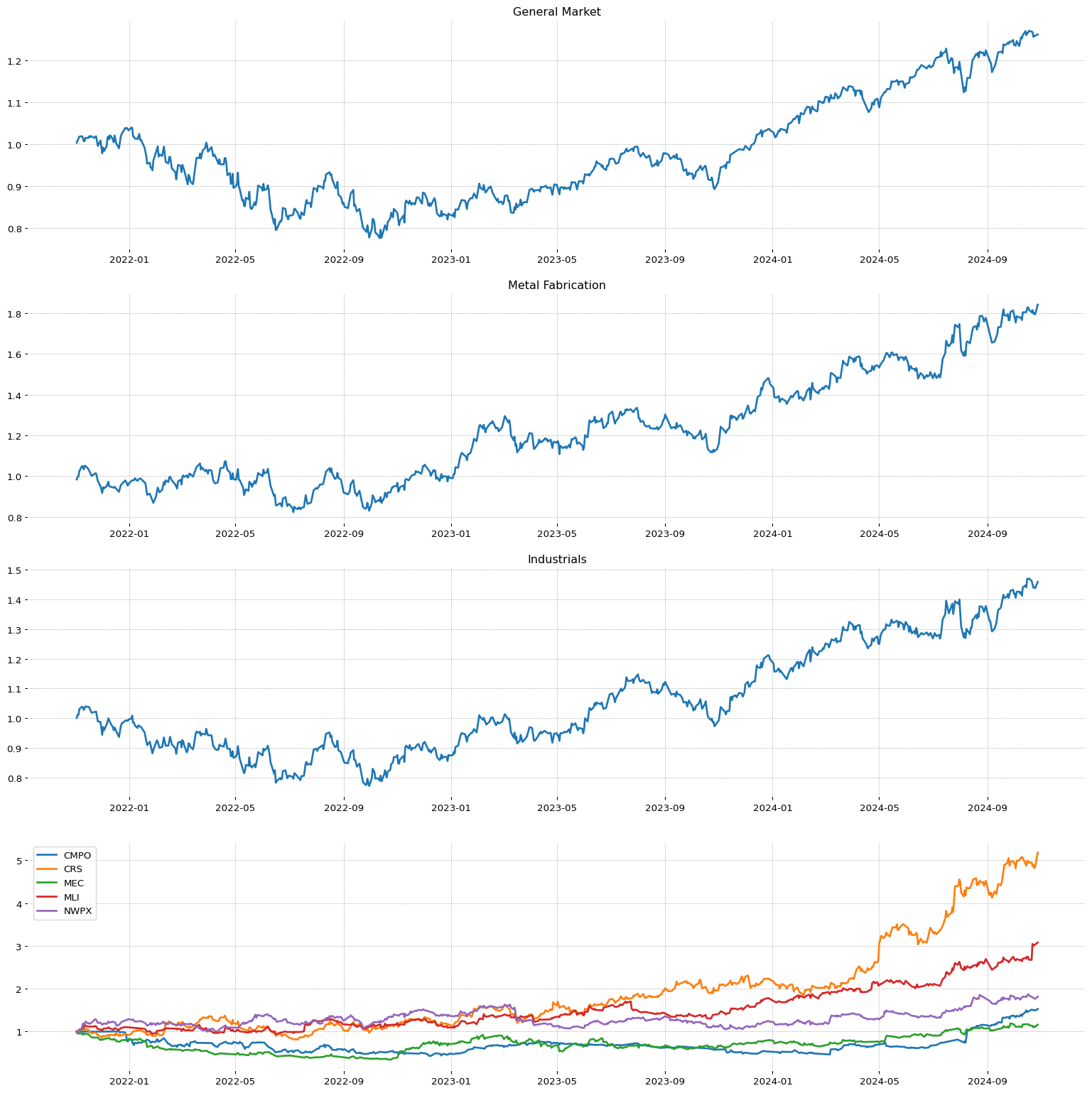

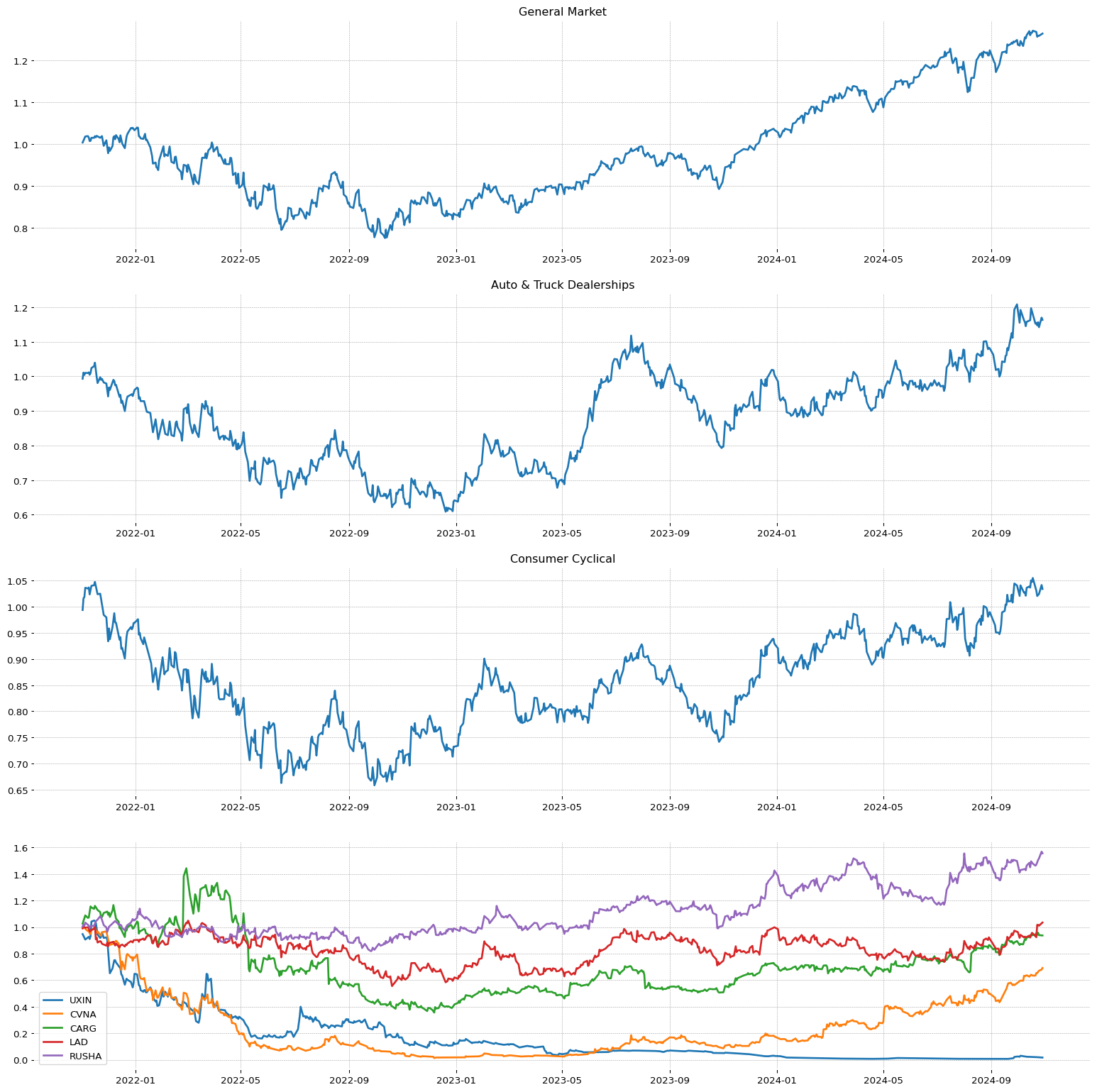

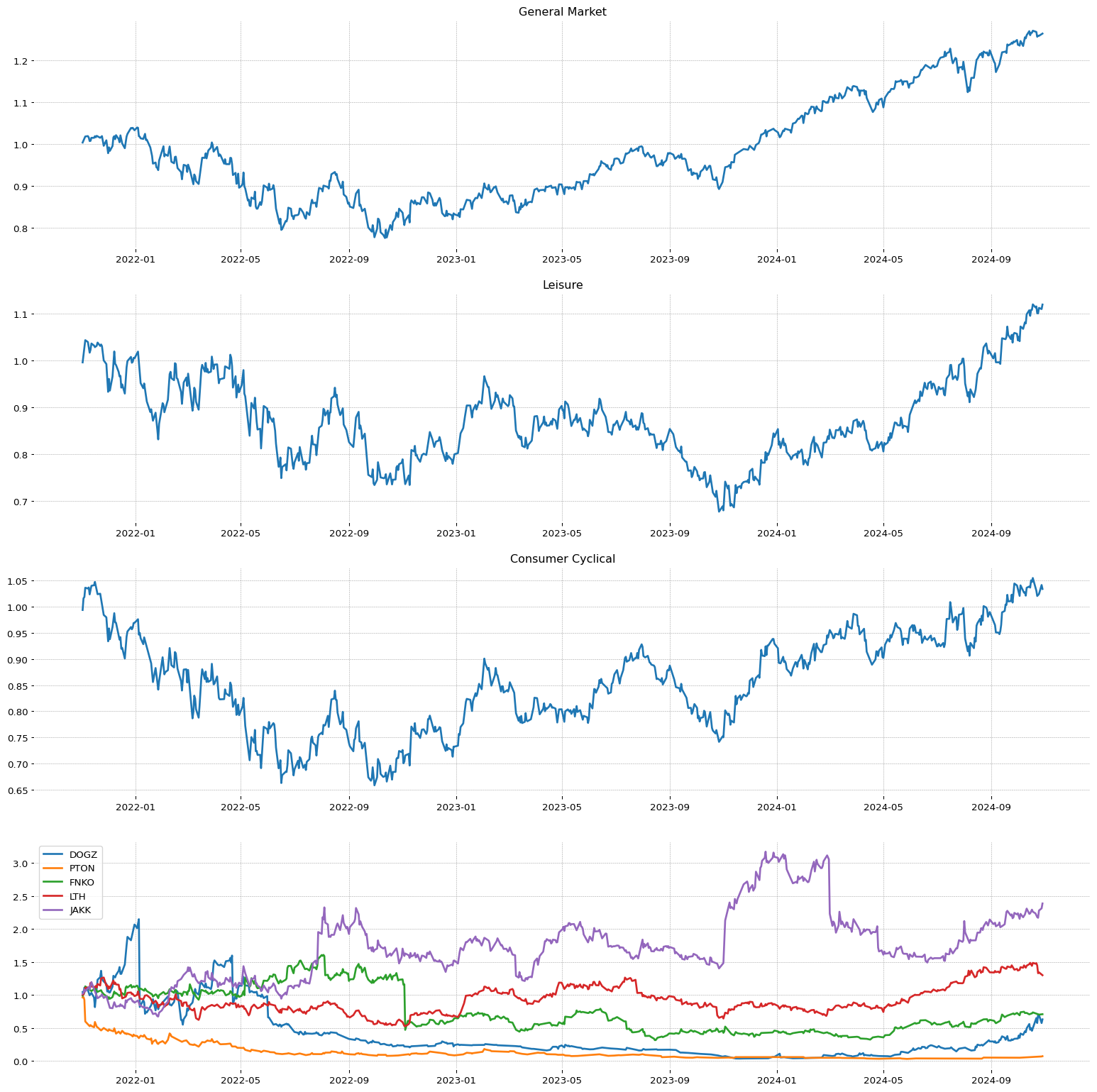

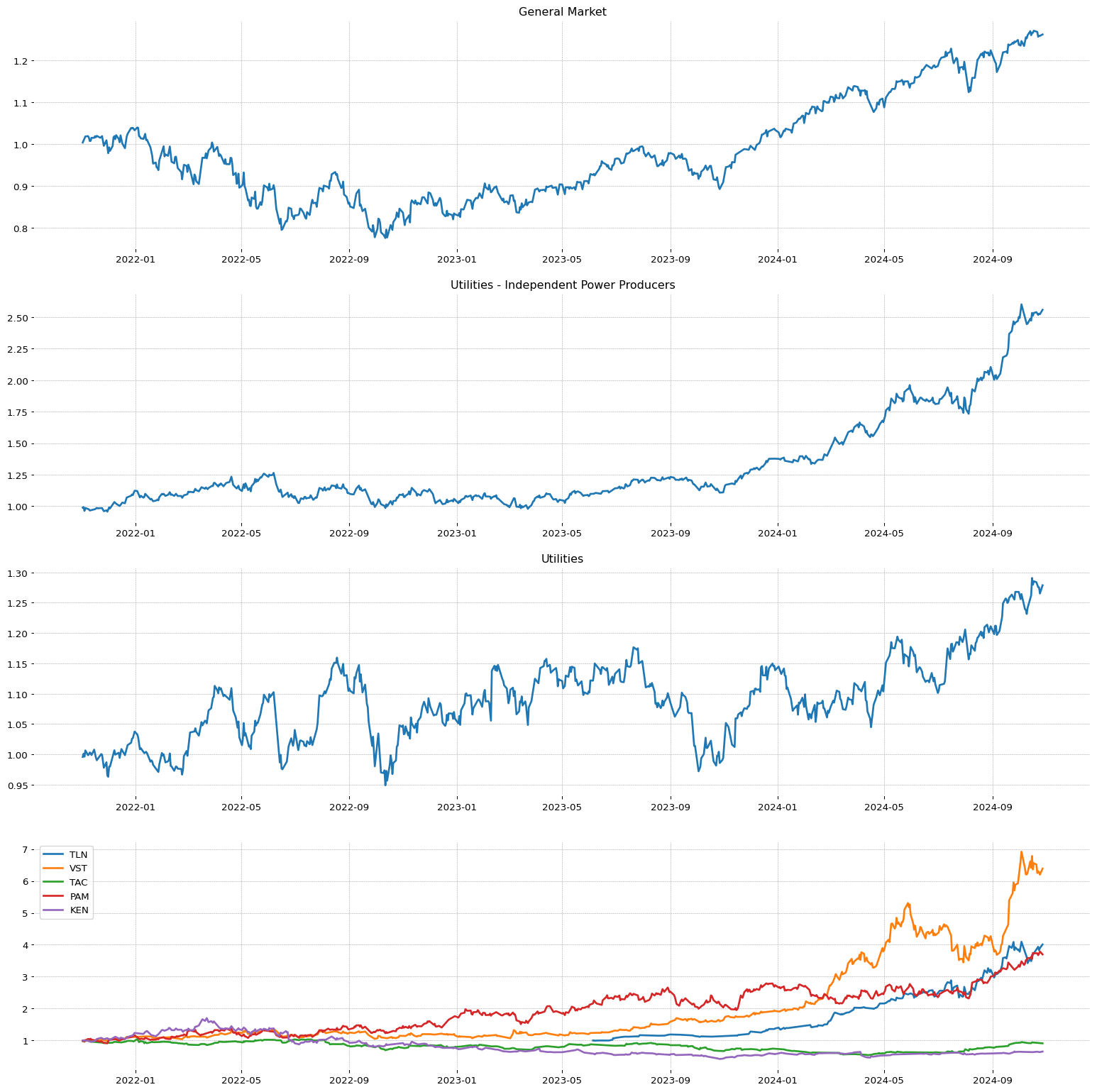

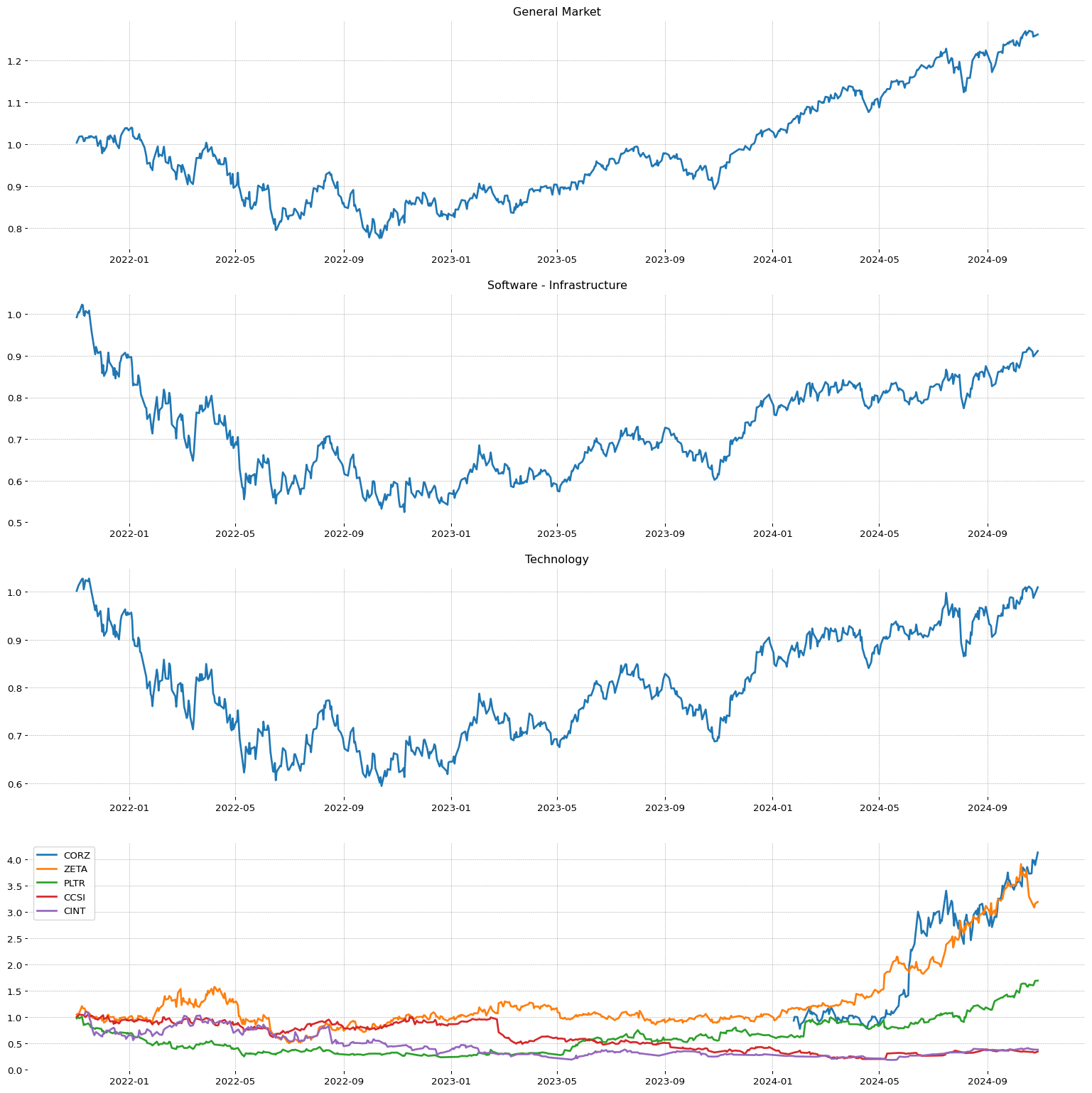

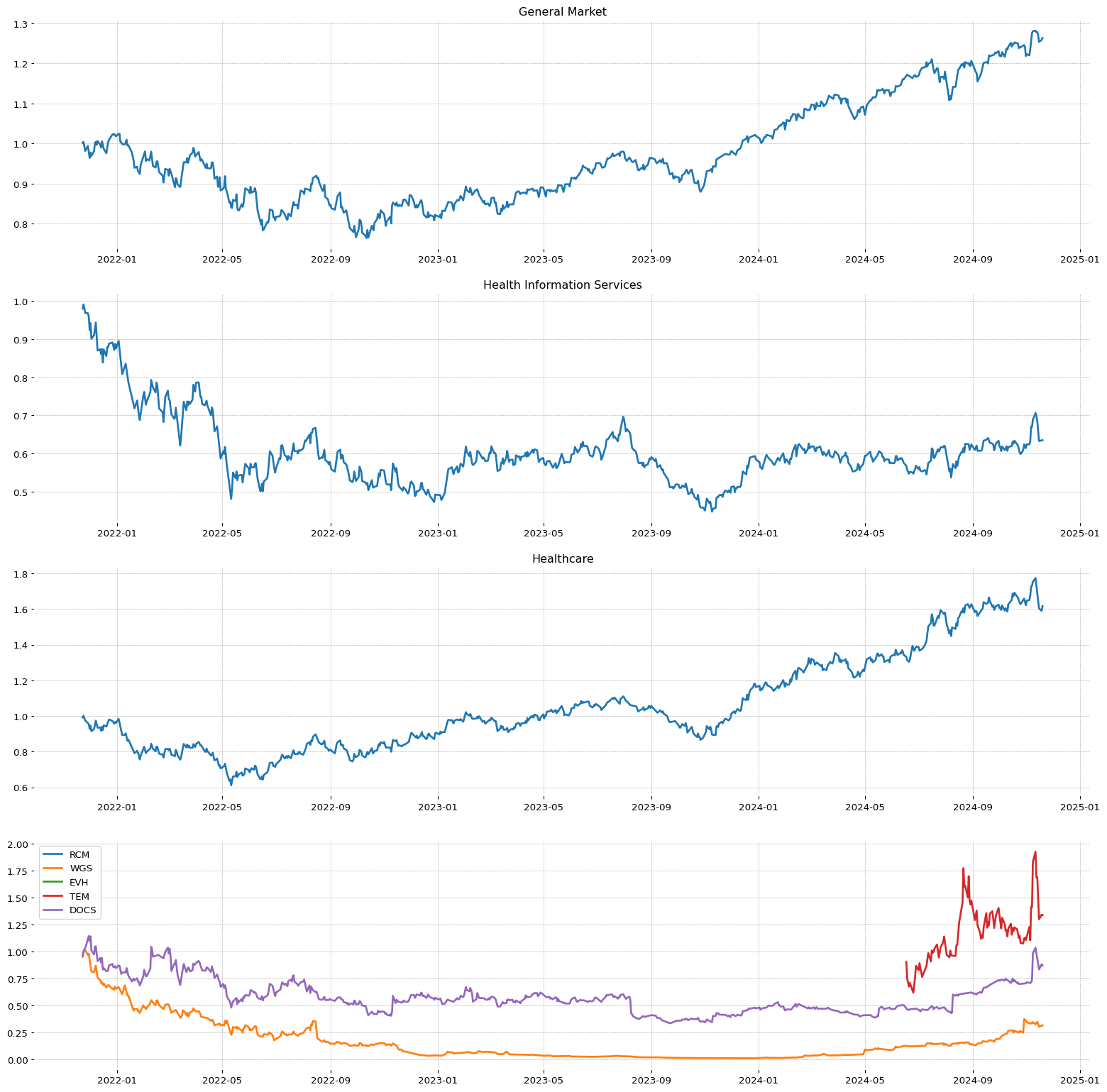

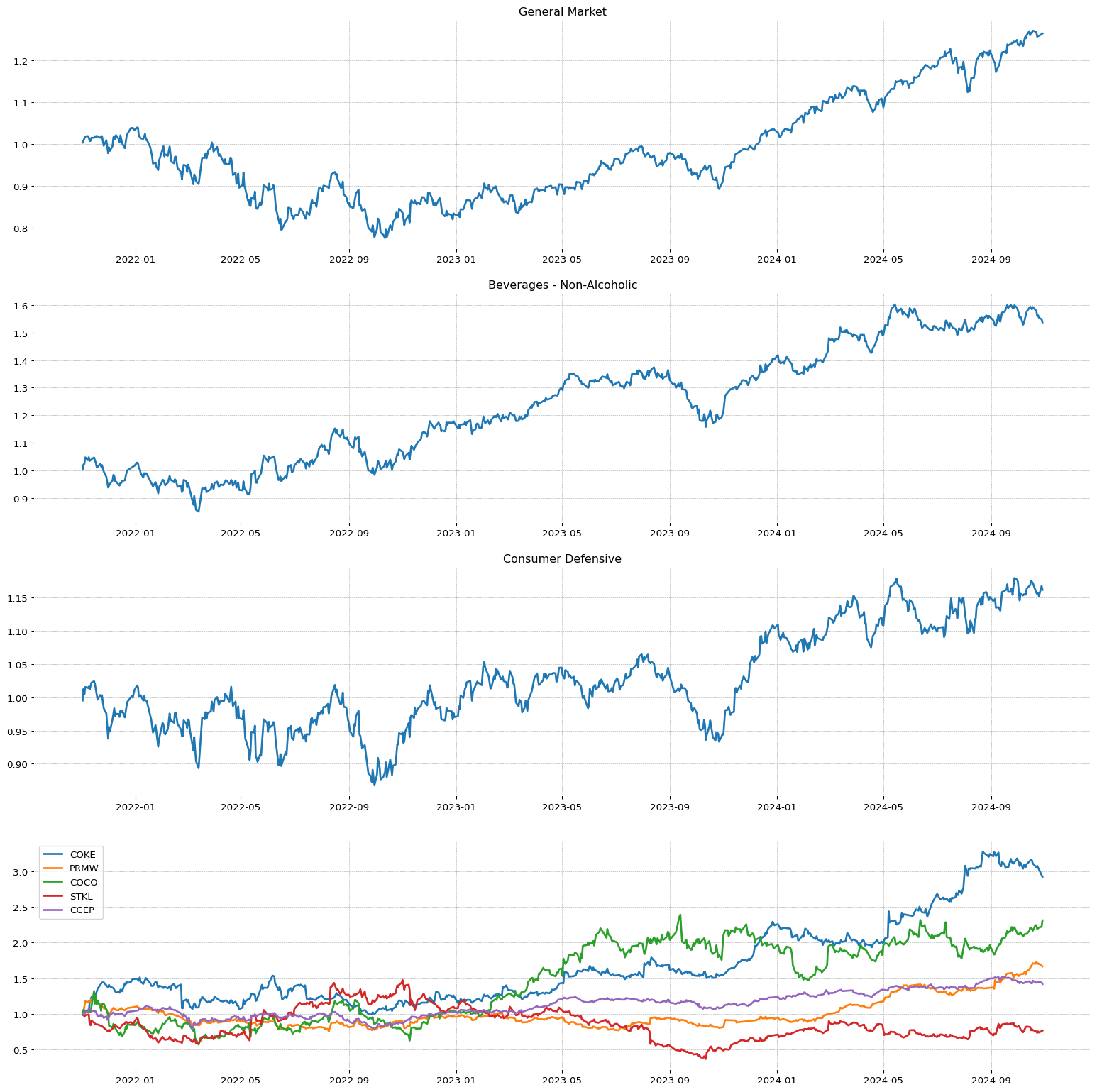

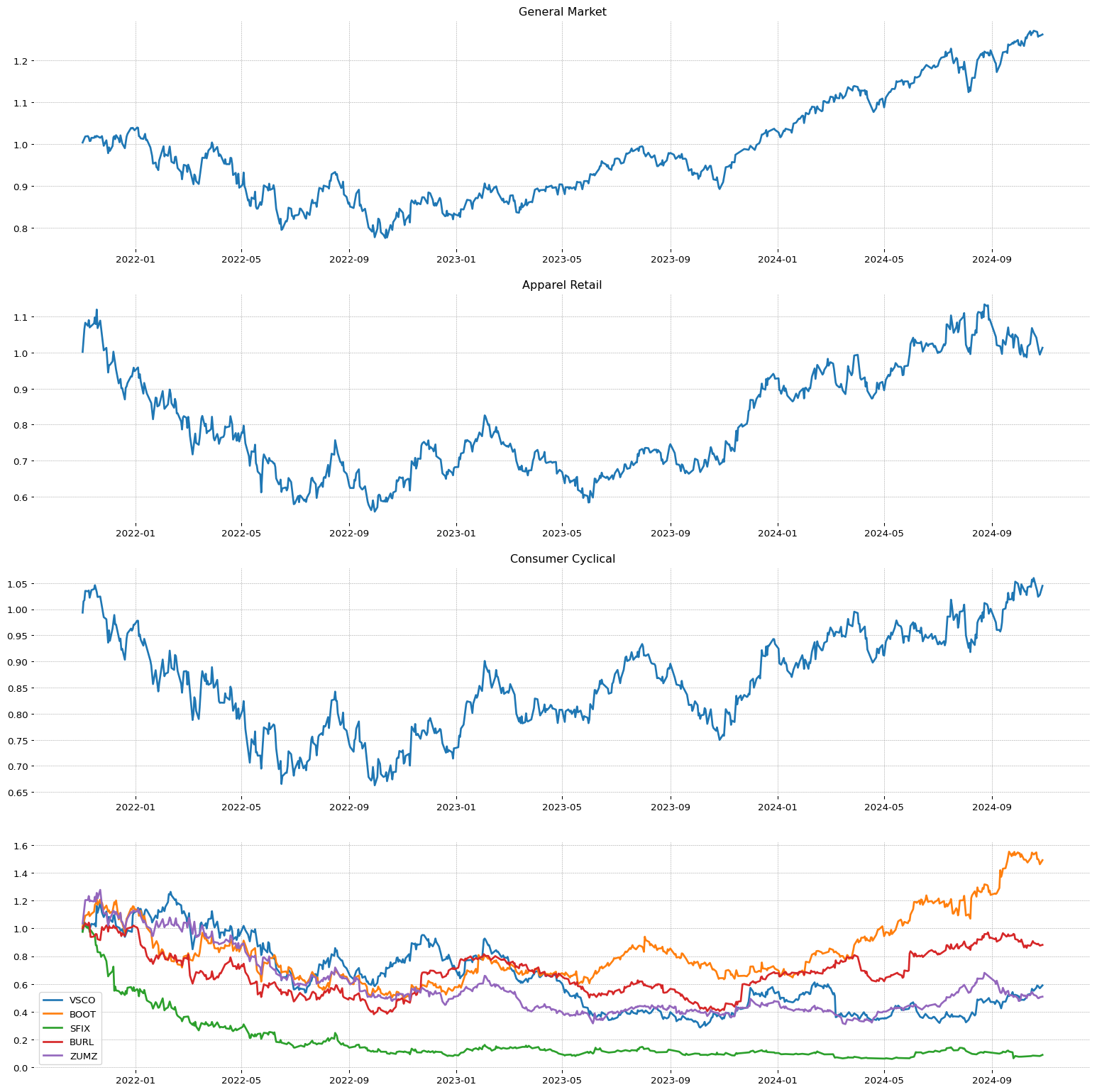

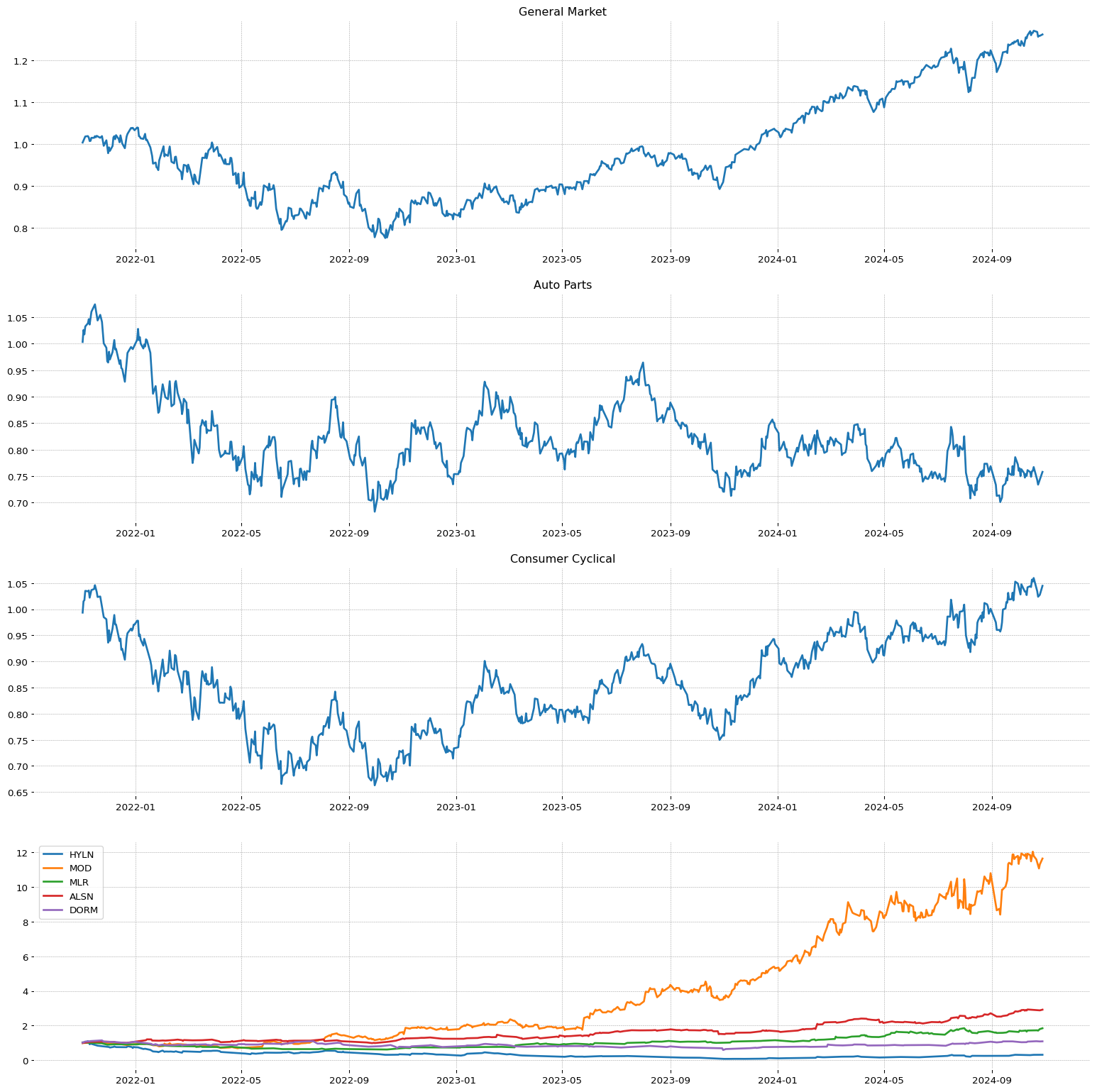

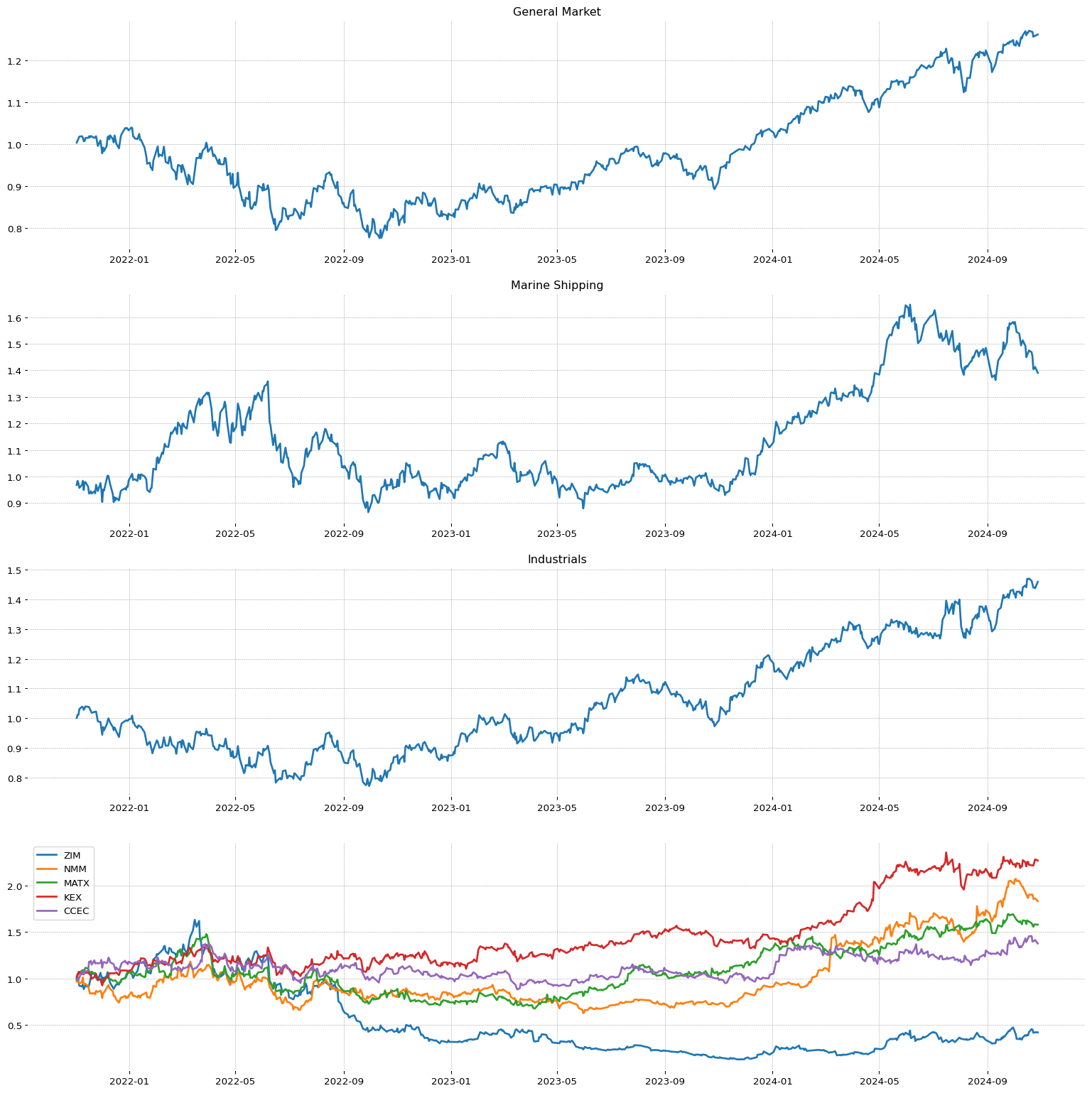

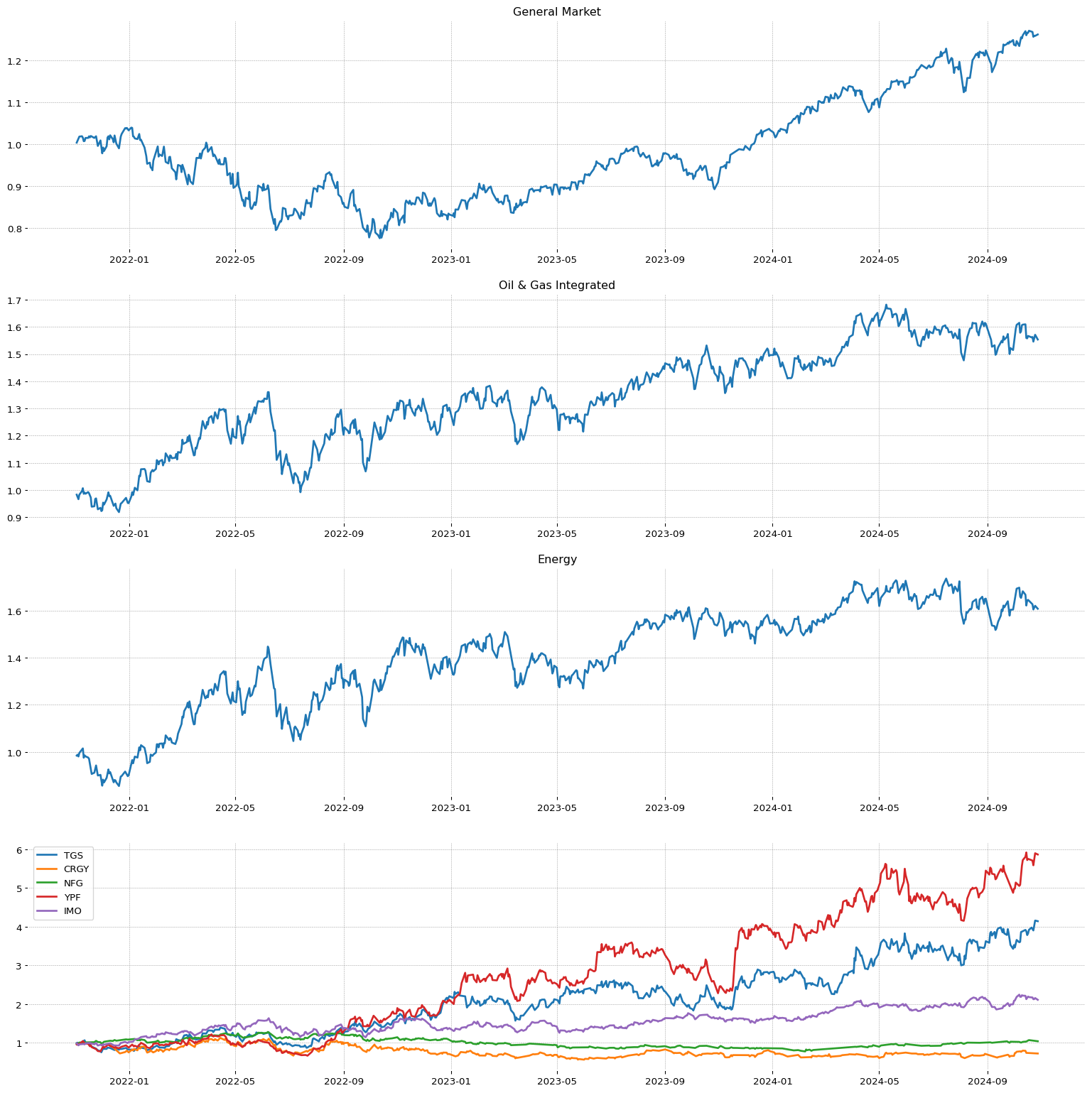

Return of Sector Group (now calculated on 27 weeks instead of 1 year)

| Pos. | |

Name | |

Today | |

3 weeks | |

6 weeks | |

26 weeks | |

1DAY | |

Ytoday | |

1YEAR | |

| 1.0 |

Healthcare |

100.0 |

63.0 |

72.0 |

100.0 |

1.91 |

32.37 |

75.31 |

| 2.0 |

Technology |

90.0 |

54.0 |

54.0 |

81.0 |

1.44 |

14.08 |

43.6 |

| 3.0 |

Financial |

81.0 |

90.0 |

81.0 |

63.0 |

1.56 |

18.61 |

45.84 |

| 4.0 |

Communication Services |

72.0 |

100.0 |

63.0 |

36.0 |

1.67 |

13.33 |

29.48 |

| 5.0 |

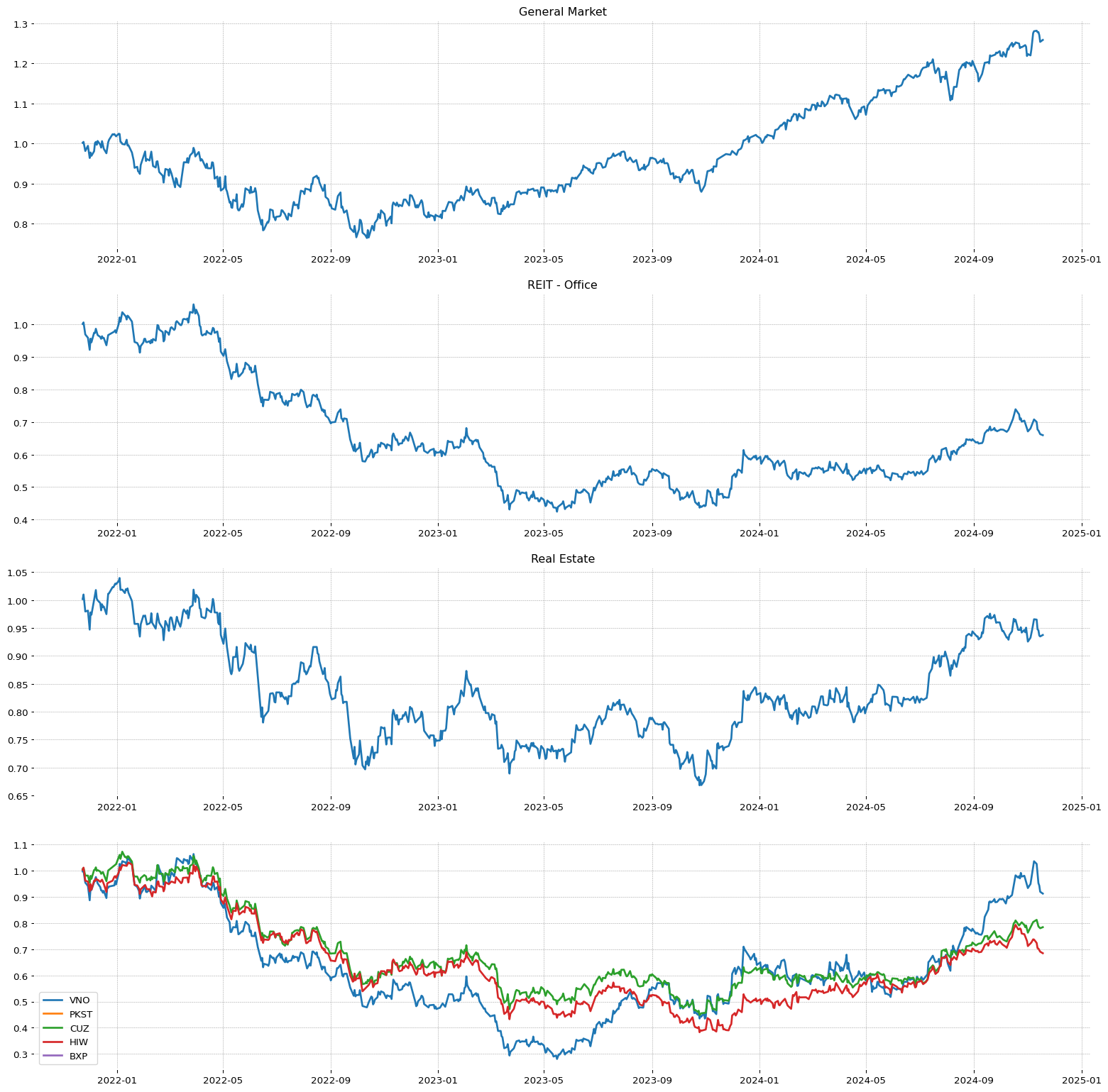

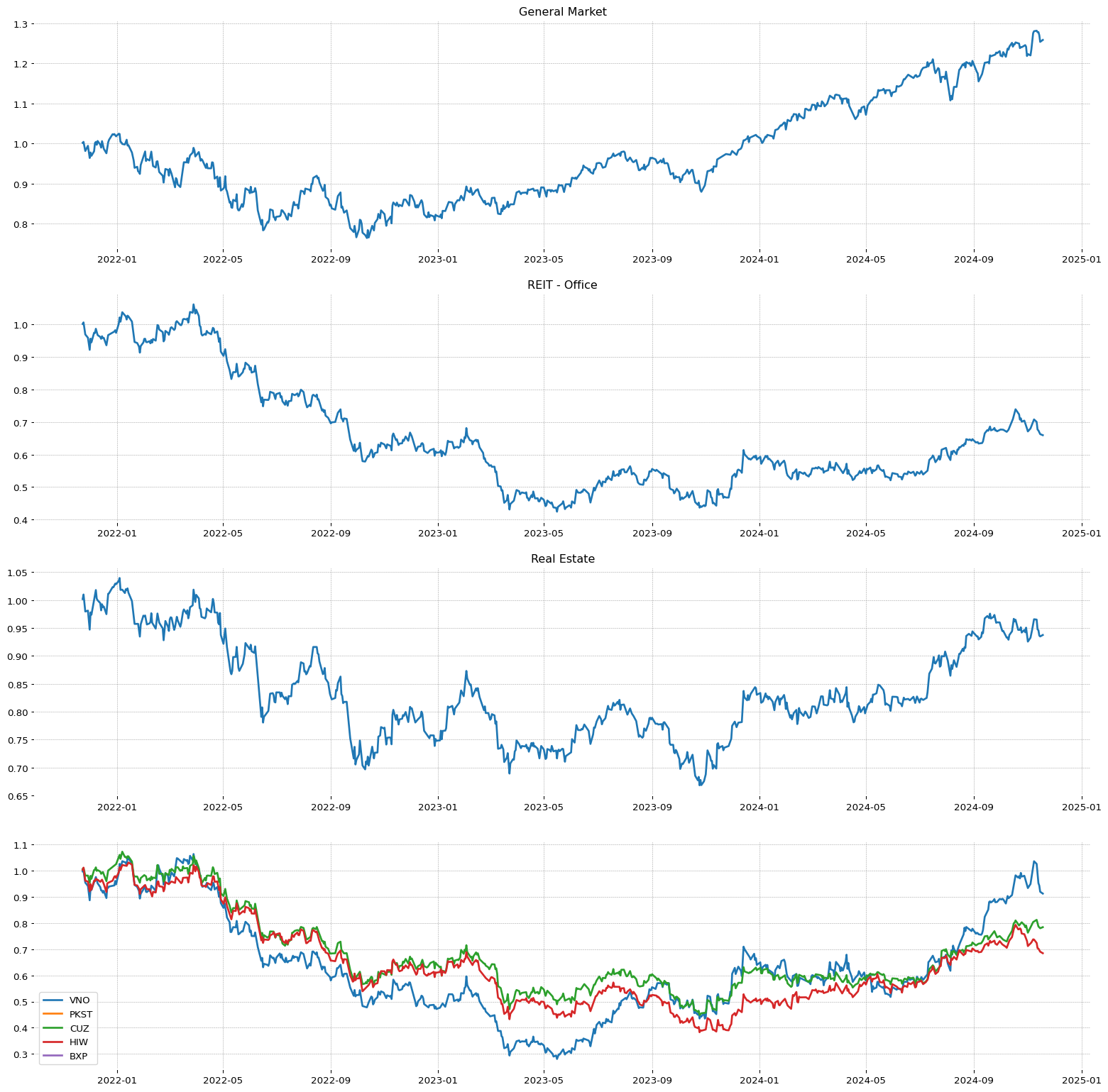

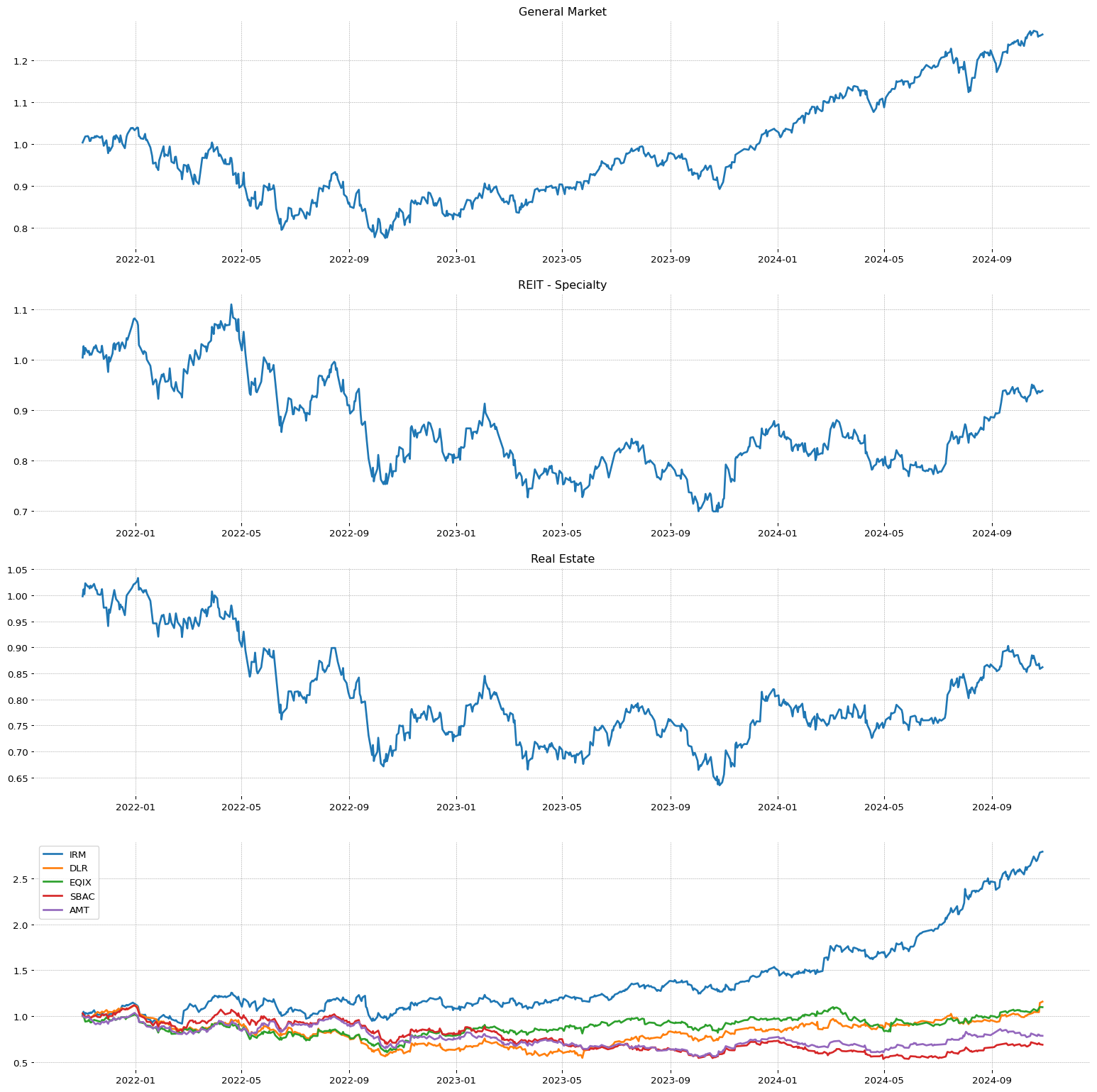

Real Estate |

63.0 |

81.0 |

100.0 |

27.0 |

0.39 |

6.41 |

31.71 |

| 6.0 |

Consumer Cyclical |

54.0 |

45.0 |

27.0 |

90.0 |

1.67 |

17.12 |

45.3 |

| 7.0 |

Industrials |

45.0 |

36.0 |

45.0 |

72.0 |

1.49 |

20.44 |

43.4 |

| 8.0 |

Utilities |

36.0 |

72.0 |

90.0 |

18.0 |

1.07 |

13.22 |

28.25 |

| 9.0 |

Basic Materials |

27.0 |

18.0 |

36.0 |

54.0 |

1.1 |

14.73 |

37.04 |

| 10.0 |

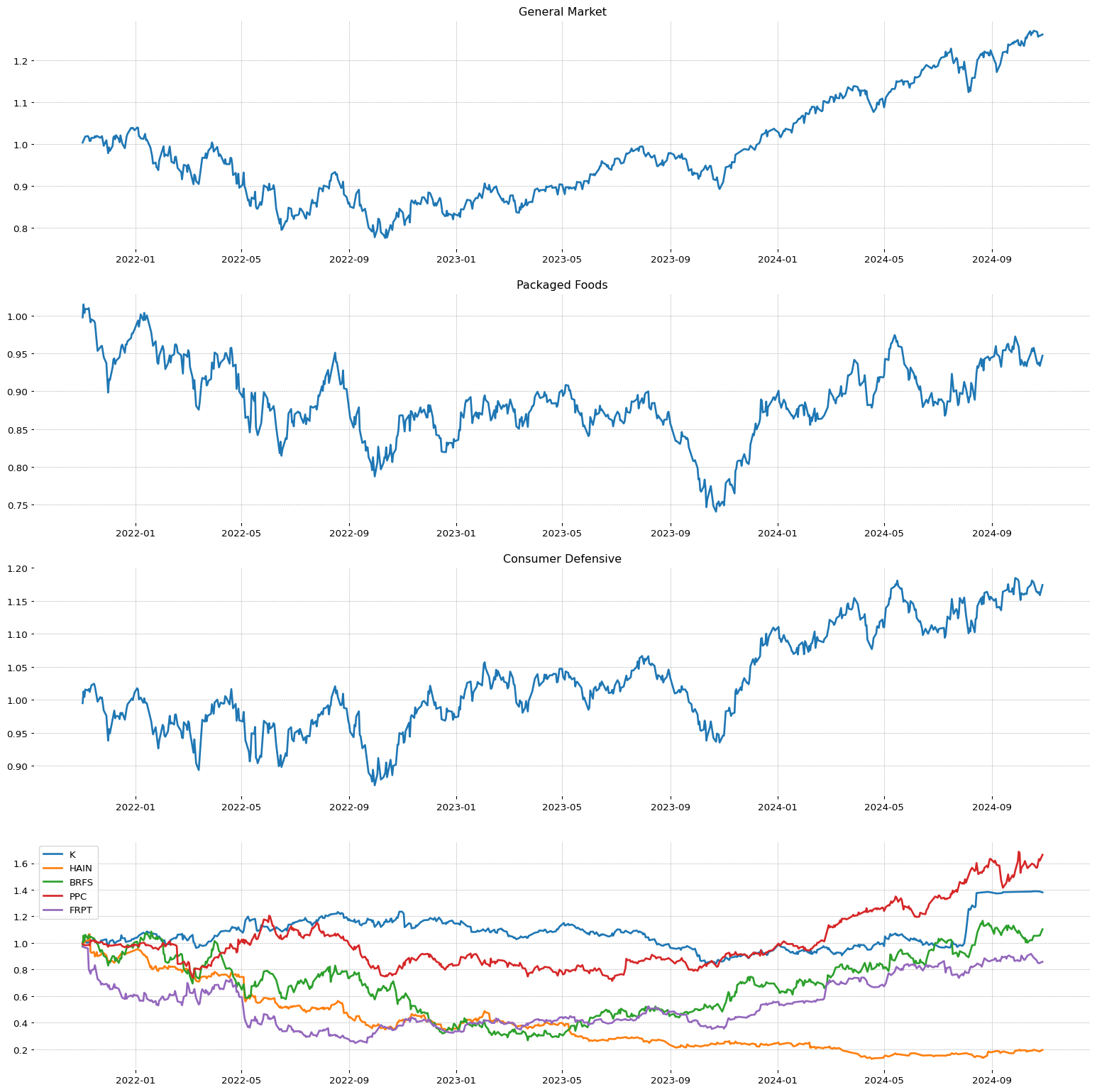

Consumer Defensive |

18.0 |

27.0 |

18.0 |

45.0 |

1.33 |

7.23 |

25.16 |

Best 50 Stock Industry Group

| Pos. | |

Name | |

Today | |

3 weeks | |

6 weeks | |

26 weeks | |

1DAY | |

Ytoday | |

1YEAR | |

|| |

Pos. | |

Name | |

Today | |

3 weeks | |

6 weeks | |

26 weeks | |

1DAY | |

7DAY | |

30DAY | |

Ytoday | |

1YEAR | |

Ratio_GP | |

Ratio_NI | |

ROE | |

| 1.0 |

Communication Equipment |

100.0 |

100.0 |

100.0 |

64.0 |

1.07 |

48.07 |

98.14 |

34.41 |

-7.57 |

6.03 |

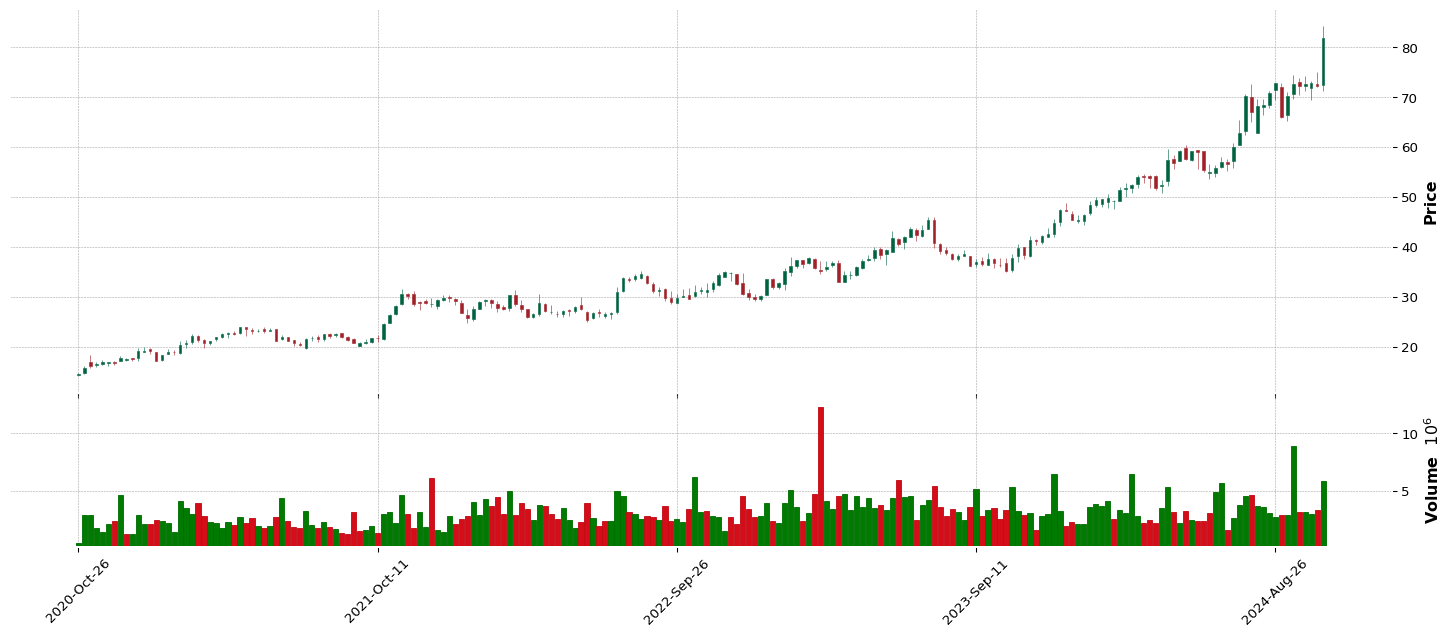

|| |

26.0 |

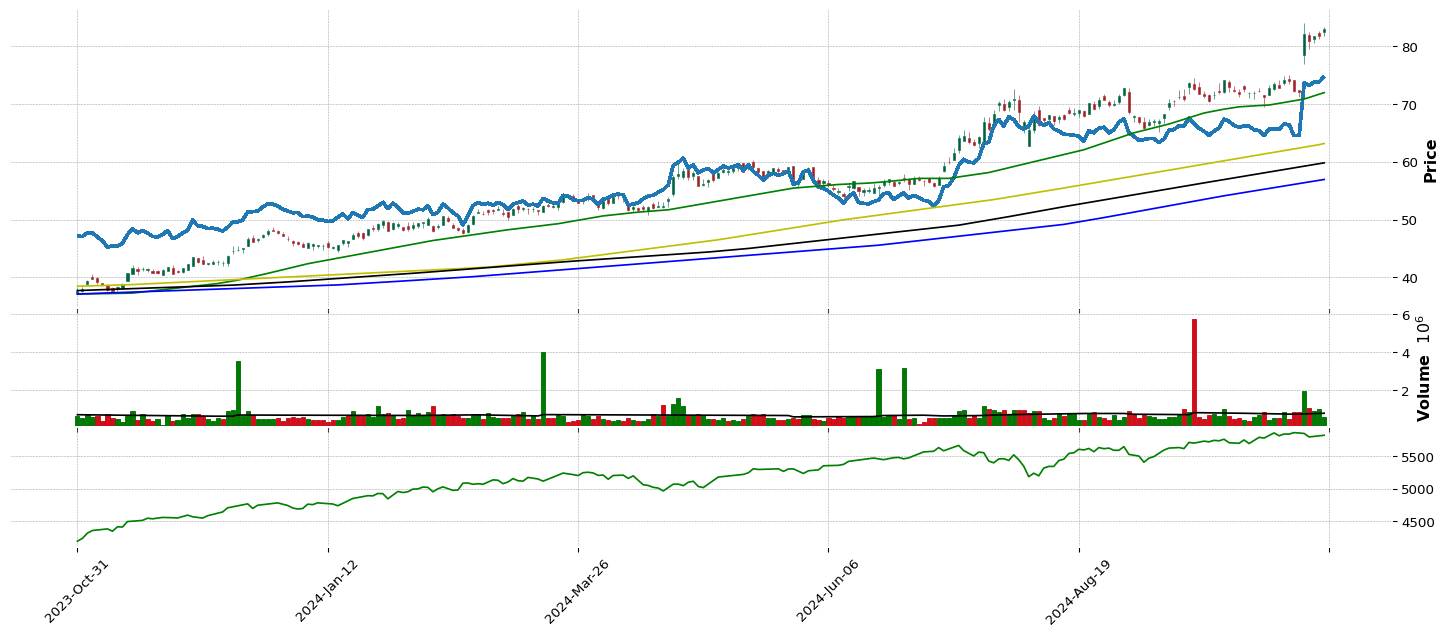

Metal Fabrication |

82.0 |

87.0 |

87.0 |

61.0 |

2.67 |

38.09 |

63.53% |

25.74 |

4.5 |

8.24 |

| 2.0 |

Healthcare Plans |

99.0 |

99.0 |

99.0 |

55.0 |

-0.59 |

32.68 |

50.64 |

47.73 |

0.29 |

-5.42 |

|| |

27.0 |

REIT - Healthcare Facilities |

82.0 |

94.0 |

93.0 |

24.0 |

0.52 |

10.45 |

27.02% |

49.02 |

1.43 |

1.48 |

| 3.0 |

Leisure |

98.0 |

97.0 |

93.0 |

76.0 |

-0.44 |

48.56 |

64.98 |

44.23 |

-0.83 |

-10.35 |

|| |

28.0 |

Insurance - Specialty |

81.0 |

76.0 |

82.0 |

49.0 |

1.31 |

27.86 |

49.55% |

83.57 |

25.44 |

6.08 |

| 4.0 |

Pollution & Treatment Controls |

97.0 |

95.0 |

88.0 |

85.0 |

-0.49 |

68.1 |

82.03 |

31.96 |

7.59 |

8.79 |

|| |

29.0 |

Aerospace & Defense |

80.0 |

80.0 |

63.0 |

59.0 |

0.85 |

35.1 |

52.46% |

26.49 |

-6.1 |

7.44 |

| 5.0 |

Utilities - Independent Power Producers |

97.0 |

98.0 |

97.0 |

97.0 |

1.37 |

94.36 |

137.41 |

30.83 |

16.36 |

20.5 |

|| |

30.0 |

Drug Manufacturers - Specialty & Generic |

80.0 |

70.0 |

74.0 |

60.0 |

1.52 |

22.25 |

48.26% |

54.78 |

-8.76 |

5.24 |

| 6.0 |

Capital Markets |

96.0 |

92.0 |

80.0 |

94.0 |

4.48 |

27.95 |

75.24 |

50.67 |

12.53 |

4.11 |

|| |

31.0 |

Gold |

79.0 |

55.0 |

95.0 |

61.0 |

-0.45 |

33.31 |

53.84% |

28.78 |

1.37 |

-0.29 |

| 7.0 |

Silver |

95.0 |

44.0 |

98.0 |

75.0 |

2.01 |

60.3 |

82.65 |

16.13 |

2.14 |

2.31 |

|| |

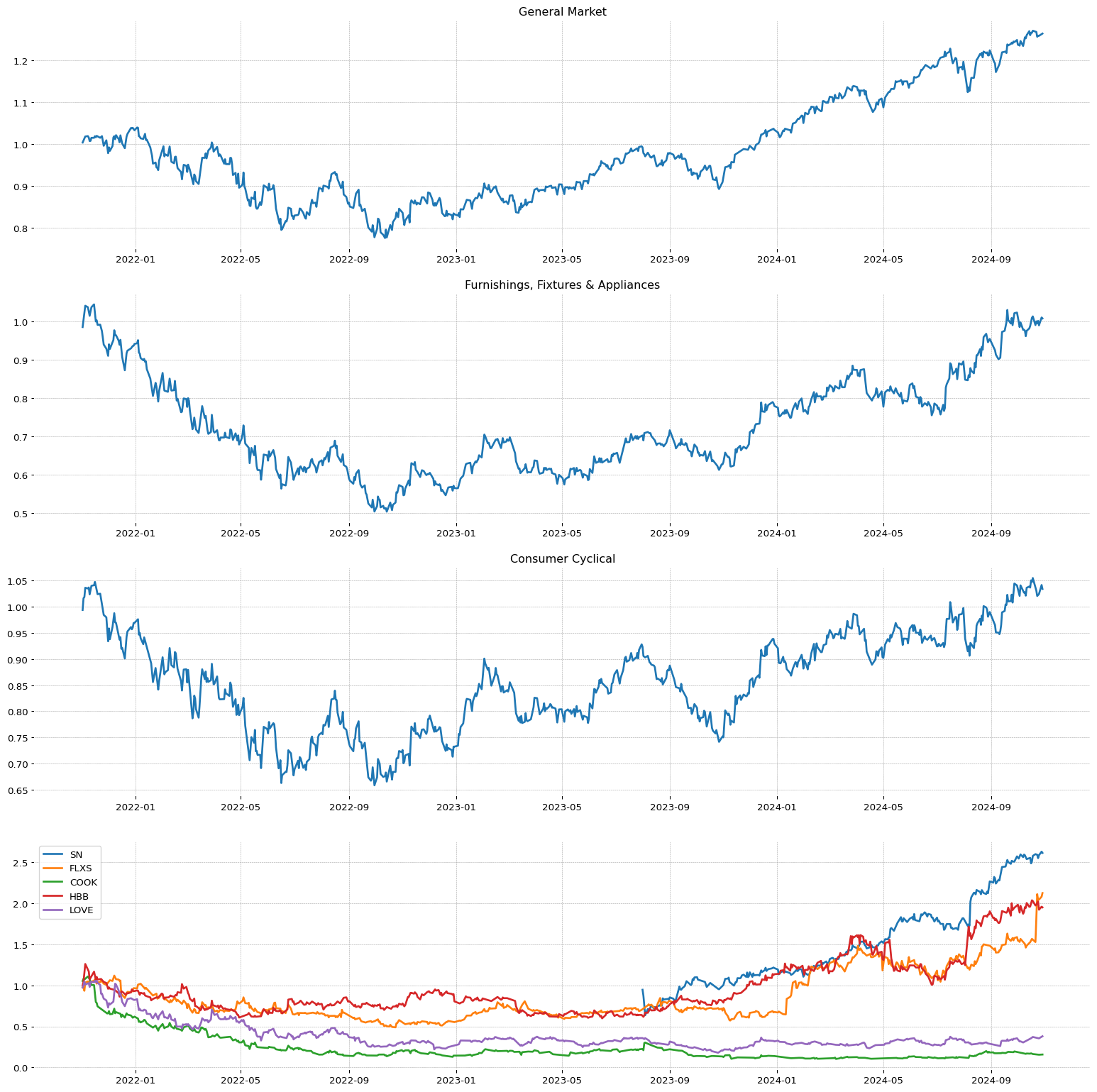

32.0 |

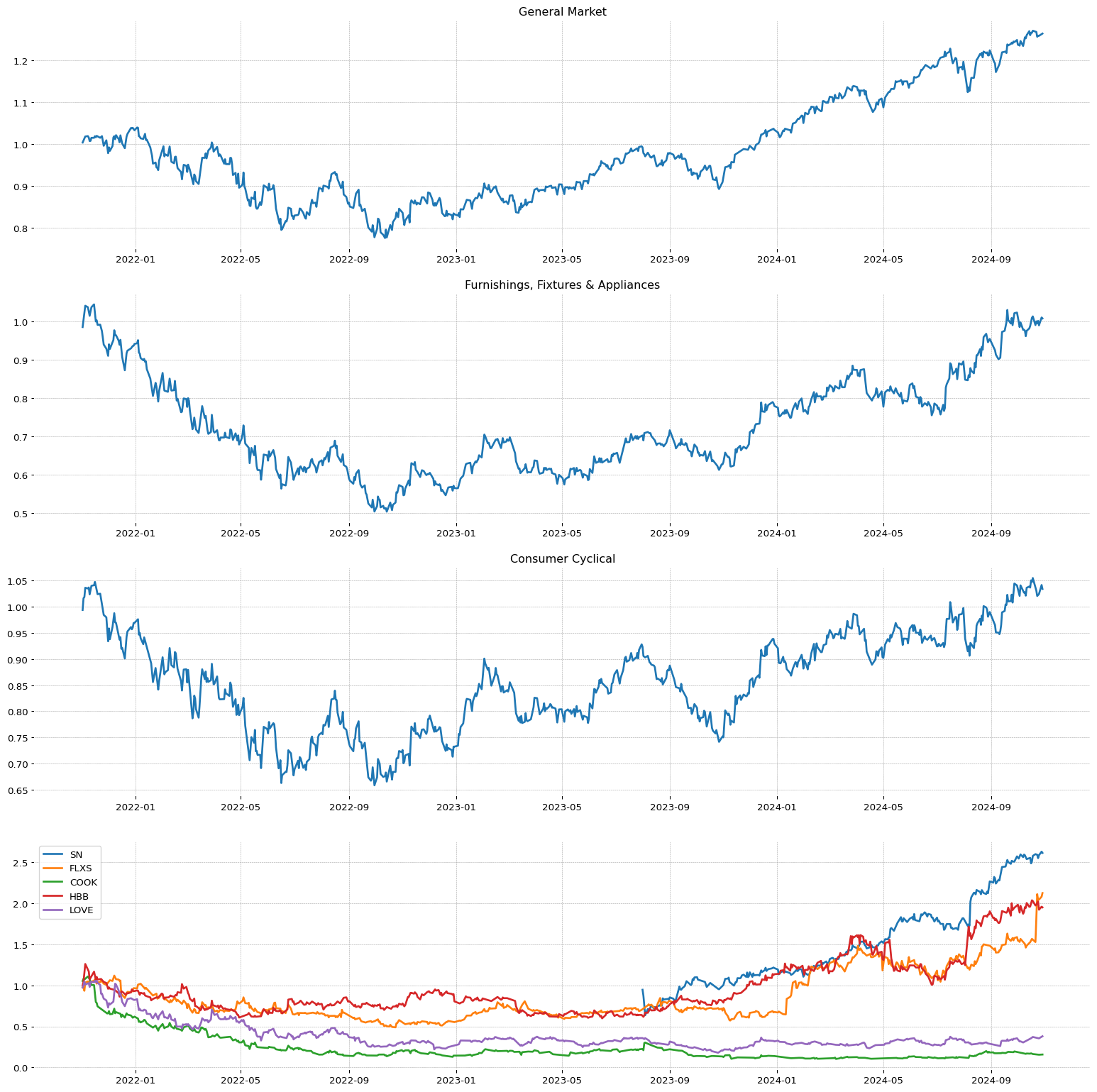

Furnishings, Fixtures & Appliances |

78.0 |

68.0 |

78.0 |

39.0 |

1.38 |

30.4 |

53.53% |

35.81 |

-0.99 |

16.71 |

| 8.0 |

Thermal Coal |

95.0 |

97.0 |

60.0 |

6.0 |

1.35 |

10.16 |

11.74 |

37.86 |

45.64 |

27.18 |

|| |

33.0 |

Financial Data & Stock Exchanges |

78.0 |

63.0 |

57.0 |

72.0 |

1.06 |

16.9 |

50.89% |

62.02 |

24.95 |

5.31 |

| 9.0 |

Electrical Equipment & Parts |

94.0 |

84.0 |

43.0 |

40.0 |

2.61 |

30.33 |

40.56 |

7.54 |

-16.5 |

7.38 |

|| |

34.0 |

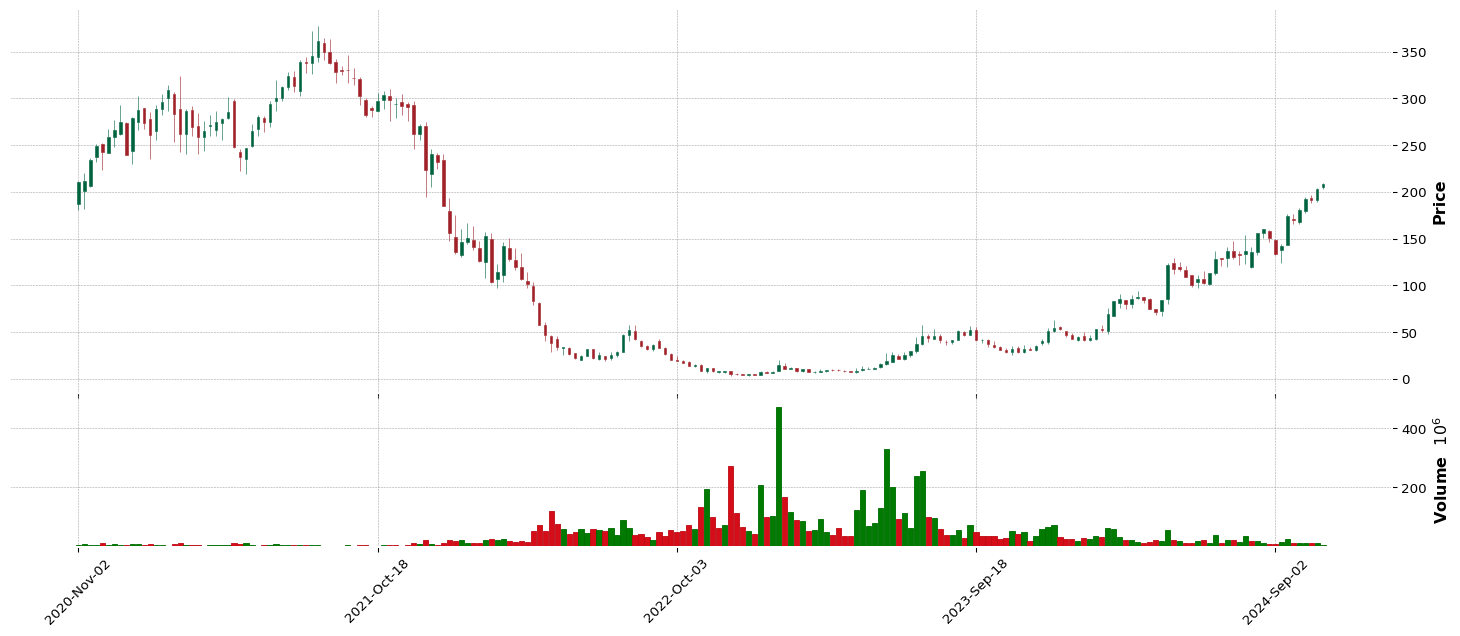

Auto & Truck Dealerships |

77.0 |

87.0 |

53.0 |

68.0 |

2.46 |

15.38 |

55.77% |

28.26 |

-1.4 |

28.75 |

| 10.0 |

Information Technology Services |

93.0 |

91.0 |

72.0 |

27.0 |

1.35 |

15.17 |

40.07 |

30.4 |

-4.61 |

24.88 |

|| |

35.0 |

Food Distribution |

76.0 |

77.0 |

48.0 |

34.0 |

1.81 |

12.26 |

32.4% |

13.8 |

0.85 |

14.43 |

| 11.0 |

Publishing |

93.0 |

96.0 |

96.0 |

57.0 |

1.68 |

38.4 |

44.0 |

36.84 |

-9.99 |

26.06 |

|| |

36.0 |

Gambling |

76.0 |

74.0 |

82.0 |

82.0 |

0.42 |

36.64 |

47.22% |

52.61 |

2.41 |

-2.89 |

| 12.0 |

Specialty Retail |

92.0 |

75.0 |

44.0 |

100.0 |

2.02 |

62.54 |

102.7 |

39.61 |

1.94 |

8.69 |

|| |

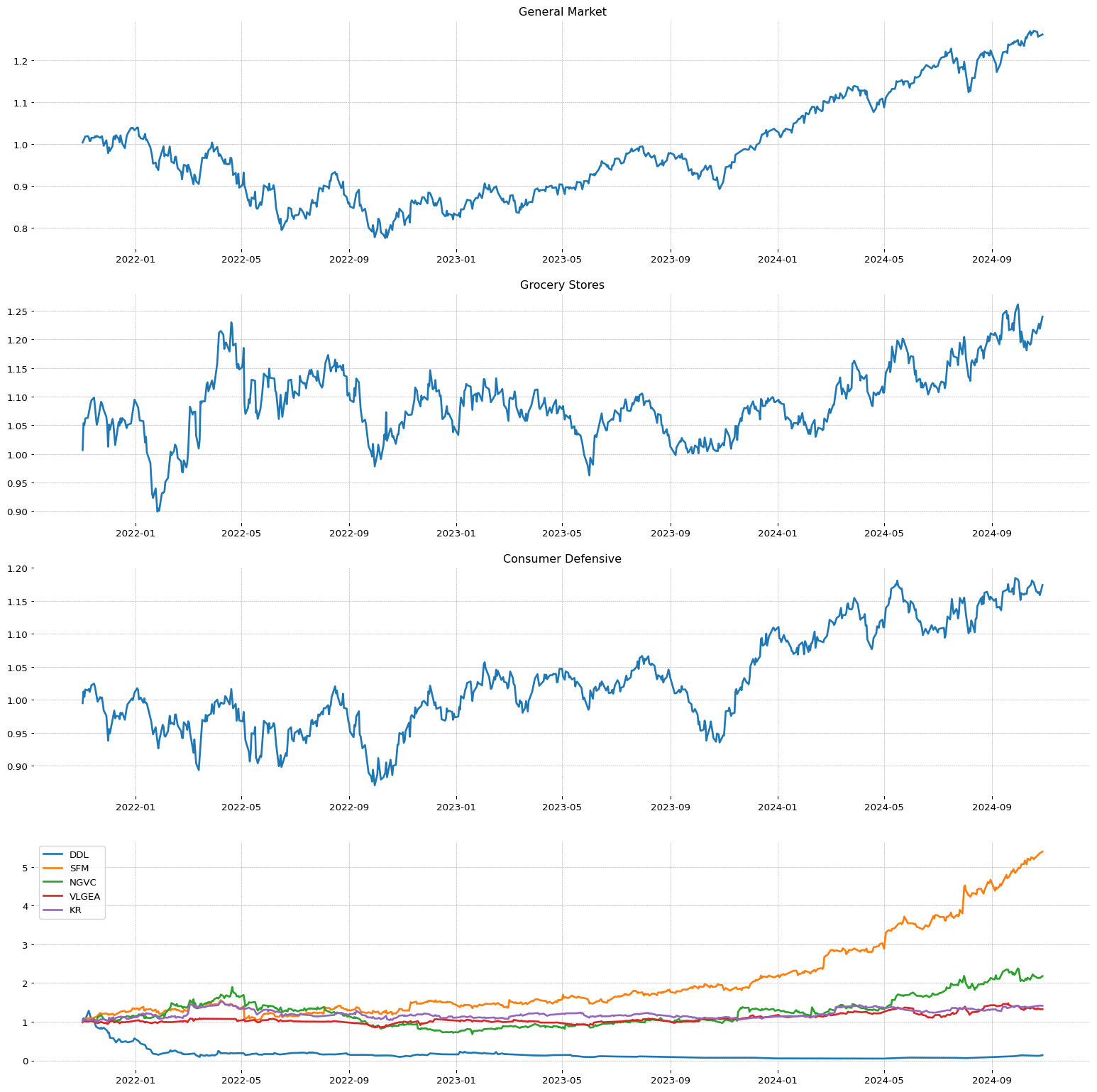

37.0 |

Grocery Stores |

75.0 |

69.0 |

83.0 |

19.0 |

1.74 |

23.72 |

28.54% |

29.63 |

3.57 |

12.7 |

| 13.0 |

Other Precious Metals & Mining |

91.0 |

55.0 |

97.0 |

88.0 |

-0.46 |

66.13 |

85.67 |

17.98 |

-12.05 |

-6.92 |

|| |

38.0 |

Insurance - Diversified |

74.0 |

71.0 |

61.0 |

46.0 |

1.26 |

30.25 |

44.33% |

63.89 |

27.93 |

11.13 |

| 14.0 |

Medical Care Facilities |

91.0 |

82.0 |

85.0 |

63.0 |

1.26 |

21.08 |

54.38 |

26.73 |

-1.9 |

38.82 |

|| |

39.0 |

Electronic Components |

74.0 |

64.0 |

72.0 |

84.0 |

0.94 |

21.7 |

44.4% |

28.45 |

5.96 |

11.87 |

| 15.0 |

Real Estate Services |

90.0 |

90.0 |

95.0 |

69.0 |

1.08 |

24.95 |

68.77 |

32.38 |

-2.9 |

-5.36 |

|| |

40.0 |

Specialty Industrial Machinery |

73.0 |

42.0 |

28.0 |

74.0 |

2.3 |

23.33 |

47.37% |

30.67 |

0.52 |

15.76 |

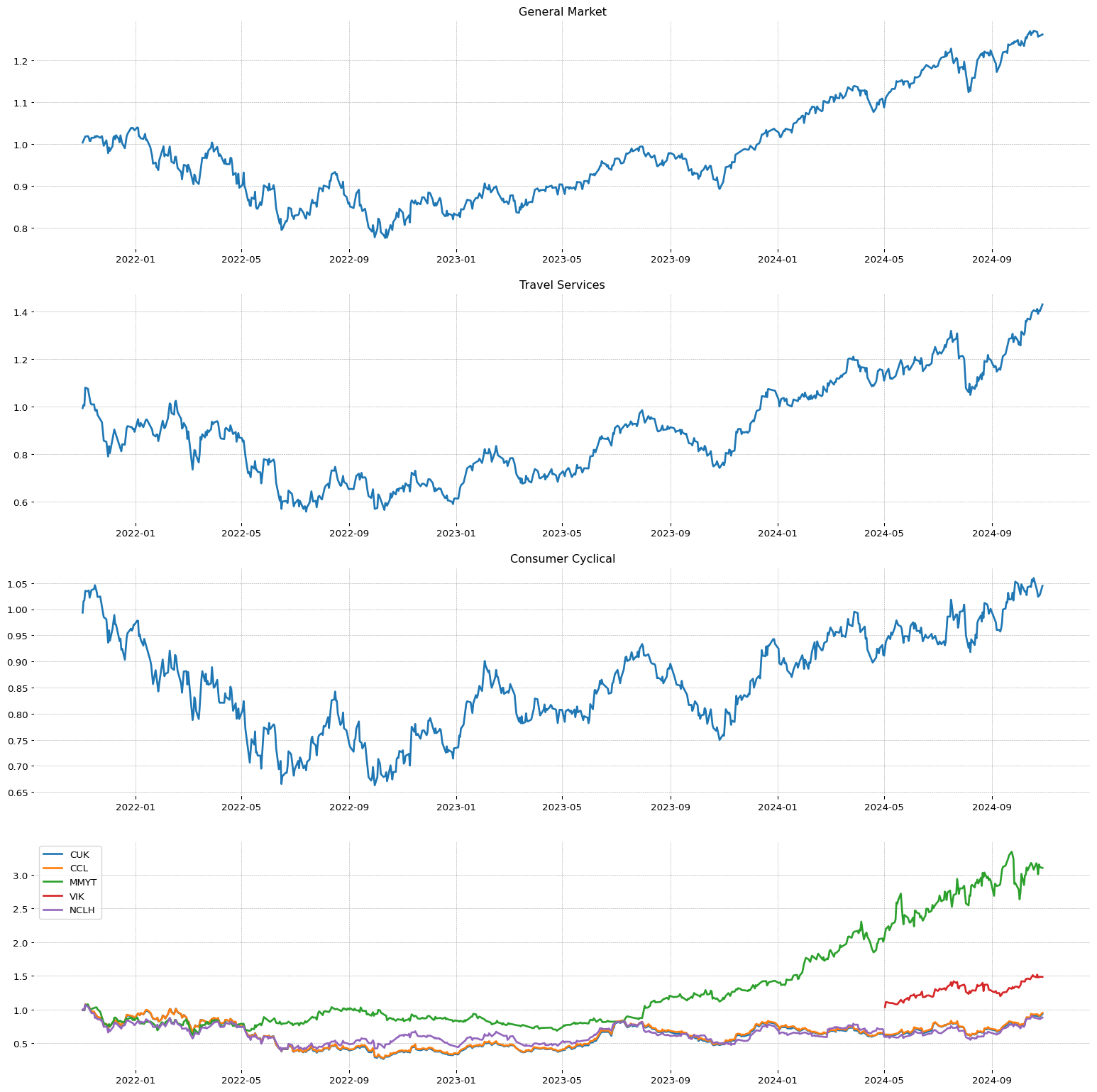

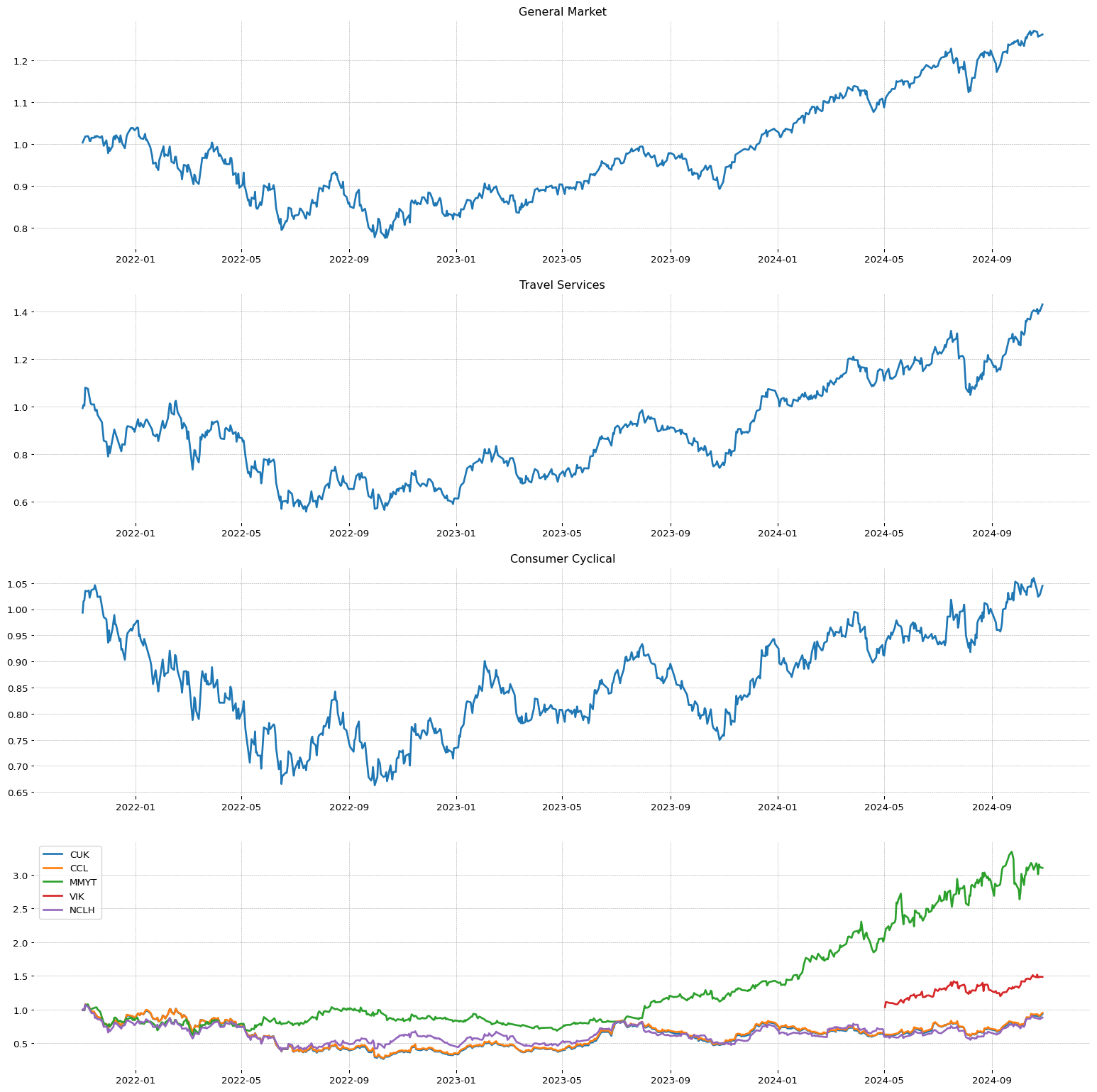

| 16.0 |

Travel Services |

89.0 |

59.0 |

46.0 |

86.0 |

2.07 |

30.9 |

75.41 |

53.89 |

25.61 |

17.43 |

|| |

41.0 |

Uranium |

72.0 |

22.0 |

4.0 |

9.0 |

3.21 |

14.53 |

20.22% |

543.5 |

-28.55 |

-10.03 |

| 17.0 |

Credit Services |

89.0 |

70.0 |

66.0 |

89.0 |

2.22 |

44.6 |

111.9 |

72.1 |

13.61 |

14.87 |

|| |

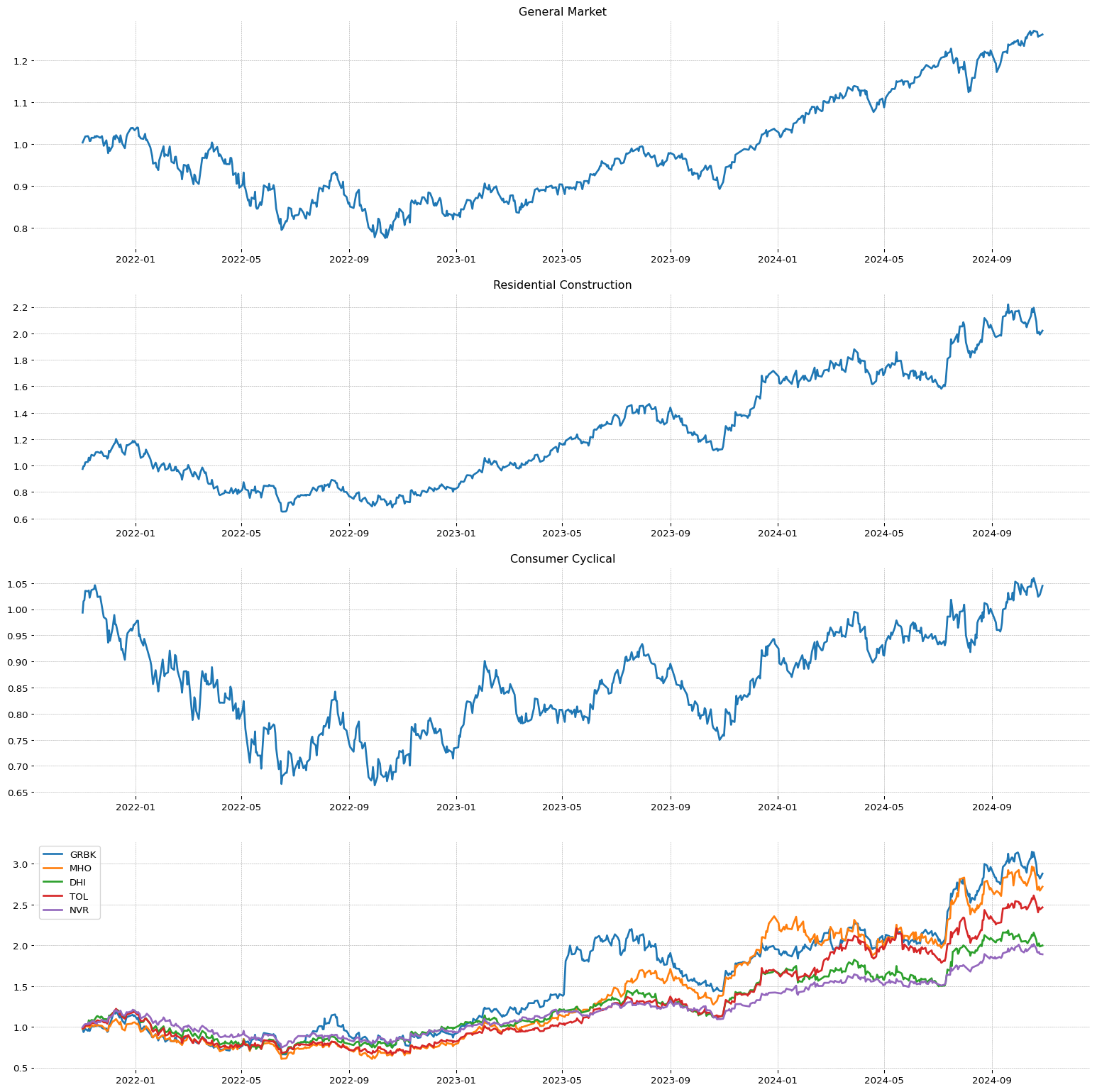

42.0 |

Residential Construction |

72.0 |

89.0 |

89.0 |

87.0 |

1.52 |

19.64 |

74.57% |

30.22 |

12.41 |

22.88 |

| 18.0 |

Electronic Gaming & Multimedia |

88.0 |

95.0 |

70.0 |

53.0 |

1.48 |

30.49 |

38.09 |

58.16 |

-4.9 |

-24.2 |

|| |

43.0 |

Tobacco |

71.0 |

88.0 |

56.0 |

29.0 |

1.24 |

10.06 |

29.86% |

45.54 |

8.77 |

-32.24 |

| 19.0 |

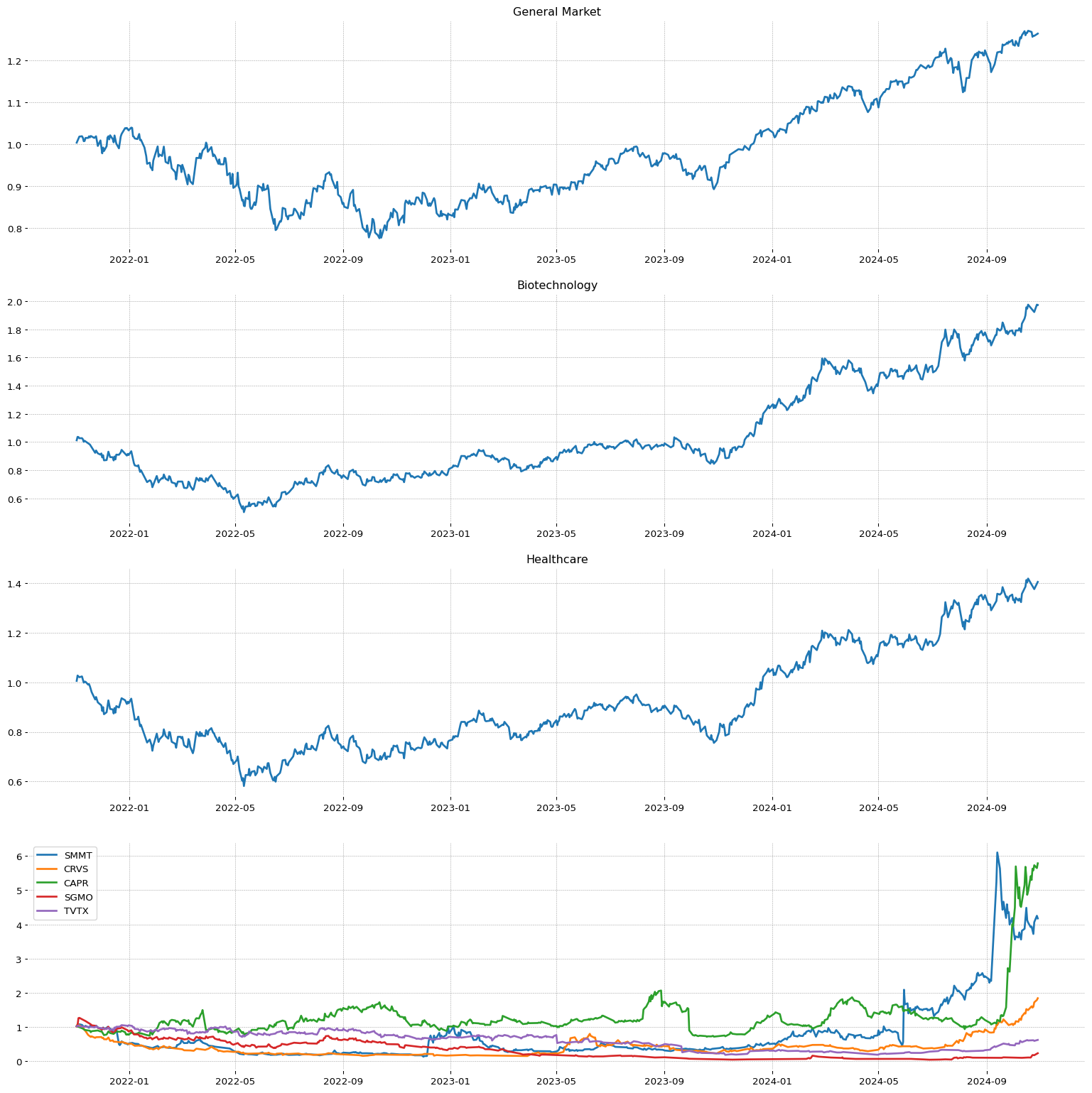

Biotechnology |

87.0 |

63.0 |

71.0 |

95.0 |

2.74 |

47.29 |

101.74 |

43.17 |

464.83 |

4.65 |

|| |

44.0 |

Electronics & Computer Distribution |

70.0 |

80.0 |

78.0 |

67.0 |

0.85 |

23.04 |

46.71% |

14.08 |

2.56 |

12.49 |

| 20.0 |

Insurance Brokers |

87.0 |

93.0 |

87.0 |

57.0 |

0.86 |

31.16 |

46.23 |

44.15 |

8.36 |

5.37 |

|| |

45.0 |

REIT - Retail |

70.0 |

72.0 |

81.0 |

29.0 |

0.82 |

9.79 |

30.47% |

58.26 |

23.59 |

6.3 |

| 21.0 |

Engineering & Construction |

86.0 |

91.0 |

85.0 |

90.0 |

0.8 |

49.1 |

73.25 |

23.74 |

4.22 |

11.81 |

|| |

46.0 |

Consulting Services |

69.0 |

74.0 |

68.0 |

54.0 |

0.9 |

27.6 |

37.52% |

38.78 |

10.53 |

26.4 |

| 22.0 |

Banks - Regional |

85.0 |

86.0 |

90.0 |

38.0 |

3.04 |

17.18 |

51.75 |

89.74 |

16.62 |

10.78 |

|| |

47.0 |

Internet Retail |

68.0 |

78.0 |

33.0 |

92.0 |

2.28 |

21.24 |

61.01% |

41.75 |

-1.66 |

12.96 |

| 23.0 |

Telecom Services |

85.0 |

85.0 |

80.0 |

10.0 |

0.45 |

11.22 |

24.35 |

46.15 |

0.79 |

54.33 |

|| |

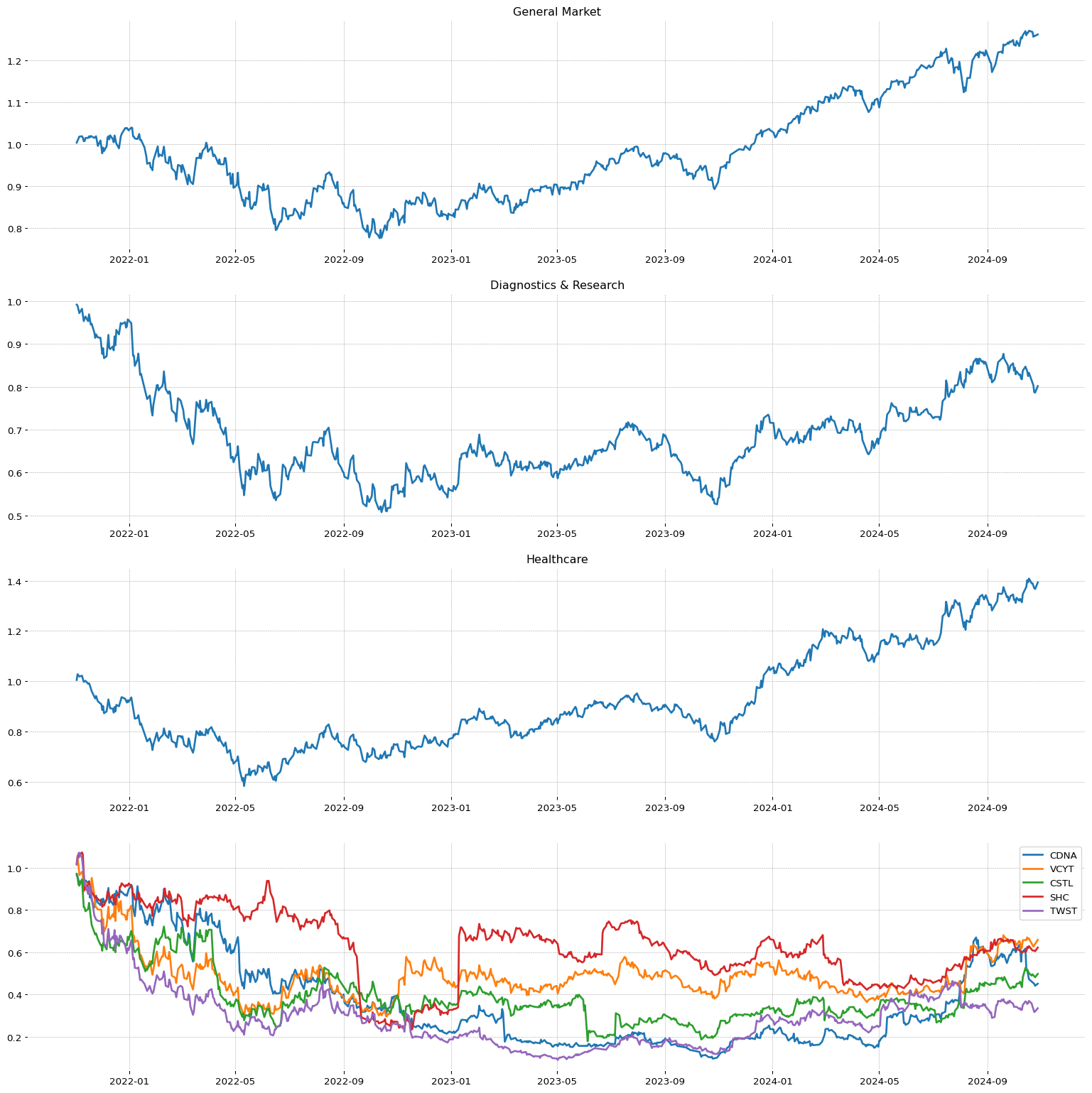

48.0 |

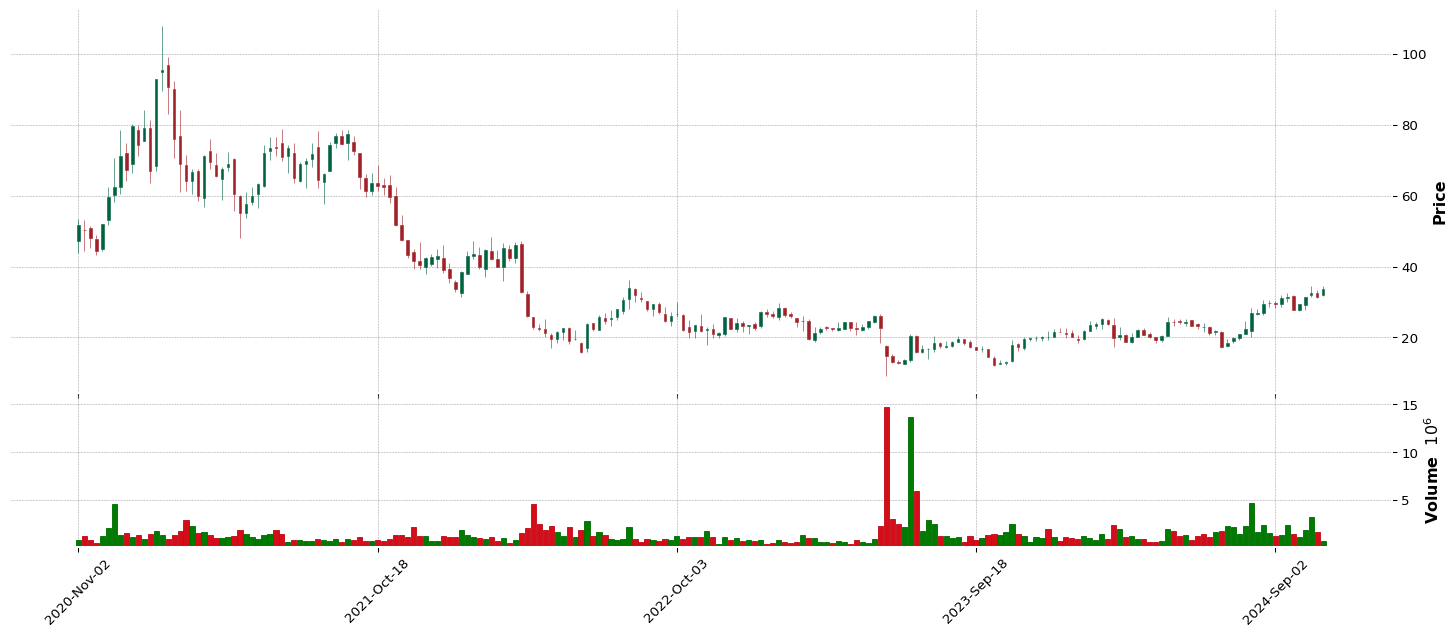

Diagnostics & Research |

68.0 |

85.0 |

91.0 |

85.0 |

1.92 |

10.8 |

50.17% |

42.0 |

-14.32 |

-4.99 |

| 24.0 |

Personal Services |

84.0 |

93.0 |

92.0 |

72.0 |

0.64 |

25.73 |

51.7 |

39.27 |

11.19 |

120.74 |

|| |

49.0 |

Luxury Goods |

67.0 |

89.0 |

5.0 |

79.0 |

-0.83 |

28.15 |

56.64% |

52.46 |

5.82 |

16.75 |

| 25.0 |

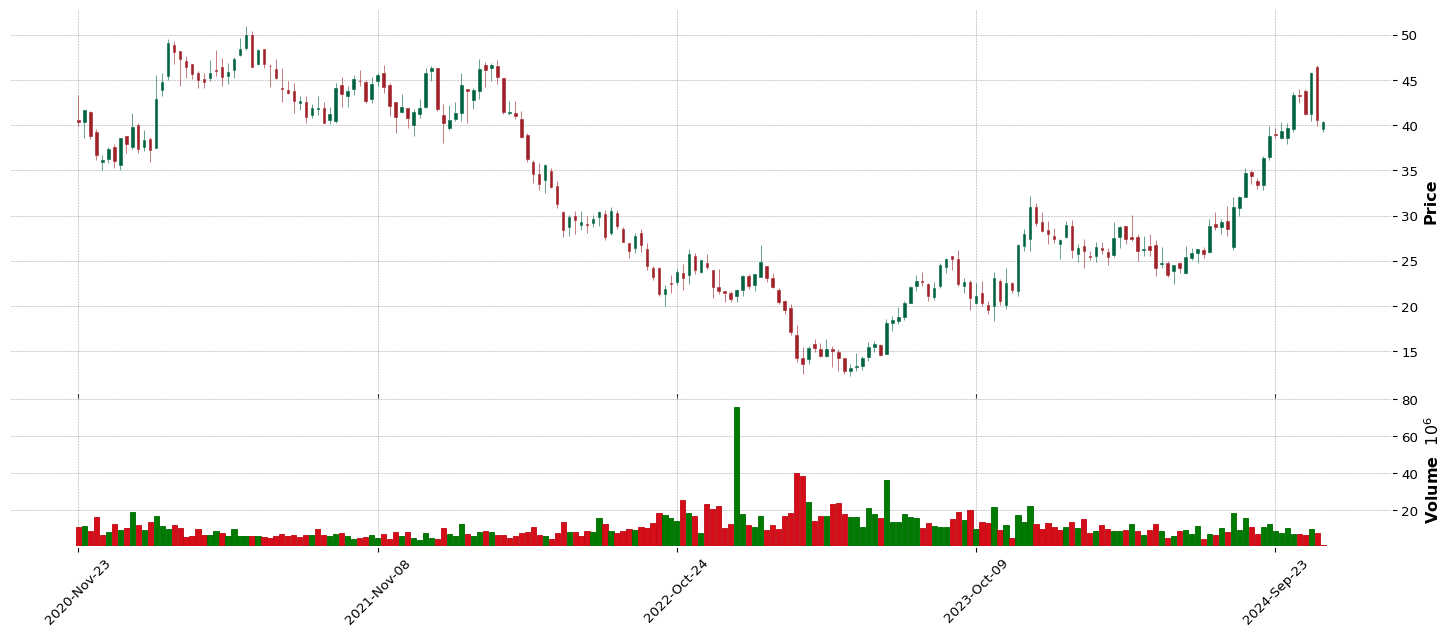

REIT - Office |

83.0 |

81.0 |

84.0 |

41.0 |

0.1 |

15.76 |

50.75 |

41.45 |

-2.83 |

-3.63 |

|| |

50.0 |

Insurance - Life |

66.0 |

65.0 |

50.0 |

45.0 |

1.15 |

19.24 |

41.14% |

88.24 |

10.28 |

8.0 |

Best 30 Stock

| Pos. | |

Name | |

RS Today | |

RS 3Wk | |

RS 6Wk | |

RS 26wk | |

Secotr | |

Industry | |

Pos Ind | |

EPS | |

SMR | |

A/C | |

CR | |

Ind Pos. | |

Sec Pos. | |

Close. | |

10wk | |

26wk | |

| 1.0 |

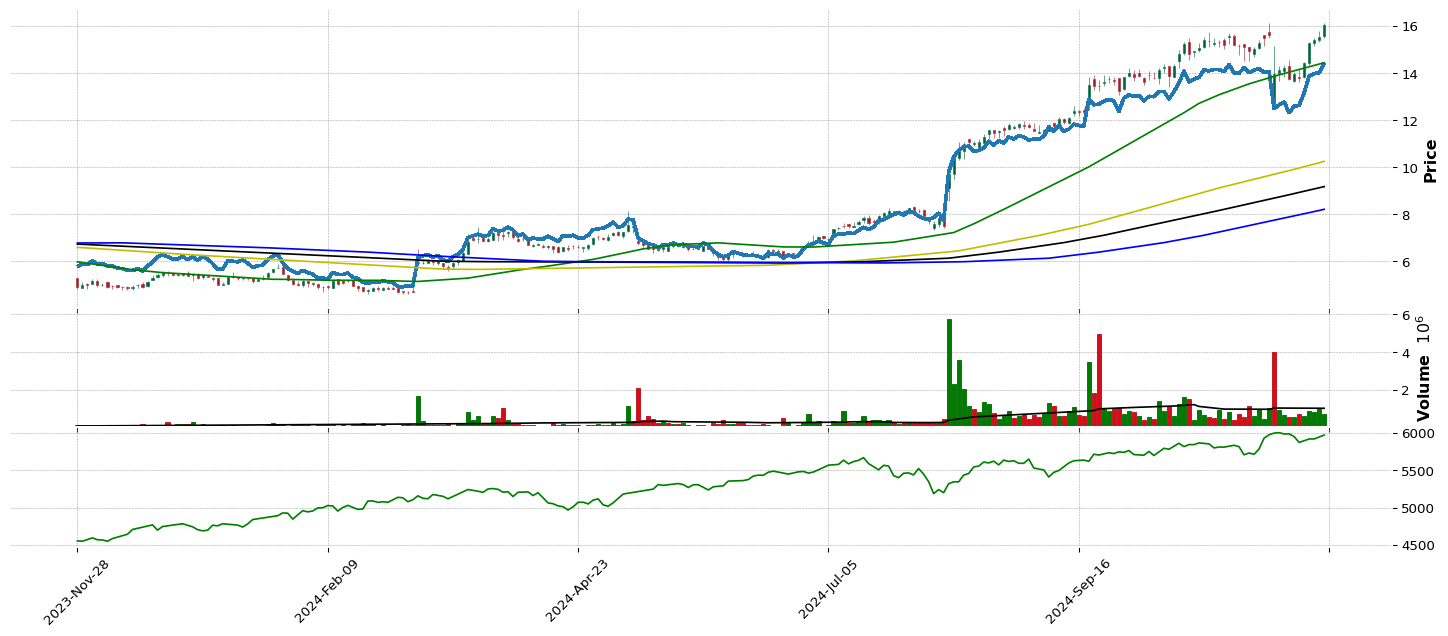

WGS |

100.0 |

100.0 |

99.9 |

95.64 |

Healthcare |

Health Information Services |

111 |

97.33 |

96.88 |

88.99 |

37.45 |

1.0 |

1.0 |

56.06 |

1.0 |

1.0 |

| 2.0 |

FTEL |

99.96 |

99.93 |

99.81 |

0.0 |

Consumer Cyclical |

Specialty Retail |

12 |

0.0 |

0.0 |

52.44 |

0.0 |

1.0 |

1.0 |

31.31 |

1.0 |

1.0 |

| 3.0 |

SEZL |

99.93 |

99.96 |

99.93 |

0.0 |

Financial |

Credit Services |

17 |

94.86 |

86.39 |

86.2 |

70.23 |

1.0 |

1.0 |

220.91 |

1.0 |

1.0 |

| 4.0 |

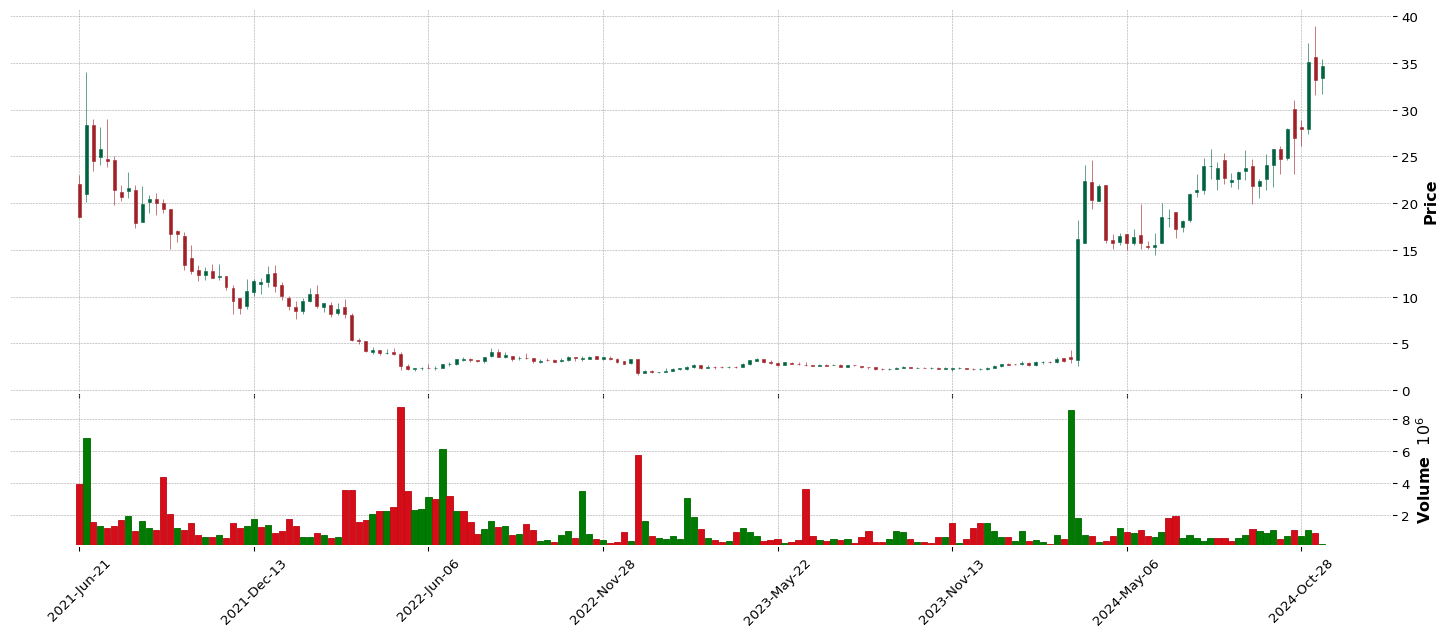

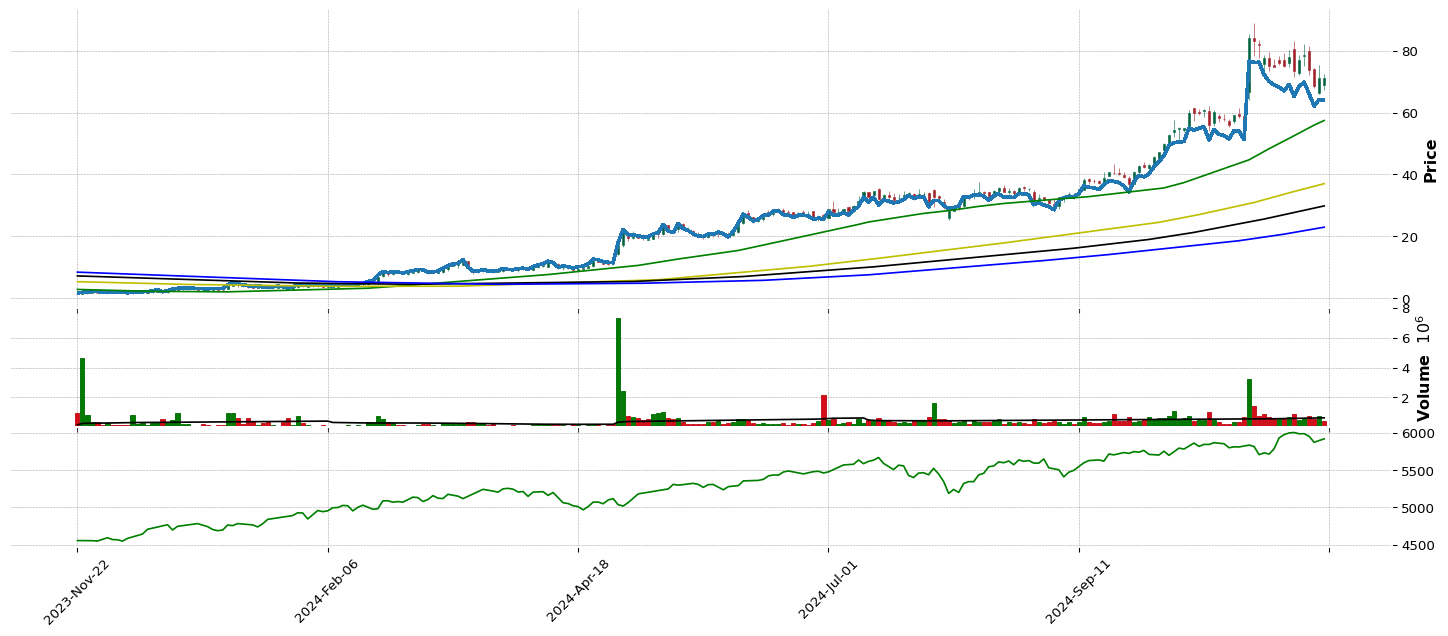

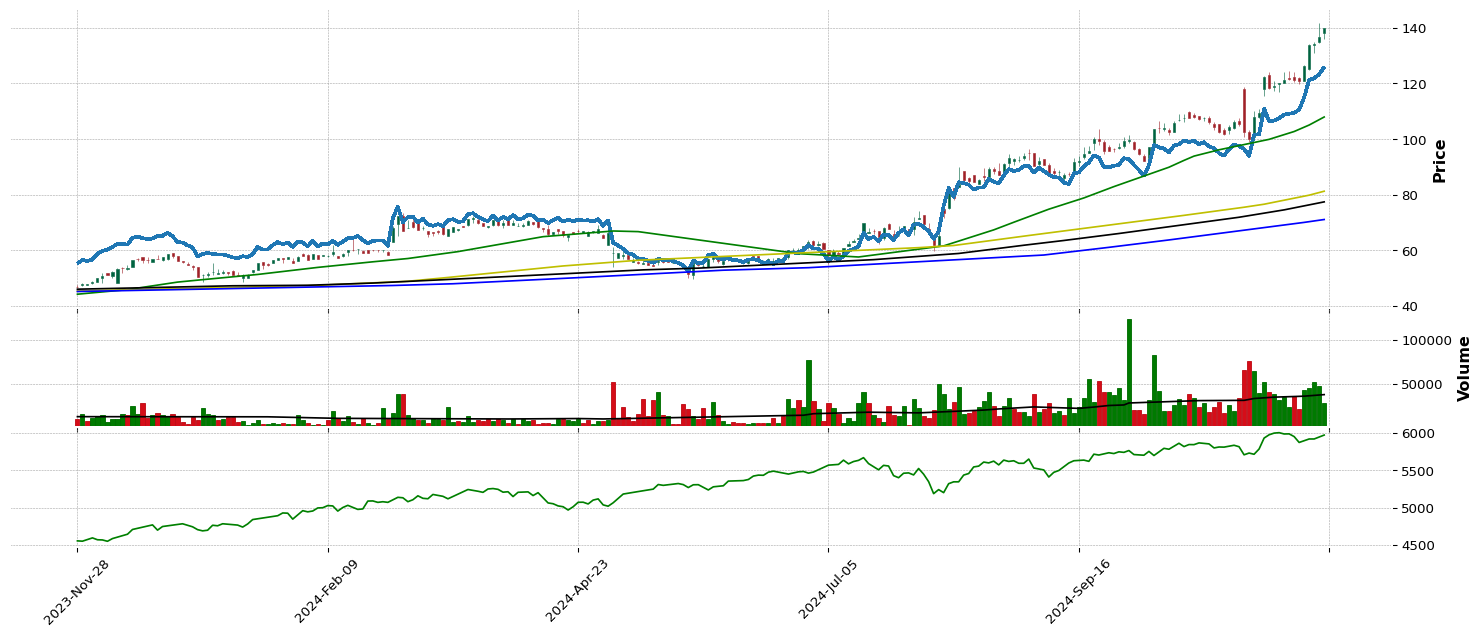

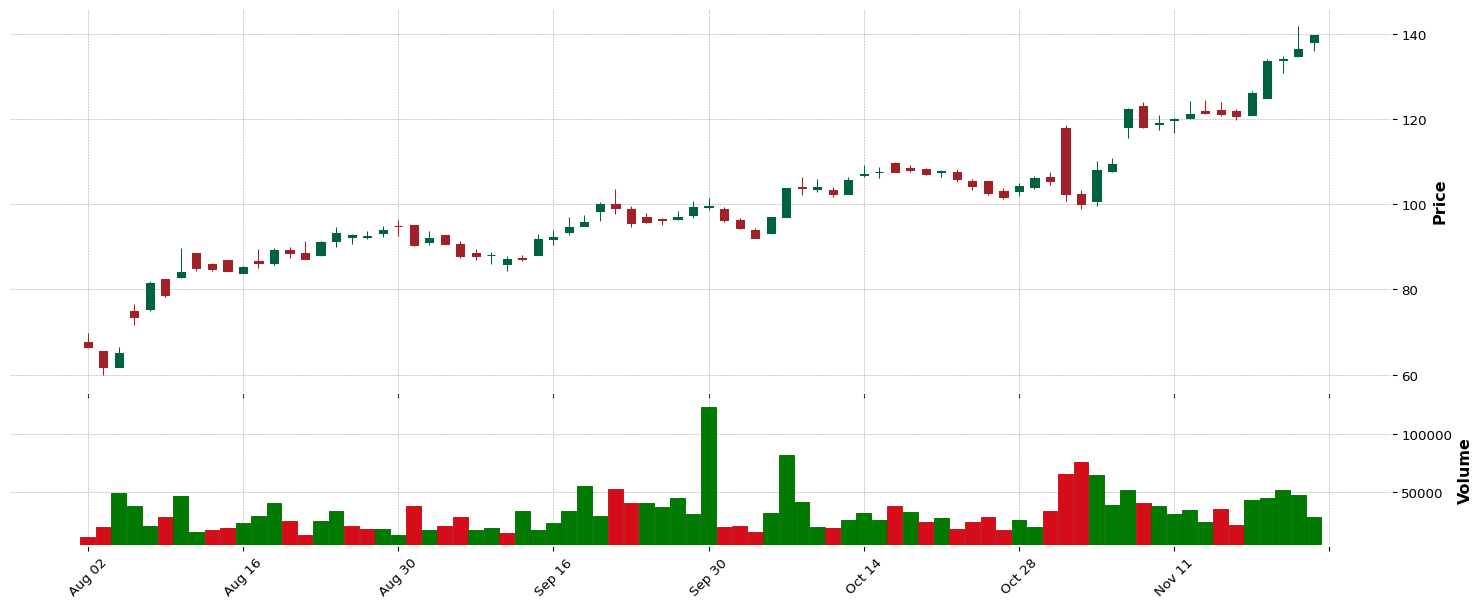

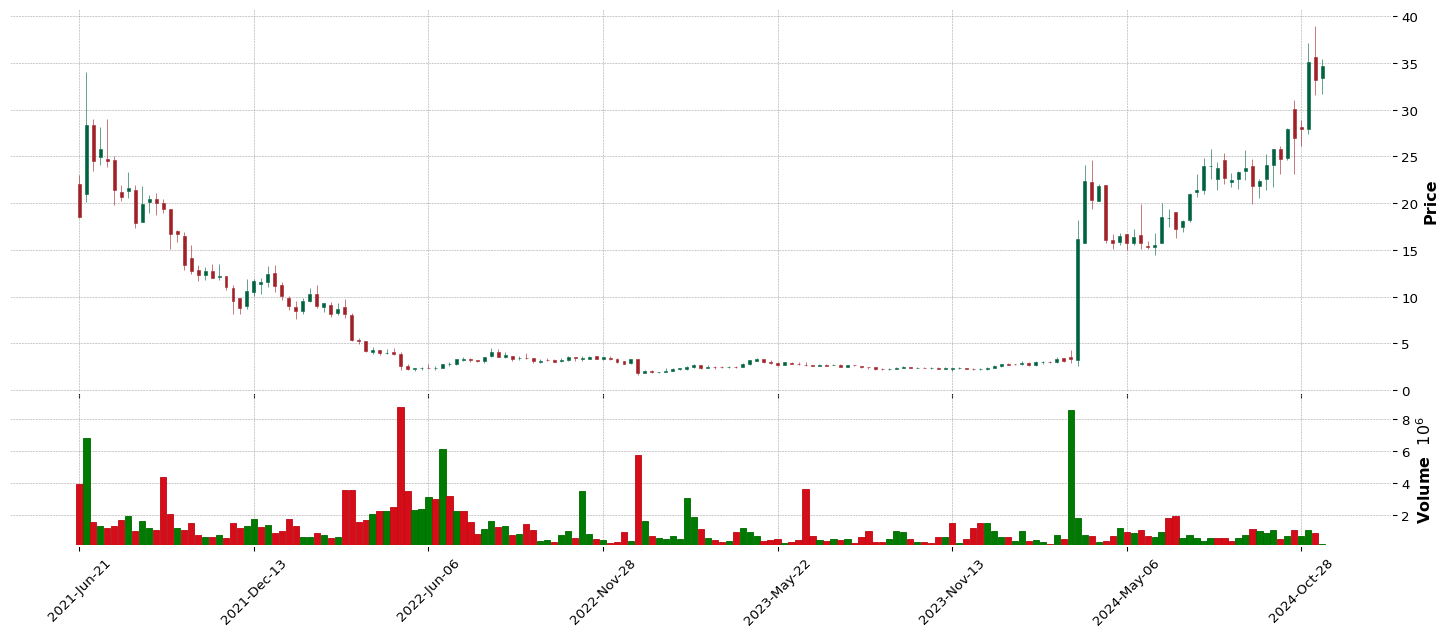

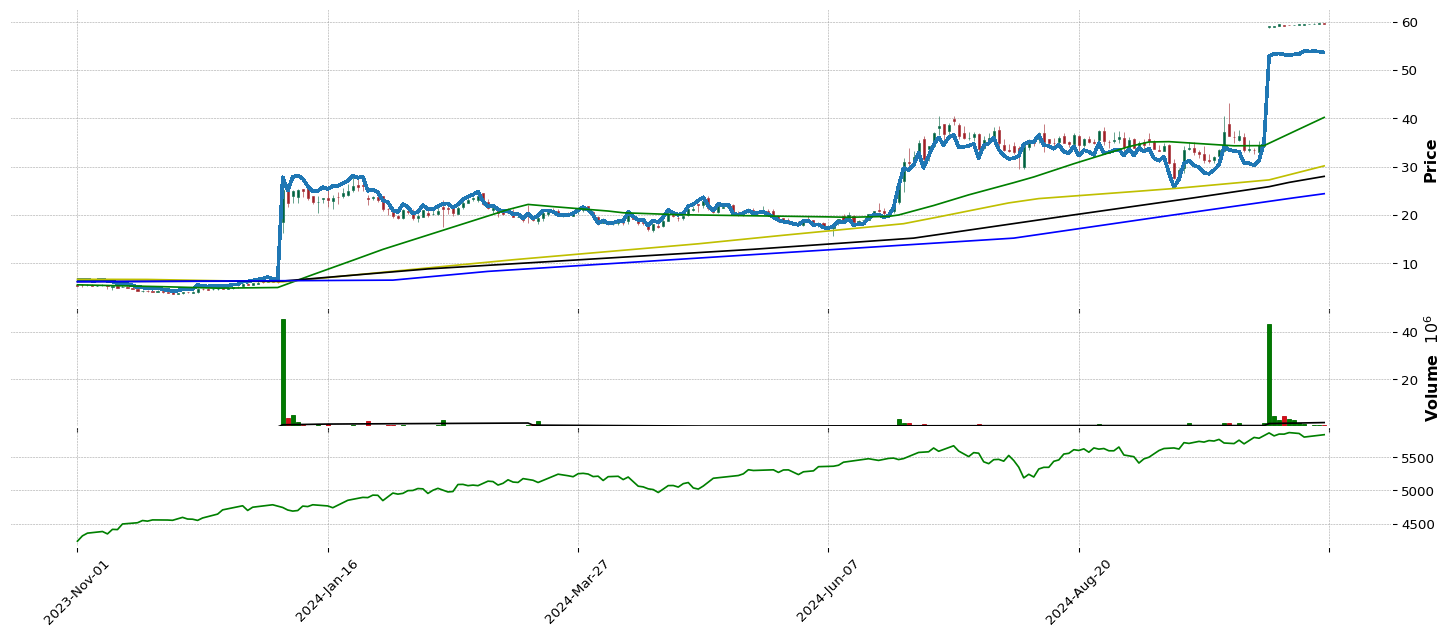

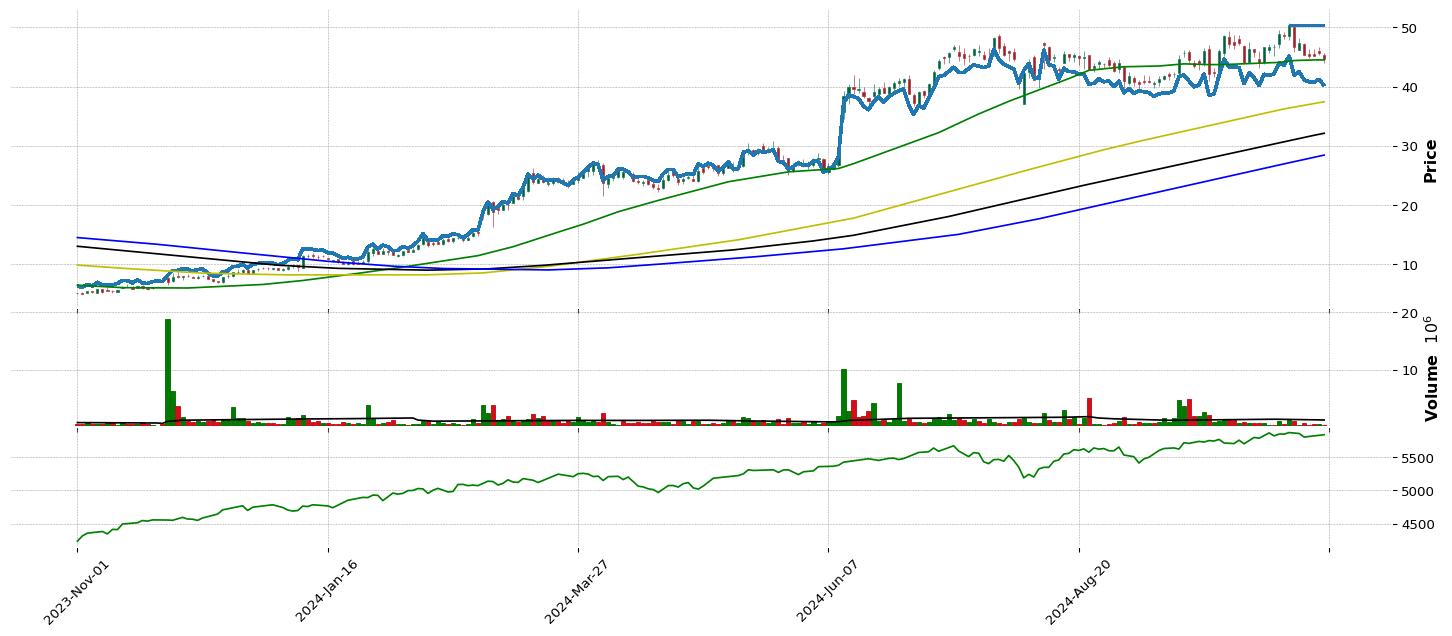

SMMT |

99.9 |

99.9 |

100.0 |

97.1 |

Healthcare |

Biotechnology |

19 |

13.85 |

0.0 |

15.85 |

0.0 |

1.0 |

2.0 |

22.23 |

1.0 |

1.0 |

| 5.0 |

LENZ |

99.87 |

99.87 |

99.87 |

99.56 |

Healthcare |

Biotechnology |

19 |

23.1 |

0.0 |

48.72 |

0.0 |

2.0 |

3.0 |

28.5 |

1.0 |

1.0 |

| 6.0 |

LBPH |

99.84 |

99.72 |

99.59 |

97.76 |

Healthcare |

Biotechnology |

19 |

0.0 |

0.0 |

80.69 |

0.0 |

3.0 |

4.0 |

59.68 |

1.0 |

1.0 |

| 7.0 |

RNA |

99.81 |

99.81 |

99.75 |

95.33 |

Healthcare |

Biotechnology |

19 |

11.72 |

35.8 |

64.39 |

33.74 |

4.0 |

5.0 |

45.72 |

1.0 |

1.0 |

| 8.0 |

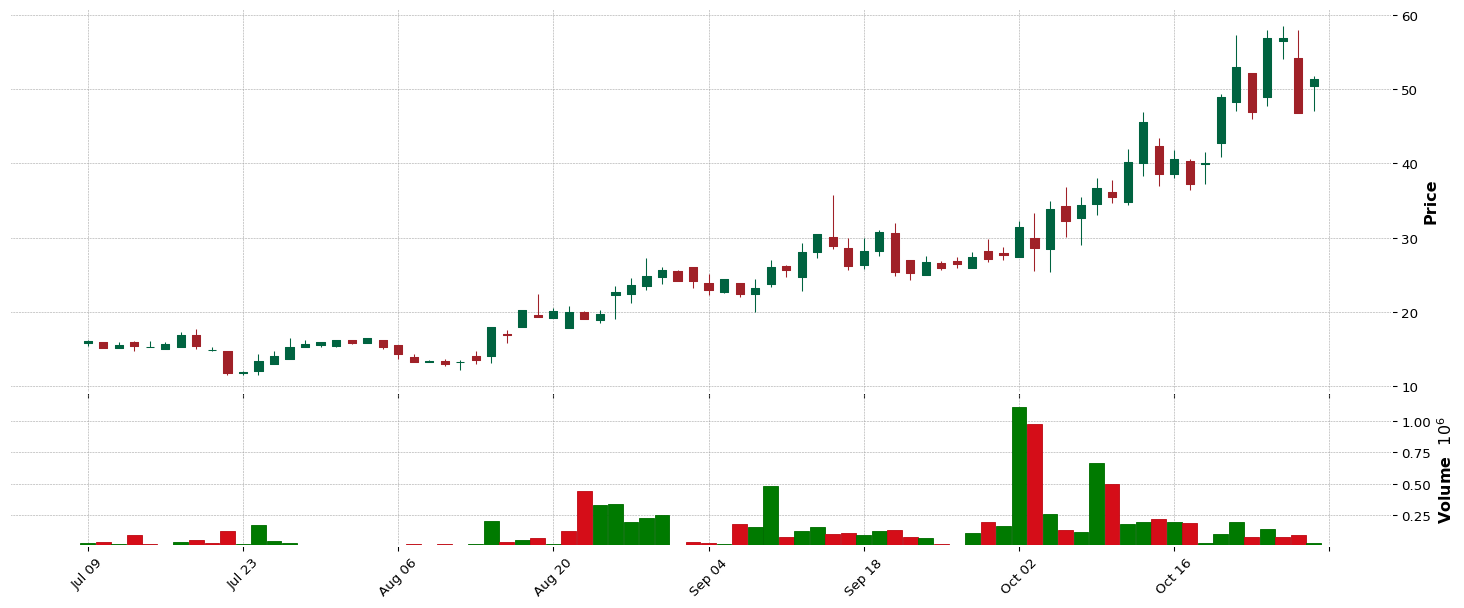

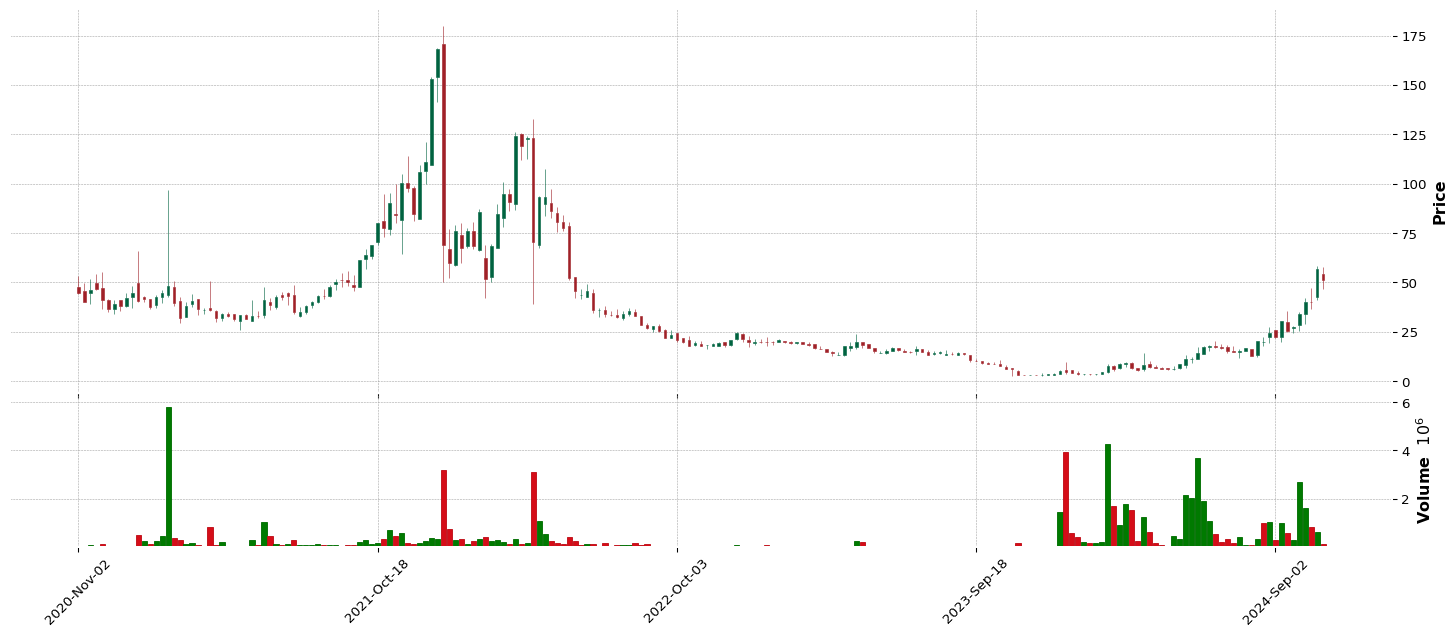

DOGZ |

99.78 |

99.04 |

96.85 |

1.21 |

Consumer Cyclical |

Leisure |

3 |

45.8 |

0.28 |

78.57 |

38.21 |

1.0 |

2.0 |

46.81 |

1.0 |

1.0 |

| 9.0 |

JANX |

99.75 |

99.38 |

99.66 |

99.12 |

Healthcare |

Biotechnology |

19 |

31.24 |

34.1 |

88.99 |

41.08 |

5.0 |

6.0 |

54.36 |

1.0 |

1.0 |

| 10.0 |

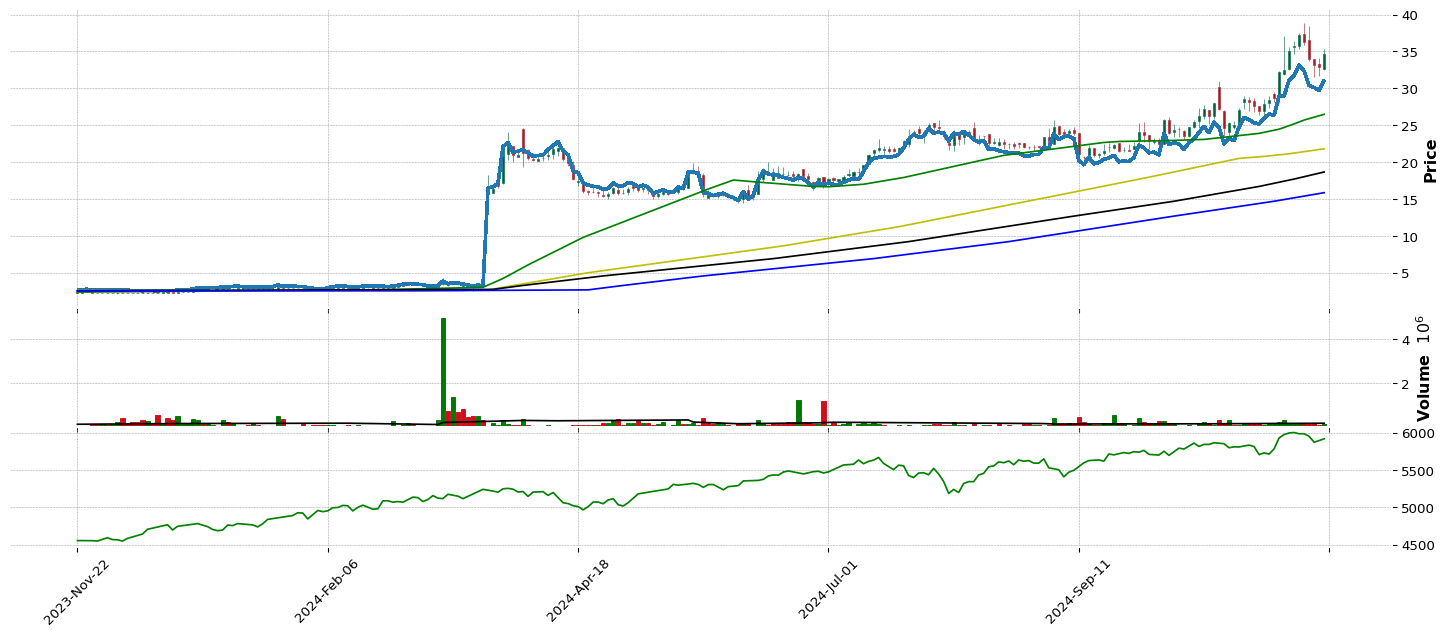

ASTS |

99.72 |

99.78 |

99.84 |

2.73 |

Technology |

Communication Equipment |

1 |

13.6 |

0.0 |

19.2 |

0.0 |

1.0 |

1.0 |

26.72 |

0.0 |

1.0 |

| 11.0 |

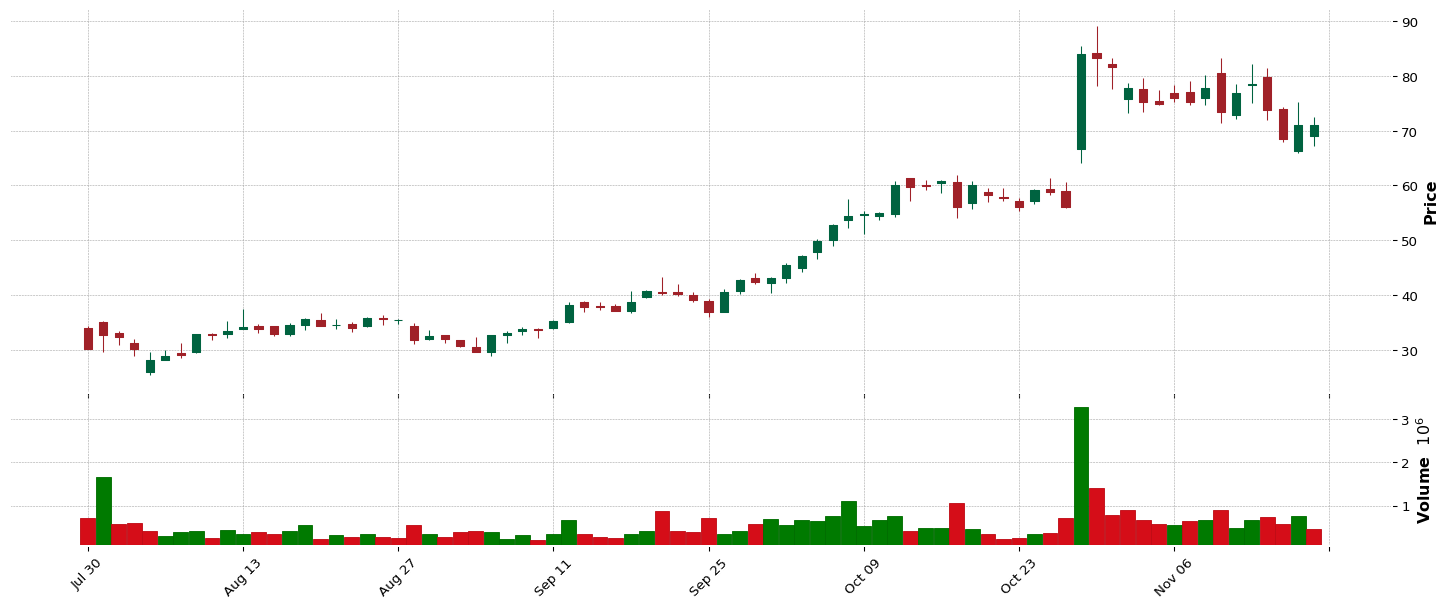

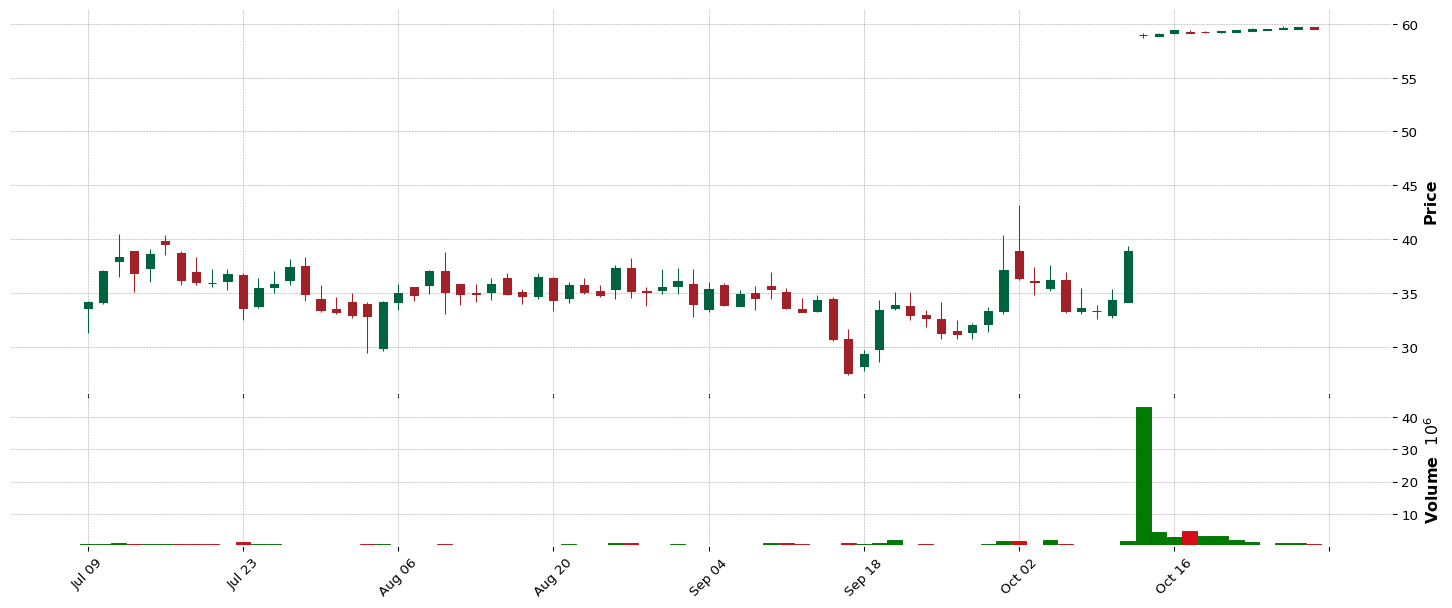

CAPR |

99.66 |

99.75 |

18.75 |

75.44 |

Healthcare |

Biotechnology |

19 |

7.17 |

74.55 |

80.3 |

17.93 |

7.0 |

8.0 |

21.45 |

1.0 |

1.0 |

| 12.0 |

VKTX |

99.63 |

99.63 |

99.56 |

99.09 |

Healthcare |

Biotechnology |

19 |

8.69 |

0.0 |

68.27 |

0.0 |

8.0 |

9.0 |

74.51 |

1.0 |

1.0 |

| 13.0 |

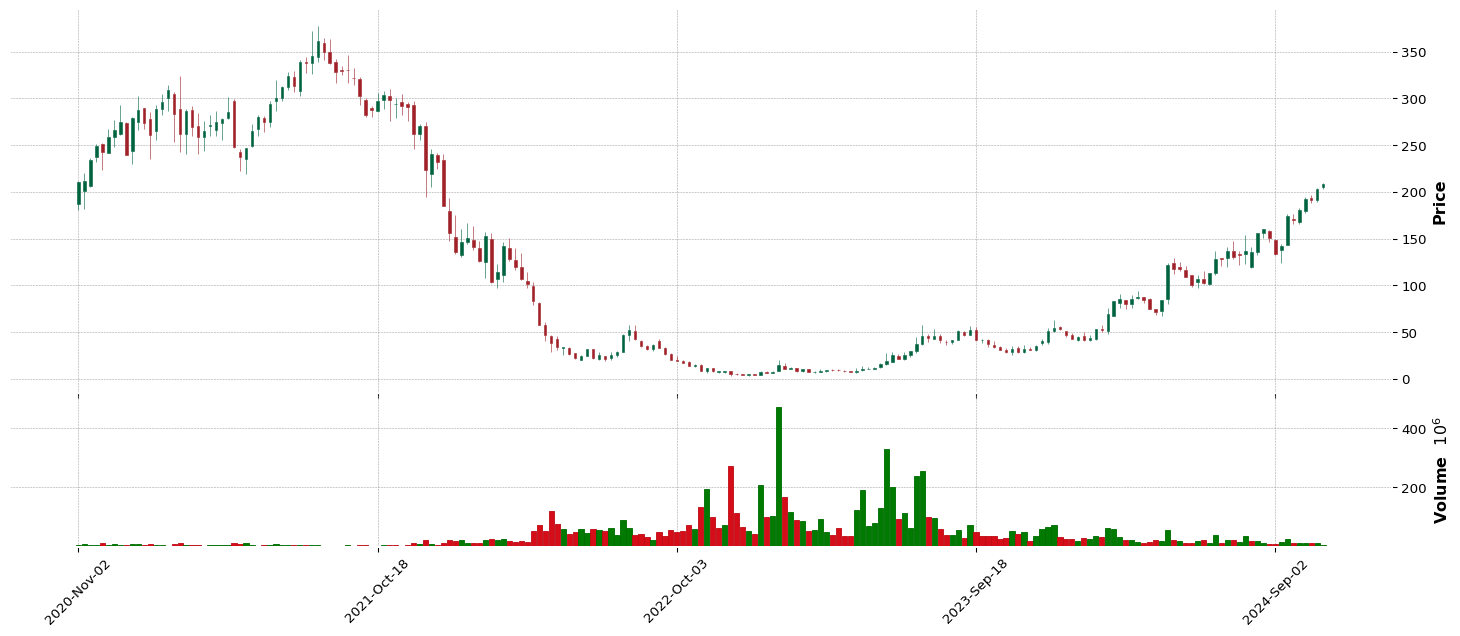

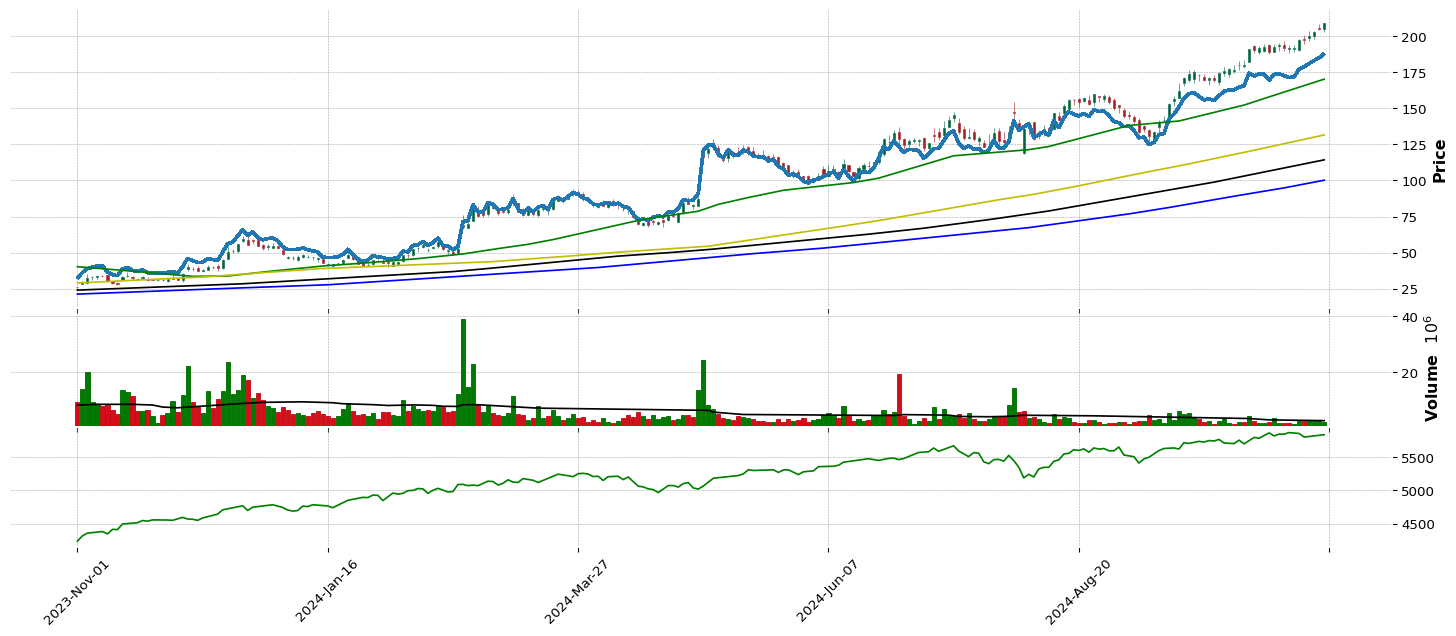

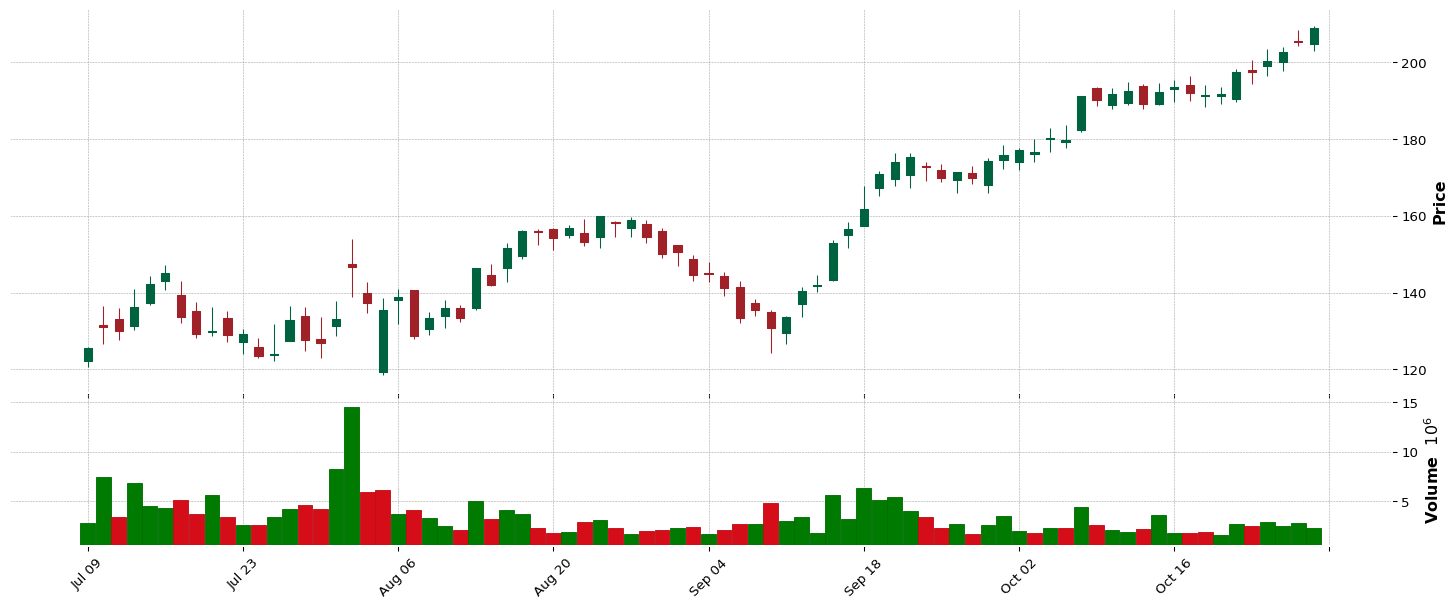

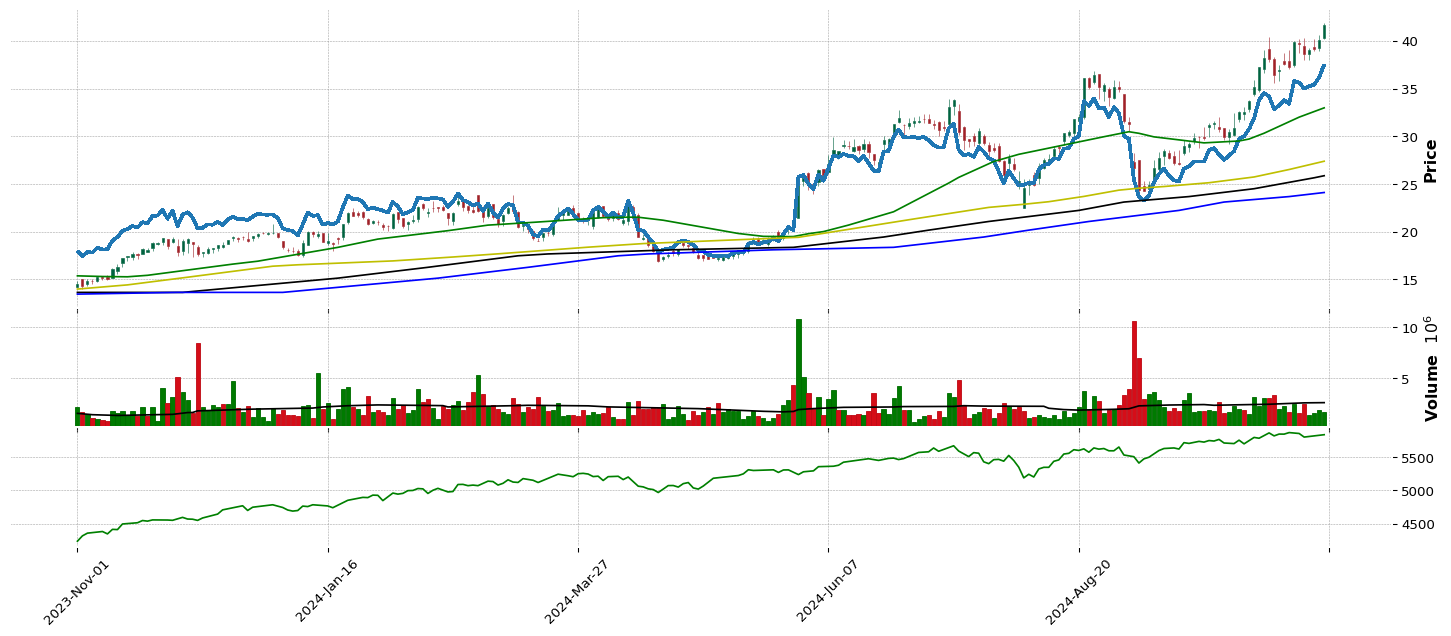

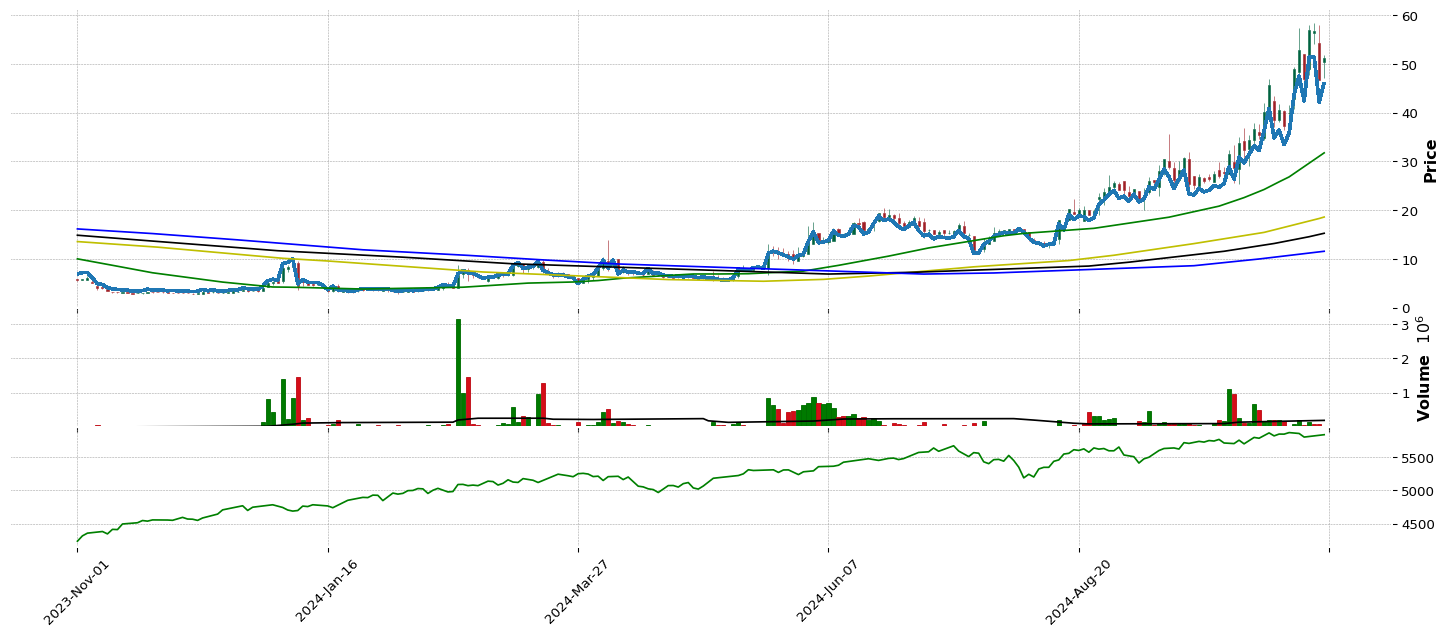

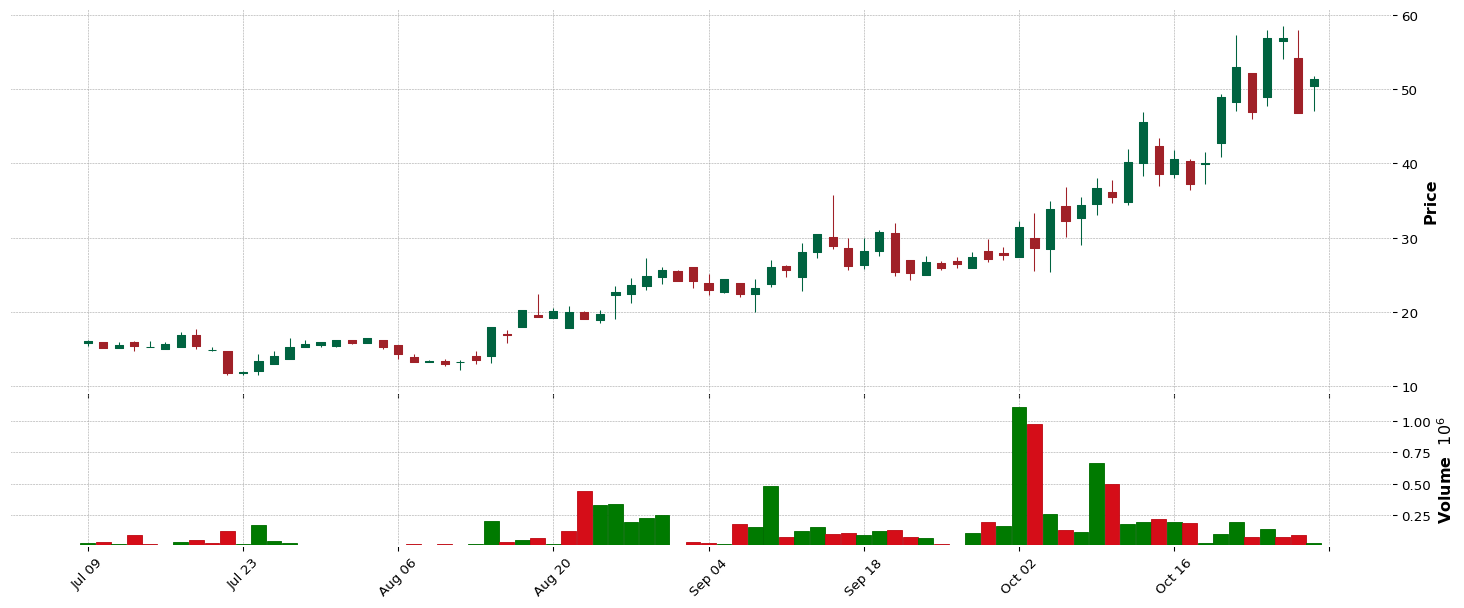

CVNA |

99.59 |

99.5 |

99.04 |

99.87 |

Consumer Cyclical |

Auto and Truck Dealerships |

34 |

77.54 |

76.45 |

99.06 |

82.96 |

1.0 |

3.0 |

205.02 |

1.0 |

1.0 |

| 14.0 |

DAVE |

99.56 |

99.84 |

99.78 |

99.81 |

Technology |

Software - Application |

76 |

49.95 |

80.91 |

61.23 |

36.65 |

1.0 |

2.0 |

39.27 |

0.0 |

1.0 |

| 15.0 |

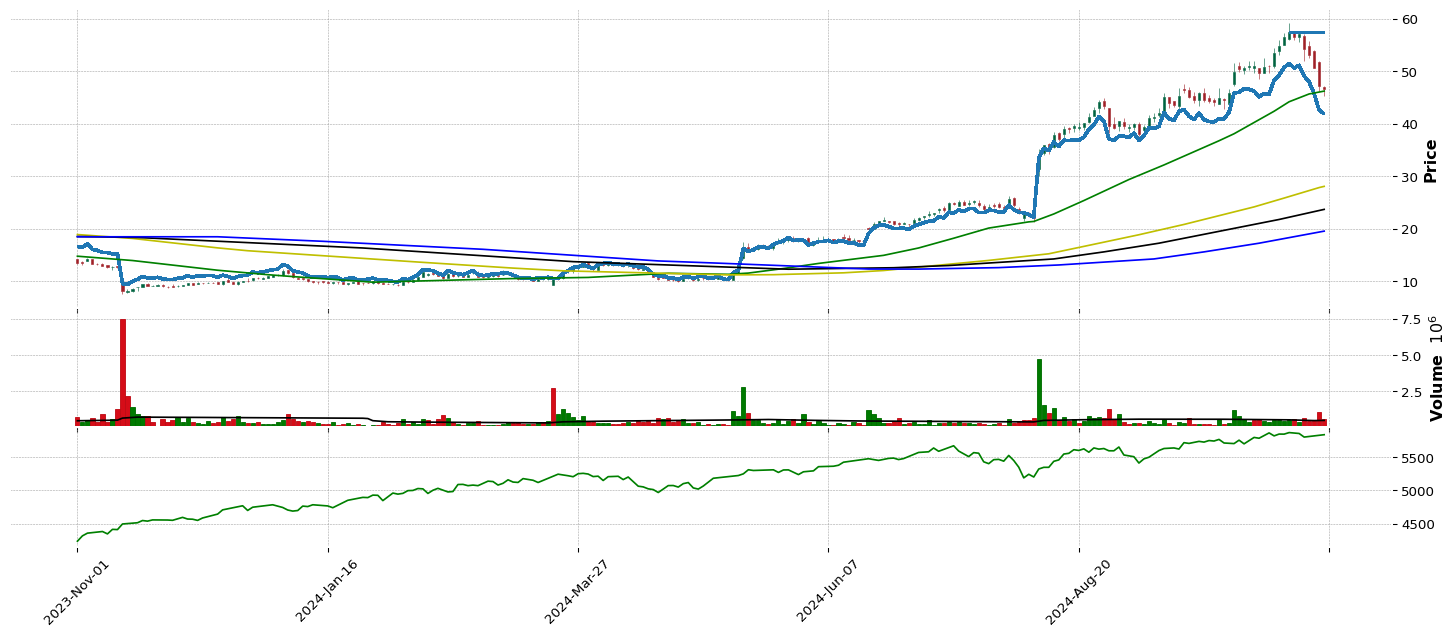

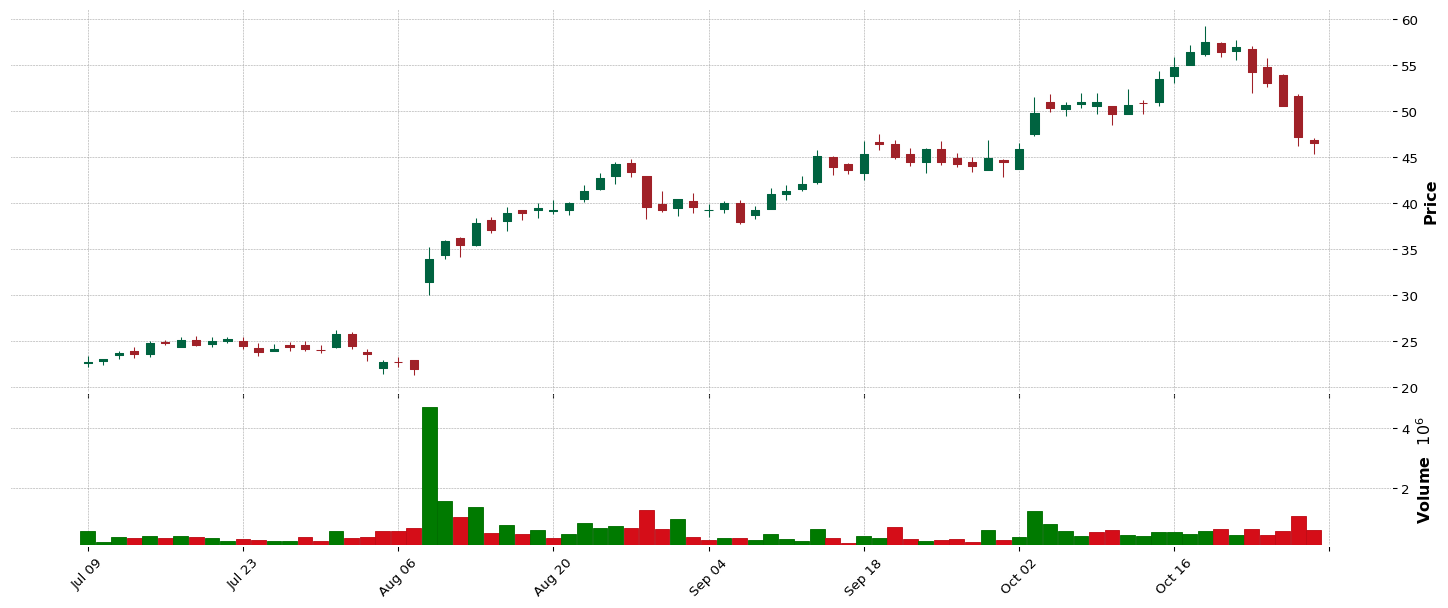

SMR |

99.53 |

95.04 |

86.73 |

11.99 |

Industrials |

Specialty Industrial Machinery |

40 |

6.55 |

11.22 |

83.3 |

17.3 |

1.0 |

1.0 |

22.0 |

1.0 |

1.0 |

| 16.0 |

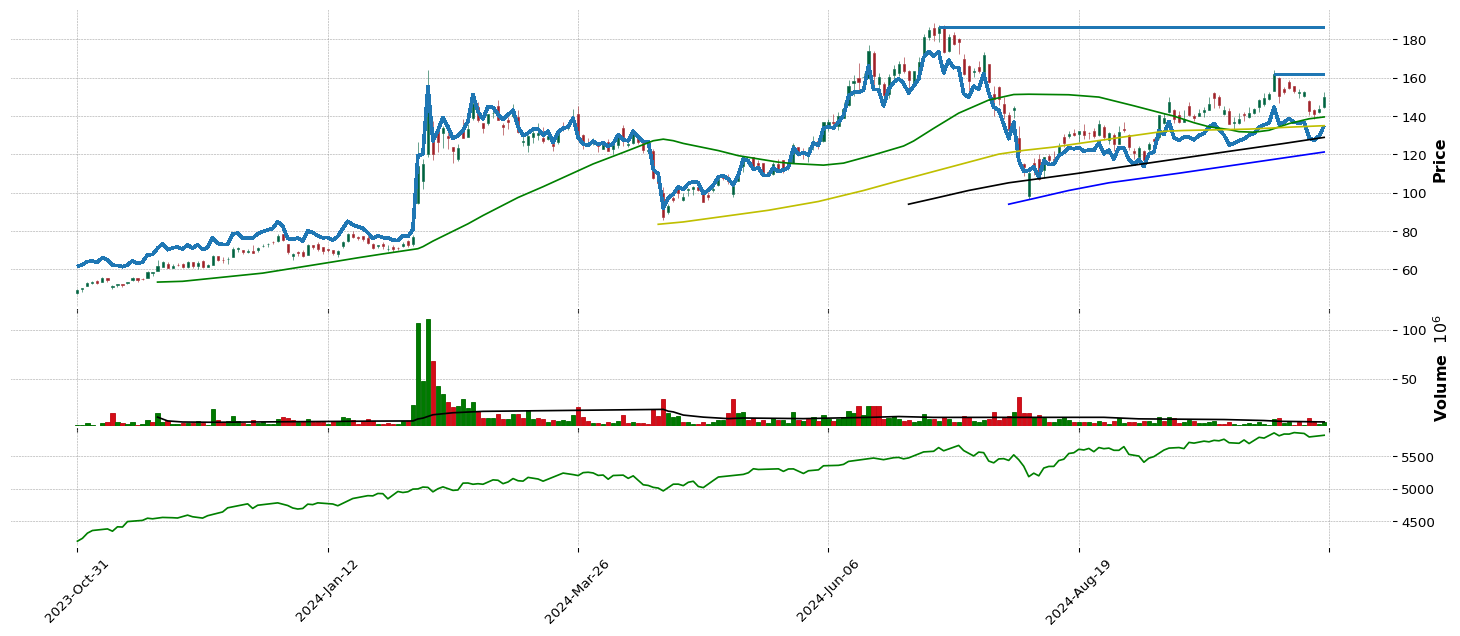

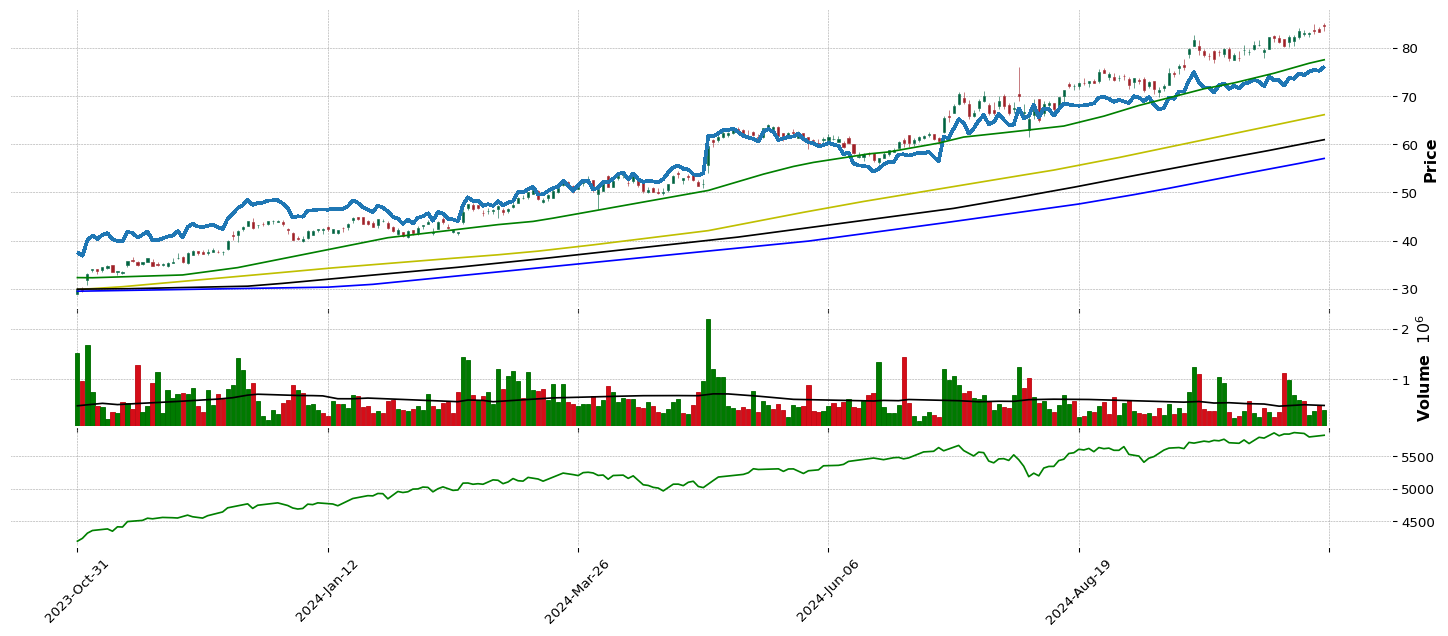

MSTR |

99.5 |

99.59 |

99.44 |

98.91 |

Technology |

Software - Application |

76 |

1.29 |

24.31 |

80.85 |

83.55 |

2.0 |

3.0 |

255.33 |

1.0 |

1.0 |

| 17.0 |

KRRO |

99.44 |

95.16 |

92.59 |

98.47 |

Healthcare |

Biotechnology |

19 |

0.0 |

0.0 |

24.38 |

0.0 |

10.0 |

11.0 |

63.84 |

1.0 |

1.0 |

| 18.0 |

EWTX |

99.41 |

99.29 |

98.36 |

93.78 |

Healthcare |

Biotechnology |

19 |

9.68 |

0.0 |

97.16 |

0.0 |

11.0 |

12.0 |

34.04 |

1.0 |

1.0 |

| 19.0 |

ADMA |

99.35 |

99.66 |

99.72 |

92.75 |

Healthcare |

Biotechnology |

19 |

98.6 |

99.32 |

68.27 |

21.73 |

12.0 |

13.0 |

16.43 |

0.0 |

1.0 |

| 20.0 |

GGAL |

99.29 |

98.61 |

98.45 |

98.25 |

Financial |

Banks - Regional |

22 |

98.91 |

97.43 |

90.06 |

57.35 |

2.0 |

3.0 |

54.11 |

1.0 |

1.0 |

| 21.0 |

NRIX |

99.26 |

98.21 |

97.65 |

69.13 |

Healthcare |

Biotechnology |

19 |

8.72 |

52.87 |

51.0 |

24.71 |

13.0 |

15.0 |

26.45 |

1.0 |

1.0 |

| 22.0 |

PRAX |

99.23 |

97.72 |

97.22 |

98.97 |

Healthcare |

Biotechnology |

19 |

87.78 |

0.0 |

88.99 |

0.0 |

14.0 |

16.0 |

71.73 |

1.0 |

1.0 |

| 23.0 |

APP |

99.1 |

98.58 |

98.85 |

99.28 |

Technology |

Software - Application |

76 |

95.14 |

99.93 |

92.14 |

84.59 |

3.0 |

4.0 |

166.18 |

1.0 |

1.0 |

| 24.0 |

VERA |

99.07 |

98.55 |

96.94 |

99.68 |

Healthcare |

Biotechnology |

19 |

34.61 |

0.0 |

47.38 |

0.0 |

15.0 |

19.0 |

47.34 |

1.0 |

1.0 |

| 25.0 |

IGMS |

99.01 |

97.87 |

97.13 |

14.29 |

Healthcare |

Biotechnology |

19 |

43.36 |

97.94 |

40.94 |

22.18 |

16.0 |

20.0 |

17.82 |

1.0 |

1.0 |

| 26.0 |

ROOT |

98.98 |

98.79 |

99.32 |

99.96 |

Financial |

Insurance - Property and Casualty |

96 |

74.6 |

60.12 |

91.24 |

45.55 |

1.0 |

4.0 |

40.47 |

0.0 |

0.0 |

| 27.0 |

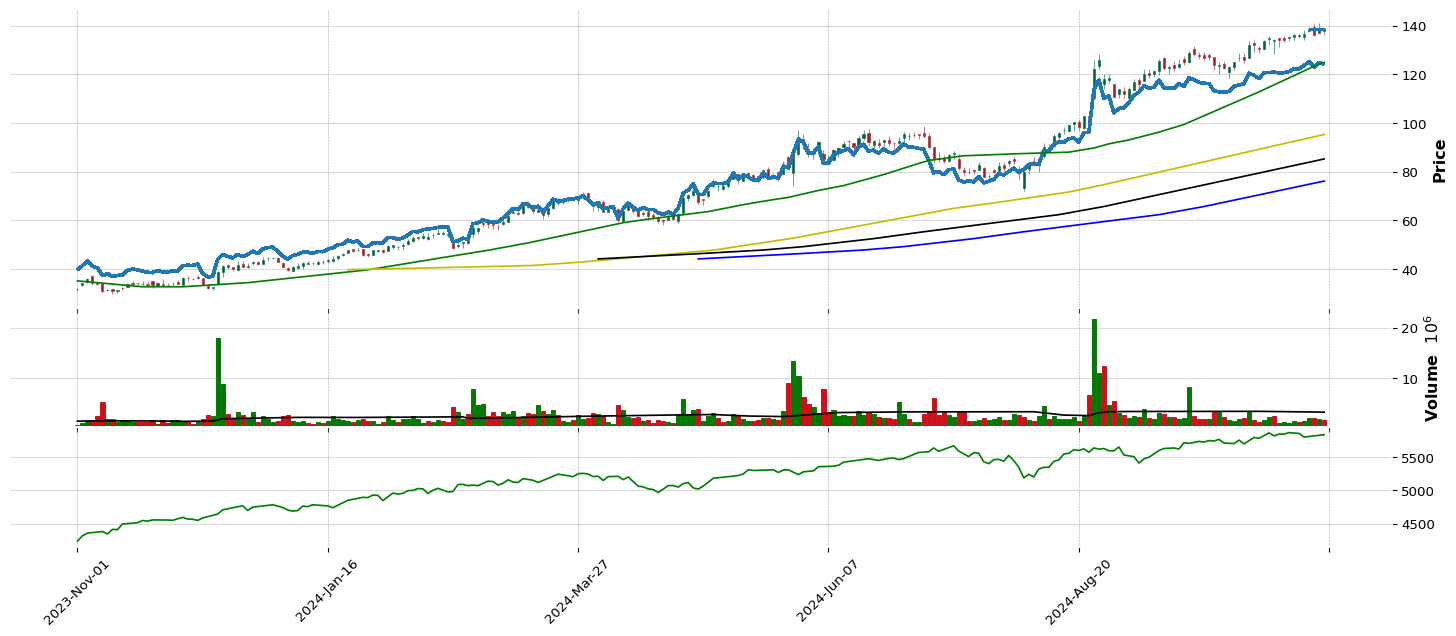

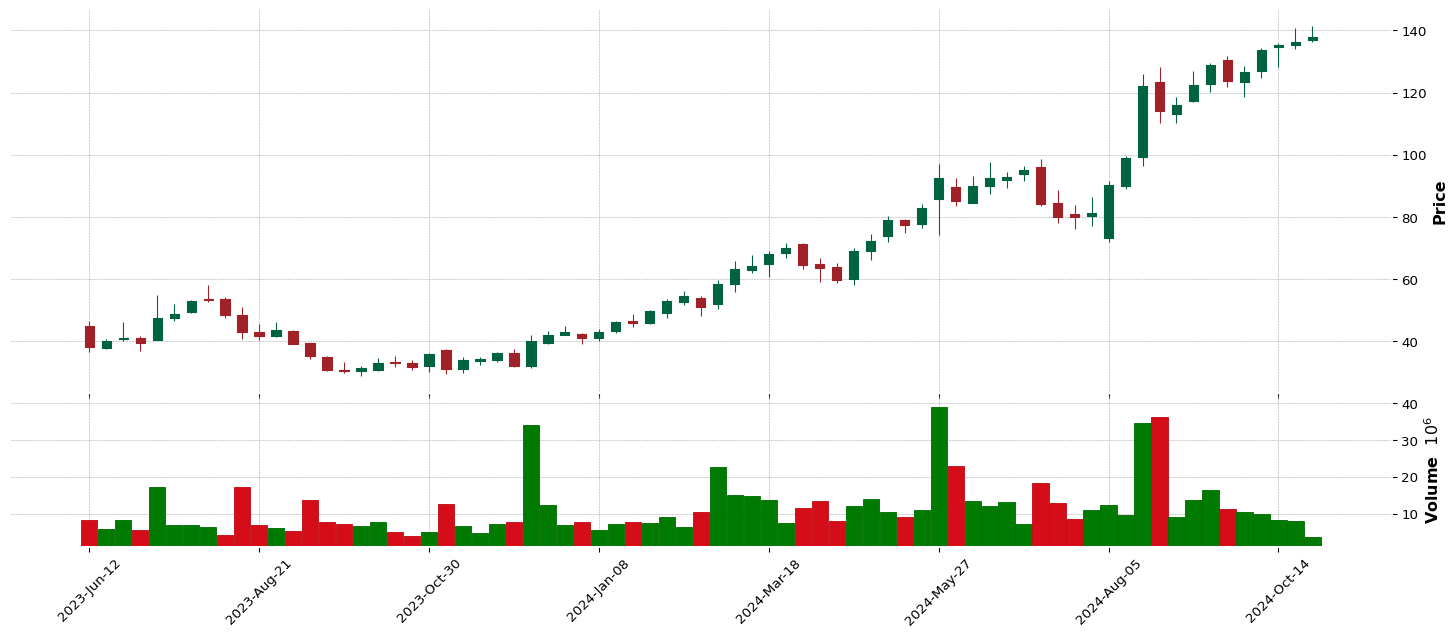

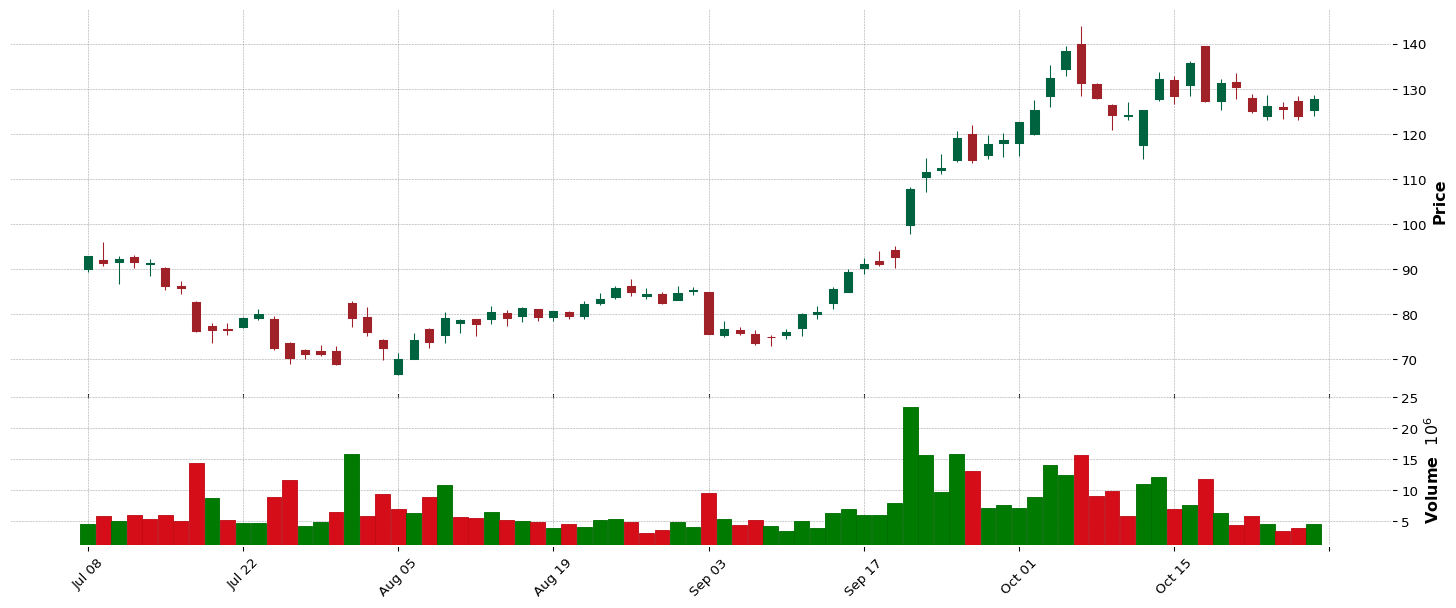

CAVA |

98.92 |

99.19 |

99.38 |

0.0 |

Consumer Cyclical |

Restaurants |

82 |

0.0 |

98.71 |

83.3 |

0.0 |

1.0 |

4.0 |

138.47 |

1.0 |

1.0 |

| 28.0 |

DYN |

98.89 |

99.13 |

99.25 |

95.55 |

Healthcare |

Biotechnology |

19 |

29.72 |

0.0 |

28.34 |

0.0 |

17.0 |

21.0 |

30.78 |

0.0 |

0.0 |

| 29.0 |

BMA |

98.86 |

98.98 |

98.7 |

98.63 |

Financial |

Banks - Regional |

22 |

84.93 |

92.01 |

49.8 |

66.9 |

3.0 |

5.0 |

79.11 |

1.0 |

1.0 |

| 30.0 |

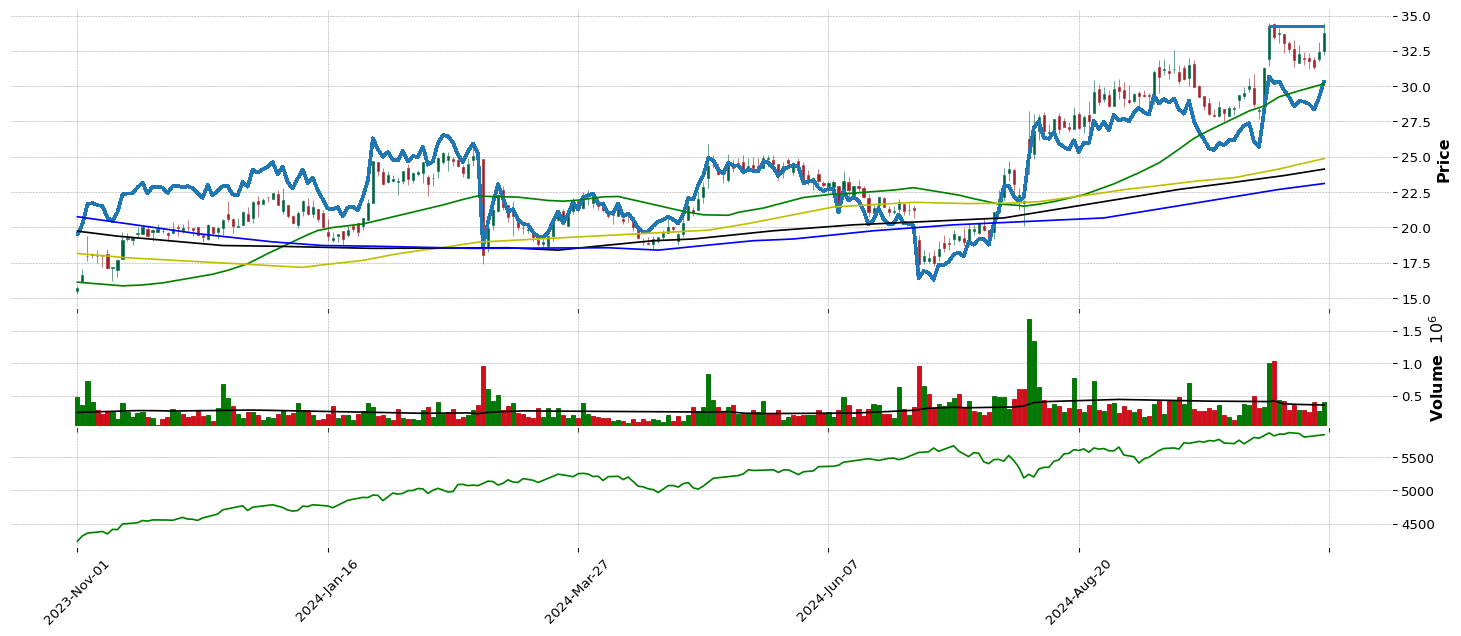

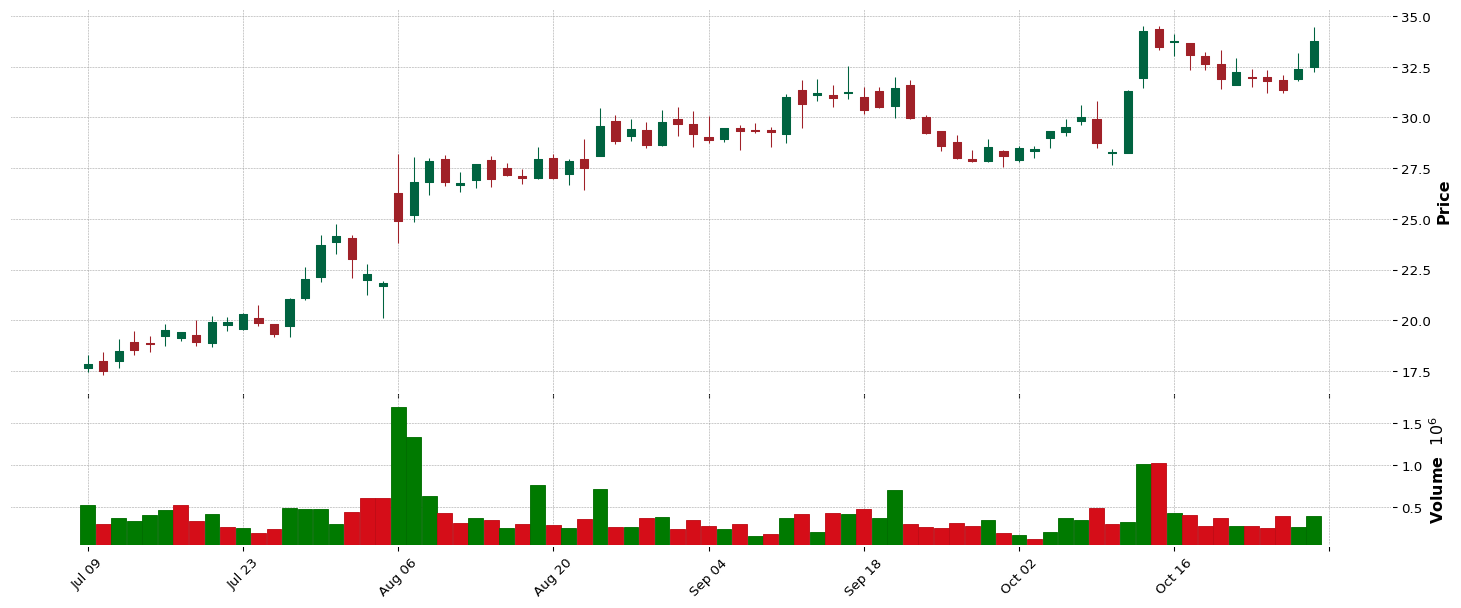

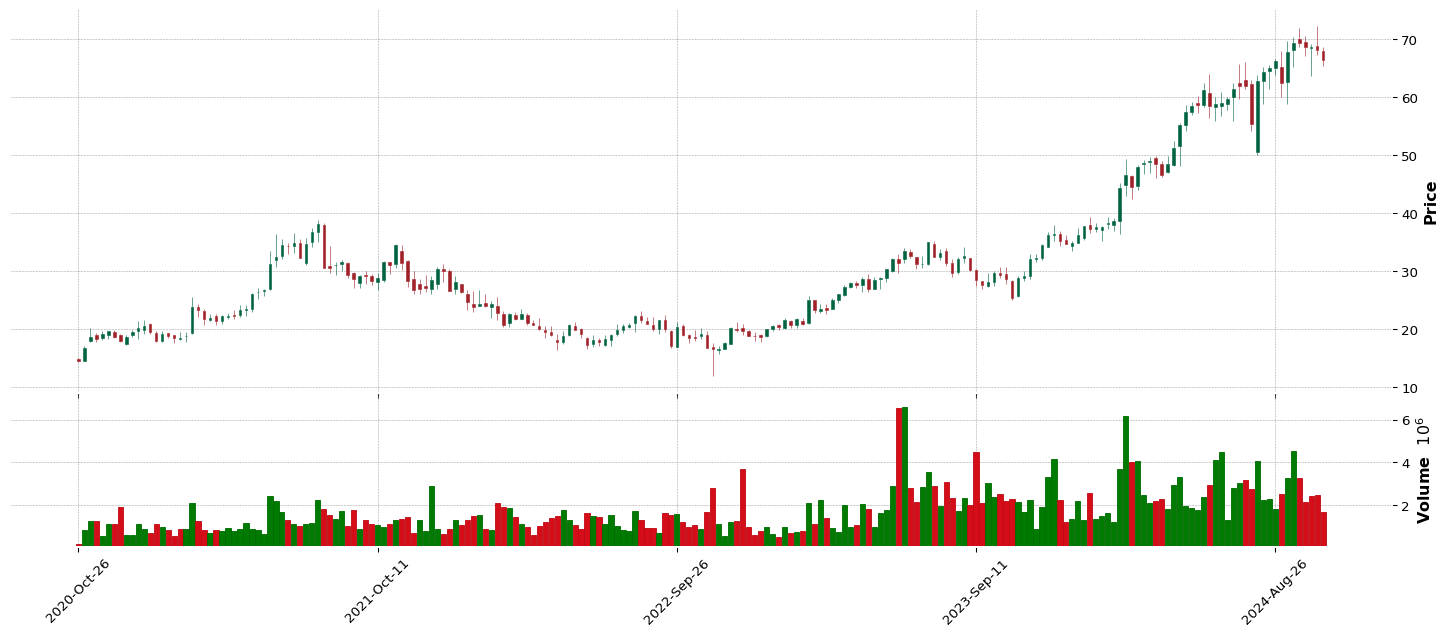

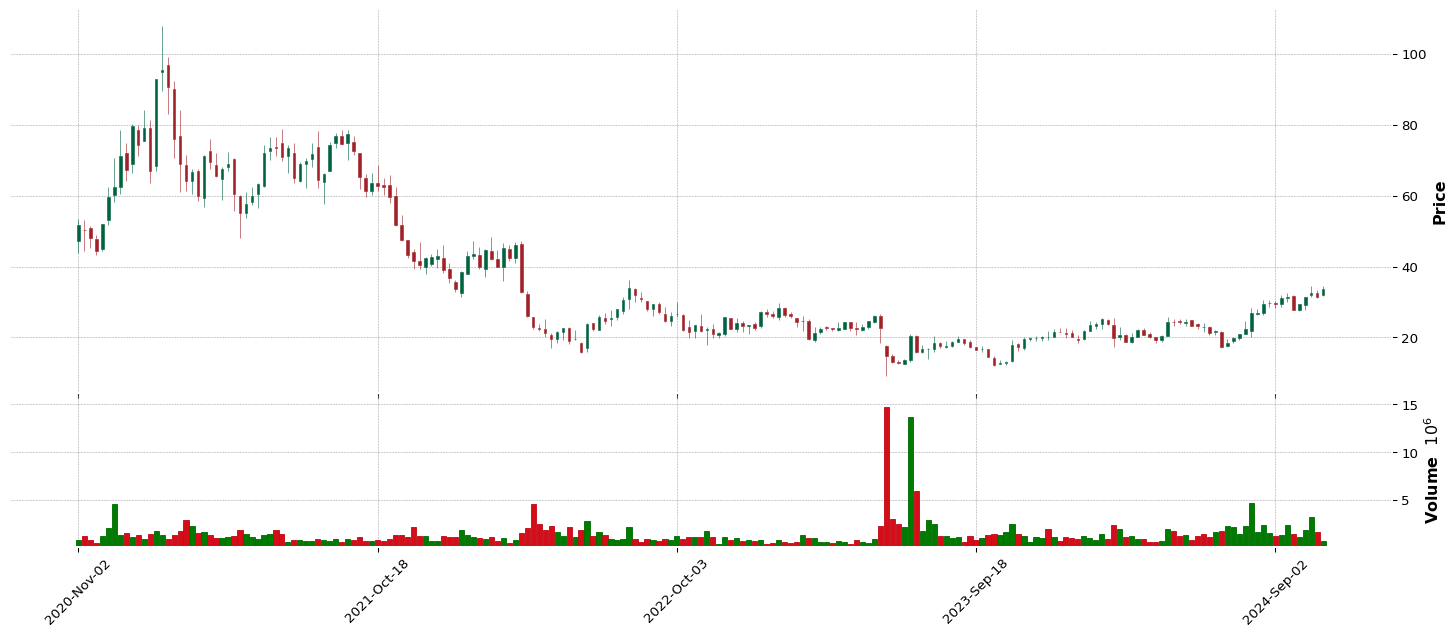

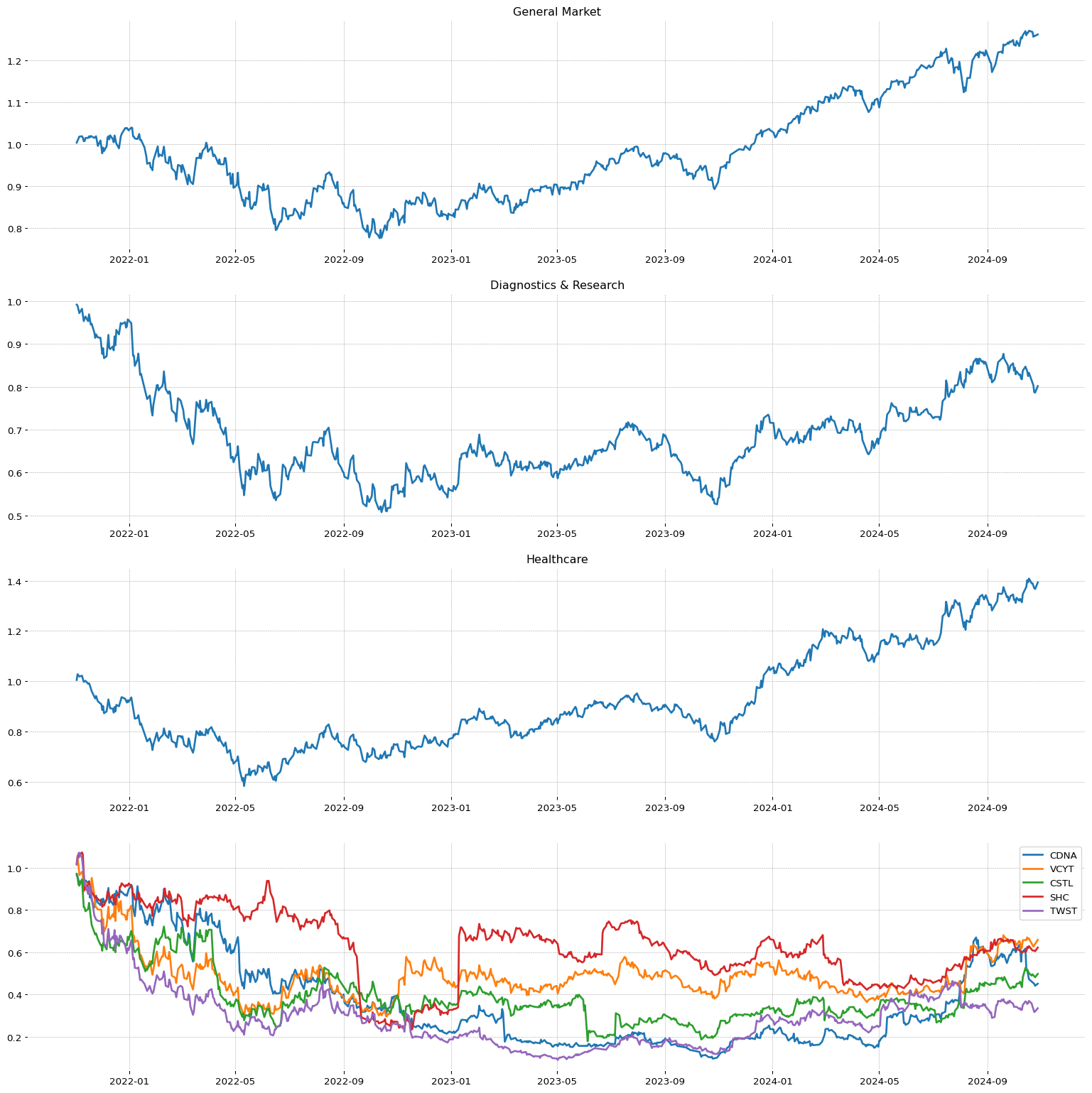

CDNA |

98.79 |

99.56 |

99.35 |

25.36 |

Healthcare |

Diagnostics and Research |

48 |

30.74 |

20.4 |

8.37 |

20.21 |

1.0 |

22.0 |

22.88 |

0.0 |

1.0 |

Canslim Selection

| Pos. | |

Name | |

RS Today | |

RS 3Wk | |

RS 6Wk | |

RS 26wk | |

Secotr | |

Industry | |

Pos Ind | |

EPS | |

SMR | |

A/C | |

CR | |

Ind Pos. | |

Sec Pos. | |

Close. | |

10wk | |

26wk | |

| 1.0 |

SEZL |

99.93 |

99.96 |

99.93 |

0.0 |

Financial |

Credit Services |

17 |

94.86 |

86.39 |

86.2 |

70.23 |

1.0 |

1.0 |

220.91 |

1.0 |

1.0 |

| 2.0 |

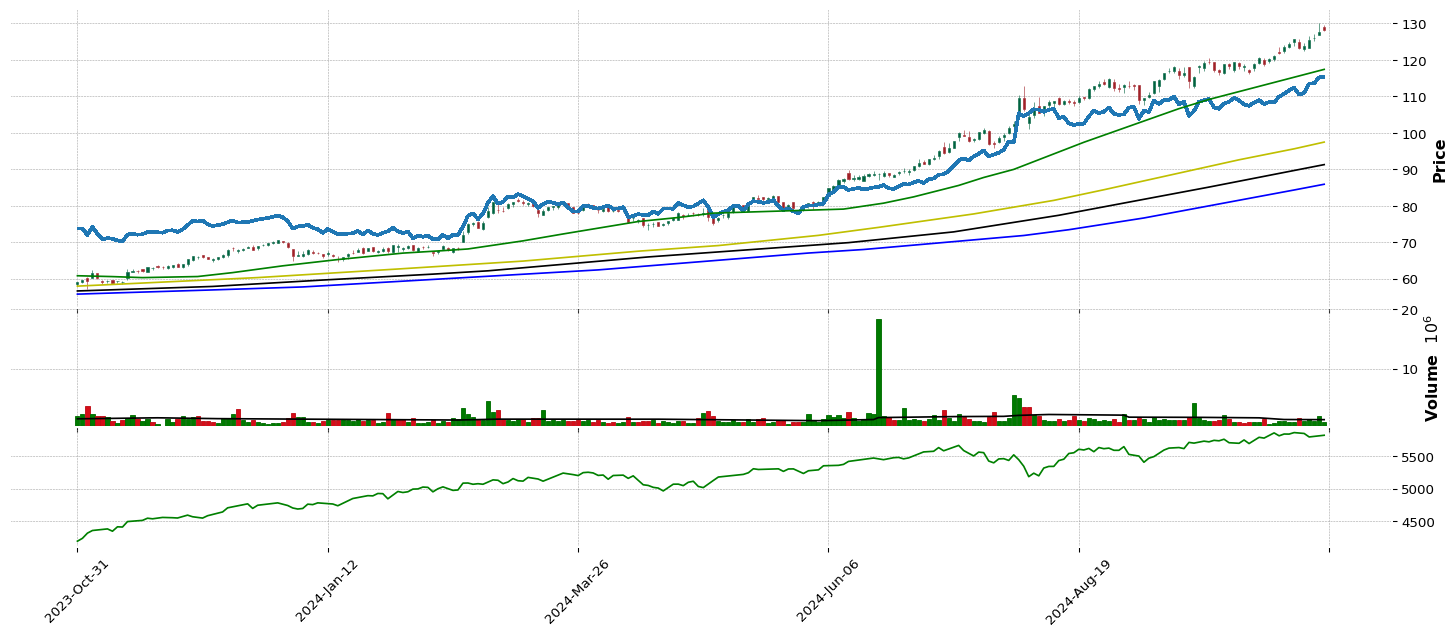

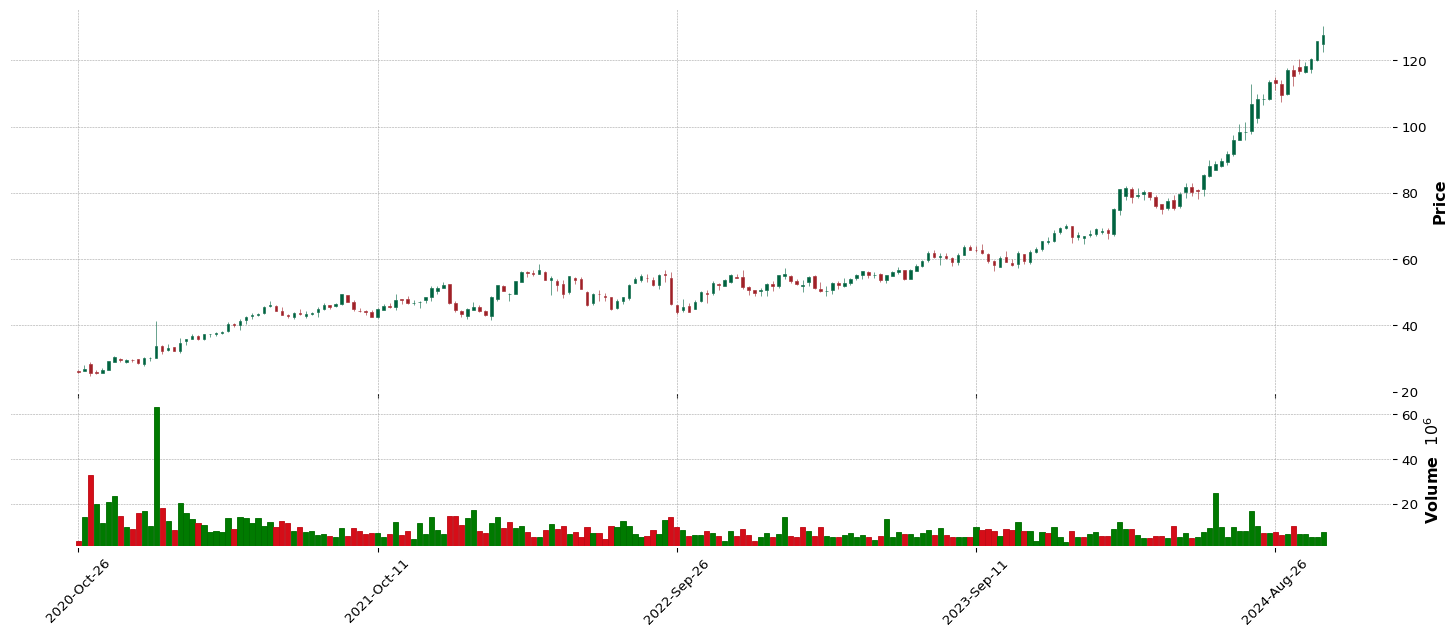

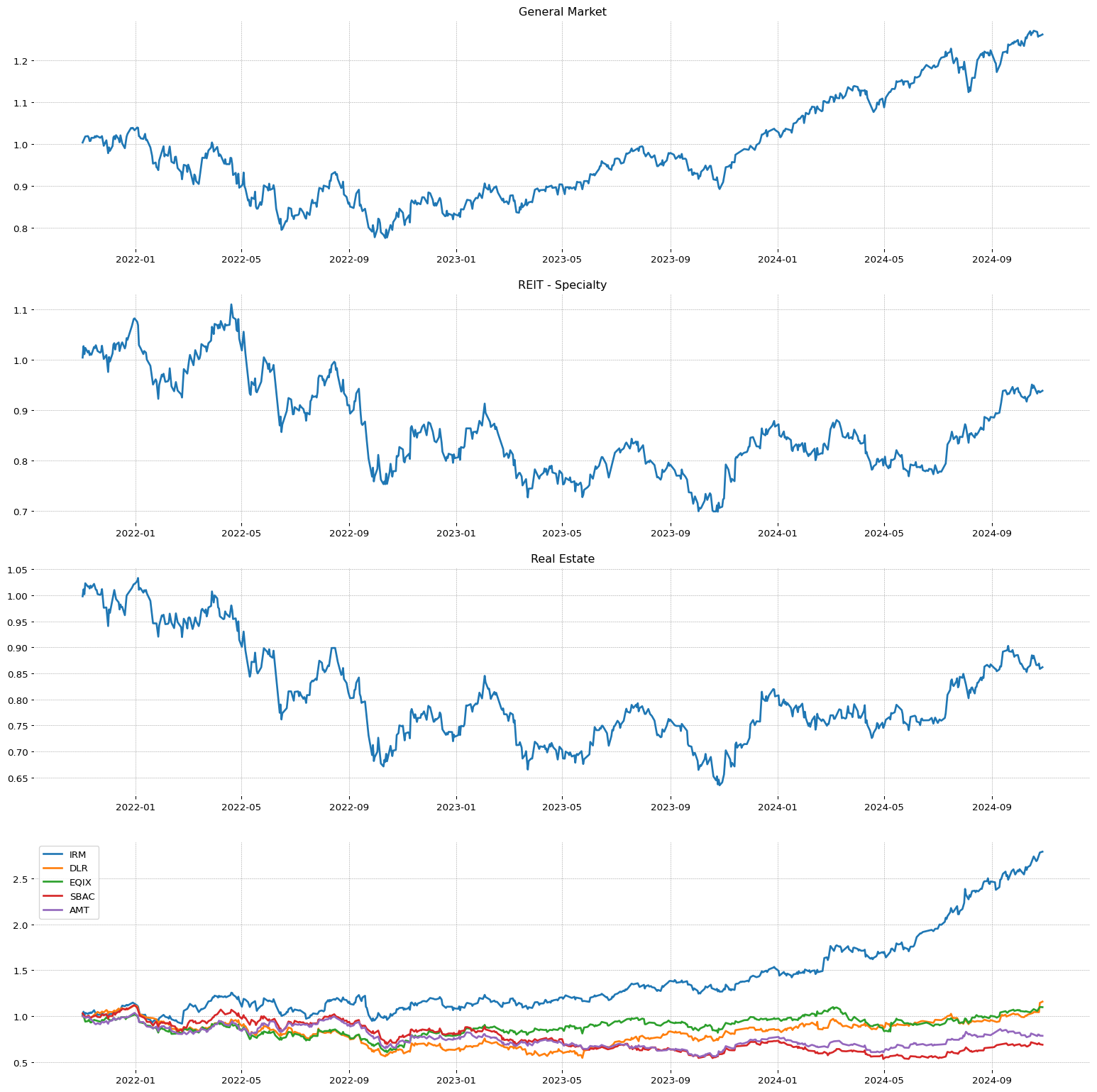

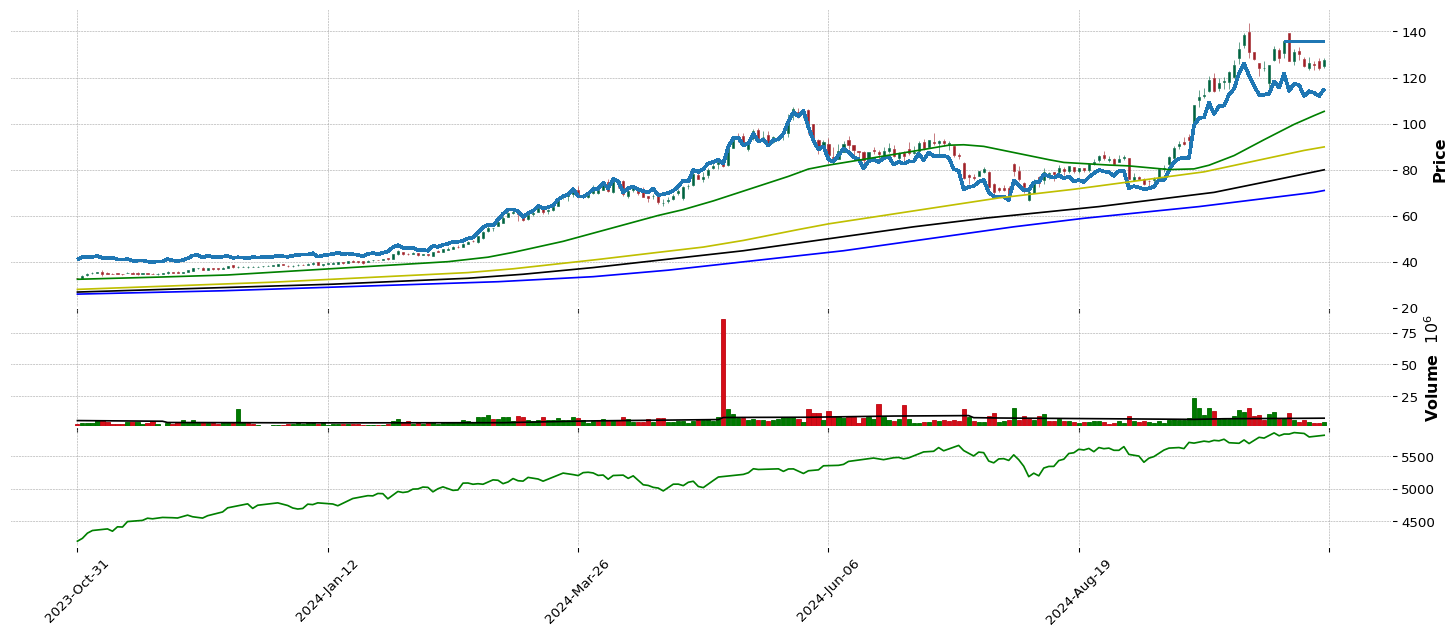

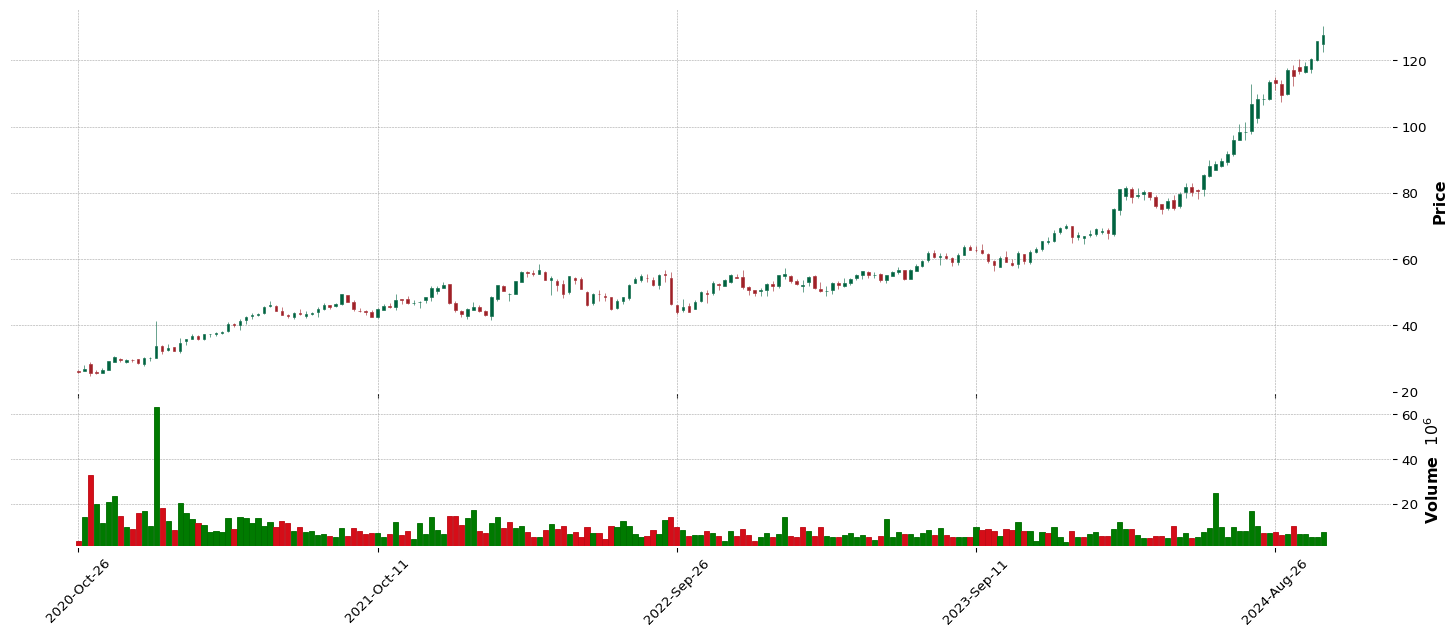

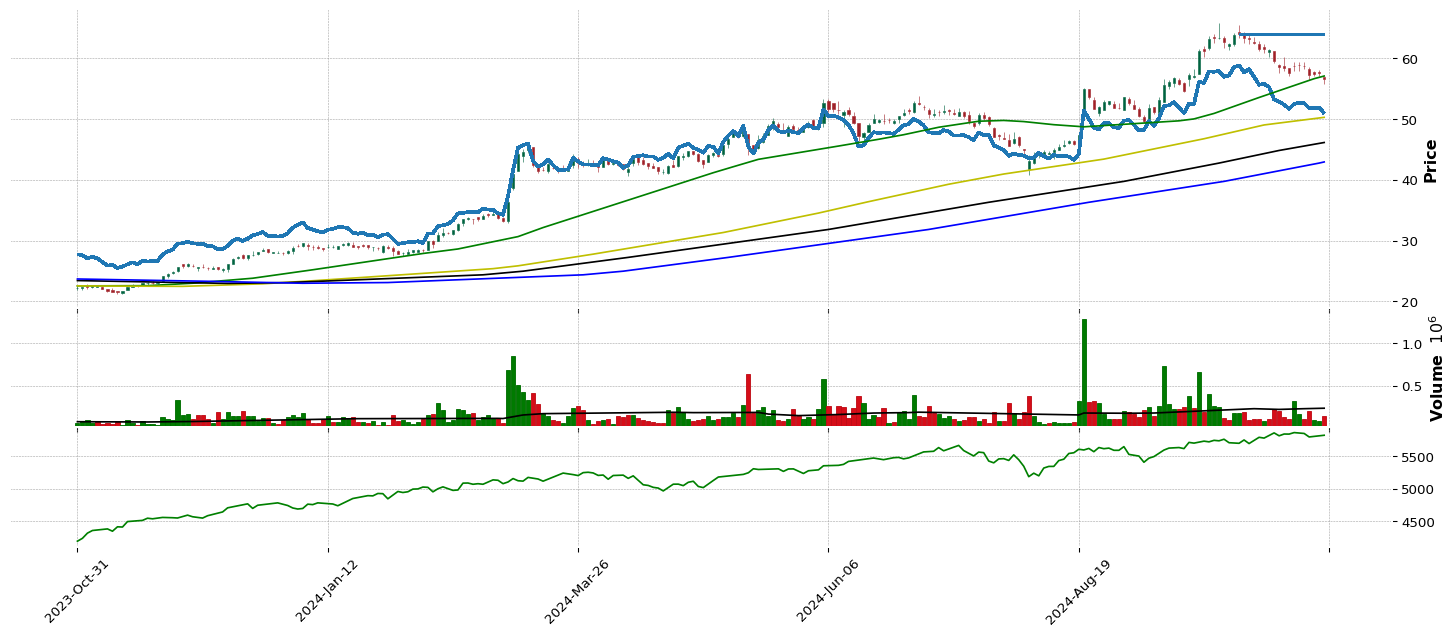

IRM |

91.87 |

92.02 |

91.57 |

77.49 |

Real Estate |

REIT - Specialty |

53 |

61.76 |

32.4 |

94.42 |

83.1 |

1.0 |

7.0 |

128.13 |

1.0 |

1.0 |

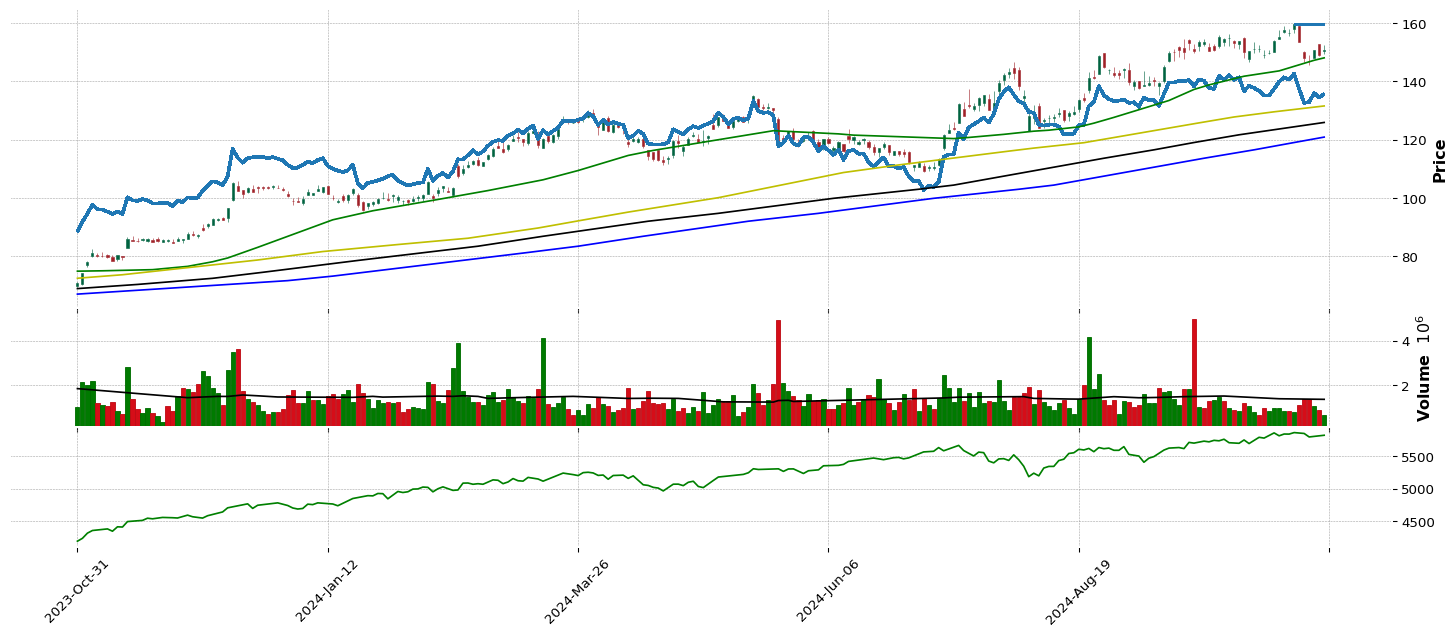

| 3.0 |

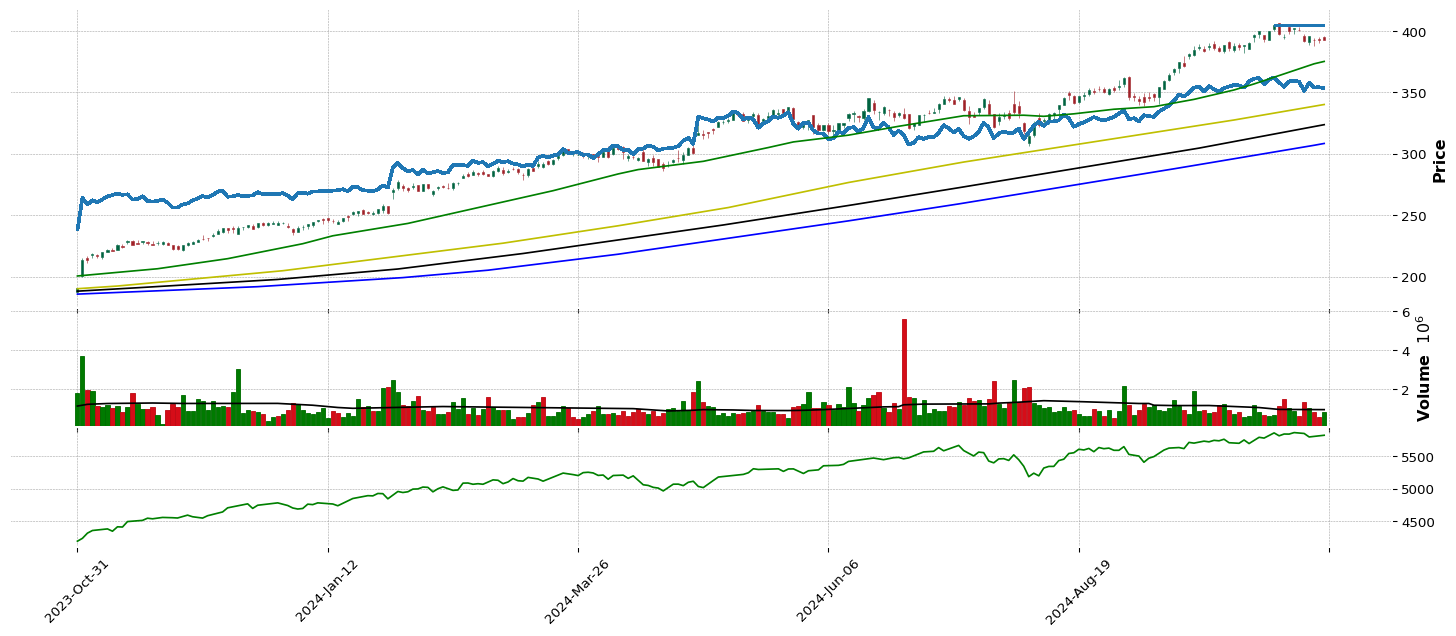

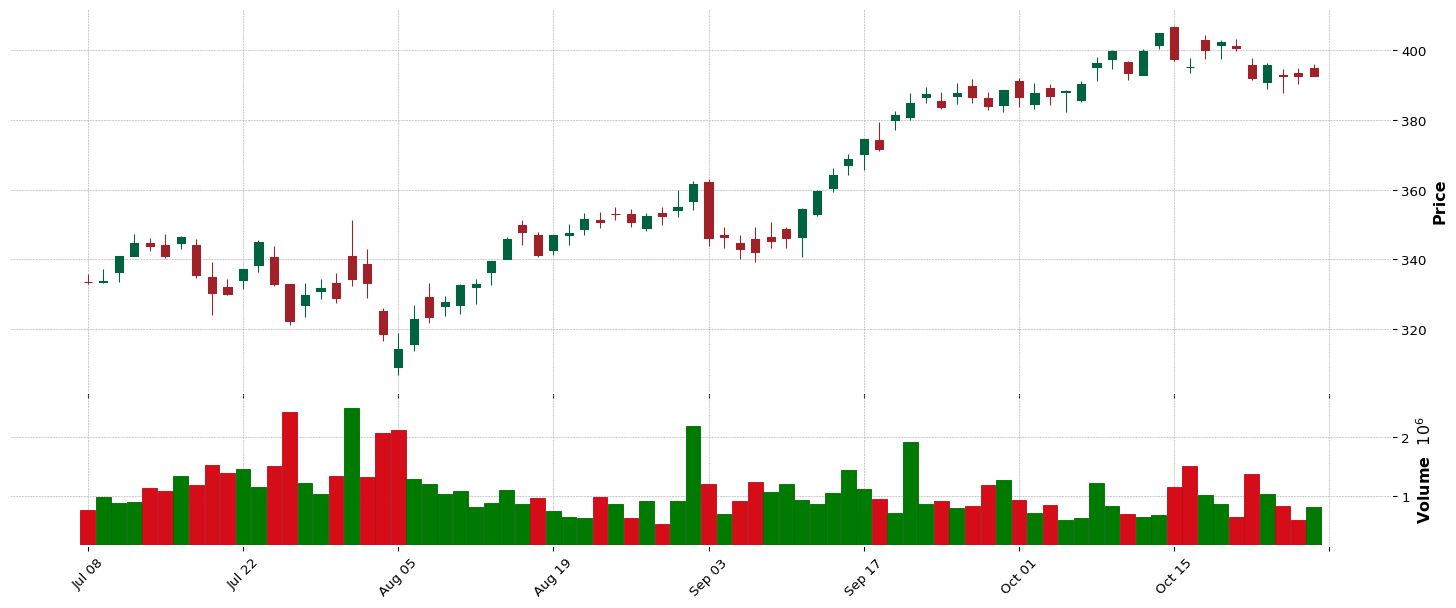

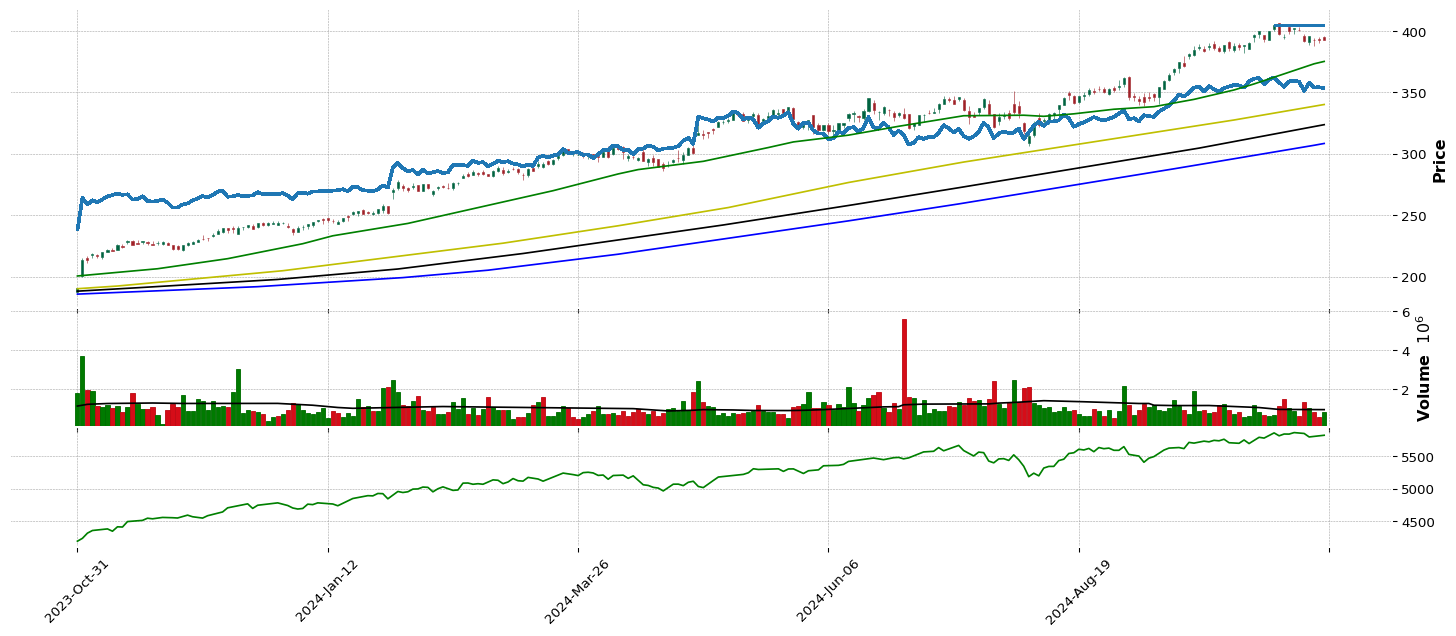

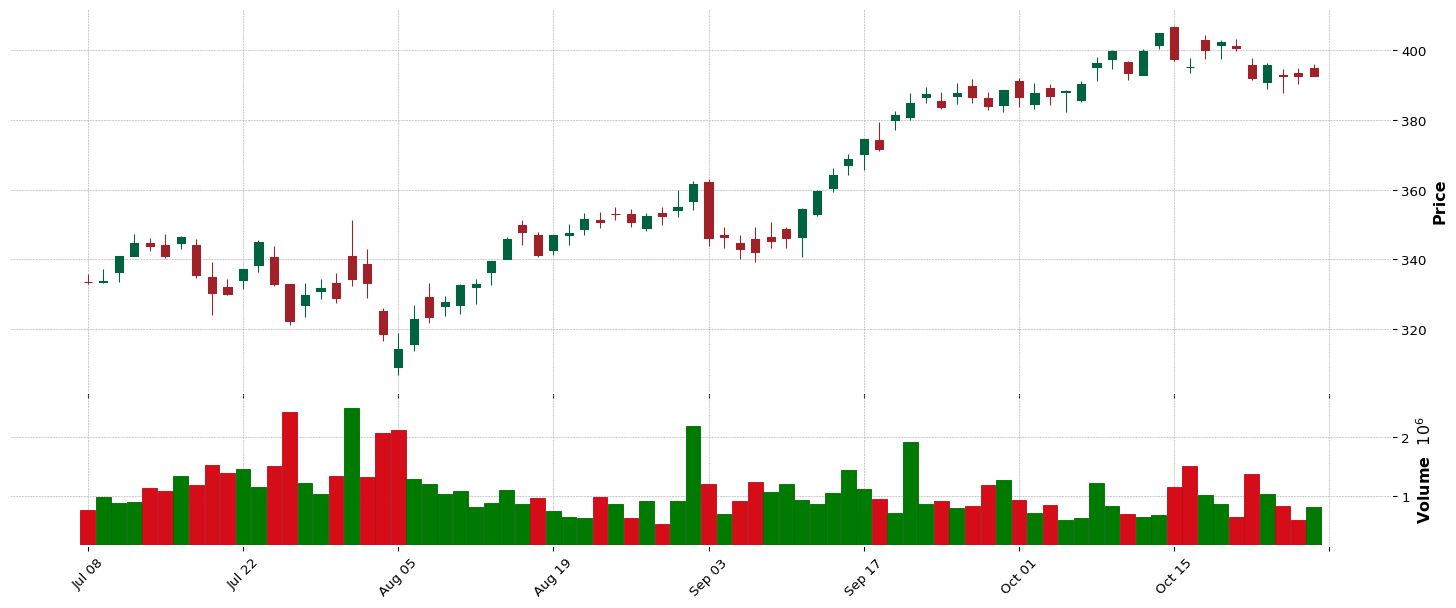

FIX |

91.44 |

96.02 |

94.04 |

95.05 |

Industrials |

Engineering and Construction |

21 |

90.87 |

92.65 |

61.23 |

97.26 |

6.0 |

36.0 |

389.29 |

1.0 |

1.0 |

| 4.0 |

ALNY |

87.22 |

83.52 |

83.52 |

10.63 |

Healthcare |

Biotechnology |

19 |

71.11 |

98.1 |

3.79 |

94.87 |

81.0 |

119.0 |

286.91 |

1.0 |

1.0 |

| 5.0 |

DECK |

81.43 |

91.22 |

90.58 |

89.43 |

Consumer Cyclical |

Footwear and Accessories |

66 |

89.79 |

93.51 |

57.04 |

90.68 |

3.0 |

67.0 |

169.28 |

1.0 |

1.0 |

| 6.0 |

MELI |

79.52 |

83.62 |

83.58 |

55.48 |

Consumer Cyclical |

Internet Retail |

47 |

99.31 |

72.24 |

51.0 |

99.86 |

7.0 |

74.0 |

2056.09 |

1.0 |

1.0 |

| 7.0 |

NTAP |

79.24 |

84.51 |

83.61 |

88.0 |

Technology |

Computer Hardware |

77 |

74.38 |

75.39 |

52.44 |

84.9 |

6.0 |

109.0 |

120.41 |

0.0 |

1.0 |

| 8.0 |

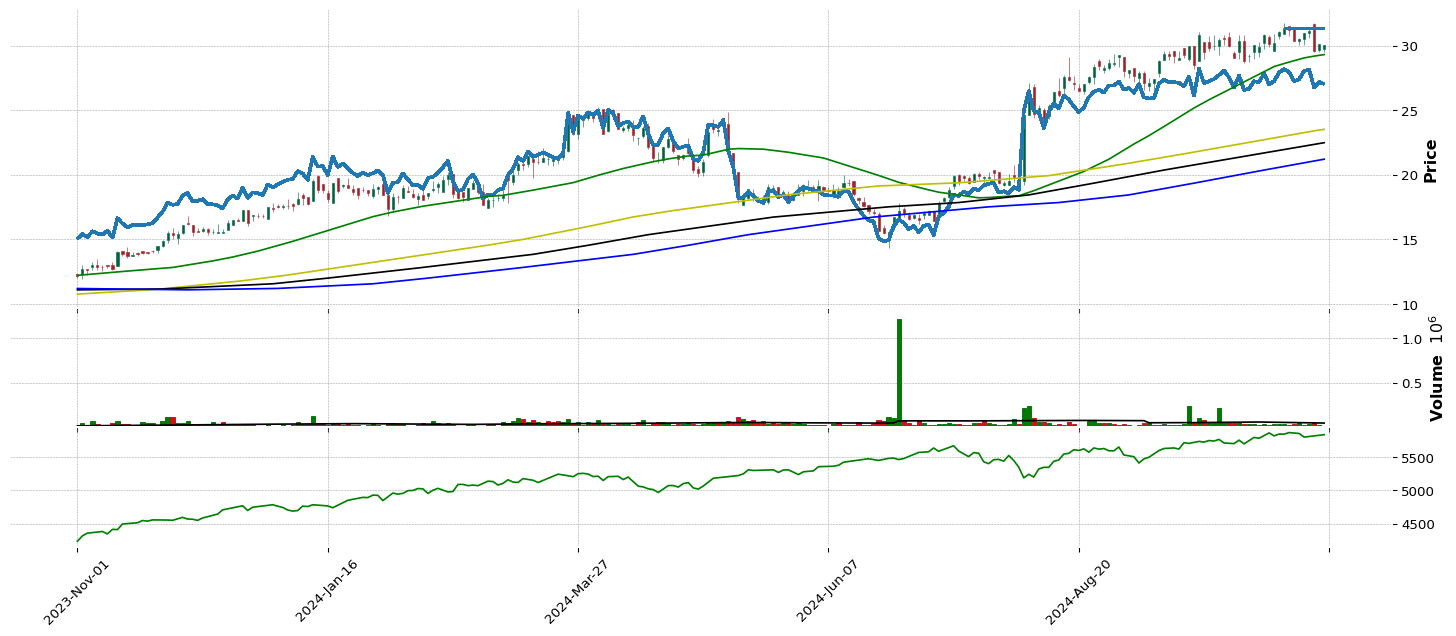

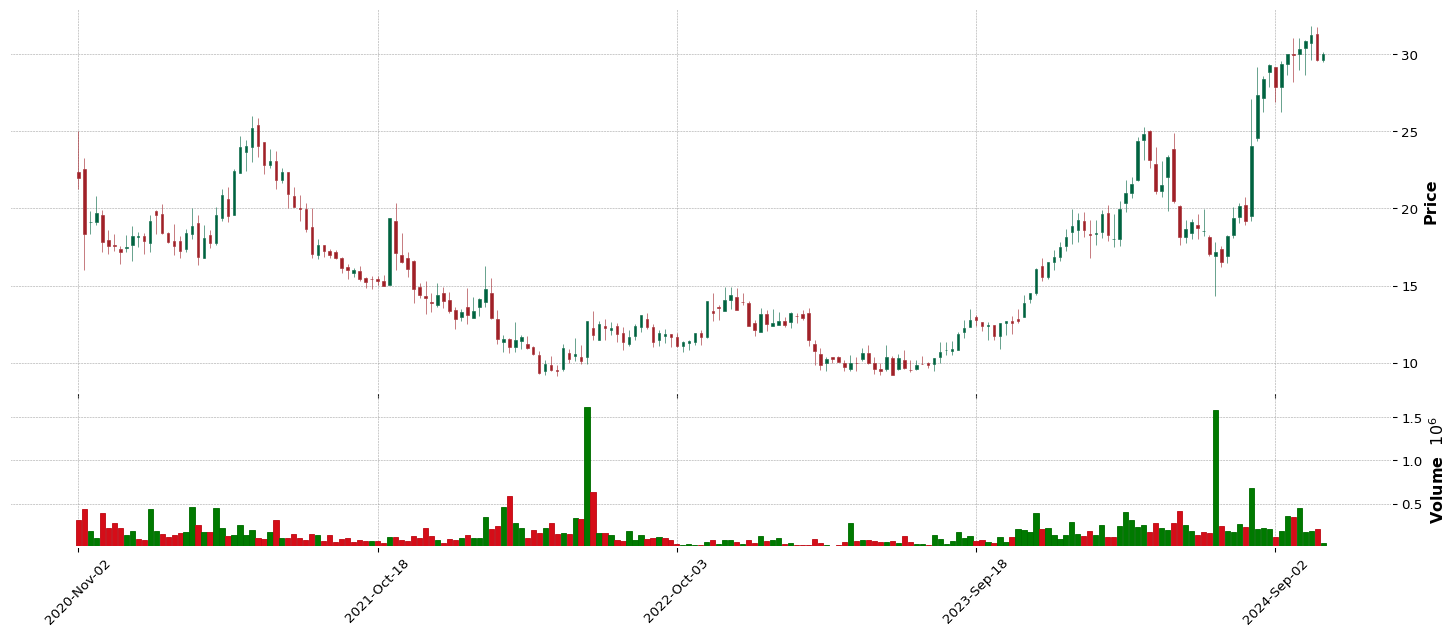

DFH |

78.29 |

80.94 |

82.22 |

96.48 |

Consumer Cyclical |

Residential Construction |

42 |

86.63 |

62.84 |

52.44 |

52.33 |

13.0 |

80.0 |

32.2 |

0.0 |

1.0 |

| 9.0 |

ODFL |

26.66 |

18.41 |

24.71 |

54.7 |

Industrials |

Trucking |

75 |

43.82 |

47.38 |

30.28 |

90.82 |

8.0 |

297.0 |

200.88 |

1.0 |

1.0 |

| 10.0 |

NXT |

16.56 |

21.95 |

19.34 |

78.61 |

Technology |

Solar |

134 |

42.31 |

99.8 |

5.22 |

53.4 |

5.0 |

356.0 |

32.56 |

0.0 |

0.0 |

Base Formation Stock

| Pos. | |

Name | |

RS Today | |

RS 3Wk | |

RS 6Wk | |

RS 26wk | |

Secotr | |

Industry | |

Pos Ind | |

EPS | |

SMR | |

A/C | |

CR | |

Ind Pos. | |

Sec Pos. | |

Close. | |

10wk | |

26wk | |

| 1.0 |

VERA |

99.07 |

98.55 |

96.94 |

99.68 |

Healthcare |

Biotechnology |

19 |

34.61 |

0.0 |

47.38 |

0.0 |

15.0 |

19.0 |

47.34 |

1.0 |

1.0 |

| 2.0 |

OSCR |

96.7 |

98.67 |

99.19 |

97.48 |

Healthcare |

Healthcare Plans |

2 |

83.17 |

92.71 |

31.56 |

23.5 |

2.0 |

51.0 |

15.35 |

0.0 |

0.0 |

| 3.0 |

INSM |

96.3 |

97.66 |

98.33 |

66.33 |

Healthcare |

Biotechnology |

19 |

11.5 |

84.98 |

68.27 |

65.73 |

38.0 |

56.0 |

71.95 |

0.0 |

1.0 |

| 4.0 |

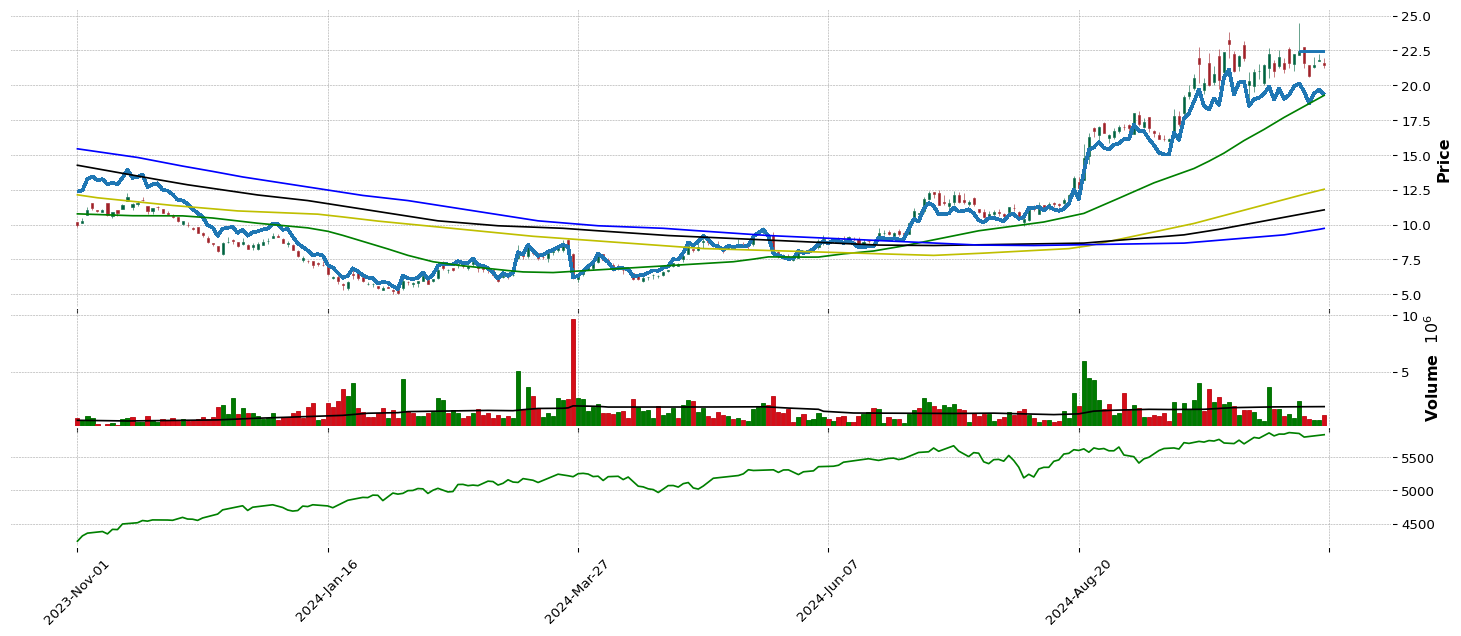

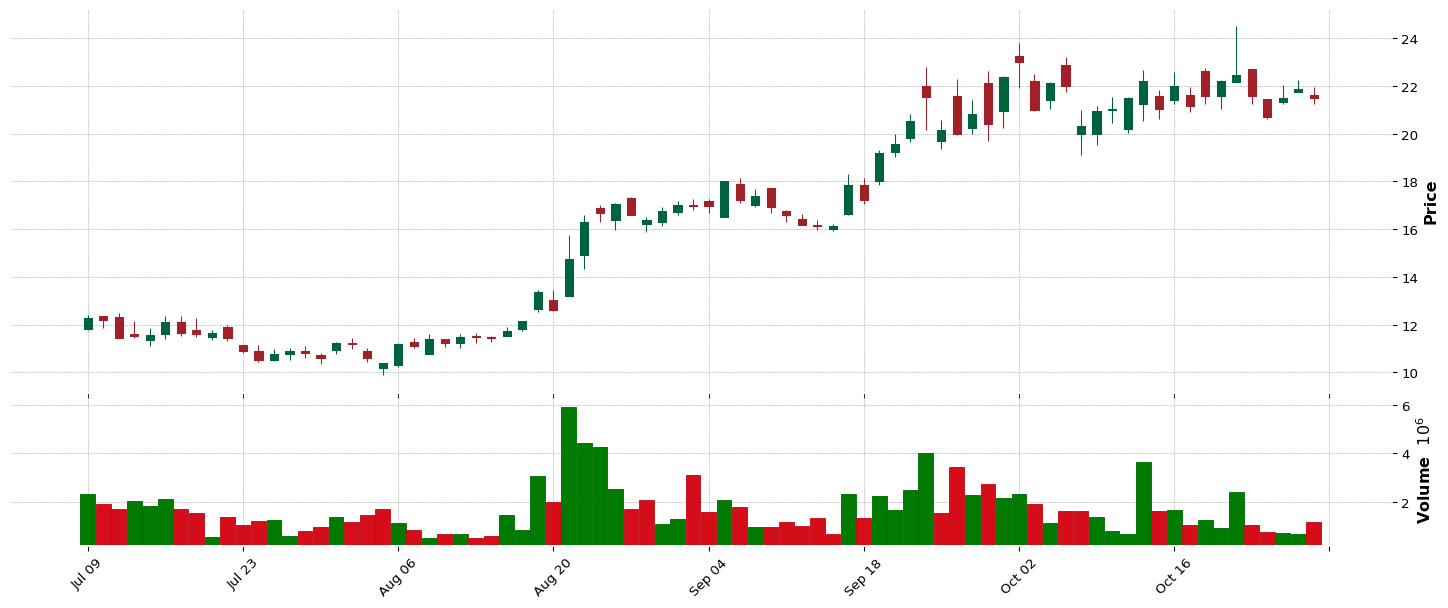

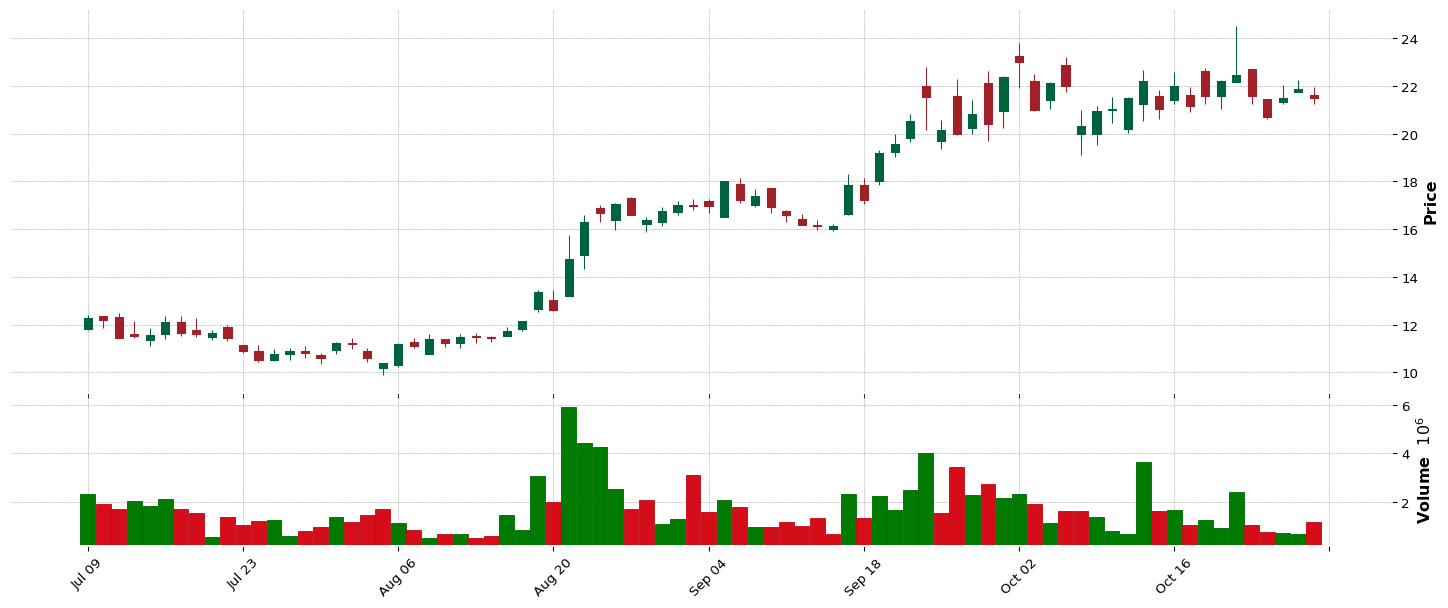

INOD |

95.75 |

92.88 |

93.15 |

24.18 |

Technology |

Information Technology Services |

10 |

46.95 |

95.92 |

40.94 |

31.18 |

2.0 |

19.0 |

20.48 |

1.0 |

1.0 |

| 5.0 |

HOV |

94.73 |

95.28 |

95.15 |

94.21 |

Consumer Cyclical |

Residential Construction |

42 |

79.92 |

54.79 |

40.94 |

86.98 |

1.0 |

17.0 |

176.17 |

0.0 |

1.0 |

| 6.0 |

ERJ |

94.39 |

96.15 |

96.79 |

90.08 |

Industrials |

Aerospace and Defense |

29 |

91.09 |

90.98 |

88.99 |

52.54 |

5.0 |

23.0 |

34.38 |

1.0 |

1.0 |

| 7.0 |

DNTH |

93.41 |

95.25 |

93.55 |

100.0 |

Healthcare |

Biotechnology |

19 |

74.85 |

38.94 |

57.04 |

41.84 |

60.0 |

83.0 |

28.12 |

1.0 |

1.0 |

| 8.0 |

INBK |

92.27 |

90.91 |

94.53 |

97.94 |

Financial |

Banks - Regional |

22 |

0.0 |

0.0 |

8.37 |

0.0 |

7.0 |

25.0 |

35.97 |

1.0 |

1.0 |

| 9.0 |

AGIO |

92.17 |

87.4 |

92.22 |

78.58 |

Healthcare |

Biotechnology |

19 |

10.45 |

22.36 |

24.38 |

48.28 |

66.0 |

93.0 |

46.08 |

1.0 |

1.0 |

| 10.0 |

GDDY |

92.11 |

93.75 |

94.6 |

89.99 |

Technology |

Software - Infrastructure |

55 |

99.87 |

38.24 |

68.27 |

87.67 |

11.0 |

39.0 |

159.89 |

1.0 |

1.0 |

| 11.0 |

IBP |

90.94 |

92.08 |

92.44 |

93.53 |

Consumer Cyclical |

Residential Construction |

42 |

74.51 |

50.11 |

74.48 |

92.66 |

3.0 |

26.0 |

234.71 |

1.0 |

1.0 |

| 12.0 |

BURL |

90.7 |

93.04 |

92.74 |

32.88 |

Consumer Cyclical |

Apparel Retail |

80 |

96.47 |

76.77 |

58.34 |

94.18 |

4.0 |

27.0 |

253.27 |

0.0 |

1.0 |

| 13.0 |

AORT |

90.57 |

87.68 |

88.09 |

80.41 |

Healthcare |

Medical Devices |

95 |

41.97 |

45.1 |

68.27 |

40.63 |

8.0 |

104.0 |

26.45 |

1.0 |

1.0 |

| 14.0 |

WING |

89.47 |

94.85 |

96.72 |

90.82 |

Consumer Cyclical |

Restaurants |

82 |

96.41 |

85.43 |

8.37 |

96.43 |

5.0 |

30.0 |

368.55 |

0.0 |

0.0 |

| 15.0 |

MPWR |

89.43 |

89.9 |

93.18 |

79.42 |

Technology |

Semiconductors |

79 |

52.95 |

24.35 |

20.31 |

99.2 |

8.0 |

53.0 |

890.46 |

0.0 |

1.0 |

| 16.0 |

NVMI |

89.1 |

91.62 |

89.87 |

92.91 |

Technology |

Semiconductor Equipment and Materials |

133 |

86.66 |

57.52 |

25.96 |

89.54 |

1.0 |

56.0 |

189.05 |

0.0 |

0.0 |

| 17.0 |

REVG |

88.88 |

85.52 |

91.54 |

94.87 |

Industrials |

Farm and Heavy Construction Machinery |

116 |

92.45 |

86.1 |

1.86 |

44.96 |

2.0 |

53.0 |

28.2 |

1.0 |

1.0 |

| 18.0 |

GKOS |

88.63 |

89.59 |

85.25 |

95.02 |

Healthcare |

Medical Devices |

95 |

5.22 |

53.44 |

22.7 |

79.95 |

10.0 |

111.0 |

134.08 |

1.0 |

1.0 |

| 19.0 |

UTI |

87.77 |

90.08 |

93.52 |

96.89 |

Consumer Defensive |

Education and Training Services |

119 |

98.2 |

79.65 |

40.94 |

32.6 |

1.0 |

14.0 |

16.79 |

1.0 |

1.0 |

| 20.0 |

DKS |

87.71 |

91.04 |

93.02 |

77.86 |

Consumer Cyclical |

Specialty Retail |

12 |

0.0 |

0.0 |

5.81 |

0.0 |

3.0 |

38.0 |

205.27 |

0.0 |

0.0 |

| 21.0 |

GHM |

87.37 |

86.69 |

92.31 |

96.36 |

Industrials |

Specialty Industrial Machinery |

40 |

92.76 |

94.64 |

40.94 |

49.15 |

7.0 |

60.0 |

29.56 |

0.0 |

1.0 |

| 22.0 |

BFH |

87.34 |

77.98 |

80.62 |

82.09 |

Financial |

Credit Services |

17 |

82.7 |

63.36 |

32.7 |

63.23 |

8.0 |

50.0 |

51.25 |

0.0 |

1.0 |

| 23.0 |

BHE |

86.69 |

87.83 |

91.45 |

76.09 |

Technology |

Electronic Components |

39 |

86.51 |

52.77 |

64.39 |

61.4 |

3.0 |

66.0 |

45.16 |

1.0 |

1.0 |

| 24.0 |

MLR |

86.63 |

81.15 |

80.06 |

78.8 |

Consumer Cyclical |

Auto Parts |

136 |

89.63 |

97.81 |

77.07 |

73.31 |

4.0 |

45.0 |

67.76 |

1.0 |

1.0 |

| 25.0 |

AX |

86.45 |

83.99 |

87.75 |

72.61 |

Financial |

Banks - Regional |

22 |

85.49 |

60.37 |

22.7 |

68.95 |

17.0 |

61.0 |

67.02 |

1.0 |

1.0 |

NEW STAGGE 1

| Pos. | |

Name | |

RS Today | |

RS 3Wk | |

RS 6Wk | |

RS 26wk | |

Secotr | |

Industry | |

Pos Ind | |

EPS | |

SMR | |

A/C | |

CR | |

Ind Pos. | |

Sec Pos. | |

Close. | |

10wk | |

26wk | |

| 1.0 |

WRB |

53.32 |

66.68 |

68.31 |

72.55 |

Financial |

Insurance - Property and Casualty |

96 |

86.6 |

68.07 |

33.6 |

69.43 |

19.0 |

382.0 |

58.4 |

1.0 |

1.0 |

| 2.0 |

ORLY |

51.57 |

59.88 |

54.02 |

48.74 |

Consumer Cyclical |

Specialty Retail |

12 |

19.51 |

68.43 |

40.94 |

99.65 |

15.0 |

151.0 |

1197.1 |

1.0 |

1.0 |

| 3.0 |

CHDN |

51.47 |

53.47 |

51.89 |

21.44 |

Consumer Cyclical |

Gambling |

36 |

83.51 |

74.59 |

40.94 |

88.36 |

7.0 |

154.0 |

141.16 |

1.0 |

1.0 |

| 4.0 |

CHH |

50.27 |

31.28 |

32.18 |

26.01 |

Consumer Cyclical |

Lodging |

52 |

58.89 |

11.48 |

17.46 |

83.59 |

7.0 |

159.0 |

140.83 |

1.0 |

1.0 |

| 5.0 |

PAYX |

49.26 |

45.38 |

50.94 |

50.88 |

Technology |

Software - Application |

76 |

50.01 |

53.89 |

11.92 |

85.25 |

64.0 |

241.0 |

140.27 |

1.0 |

1.0 |

| 6.0 |

EIG |

49.07 |

50.58 |

52.73 |

47.28 |

Financial |

Insurance - Specialty |

28 |

47.07 |

65.92 |

11.92 |

61.05 |

12.0 |

425.0 |

47.93 |

1.0 |

1.0 |

| 7.0 |

GD |

48.92 |

57.01 |

69.79 |

75.03 |

Industrials |

Aerospace and Defense |

29 |

41.63 |

50.43 |

91.24 |

96.22 |

25.0 |

228.0 |

303.92 |

1.0 |

1.0 |

| 8.0 |

PCG |

48.76 |

53.72 |

47.14 |

35.28 |

Utilities |

Utilities - Regulated Electric |

59 |

0.0 |

0.0 |

63.25 |

0.0 |

17.0 |

35.0 |

20.51 |

1.0 |

1.0 |

| 9.0 |

LNT |

48.21 |

50.21 |

50.1 |

25.8 |

Utilities |

Utilities - Regulated Electric |

59 |

0.0 |

0.0 |

40.94 |

0.0 |

18.0 |

36.0 |

61.13 |

1.0 |

1.0 |

| 10.0 |

BR |

48.15 |

48.98 |

47.48 |

66.24 |

Technology |

Information Technology Services |

10 |

36.0 |

61.05 |

93.24 |

93.56 |

24.0 |

244.0 |

213.69 |

1.0 |

1.0 |

| 11.0 |

WPP |

48.02 |

36.54 |

38.07 |

24.43 |

Communication Services |

Advertising Agencies |

78 |

62.57 |

19.63 |

28.34 |

63.06 |

10.0 |

71.0 |

53.84 |

1.0 |

1.0 |

| 12.0 |

NODK |

47.69 |

53.81 |

51.52 |

55.54 |

Financial |

Insurance - Property and Casualty |

96 |

32.19 |

80.75 |

83.3 |

33.92 |

25.0 |

441.0 |

15.85 |

1.0 |

1.0 |

| 13.0 |

PFG |

47.59 |

52.61 |

39.46 |

54.14 |

Financial |

Asset Management |

61 |

70.73 |

32.49 |

71.99 |

77.91 |

39.0 |

442.0 |

84.48 |

1.0 |

1.0 |

| 14.0 |

BKH |

47.56 |

46.52 |

43.96 |

19.73 |

Utilities |

Utilities - Regulated Gas |

117 |

24.15 |

52.96 |

83.3 |

69.19 |

5.0 |

37.0 |

60.34 |

1.0 |

1.0 |

| 15.0 |

ET |

47.41 |

47.16 |

48.78 |

65.65 |

Energy |

Oil and Gas Midstream |

97 |

73.61 |

34.0 |

40.94 |

31.98 |

15.0 |

35.0 |

16.39 |

1.0 |

1.0 |

| 16.0 |

IIIV |

46.73 |

42.51 |

36.59 |

35.25 |

Technology |

Software - Infrastructure |

55 |

25.82 |

62.78 |

40.94 |

39.8 |

59.0 |

249.0 |

23.28 |

1.0 |

1.0 |

| 17.0 |

EVRG |

46.61 |

49.29 |

46.86 |

19.58 |

Utilities |

Utilities - Regulated Electric |

59 |

27.83 |

34.58 |

40.94 |

65.45 |

19.0 |

38.0 |

60.97 |

1.0 |

1.0 |

| 18.0 |

PBH |

46.42 |

43.62 |

62.41 |

58.43 |

Healthcare |

Drug Manufacturers - Specialty and Generic |

30 |

66.9 |

68.04 |

71.99 |

76.32 |

23.0 |

251.0 |

73.62 |

1.0 |

1.0 |

| 19.0 |

WTW |

46.15 |

70.5 |

71.05 |

51.63 |

Financial |

Insurance Brokers |

20 |

66.62 |

81.48 |

77.83 |

96.33 |

8.0 |

463.0 |

292.11 |

1.0 |

1.0 |

| 20.0 |

FWONK |

46.02 |

36.82 |

52.76 |

37.11 |

Communication Services |

Entertainment |

73 |

73.16 |

23.53 |

2.7 |

71.85 |

17.0 |

73.0 |

80.05 |

1.0 |

1.0 |

| 21.0 |

OSBC |

45.96 |

35.74 |

57.32 |

59.99 |

Financial |

Banks - Regional |

22 |

50.51 |

43.27 |

88.99 |

34.96 |

190.0 |

466.0 |

16.77 |

1.0 |

1.0 |

| 22.0 |

KVUE |

45.28 |

39.68 |

44.12 |

0.0 |

Consumer Defensive |

Household and Personal Products |

123 |

35.38 |

42.18 |

96.11 |

42.47 |

7.0 |

55.0 |

22.87 |

1.0 |

1.0 |

| 23.0 |

GTY |

44.27 |

39.56 |

40.35 |

16.38 |

Real Estate |

REIT - Retail |

45 |

38.75 |

29.09 |

96.11 |

52.82 |

15.0 |

93.0 |

32.52 |

1.0 |

1.0 |

| 24.0 |

HBT |

44.15 |

45.75 |

62.11 |

45.25 |

Financial |

Banks - Regional |

22 |

62.29 |

76.22 |

40.94 |

41.74 |

196.0 |

493.0 |

21.97 |

1.0 |

1.0 |

| 25.0 |

OGS |

43.96 |

29.49 |

27.46 |

16.47 |

Utilities |

Utilities - Regulated Gas |

117 |

17.84 |

31.82 |

74.48 |

72.06 |

6.0 |

41.0 |

73.69 |

1.0 |

1.0 |

| 26.0 |

INCY |

43.65 |

44.05 |

41.0 |

13.14 |

Healthcare |

Biotechnology |

19 |

78.41 |

77.83 |

40.94 |

72.93 |

142.0 |

261.0 |

65.69 |

1.0 |

1.0 |

| 27.0 |

POR |

43.53 |

35.16 |

43.72 |

20.88 |

Utilities |

Utilities - Regulated Electric |

59 |

91.27 |

44.3 |

57.04 |

65.97 |

22.0 |

42.0 |

48.7 |

1.0 |

1.0 |

| 28.0 |

SRE |

43.34 |

47.69 |

47.57 |

28.44 |

Utilities |

Utilities - Diversified |

88 |

78.87 |

50.59 |

40.94 |

77.88 |

3.0 |

43.0 |

85.16 |

1.0 |

1.0 |

| 29.0 |

MPLX |

43.16 |

54.74 |

60.66 |

60.8 |

Energy |

Oil and Gas Midstream |

97 |

90.34 |

71.31 |

4.38 |

61.78 |

16.0 |

37.0 |

43.77 |

1.0 |

1.0 |

| 30.0 |

VOYA |

42.05 |

46.85 |

42.91 |

34.72 |

Financial |

Financial Conglomerates |

87 |

87.47 |

77.09 |

65.61 |

79.23 |

2.0 |

520.0 |

80.66 |

1.0 |

1.0 |

| 31.0 |

PFIS |

42.02 |

36.42 |

37.76 |

36.43 |

Financial |

Banks - Regional |

22 |

6.74 |

44.52 |

68.27 |

60.57 |

198.0 |

521.0 |

47.36 |

1.0 |

1.0 |

| 32.0 |

ABR |

41.74 |

27.89 |

24.25 |

57.94 |

Real Estate |

REIT - Mortgage |

120 |

0.0 |

0.0 |

83.3 |

0.0 |

9.0 |

99.0 |

15.18 |

1.0 |

1.0 |

| 33.0 |

ALE |

41.13 |

47.84 |

47.63 |

29.37 |

Utilities |

Utilities - Diversified |

88 |

31.11 |

31.21 |

22.7 |

65.03 |

5.0 |

48.0 |

64.29 |

1.0 |

1.0 |

| 34.0 |

UGI |

40.94 |

37.43 |

25.39 |

15.23 |

Utilities |

Utilities - Regulated Gas |

117 |

65.26 |

46.39 |

72.94 |

46.0 |

7.0 |

50.0 |

24.95 |

1.0 |

1.0 |

| 35.0 |

DGX |

40.82 |

52.15 |

59.82 |

38.26 |

Healthcare |

Diagnostics and Research |

48 |

17.56 |

37.11 |

83.3 |

87.98 |

17.0 |

274.0 |

155.91 |

1.0 |

1.0 |

| 36.0 |

ED |

40.45 |

44.11 |

47.39 |

31.08 |

Utilities |

Utilities - Regulated Electric |

59 |

41.57 |

68.91 |

79.65 |

83.35 |

24.0 |

52.0 |

104.8 |

1.0 |

1.0 |

| 37.0 |

WEC |

40.17 |

42.27 |

40.85 |

22.07 |

Utilities |

Utilities - Regulated Electric |

59 |

23.87 |

25.92 |

78.57 |

78.53 |

25.0 |

53.0 |

97.0 |

1.0 |

1.0 |

| 38.0 |

OGE |

39.5 |

46.55 |

47.67 |

28.81 |

Utilities |

Utilities - Regulated Electric |

59 |

0.0 |

0.0 |

68.27 |

0.0 |

27.0 |

55.0 |

40.65 |

1.0 |

1.0 |

| 39.0 |

ARW |

38.42 |

39.74 |

30.14 |

50.6 |

Technology |

Electronics and Computer Distribution |

44 |

31.73 |

5.0 |

2.7 |

77.18 |

6.0 |

266.0 |

133.82 |

1.0 |

1.0 |

| 40.0 |

ENS |

38.08 |

31.21 |

32.98 |

50.01 |

Industrials |

Electrical Equipment and Parts |

9 |

58.7 |

71.99 |

5.81 |

79.82 |

11.0 |

253.0 |

100.77 |

1.0 |

1.0 |

| 41.0 |

AVT |

37.8 |

39.77 |

38.38 |

61.08 |

Technology |

Electronics and Computer Distribution |

44 |

35.04 |

5.71 |

40.94 |

60.29 |

7.0 |

271.0 |

54.4 |

1.0 |

1.0 |

| 42.0 |

GSBC |

37.71 |

41.9 |

56.24 |

42.71 |

Financial |

Banks - Regional |

22 |

21.55 |

49.66 |

57.04 |

66.32 |

207.0 |

570.0 |

58.36 |

1.0 |

1.0 |

| 43.0 |

IVT |

37.68 |

42.98 |

54.79 |

54.27 |

Real Estate |

REIT - Retail |

45 |

57.65 |

23.99 |

78.57 |

48.52 |

19.0 |

108.0 |

29.45 |

1.0 |

1.0 |

| 44.0 |

AEE |

36.33 |

40.24 |

35.11 |

18.3 |

Utilities |

Utilities - Regulated Electric |

59 |

32.81 |

19.12 |

59.02 |

75.07 |

28.0 |

61.0 |

88.12 |

1.0 |

1.0 |

| 45.0 |

NWE |

35.22 |

38.11 |

39.89 |

20.2 |

Utilities |

Utilities - Regulated Electric |

59 |

0.0 |

0.0 |

40.94 |

0.0 |

29.0 |

62.0 |

55.34 |

1.0 |

1.0 |

| 46.0 |

PEBO |

34.51 |

41.62 |

57.2 |

57.28 |

Financial |

Banks - Regional |

22 |

60.06 |

65.15 |

94.42 |

55.9 |

209.0 |

595.0 |

31.54 |

1.0 |

1.0 |

| 47.0 |

HDB |

34.11 |

28.04 |

36.37 |

17.93 |

Financial |

Banks - Regional |

22 |

21.86 |

50.78 |

24.38 |

66.56 |

210.0 |

601.0 |

64.5 |

1.0 |

1.0 |

| 48.0 |

HSTM |

34.05 |

62.56 |

71.24 |

45.91 |

Healthcare |

Health Information Services |

111 |

80.85 |

49.56 |

24.38 |

47.94 |

9.0 |

291.0 |

28.95 |

1.0 |

1.0 |

| 49.0 |

DE |

32.75 |

28.78 |

27.83 |

40.09 |

Industrials |

Farm and Heavy Construction Machinery |

116 |

64.76 |

46.61 |

17.46 |

97.43 |

9.0 |

271.0 |

412.35 |

1.0 |

1.0 |

| 50.0 |

XOM |

32.2 |

43.19 |

26.99 |

49.76 |

Energy |

Oil and Gas Integrated |

132 |

71.75 |

8.05 |

33.6 |

81.55 |

6.0 |

56.0 |

118.9 |

1.0 |

1.0 |

| 51.0 |

WABC |

30.88 |

32.11 |

53.99 |

65.62 |

Financial |

Banks - Regional |

22 |

48.19 |

41.22 |

40.94 |

63.89 |

214.0 |

623.0 |

52.5 |

1.0 |

1.0 |

| 52.0 |

KMT |

30.44 |

26.57 |

32.39 |

21.79 |

Industrials |

Tools and Accessories |

108 |

35.84 |

22.1 |

80.3 |

43.26 |

5.0 |

281.0 |

25.59 |

1.0 |

1.0 |

| 53.0 |

LNG |

29.95 |

36.23 |

44.09 |

50.29 |

Energy |

Oil and Gas Midstream |

97 |

44.41 |

11.26 |

40.94 |

88.47 |

25.0 |

61.0 |

183.58 |

1.0 |

1.0 |

| 54.0 |

NWN |

29.67 |

25.49 |

29.68 |

17.84 |

Utilities |

Utilities - Regulated Gas |

117 |

8.9 |

17.29 |

68.27 |

53.47 |

10.0 |

69.0 |

40.4 |

1.0 |

1.0 |

| 55.0 |

IDA |

29.24 |

29.03 |

35.6 |

20.01 |

Utilities |

Utilities - Regulated Electric |

59 |

31.36 |

27.91 |

11.92 |

75.18 |

33.0 |

71.0 |

103.81 |

1.0 |

1.0 |

| 56.0 |

FSK |

29.06 |

28.6 |

26.78 |

45.13 |

Financial |

Asset Management |

61 |

64.27 |

49.43 |

61.23 |

40.46 |

55.0 |

634.0 |

20.72 |

1.0 |

1.0 |

| 57.0 |

AC |

27.21 |

31.8 |

20.88 |

23.65 |

Financial |

Asset Management |

61 |

55.49 |

90.05 |

91.24 |

61.64 |

58.0 |

649.0 |

36.09 |

1.0 |

1.0 |

| 58.0 |

AWR |

26.69 |

28.66 |

32.33 |

15.44 |

Utilities |

Utilities - Regulated Water |

105 |

21.0 |

24.15 |

40.94 |

71.58 |

6.0 |

73.0 |

83.26 |

1.0 |

1.0 |

| 59.0 |

TXNM |

23.64 |

24.87 |

25.6 |

13.7 |

Utilities |

Utilities - Regulated Electric |

59 |

8.22 |

0.0 |

94.42 |

0.0 |

35.0 |

77.0 |

43.74 |

1.0 |

1.0 |

| 60.0 |

EXC |

23.52 |

25.3 |

27.42 |

23.18 |

Utilities |

Utilities - Regulated Electric |

59 |

50.13 |

56.4 |

74.48 |

61.43 |

36.0 |

78.0 |

40.22 |

1.0 |

1.0 |

| 61.0 |

GBLI |

18.96 |

21.85 |

20.95 |

52.96 |

Financial |

Insurance - Property and Casualty |

96 |

95.76 |

78.82 |

59.02 |

61.26 |

33.0 |

678.0 |

34.0 |

1.0 |

1.0 |

| 62.0 |

WINA |

16.34 |

18.28 |

28.6 |

49.08 |

Consumer Cyclical |

Specialty Retail |

12 |

35.16 |

51.39 |

20.31 |

96.5 |

24.0 |

266.0 |

377.0 |

1.0 |

1.0 |

| 63.0 |

BWA |

16.1 |

16.65 |

13.91 |

15.97 |

Consumer Cyclical |

Auto Parts |

136 |

50.35 |

21.49 |

71.99 |

54.62 |

15.0 |

269.0 |

34.4 |

1.0 |

1.0 |

New Hight

| Pos. | |

Name | |

RS Today | |

RS 3Wk | |

RS 6Wk | |

RS 26wk | |

Secotr | |

Industry | |

Pos Ind | |

EPS | |

SMR | |

A/C | |

CR | |

Ind Pos. | |

Sec Pos. | |

Close. | |

10wk | |

26wk | |

| 1.0 |

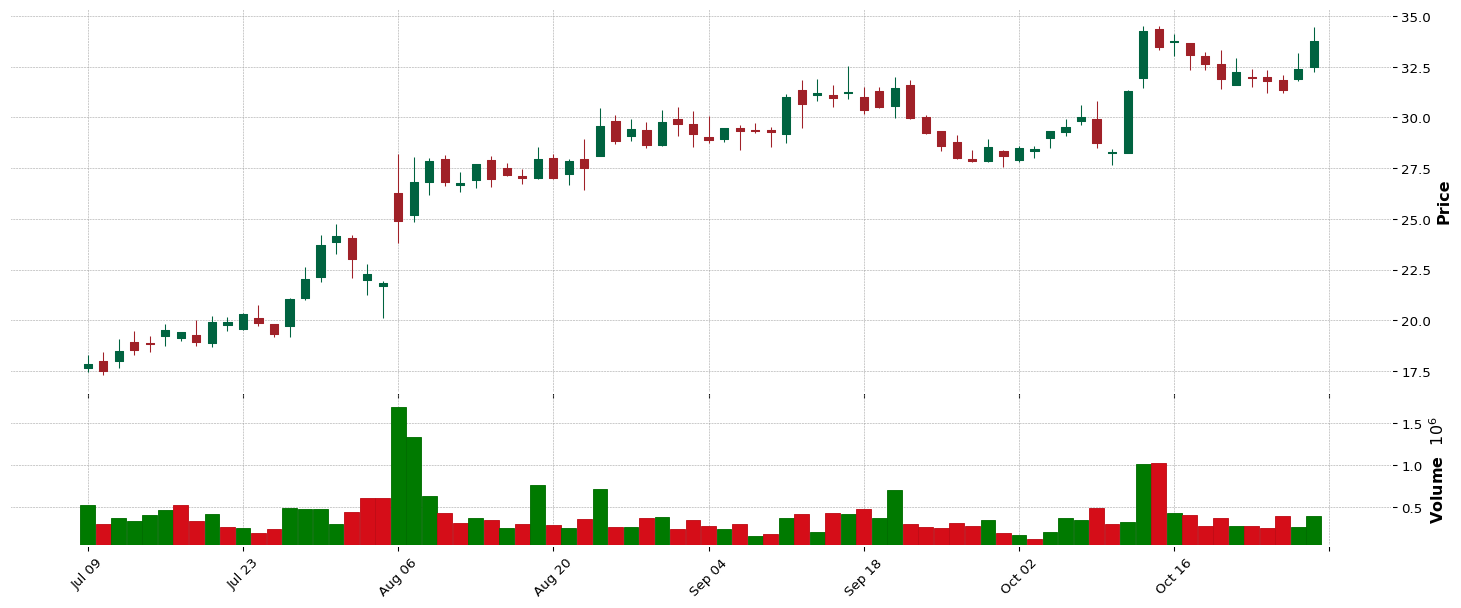

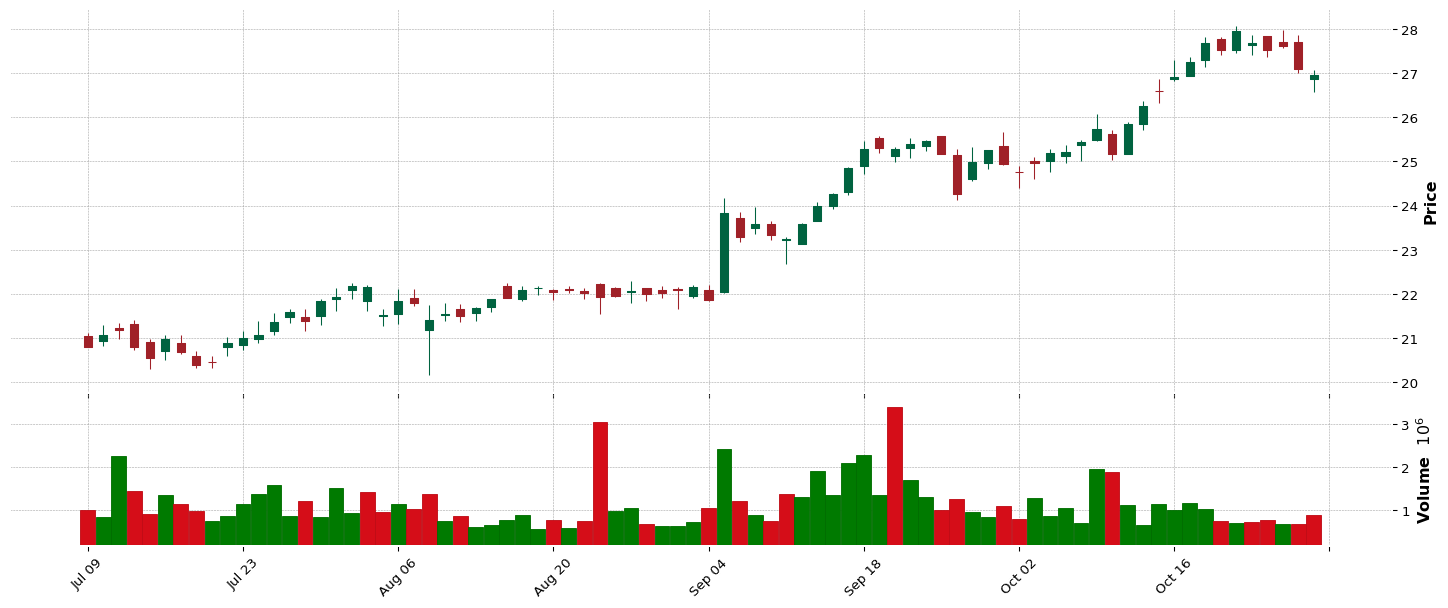

LENZ |

99.87 |

99.87 |

99.87 |

99.56 |

Healthcare |

Biotechnology |

19 |

23.1 |

0.0 |

48.72 |

0.0 |

2.0 |

3.0 |

28.5 |

1.0 |

1.0 |

| 2.0 |

LBPH |

99.84 |

99.72 |

99.59 |

97.76 |

Healthcare |

Biotechnology |

19 |

0.0 |

0.0 |

80.69 |

0.0 |

3.0 |

4.0 |

59.68 |

1.0 |

1.0 |

| 3.0 |

DOGZ |

99.78 |

99.04 |

96.85 |

1.21 |

Consumer Cyclical |

Leisure |

3 |

45.8 |

0.28 |

78.57 |

38.21 |

1.0 |

2.0 |

46.81 |

1.0 |

1.0 |

| 4.0 |

CAPR |

99.66 |

99.75 |

18.75 |

75.44 |

Healthcare |

Biotechnology |

19 |

7.17 |

74.55 |

80.3 |

17.93 |

7.0 |

8.0 |

21.45 |

1.0 |

1.0 |

| 5.0 |

CVNA |

99.59 |

99.5 |

99.04 |

99.87 |

Consumer Cyclical |

Auto & Truck Dealerships |

34 |

77.54 |

76.45 |

99.06 |

82.96 |

1.0 |

3.0 |

205.02 |

1.0 |

1.0 |

| 6.0 |

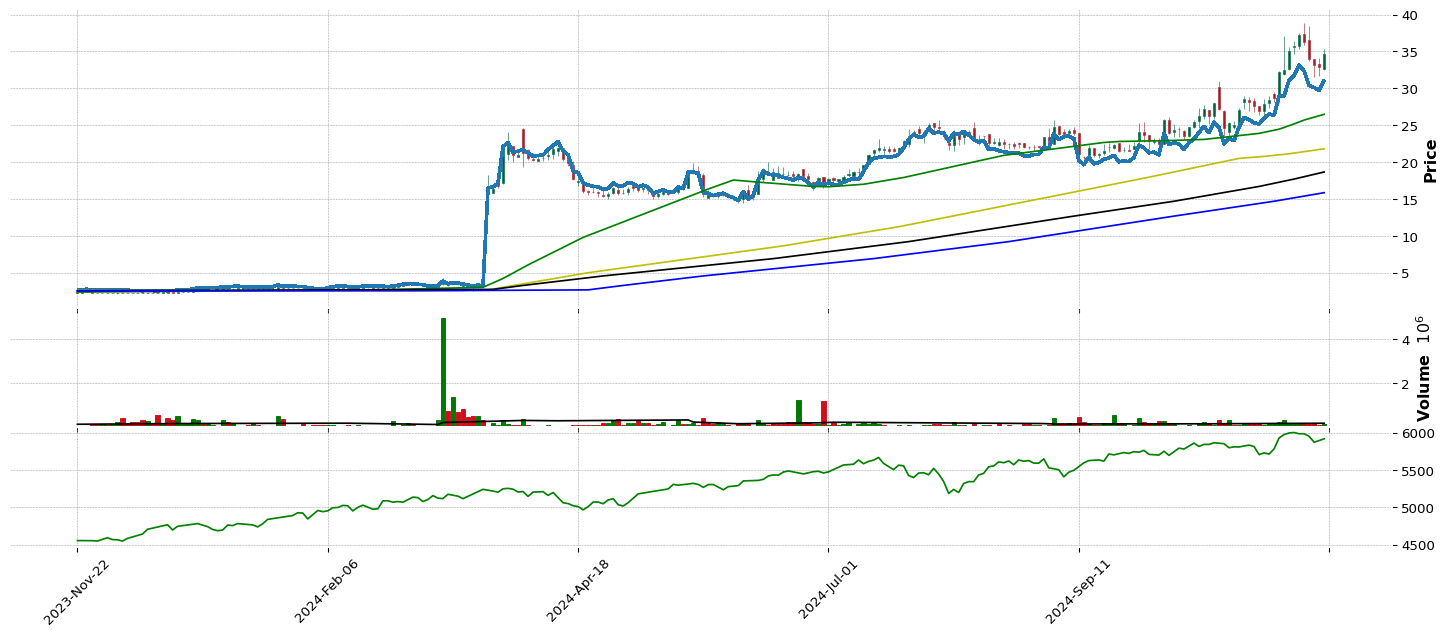

SMR |

99.53 |

95.04 |

86.73 |

11.99 |

Industrials |

Specialty Industrial Machinery |

40 |

6.55 |

11.22 |

83.3 |

17.3 |

1.0 |

1.0 |

22.0 |

1.0 |

1.0 |

| 7.0 |

MSTR |

99.5 |

99.59 |

99.44 |

98.91 |

Technology |

Software - Application |

76 |

1.29 |

24.31 |

80.85 |

83.55 |

2.0 |

3.0 |

255.33 |

1.0 |

1.0 |

| 8.0 |

GGAL |

99.29 |

98.61 |

98.45 |

98.25 |

Financial |

Banks - Regional |

22 |

98.91 |

97.43 |

90.06 |

57.35 |

2.0 |

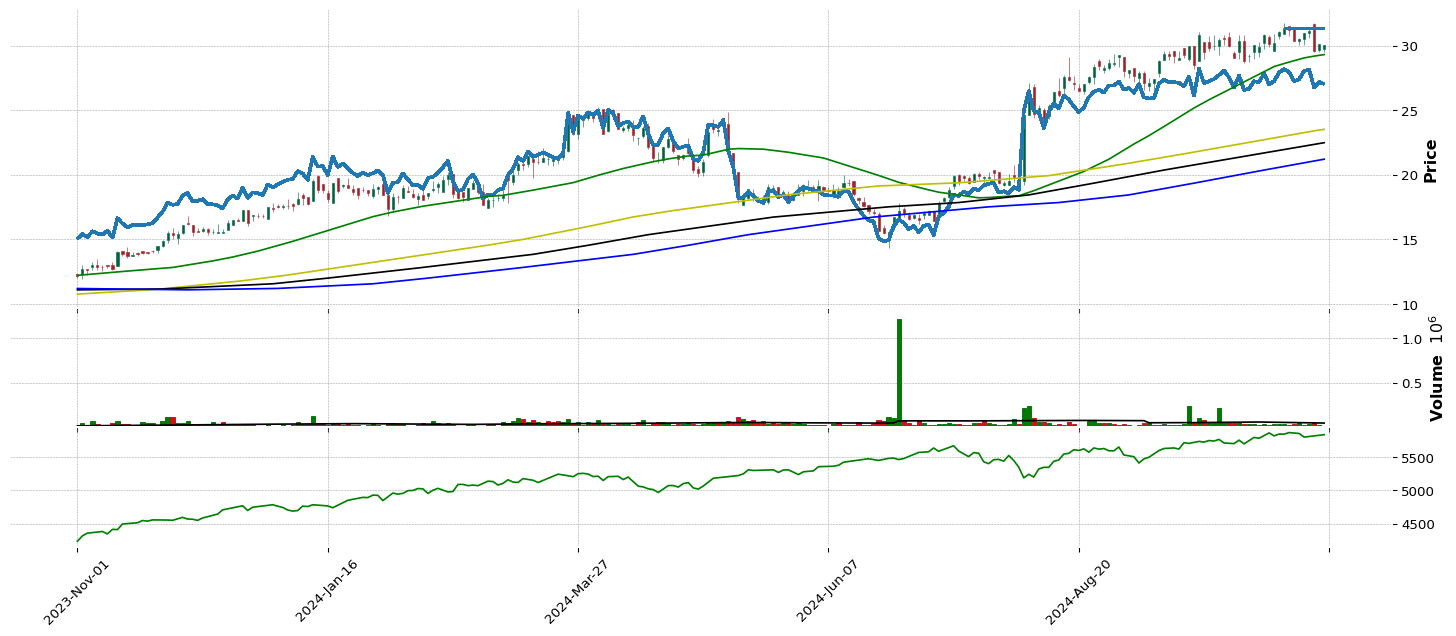

3.0 |

54.11 |

1.0 |

1.0 |

| 9.0 |

NRIX |

99.26 |

98.21 |

97.65 |

69.13 |

Healthcare |

Biotechnology |

19 |

8.72 |

52.87 |

51.0 |

24.71 |

13.0 |

15.0 |

26.45 |

1.0 |

1.0 |

| 10.0 |

APP |

99.1 |

98.58 |

98.85 |

99.28 |

Technology |

Software - Application |

76 |

95.14 |

99.93 |

92.14 |

84.59 |

3.0 |

4.0 |

166.18 |

1.0 |

1.0 |

| 11.0 |

IGMS |

99.01 |

97.87 |

97.13 |

14.29 |

Healthcare |

Biotechnology |

19 |

43.36 |

97.94 |

40.94 |

22.18 |

16.0 |

20.0 |

17.82 |

1.0 |

1.0 |

| 12.0 |

CAVA |

98.92 |

99.19 |

99.38 |

0.0 |

Consumer Cyclical |

Restaurants |

82 |

0.0 |

98.71 |

83.3 |

0.0 |

1.0 |

4.0 |

138.47 |

1.0 |

1.0 |

| 13.0 |

BMA |

98.86 |

98.98 |

98.7 |

98.63 |

Financial |

Banks - Regional |

22 |

84.93 |

92.01 |

49.8 |

66.9 |

3.0 |

5.0 |

79.11 |

1.0 |

1.0 |

| 14.0 |

GATO |

98.52 |

98.18 |

97.87 |

83.02 |

Basic Materials |

Other Precious Metals & Mining |

13 |

93.53 |

21.88 |

95.24 |

27.34 |

1.0 |

3.0 |

19.3 |

1.0 |

1.0 |

| 15.0 |

PRCT |

97.72 |

96.52 |

96.97 |

91.63 |

Healthcare |

Medical Devices |

95 |

21.09 |

91.97 |

49.8 |

69.57 |

3.0 |

37.0 |

91.0 |

1.0 |

1.0 |

| 16.0 |

PTGX |

97.47 |

97.5 |

97.56 |

40.56 |

Healthcare |

Biotechnology |

19 |

75.4 |

0.0 |

8.37 |

0.0 |

29.0 |

42.0 |

48.2 |

1.0 |

1.0 |

| 17.0 |

VHI |

97.25 |

96.64 |

94.66 |

32.82 |

Basic Materials |

Chemicals |

81 |

68.07 |

80.87 |

57.04 |

47.28 |

2.0 |

5.0 |

36.2 |

1.0 |

1.0 |

| 18.0 |

HOOD |

96.85 |

96.98 |

95.71 |

94.09 |

Financial |

Capital Markets |

6 |

86.82 |

93.16 |

94.42 |

42.57 |

3.0 |

10.0 |

27.87 |

1.0 |

1.0 |

| 19.0 |

PLTR |

96.79 |

95.56 |

97.03 |

98.29 |

Technology |

Software - Infrastructure |

55 |

0.0 |

0.0 |

97.16 |

0.0 |

2.0 |

14.0 |

44.97 |

1.0 |

1.0 |

| 20.0 |

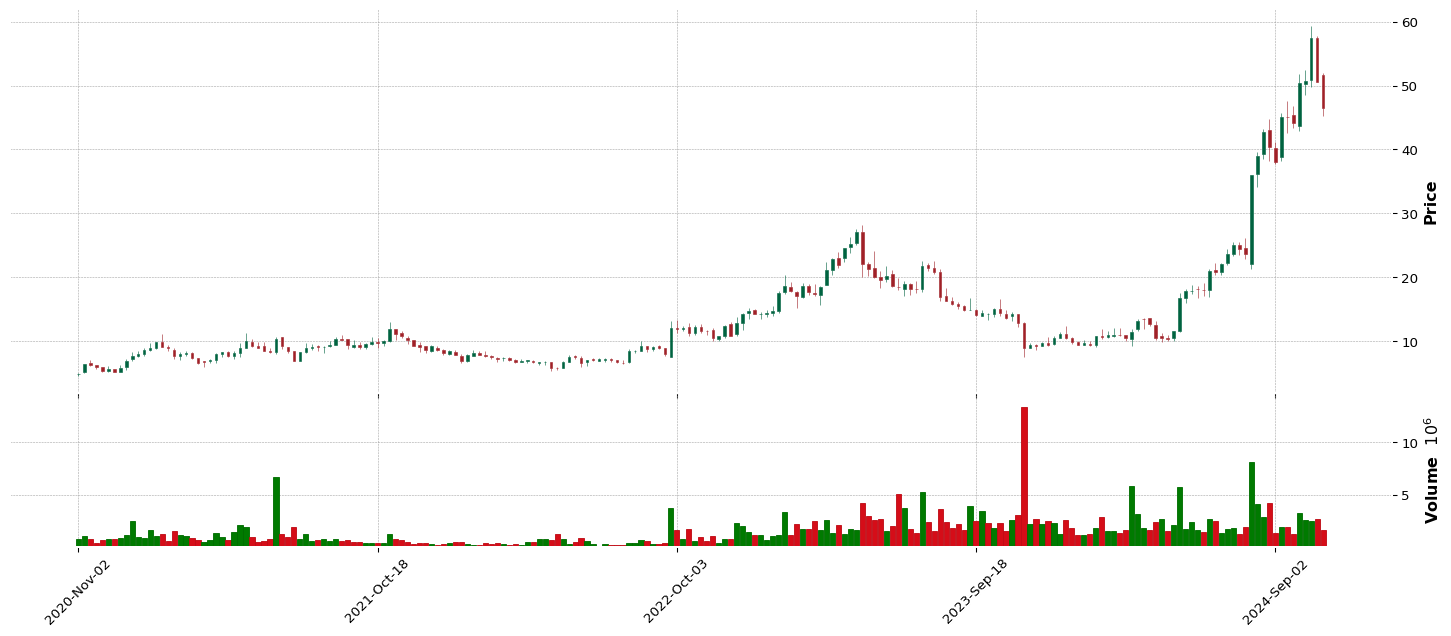

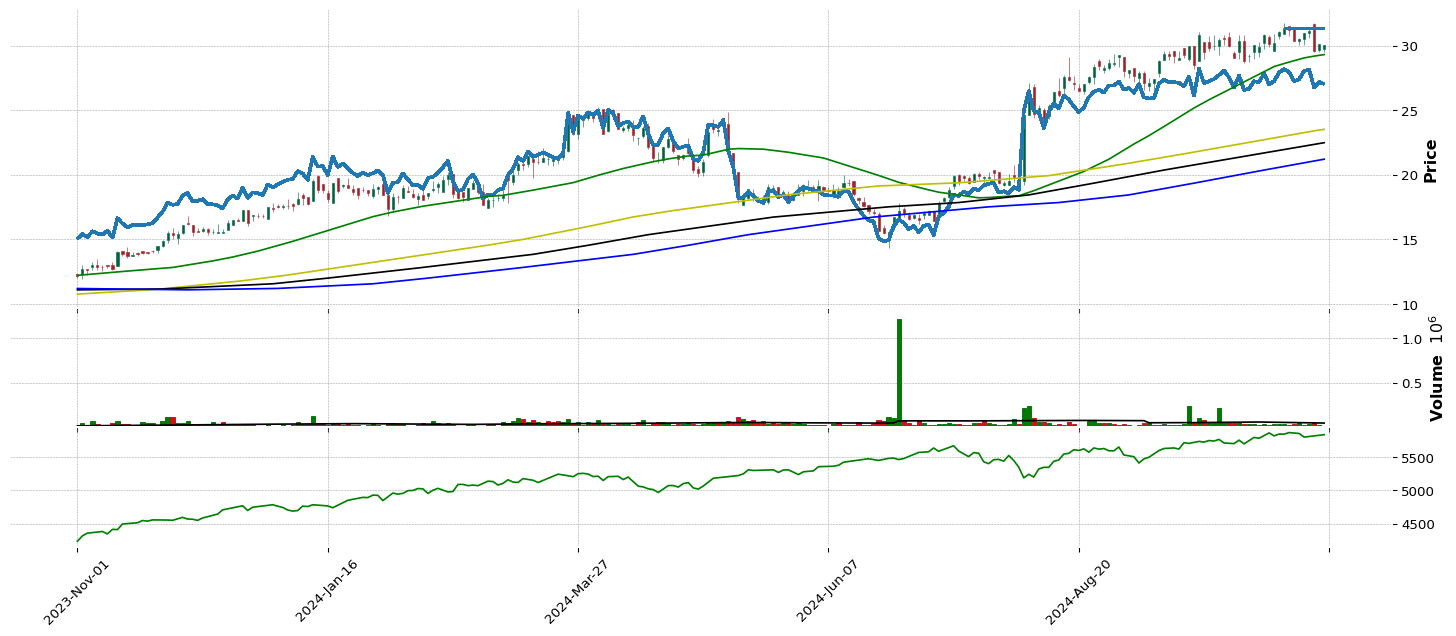

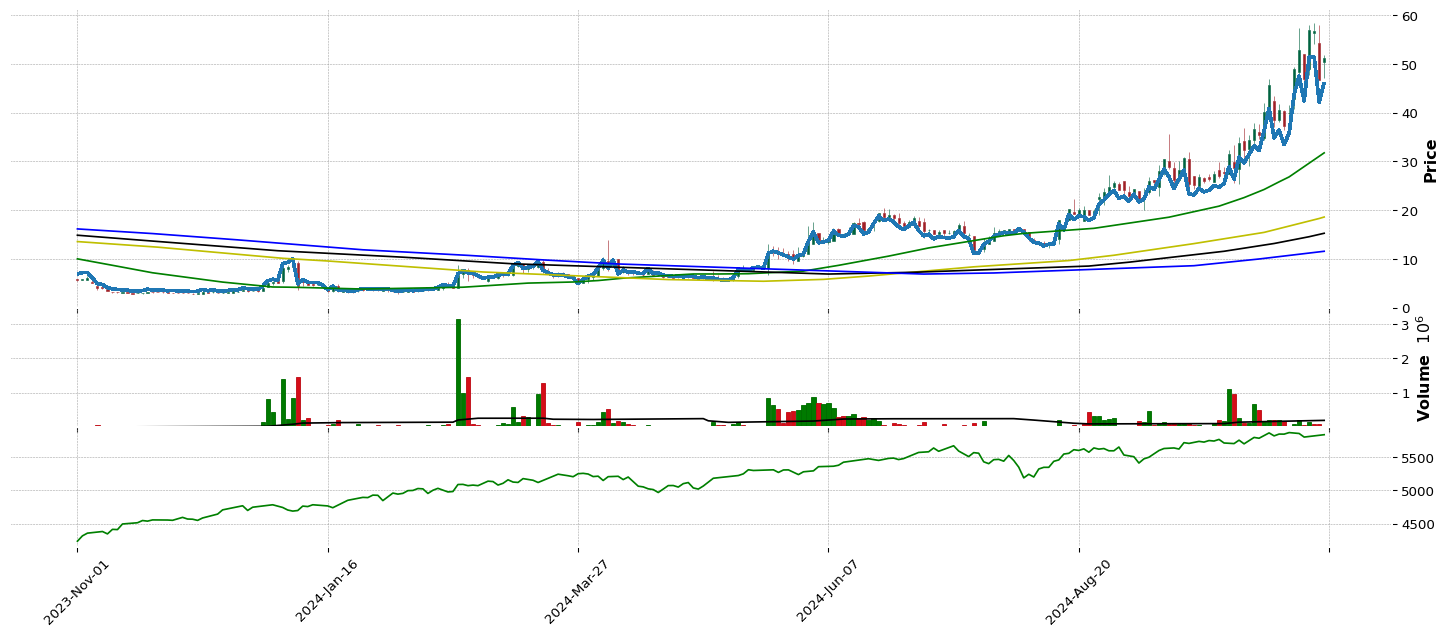

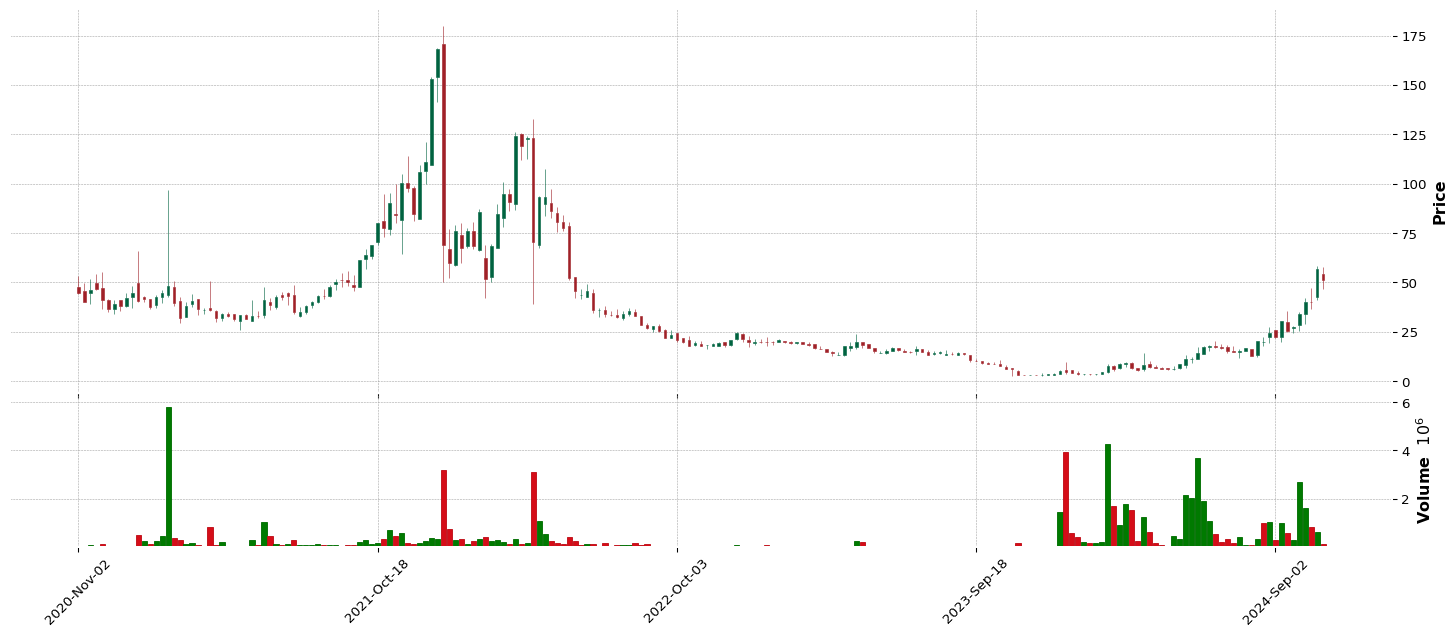

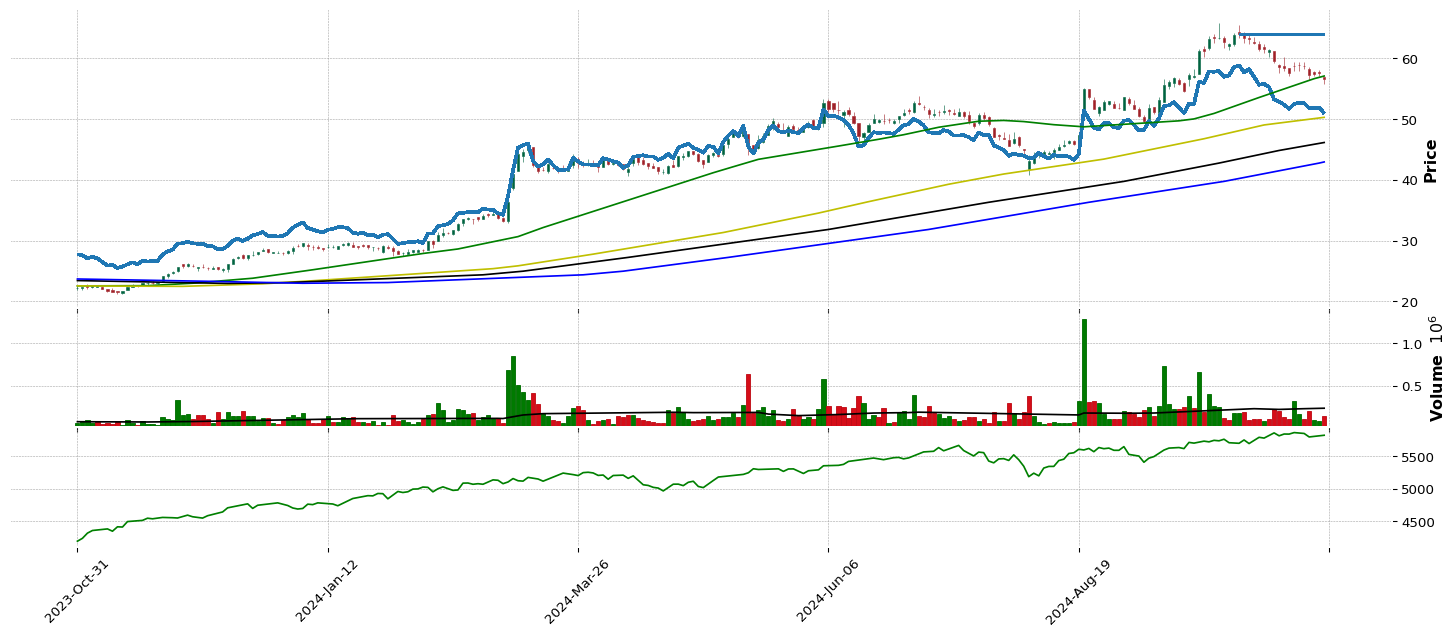

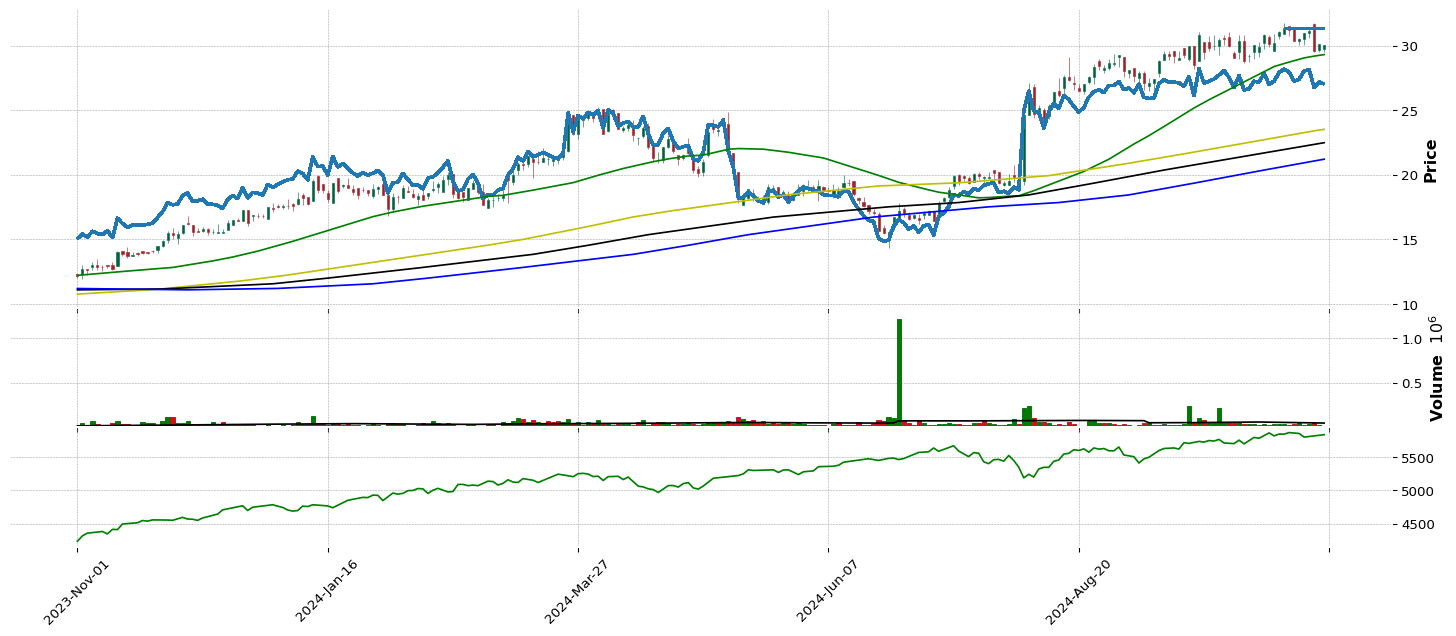

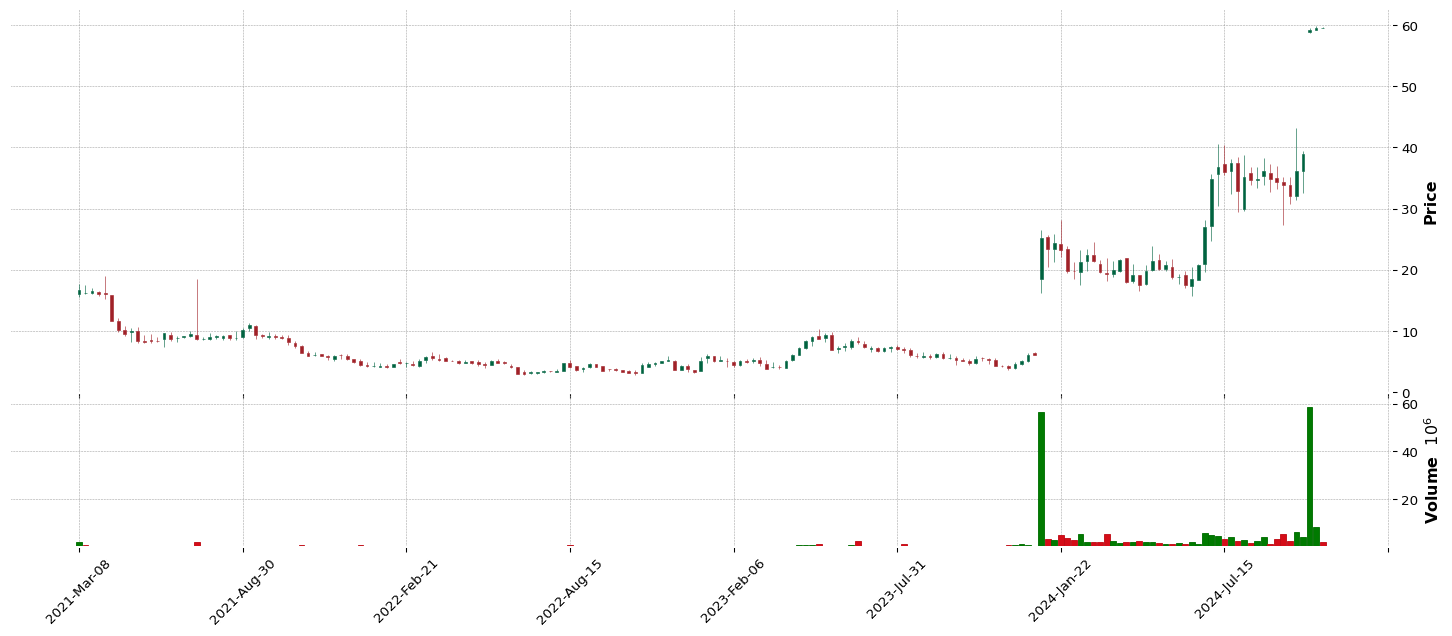

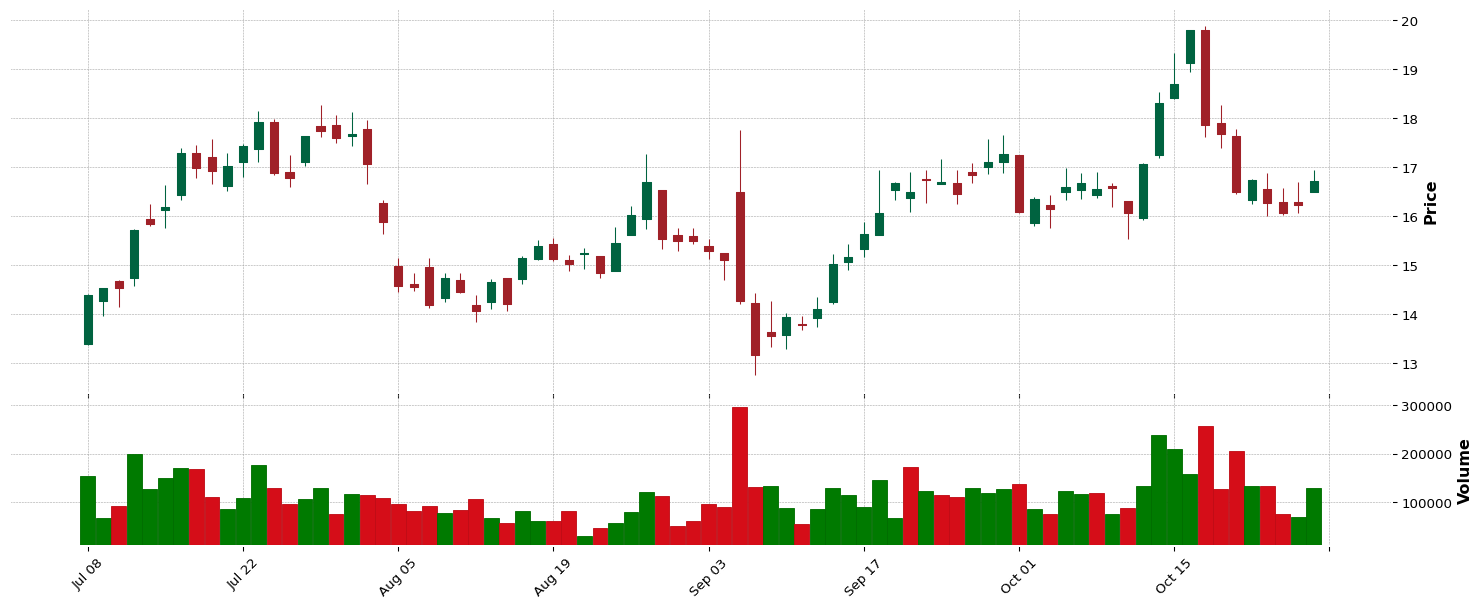

CLS |

96.76 |

93.81 |

94.78 |

99.19 |

Technology |

Electronic Components |

39 |

99.22 |

96.63 |

80.3 |

68.67 |

1.0 |

15.0 |

70.3 |

1.0 |

1.0 |

| 21.0 |

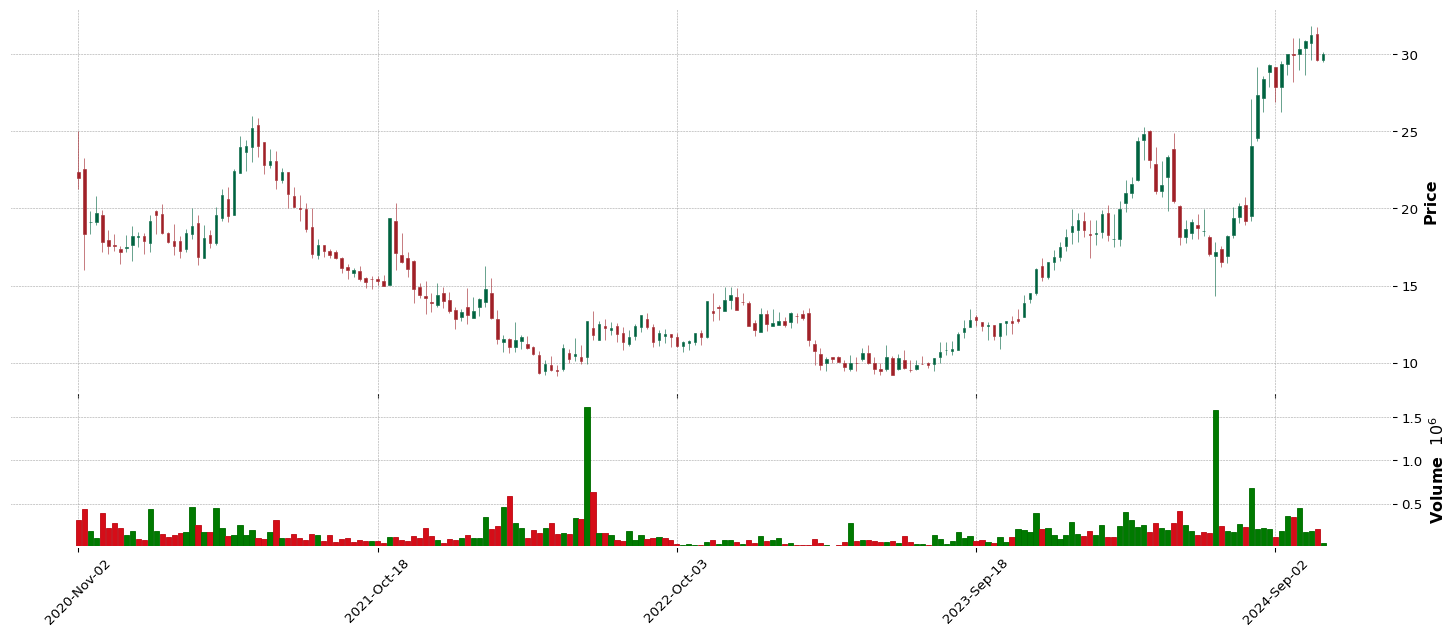

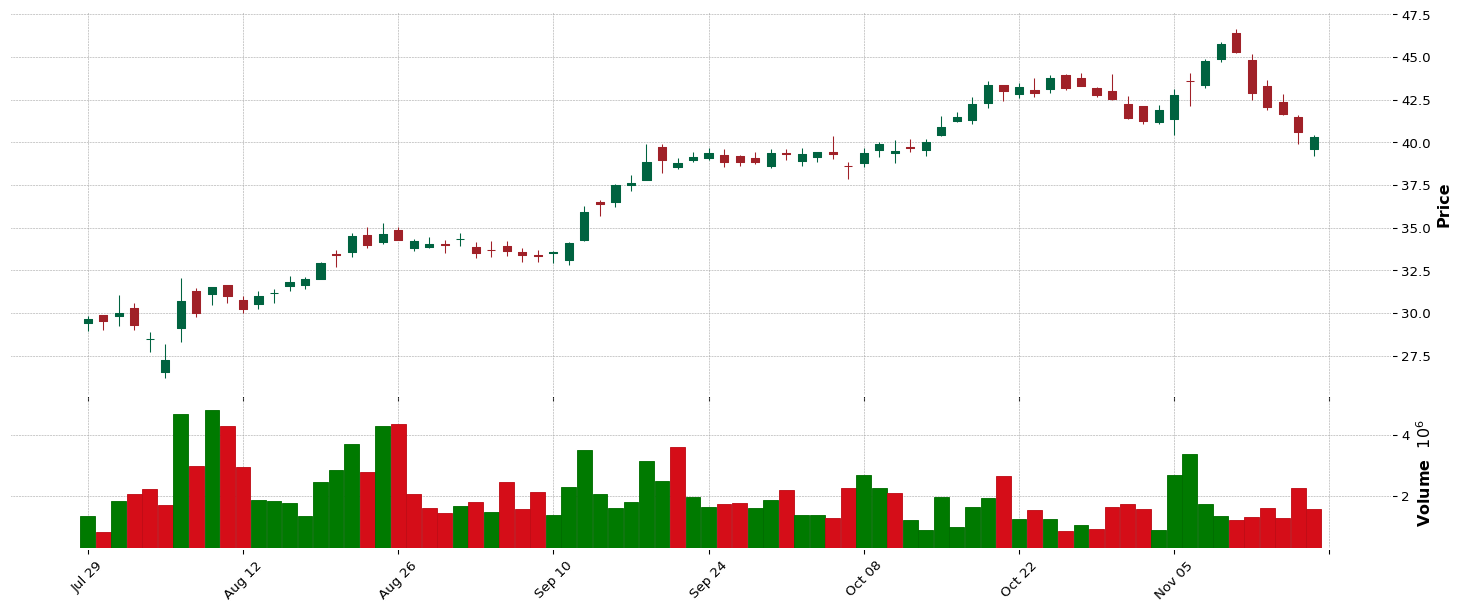

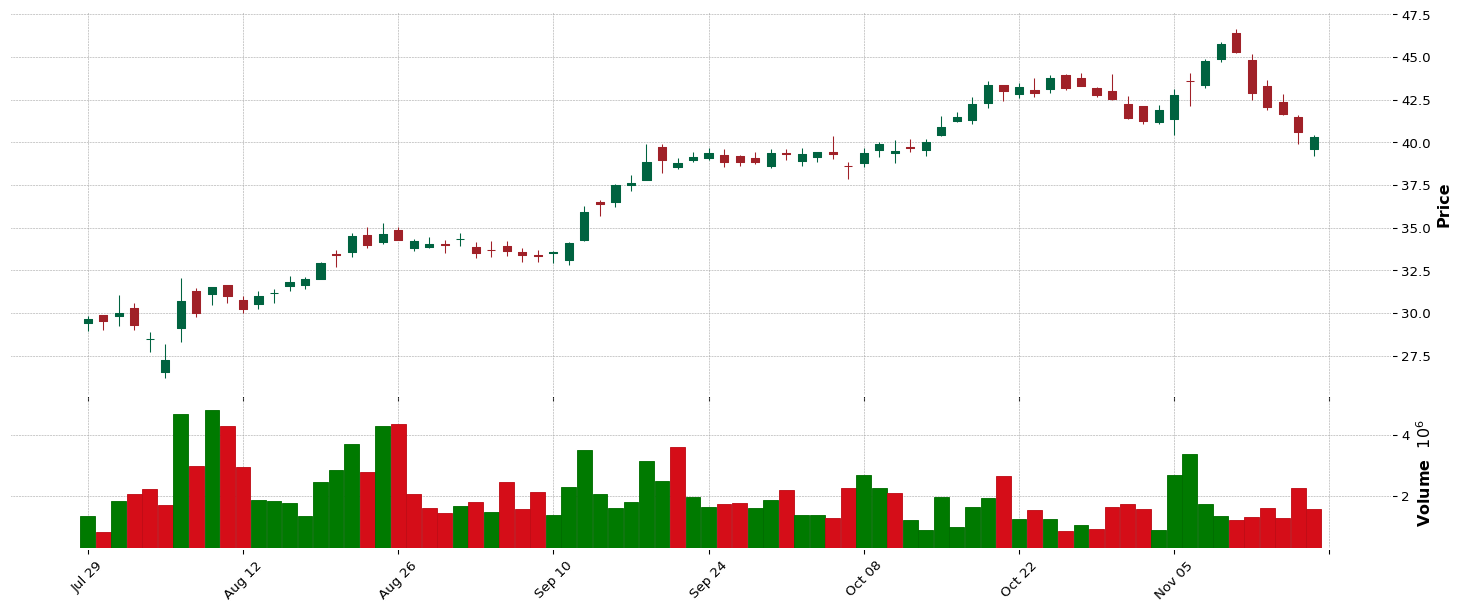

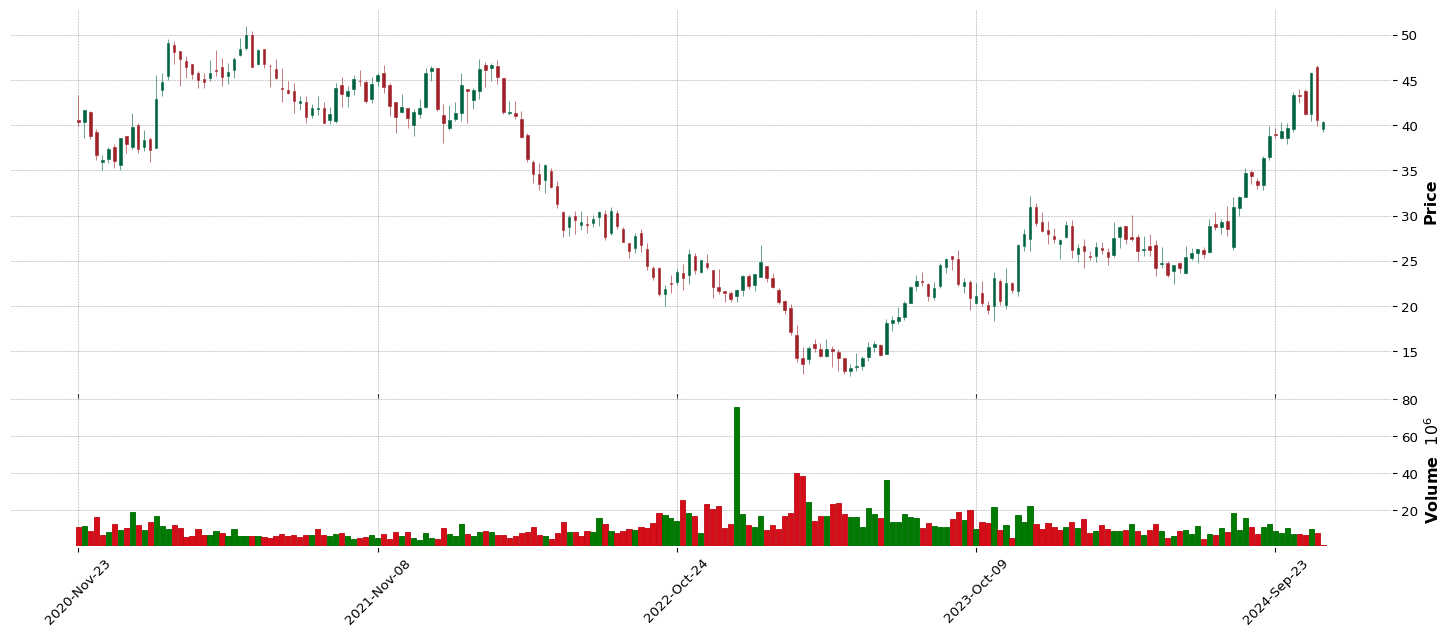

FLXS |

96.73 |

94.18 |

95.24 |

94.65 |

Consumer Cyclical |

Furnishings, Fixtures & Appliances |

32 |

0.0 |

0.0 |

94.42 |

0.0 |

1.0 |

9.0 |

58.02 |

1.0 |

1.0 |

| 22.0 |

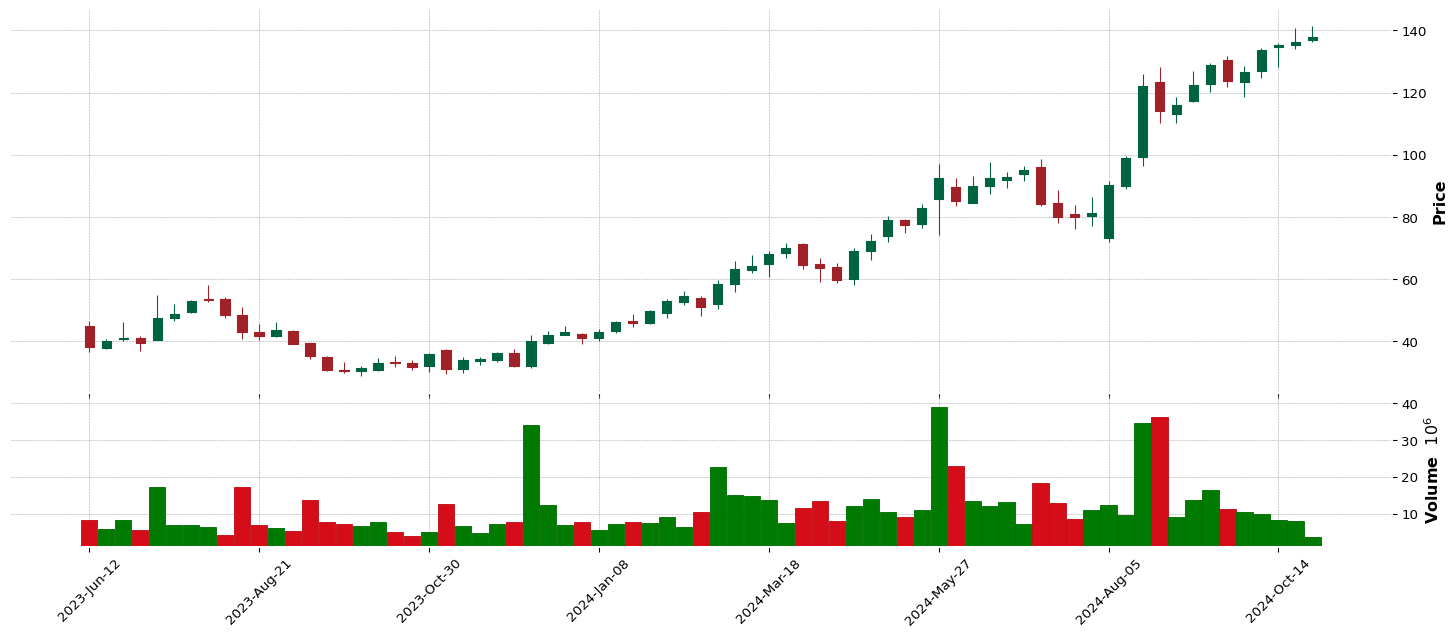

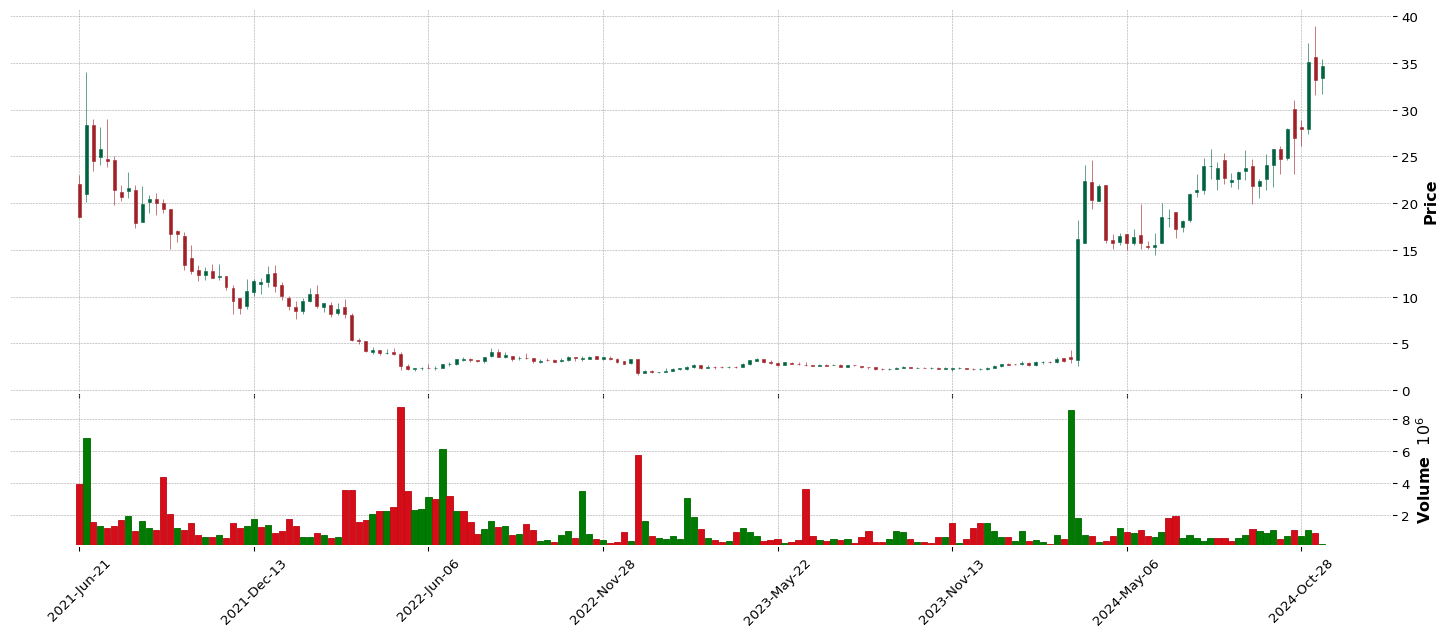

EAT |

96.33 |

97.32 |

96.48 |

76.06 |

Consumer Cyclical |

Restaurants |

82 |

30.34 |

24.18 |

98.21 |

72.41 |

3.0 |

12.0 |

97.73 |

1.0 |

1.0 |

| 23.0 |

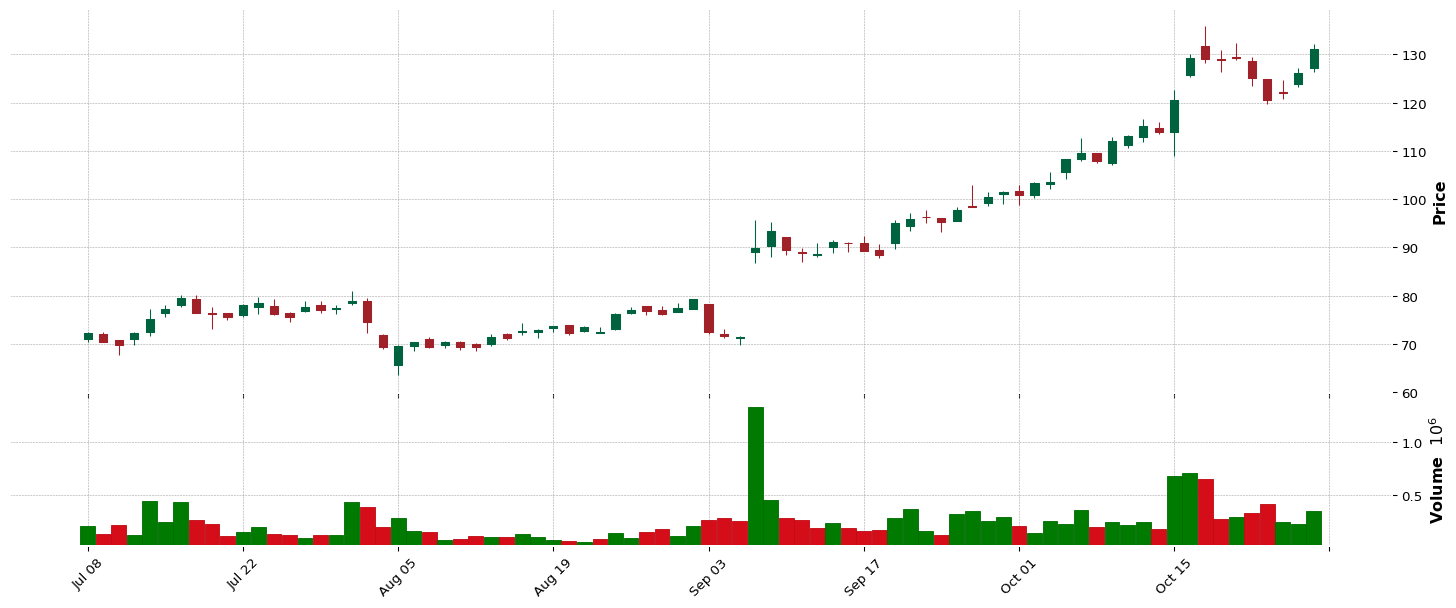

AGX |

96.27 |

95.41 |

94.1 |

82.0 |

Industrials |

Engineering & Construction |

21 |

82.74 |

57.0 |

85.73 |

82.06 |

3.0 |

14.0 |

131.19 |

1.0 |

1.0 |

| 24.0 |

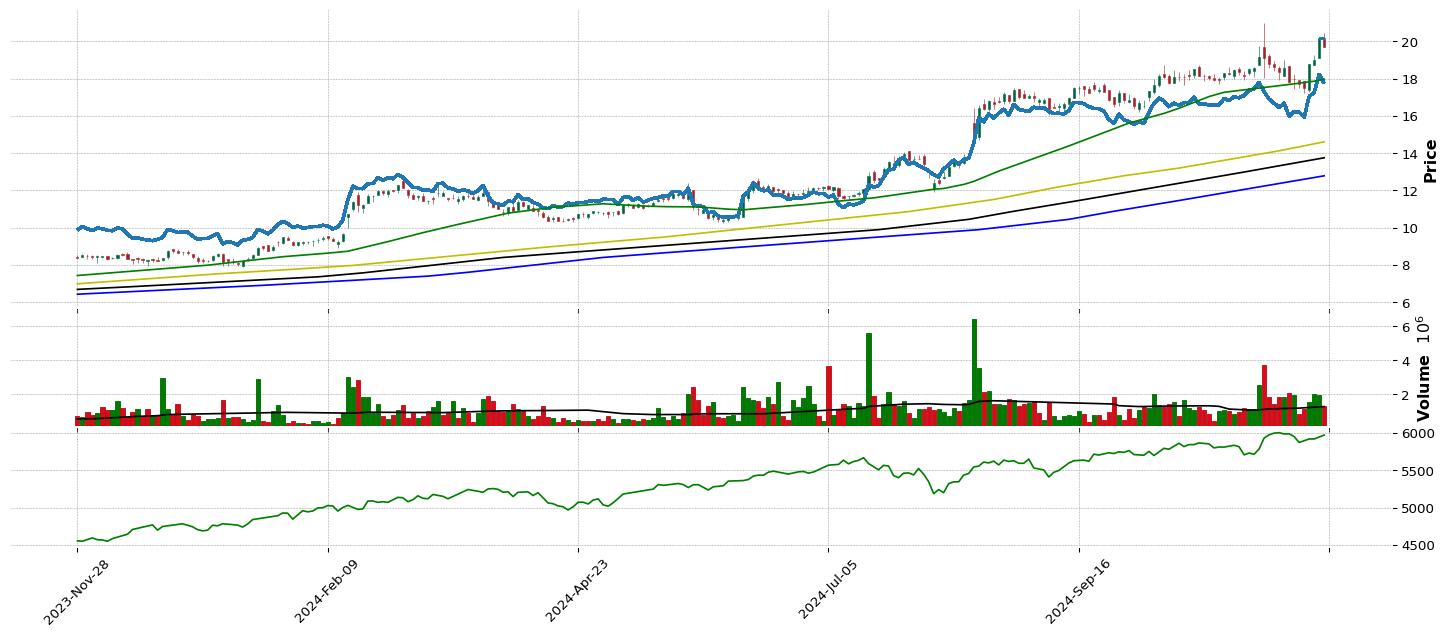

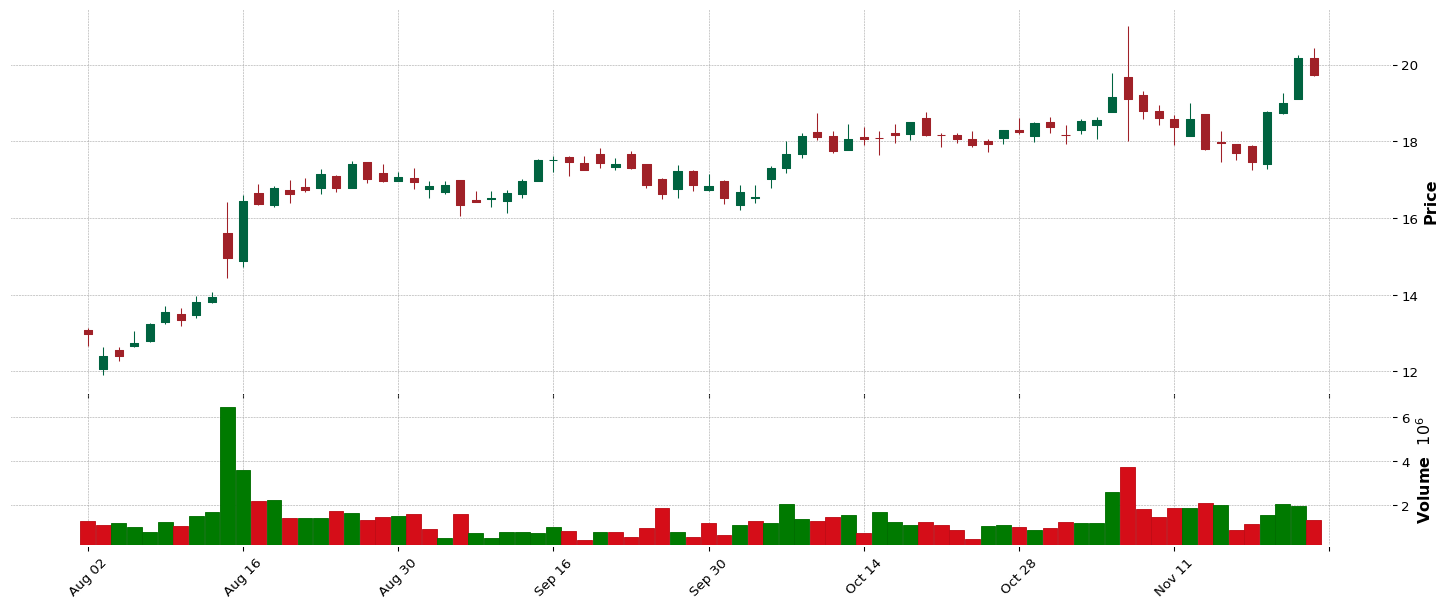

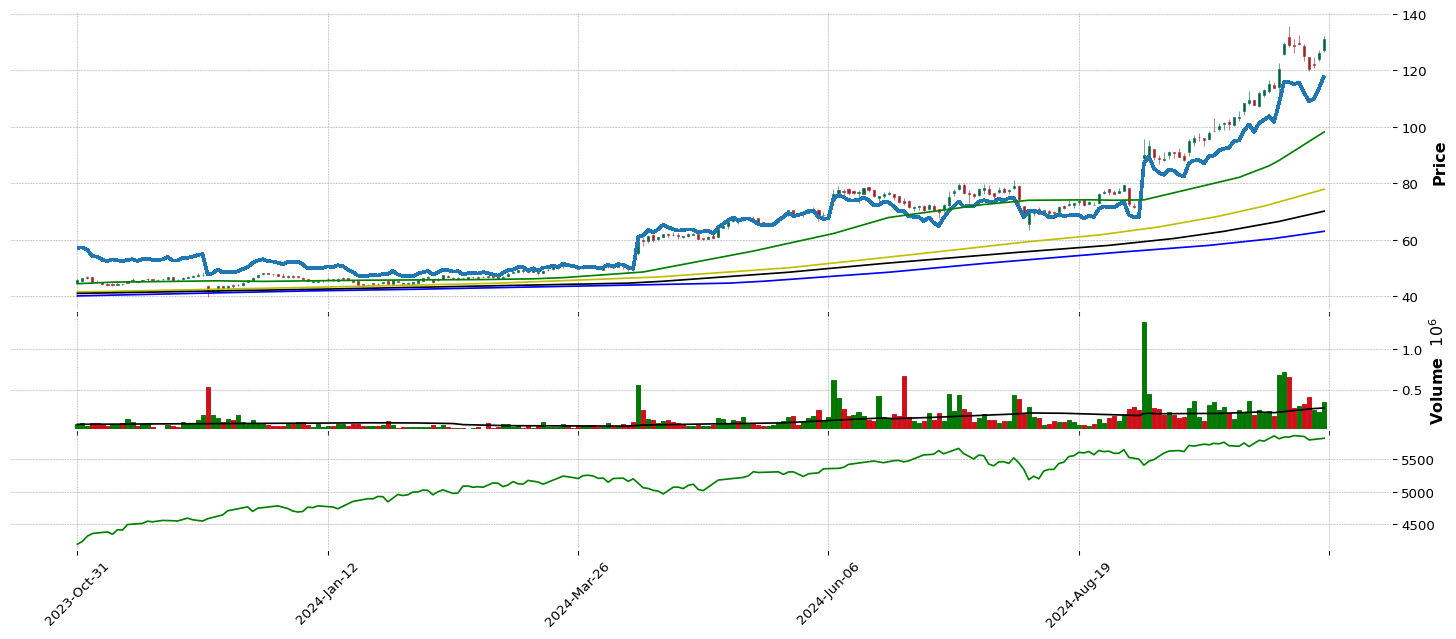

SFM |

96.24 |

97.04 |

97.46 |

91.98 |

Consumer Defensive |

Grocery Stores |

37 |

0.0 |

0.0 |

64.39 |

0.0 |

1.0 |

4.0 |

120.18 |

1.0 |

1.0 |

| 25.0 |

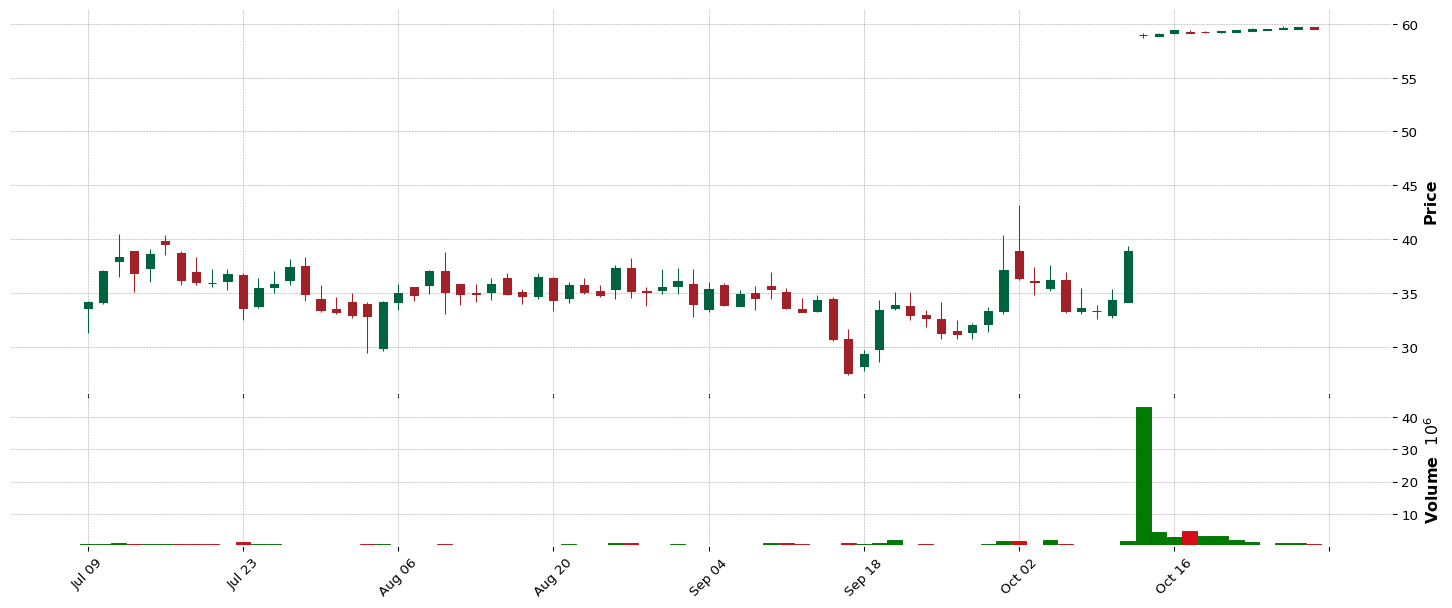

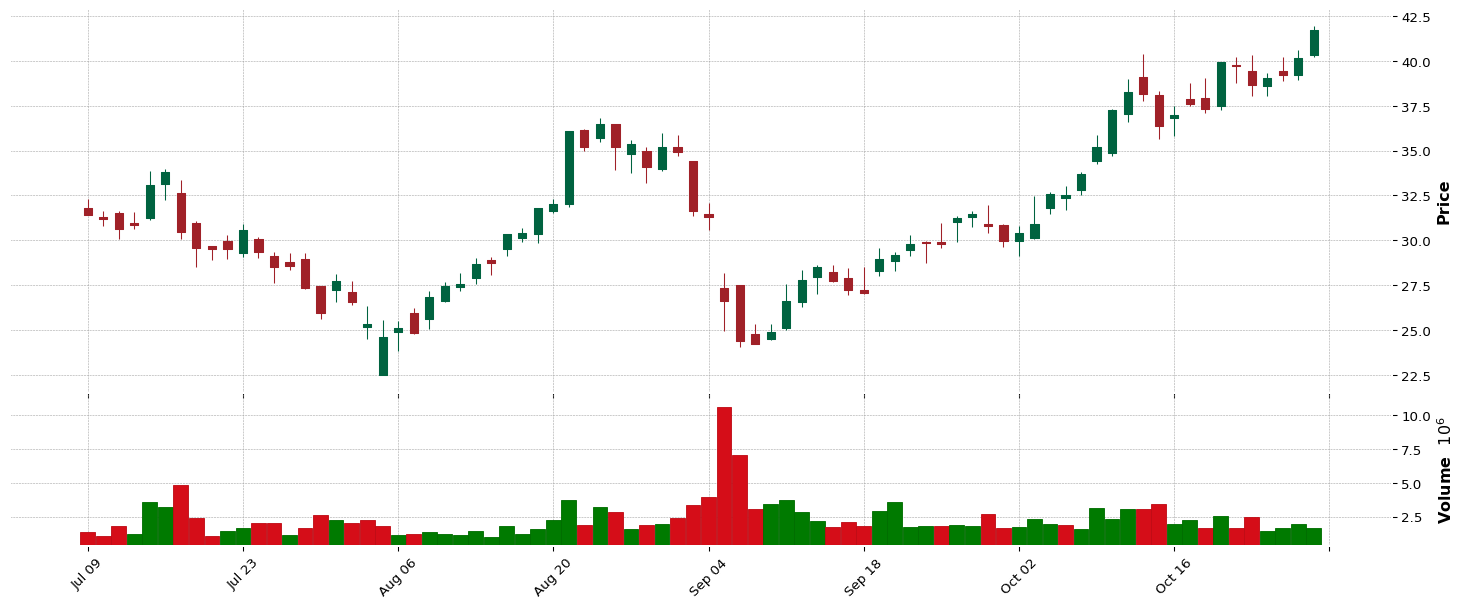

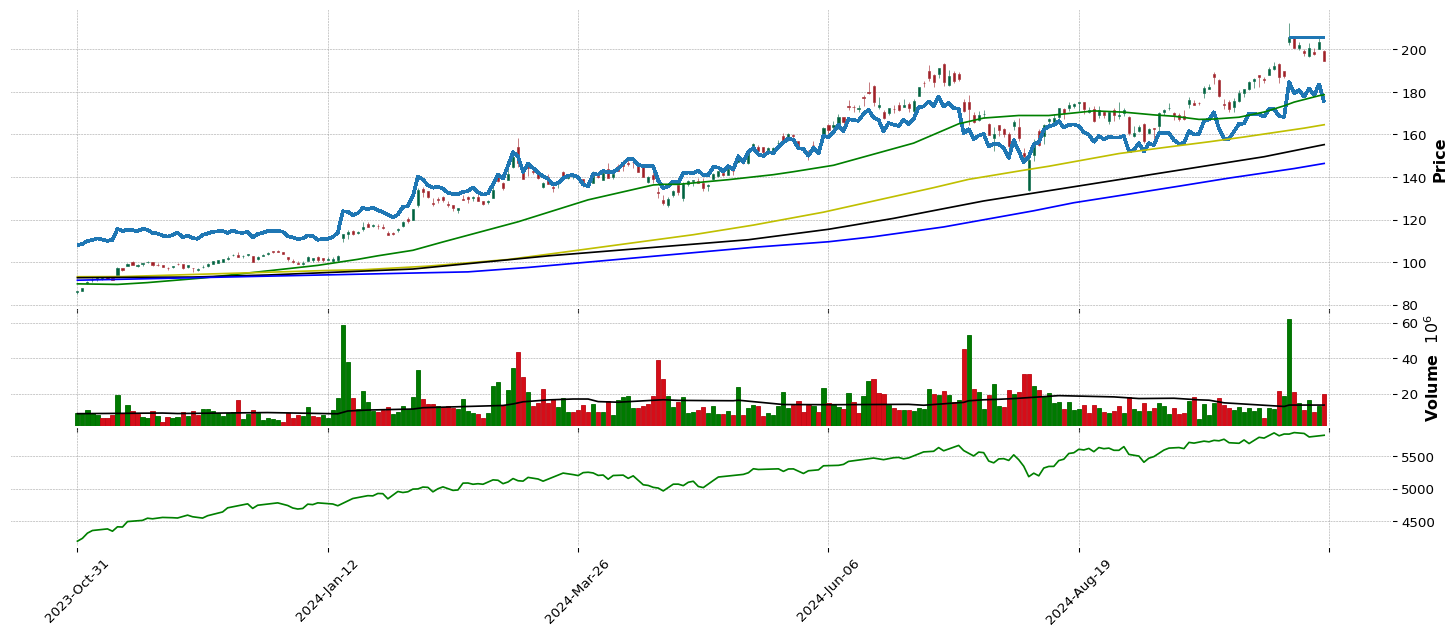

CRDO |

96.21 |

93.71 |

91.85 |

97.04 |

Technology |

Semiconductors |

79 |

45.37 |

59.67 |

47.94 |

48.59 |

4.0 |

16.0 |

40.13 |

1.0 |

1.0 |

| 26.0 |

QTWO |

96.15 |

96.08 |

96.69 |

96.54 |

Technology |

Software - Application |

76 |

40.33 |

70.0 |

40.94 |

69.4 |

5.0 |

18.0 |

84.5 |

1.0 |

1.0 |

| 27.0 |

TARS |

96.02 |

93.96 |

92.13 |

95.21 |

Healthcare |

Biotechnology |

19 |

10.42 |

56.36 |

78.57 |

47.62 |

41.0 |

59.0 |

39.66 |

1.0 |

1.0 |

| 28.0 |

JXN |

95.96 |

96.49 |

95.52 |

94.56 |

Financial |

Insurance - Life |

50 |

78.1 |

63.23 |

8.37 |

74.45 |

1.0 |

12.0 |

101.36 |

1.0 |

1.0 |

| 29.0 |

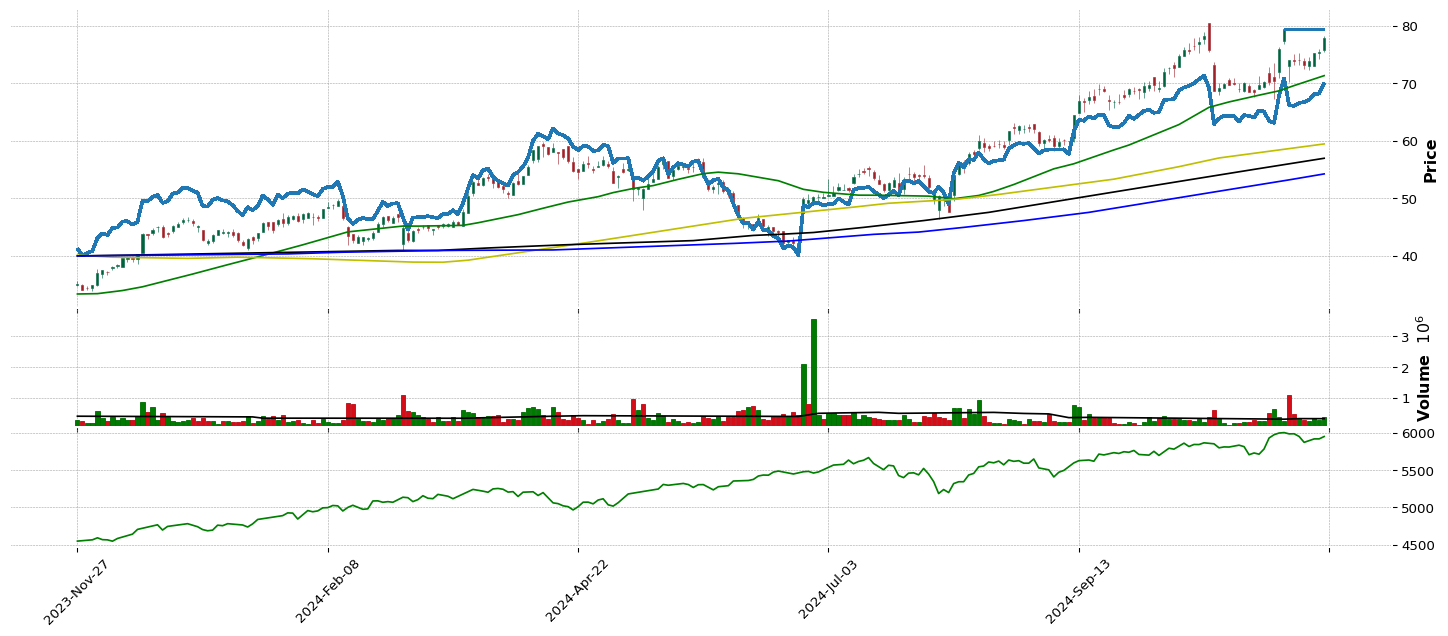

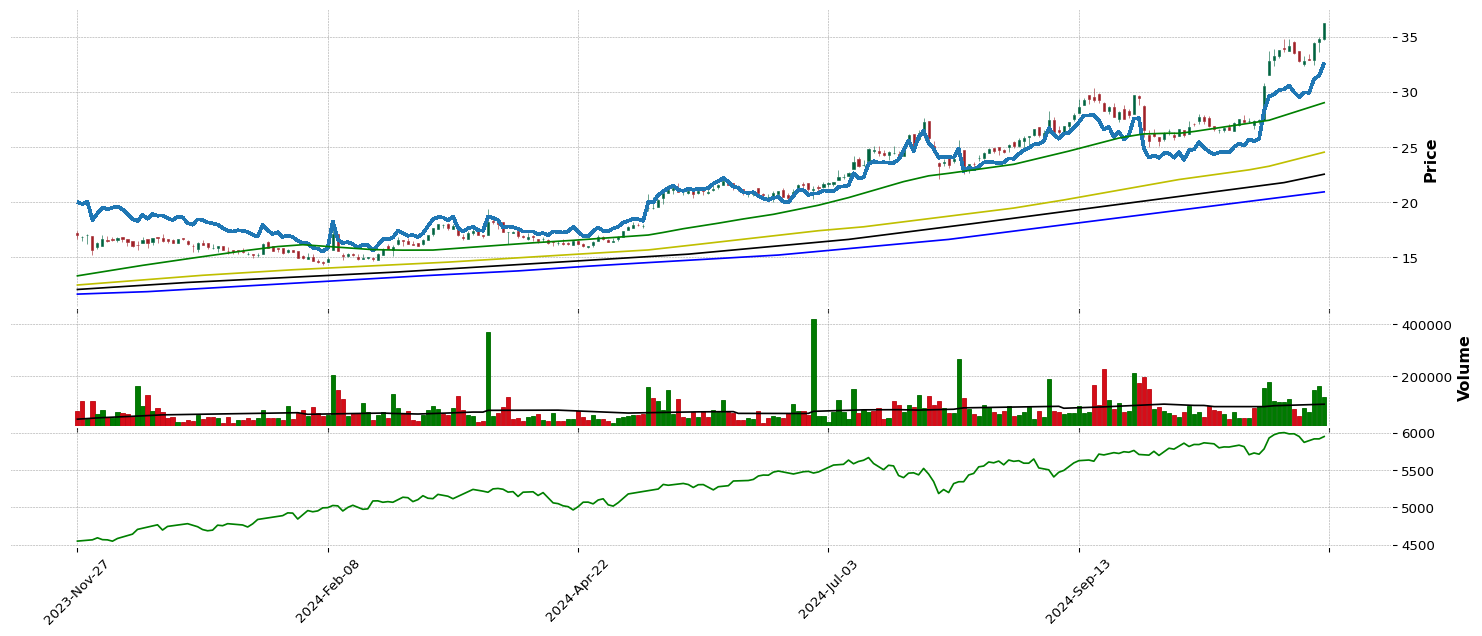

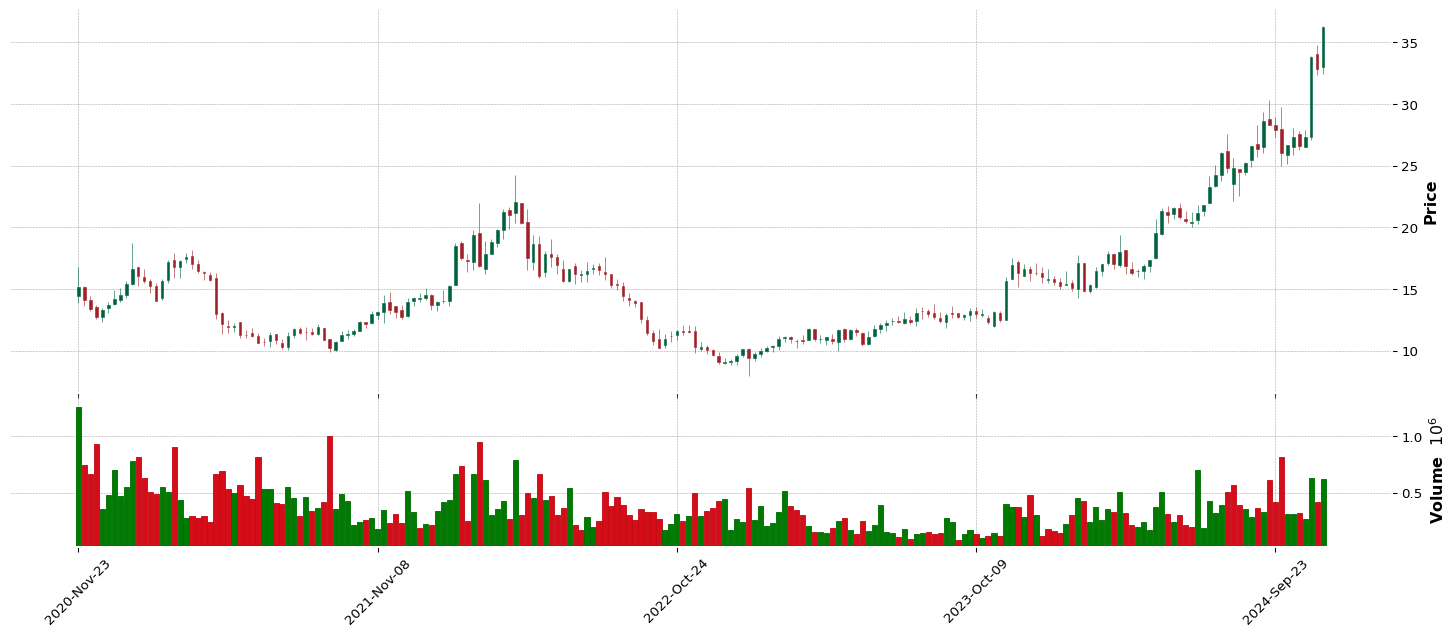

USLM |

95.44 |

94.98 |

95.83 |

94.03 |

Basic Materials |

Building Materials |

63 |

89.01 |

89.86 |

77.07 |

79.09 |

1.0 |

12.0 |

106.41 |

1.0 |

1.0 |

| 30.0 |

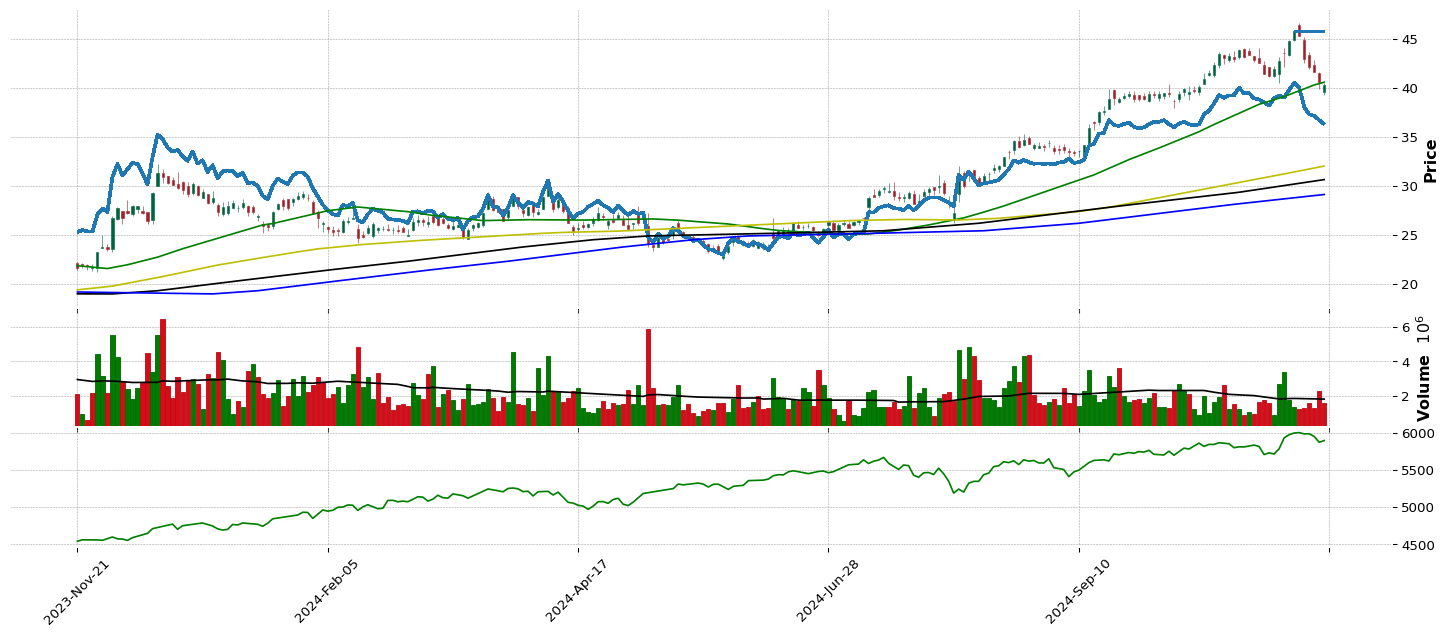

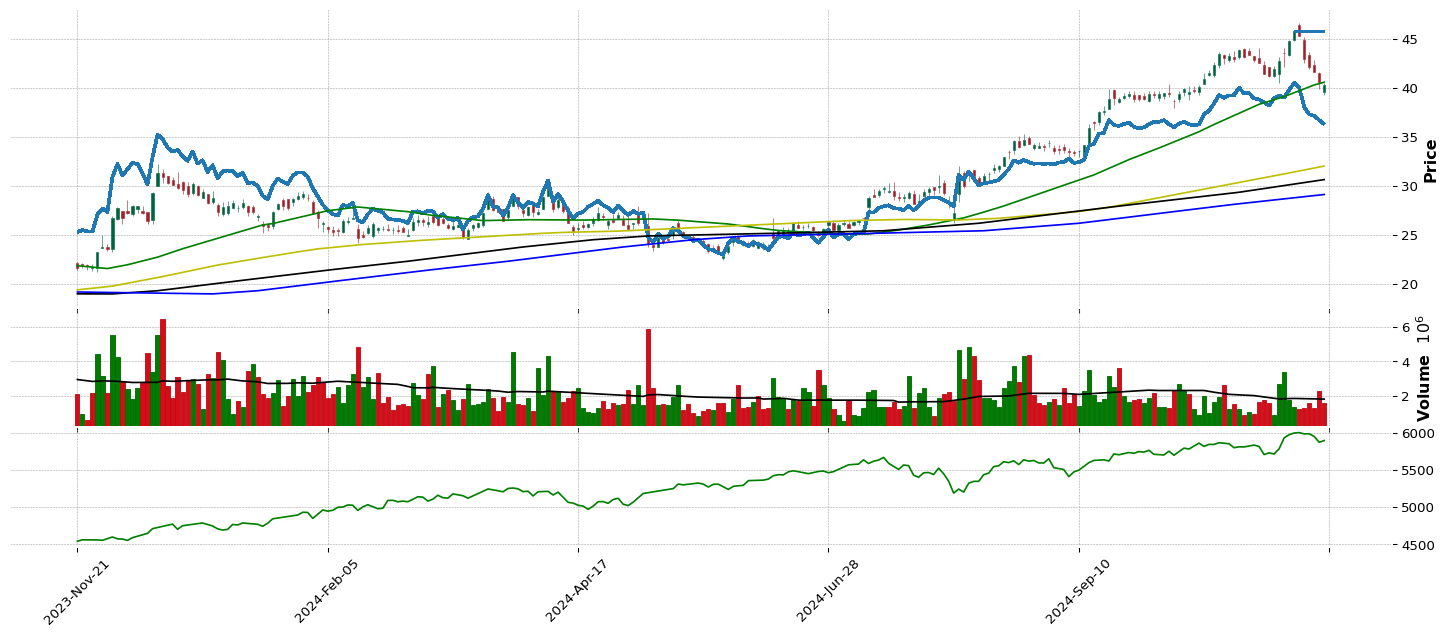

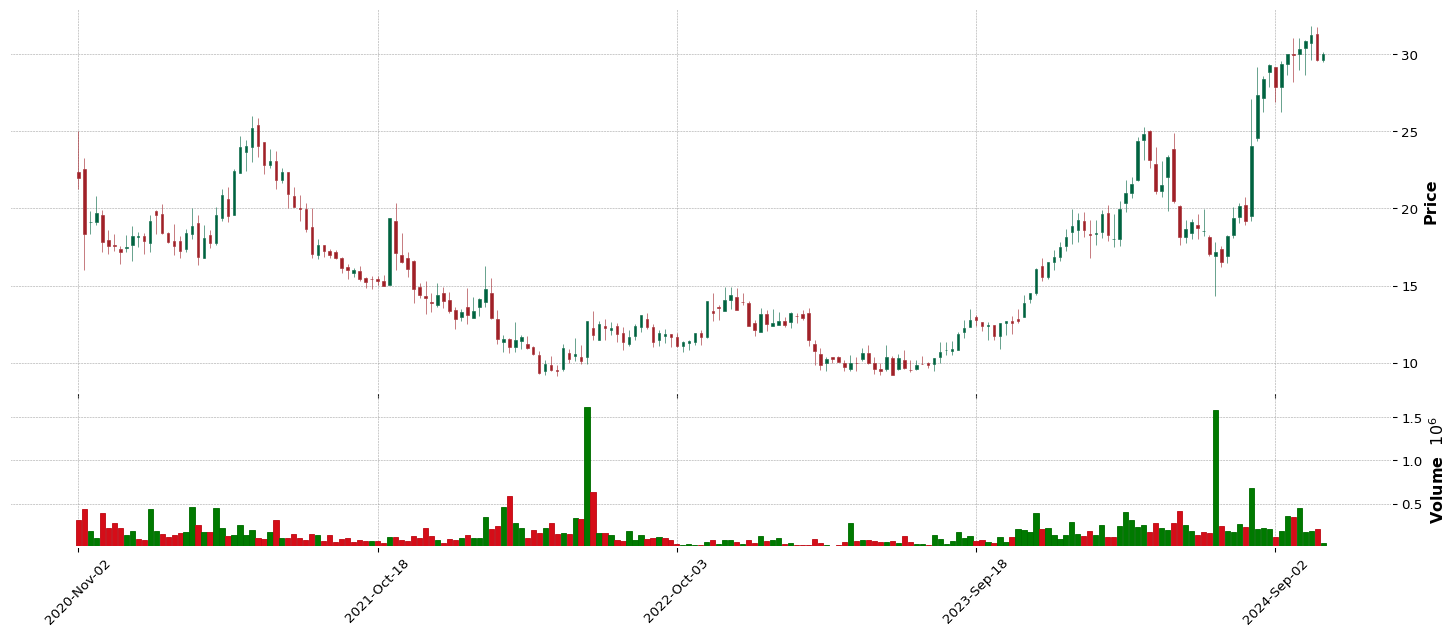

SN |

95.28 |

96.45 |

96.42 |

0.0 |

Consumer Cyclical |

Furnishings, Fixtures & Appliances |

32 |

46.08 |

95.5 |

78.57 |

78.95 |

2.0 |

15.0 |

111.12 |

1.0 |

1.0 |

| 31.0 |

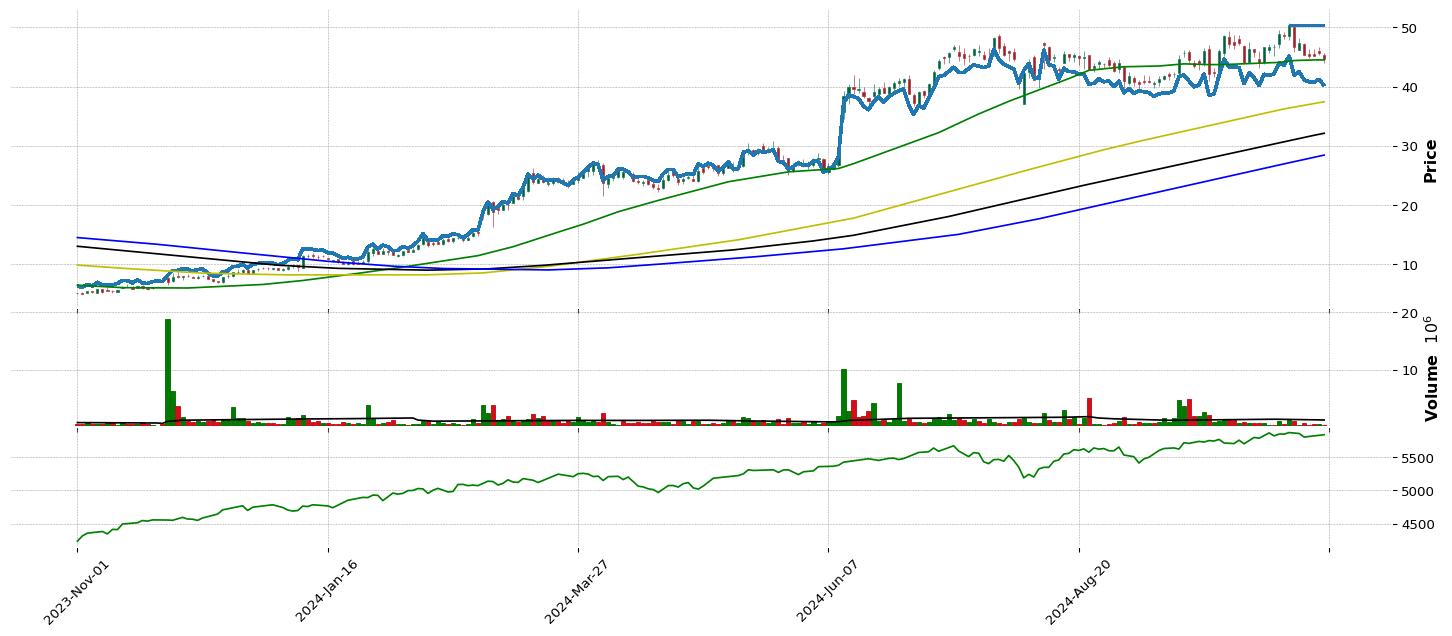

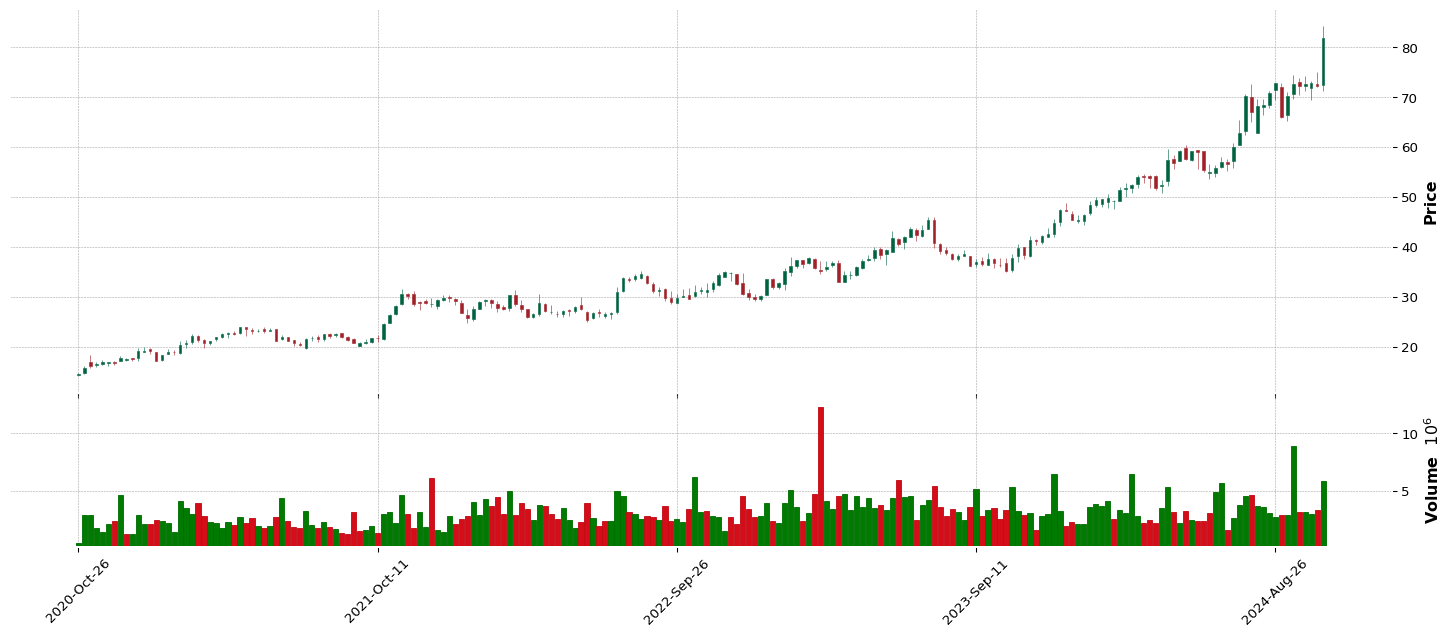

CRS |

95.22 |

95.38 |

94.84 |

88.18 |

Industrials |

Metal Fabrication |

26 |

89.29 |

93.71 |

92.61 |

88.43 |

1.0 |

17.0 |

166.03 |

1.0 |

1.0 |

| 32.0 |

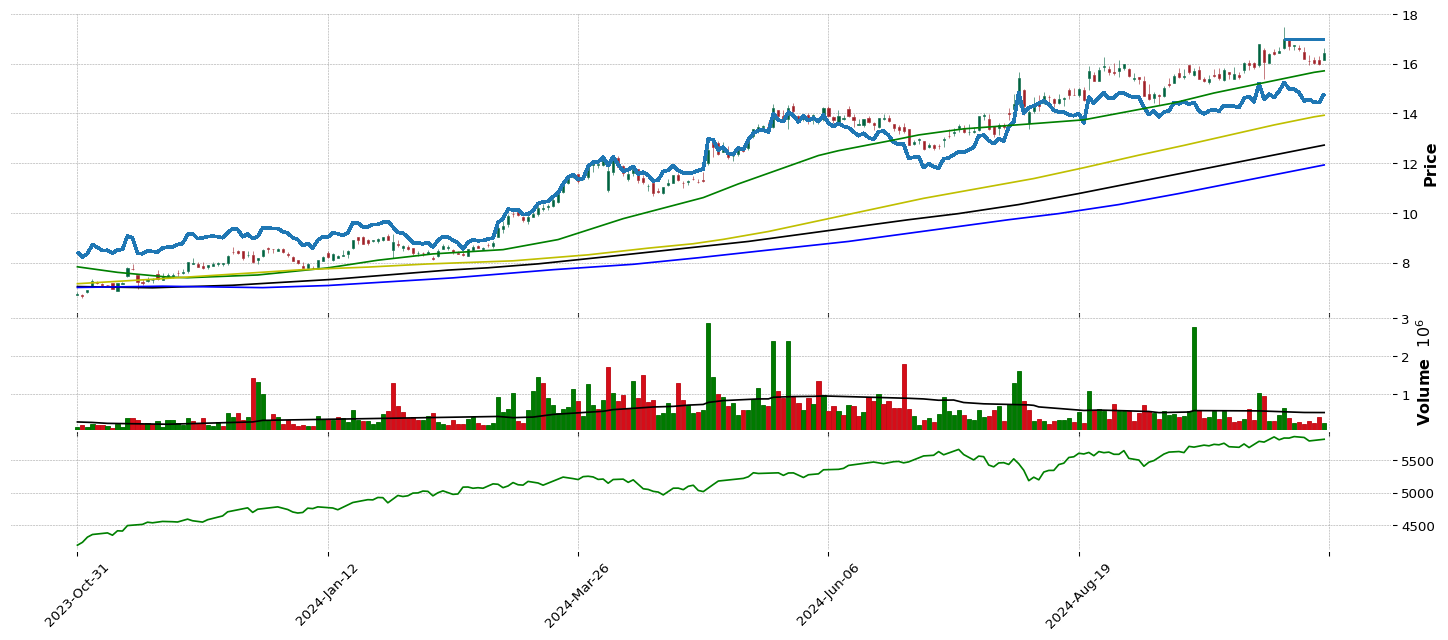

WLDN |

95.1 |

93.99 |

92.65 |

93.5 |

Industrials |

Engineering & Construction |

21 |

99.13 |

89.95 |

85.81 |

60.15 |

4.0 |

18.0 |

46.27 |

1.0 |

1.0 |

| 33.0 |

EDN |

94.91 |

89.37 |

93.24 |

92.04 |

Utilities |

Utilities - Regulated Electric |

59 |

97.4 |

99.42 |

90.06 |

46.24 |

1.0 |

3.0 |

26.47 |

1.0 |

1.0 |

| 34.0 |

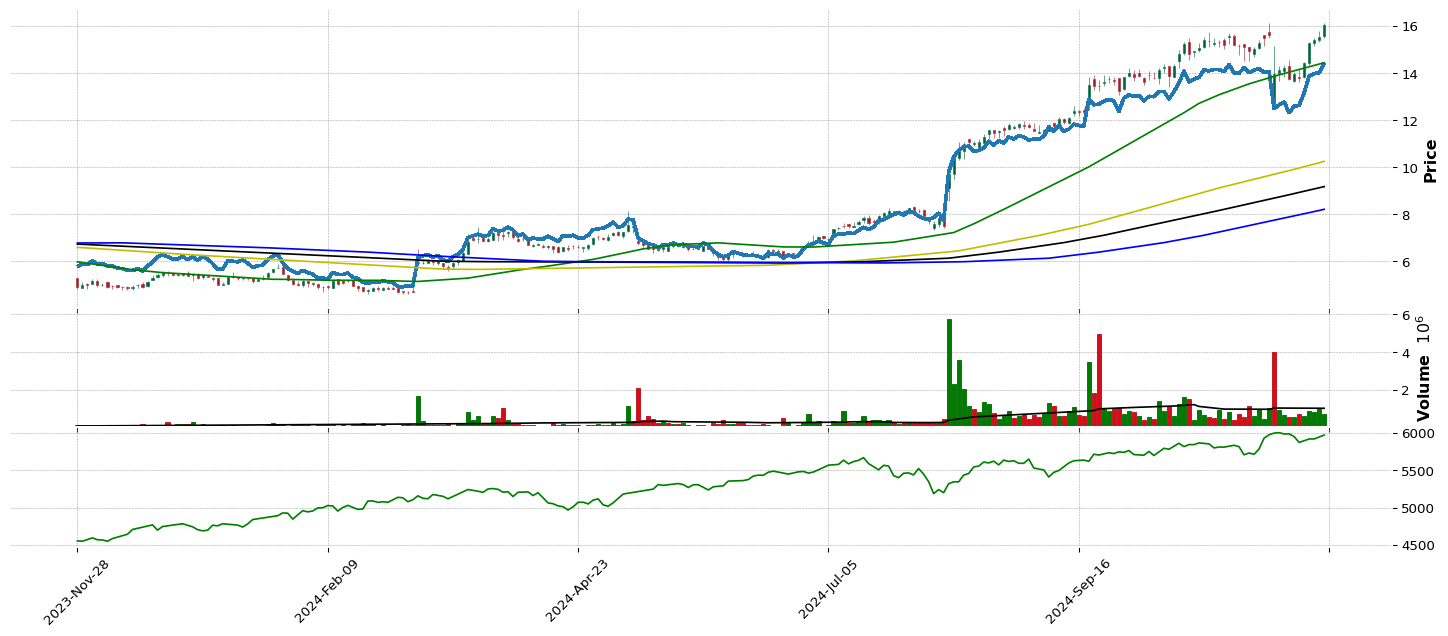

CMPO |

94.88 |

95.32 |

91.79 |

28.9 |

Industrials |

Metal Fabrication |

26 |

48.65 |

26.72 |

83.3 |

23.64 |

2.0 |

20.0 |

15.56 |

1.0 |

1.0 |

| 35.0 |

KKR |

94.76 |

93.59 |

94.19 |

91.57 |

Financial |

Asset Management |

61 |

0.0 |

0.0 |

86.83 |

0.0 |

1.0 |

17.0 |

140.75 |

1.0 |

1.0 |

| 36.0 |

QTTB |

94.64 |

95.35 |

96.01 |

85.73 |

Healthcare |

Biotechnology |

19 |

56.72 |

0.0 |

74.48 |

0.0 |

50.0 |

71.0 |

46.74 |

1.0 |

1.0 |

| 37.0 |

DBD |

94.51 |

95.62 |

96.51 |

0.0 |

Technology |

Software - Application |

76 |

85.92 |

53.99 |

74.48 |

58.46 |

6.0 |

22.0 |

47.0 |

1.0 |

1.0 |

| 38.0 |

TPG |

94.42 |

90.97 |

92.37 |

86.07 |

Financial |

Asset Management |

61 |

39.8 |

93.64 |

79.65 |

68.15 |

2.0 |

18.0 |

68.26 |

1.0 |

1.0 |

| 39.0 |

RCL |

93.93 |

93.25 |

90.06 |

95.24 |

Consumer Cyclical |

Travel Services |

16 |

98.7 |

92.23 |

98.21 |

91.72 |

2.0 |

20.0 |

203.52 |

1.0 |

1.0 |

| 40.0 |

SE |

93.78 |

94.33 |

95.18 |

19.36 |

Consumer Cyclical |

Internet Retail |

47 |

27.03 |

36.41 |

83.3 |

74.76 |

2.0 |

21.0 |

99.26 |

1.0 |

1.0 |

| 41.0 |

OKLO |

93.75 |

23.7 |

5.15 |

73.82 |

Utilities |

Utilities - Regulated Electric |

59 |

0.0 |

0.0 |

29.38 |

0.0 |

2.0 |

4.0 |

24.5 |

1.0 |

1.0 |

| 42.0 |

QFIN |

93.68 |

90.36 |

87.16 |

47.9 |

Financial |

Credit Services |

17 |

22.45 |

36.99 |

46.84 |

44.4 |

4.0 |

21.0 |

34.97 |

1.0 |

1.0 |

| 43.0 |

TRU |

93.62 |

76.97 |

66.18 |

52.19 |

Financial |

Financial Data & Stock Exchanges |

33 |

29.5 |

13.85 |

51.0 |

73.34 |

2.0 |

22.0 |

103.68 |

1.0 |

1.0 |

| 44.0 |

SPOT |

93.38 |

95.84 |

95.12 |

94.8 |

Communication Services |

Internet Content & Information |

103 |

56.41 |

90.95 |

94.42 |

96.81 |

3.0 |

6.0 |

384.35 |

1.0 |

1.0 |

| 45.0 |

TPB |

93.31 |

89.56 |

85.68 |

68.41 |

Consumer Defensive |

Tobacco |

43 |

81.34 |

87.16 |

93.24 |

61.92 |

1.0 |

7.0 |

46.72 |

1.0 |

1.0 |

| 46.0 |

SLNO |

93.22 |

93.31 |

99.96 |

99.9 |

Healthcare |

Biotechnology |

19 |

63.59 |

0.0 |

40.94 |

0.0 |

61.0 |

84.0 |

55.31 |

1.0 |

1.0 |

| 47.0 |

MNDY |

93.13 |

90.73 |

86.48 |

89.77 |

Technology |

Software - Application |

76 |

95.23 |

96.98 |

83.3 |

95.77 |

9.0 |

31.0 |

297.35 |

1.0 |

1.0 |

| 48.0 |

VNO |

92.94 |

88.48 |

80.0 |

93.65 |

Real Estate |

REIT - Office |

25 |

52.83 |

47.93 |

68.27 |

56.1 |

2.0 |

4.0 |

43.31 |

1.0 |

1.0 |

| 49.0 |

B |

92.82 |

71.05 |

36.65 |

18.18 |

Industrials |

Specialty Industrial Machinery |

40 |

6.43 |

34.9 |

77.07 |

54.48 |

3.0 |

27.0 |

46.77 |

1.0 |

1.0 |

| 50.0 |

AAON |

92.64 |

90.17 |

83.86 |

80.1 |

Industrials |

Building Products & Equipment |

58 |

75.22 |

82.16 |

88.99 |

83.86 |

4.0 |

29.0 |

121.33 |

1.0 |

1.0 |

| 51.0 |

MLI |

92.33 |

91.37 |

93.36 |

84.33 |

Industrials |

Metal Fabrication |

26 |

63.13 |

12.25 |

17.46 |

68.53 |

3.0 |

32.0 |

83.05 |

1.0 |

1.0 |

| 52.0 |

ENVA |

92.08 |

83.8 |

88.61 |

77.89 |

Financial |

Credit Services |

17 |

25.11 |

41.7 |

68.27 |

72.34 |

5.0 |

27.0 |

86.97 |

1.0 |

1.0 |

| 53.0 |

STEP |

92.05 |

91.81 |

89.69 |

89.02 |

Financial |

Asset Management |

61 |

17.63 |

80.39 |

97.76 |

66.83 |

3.0 |

28.0 |

61.58 |

1.0 |

1.0 |

| 54.0 |

AXON |

91.99 |

91.77 |

92.5 |

78.55 |

Industrials |

Aerospace & Defense |

29 |

85.7 |

81.0 |

77.07 |

97.85 |

7.0 |

33.0 |

444.76 |

1.0 |

1.0 |

| 55.0 |

UAL |

91.96 |

75.92 |

53.19 |

57.1 |

Industrials |

Airlines |

68 |

95.97 |

52.83 |

96.11 |

73.55 |

1.0 |

34.0 |

76.08 |

1.0 |

1.0 |

| 56.0 |

HLNE |

91.93 |

92.11 |

89.44 |

86.66 |

Financial |

Asset Management |

61 |

30.28 |

52.19 |

98.52 |

88.68 |

4.0 |

29.0 |

182.61 |

1.0 |

1.0 |

| 57.0 |

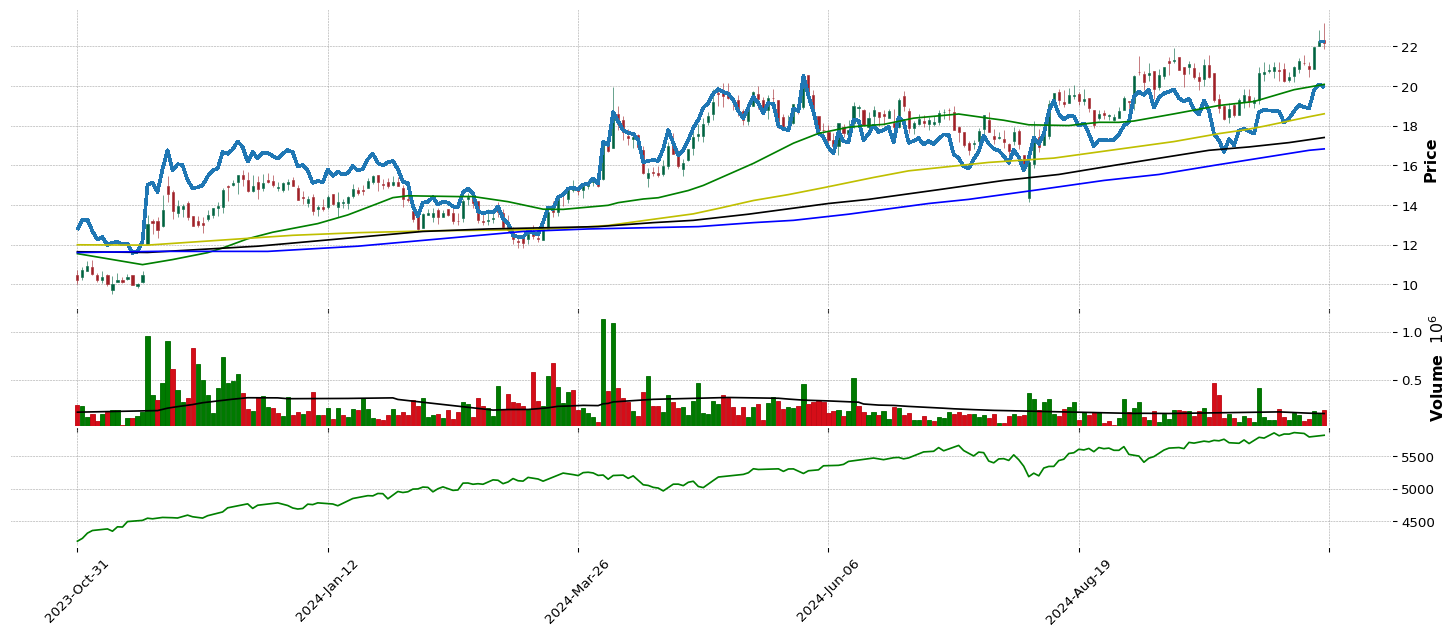

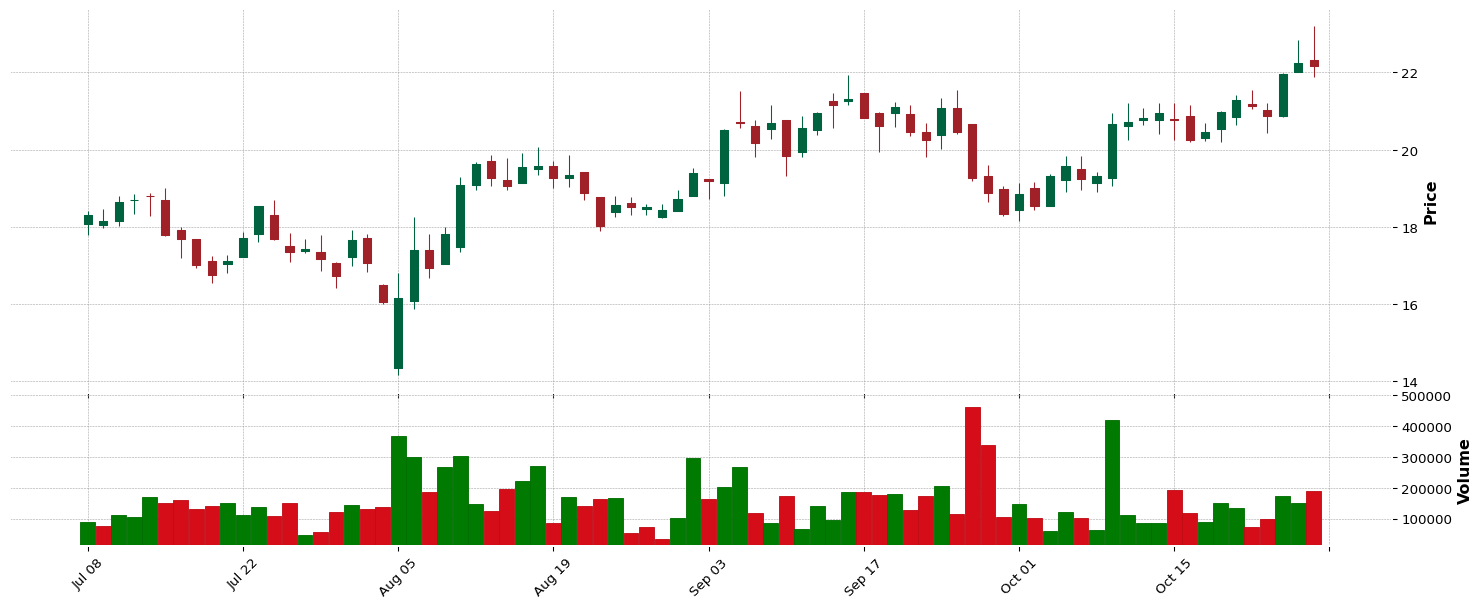

TGS |

91.9 |

83.55 |

92.1 |

87.19 |

Energy |

Oil & Gas Integrated |

132 |

100.0 |

84.08 |

40.94 |

40.32 |

2.0 |

2.0 |

22.15 |

1.0 |

1.0 |

| 58.0 |

IRM |

91.87 |

92.02 |

91.57 |

77.49 |

Real Estate |

REIT - Specialty |

53 |

61.76 |

32.4 |

94.42 |

83.1 |

1.0 |

7.0 |

128.13 |

1.0 |

1.0 |

| 59.0 |

LGND |

91.81 |

87.93 |

88.89 |

27.19 |

Healthcare |

Biotechnology |

19 |

76.12 |

66.66 |

98.9 |

81.96 |

67.0 |

94.0 |

113.37 |

1.0 |

1.0 |

| 60.0 |

ALKT |

91.68 |

91.56 |

87.87 |

95.89 |

Technology |

Software - Application |

76 |

43.39 |

83.28 |

78.57 |

55.41 |

12.0 |

40.0 |

38.77 |

1.0 |

1.0 |

| 61.0 |

PTCT |

91.65 |

90.02 |

71.61 |

5.4 |

Healthcare |

Biotechnology |

19 |

45.71 |

27.14 |

34.72 |

49.84 |

68.0 |

96.0 |

40.47 |

1.0 |

1.0 |

| 62.0 |

JLL |

91.28 |

90.85 |

87.22 |

73.98 |

Real Estate |

Real Estate Services |

15 |

75.19 |

80.94 |

15.85 |

93.8 |

5.0 |

8.0 |

273.07 |

1.0 |

1.0 |

| 63.0 |

UI |

91.22 |

91.68 |

73.27 |

2.82 |

Technology |

Communication Equipment |

1 |

10.67 |

8.82 |

97.52 |

91.62 |

6.0 |

42.0 |

258.6 |

1.0 |

1.0 |

| 64.0 |

TCBX |

91.0 |

77.21 |

79.94 |

81.87 |

Financial |

Banks - Regional |

22 |

82.8 |

60.92 |

83.3 |

50.74 |

9.0 |

34.0 |

32.79 |

1.0 |

1.0 |

| 65.0 |

PRIM |

90.97 |

91.28 |

87.5 |

93.16 |

Industrials |

Engineering & Construction |

21 |

68.2 |

78.44 |

90.06 |

69.26 |

7.0 |

38.0 |

63.56 |

1.0 |

1.0 |

| 66.0 |

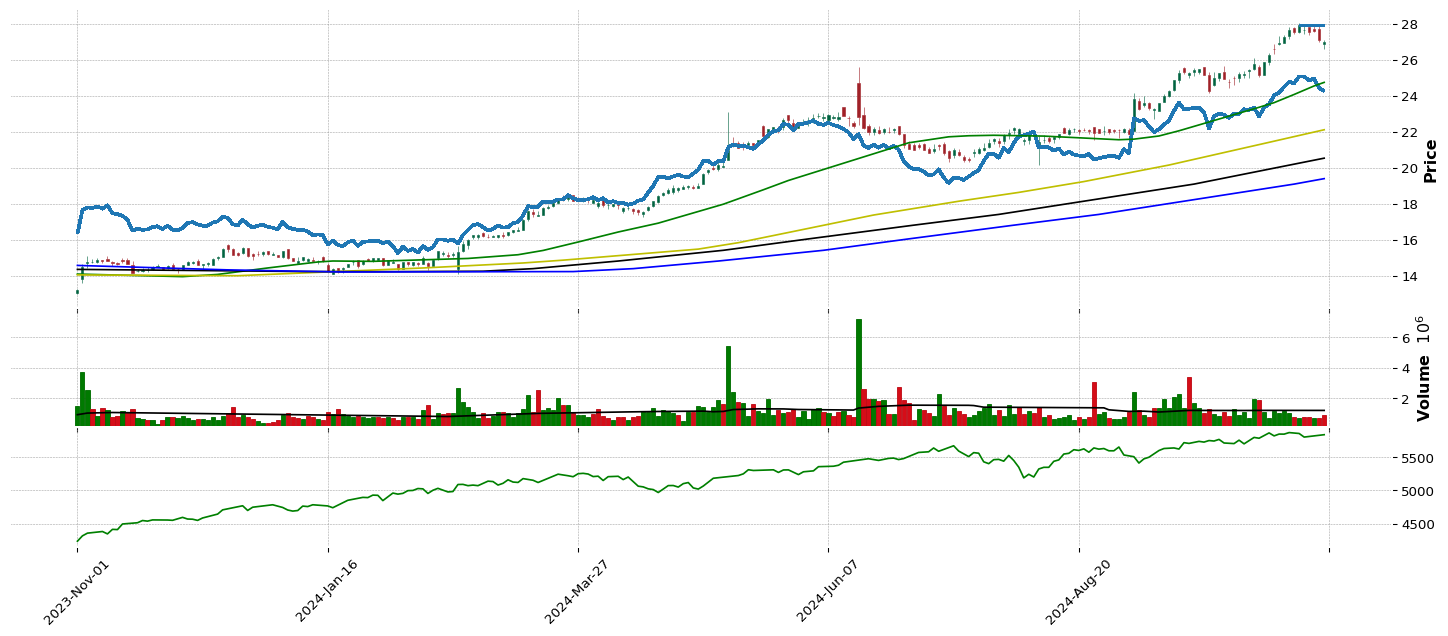

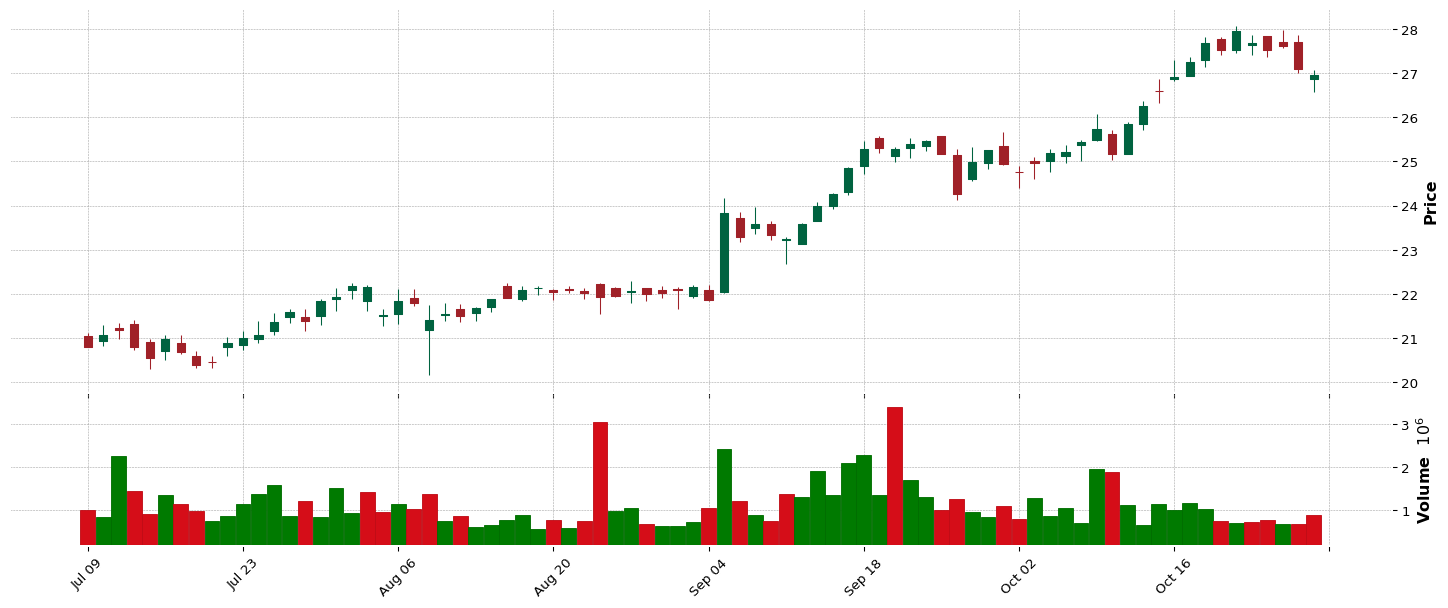

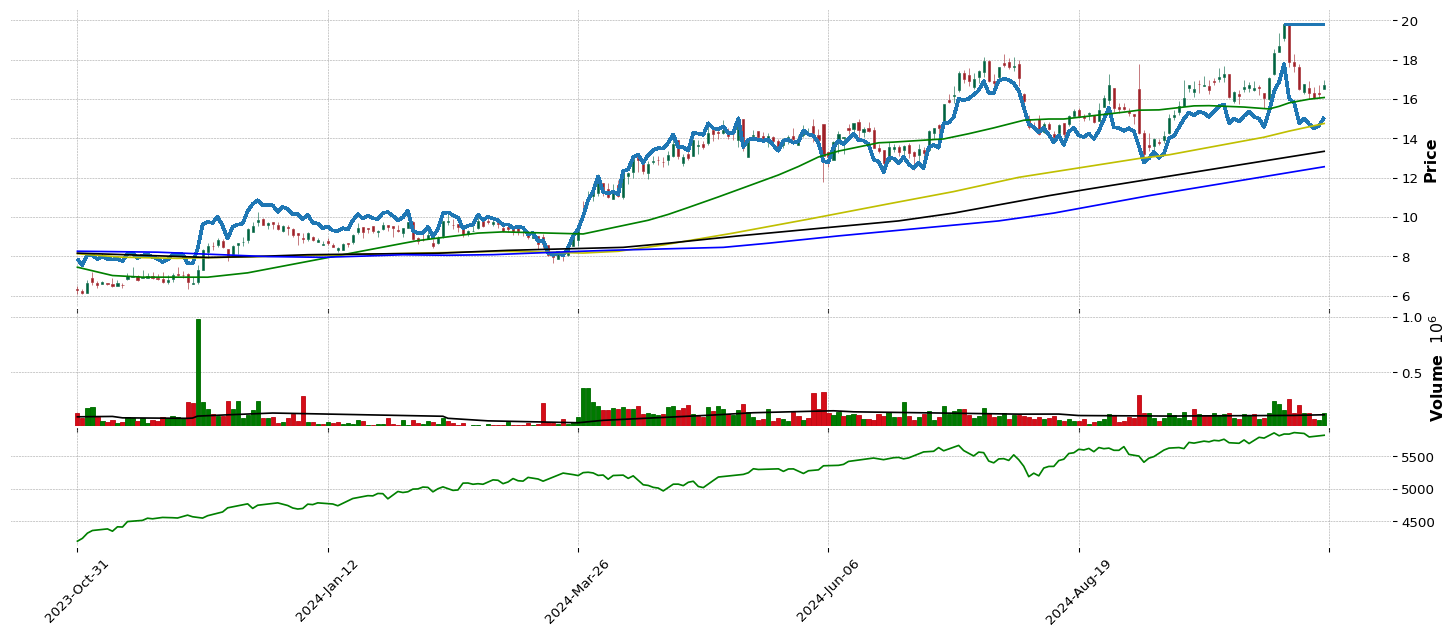

PRMW |

90.54 |

90.88 |

89.41 |

65.27 |

Consumer Defensive |

Beverages - Non-Alcoholic |

107 |

92.08 |

65.12 |

79.65 |

45.79 |

1.0 |

11.0 |

27.09 |

1.0 |

1.0 |

| 67.0 |

TECX |

90.39 |

85.46 |

31.44 |

91.1 |

Healthcare |

Biotechnology |

19 |

52.27 |

0.0 |

87.62 |

0.0 |

75.0 |

106.0 |

39.45 |

1.0 |

1.0 |

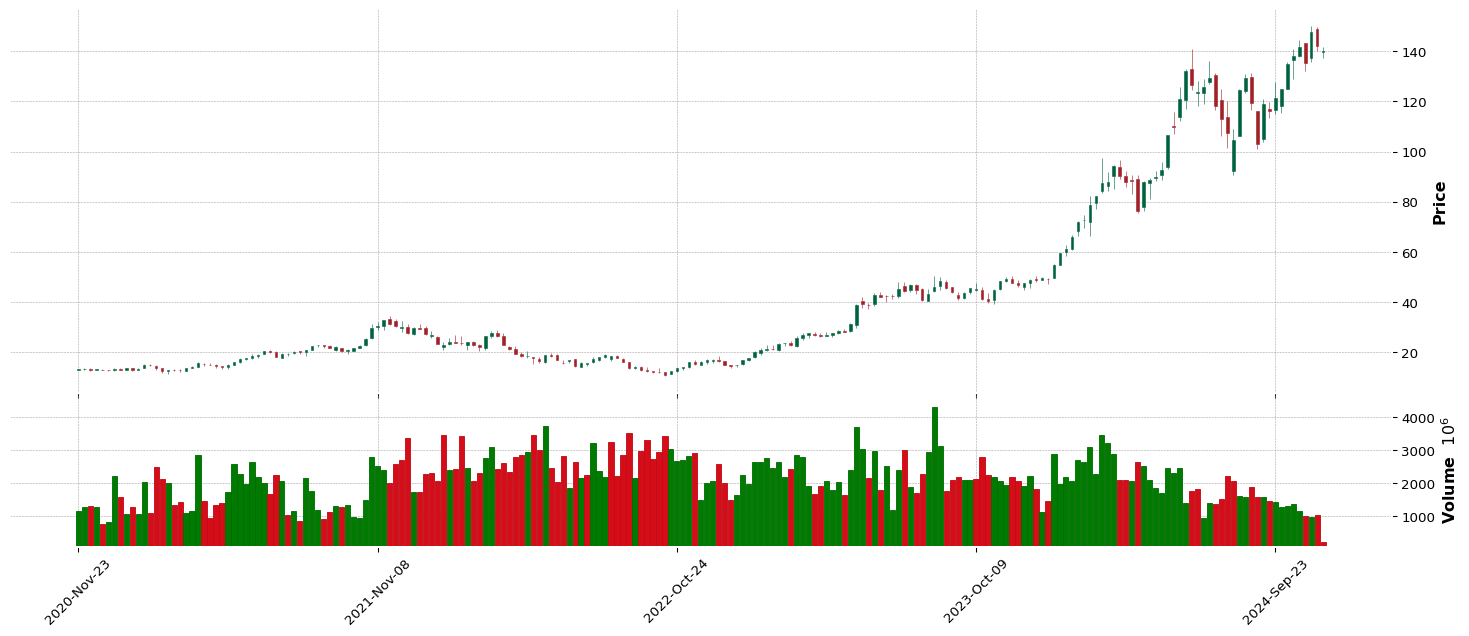

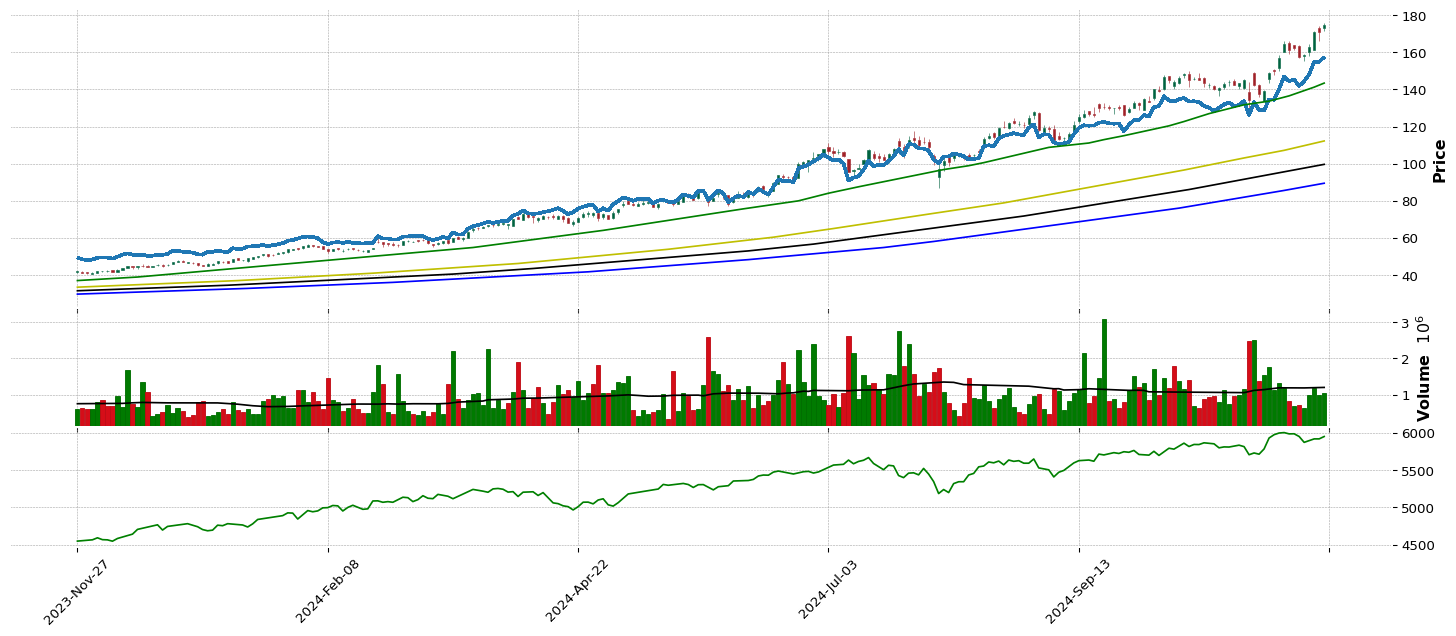

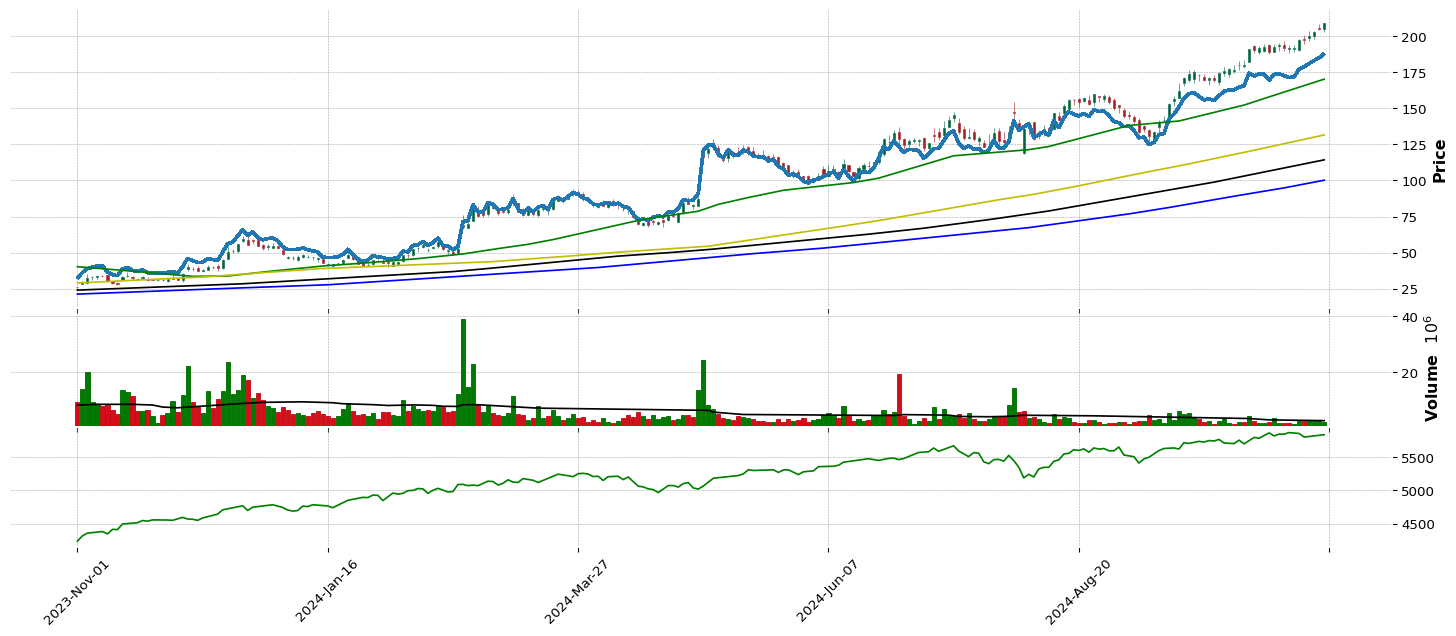

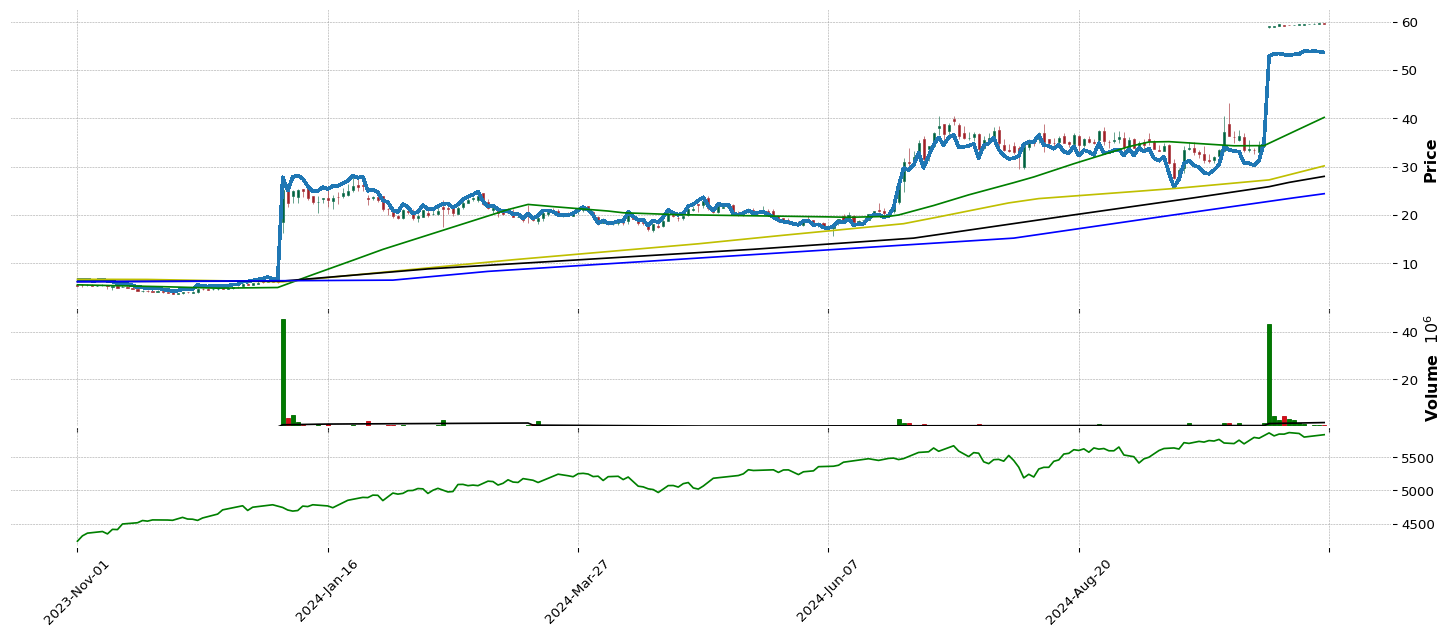

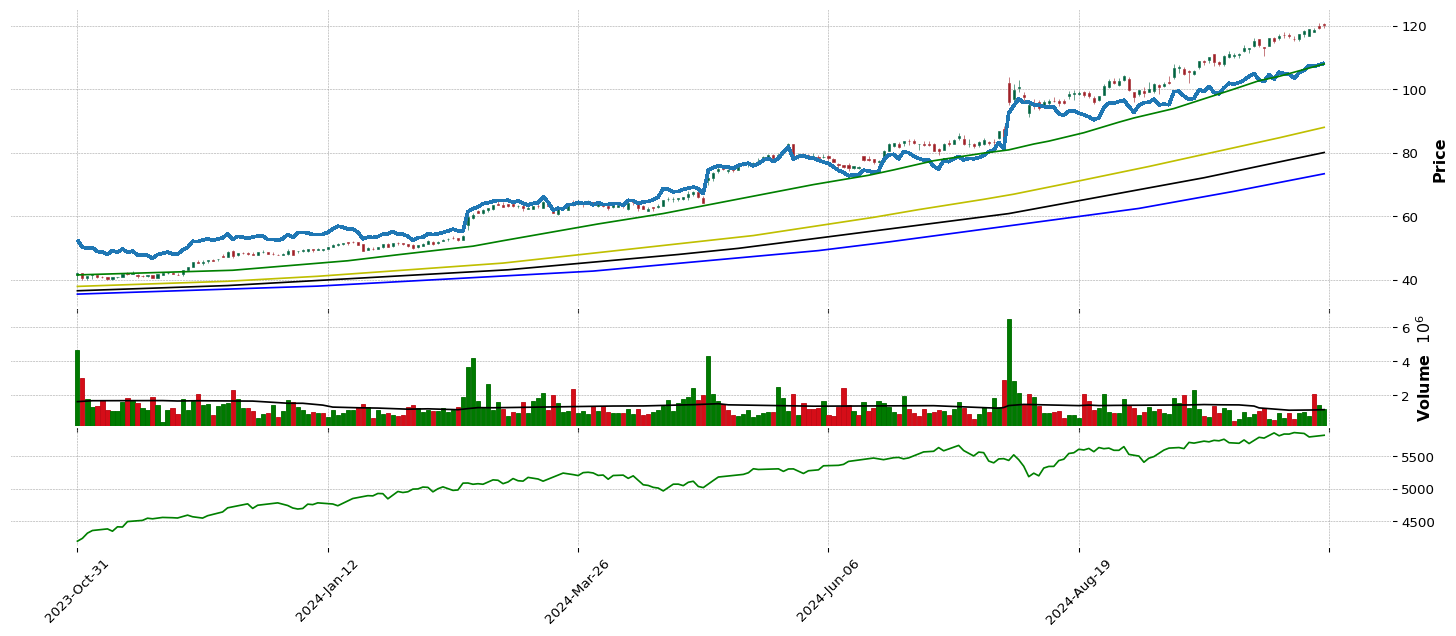

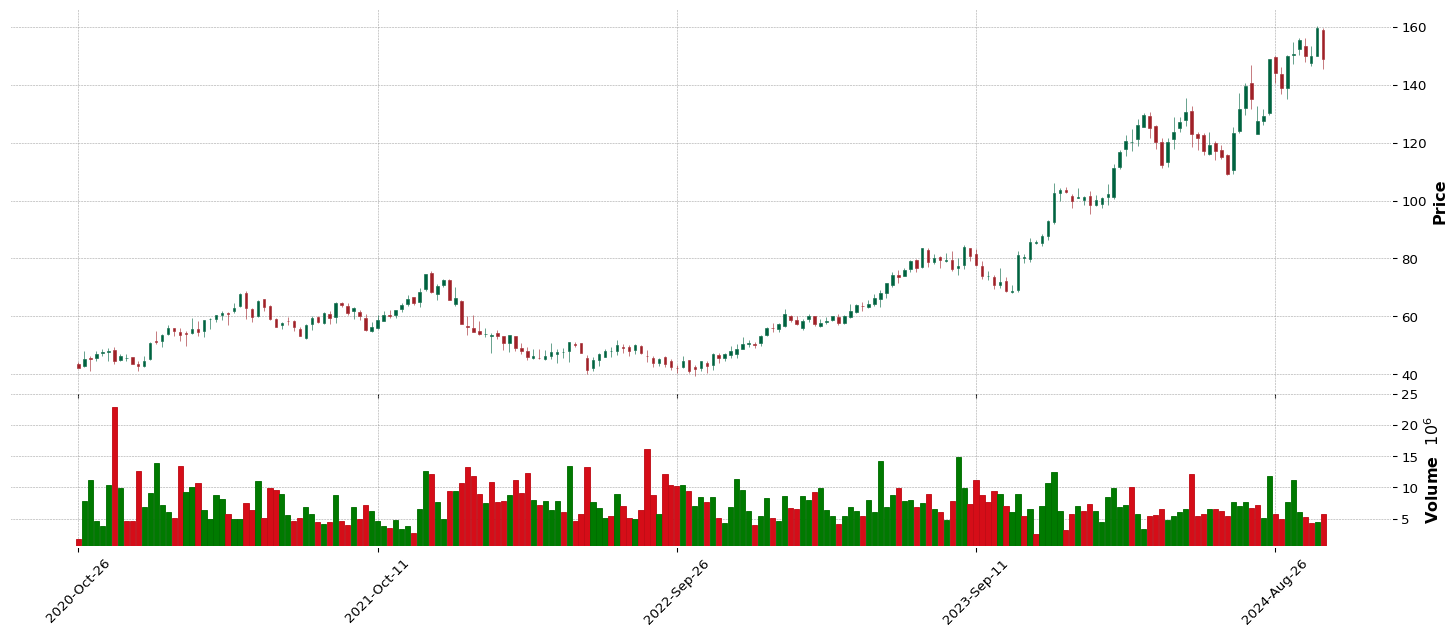

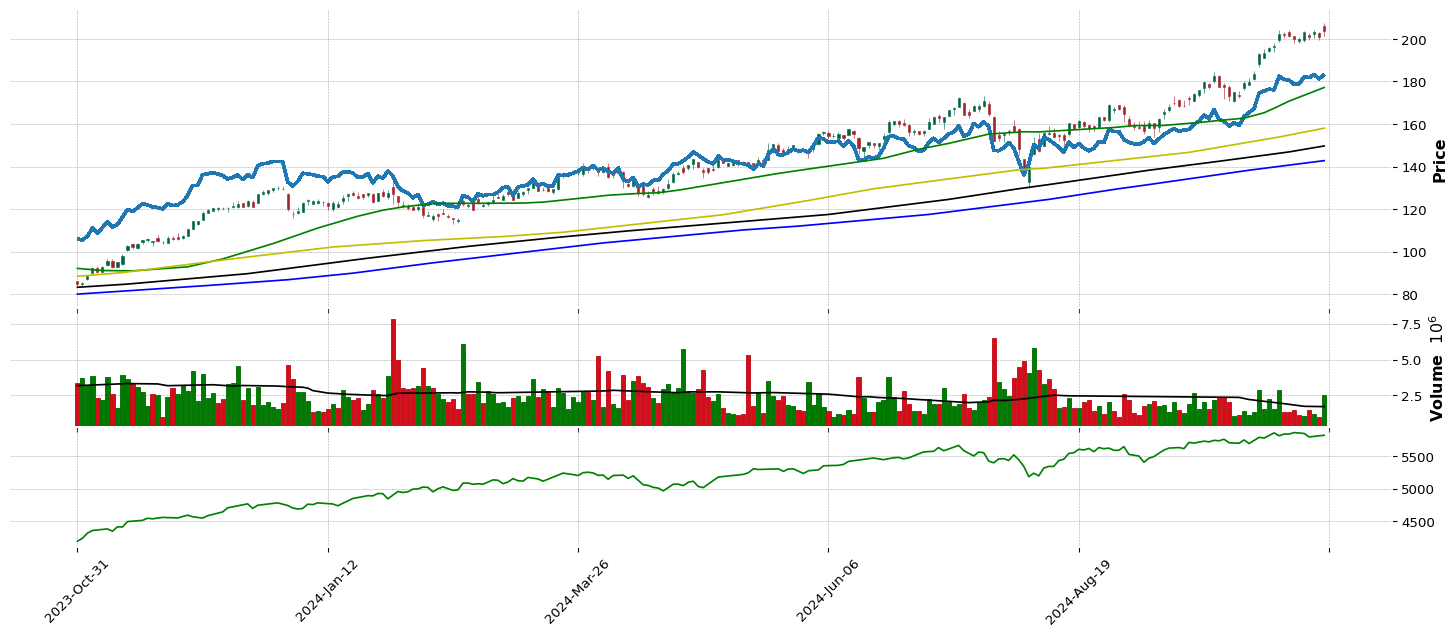

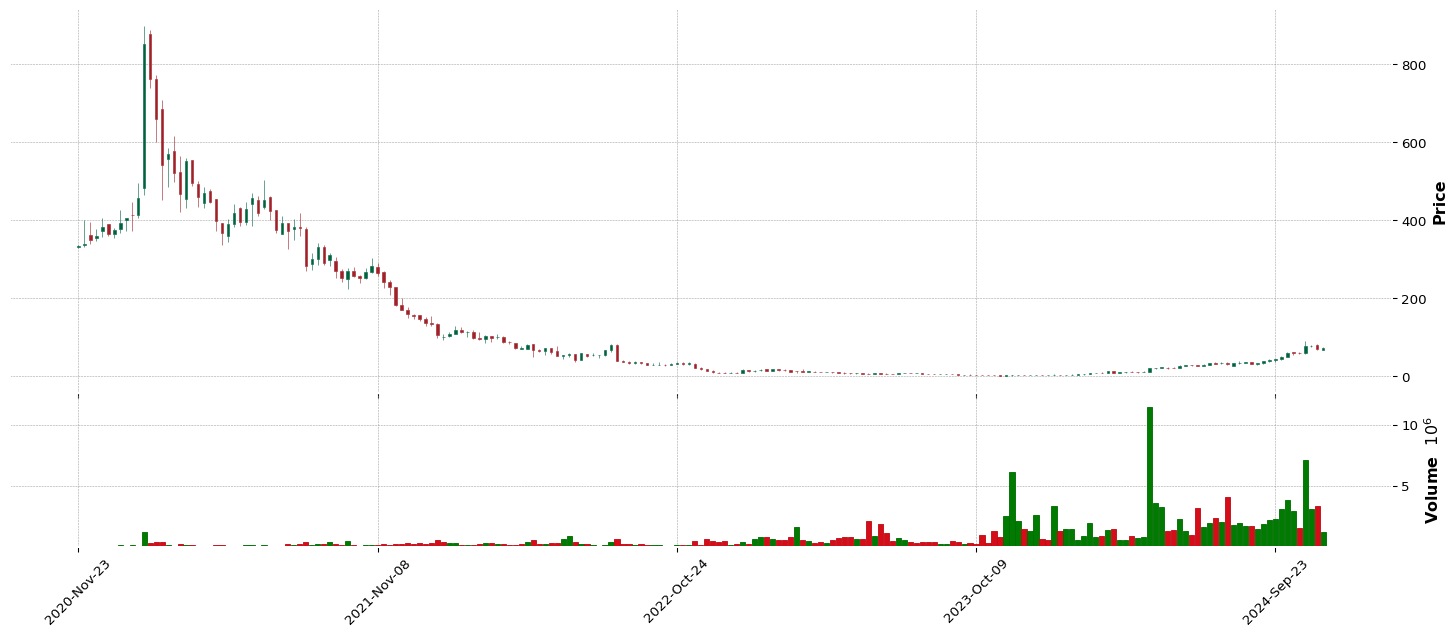

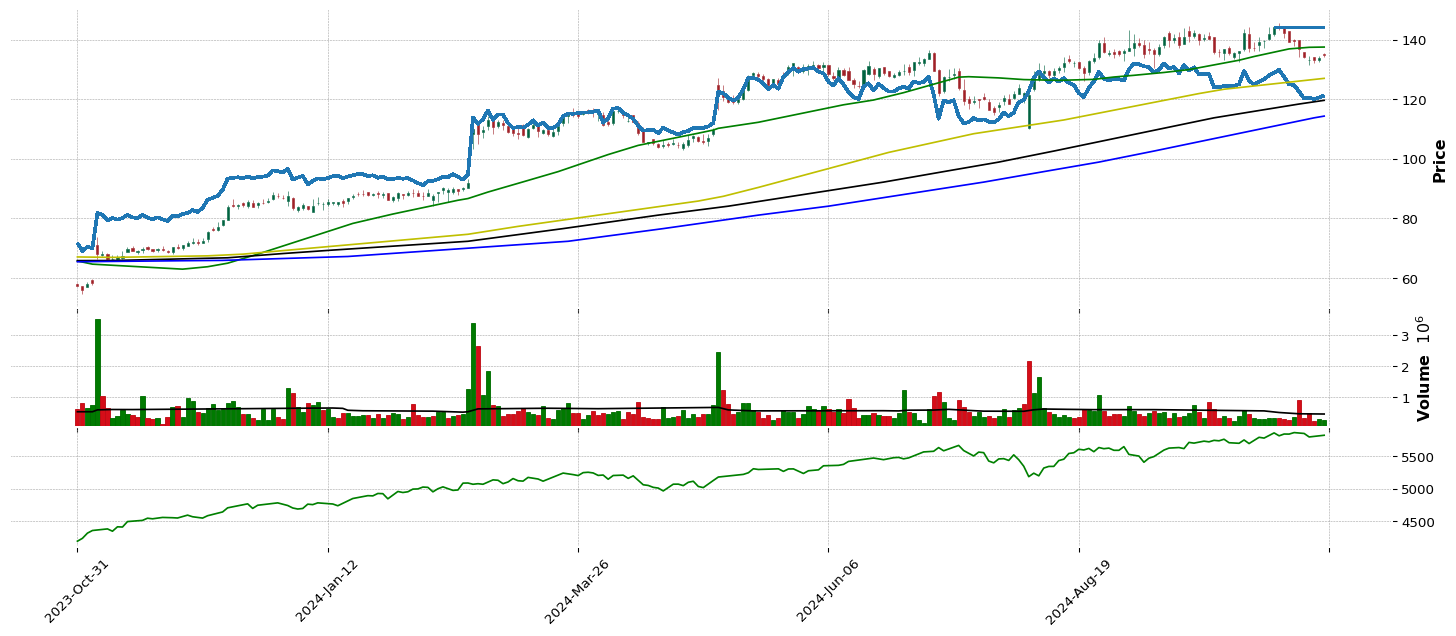

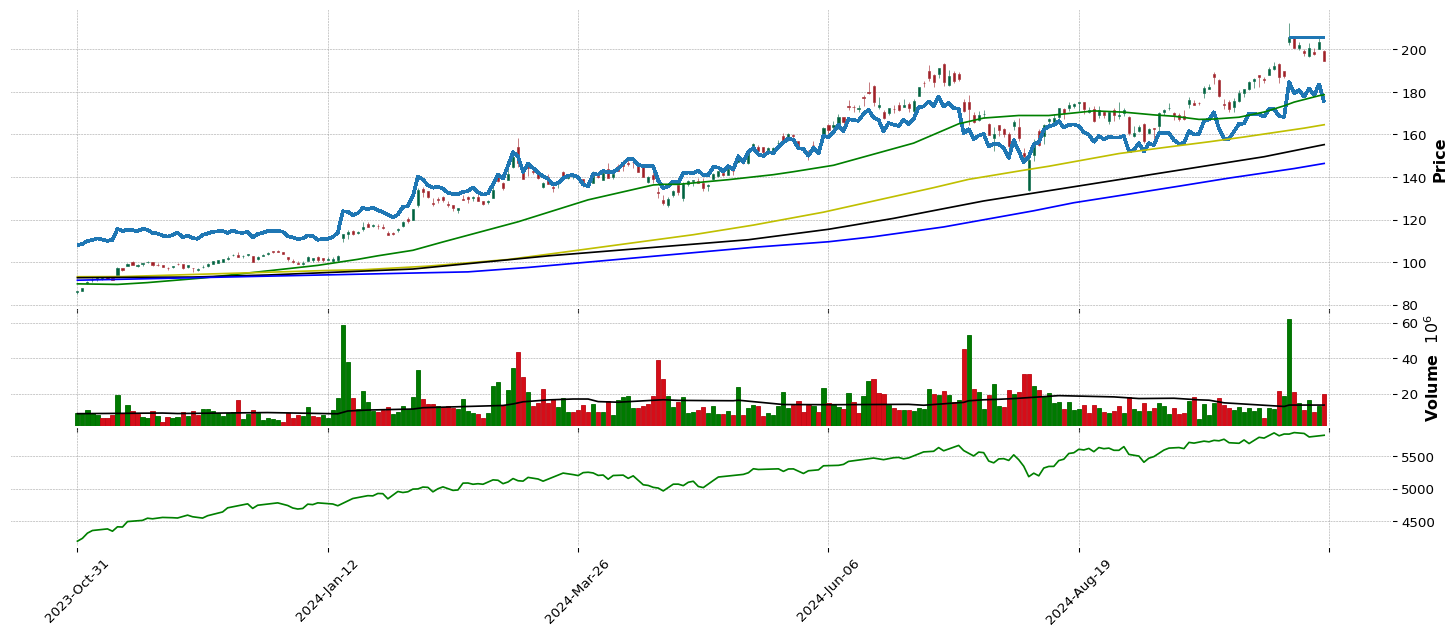

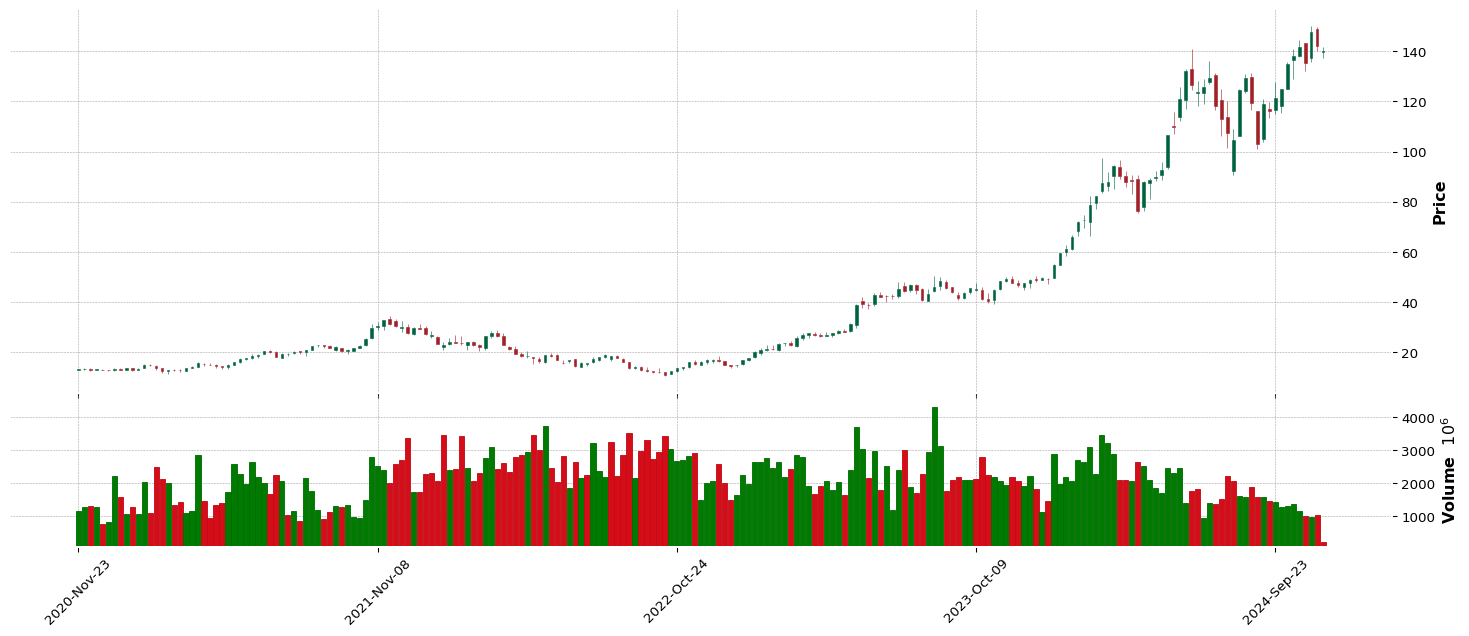

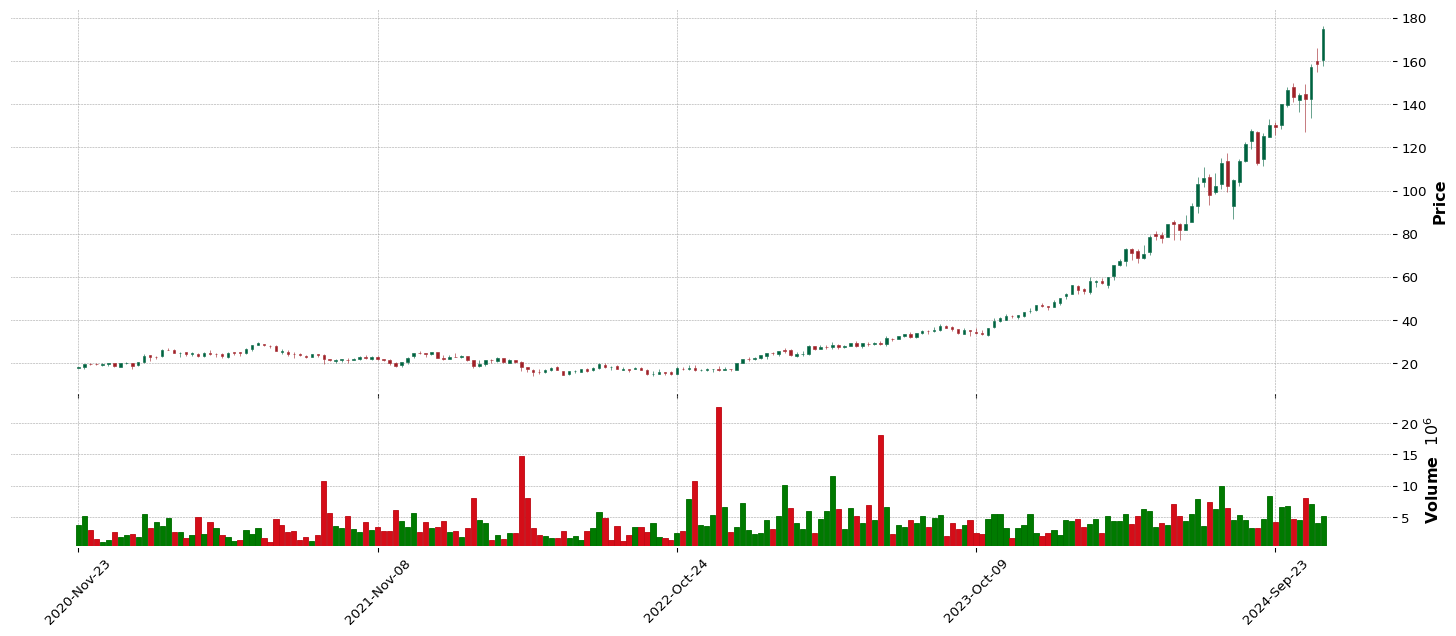

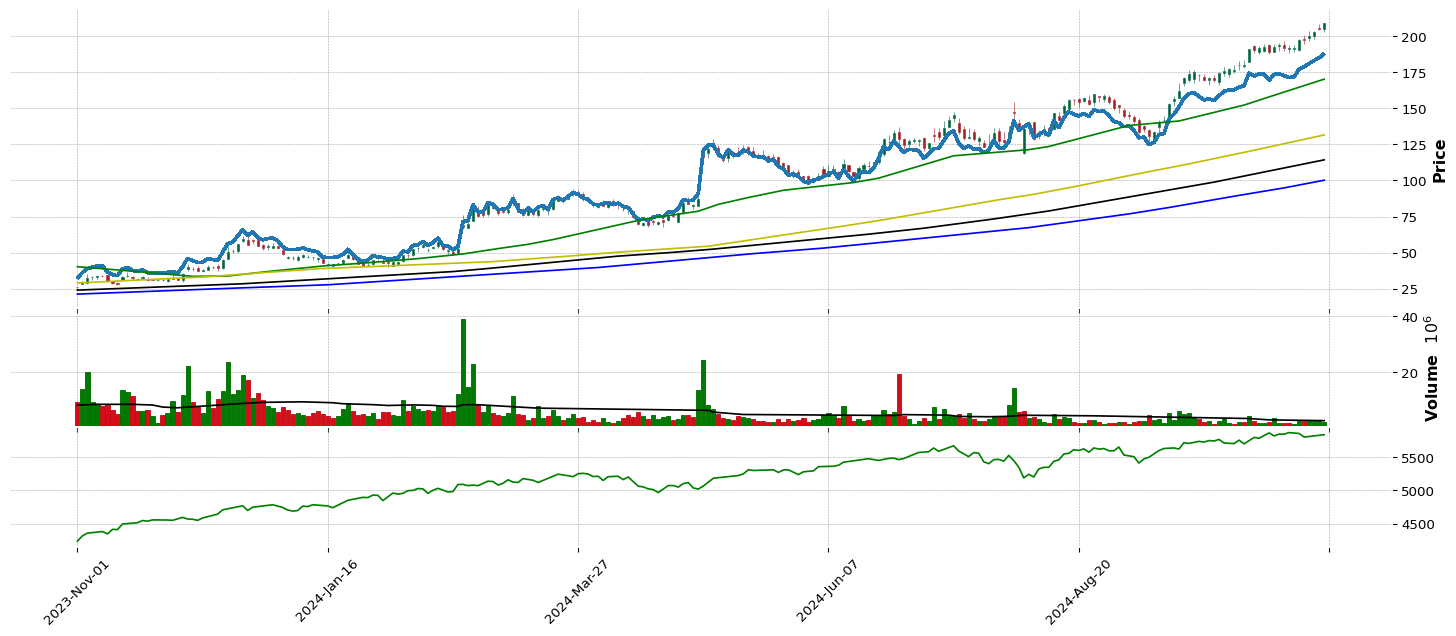

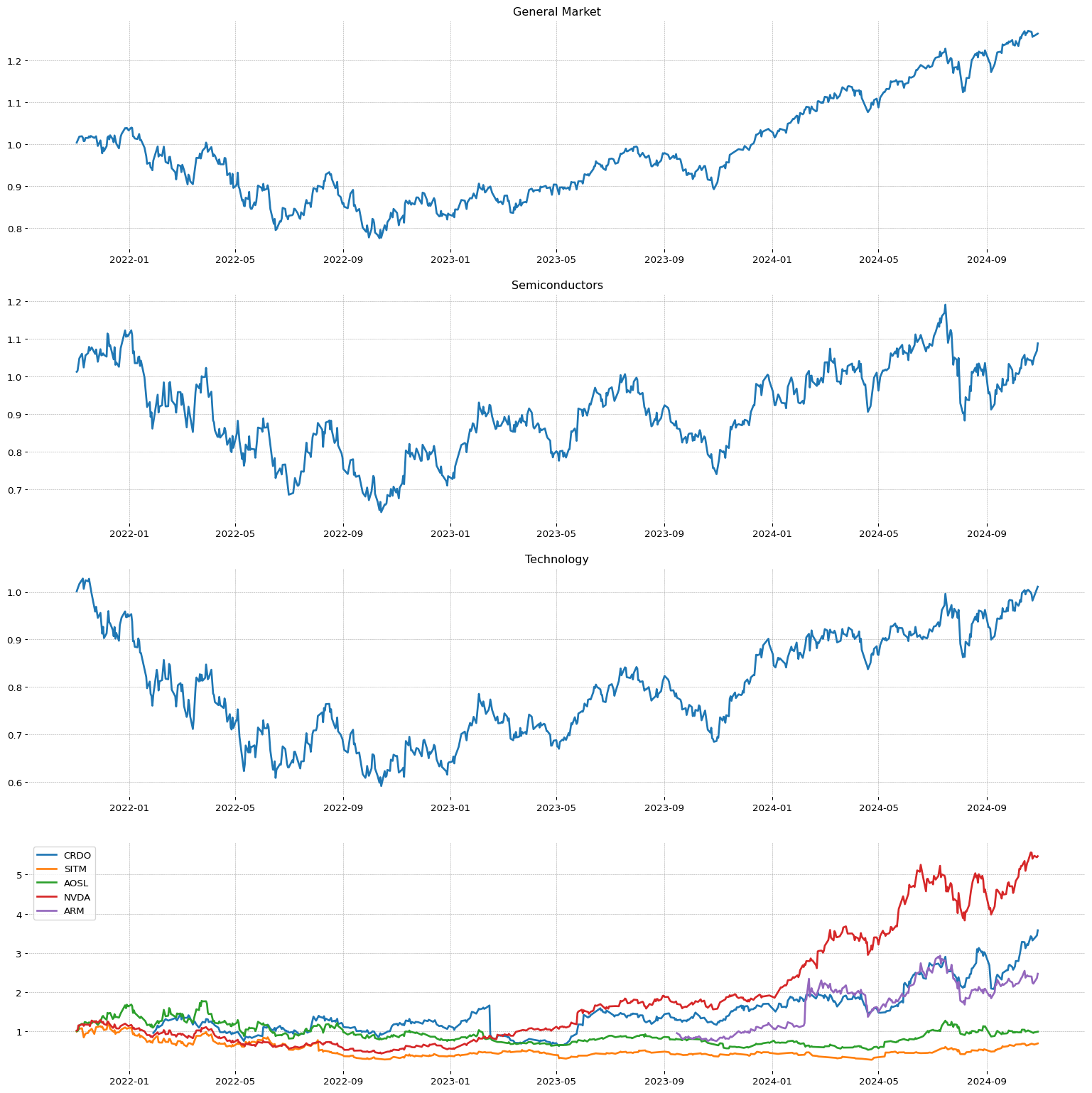

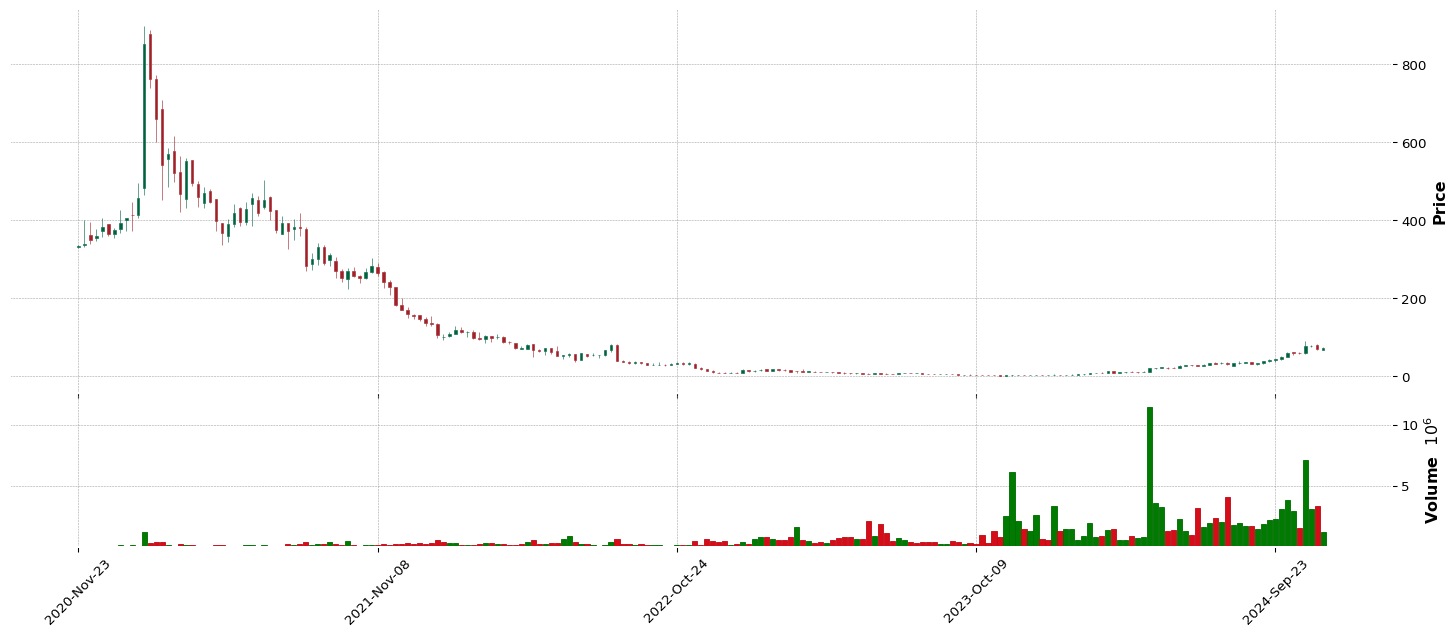

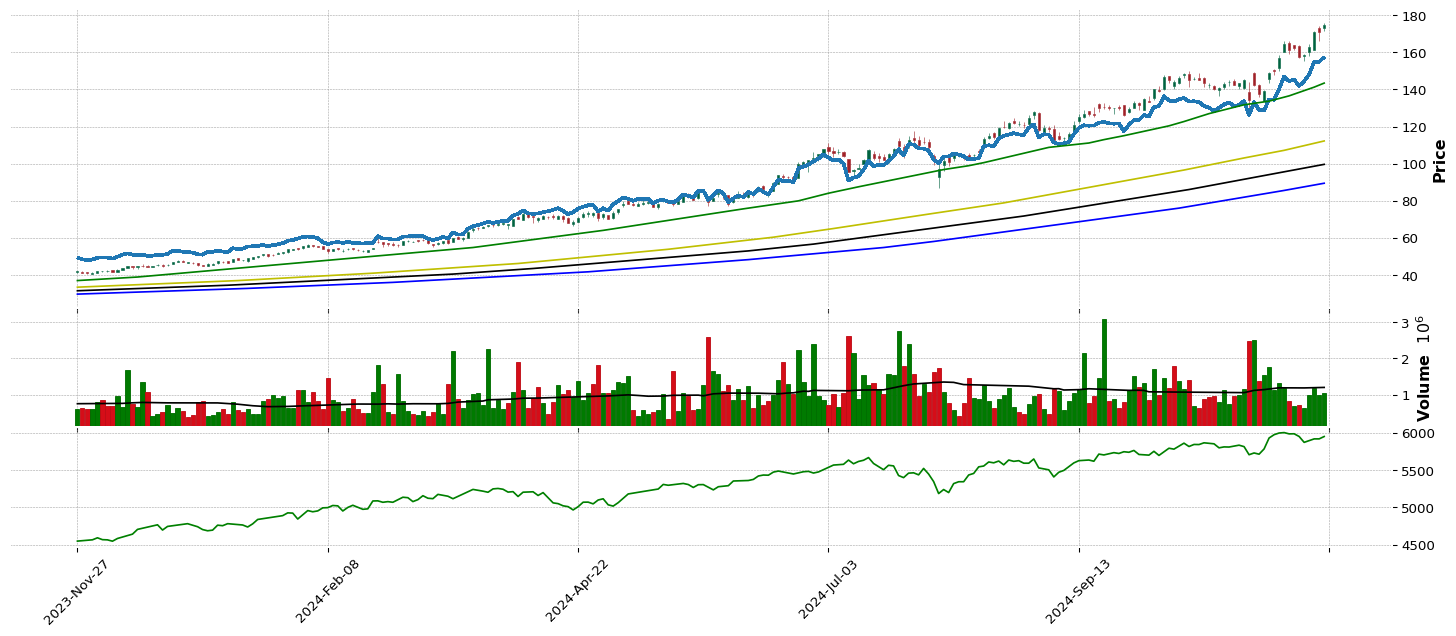

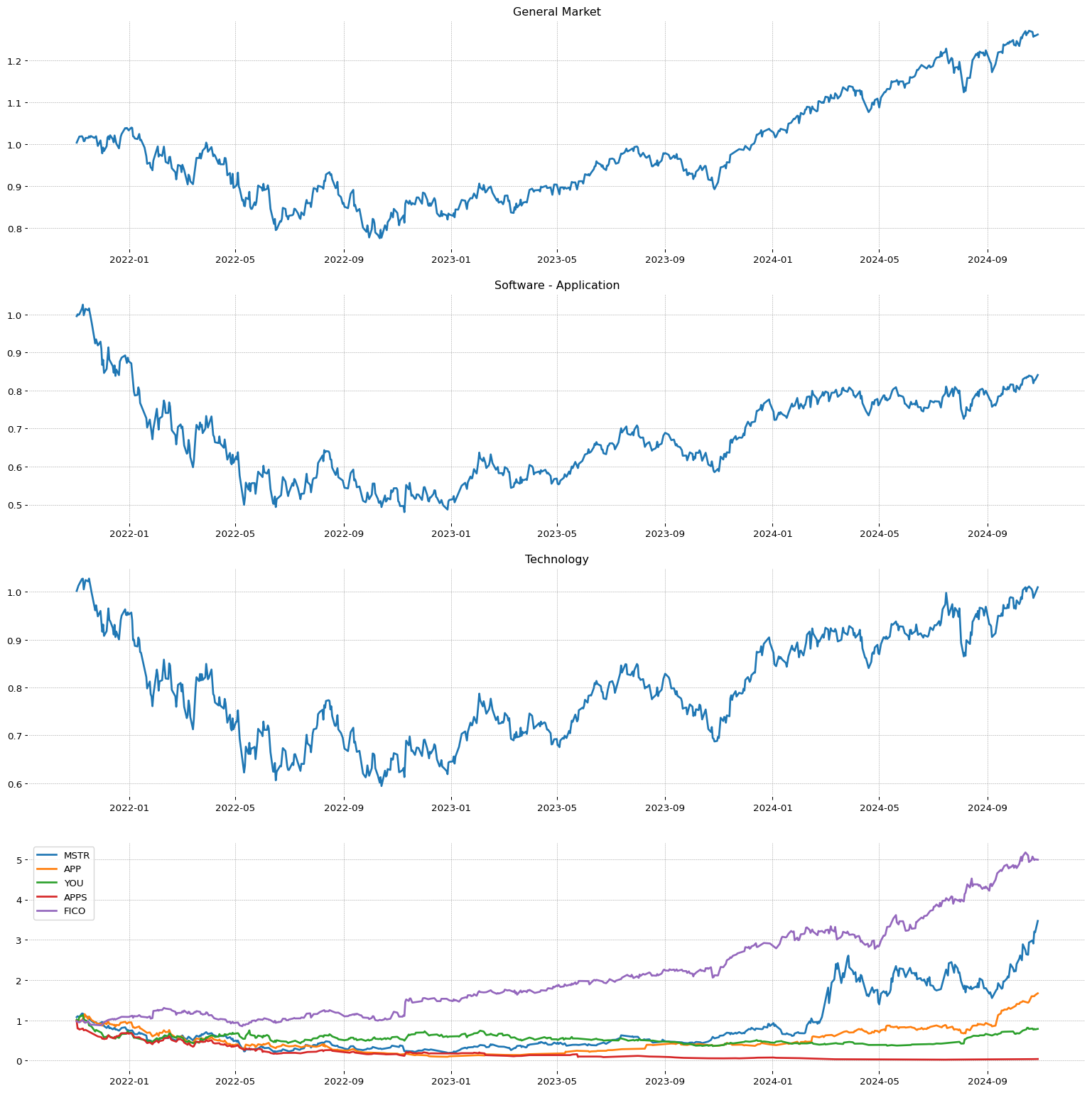

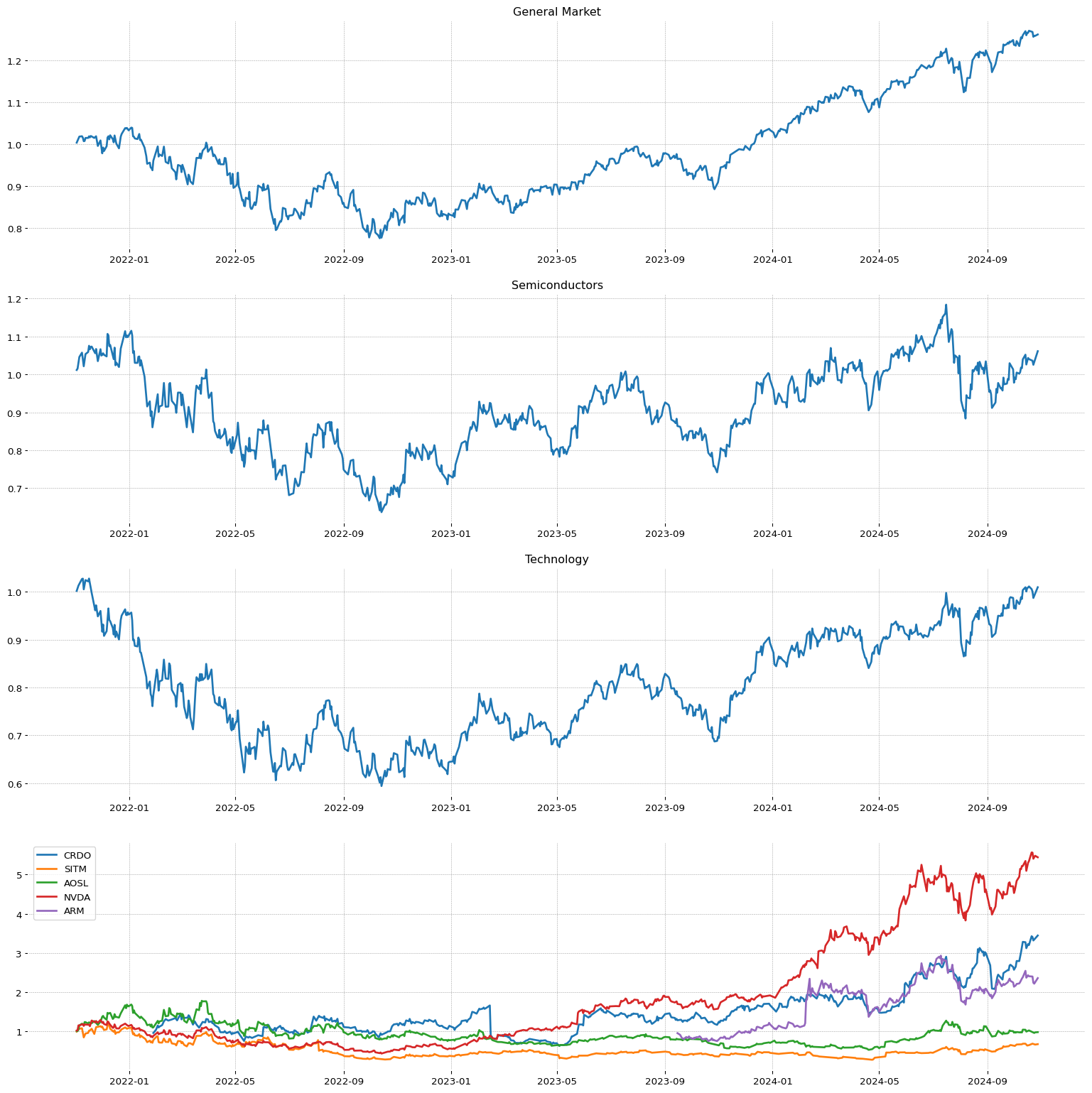

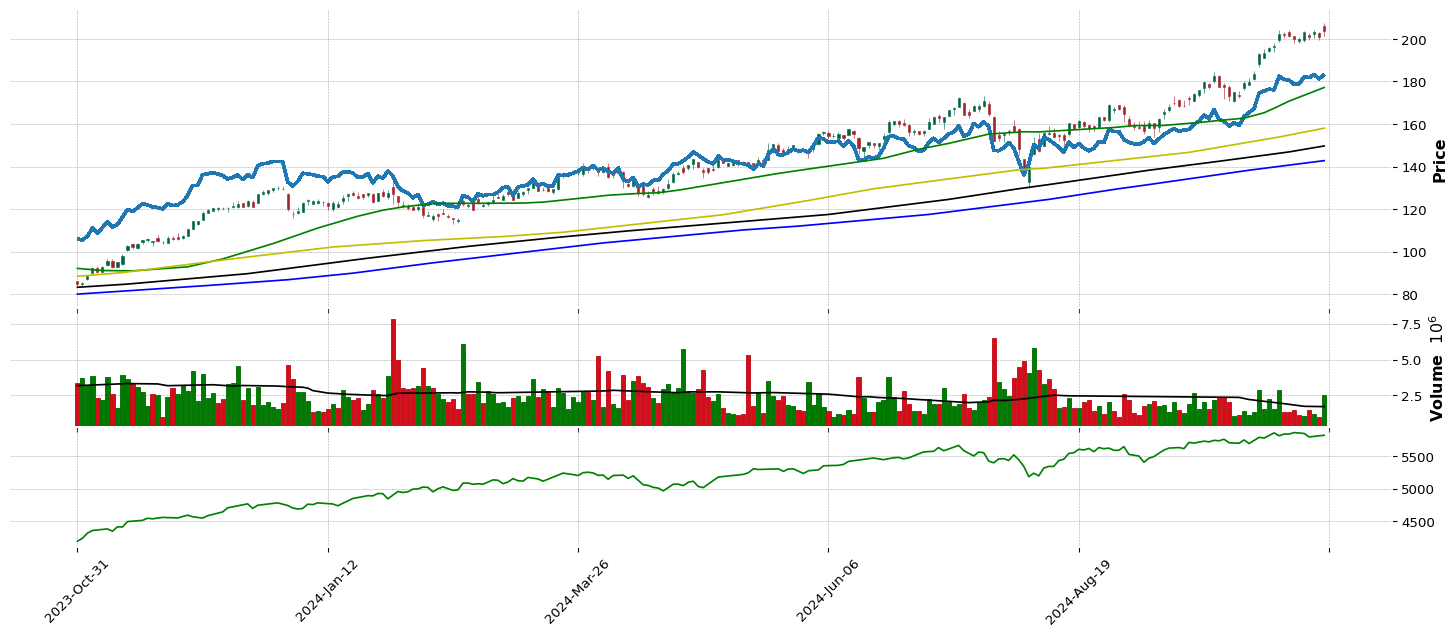

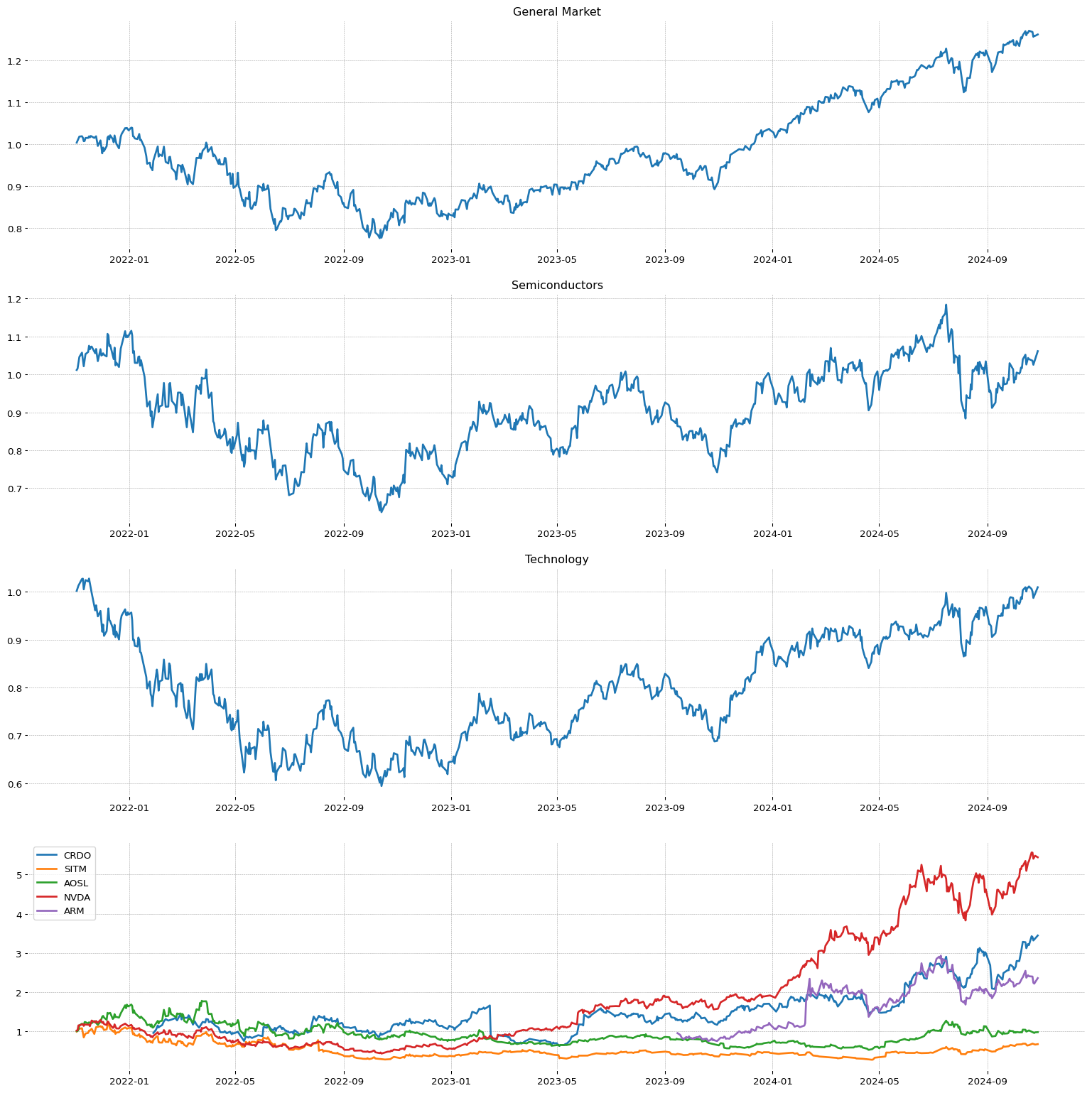

**** FONDAMENTALE ****NVDA

***************************

--> GENERAL INFORMATION NVDA :

| Total stock number: | 23.54B |

| Market Cap: | 3469.438905487B |

| Namee: | NVIDIA Corporation |

| IPO date: | 1999-01-22 |

| Type of Sector: | Technology |

| Sector Position: | 2/11 |

| RSI Sector: | 30/445 |

| Type of industry: | Semiconductors |

| Industry stock position: | 79/147 |

| Industry stock position: | 1/47 |

| RS Rating: | 97.84 |

| EPS Rating: | 98.76 |

| SMR Rating: | 99.9 |

| 1 year return: | 244.58 |

| Stability Value of Earnigs: | 61.75 |

Top competitor on same industry:

| Stock: | RS | EPS | SMR | 2Q | 1Q |

| NVDA | 97 | 98 | 99 | 622 | 172 |

| SMTC | 97 | 35 | 19 | 21 | 56 |

| CRDO | 96 | 45 | 59 | 41 | 26 |

| ARM | 96 | 68 | 0 | 7486 | 110 |

| SKYT | 92 | 44 | 43 | -23 | 78 |

| TSM | 92 | 67 | 38 | 9 | 36 |

| AVGO | 89 | 0 | 0 | 0 | 0 |

| MPWR | 89 | 52 | 24 | -18 | -1 |

| TSEM | 88 | 71 | 23 | -38 | 2 |

| CRUS | 85 | 87 | 88 | 185 | 182 |

--->QUARTER

| 3Q | 2Q | 1Q |

| Increase Earnings of last quarters: | 777.19 | 622.89 | 172.0% |

| Quarter maggiori 20% / 50% / 100% in 20: | 7 | 5 | 5 |

| Percentage surprise: | 13.04 | 8.92 | 6.25% |

| 2Q Increase Earnings: | 1042.3 | 700.04 | 397.44% |

| 5/3/1 anno di Earnigs: | 0.16 | 0.24 | 0.54 |

| Perc. increase 3/1 Earnigs Vs 5/3: | | 45.36 | 124.45% |

| Revenue increase: | 265.27 | 262.12 | 122.4% |

| 2Q Revenue increase: | 235.39 | 263.7 | 192.26% |

| NeT income Ratio: | 55.58 | 57.13 | 55.25% |

| NeT income Increase: | 137.84 | 101.14 | 20.61% |

| EARNINGS | This Q | Next Q |

| this and next q growth: | 94.73 | 62.0% |

| Revision % of extimate growth | 0.0 | 0.0% |

| This Quarter / Next Quarter | 0.74 | 0.81 |

| last 7 | 0.74 | 0.81 |

| last 30 | 0.74 | 0.81 |

| last 60 | 0.64 | 0.71 |

| last 90 | 0.7 | 0.77 |

| REVENUE | This Q | Next Q |

| Growth sales extimation: | -- | 65.30% |

--->ANNUAL

| 2022 | 2023 | 2024 | ttm |

| Earnings A/A increase: | 116.66 | -53.84 | 572.22% |

| Earnings 2 A/A increase: | 83.33 | 31.41 | 259.18% |

| ROE value: | 44.83 | 17.93 | 91.45 | 98.8% |

| Net income Increase: | 125.11 | -55.2 | 581.31% |

--> Annual breakout:

2015/0.028

2016/0.028

2017/0.077

2018/0.13

2019/0.17

2020/0.12

2021/0.18

2022/0.39

2023/0.18

2024/1.21

2025/2.84

2026/4.06 |

| Current Year | Next Year |

| Sales Improve: | 125.60% | 42.60% |

| |

| EPS Growth Estimates |

|

| Current Qtr. | 100.00% |

| Next Qtr. | 72.30% |

| Current Year | 138.70% |

| Next Year | 43.00% |

| Next 5 Years (per annum) | 57.38% |

| Past 5 Years (per annum) | 66.59% |

--> Fincancial Situation yaer/year

| 2021 | 2022 | 2024 | ttm |

| Current Liabilities/Current Asset: | 15.03 | 28.44 | 23.97% |

| Non Current Liabilities/Non current Asset: | 86.2 | 69.12 | 56.67% |

| Total Liabilities/Current Asset: | 60.96 | 82.69 | 51.3% |

| Y/Y short debt situation: | 10.44 | 51.39 | 61.98% |

| Y/Y long debt situation: | 66.06 | -5.45 | -3.18% |

--> 2Q average 3I

| 3Q | 2Q | 1Q |

| 2Q Increase Earnings: | 1042.3 | 700.04 | 397.44% |

| 2Q Revenue increase: | 235.39 | 263.7 | 192.26% |

| 2Q NeT income Ratio: | 53.29 | 56.35 | 56.19% |

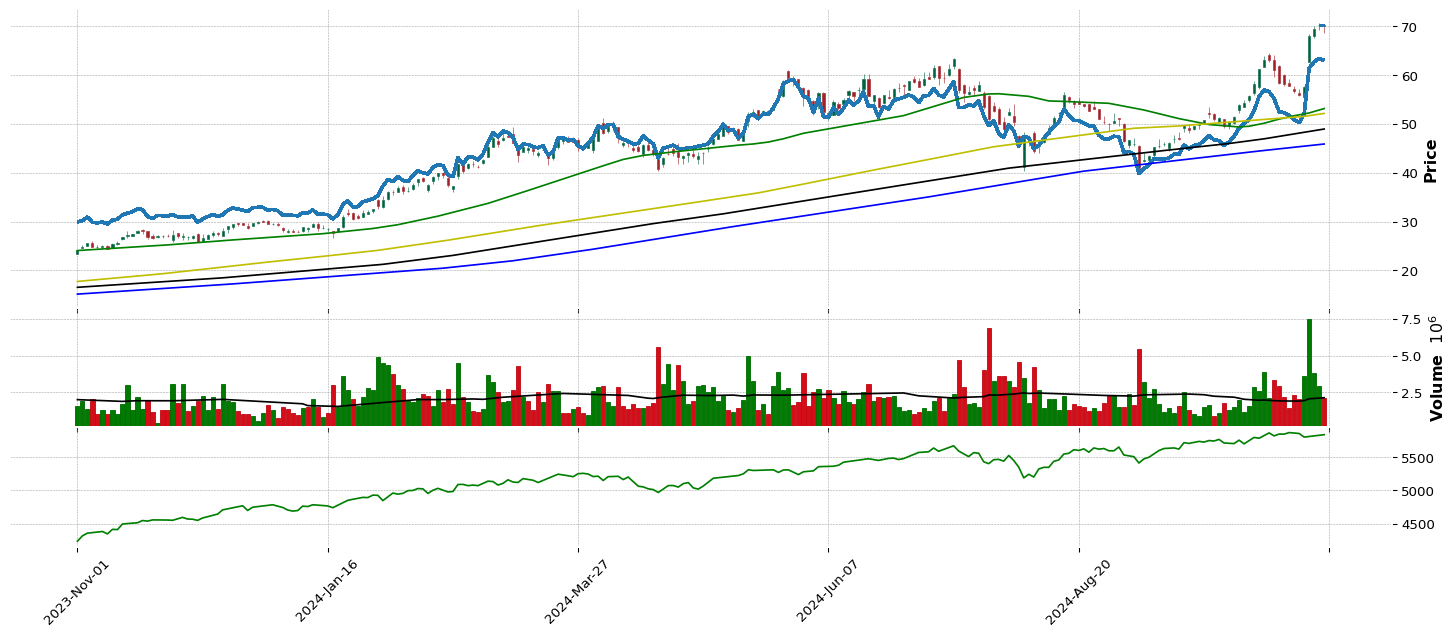

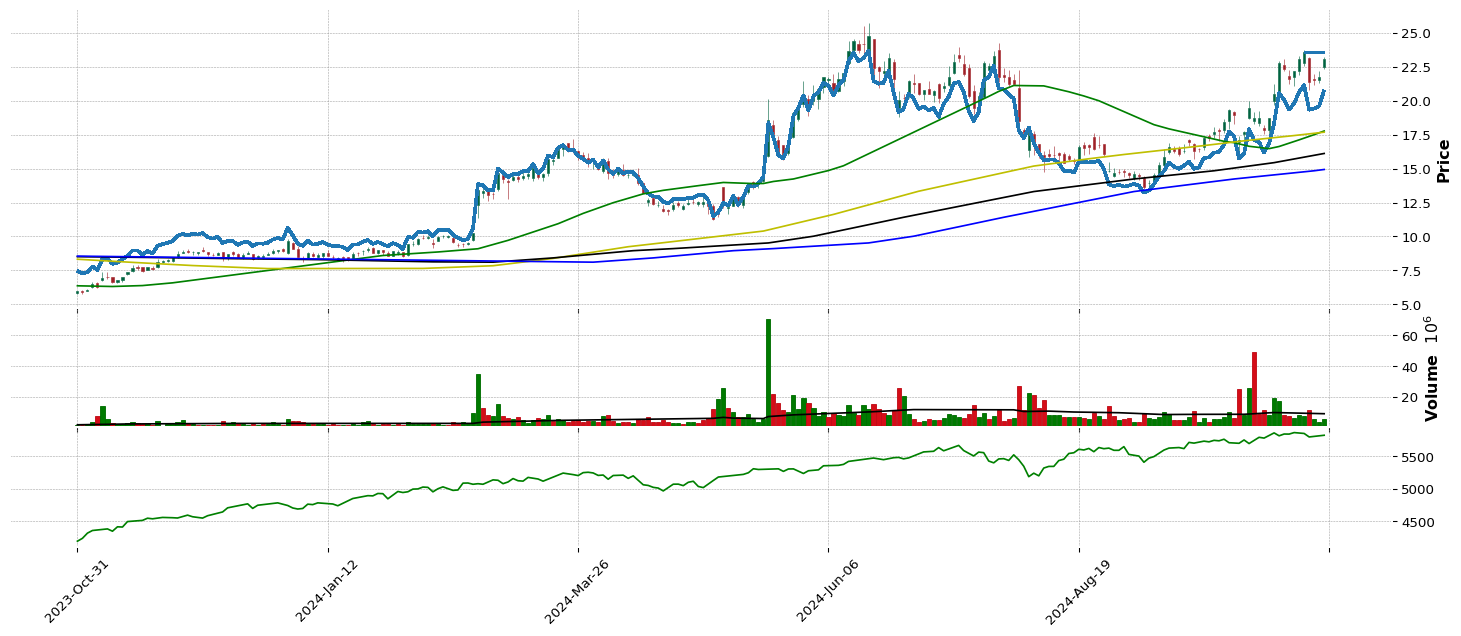

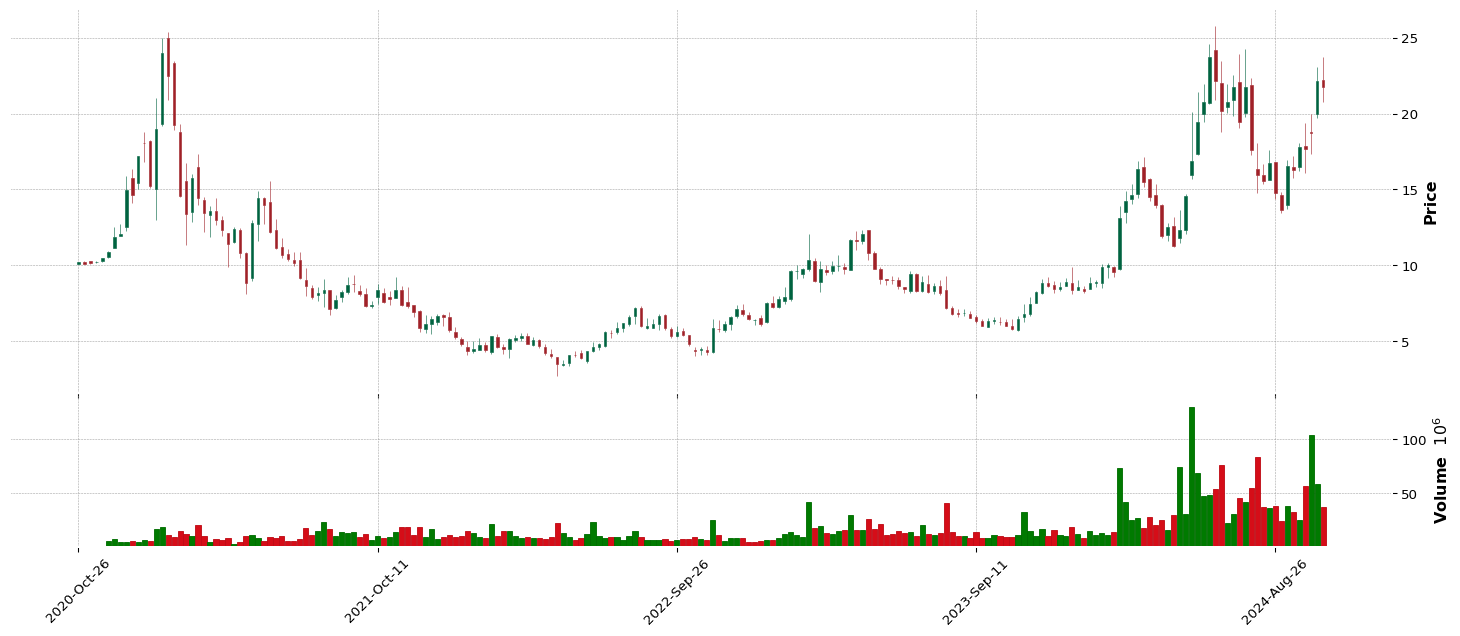

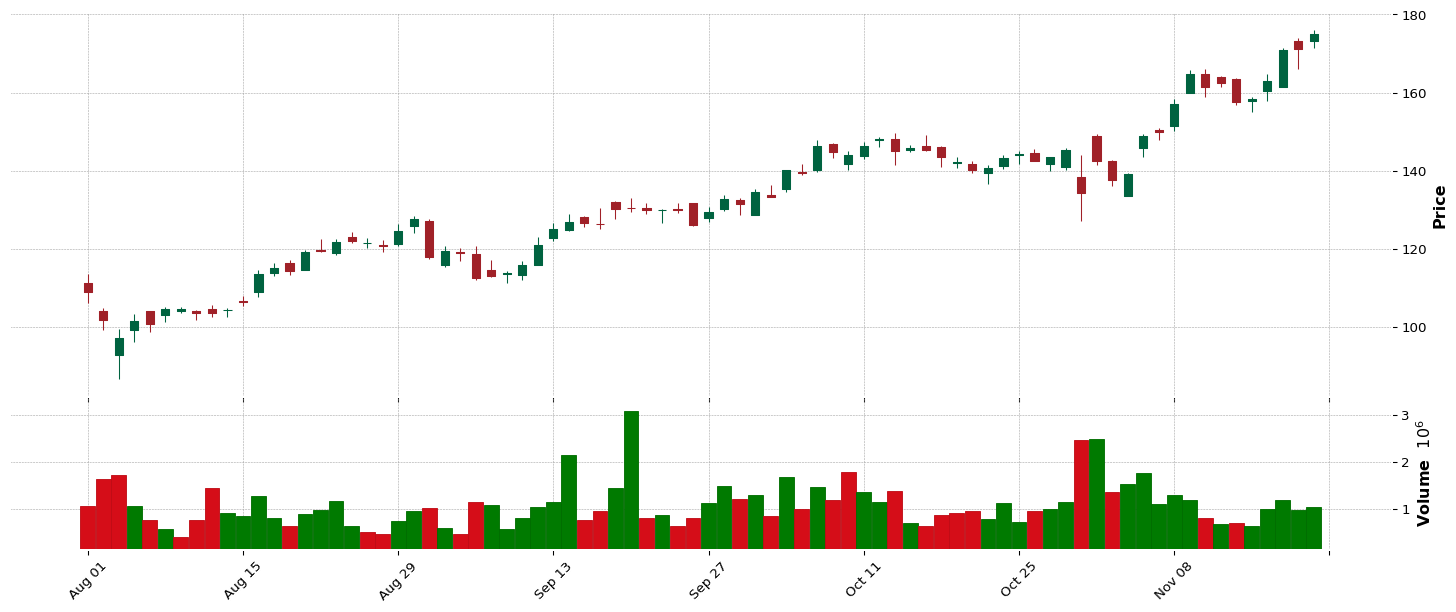

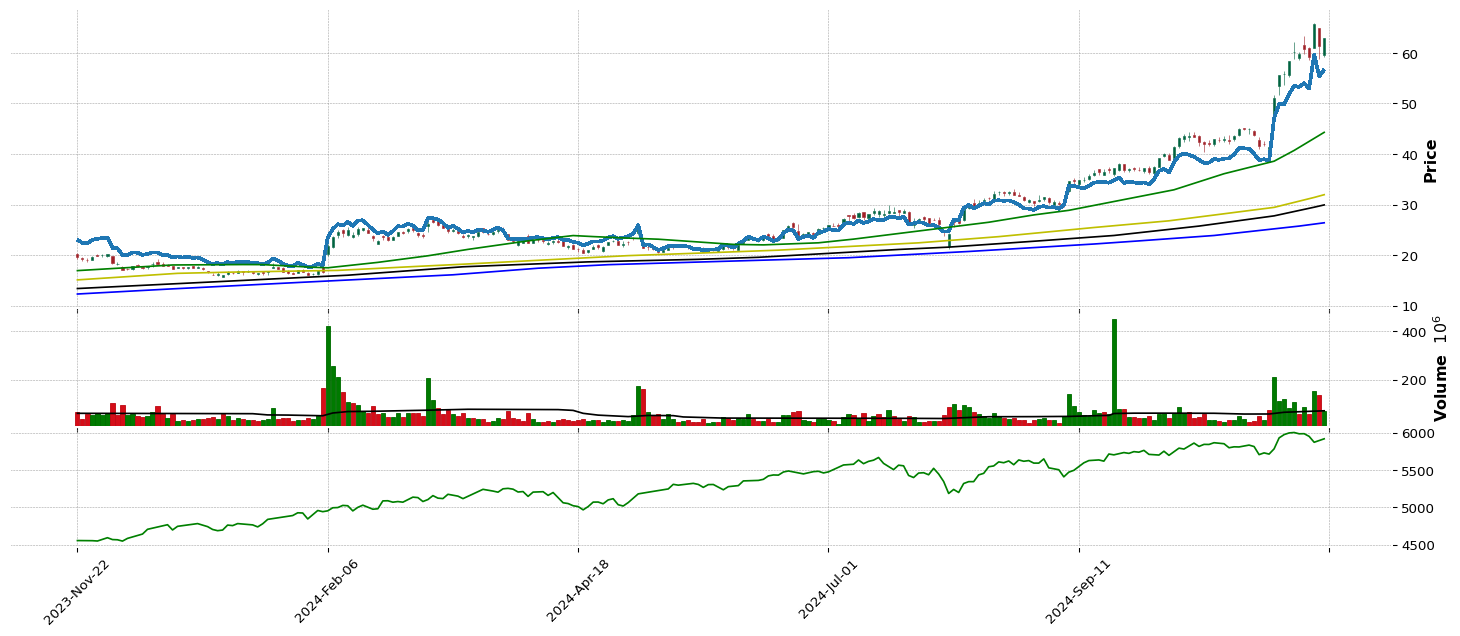

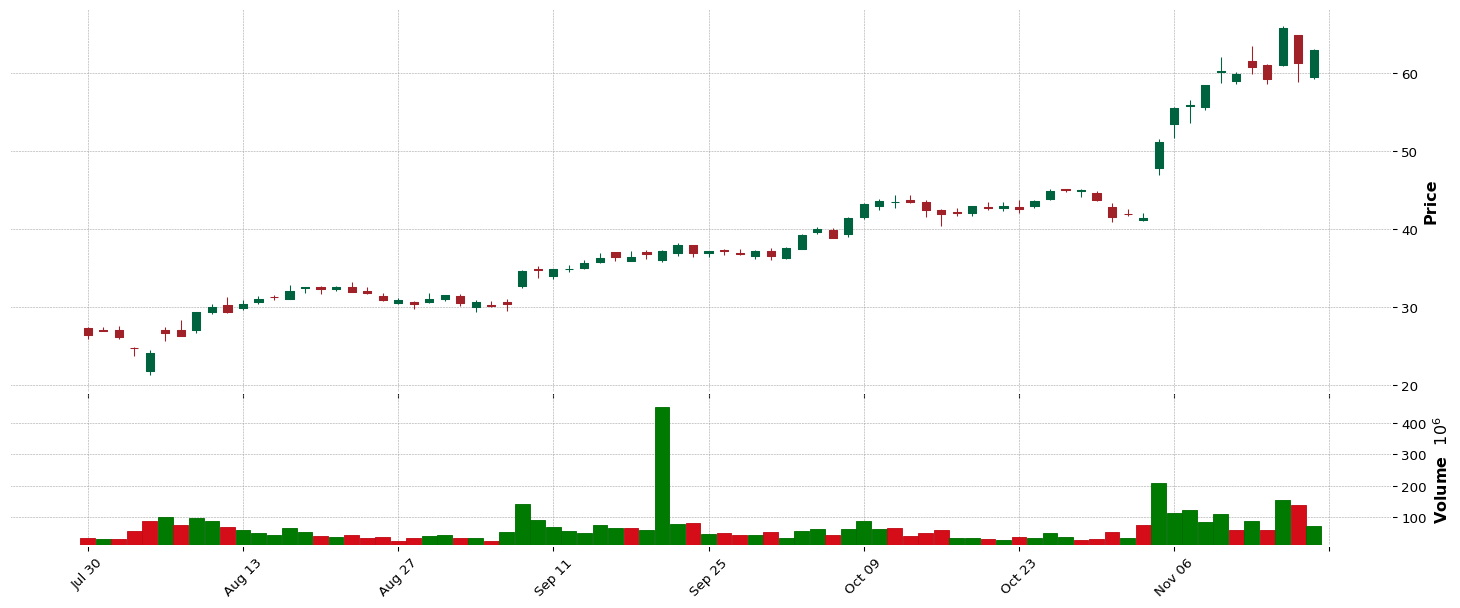

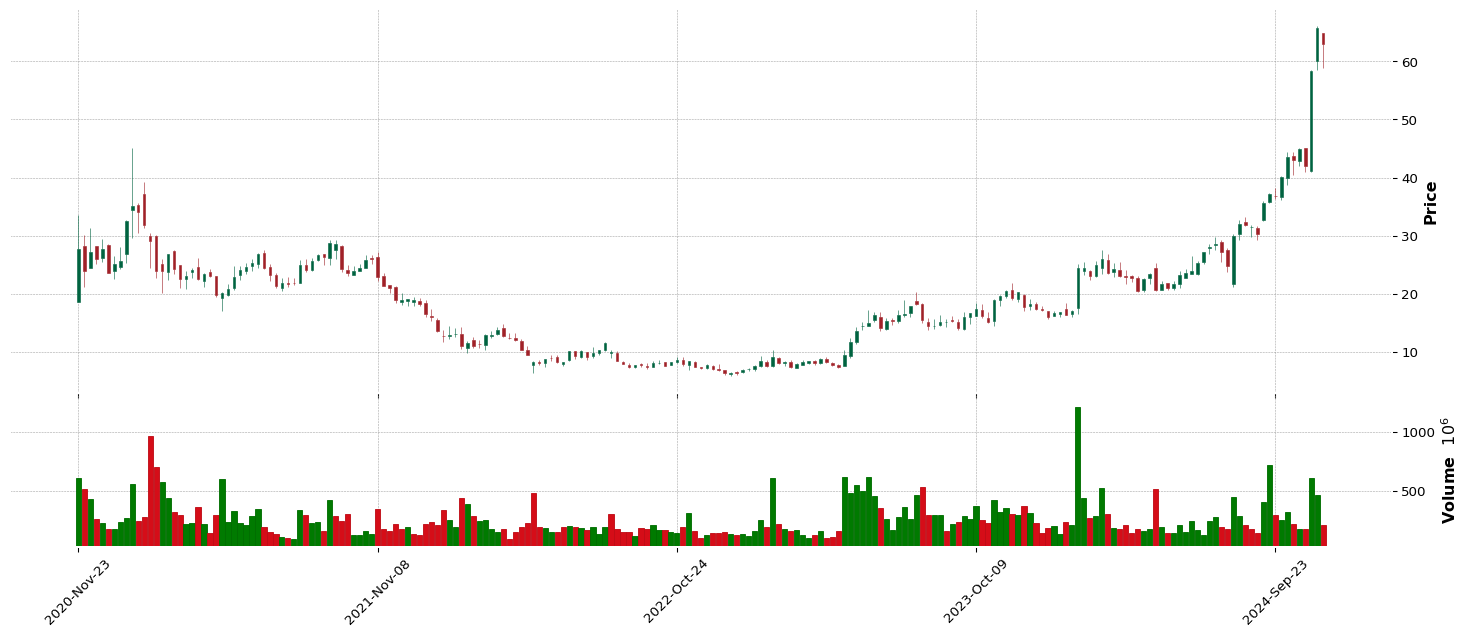

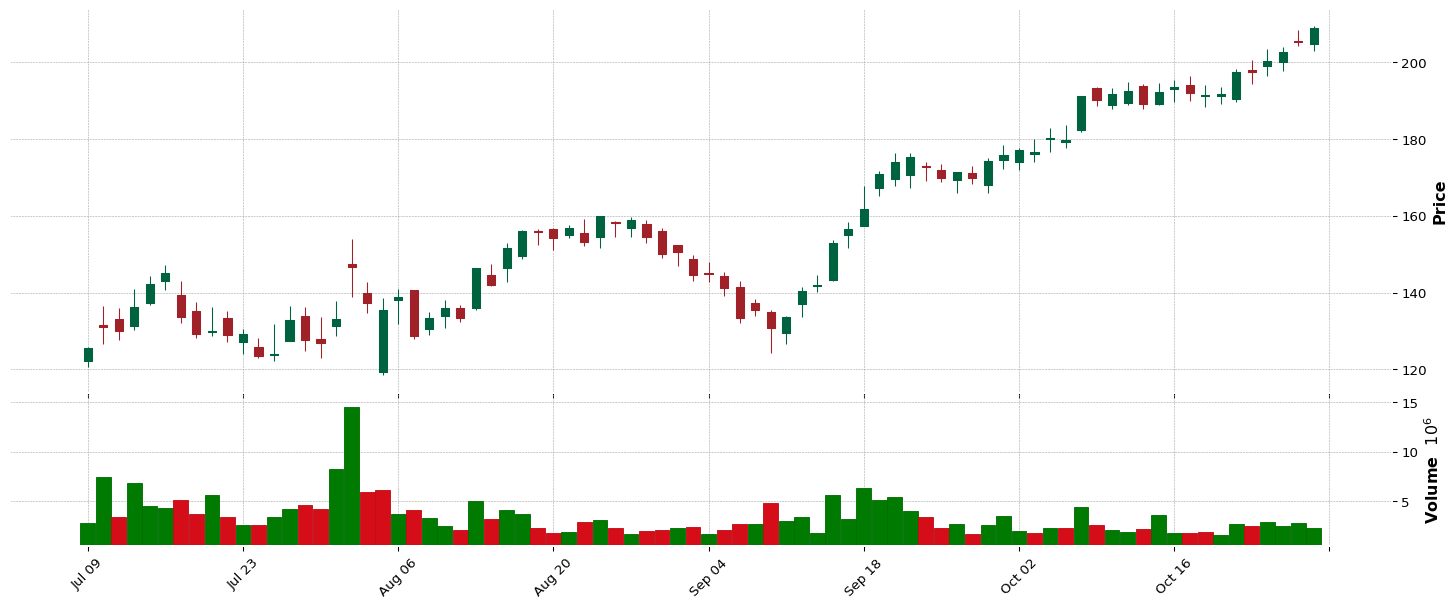

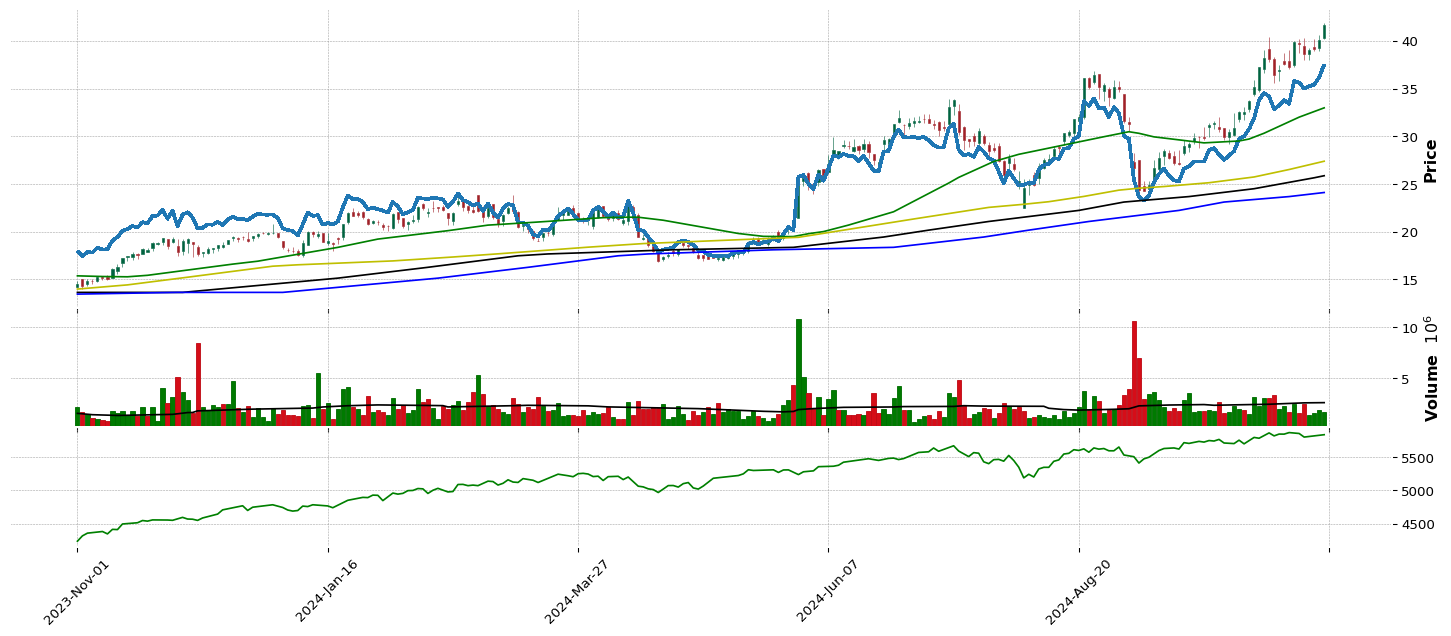

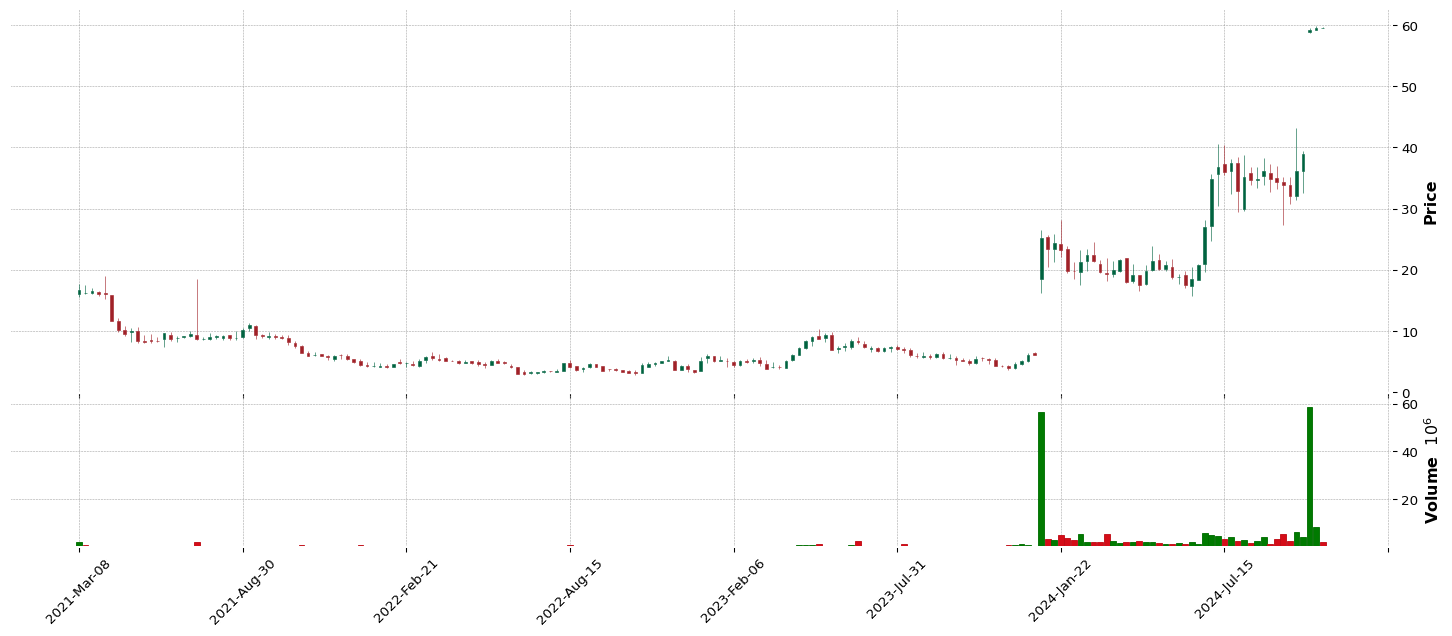

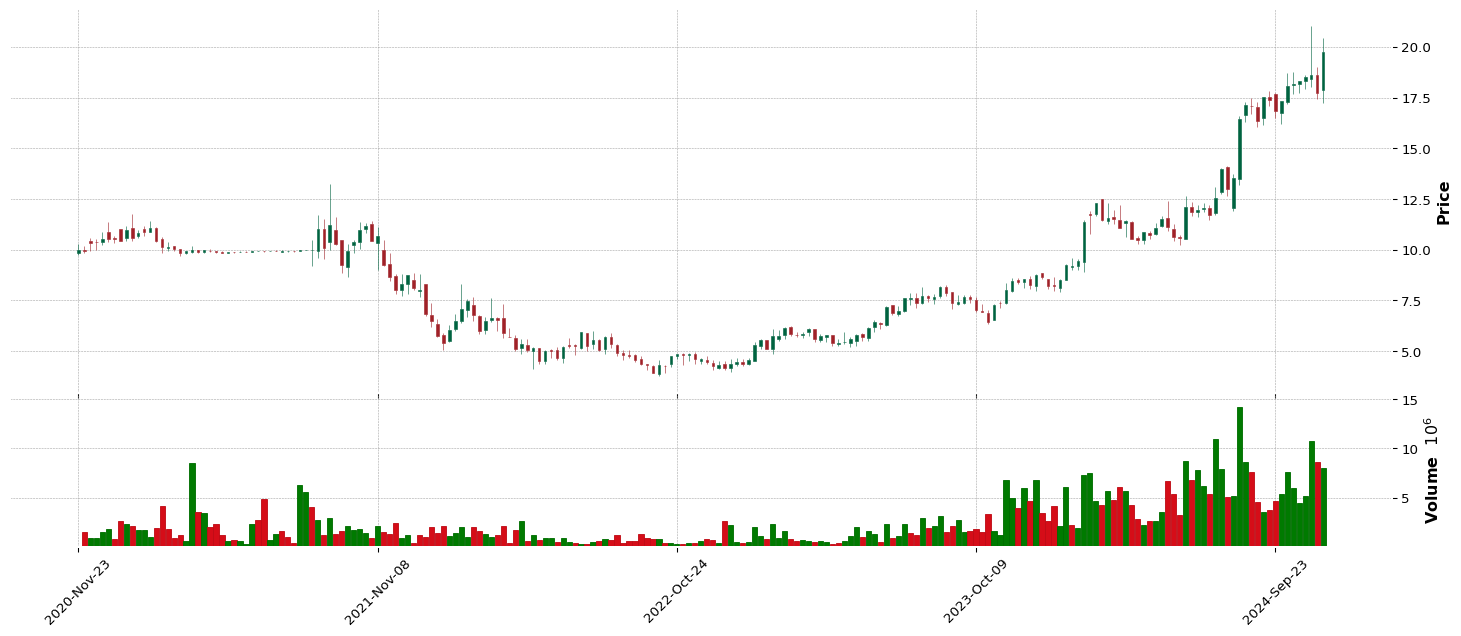

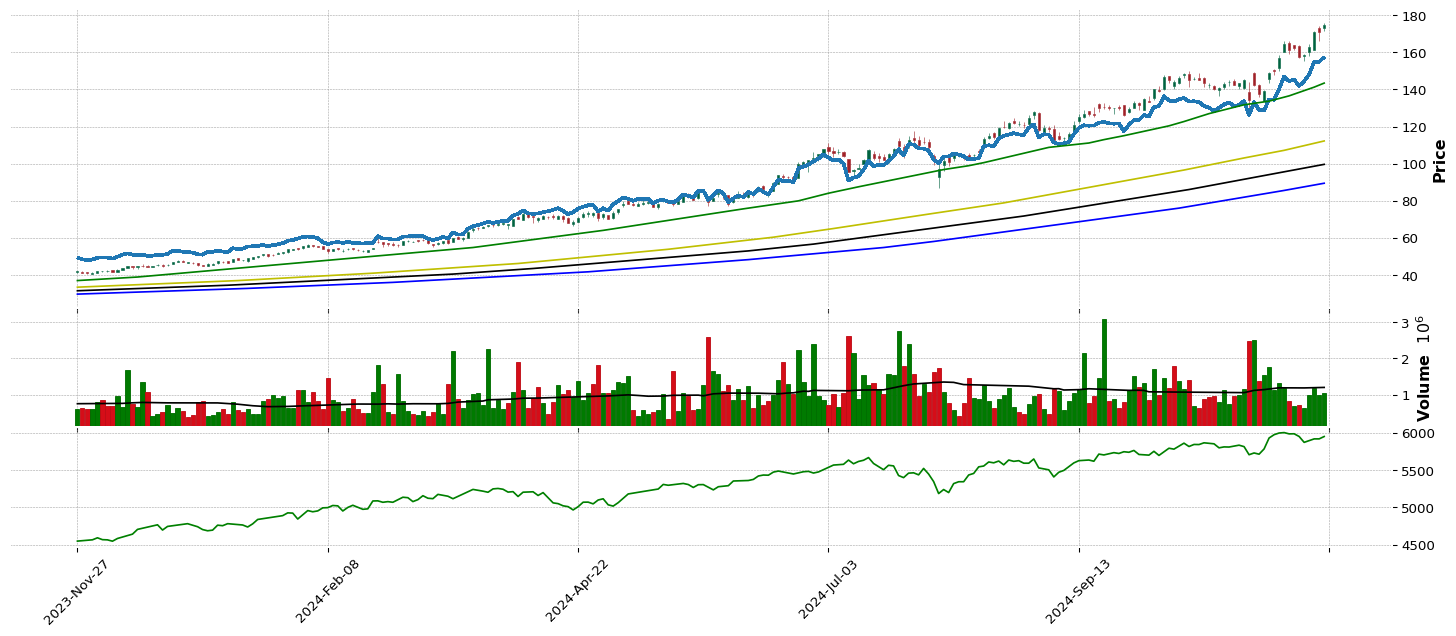

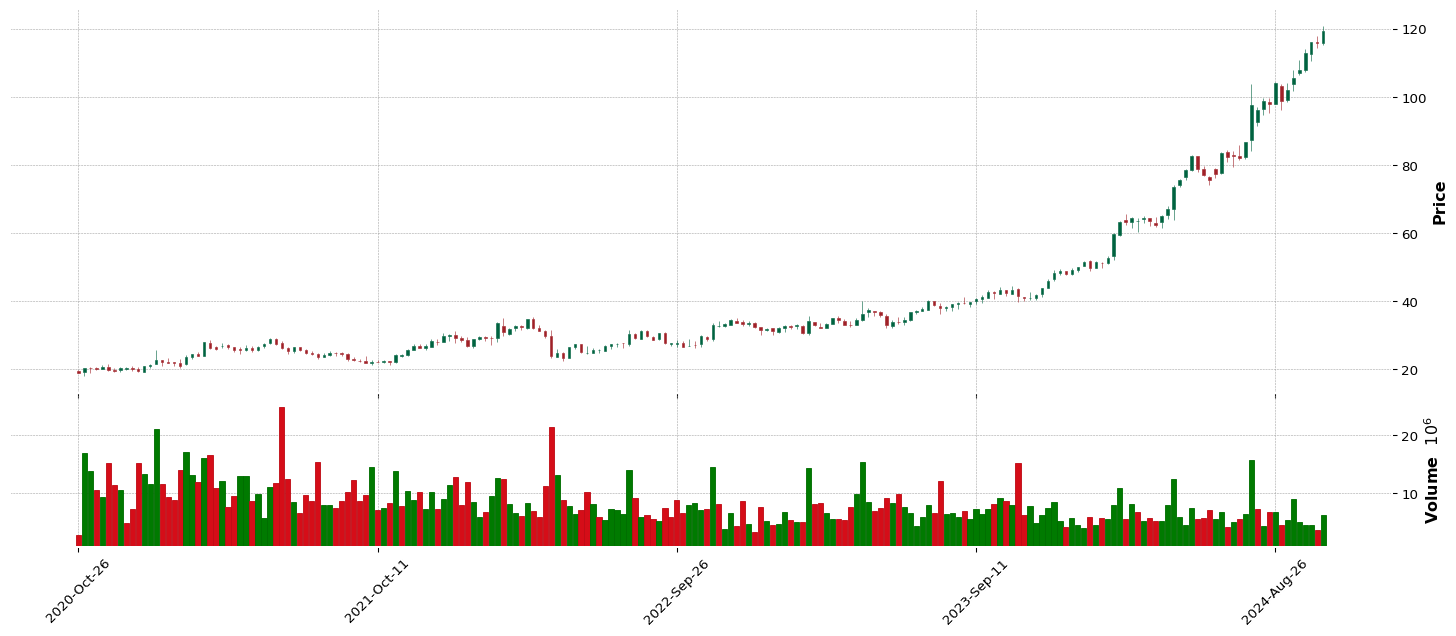

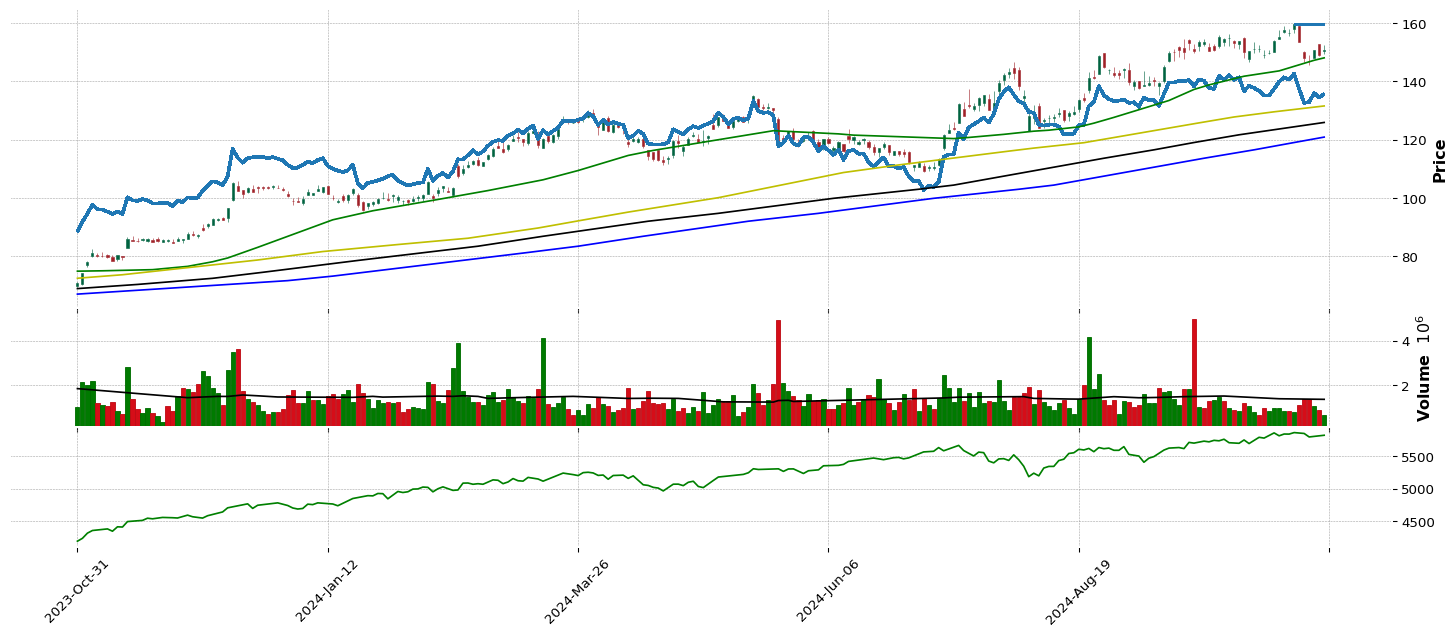

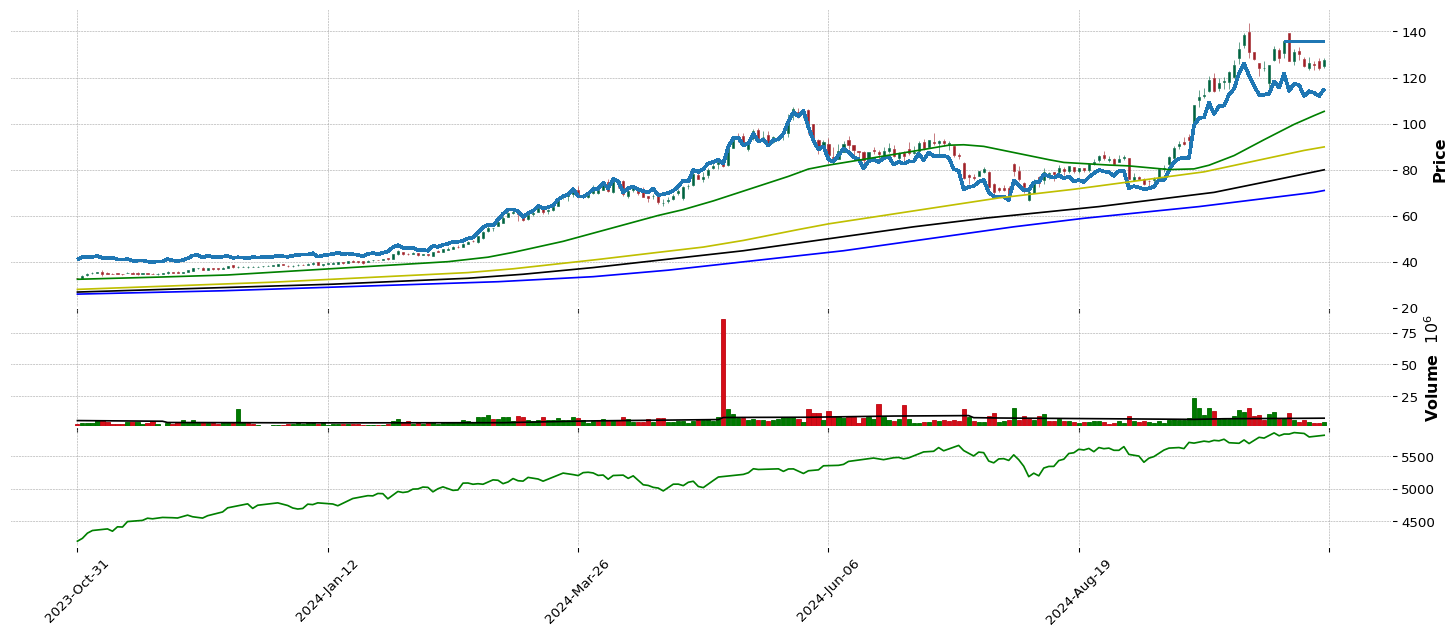

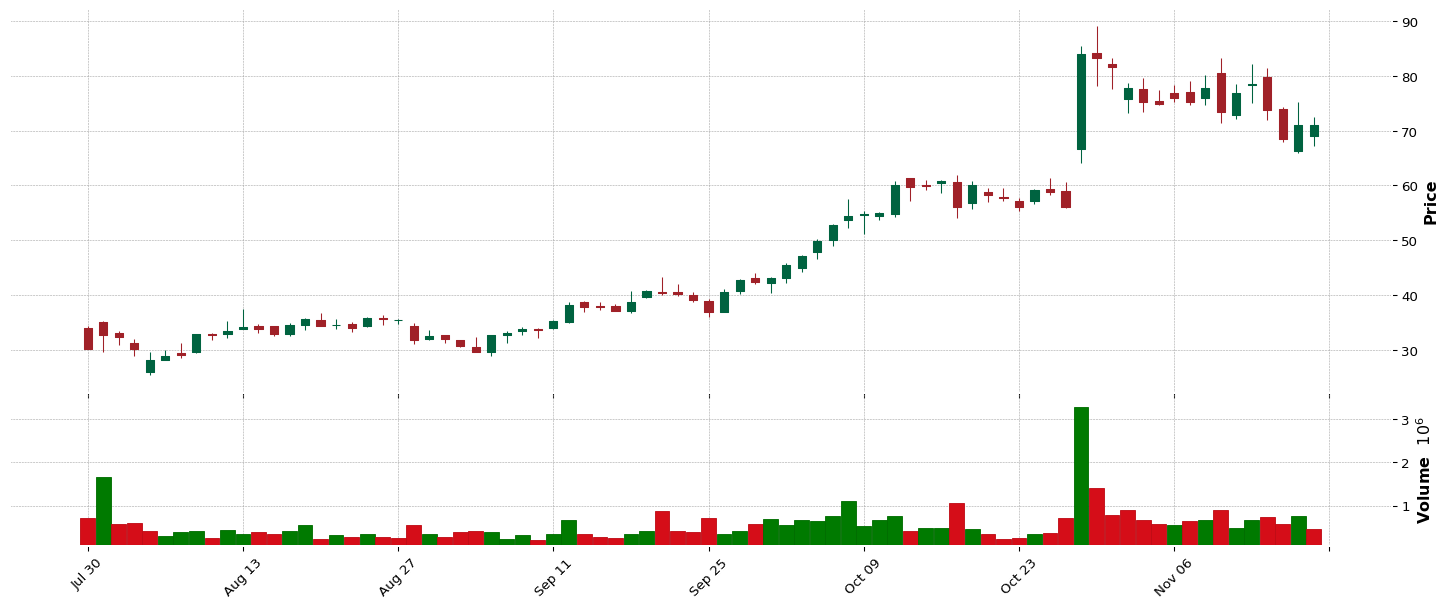

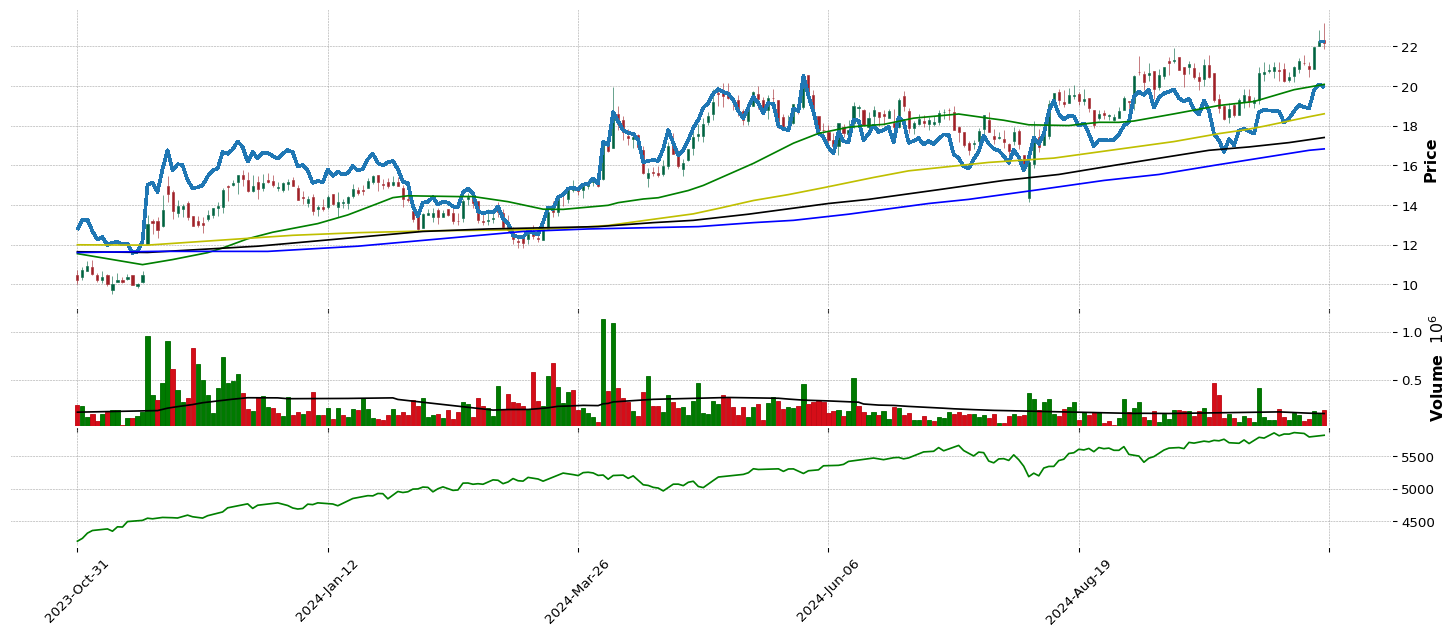

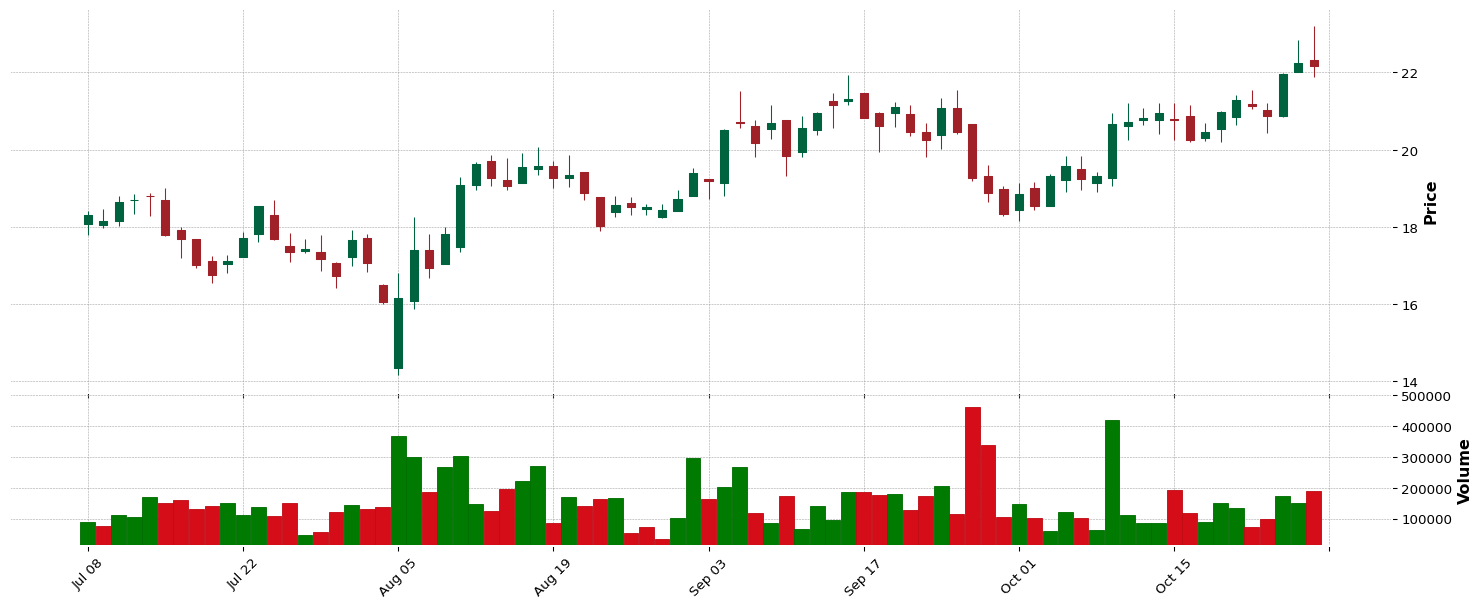

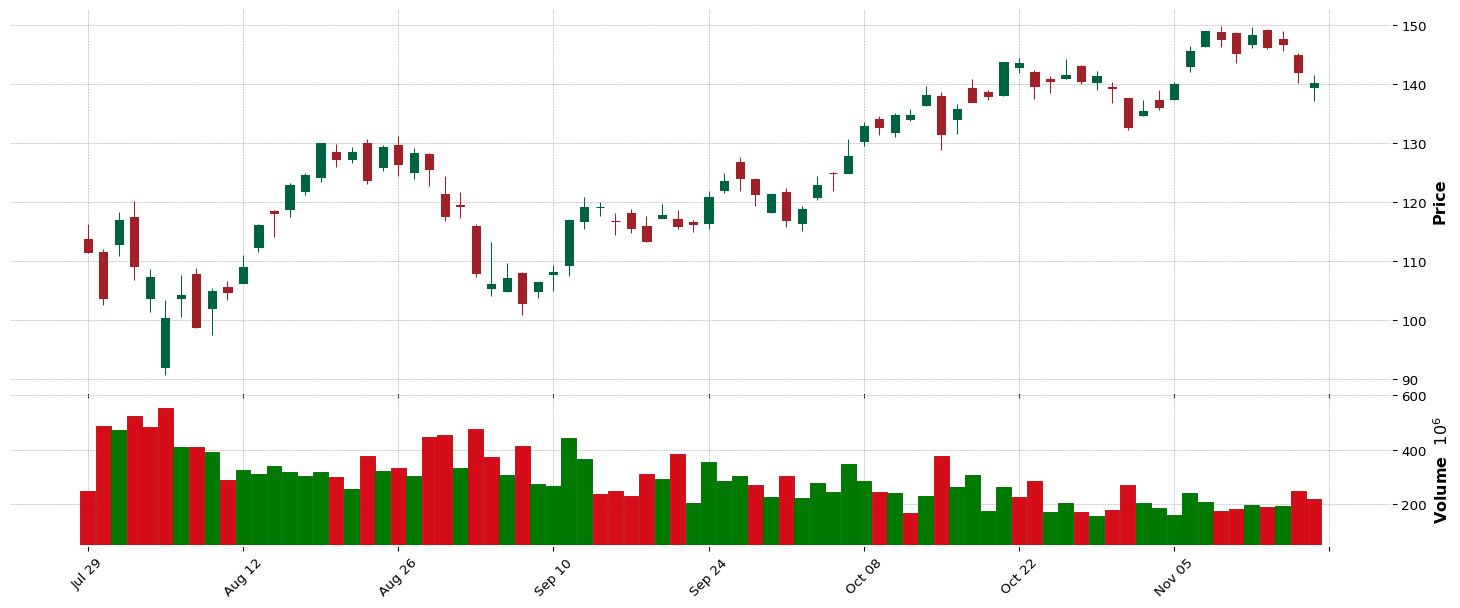

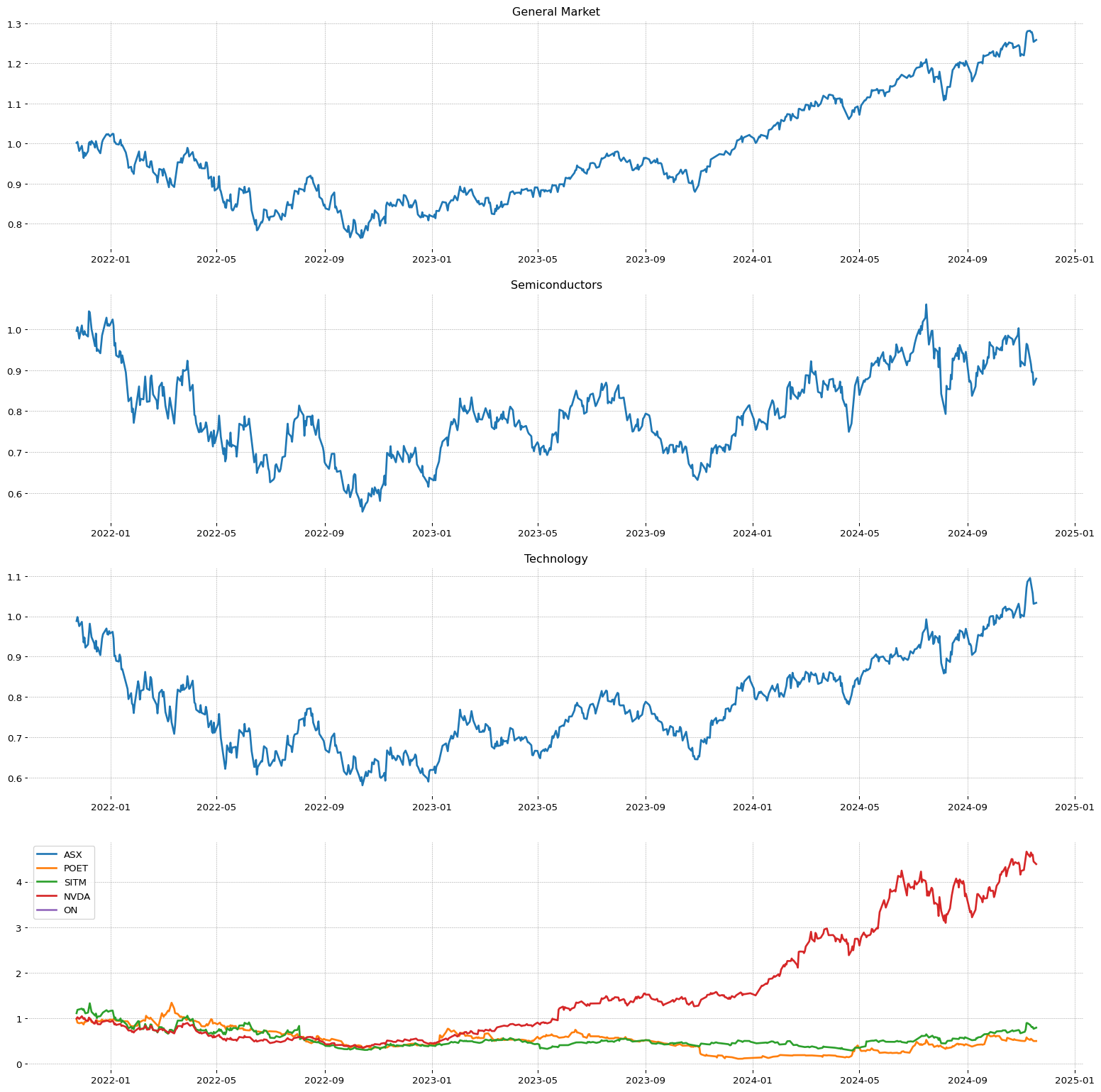

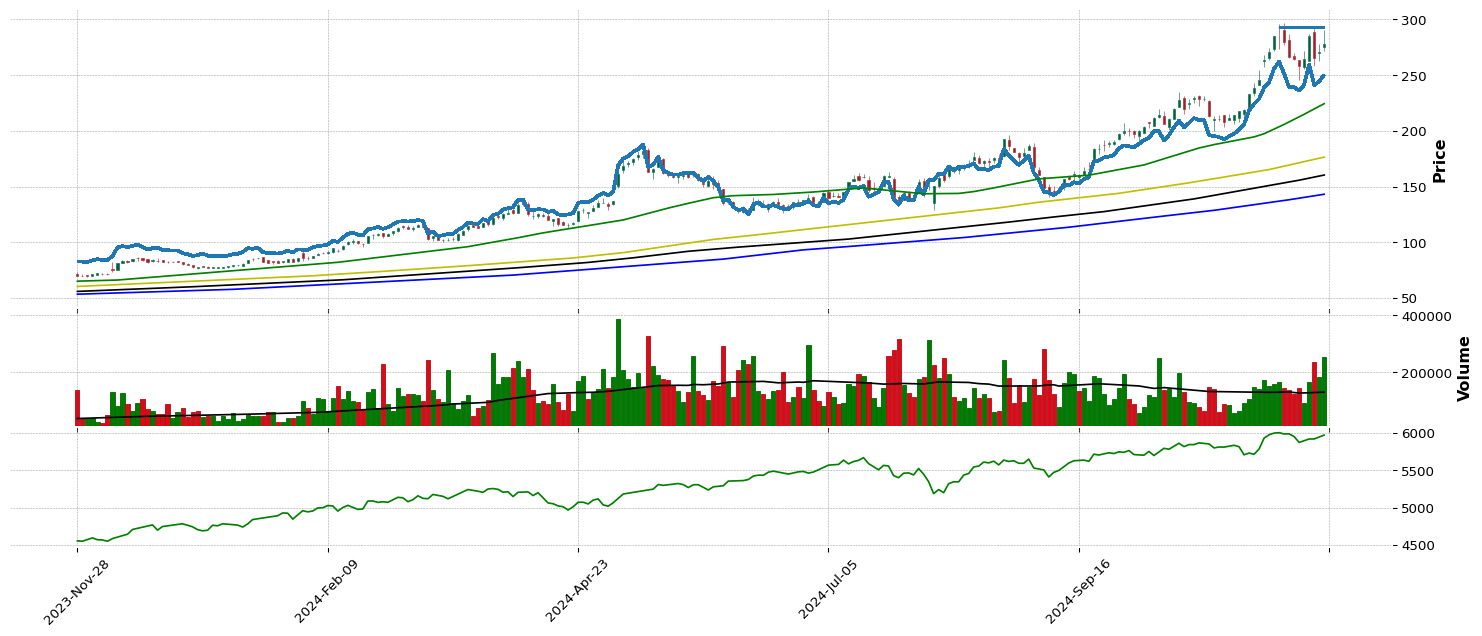

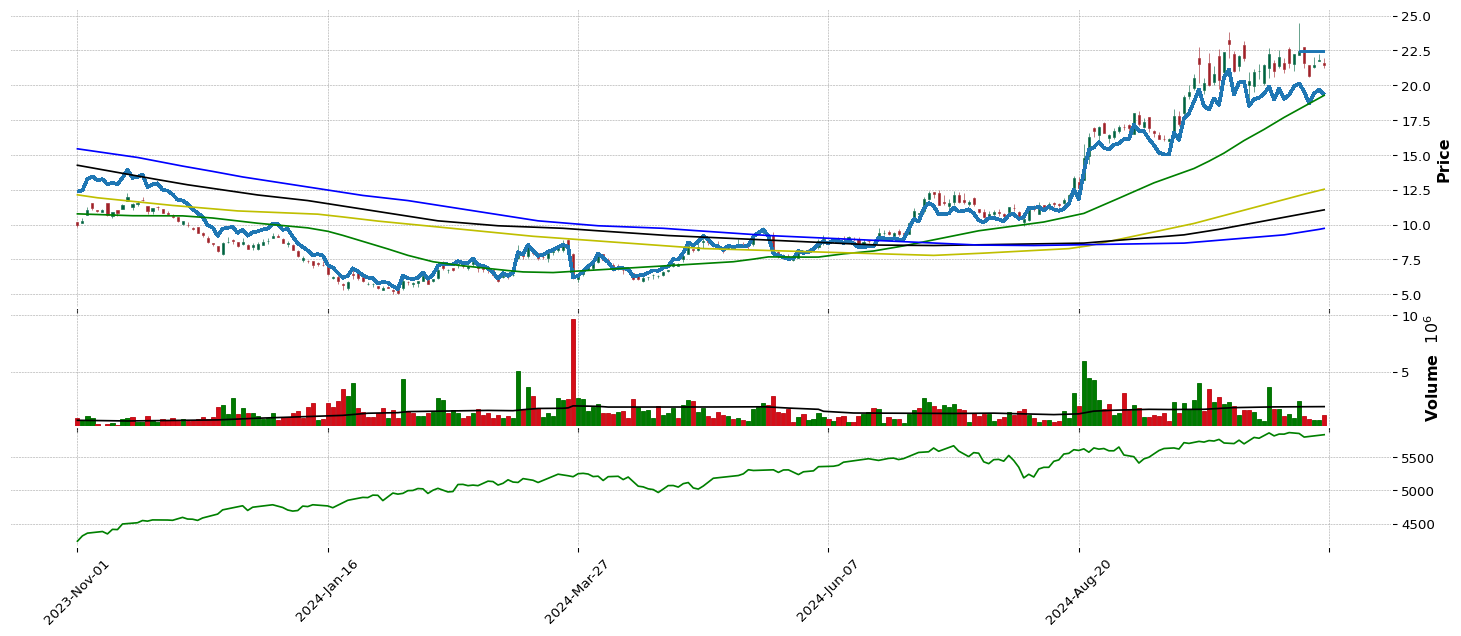

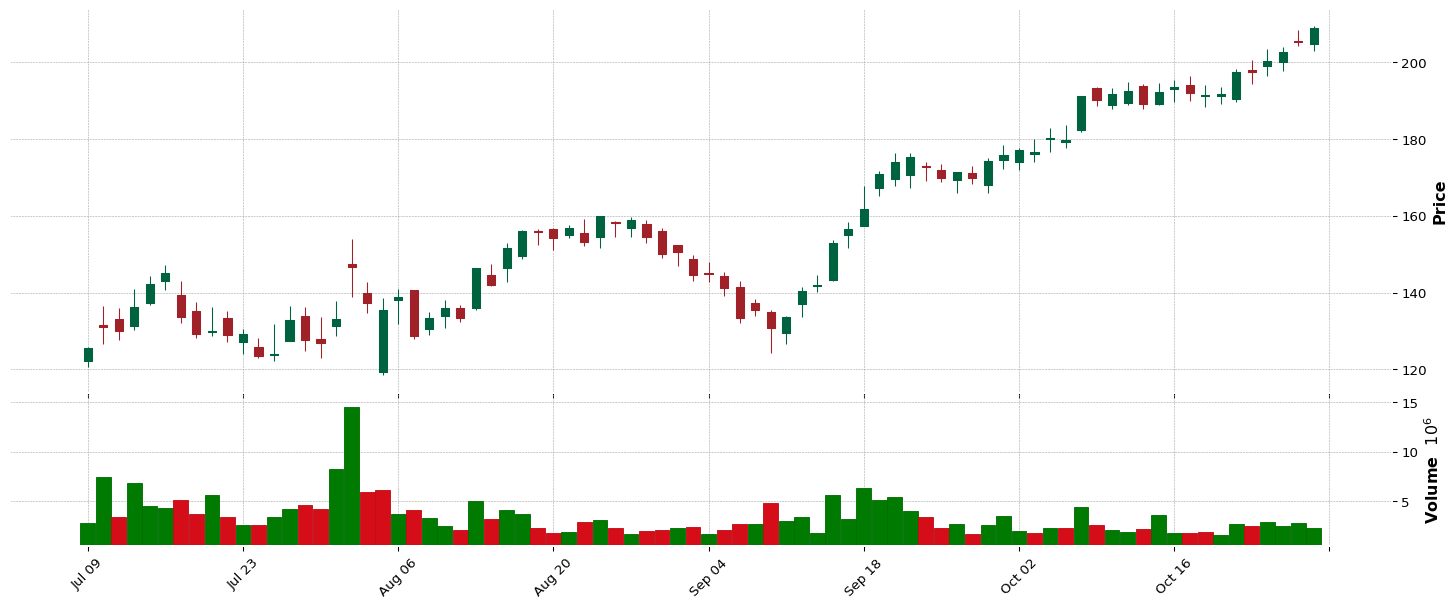

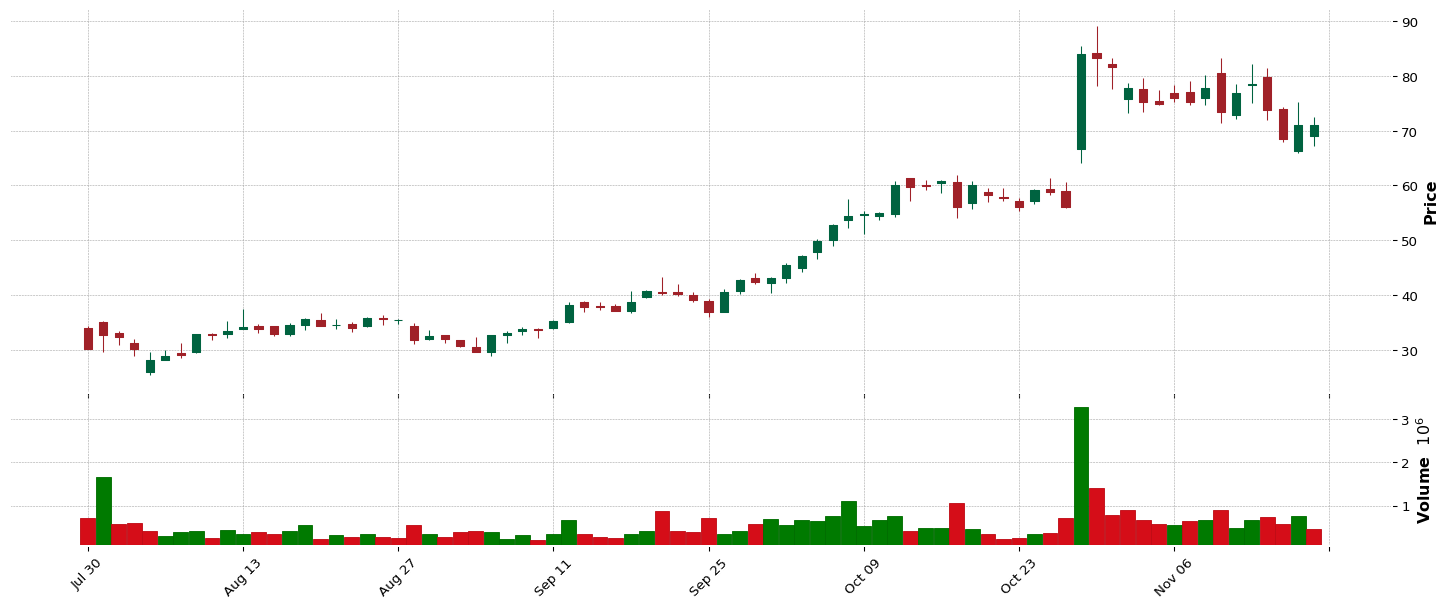

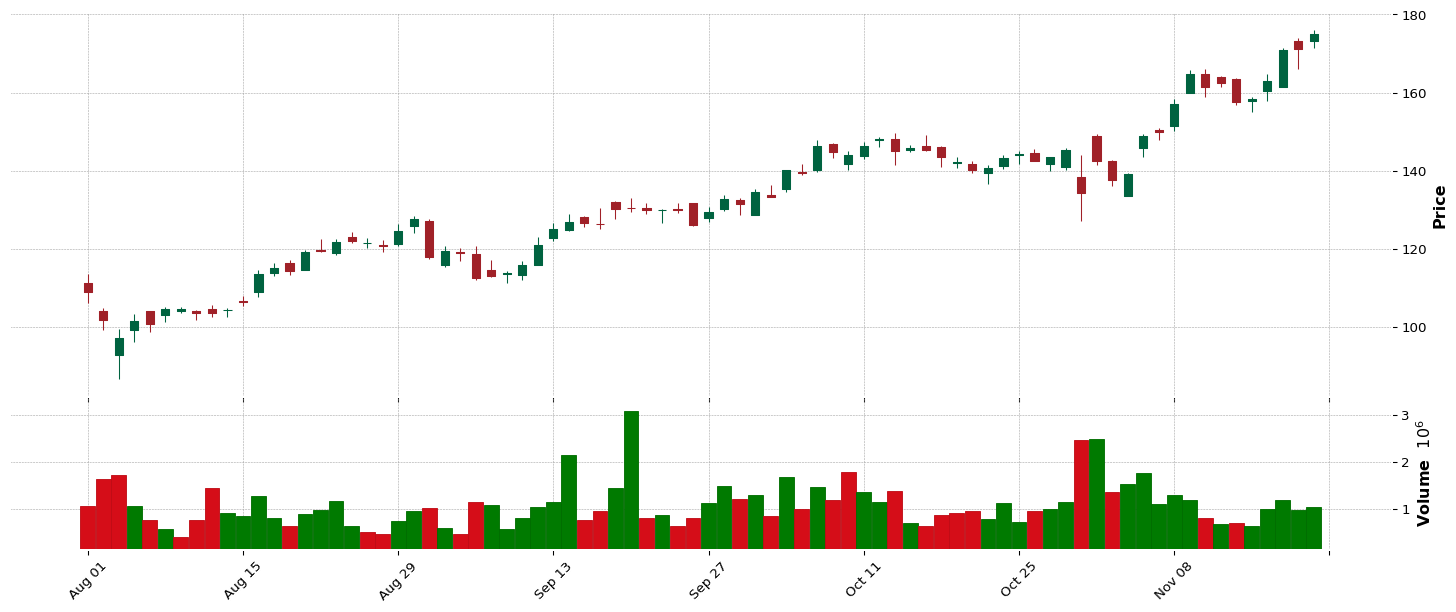

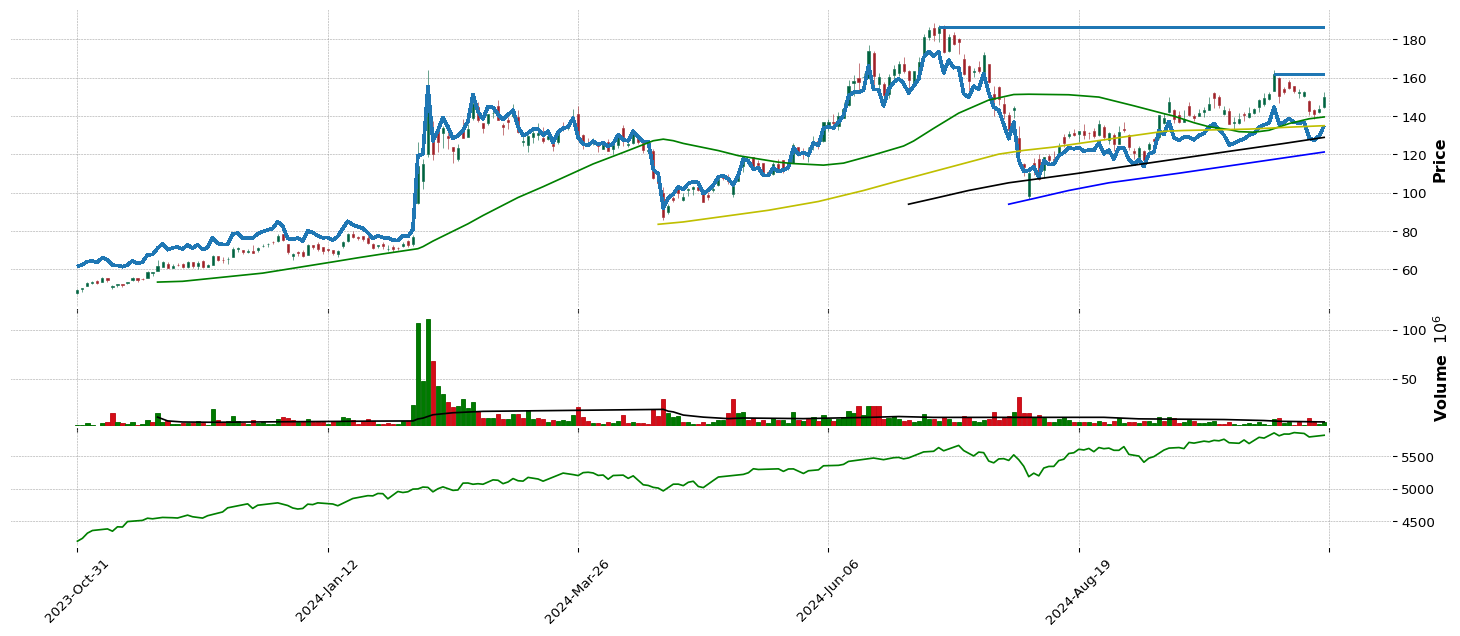

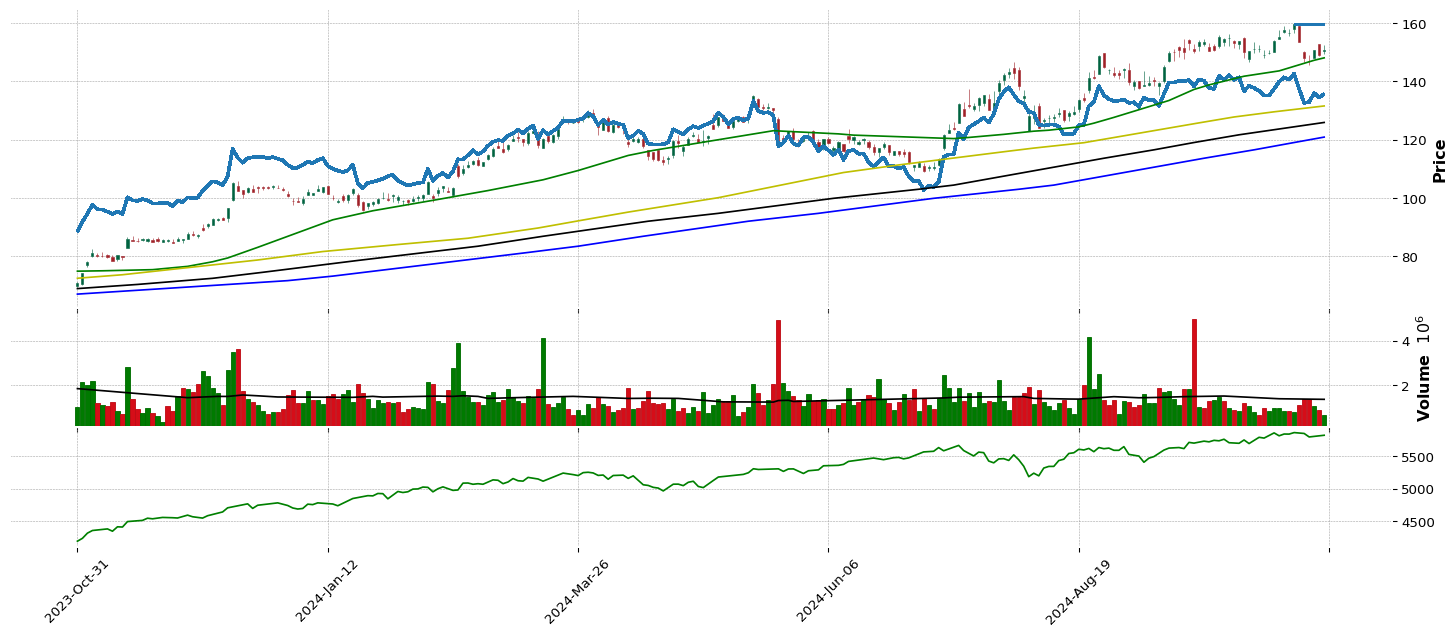

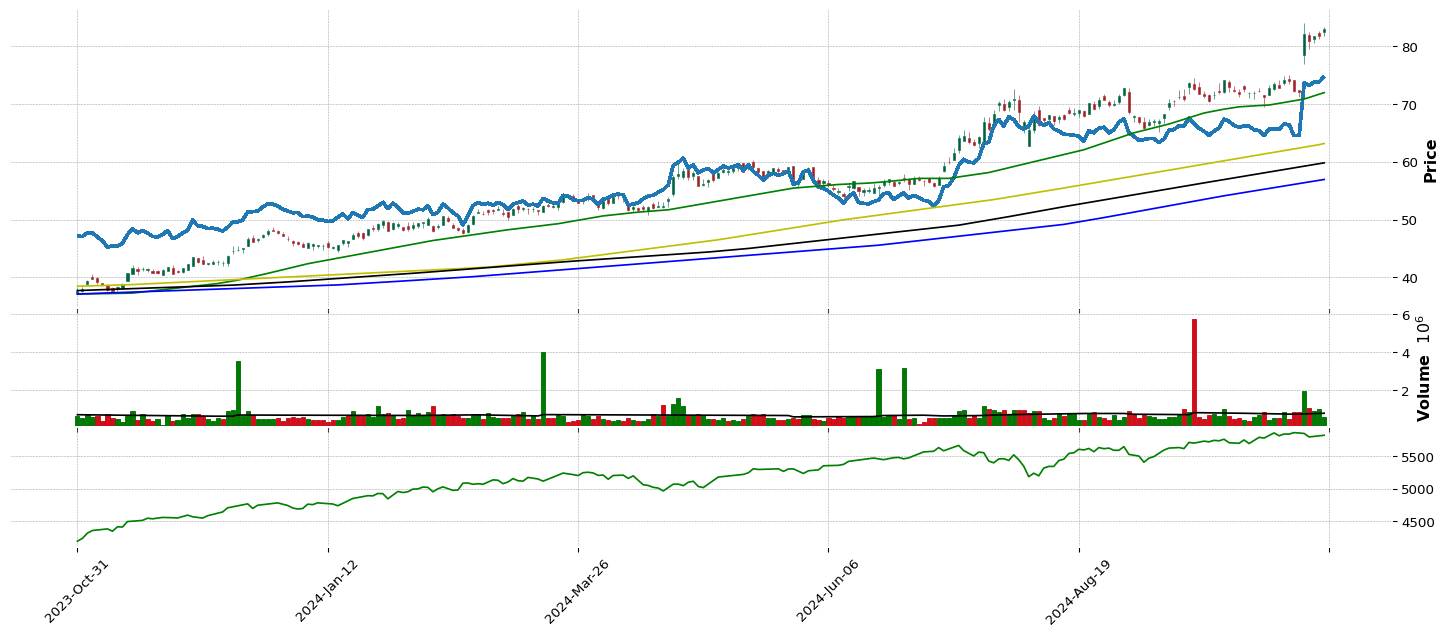

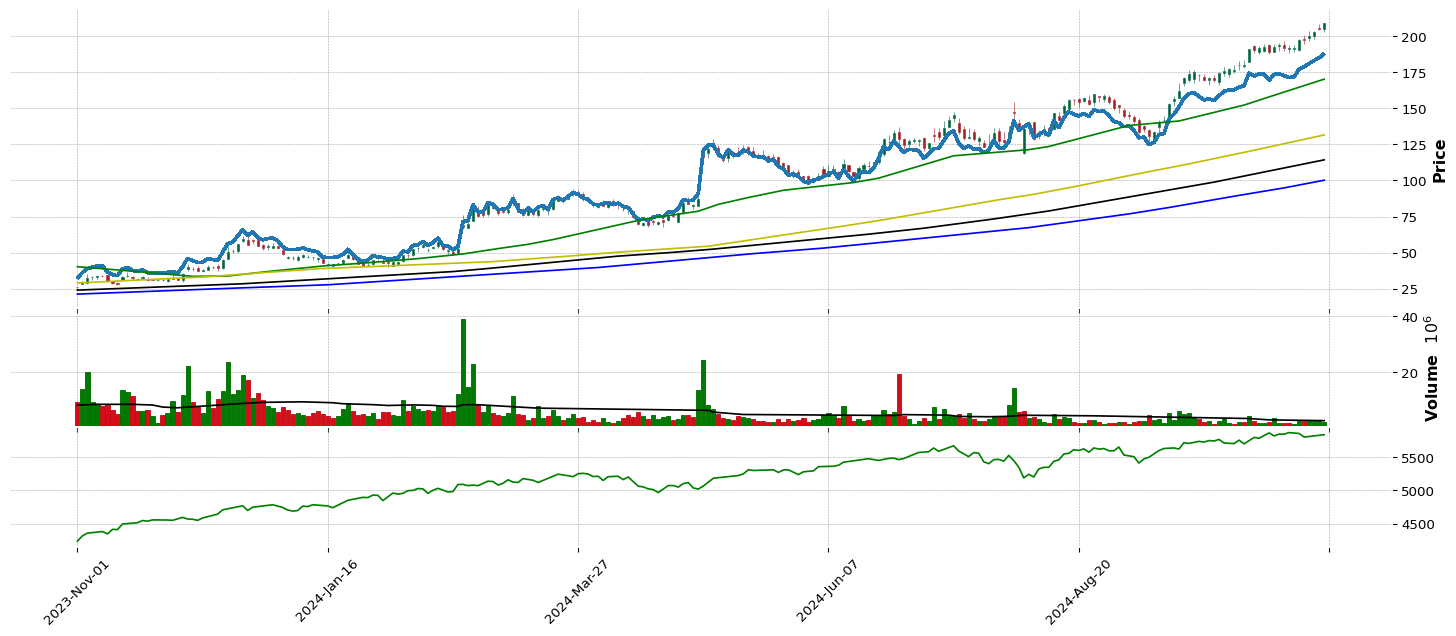

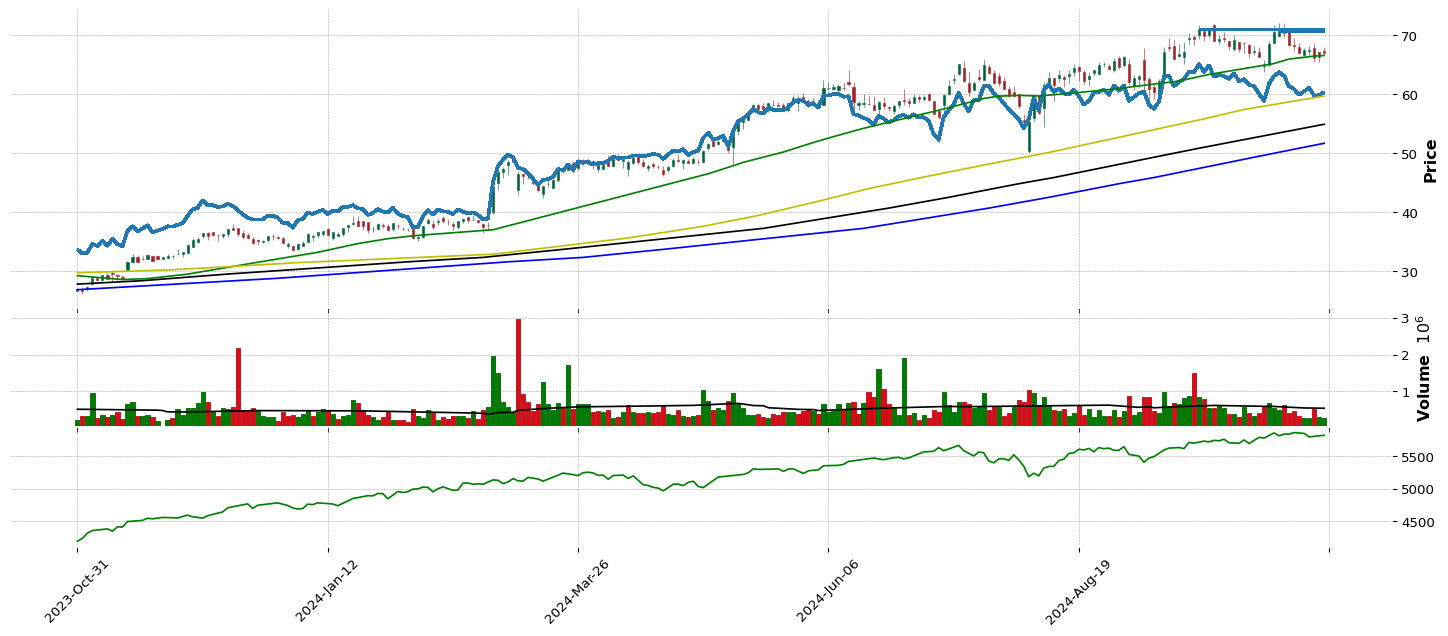

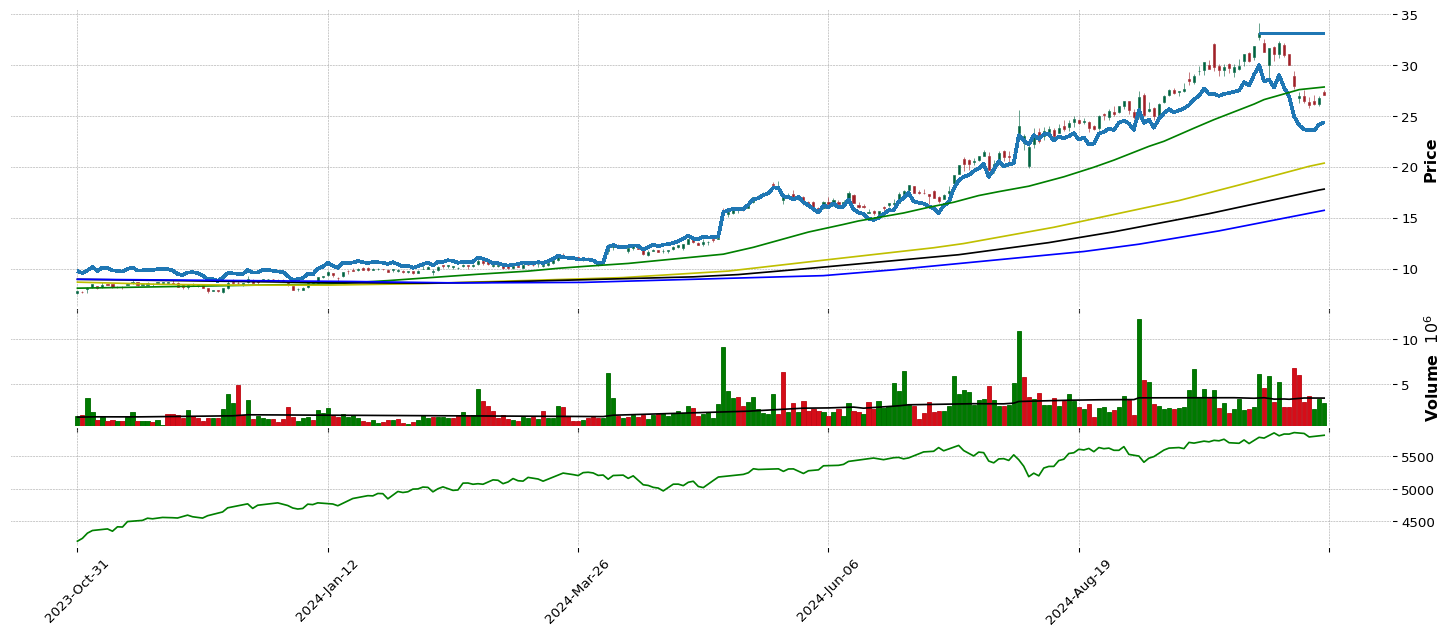

**** FONDAMENTALE ****CLS

***************************

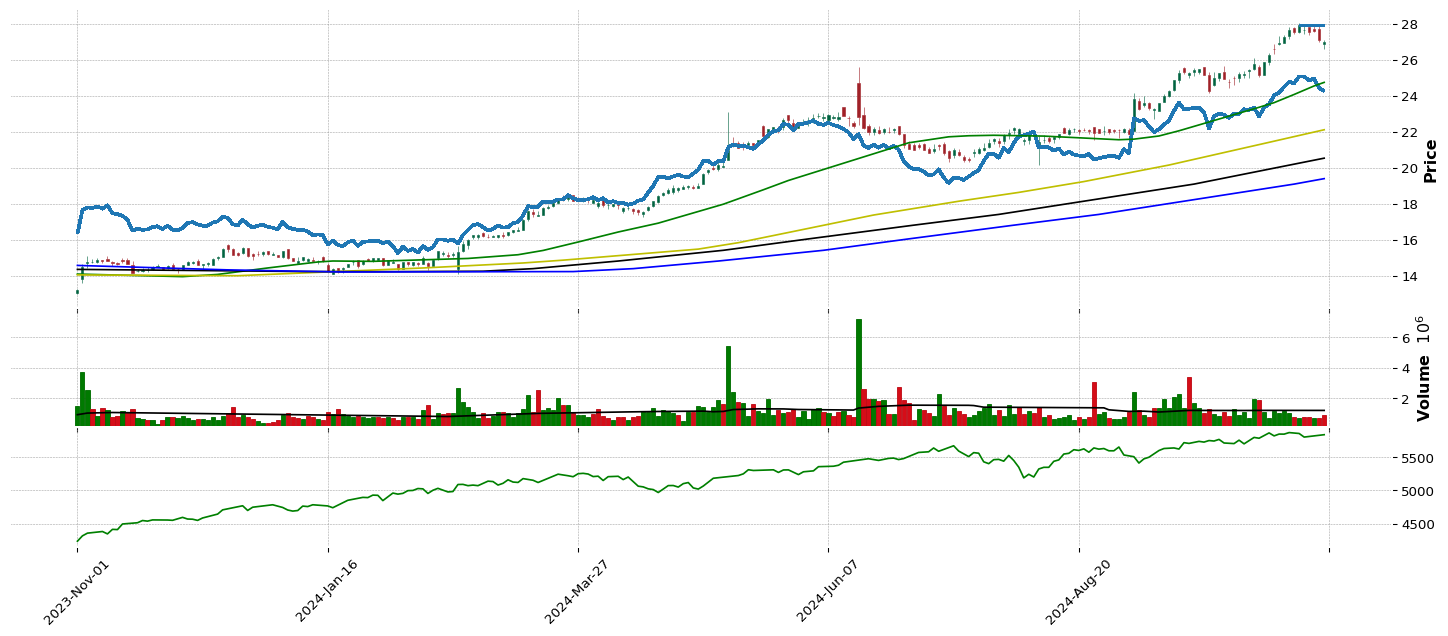

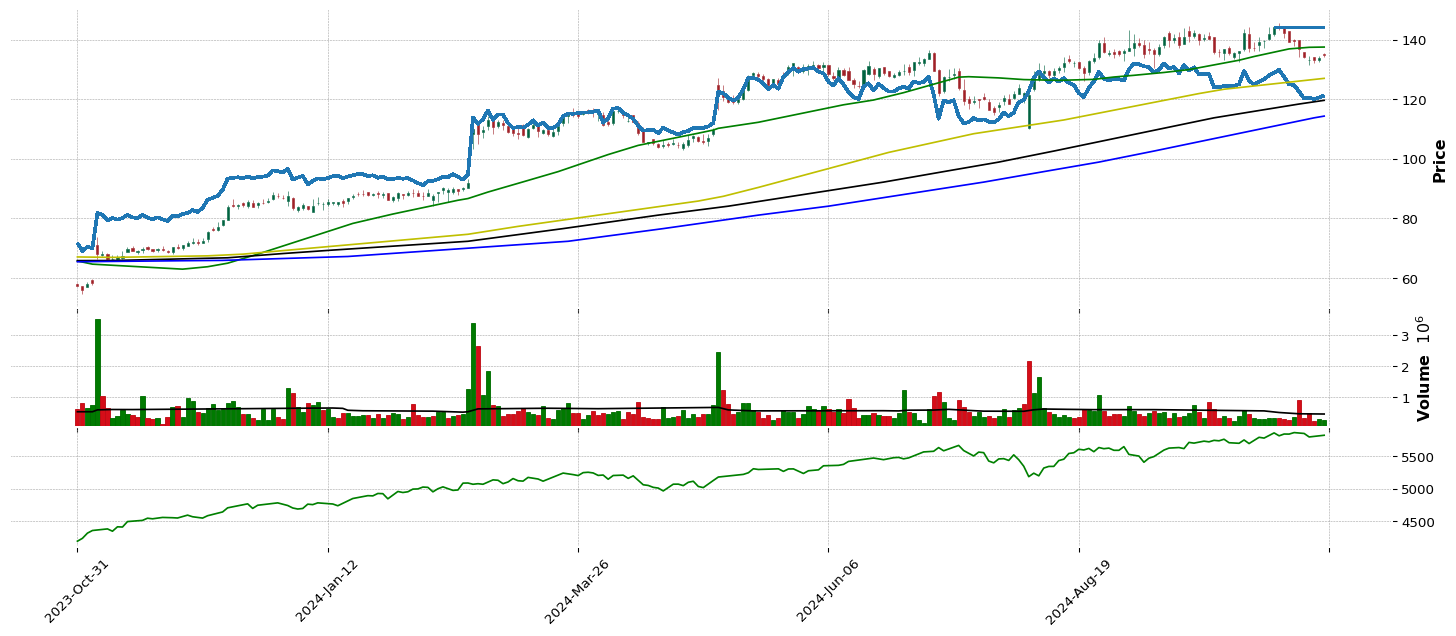

--> GENERAL INFORMATION CLS :

| Total stock number: | 116.94M |

| Market Cap: | 8.443030366B |

| Namee: | Celestica Inc. |

| IPO date: | 1998-06-30 |

| Type of Sector: | Technology |

| Sector Position: | 2/11 |

| RSI Sector: | 38/445 |

| Type of industry: | Electronic Components |

| Industry stock position: | 39/147 |

| Industry stock position: | 1/22 |

| RS Rating: | 96.76 |

| EPS Rating: | 99.22 |

| SMR Rating: | 96.63 |

| 1 year return: | 201.07 |

| Stability Value of Earnigs: | 24.65 |

Top competitor on same industry:

| Stock: | RS | EPS | SMR | 2Q | 1Q |

| CLS | 96 | 99 | 96 | 324 | 78 |

| OUST | 88 | 0 | 0 | 0 | 0 |

| BHE | 86 | 86 | 52 | 11 | 10 |

| FLEX | 85 | 44 | 46 | 16 | -42 |

| GLW | 83 | 36 | 16 | 19 | -80 |

| TTMI | 82 | 96 | 46 | 276 | 291 |

| APH | 81 | 66 | 68 | 24 | 12 |

| FN | 75 | 0 | 0 | 0 | 0 |

| OLED | 68 | 64 | 39 | 43 | 5 |

| PLXS | 67 | 32 | 23 | -60 | 61 |

--->QUARTER

| 3Q | 2Q | 1Q |

| Increase Earnings of last quarters: | 324.99 | 78.72 | 18.18% |

| Quarter maggiori 20% / 50% / 100% in 20: | 1 | 0 | 0 |

| Percentage surprise: | 19.44 | 12.34 | 10.63% |

| 2Q Increase Earnings: | 216.78 | 201.86 | 48.45% |

| 5/3/1 anno di Earnigs: | 0.34 | 0.49 | 0.8 |

| Perc. increase 3/1 Earnigs Vs 5/3: | | 42.95 | 60.8% |

| Revenue increase: | 19.65 | 23.3 | 23.31% |

| 2Q Revenue increase: | 13.67 | 21.48 | 23.3% |

| NeT income Ratio: | 4.62 | 4.16 | 3.66% |

| NeT income Increase: | 244.1 | 45.53 | -6.52% |

| EARNINGS | This Q | Next Q |

| this and next q growth: | 42.46 | 17.64% |

| Revision % of extimate growth | 10.63 | 7.52% |

| This Quarter / Next Quarter | 1.04 | 1.0 |

| last 7 | 0.95 | 0.94 |

| last 30 | 0.94 | 0.93 |

| last 60 | 0.94 | 0.93 |

| last 90 | 0.94 | 0.93 |

| REVENUE | This Q | Next Q |

| Growth sales extimation: | 17.10% | 8.90% |

--->ANNUAL

| 2021 | 2022 | 2023 | ttm |

| Earnings A/A increase: | 65.3 | 39.5 | 83.18% |

| Earnings 2 A/A increase: | 27.19 | 52.4 | 61.34% |

| ROE value: | 7.23 | 9.26 | 14.23 | 20.88% |

| Net income Increase: | 71.45 | 40.03 | 68.1% |

--> Annual breakout:

2014/0.61

2015/0.43

2016/0.98

2017/0.74

2018/0.71

2019/0.55

2020/0.49

2021/0.81

2022/1.13

2023/2.07

2024/3.85

2025/4.44 |

| Current Year | Next Year |

| Sales Improve: | 20.70% | 9.90% |

| |

| EPS Growth Estimates |

|

| Current Qtr. | 36.80% |

| Next Qtr. | 16.30% |

| Current Year | 58.40% |

| Next Year | 15.30% |

| Next 5 Years (per annum) | 28.00% |

| Past 5 Years (per annum) | 44.09% |

--> Fincancial Situation yaer/year

| 2020 | 2021 | 2023 | ttm |

| Current Liabilities/Current Asset: | 65.59 | 70.6 | 71.34% |

| Non Current Liabilities/Non current Asset: | 77.16 | 68.8 | 65.5% |

| Total Liabilities/Current Asset: | 93.26 | 91.29 | 91.34% |

| Y/Y short debt situation: | 42.78 | 35.57 | 4.83% |

| Y/Y long debt situation: | 40.4 | -5.81 | 0.33% |

--> 2Q average 3I

| 3Q | 2Q | 1Q |

| 2Q Increase Earnings: | 216.78 | 201.86 | 48.45% |

| 2Q Revenue increase: | 13.67 | 21.48 | 23.3% |

| 2Q NeT income Ratio: | 4.22 | 4.39 | 3.91% |

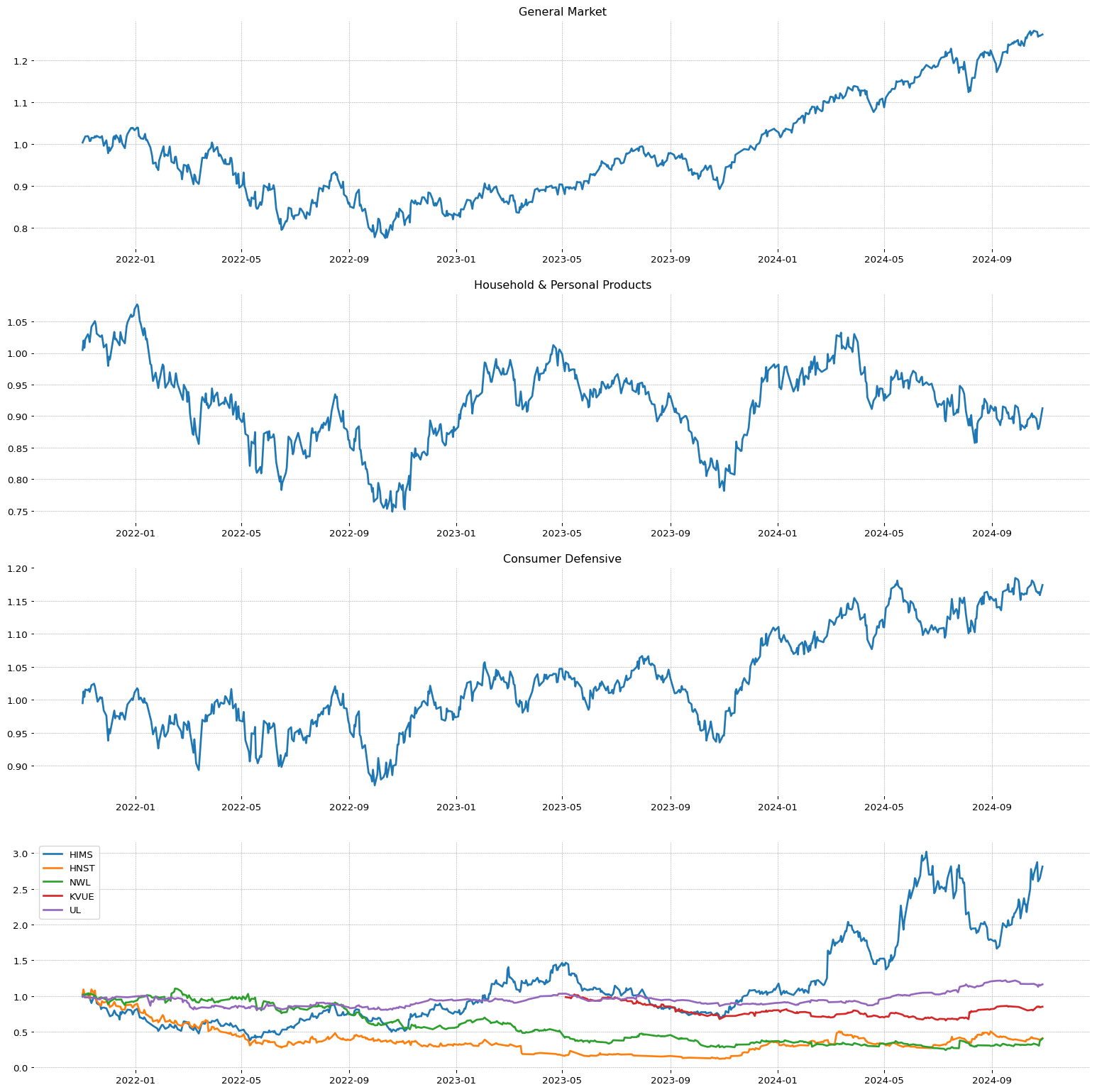

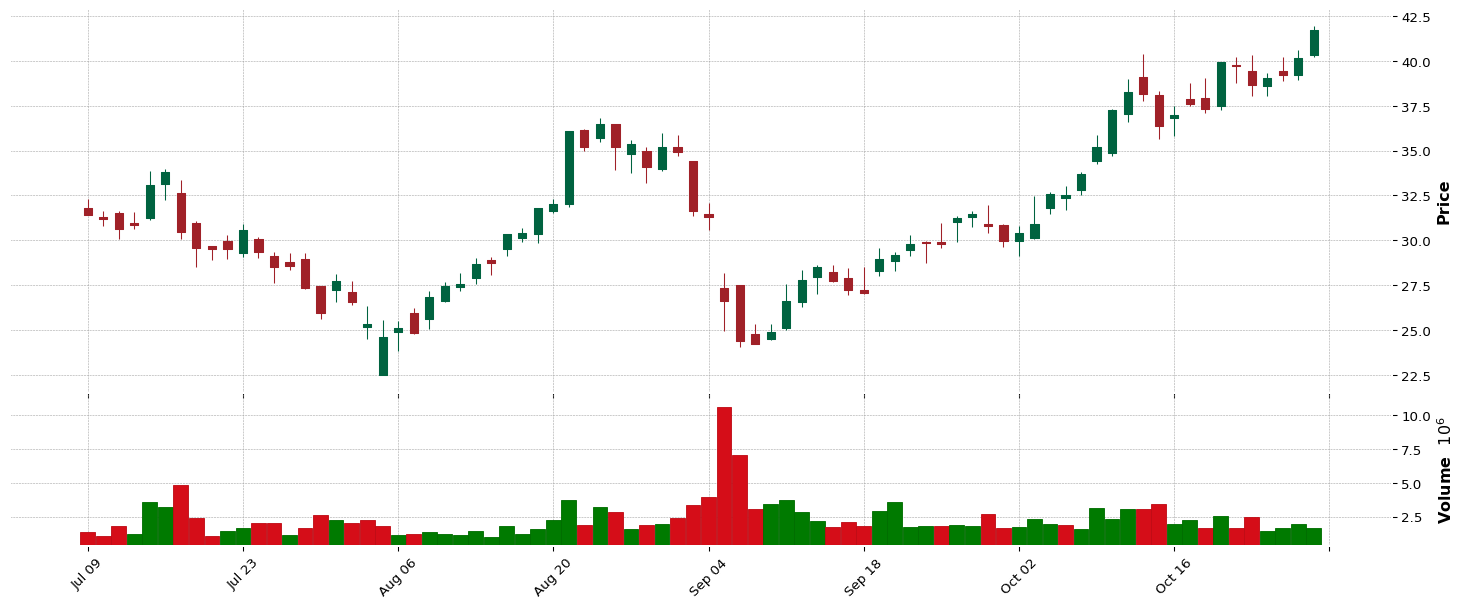

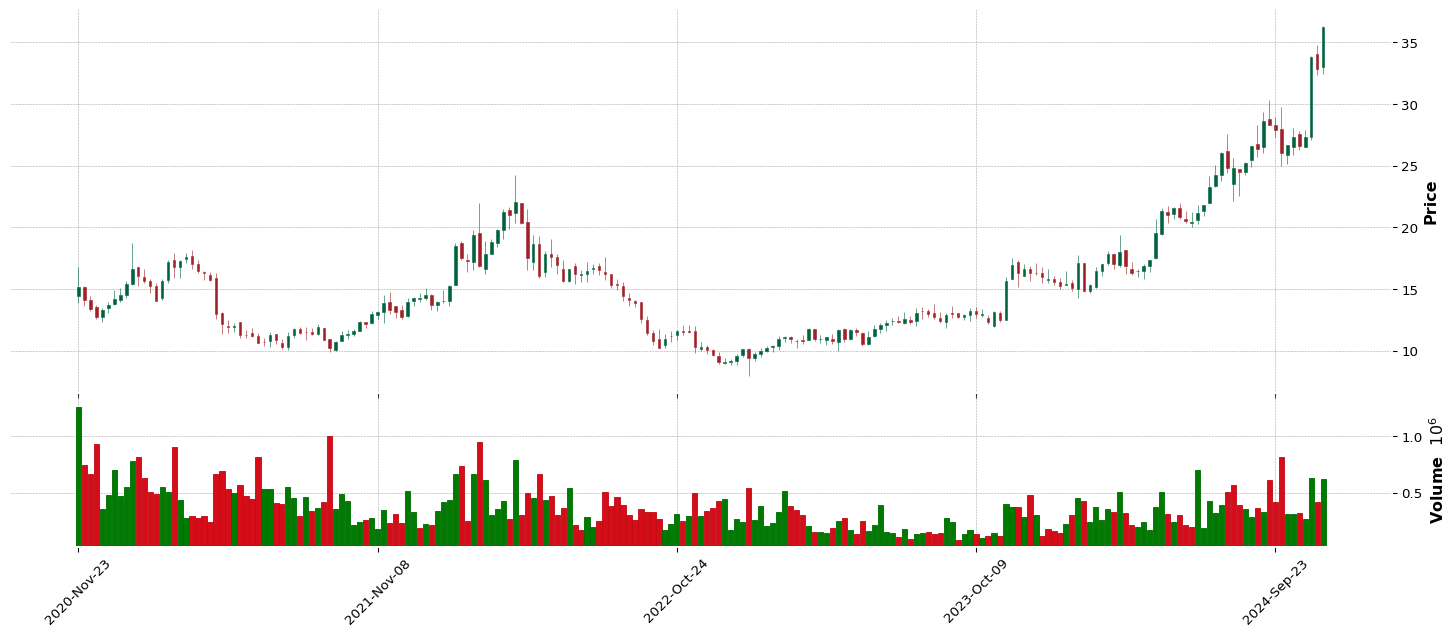

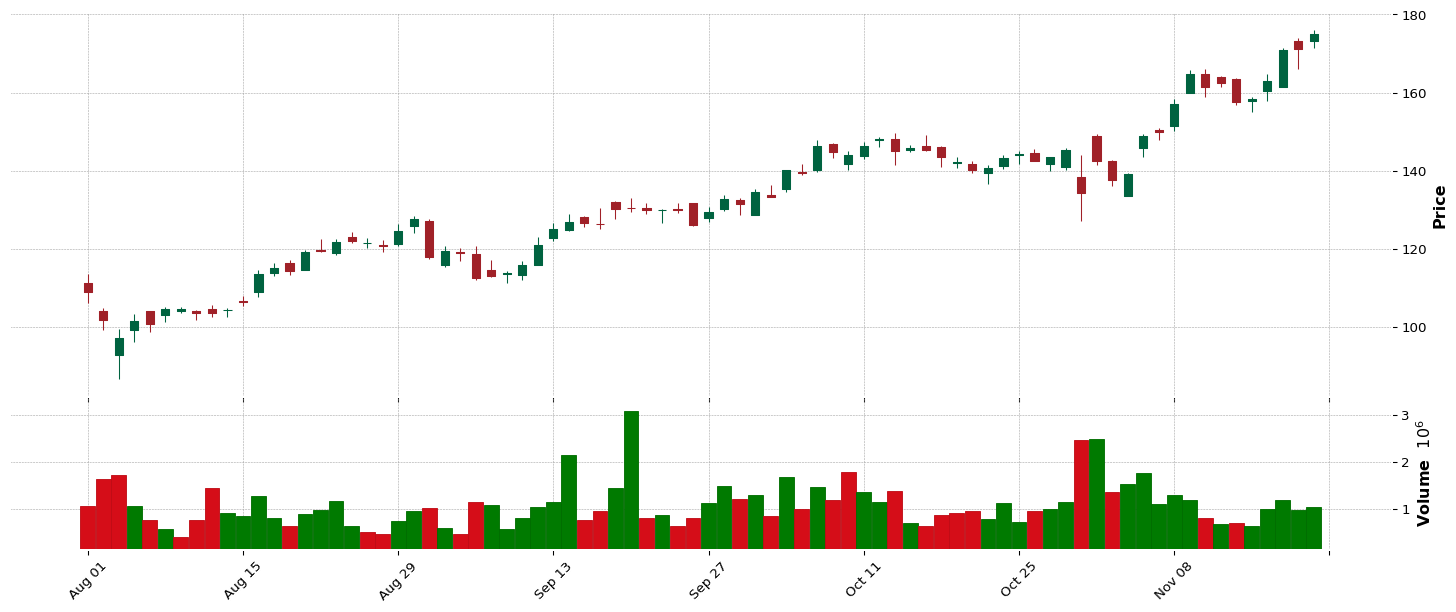

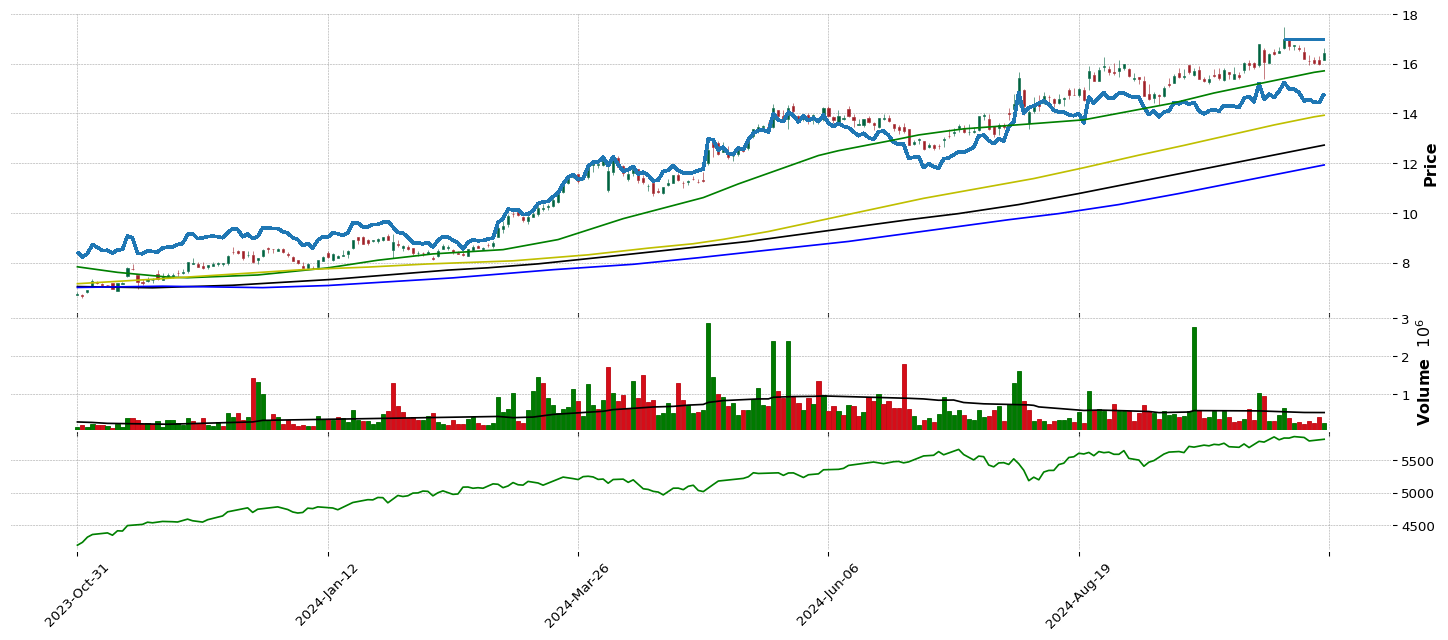

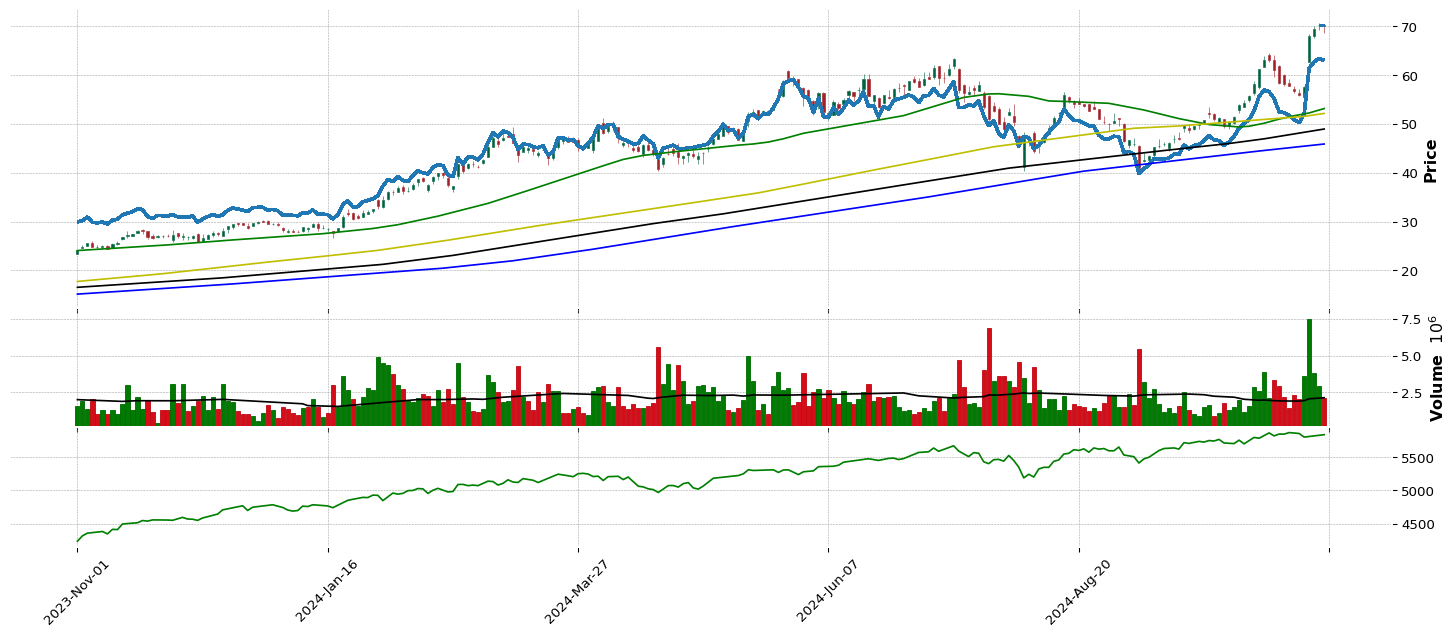

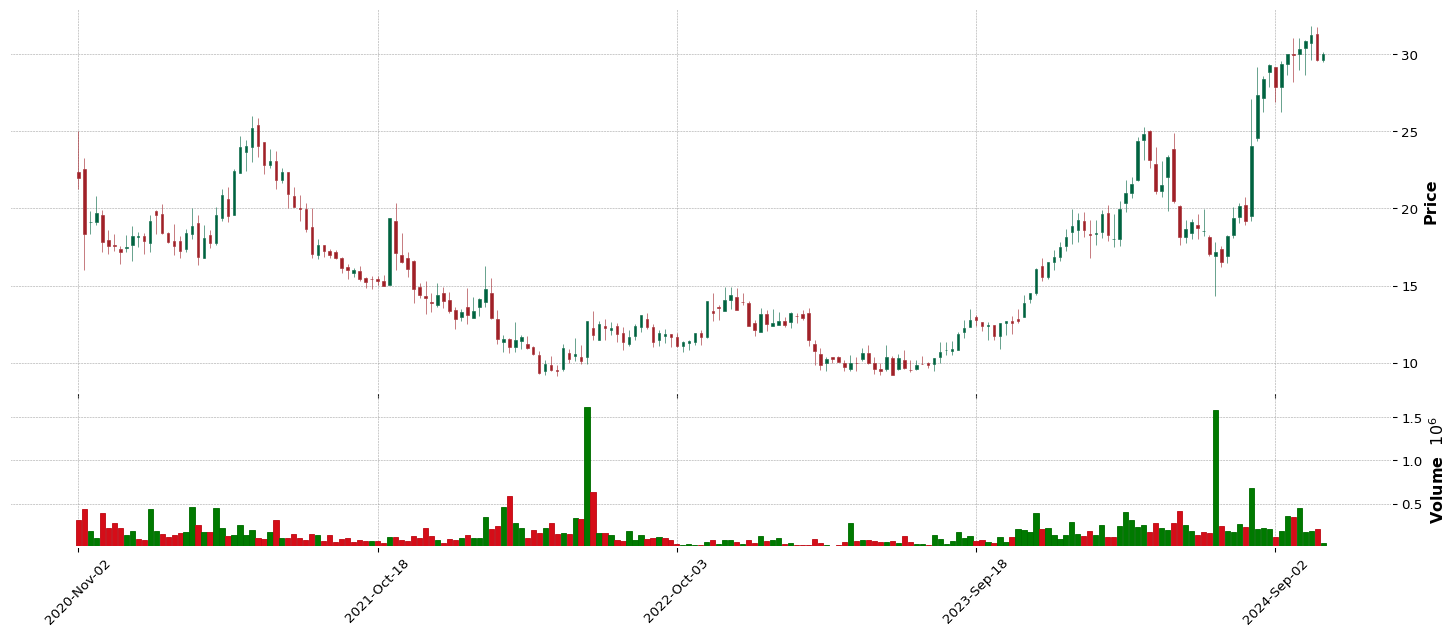

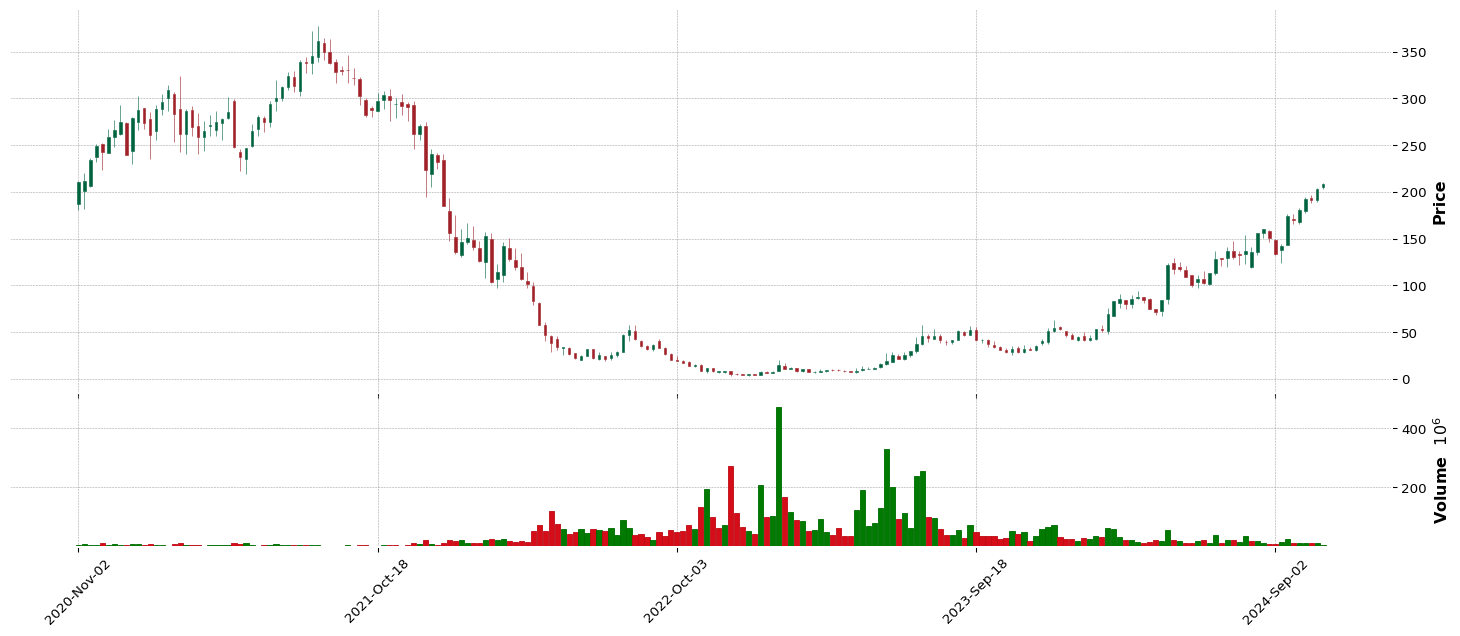

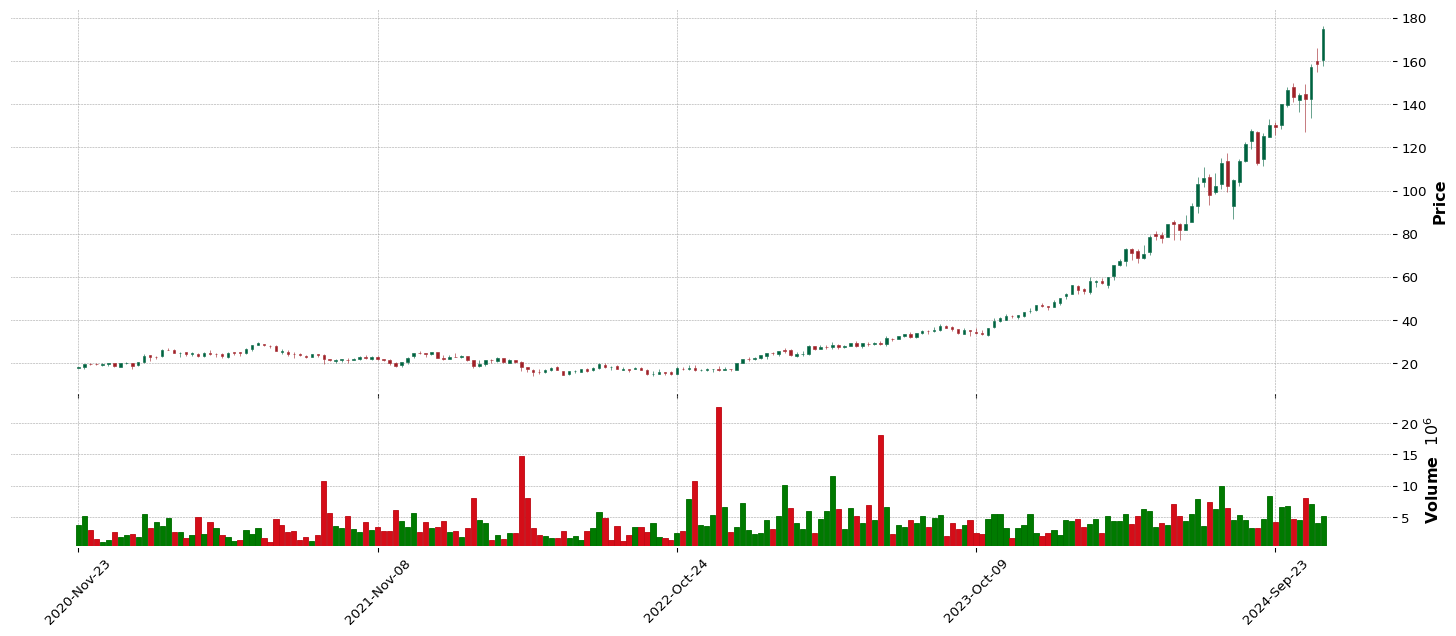

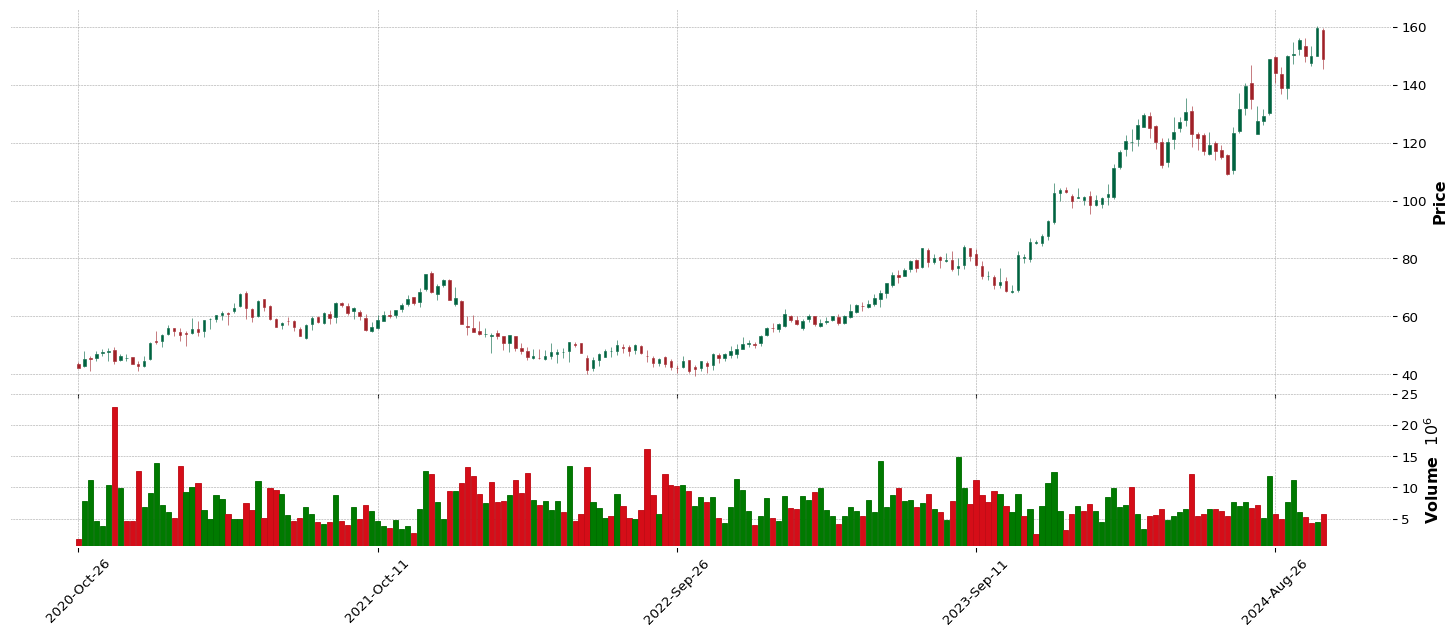

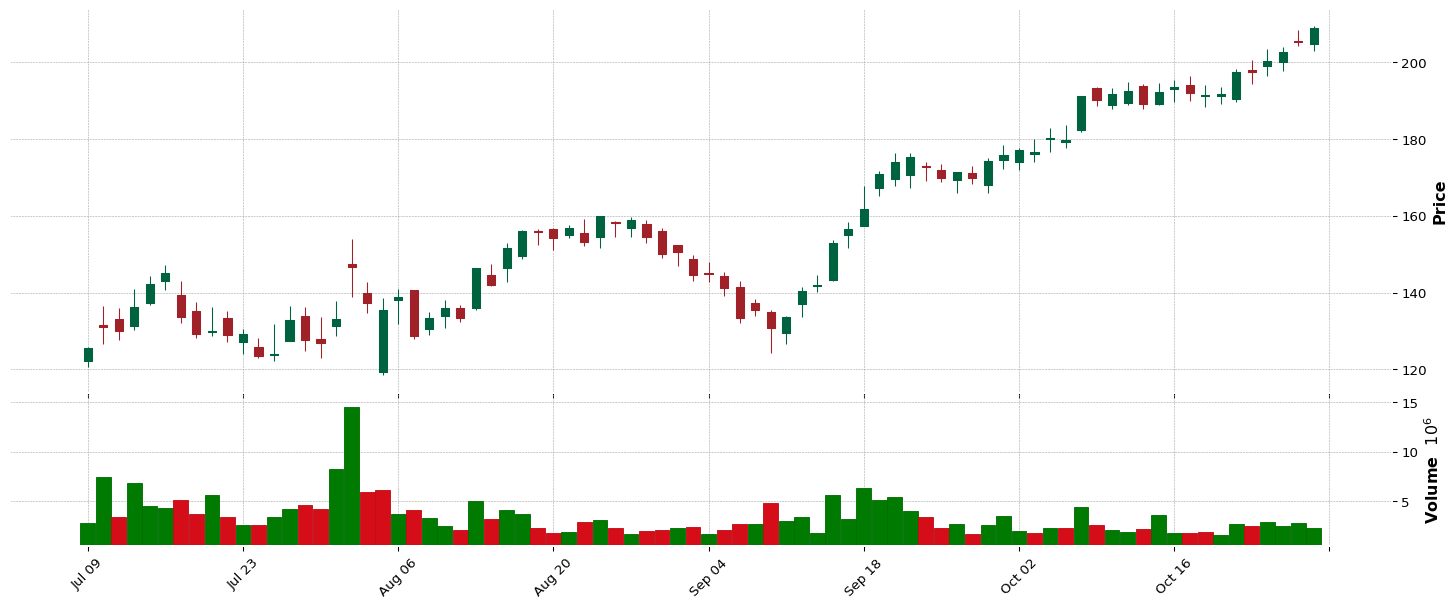

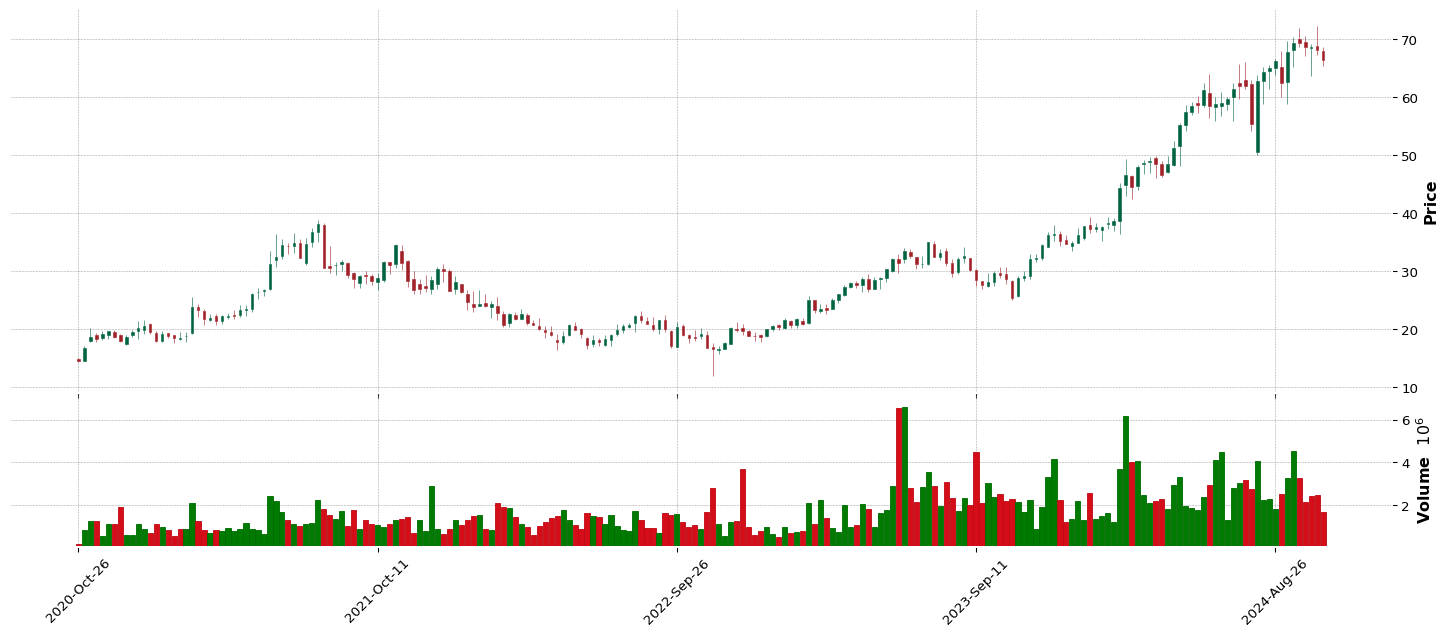

**** 8585 ****

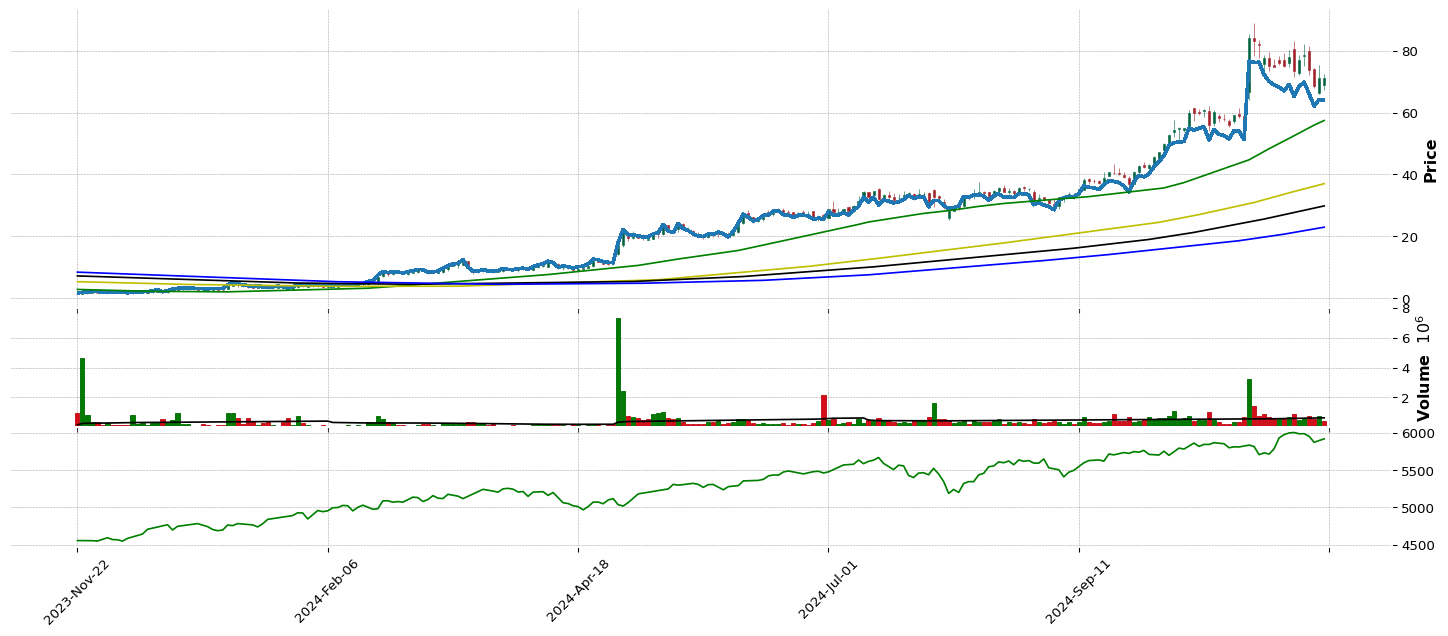

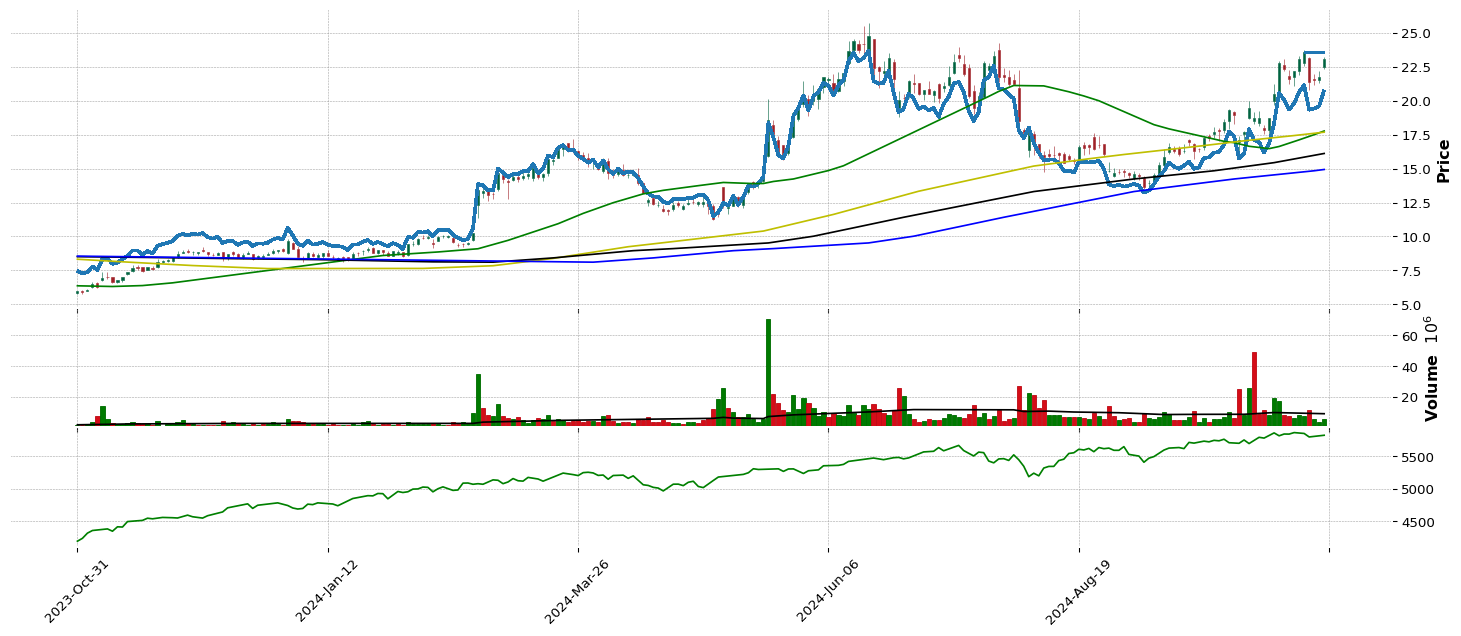

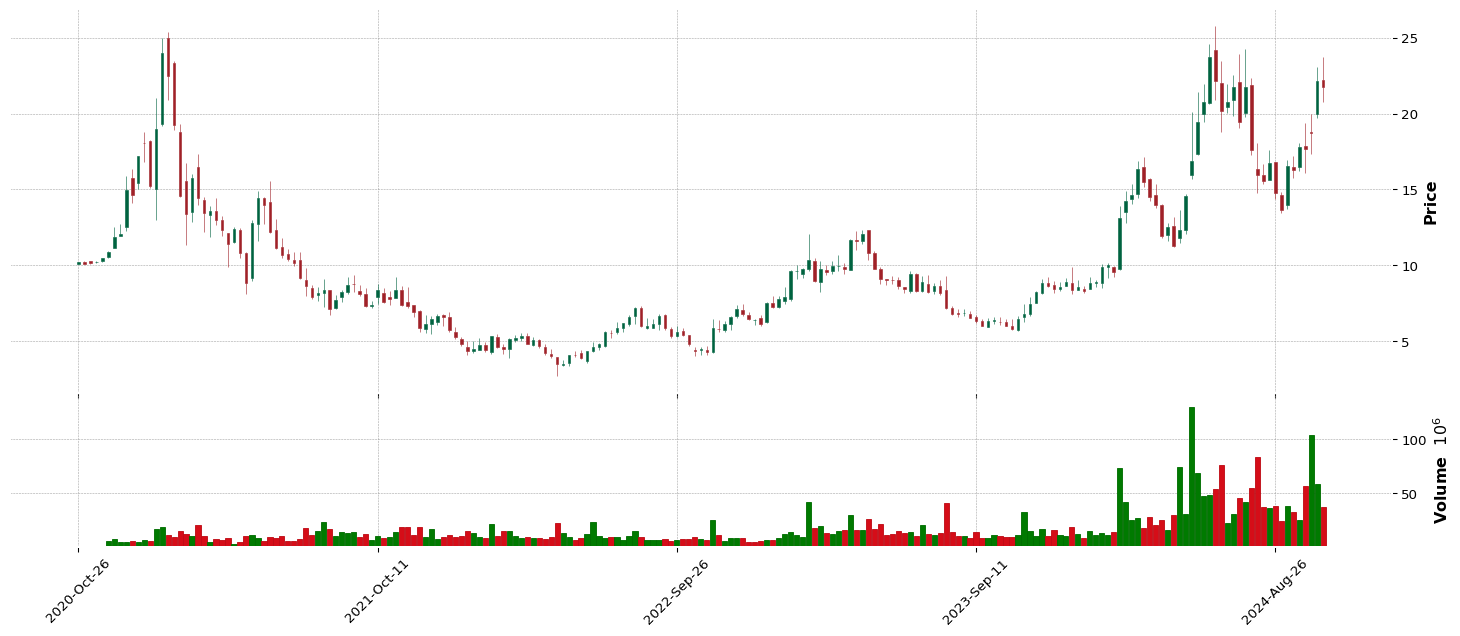

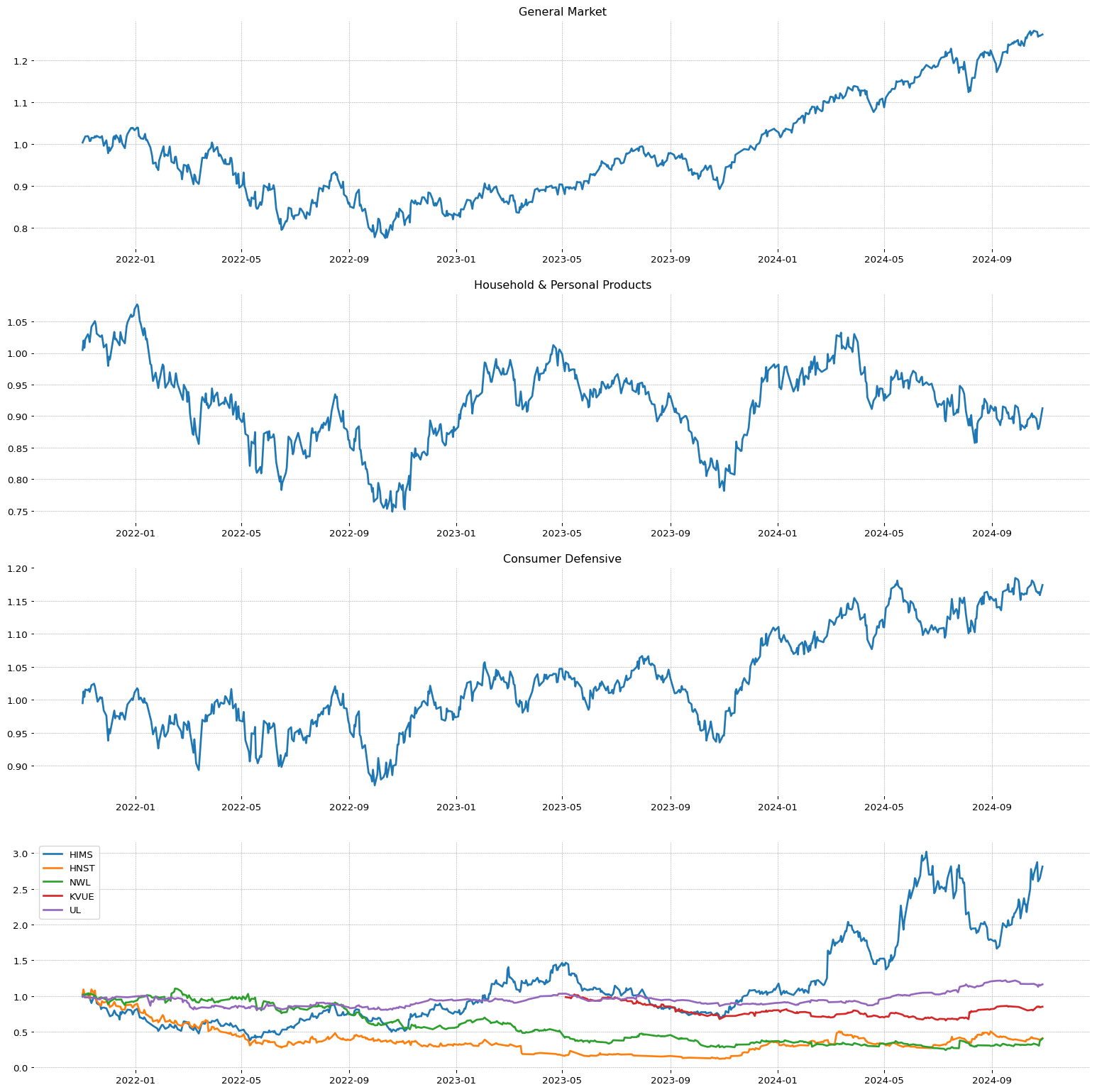

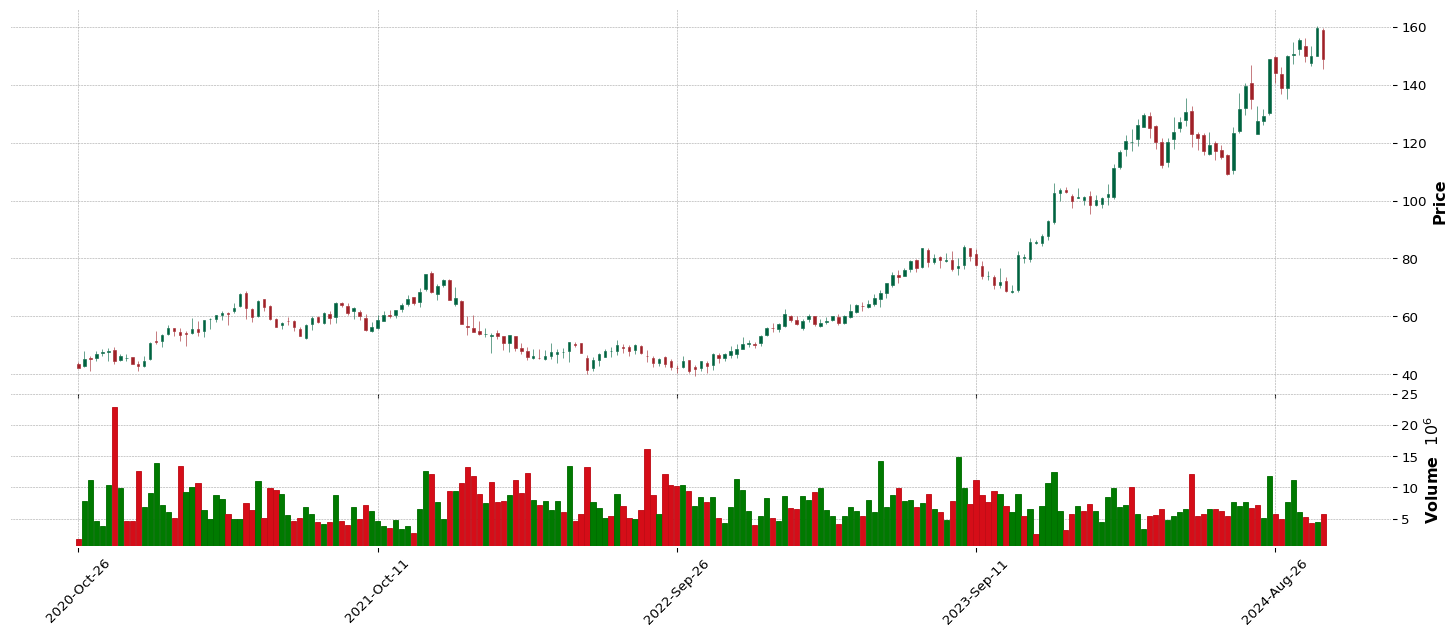

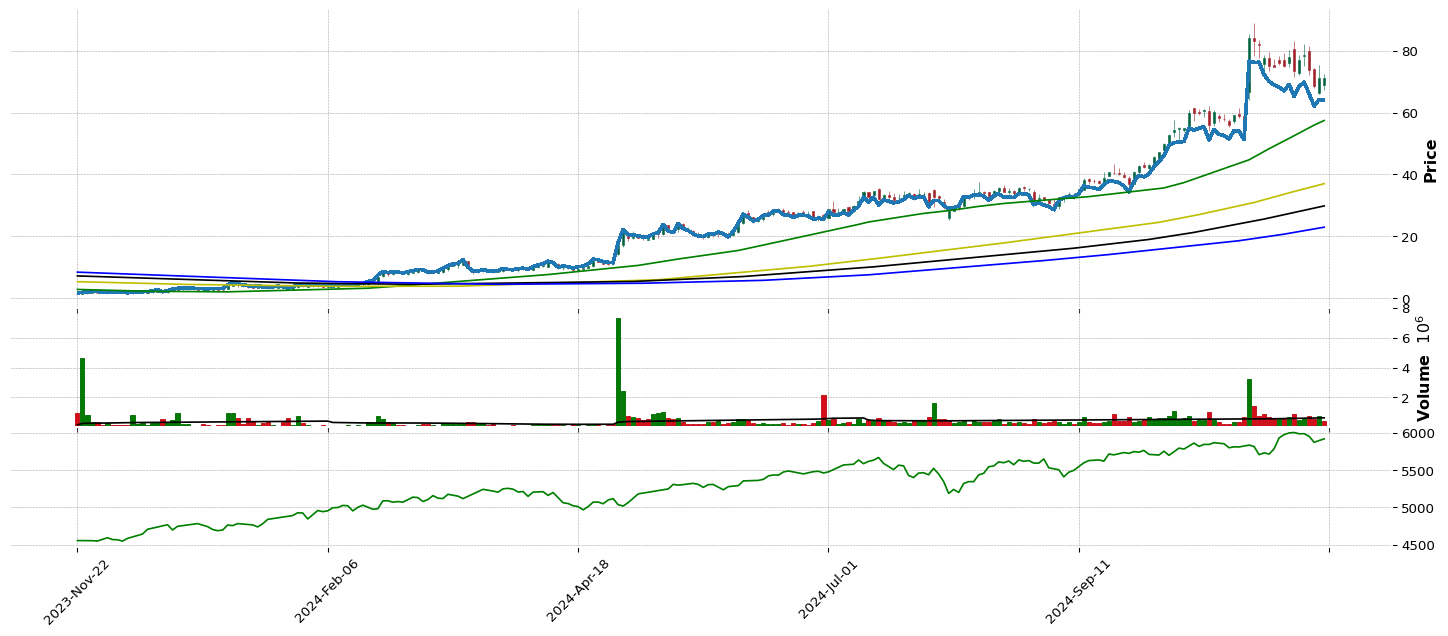

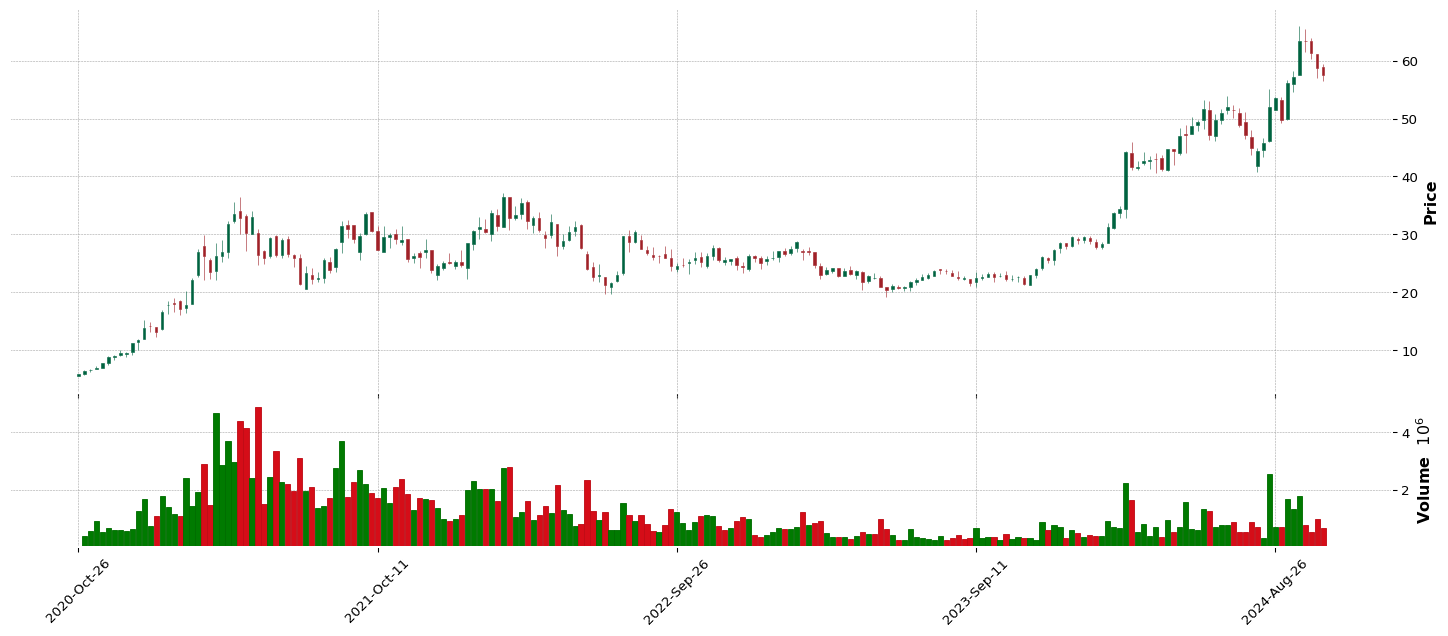

**** 8585 ****HIMS

***************************

--> GENERAL INFORMATION HIMS :

| Total stock number: | 187.39M |

| Market Cap: | 4.831675936B |

| Namee: | Hims & Hers Health, Inc. |

| IPO date: | 2019-09-13 |

| Type of Sector: | Consumer Defensive |

| Sector Position: | 10/11 |

| RSI Sector: | 4/147 |

| Type of industry: | Household & Personal Products |

| Industry stock position: | 123/147 |

| Industry stock position: | 1/19 |

| RS Rating: | 98.27 |

| EPS Rating: | 95.08 |

| SMR Rating: | 94.38 |

| 1 year return: | 285.95 |

| Stability Value of Earnigs: | 50.63 |

Top competitor on same industry:

| Stock: | RS | EPS | SMR | 2Q | 1Q |

| HIMS | 98 | 95 | 94 | 202 | 280 |

| HNST | 97 | 57 | 90 | 92 | 70 |

| NWL | 64 | 55 | 50 | 91 | 152 |

| CLX | 57 | 50 | 84 | 75 | 22 |

| UL | 55 | 48 | 42 | 2 | 28 |

| CL | 50 | 59 | 90 | 84 | 45 |

| KVUE | 45 | 35 | 42 | -11 | -86 |

| SPB | 40 | 24 | 90 | 210 | -99 |

| ELF | 39 | 88 | 80 | 36 | -16 |

| KMB | 33 | 53 | 64 | 14 | 1363 |

--->QUARTER

| 3Q | 2Q | 1Q |

| Increase Earnings of last quarters: | 111.15 | 202.88 | 280.75% |

| Quarter maggiori 20% / 50% / 100% in 20: | 8 | 5 | 3 |

| Percentage surprise: | 150.0 | 316.66 | 40.41% |

| 2Q Increase Earnings: | 85.96 | 157.01 | 241.81% |

| 5/3/1 anno di Earnigs: | -0.09 | -0.04 | 0.02 |

| Perc. increase 3/1 Earnigs Vs 5/3: | | 53.11 | 144.47% |

| Revenue increase: | 47.49 | 45.81 | 51.81% |

| 2Q Revenue increase: | 52.0 | 46.65 | 48.81% |

| NeT income Ratio: | 0.5 | 4.0 | 4.21% |

| NeT income Increase: | 107.73 | 175.8 | 222.37% |

| EARNINGS | This Q | Next Q |

| this and next q growth: | 211.11 | 1086.44% |

| Revision % of extimate growth | 0.0 | 0.0% |

| This Quarter / Next Quarter | 0.04 | 0.07 |

| last 7 | 0.04 | 0.07 |

| last 30 | 0.04 | 0.07 |

| last 60 | 0.05 | 0.08 |

| last 90 | 0.04 | 0.04 |

| REVENUE | This Q | Next Q |

| Growth sales extimation: | 68.30% | 70.50% |

--->ANNUAL

| 2021 | 2022 | 2023 | ttm |

| Earnings A/A increase: | -13.72 | 44.82 | 65.62% |

| Earnings 2 A/A increase: | 34.22 | 15.55 | 55.22% |

| ROE value: | -114.68 | -20.32 | -7.18 | 5.12% |

| Net income Increase: | -494.34 | 38.99 | 64.14% |

--> Annual breakout:

2018/-1.12

2019/-2.86

2020/-0.51

2021/-0.58

2022/-0.32

2023/-0.11

2024/0.23

2025/0.36 |

| Current Year | Next Year |

| Sales Improve: | 58.70% | 34.20% |

| |

| EPS Growth Estimates |

|

| Current Qtr. | 200.00% |

| Next Qtr. | 600.00% |

| Current Year | 309.10% |

| Next Year | 56.50% |

| Next 5 Years (per annum) | 94.90% |

| Past 5 Years (per annum) | -- |

--> Fincancial Situation yaer/year

| 2020 | 2021 | 2023 | ttm |

| Current Liabilities/Current Asset: | 29.35 | 22.13 | 33.37% |

| Non Current Liabilities/Non current Asset: | 4.47 | 4.44 | 4.93% |

| Total Liabilities/Current Asset: | 31.85 | 25.2 | 36.65% |

| Y/Y short debt situation: | 420.23 | -39.48 | 84.53% |

| Y/Y long debt situation: | -97.3 | -1.27 | 30.48% |

--> 2Q average 3I

| 3Q | 2Q | 1Q |

| 2Q Increase Earnings: | 85.96 | 157.01 | 241.81% |

| 2Q Revenue increase: | 52.0 | 46.65 | 48.81% |

| 2Q NeT income Ratio: | -1.41 | 2.25 | 4.1% |

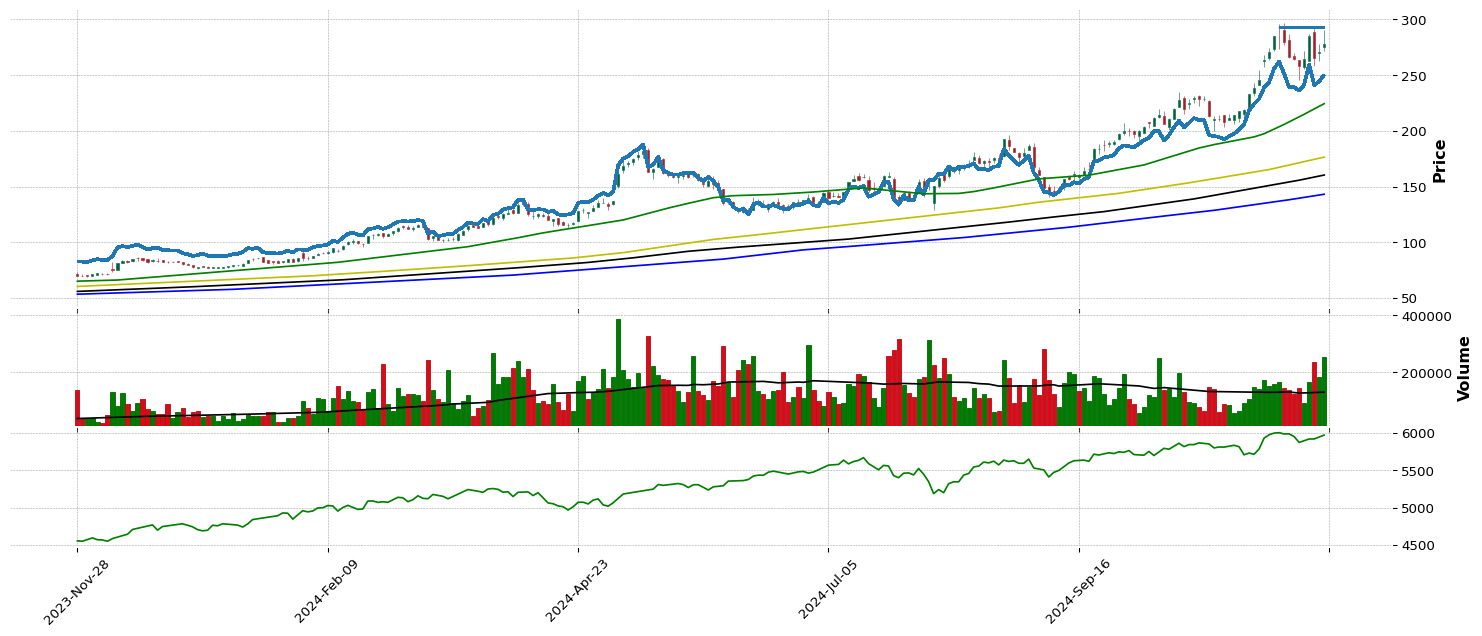

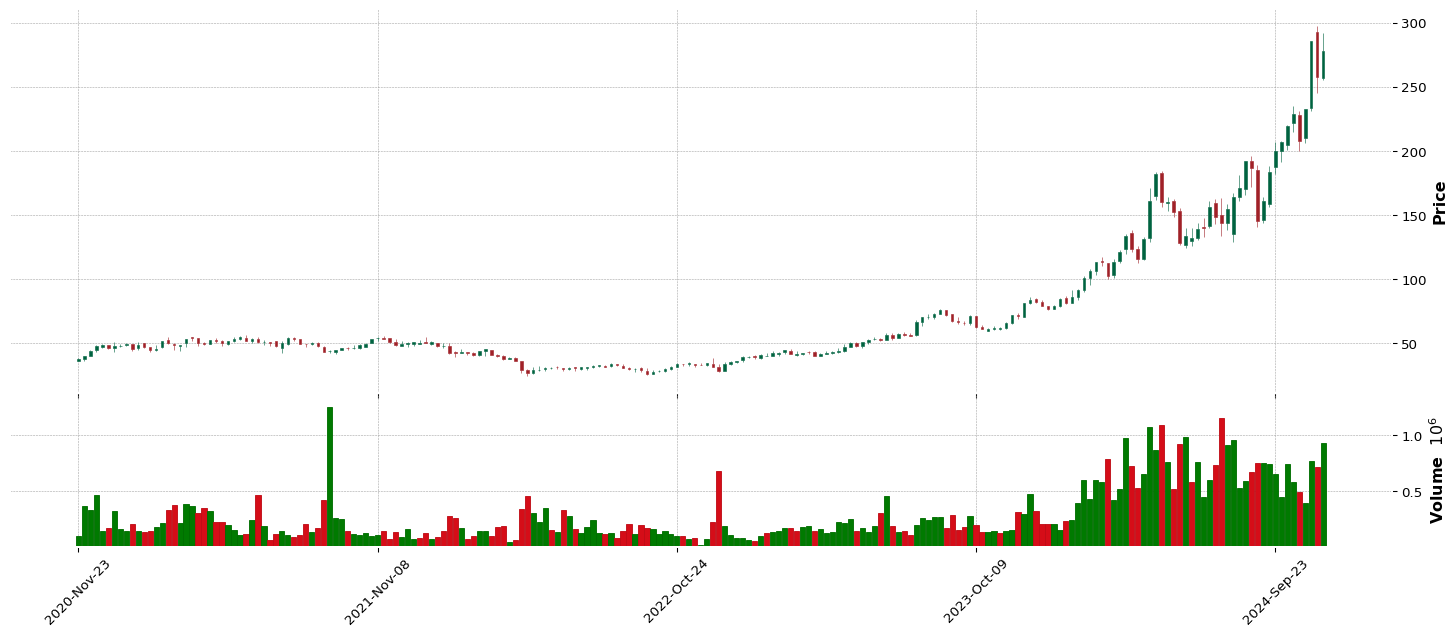

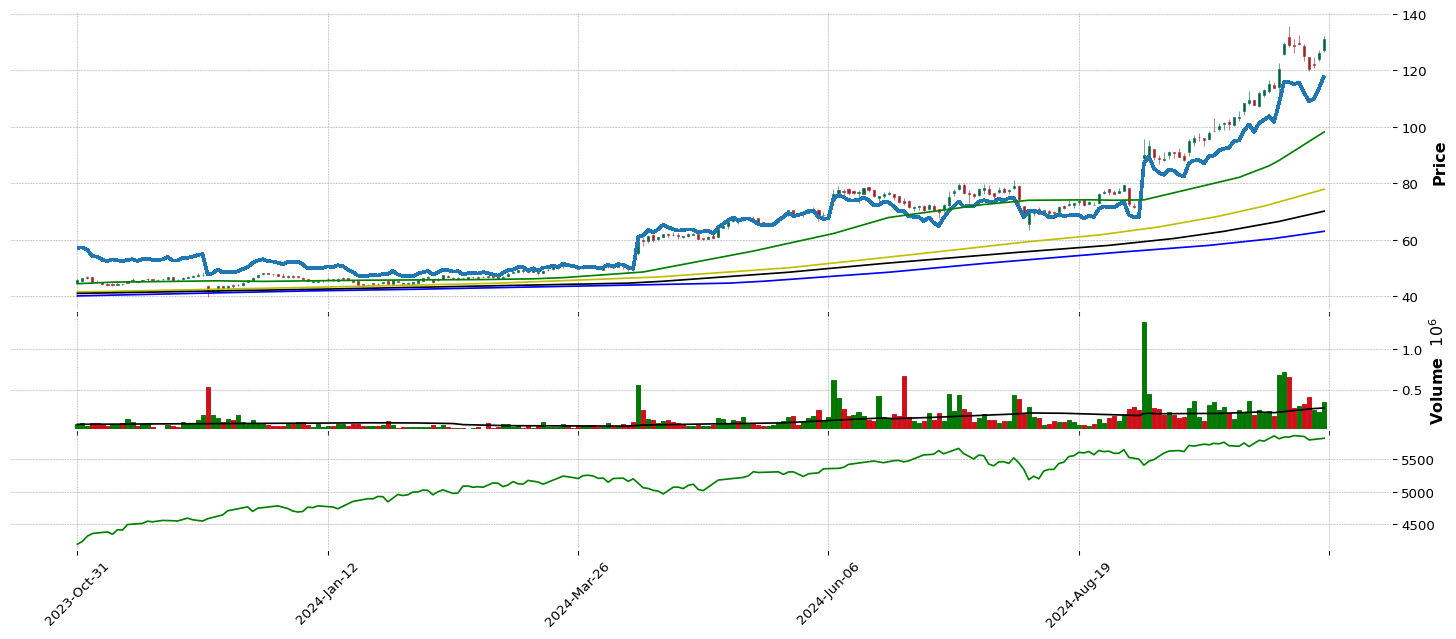

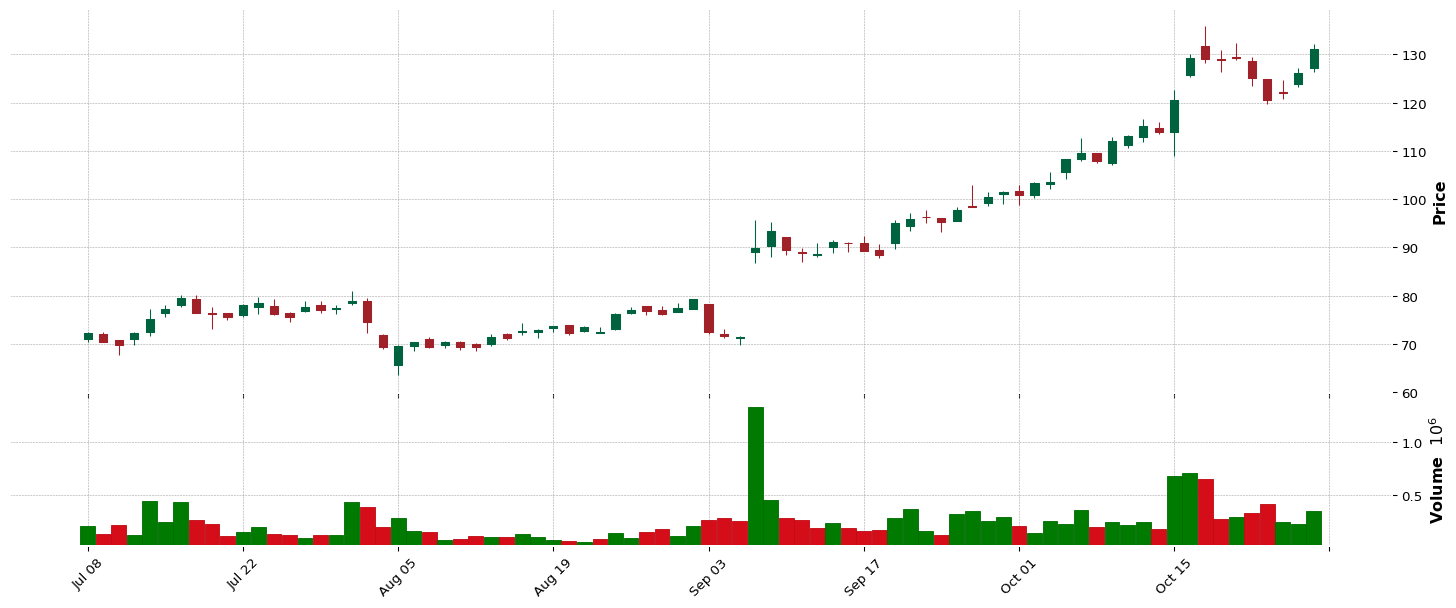

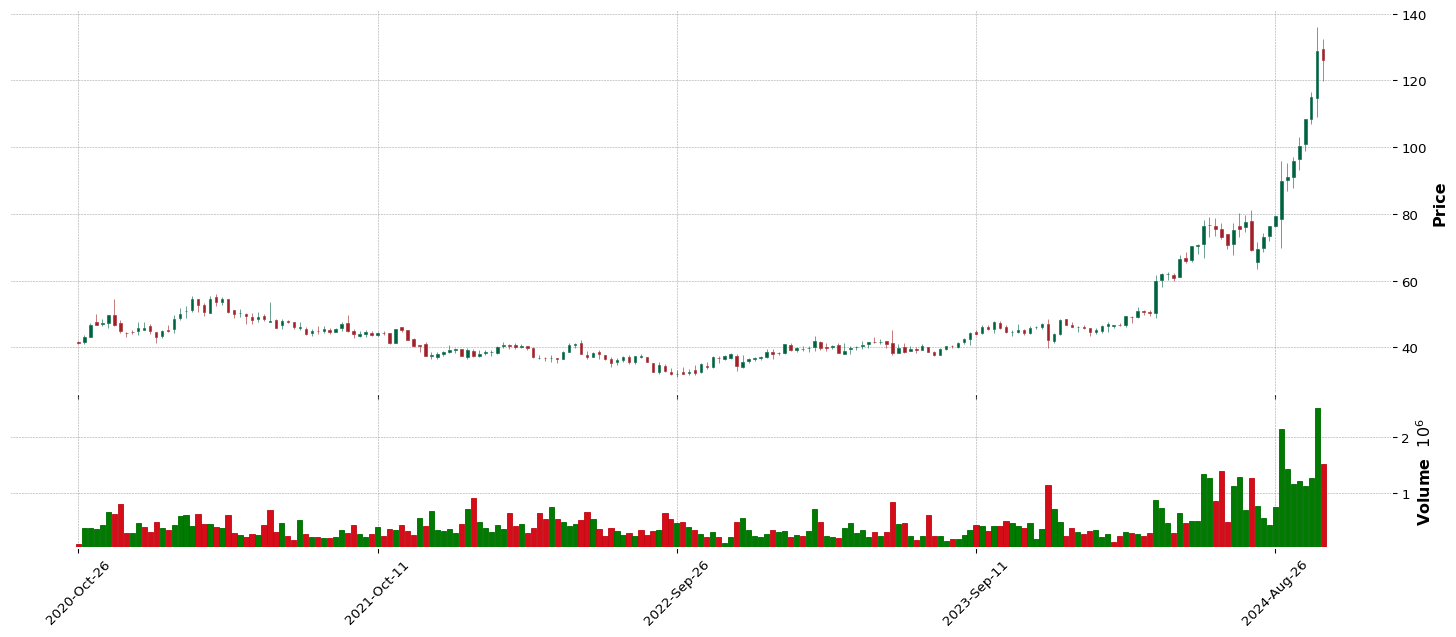

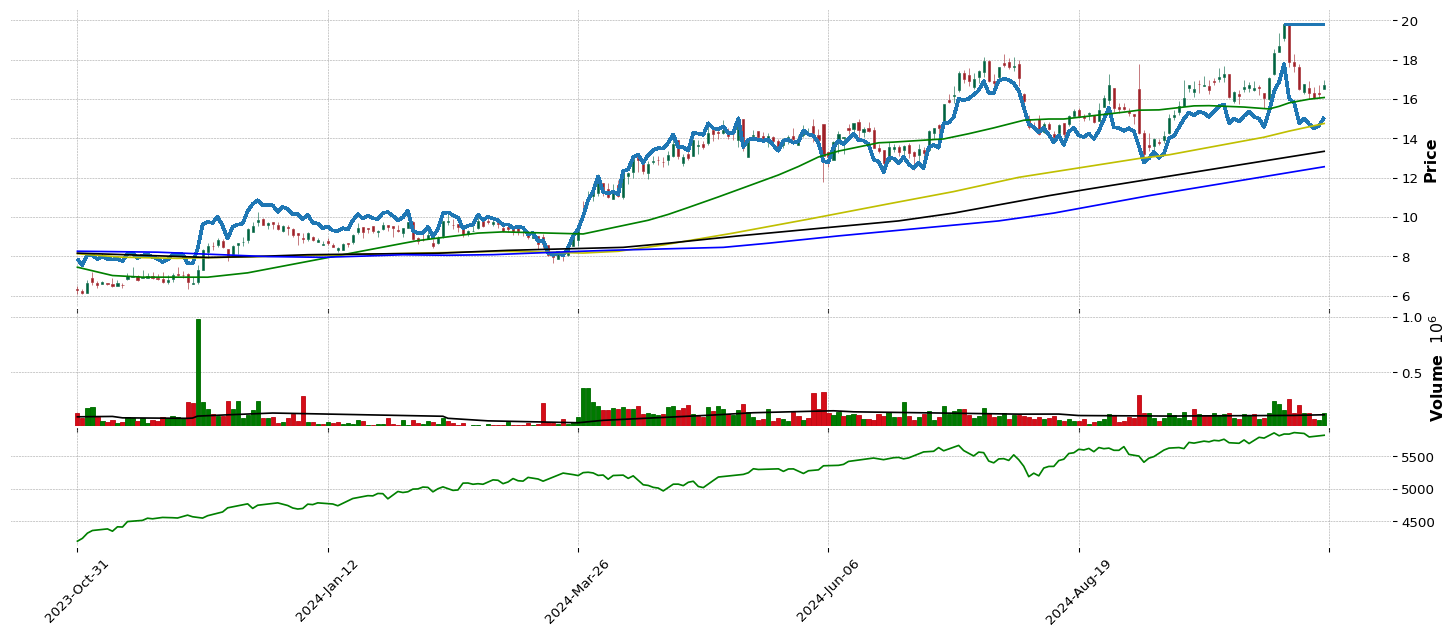

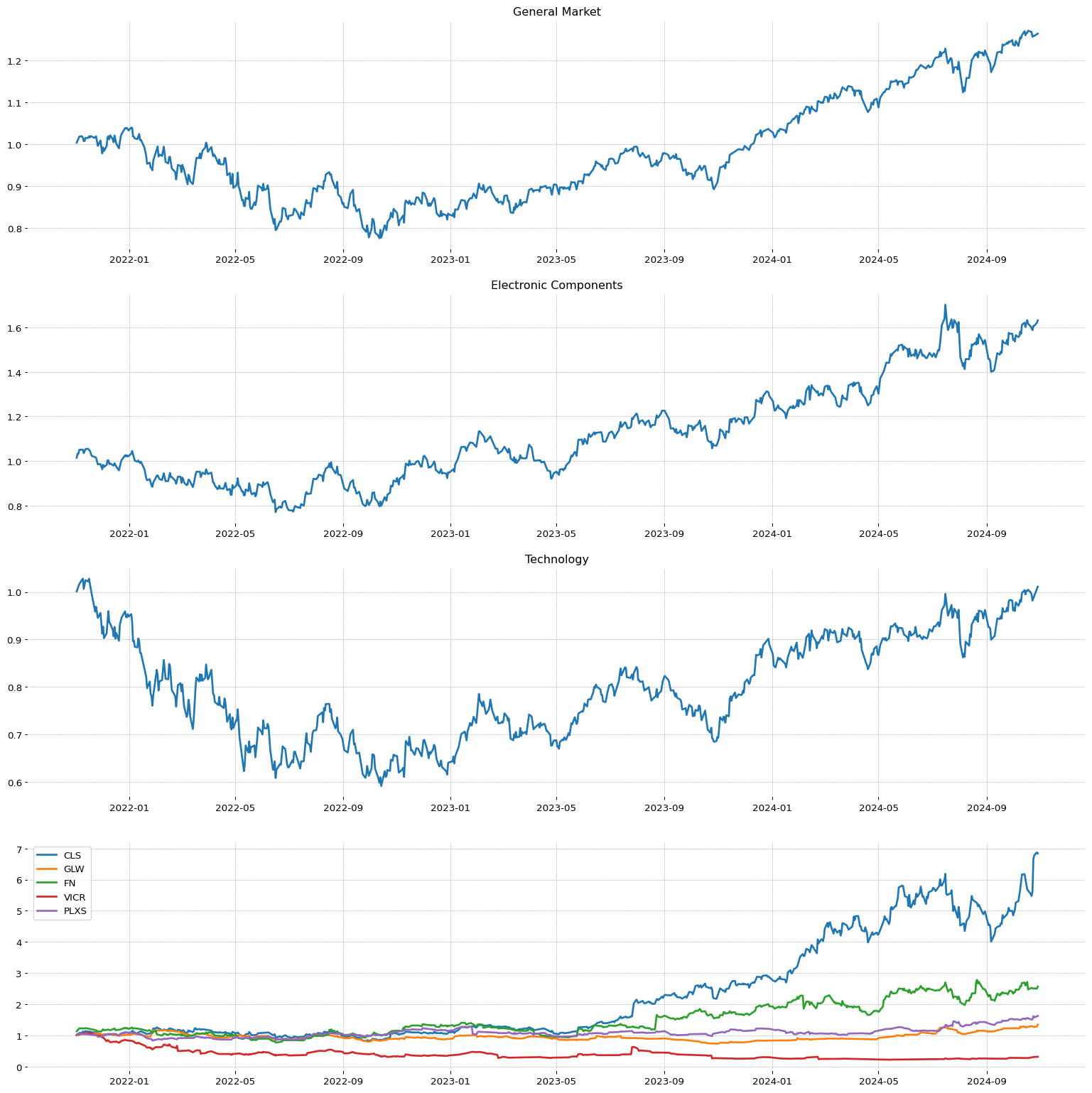

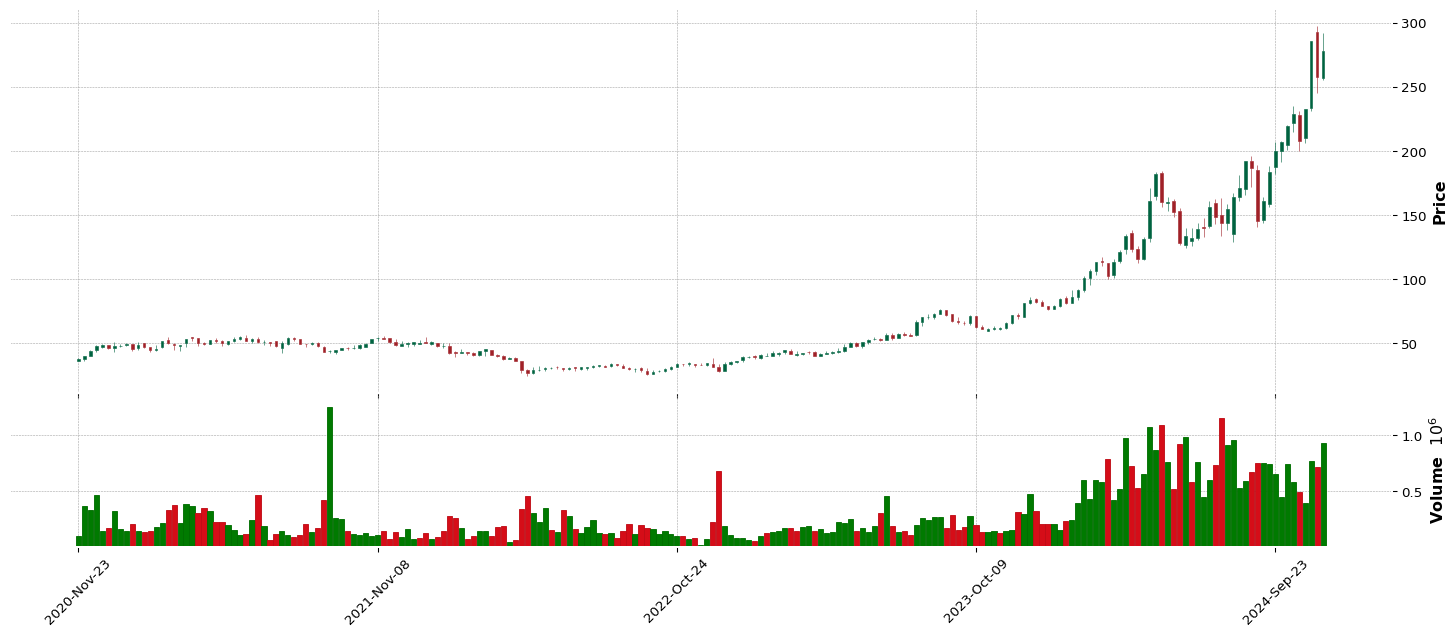

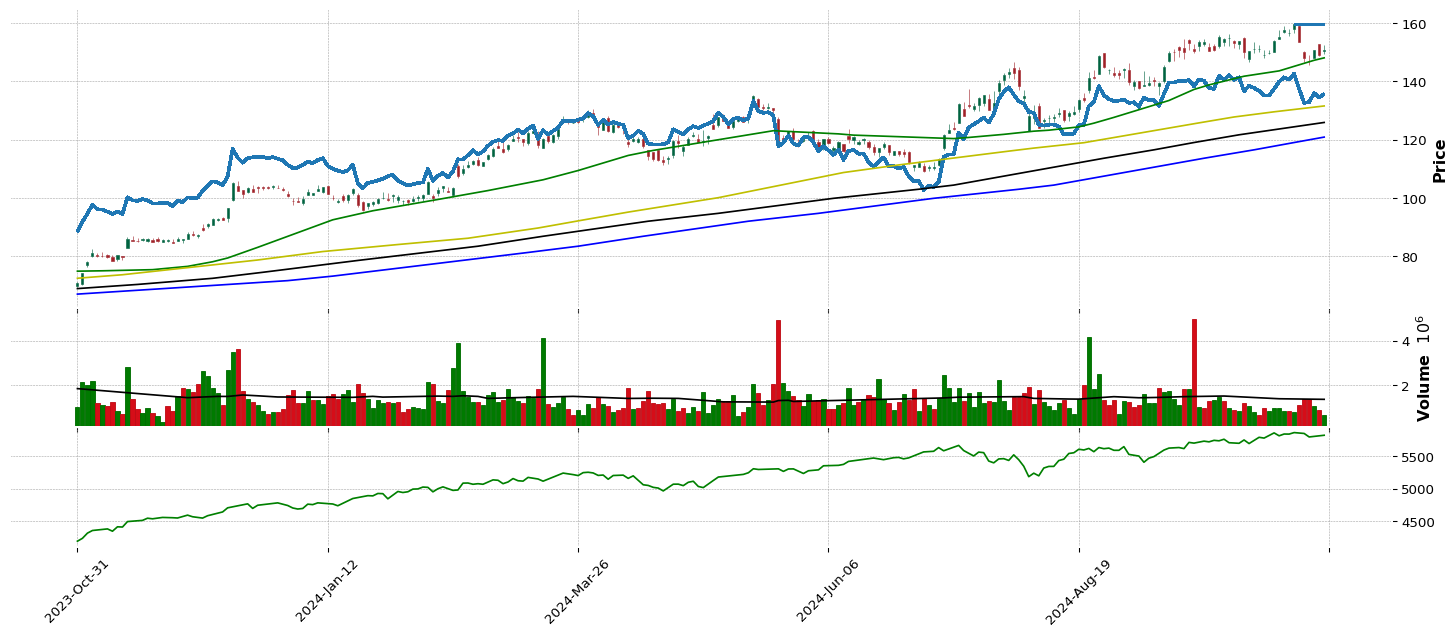

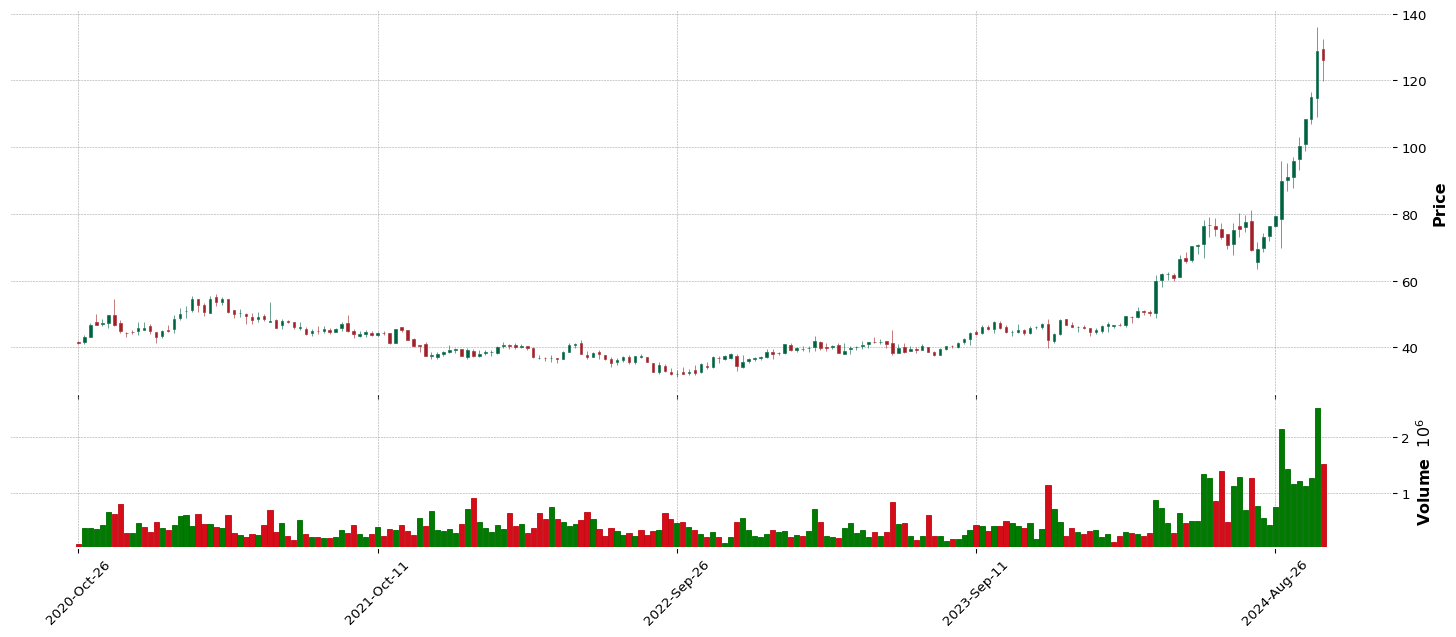

**** 8585 ****IESC

***************************

--> GENERAL INFORMATION IESC :

| Total stock number: | 8.76M |

| Market Cap: | 4.267796324B |

| Namee: | IES Holdings, Inc. |

| IPO date: | 1998-01-28 |

| Type of Sector: | Industrials |

| Sector Position: | 7/11 |

| RSI Sector: | 22/402 |

| Type of industry: | Engineering & Construction |

| Industry stock position: | 21/147 |

| Industry stock position: | 2/31 |

| RS Rating: | 97.69 |

| EPS Rating: | 94.77 |

| SMR Rating: | 99.0 |

| 1 year return: | 239.56 |

| Stability Value of Earnigs: | 40.3 |